Global Motorsports Market Size, Share, Trends & Growth Forecast Report By Type (League Organizers and Promoters, Race teams, Track Owners/Runners), Racing Series (Formula One, MotoGP, NASCAR, GT, Off-Road and Others), Revenue Channel (Broadcasting, Ticketing, Sponsorship, Merchandising and Others) and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa), Industry Analysis from 2025 to 2033

Global Motorsports Market Size

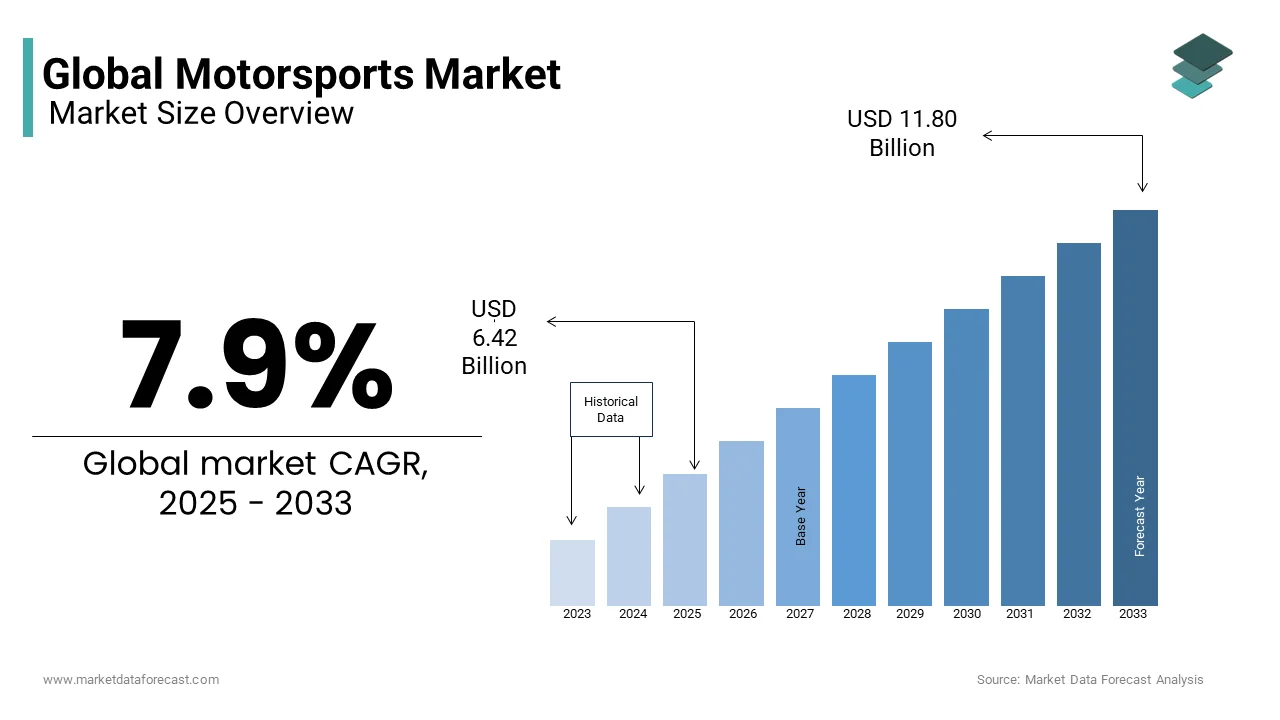

The size of the global motorsports market was valued at USD 5.95 billion in 2024. The global market size is expected to be valued at USD 6.42 billion in 2025 from USD 11.80 billion by 2033, growing at a CAGR of 7.9% during the forecast period from 2025 to 2033.

Motorsports is a rapidly expanding global industry that draws fans, sponsors, and investors from all corners of the world. With its roots in early 20th-century car and motorcycle racing, motorsports have evolved into a multi-billion-dollar market that transcends borders and offers a unique blend of speed, technology, and entertainment. From Formula 1 and NASCAR to MotoGP and rally racing, the sheer diversity of motorsports events speaks to its widespread appeal. One of the key drivers behind this growth is the global fan base, which is estimated to be over 500 million strong. As these events are broadcast across major platforms and attended by spectators from numerous countries, motorsports create opportunities for international brands to engage with a highly passionate audience. The rise of digital streaming platforms and esports racing has only increased accessibility, allowing fans to connect in real-time from any location.

The economic impact of motorsports is also substantial, with significant revenue generated from sponsorship deals, merchandising, and tourism related to racing events. Emerging markets such as the Middle East and Southeast Asia are becoming key players in hosting major races, further solidifying motorsports as a worldwide phenomenon. The sport’s mix of adrenaline, innovation, and global unity makes it a market with limitless growth potential.

MOTORSPORTS MARKET TRENDS

Adoption of Electric & Autonomous Vehicles

Formula E, the all-electric racing series, has rapidly positioned itself as a pioneer in the development of electric vehicle (EV) technology. Established in 2014, Formula E serves not only as an exciting motorsports event but also as a cutting-edge testing ground for automakers and tech companies to advance EV innovation. Teams in Formula E continually push the boundaries of battery efficiency, electric powertrains, and regenerative braking systems, all of which have direct implications for the consumer EV market. Many of the technological advancements tested in Formula E are later applied to commercial electric vehicles to accelerate the transition to greener transportation solutions. The emphasis of Formula E on sustainable energy solutions also aligns with global environmental goals, making it a crucial player in shaping the future of mobility. Manufacturers such as Jaguar, Porsche and Nissan use Formula E as a real-world lab to test and refine their electric drivetrains. The commitment of Formula E to a fully electric future, combined with its role in advancing battery and energy management technologies, is ensuring that it remains at the forefront of EV innovation.

The Indy Autonomous Challenge (IAC) represents a bold step into the future of motorsports, combining the thrill of high-speed racing with groundbreaking autonomous vehicle (AV) technology. In this competition, teams of engineers and researchers from top universities around the world develop and race fully autonomous vehicles. The IAC is more than just a spectacle of self-driving race cars; it serves as a vital testing ground for the future of autonomous mobility. One of the key benefits of the IAC is that it pushes the limits of AV technology in high-pressure, dynamic environments. The race cars, equipped with state-of-the-art sensors and AI, must navigate complex, real-time decision-making scenarios at high speeds. Lessons learned from these events are expected to accelerate the adoption of autonomous driving technologies in everyday vehicles, improving safety and efficiency. The rise of autonomous racing events like the IAC highlights the intersection of motorsports and advanced AI, underscoring the role these competitions play in driving innovation across the entire automotive industry.

Sustainability Efforts

Sustainability has become a major focus in motorsports, with Formula 1 leading the charge through its ambitious goal of becoming carbon neutral by 2030. The sport has already introduced hybrid power units, which significantly reduce fuel consumption, and is continually working on more eco-friendly solutions such as advanced biofuels and energy recovery systems. By 2026, Formula 1 plans to introduce a fully sustainable fuel, which will further reduce its environmental footprint. Alongside these innovations, F1 has also committed to reducing single-use plastics and implementing more sustainable logistics for its global events. Meanwhile, Extreme E, an off-road racing series, is making waves with its commitment to raising awareness about climate change. Races are held in remote locations that have been impacted by environmental challenges, such as melting ice caps and deforestation. Extreme E uses electric SUVs to minimize emissions and partners with local environmental organizations to leave a positive legacy. The series also emphasizes gender equality by requiring mixed-gender teams. Together, Formula 1 and Extreme E exemplify motorsports’ growing commitment to sustainability, leading the charge in promoting greener, more responsible practices both on and off the track.

Digital Fan Engagement

The motorsports market is embracing digital technologies to enhance fan engagement through virtual reality (VR), augmented reality (AR), and esports. These innovations are transforming how fans experience races, offering more interactive and immersive ways to connect with the sport. VR allows fans to virtually step into the driver’s seat, providing a first-person perspective of high-speed racing that traditional broadcasts can’t offer. With AR, fans can interact with real-time data overlays during live events, enhancing their understanding of race strategies and car performance. Esports, particularly virtual racing championships like F1 Esports and the eNASCAR iRacing series, have also surged in popularity. These platforms allow fans to compete in digital versions of real-world racing events, breaking down the barriers between professional drivers and everyday enthusiasts. Esports also provide year-round engagement, keeping fans connected to the sport even in the off-season. The integration of these technologies not only broadens motorsports’ reach but also attracts a younger, tech-savvy audience. As VR, AR, and esports continue to evolve, they will play a crucial role in shaping the future of fan engagement in motorsports.

MOTORSPORTS MARKET DRIVERS

Technological Advancements

Technological innovations have been a primary driver of growth in the motorsports market, with hybrid power units, artificial intelligence (AI), and autonomous vehicle (AV) technology leading the charge. Hybrid engines, first introduced in Formula 1 in 2014, have drastically improved fuel efficiency, reducing fuel consumption by over 35% while maintaining top speeds of over 230 mph. These power units combine internal combustion engines with electric motors, paving the way for cleaner, more efficient racing without sacrificing performance. AI is increasingly crucial for optimizing race strategies. Teams now rely on AI algorithms to analyze real-time data, such as track conditions, tire wear, and competitor performance. This has improved strategic decisions by up to 20%, allowing teams to anticipate optimal moments for pit stops, fuel management, and tire changes, providing a competitive edge. The rise of autonomous racing events, like the Indy Autonomous Challenge, demonstrates how AV technology is being tested under extreme conditions. Vehicles in these races reach speeds of over 150 mph without human intervention. These races act as a proving ground for the broader automotive industry, pushing forward the development of autonomous technology, which is projected to be worth $733 billion globally by 2030.

Sustainability Push

Sustainability is a growing priority in motorsports, with electric vehicle (EV) racing playing a central role in reducing carbon emissions. Formula E, the leading all-electric racing series, is at the forefront of this shift. The EV market is expected to reach a valuation of $847.14 billion by 2032, and Formula E contributes significantly to this growth by serving as a platform for testing innovations in battery technology, powertrain efficiency, and regenerative braking. The introduction of the Gen3 car in the 2023 season, which is 40% more energy efficient than its predecessor, highlights the progress made in reducing motorsports’ environmental impact.

Extreme E goes a step further by combining electric off-road racing with environmental awareness. By hosting races in remote areas affected by climate change, such as Greenland and the Amazon, Extreme E raises awareness of environmental degradation while showcasing the capabilities of electric SUVs. The series offsets its carbon emissions through extensive reforestation and renewable energy projects, contributing to global sustainability efforts. Both Formula E and Extreme E illustrate how motorsports are helping to reduce emissions and lead the way in the global transition to cleaner, more sustainable transportation.

Digital Transformation

The digital transformation of motorsports has led to new forms of fan engagement and revenue generation, with virtual racing, augmented reality (AR), virtual reality (VR), and esports driving this shift. Virtual racing has exploded in popularity, with F1 Esports reporting a 76% increase in viewership in 2021, attracting over 23 million fans globally. This growing popularity is not just limited to viewing but also participation, as fans compete in virtual replicas of real-world events, creating an immersive experience that bridges gaming and motorsports. AR and VR technologies offer fans an enhanced, interactive experience. VR allows users to virtually step into a race car and experience the thrill of racing from the driver’s perspective, while AR provides real-time data overlays during live races, offering detailed insights into strategies, lap times, and car performance. Esports, particularly virtual racing events, have become a major revenue stream for motorsports, generating over $1.1 billion in revenue in 2021, with projections to surpass $2.4 billion by 2025. By integrating digital engagement tools and esports competitions, motorsports have managed to attract younger audiences and create year-round engagement, which has become essential for the sport’s future growth.

MOTORSPORTS MARKET RESTRAINTS

High Operational Costs

Operating a Formula 1 team is notoriously expensive, with team budgets often exceeding $150 million annually. While the FIA introduced a budget cap in 2021 to limit team spending to $145 million (now $150 million), teams still face high operational costs, including driver salaries, research and development, and travel for global races. These expenses significantly impact profitability, especially for smaller teams with fewer sponsorships and commercial backing. For larger teams, the budget cap has helped level the playing field by controlling spiraling costs, but maintaining cutting-edge performance remains expensive. Profitability now hinges more on securing lucrative sponsorships, broadcast deals, and prize money, which can contribute up to 80% of a team's revenue. Though the budget cap reduces financial strain, teams still need to balance cost-effective operations with performance excellence to remain competitive and profitable in the long term.

Environmental Concerns

Motorsports face growing pressure to reduce their environmental impact, with carbon emissions a major concern. Formula 1, for example, generates significant CO2 emissions, especially through logistics and air travel. In response, F1 has pledged to achieve carbon neutrality by 2030. This includes initiatives like hybrid power units that have already reduced fuel consumption by 35% and the development of sustainable fuels set to debut in 2026. Other series, like Formula E and Extreme E, are at the forefront of sustainability, using all-electric vehicles and promoting environmental awareness. However, motorsports must balance performance with eco-friendly solutions, and the transition to sustainable practices remains a challenge. Despite progress, the industry continues to face scrutiny from environmental advocates, putting pressure on motorsports organizations to accelerate their sustainability efforts.

Regulatory Challenges

Motorsports are subject to stringent safety and environmental regulations designed to protect both drivers and the environment. One of the most notable recent advancements in driver safety is the Halo device, introduced in Formula 1 in 2018. The Halo, a titanium structure placed around the cockpit, has been credited with saving lives by deflecting debris and protecting drivers in high-impact crashes, such as Romain Grosjean's 2020 accident. While the Halo has improved safety, it has added complexity and cost to car design. On the environmental front, stricter regulations are pushing for cleaner technologies, such as hybrid engines and sustainable fuels. These evolving standards challenge teams to innovate while complying with increasingly demanding rules. Meeting these regulatory requirements is critical for motorsports organizations to maintain their competitive edge, but doing so often adds significant costs and operational hurdles.

MOTORSPORTS MARKET OPPORTUNITIES

Emerging Markets

The motorsports market is expanding rapidly in Asia and the Middle East, with key events like the Chinese and Saudi Arabian Grand Prix playing pivotal roles. The Chinese Grand Prix, held in Shanghai, taps into one of the world’s largest consumer markets, with China’s motorsport fan base projected to grow by 30% by 2025. The Saudi Arabian Grand Prix, first introduced in 2021, reflects the region's increased investment in global sports. With state-of-the-art circuits and large-scale government backing, these events are attracting international audiences and sponsors, driving growth in these emerging markets.

Event Diversification

Motorsports are diversifying event formats to appeal to younger, more tech-savvy audiences. Hybrid events that combine live racing with entertainment experiences, such as concerts, fan zones, and esports competitions, are becoming more common. For instance, Formula 1’s Miami Grand Prix incorporated musical performances and digital fan experiences, attracting a broader demographic beyond traditional race fans. These hybrid formats, blending real-world racing with immersive digital content, help motorsports engage younger audiences and increase event attendance while also opening new revenue streams through entertainment and merchandise sales.

Impact of COVID-19 on the Global Motorsports Market

The COVID-19 pandemic had a profound impact on the motorsports market, disrupting events globally and causing significant financial losses. Major races such as Formula 1, MotoGP, and NASCAR were either canceled or postponed in 2020, resulting in a 43% decline in race-related revenue. With restrictions on large gatherings, fan attendance plummeted, and many races were held without spectators, further affecting ticket sales and in-venue revenue streams. Teams and sponsors faced financial strain due to reduced exposure and limited commercial opportunities, forcing some to cut budgets or exit the market entirely. However, the pandemic accelerated the adoption of digital fan engagement, with esports and virtual racing emerging as popular alternatives. Events like F1 Esports saw a surge in viewership, helping to maintain fan interest. While the market is now recovering, the pandemic has led to lasting changes, including hybrid event formats and a stronger focus on digital engagement and sustainability.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

7.9% |

|

Segments Covered |

By Racing Series, Revenue Channel, and Region. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Mercedes AMG (Germany), BMW (Germany), McLaren (UK), Williams (UK), Yamaha (Japan), Ducati (Japan), Suzuki (Japan), Aprilia (Italy), Pirelli (Italy), MRF (India), and Others. |

SEGMENTAL ANALYSIS

By Racing Series Insights

In 2023, the Formula 1 (F1) segment held the largest share of the global motorsports market, accounting for 53.5%. Its growth is driven by global popularity, high-profile sponsorships, and extensive media rights. Key technological advancements, such as hybrid power units that cut fuel consumption by over 35%, contribute to its sustainability and performance. The 2023 launch of the Las Vegas Grand Prix reflects F1’s expansion into new markets. F1 also leads in environmental efforts, aiming for carbon neutrality by 2030, which attracts eco-conscious fans and sponsors. Netflix’s Drive to Survive has been instrumental in boosting F1’s viewership by 50%, especially among younger audiences.

The MotoGP is a promising segment in the worldwide motorsports market. MotoGP is a dominant motorsports segment, particularly popular in Europe and Asia. Known for its high-speed races and cutting-edge aerodynamics, MotoGP attracted over 400,000 live spectators at events in Italy, Spain, and Japan in 2023. The sport plans to introduce sustainable fuels by 2024, aligning with global efforts toward green technology. The addition of sprint races in 2023 helped increase fan engagement, particularly among younger demographics, further expanding MotoGP's appeal. This focus on sustainability and innovation makes MotoGP a key player in the motorsports market.

The NASCAR segment held 25.8% of the global motorsports market share in 2023, with a strong presence in North America. Although stock car racing remains NASCAR’s core, hybrid engines are set to debut by 2024, signaling the sport’s modernization. NASCAR's efforts to diversify its audience through initiatives like the Chicago Street Race and diversity programs have broadened its fan base. Sponsorship deals with major brands like Coca-Cola, Toyota, and Goodyear remain crucial, providing significant revenue streams. NASCAR continues to draw large audiences, with over 3 million viewers tuning in for its races regularly, demonstrating its deep-rooted popularity.

The GT racing segment is anticipated to witness a healthy CAGR during the forecast period. GT Racing is a niche but valuable segment within the motorsports market, primarily focused on endurance events like the 24 Hours of Le Mans and the IMSA WeatherTech SportsCar Championship. These events attract global attention and feature luxury car manufacturers such as Ferrari, Porsche, and Lamborghini. In 2023, more automakers joined the segment to showcase their technological advancements, particularly in aerodynamics and hybrid-electric propulsion systems. The segment’s emphasis on sustainable racing technologies aligns with the growing interest from eco-conscious fans and manufacturers, further driving its growth in the market.

The Off-road racing segment is estimated to do well in the global market during the forecast period. Off-road racing, highlighted by events like the Dakar Rally and Baja 1000, is seeing steady growth due to the rise of electric off-road competitions such as Extreme E. Extreme E showcases electric vehicles and promotes environmental awareness by holding races in ecologically sensitive regions, including the Arctic and Amazon. Traditional off-road racing is also evolving, with hybrid and electric vehicles appealing to adventure-seeking fans. The integration of autonomous vehicle technology in off-road racing further drives innovation, while Extreme E’s blend of racing and environmental activism attracts eco-conscious sponsors and fans, positioning it as a key growth area in the motorsports market.

By Revenue Channel Insights

The broadcasting segment accounted for 40.8% of the global motorsports market revenue in 2023, making it the largest revenue channel. The shift to digital platforms has transformed how fans engage with motorsports, with over 50% of fans now consuming content through platforms like YouTube, Twitch, and social media. Formula 1’s $300 million per year media rights deal with ESPN is a prime example of the growing value of broadcasting. Despite the rise of digital streaming, traditional TV broadcasts remain robust, with events like the British Grand Prix drawing millions of global viewers, ensuring motorsports maintain broad visibility.

The sponsorships segment accounted for 32.2% of the global motorsports market in 2023, playing a critical role in the industry’s financial ecosystem. Formula 1 teams like Mercedes and Red Bull Racing generate as much as 40% of their revenue from sponsorships, with deals often exceeding $100 million annually. Major brands such as Shell, Pirelli, and Petronas leverage motorsports to gain global exposure. As sustainability becomes a focal point, sponsors are increasingly aligning with electric racing formats like Formula E and Extreme E, which emphasize green technology, further enhancing the appeal of motorsports to socially responsible brands.

The ticket sales segment experienced a strong post-pandemic recovery, with events like the British Grand Prix attracting over 356,000 spectators in 2022. This recovery has boosted live attendance, with Formula 1 and NASCAR leading the charge in ticket revenue. VIP experiences, such as paddock tours and hospitality packages, are becoming increasingly popular, driving up ticket prices for premium events like the Monaco Grand Prix. The expansion of motorsport events into emerging markets, particularly in Asia and the Middle East, has further fueled ticket sales, with modern racing infrastructure and rising disposable incomes attracting more fans to live events.

Although a smaller portion of motorsports revenue, the merchandising segment holds significant growth potential as fan demand for team apparel, memorabilia, and digital collectibles increases. Formula 1 teams like Ferrari and McLaren generate substantial income from branded clothing and accessories. The rise of esports and virtual motorsports has opened new opportunities for digital merchandise, including virtual team gear and NFTs. Digital collectibles and video games tied to motorsports events are especially popular among younger fans, diversifying motorsports' revenue streams and enhancing global fan engagement through innovative, tech-driven merchandise.

REGIONAL INSIGHTS

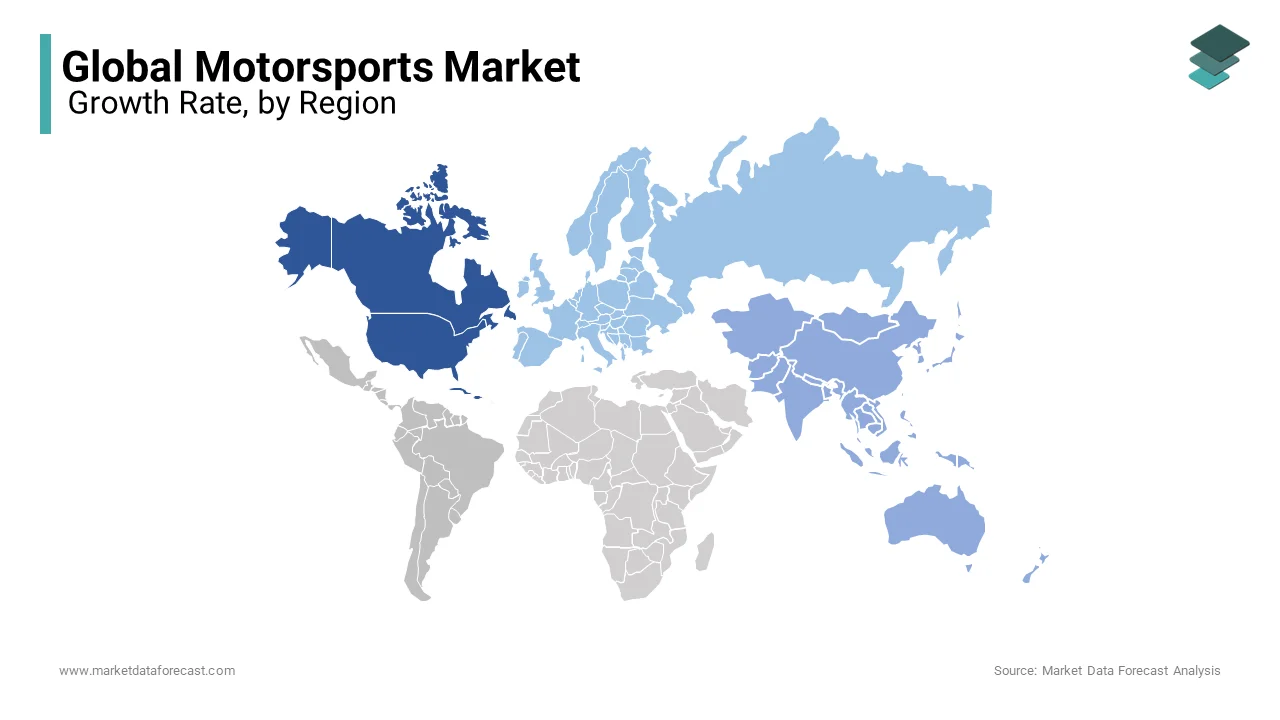

North America holds a significant share of the global motorsports market, with NASCAR and IndyCar leading in popularity. NASCAR alone accounts for 25% of the global market, with over 3 million viewers tuning in per race. The growth of the North American market is majorly driven by loyal fan bases, well-developed racing infrastructure, and extensive media coverage. Iconic events like the Indianapolis 500 and the resurgence of the U.S. Grand Prix, particularly in Austin, reflect a growing interest in Formula 1. Recent investments in new venues, such as Miami and Las Vegas, further enhance fan engagement and revenue opportunities. The rise of streaming services and the use of virtual and augmented reality in fan experiences are key growth drivers. Additionally, NASCAR’s plans to introduce hybrid engines by 2024 show a commitment to sustainability, aligning with global efforts to make motorsports more environmentally conscious.

Europe remains the epicenter of the global motorsports market, holding approximately 45% of the total market share, largely due to Formula 1’s dominance. Legendary events like the Monaco Grand Prix and 24 Hours of Le Mans continue to draw millions of fans worldwide. The region boasts a rich motorsport history, with countries such as the UK, Italy, and Germany serving as homes to top teams like Ferrari, Mercedes, and Red Bull Racing. The sustainability initiatives and growing interest in Formula E propel the European market growth. Europe leads the global adoption of green technologies, such as hybrid engines and sustainable fuels. Formula 1’s ambitious goal of achieving carbon neutrality by 2030 aligns with the region’s broader environmental agenda. Additionally, Europe’s expertise in motorsport engineering and cutting-edge technological advancements ensure it remains a global leader in the industry.

The Asia-Pacific (APAC) region is a rapidly growing motorsport market, projected to expand at a 6-7% CAGR from 2023 to 2032. The rising interest in Formula E and local motorsports events are driving the motorsports market in the Asia-Pacific region. Key markets like China, Japan, and India serve as growth hubs, with China’s return to the Formula 1 calendar in 2023 significantly boosting its profile. Formula E has also experienced fast-paced expansion in APAC, with races in cities like Seoul and Jakarta, drawing millions of fans. The region’s rising middle class and increasing disposable incomes are driving demand for motorsport events. Investments in motorsport infrastructure, particularly in China and India, are creating new opportunities for growth. The focus on electric vehicles and sustainable racing aligns with the region’s commitment to reducing emissions and embracing green technologies. Governments across APAC are investing heavily in motorsports to boost tourism and economic development, positioning the region as a major player in the future of motorsports.

The Middle East is emerging as a critical player in the global motorsports market, commanding around 10% of the overall market share. Countries like Saudi Arabia and the UAE have made substantial investments, hosting major events such as the Saudi Arabian Grand Prix and the Abu Dhabi Grand Prix. Government-led efforts to boost tourism and enhance global visibility through motorsports are contributing to regional market expansion. The development of world-class racing facilities in the region is attracting international audiences and sponsors. Saudi Arabia’s increasing involvement in Formula E and its collaboration with Extreme E emphasize the Middle East’s focus on sustainability and green technologies. Growing fan bases and global sponsorships are propelling the Middle East to become a key market for motorsports expansion. The region’s strategic position, connecting European and Asian motorsport enthusiasts, also contributes to its rapid growth.

COMPETITIVE LANDSCAPE

The global motorsports market is dominated by major automotive and motorcycle manufacturers, each using strategic approaches to stay competitive. Mercedes AMG leads in Formula 1 by investing in hybrid technology and leveraging its dominance as a seven-time Constructors' Champion. The team’s innovations in aerodynamics and AI-based telemetry keep it at the forefront of the sport. Additionally, Mercedes' entry into Formula E aligns with the growing demand for sustainable racing technologies. BMW has expanded its focus on endurance racing and electric vehicle technology. In 2023, BMW introduced the BMW M Hybrid V8 for the IMSA WeatherTech SportsCar Championship, marking its return to top-tier racing and EV development. McLaren continues to innovate with advanced aerodynamics in Formula 1 and has built a strong presence in IndyCar by partnering with Arrow Electronics to enhance performance through data analytics.

In motorcycle racing, Yamaha and Ducati dominate MotoGP. Yamaha focuses on engine development, while Ducati excels in aerodynamics and rider safety, driven by continuous technical advancements. Ducati's Desmosedici GP23 showcases improvements in performance, while Aprilia invests heavily in R&D to enhance the reliability and performance of its RS-GP bike. In the tire segment, Pirelli and MRF lead the market. Pirelli, a key supplier for Formula 1 and World Superbike, introduced new tire compounds in 2023 to optimize performance. MRF focuses on rally and endurance events, strengthening its global presence by expanding its high-performance tire portfolio.

The list of Key Market Participants Profiled In This Report Includes

- Mercedes AMG (Germany)

- BMW (Germany)

- McLaren (UK)

- Williams (UK)

- Yamaha (Japan)

- Ducati (Japan)

- Suzuki (Japan)

- Aprilia (Italy)

- Pirelli (Italy)

- MRF (India)

RECENT MARKET DEVELOPMENTS

- In 2024, Mercedes AMG restructured its GT Sports Division, establishing Affalterbach Racing GmbH and acquiring HWA AG to strengthen its position in GT sports.

- BMW introduced the BMW M Hybrid V8 for endurance racing in 2023, marking its return to top-tier motorsport.

- McLaren partnered with Arrow Electronics in 2023 to enhance its IndyCar performance using advanced data analytics.

- Williams Racing launched its upgraded FW45 car in 2023, securing new sponsorships from Gulf Oil and Michelob ULTRA.

- Yamaha invested in the YZR-M1 bike, improving engine and aerodynamics for MotoGP success.

- Ducati introduced the Desmosedici GP23 in 2023, focusing on improved aerodynamics and rider safety.

- Aprilia enhanced the RS-GP bike, investing in R&D to boost reliability and performance.

- Pirelli launched new tire compounds in 2023 for Formula 1 and Superbike racing.

- MRF expanded its rally tire portfolio, growing its global presence in international rally events.

- Suzuki shifted its focus to endurance racing after withdrawing from MotoGP in 2022, working on new motorsport technologies.

MARKET SEGMENTATION

This research report on the global motorsports market has been segmented and sub-segmented based on racing series, revenue channel, and region.

By Type

- League Organizers and Promoters

- Race teams

- Track Owners/Runners

By Racing Series

- One-Make Series

- Porsche Supercup

- Ferrari Challenge

- Lamborghini Super Trofeo

- Others

- Touring Car Racing

- World Touring Car Championship

- BTCC

- DTM

- Others

- Stock Car Racing

- NASCAR

- ARCA Menards Series

- Others

- GT Racing

- GT Series World Challenge (Blacpain GT Series)

- Super GT

- Intercontinental GT Challenge

- Others

- Endurance Racing

- World Endurance Championship (WEC)

- IMSA WeatherTech SportsCar Championship

- 24H Series

- Others

- Rally and Off-Road Racing

- World Rally Championship (WRC)

- European Rally Championship (ERC)

- Dakar Rally

- SCORE International Off-Road Racing

- Extreme E

- NHRA Drag Racing Series

- Others

- Formula Racing

- Formula 1

- Formula 2

- Formula E

- IndyCar

- Others

- Motorbike Racing

- MotoGP

- WorldSBK

- FIM EWC

- SuperMotoCross Championship (MX)

- British SuperBikes (BSB)

- MotoCross World Championship (MXGP)

- MotoAmerica Superbike Championship

- Others

By Revenue Channel

- Broadcasting

- Ticketing

- Sponsorship

- Merchandising

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Frequently Asked Questions

What is the current market size of the global motorsports market?

The current market size of the global motorsports market was valued at USD 6.42 billion in 2025.

How big is the global motorsports market?

The size of the global motorsports market was valued at USD 5.95 billion in 2024. The global market size is expected to be valued at USD 6.42 billion in 2025 from USD 11.80 billion by 2033, growing at a CAGR of 7.9% during the forecast period from 2025 to 2033.

What segments are added and which segment is the most dominating in the global motorsports market?

The Type, Racing Series Insights, Revenue Channel Insights, and region are the segments added to the global motorsports market. The racing series segment was the most dominating segment in this motorsports market.

Who are the market players that are msot dominating in the global motorsports market?

Mercedes AMG (Germany), BMW (Germany), McLaren (UK), Williams (UK), Yamaha (Japan), Ducati (Japan), Suzuki (Japan), Aprilia (Italy), Pirelli (Italy), MRF (India). These are the market players that are dominating the motorsports market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com