Global Motorcycles Market Size, Share, Trends & Growth Forecast Report – Segmented By Motorcycle Type. Propulsion Type, Engine Capacity And By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa) - Industry Analysis Forecast (2025 to 2033)

Global Motorcycles Market Size

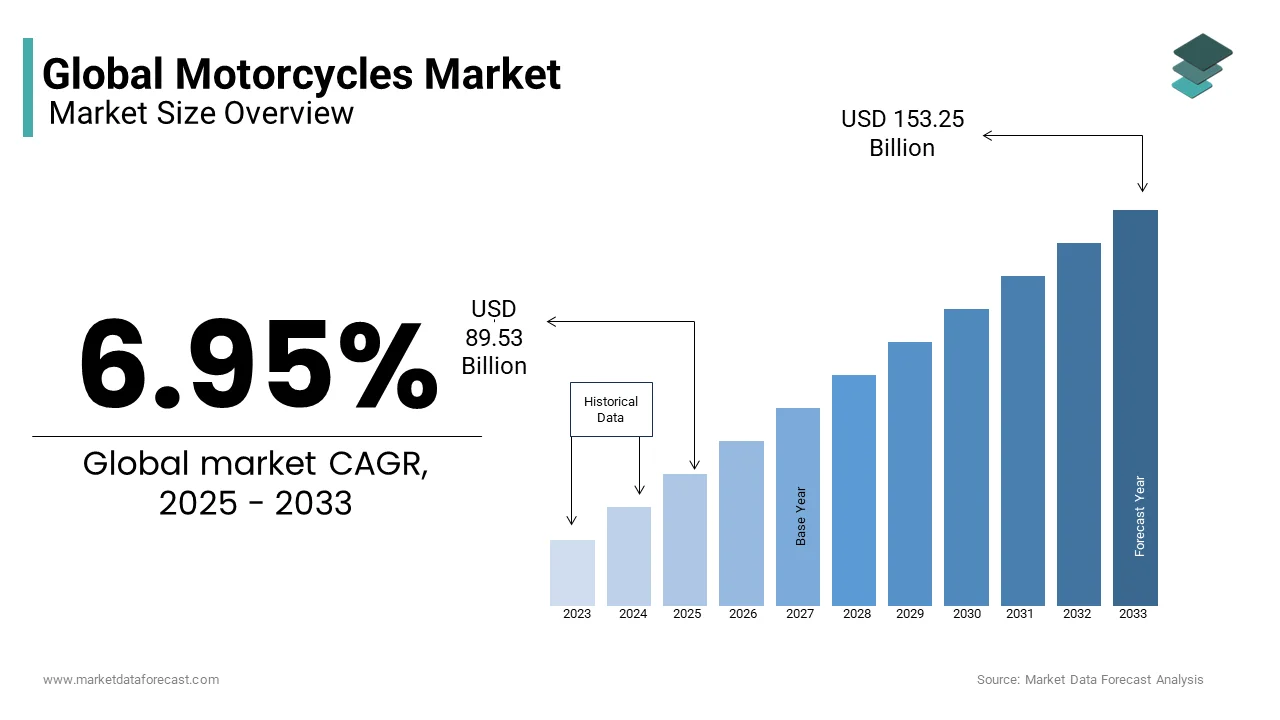

The global motorcycles market size was valued at USD 83.71 billion in 2024 and is anticipated to reach USD 89.53 billion in 2025 from USD 153.25 billion by 2033, growing at a CAGR of 6.95% during the forecast period from 2025 to 2033.

Motorcycles cater to diverse consumer needs that range from personal transportation and recreational riding to professional racing and adventure touring. In its essence, the motorcycle is not merely a mode of conveyance but an embodiment of freedom, efficiency, and cultural expression. Shifting societal preferences, and environmental concerns are majorly to fuel the demand for motorcycles in the coming years. Electric motorcycles are gaining traction as sustainability becomes a global priority, with companies like Harley-Davidson and Zero Motorcycles leading innovations in this space. According to the International Energy Agency, electric two-wheelers accounted for approximately 18% of global electric vehicle sales in 2023.

Motorcycles play a significant role in urban mobility solutions. The World Health Organization reports that over half of the world's population resides in cities, many of which face chronic traffic congestion. Motorcycles offer a practical alternative, occupying less space and consuming fewer resources than cars. Furthermore, data from the Motorcycle Industry Council reveals that motorcycling has seen increased participation among younger demographics, particularly millennials and Gen Z, who prioritize experiences over material possessions. This generational shift is reshaping marketing strategies within the industry. Additionally, the cultural significance of motorcycles persists globally; events such as Sturgis Rally in the United States attract hundreds of thousands of enthusiasts annually.

Market Drivers

Urbanization and the Need for Efficient Transportation Solutions

The rapid pace of urbanization is a significant driver propelling the motorcycles market forward. According to the Worl Bank, 56% of the global population lived in urban areas as of 2023, with projections indicating this figure will rise to 68% by 2050. This urban migration has intensified traffic congestion and increased demand for efficient, cost-effective transportation options. Motorcycles, with their smaller footprint and superior fuel efficiency, are an ideal solution for navigating crowded cityscapes. As per U.S. Environmental Protection Agency, motorcycles emit significantly lower levels of greenhouse gases per mile compared to cars, making them an environmentally friendly choice. Furthermore, governments in emerging economies, such as India and Indonesia are investing in road infrastructure to accommodate two-wheelers, boosting adoption rates among urban commuters.

Rising Interest in Sustainable Mobility and Electrification

The global push toward sustainable mobility is another critical factor driving the motorcycles market. Governments worldwide are implementing stringent emissions regulations to combat climate change, encouraging the adoption of electric motorcycles. The International Energy Agency reports that electric two-wheelers accounted for nearly 68% of all electric vehicles sold in China in 2022 is reflecting their widespread acceptance in densely populated regions. In Europe, the European Environment Agency notes that subsidies and tax incentives for electric vehicles have spurred a 40% year-over-year increase in electric motorcycle registrations. Additionally, advancements in battery technology have reduced costs and improved performance is making electric motorcycles more accessible. For instance, BloombergNEF estimates that lithium-ion battery prices have dropped by over 85% since 2010 by enhancing affordability. These trends enhance the pivotal role of sustainability in shaping consumer preferences and industry growth trajectories.

Market Restraints

Safety Concerns and High Accident Rates

Safety remains a significant restraint in the growth of the motorcycles market, as motorcyclists are disproportionately affected by road accidents. The World Health Organization reports that motorcycles account for 28% of global road traffic deaths, despite representing only a fraction of total vehicles on the roads. In low- and middle-income countries, where regulatory frameworks for road safety are often weaker, this figure rises significantly. For instance, data from the National Highway Traffic Safety Administration in the United States reveals that motorcyclists are 27 times more likely to die in a crash than passenger car occupants per mile traveled. Such alarming statistics deter potential buyers, particularly risk-averse individuals or families. Additionally, the lack of mandatory helmet laws in several regions exacerbates the issue. According to the Centers for Disease Control and Prevention, helmets reduce the risk of death by 37% and the risk of head injury by 69%. Therefore, creating awareness among public to use helmets may elevate the growth rate of the market.

Economic Volatility and Affordability Challenges

Economic instability poses another major restraint for the motorcycles market in developing nations where disposable incomes are volatile. The International Monetary Fund reports that inflation rates surged globally in 2023, with many emerging economies experiencing double-digit inflation, which directly impacts consumer purchasing power. Motorcycles, though generally more affordable than cars, still represent a significant financial investment for lower-income households. Furthermore, rising fuel prices have added to the operational costs of traditional internal combustion engine motorcycles is deterring potential buyers. For example, the U.S. Energy Information Administration notes that global gasoline prices increased by over 50% between 2021 and 2022 which is straining budgets for existing riders and discouraging new adopters. Even in developed markets, economic uncertainty has led to cautious spending behavior with consumers prioritizing essential expenses over discretionary purchases like motorcycles, thereby constraining market growth.

Market Opportunities

Expansion of Ride-Sharing and Delivery Services

The booming demand for ride-sharing and last-mile delivery services presents a significant opportunity for the motorcycles market. The rise of e-commerce has driven the need for efficient urban logistics, with motorcycles being a preferred choice due to their agility and cost-effectiveness. According to the U.S. Bureau of Labor Statistics, employment in the delivery and courier services sector grew by 20% between 2020 and 2023 is reflecting the increasing reliance on these services. In India, the Ministry of Road Transport and Highways reports that two-wheelers account for over 70% of vehicles used in food and parcel delivery operations. Additionally, platforms like Uber and DoorDash are increasingly partnering with motorcycle manufacturers to create specialized models tailored for delivery purposes. This trend is further bolstered by the International Labour Organization estimates that gig economy jobs will grow by 15% annually in urban areas that is creating a sustained demand for motorcycles as essential tools for livelihood generation.

Government Initiatives Promoting Electric Mobility

Government policies promoting electric mobility offer another promising avenue for growth in the motorcycles market. Many countries are introducing subsidies, tax incentives, and infrastructure development programs to encourage the adoption of electric motorcycles. For instance, the European Commission has allocated €20 billion under its Green Deal initiative to support electric vehicle adoption by 2030, with a specific focus on two-wheelers. Similarly, China's National Development and Reform Commission has mandated that 30% of all new two-wheeler sales must be electric by 2025 which is driving manufacturers to expand their product portfolios. In the United States, the Department of Energy studies have shown that federal tax credits of up to $4,000 are available for electric motorcycle purchases by making them more accessible to consumers. These initiatives not only reduce dependency on fossil fuels but also position electric motorcycles as a viable solution for environmentally conscious buyers is fostering innovation and market expansion.

Market Challenges

Stringent Emission Regulations and Compliance Costs

The motorcycles market faces significant challenges due to increasingly stringent emission regulations imposed by governments worldwide. The European Environment Agency has mandated that all new motorcycles meet Euro 5 emission standards which require advanced technologies to reduce carbon monoxide and hydrocarbon emissions. Compliance with such regulations often necessitates substantial investments in research and development is posing financial burdens on manufacturers among smaller market players. In the United States, the Environmental Protection Agency reports that non-compliance penalties can reach up to $4,500 per vehicle. Additionally, retrofitting existing models to meet these standards can increase production costs by 15-20%, as noted by the International Council on Clean Transportation. These regulatory pressures are forcing manufacturers to innovate rapidly, but the associated costs risk pricing out budget-conscious consumers, especially in emerging markets where affordability is a key purchasing factor.

Infrastructure Gaps for Electric Motorcycles

The lack of adequate charging infrastructure remains a critical challenge for the widespread adoption of electric motorcycles. The International Energy Agency noted that while electric cars have seen significant investment in charging networks, two-wheelers often remain underserved, with only 10% of public charging stations globally catering to electric motorcycles as of 2023. In rural areas, this gap is even more pronounced. For instance, the U.S. Department of Energy notes that 60% of rural regions lack any form of public charging infrastructure is limiting the feasibility of long-distance travel for electric motorcycle users. Furthermore, the World Bank reports that in developing countries like India and Indonesia is less than 5% of urban households have access to dedicated charging facilities at home. This infrastructure deficit not only hampers consumer confidence but also slows the transition to sustainable mobility is creating a barrier to the broader acceptance of electric motorcycles in the market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

6.95% |

|

Segments Covered |

By Motor cycle, Propulsion Type, Engine Capacity, and Region. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Honda Motor Co., Ltd. ( Japan)TVS Motor Company Ltd. (India), Bajaj Auto Ltd. (India), Yamaha Motors Co. ( Japan), Suzuki Motor Corporation (Japan), Triumph Motorcycles (U.K.), Bayerische Motoren Werke (BMW) AG (Germany), Harley-Davidson, Inc. (U.S.), Hero MotoCorp Ltd. (India), Kawasaki Motors Corp (Japan) |

SEGMENT ANALYSIS

By Motorcycle Type

The standard motorcycles segment dominated the market by holding a 35.5% of the global market share in 2024. The versatility of standard motorcycles appeals to both novice riders and experienced enthusiasts is making them ideal for commuting, casual riding, and light touring. The affordability of standard motorcycles, with prices often 20-30% lower than specialized types like sports or touring bikes, further boosts their popularity. The U.S. Department of Transportation reports show that standard motorcycles account for over 40% of first-time buyer purchases due to their user-friendly design. This segment's importance lies in its accessibility, bridging urban commuters and recreational riders is ensuring steady demand across diverse demographics.

The electric sports segment is a promising segment and is anticipated to grow at a faster CAGR of 18.5% from 2025 to 2033 due to the advancements in battery technology that reduce costs by 15% annually since 2020, as per BloombergNEF. Governments worldwide are incentivizing electric vehicle adoption with innovative initiatives to attract consumers. For instance, the European Commission offers subsidies up to €5,000 for electric motorcycles. Additionally, the U.S. Environmental Protection Agency notes that electric sports bikes produce zero tailpipe emissions with sustainability goals. Their high performance, coupled with environmental benefits, attracts tech-savvy millennials and Gen Z riders is driving demand. This segment's growth rate is additionally to increase with the shifting trend toward eco-friendly and high-performance vehicles.

By Propulsion Type

The Internal Combustion Engine (ICE) segment held the largest share of the global motorcycles market in 2024. The growth of the ICE segment in the global market is attributed to their widespread availability which is established manufacturing infrastructure, and affordability compared to electric alternatives. ICE motorcycles remain critical for consumers in developing regions like Southeast Asia, where over 90% of households rely on them for daily commuting, as reported by the Asian Development Bank. Their importance lies in providing cost-effective mobility solutions in densely populated areas.

The electric segment is expected to grow at a CAGR of 12.5% from 2025 to 2033 due to the government incentives, declining battery costs, and heightened environmental awareness. BloombergNEF reports that lithium-ion battery prices have fallen by over 85% since 2010 that is making electric motorcycles more affordable. Additionally, the European Environment Agency notes that subsidies for electric vehicles can cover up to 30% of purchase costs in some countries, accelerating adoption. In China, the National Development and Reform Commission mandates that 30% of all new two-wheelers must be electric by 2025 which further propels the market growth. The segment's importance lies in reducing urban emissions and fostering sustainable mobility is positioning it as a transformative force in the motorcycles market.

By Engine Capacity

The up to 200cc segment accounted for the leading share of the global motorcycles market in 2024 2024. The affordability and suitability of up to 200cc motorcycles for urban commuting, particularly in densely populated regions like South Asia and Africa is majorly driving the growth of the segment in the global market. The World Bank studies reported that over 70% of households in India and Indonesia rely on two-wheelers with engine capacities below 200cc for daily transportation. These motorcycles are fuel-efficient, easy to maneuver, and cost-effective by making them ideal for first-time buyers and lower-income groups. Their widespread adoption amplifies their role in providing accessible mobility solutions in emerging economies where personal vehicle ownership is rising rapidly.

The more than 800cc segment is the fastest-growing segment with a likely CAGR of 12.5% from 2025 to 2033 due to factors such as the increasing disposable incomes and a growing preference for premium motorcycles among enthusiasts in developed markets like North America and Europe. The European Motorcycle Industry Association notes that luxury touring and adventure motorcycles in this segment have gained popularity due to advancements in technology, such as advanced rider assistance systems and connectivity features. Additionally, the rise of motorcycle tourism has fueled demand, with riders seeking high-performance bikes for long-distance travel. This segment's growth reflects shifting consumer priorities toward experiential spending and makes its importance in driving innovation and profitability within the industry.

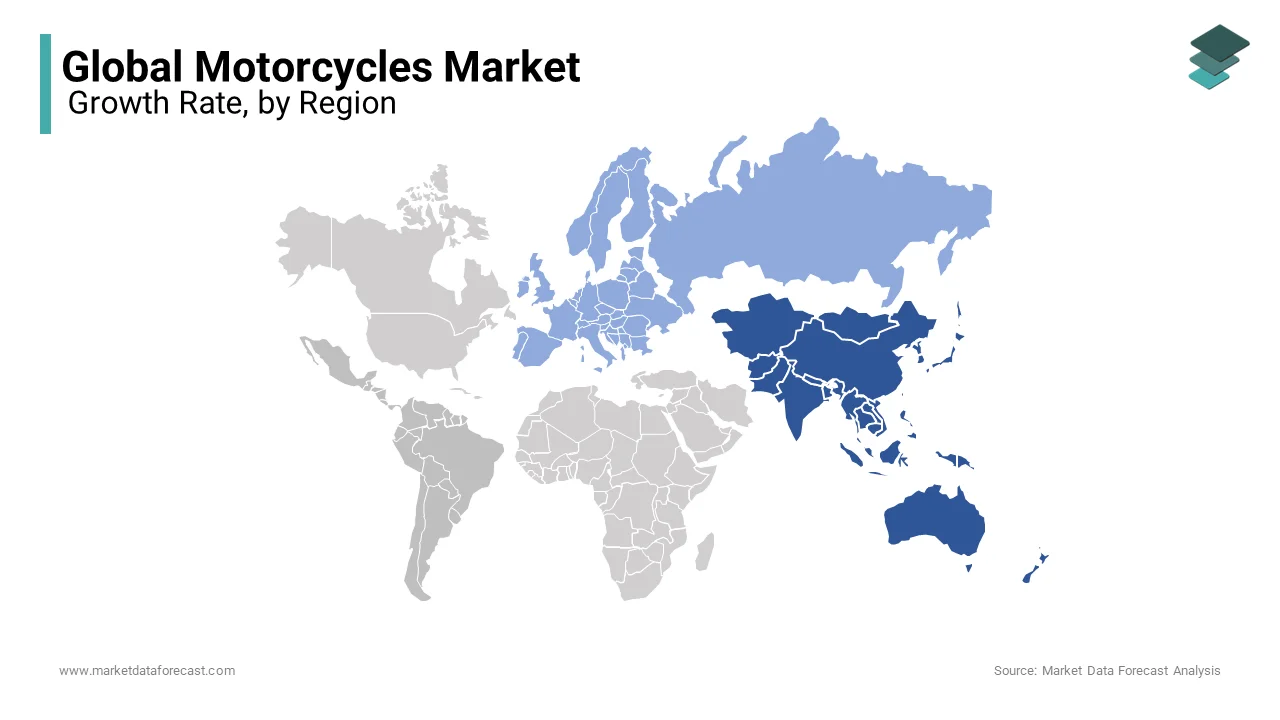

REGIONAL ANALYSIS

The Asia-Pacific region dominated the motorcycles market by holding the major share of the global market in 2024. Factors such as the vast population of Asia-Pacific, rapid urbanization, and reliance on motorcycles as a primary mode of transportation are boosting the motorcycles market expansion in this region. In India and China alone, two-wheelers represent over 80% of all vehicles sold, according to the Asian Development Bank. The affordability and fuel efficiency of motorcycles make them indispensable in densely populated cities. Additionally, governments in the region are promoting electric two-wheelers, with India's Ministry of Heavy Industries targeting 40% electrification of two-wheelers by 2030.

Europe is the fastest-growing region in the motorcycles market is likely to expand with a CAGR of 10.8% from 2025 to 2033. This rapid growth is fueled by stringent emissions regulations and a strong push toward electric mobility. The European Commission’s Green Deal initiative, which mandates a 55% reduction in carbon emissions by 2030 has accelerated the adoption of electric motorcycles. Additionally, consumer preferences are shifting toward premium and adventure motorcycles, with countries like Germany and France leading sales in this segment. As per International Energy Agency, electric two-wheeler registrations in Europe surged by over 40% in 2022 alone is driven by subsidies and tax incentives. This region's focus on sustainability and innovation elevated its importance as a key driver of transformation in the global motorcycles market.

North America is expected to witness steady growth with the growing demand for high-performance and electric motorcycles, with the U.S. Department of Energy projecting a 15% increase in electric motorcycle adoption by 2025. Latin America will likely see moderate growth, supported by urban mobility needs in Brazil, where the National Association of Motor Vehicle Manufacturers forecasts a 5% annual rise in motorcycle sales. The Middle East and Africa will benefit from infrastructure investments and rising urbanization, with motorcycle taxis playing a crucial role in Sub-Saharan Africa. Meanwhile, Asia-Pacific will remain dominant but faces challenges like regulatory shifts toward electrification. Collectively, these regions will contribute to a diversified and evolving global motorcycles market.

KEY MARKET PLAYERS

Honda Motor Co., Ltd. ( Japan)TVS Motor Company Ltd. (India), Bajaj Auto Ltd. (India), Yamaha Motors Co. ( Japan), Suzuki Motor Corporation (Japan), Triumph Motorcycles (U.K.), Bayerische Motoren Werke (BMW) AG (Germany), Harley-Davidson, Inc. (U.S.), Hero MotoCorp Ltd. (India), Kawasaki Motors Corp (Japan). These are the market players that are dominating the global motorcycle market.

Top 3 Players in the market

Honda Motor Co., Ltd. (Japan)

Honda Motor Co., Ltd. is a global leader in the motorcycles market, renowned for its extensive and diverse product portfolio. The company caters to a wide range of segments, from affordable commuter bikes like the Honda Activa to high-performance models such as the CBR series. Honda’s commitment to innovation is evident in its development of fuel-efficient engines and advancements in electric mobility, including the introduction of the Honda EV-neo electric scooter. Its strong global presence and reputation for reliability have made it a household name in both developed and emerging markets. Honda’s focus on sustainability and cutting-edge technology continues to drive its leadership in the industry.

TVS Motor Company Ltd. (India)

TVS Motor Company has established itself as a prominent player in the global motorcycles market, particularly in the affordable and mid-range segments. The company’s flagship models, such as the TVS Jupiter and Apache series, are celebrated for their affordability, durability, and innovative features, including advanced connectivity options. TVS has also made significant progress in the electric mobility space with the launch of the TVS iQube electric scooter, which has gained popularity in urban areas. Its strategic focus on expanding into international markets, especially in Asia, Africa, and Latin America, has strengthened its global footprint. TVS’s emphasis on quality and customer-centric innovations ensures its continued growth and influence in the industry.

Yamaha Motor Co., Ltd. (Japan)

Yamaha Motor Co., Ltd. is a key contributor to the global motorcycles market, known for its performance-oriented and technologically advanced products. The company offers a wide array of motorcycles, ranging from entry-level commuter bikes like the Yamaha FZ series to premium models such as the Yamaha YZF-R1. Yamaha’s strong association with motorsports has enhanced its brand image, with its bikes achieving numerous victories in global racing events. The company’s focus on developing lightweight, efficient engines has further accelerated its dominance in both developed and emerging markets. Yamaha’s strategic manufacturing facilities in regions like Southeast Asia and India have enabled it to meet local demands while fostering regional economic growth. Its dedication to innovation and performance continues to shape the future of motorcycling.

Top strategies used by the key market participants

Product Innovation and Diversification

Key players in the motorcycles market are heavily investing in product innovation to cater to evolving consumer preferences and regulatory demands. Companies like Honda and Yamaha are focusing on developing fuel-efficient engines, lightweight materials, and advanced connectivity features such as Bluetooth integration and smartphone compatibility. For instance, Yamaha’s YZF-R1 model incorporates cutting-edge electronics like traction control and ride-by-wire systems, appealing to performance enthusiasts. Similarly, TVS Motor Company has introduced innovative features like ethanol-powered bikes and AI-based safety systems in its Apache series. Electric mobility is another major focus area, with brands like Harley-Davidson launching electric models like the LiveWire to tap into the growing demand for sustainable transportation. These innovations not only enhance brand reputation but also allow companies to diversify their offerings across segments.

Strategic Partnerships and Collaborations

Collaborations and partnerships have become a cornerstone strategy for strengthening market position. For example, Bajaj Auto Ltd. has partnered with global brands like Kawasaki to co-develop products and expand its reach in international markets. Similarly, BMW Motorrad collaborates with TVS Motor Company to produce mid-range motorcycles like the BMW G 310 R, combining German engineering with Indian cost-efficiency. Such alliances enable companies to share technological expertise, reduce production costs, and penetrate new regions. Additionally, partnerships with tech firms are helping manufacturers integrate smart technologies, such as IoT-enabled tracking systems and predictive maintenance tools, further enhancing the appeal of their products.

Expansion into Emerging Markets

Emerging markets in Asia, Africa, and Latin America represent significant growth opportunities, prompting key players to establish localized manufacturing and distribution networks. Hero MotoCorp, for instance, has set up assembly plants in countries like Colombia and Bangladesh to meet regional demand while reducing costs. Similarly, Honda has expanded its production facilities in India and Southeast Asia to cater to the growing appetite for affordable two-wheelers. These expansions are often supported by government incentives, such as tax breaks or subsidies, which make it easier for companies to scale operations. By focusing on affordability and accessibility, these players are capturing untapped customer bases in low- and middle-income regions.

Focus on Sustainability and Electrification

As environmental regulations tighten globally, leading motorcycle manufacturers are prioritizing sustainability through electrification. Suzuki Motor Corporation and Kawasaki Motors Corp. are investing heavily in research and development to launch hybrid and fully electric models. For instance, Zero Motorcycles, though smaller in scale, has influenced larger players like Harley-Davidson to adopt electric drivetrains. Governments in Europe and North America are offering subsidies for electric vehicles, encouraging brands to align their strategies with green initiatives. This shift not only helps companies comply with emissions standards but also positions them as leaders in the transition toward sustainable mobility.

Brand Building and Motorsports Engagement

Engaging in motorsports and building a strong brand identity remain critical strategies for premium players like Triumph and Harley-Davidson. Participating in events like MotoGP and the Isle of Man TT enhances brand visibility and reinforces their association with performance and adventure. Harley-Davidson, for instance, leverages its iconic brand image through community-building initiatives like the Harley Owners Group (HOG), fostering customer loyalty. Similarly, Triumph’s involvement in high-profile racing events has helped it carve a niche in the premium motorcycle segment. These strategies create emotional connections with customers, driving long-term brand equity and sales.

COMPETITIVE LANDSCAPE

The global motorcycles market is characterized by intense competition, with a mix of established giants and emerging players vying for market share. Leading companies such as Honda, Yamaha, and Bajaj Auto dominate the industry through their extensive product portfolios, cutting-edge innovations, and strong distribution networks. These players leverage economies of scale to maintain affordability while investing heavily in research and development to introduce advanced technologies like electric drivetrains, AI-based safety systems, and connectivity features. For instance, Honda’s focus on hybrid models and Yamaha’s emphasis on lightweight performance bikes highlight their commitment to staying ahead in a rapidly evolving market.

Emerging markets in Asia, Africa, and Latin America have become battlegrounds for competitive expansion, with manufacturers like TVS Motor Company and Hero MotoCorp capitalizing on affordable offerings tailored to local preferences. Meanwhile, premium brands such as Harley-Davidson and BMW Motorrad differentiate themselves through brand prestige, customization options, and motorsports engagement. Strategic collaborations, such as Bajaj’s partnership with Kawasaki, further intensify competition by enabling shared expertise and expanded reach.

The shift toward sustainability has added another layer of rivalry, as companies race to develop electric motorcycles that comply with stringent emissions regulations. Government incentives for green vehicles have amplified this trend, pushing firms to innovate faster. Additionally, regional players in countries like China and India are gaining traction by offering cost-effective solutions, challenging the dominance of traditional leaders.

RECENT HAPPENINGS IN THIS MARKET

In March 2023, Honda Motor Co., Ltd. launched the EV-neo electric scooter in Japan and select Asian markets. This launch is anticipated to allow Honda to cater to urban commuters seeking eco-friendly transportation solutions and strengthen its position in the growing electric mobility segment.

In 2021, TVS Motor Company, an Indian motorcycle manufacturer, partnered with the Bahamian government to supply electric motorcycles for public transportation.

This partnership is anticipated to allow TVS to expand its global footprint while promoting sustainable mobility solutions in emerging markets.

In May 2021, Yamaha Motor Co., Ltd., a Japanese motorcycle giant, introduced the YZF-R7 mid-range supersport motorcycle. This introduction is anticipated to allow Yamaha to attract performance enthusiasts with an affordable yet high-performance model, reinforcing its dominance in the sports bike category.

In July 2023, Bajaj Auto Ltd., an Indian two-wheeler manufacturer, collaborated with Triumph Motorcycles to co-develop mid-capacity bikes for emerging markets.

This collaboration is anticipated to allow Bajaj to combine British engineering with Indian cost efficiency, targeting new customer segments and enhancing its global presence.

In February 2025, Harley-Davidson, Inc., an American motorcycle manufacturer, unveiled the Pan America 1250 Special adventure touring motorcycle.

This unveiling is anticipated to allow Harley-Davidson to diversify its product portfolio beyond its traditional cruiser segment and establish a strong presence in the growing adventure bike market.

In 2024, Hero MotoCorp Ltd., the world’s largest two-wheeler manufacturer, invested Rs 124 crore into Ather Energy, an Indian electric scooter startup.

This investment is anticipated to allow Hero MotoCorp to accelerate the development and adoption of affordable electric vehicles in India while strengthening its commitment to sustainable mobility

In July 2024, BMW Motorrad, a German premium motorcycle brand, launched the CE 04 electric scooter targeting urban professionals.

This launch is anticipated to allow BMW to offer futuristic design and advanced connectivity features, reinforcing its focus on sustainable urban mobility

MARKET SEGMENTATION

This research report on the global motorcycle market is segmented and sub-segmented into the following categories.

By Motorcycle Type

- Standard

- Sports

- Cruiser

- Touring

- Others

By Propulsion Type

- ICE

- Electric

By Engine Capacity

- Up to 200cc

- 200cc to 400cc

- 400cc to 800cc

- More than 800cc

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Frequently Asked Questions

What is the current market size of the global motorcycle market?

The current market size of the global motorcycle market size was valued at USD 89.53 billion in 2025.

What challenges are faced by the global motorcycle market?

The Stringent emission regulations compliance costs and Infrastructure gaps for electric motorcycles are the market drivers that are driving the motorcycle market.

Which region is the most dominating country in this global motorcycle market?

The Asia-Pacific region dominated the motorcycle market by holding the major share of the global market in 2024.

Who are the market players that are dominating the global motorcycle market?

Honda Motor Co., Ltd. ( Japan)TVS Motor Company Ltd. (India), Bajaj Auto Ltd. (India), Yamaha Motors Co. ( Japan), Suzuki Motor Corporation (Japan), Triumph Motorcycles (U.K.), Bayerische Motoren Werke (BMW) AG (Germany), Harley-Davidson, Inc. (U.S.), Hero MotoCorp Ltd. (India), Kawasaki Motors Corp (Japan).

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]