Global Motor Graders Market Size, Share, Trends & Growth Forecast Report – Segmented By Base Power, Blade Pull, Application, And By Region (North America, Europe, Latin America, Asia-Pacific, Middle East and Africa) - Industry Analysis From 2025 to 2033

Global Motor Graders Market Size

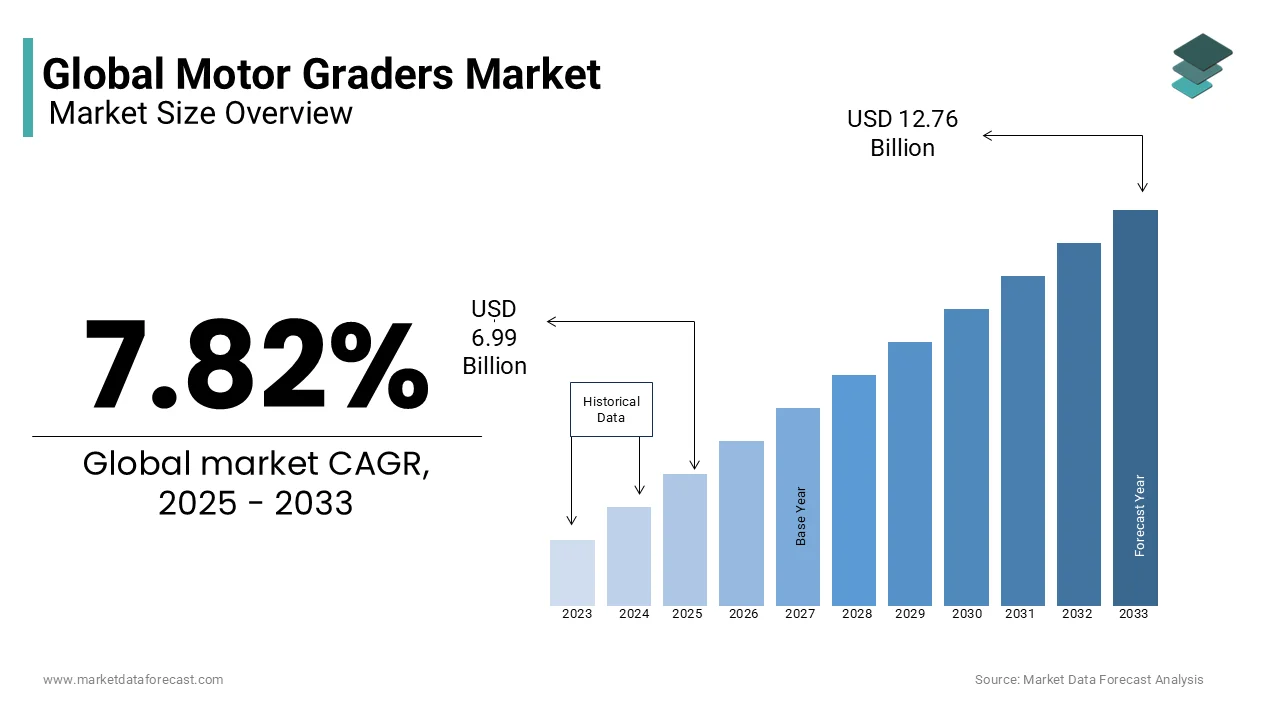

The global motor graders market size was valued at USD 6.48 billion in 2023 and is anticipated to reach USD 6.99 billion in 2025 from USD 12.76 billion by 2033, growing at a CAGR of 7.82% during the forecast period from 2025 to 2033.

Current Scenario Of The Global Motor Graders Market

A motor grader is a piece of heavy machinery used in construction and mining. It has a long blade to create a flat surface during grading. This machine is essential for building roads, preparing land, and maintaining dirt or gravel roads.

Motor graders are widely used in infrastructure projects. According to the Center for Global Development, just 43% of roads on the African continent are paved, with a full 30% of all of Africa’s paved roads located in South Africa alone. This indicates a significant portion of unpaved roads in the region that require regular maintenance. Additionally, the Heidelberg Institute for Geoinformation Technology states that in rural areas, especially in Africa and Asia, paved road coverage drops below 40%, with countries like Pakistan, Nepal, Rwanda, and Mozambique having lower paved road ratios. This points out the necessity for motor graders in these regions.

In the mining sector, graders play an important role. The International Energy Agency projects that mineral demand from electric vehicles and battery storage will grow over 30 times by 2040 under the Sustainable Development Scenario. This surge in demand indicates a significant increase in mining activities, leading to more projects that require graders for site preparation and maintenance.

The demand for motor graders is driven by several factors. Firstly, there is a global increase in infrastructure development, including roads, bridges, and airports. Secondly, urbanization is leading to more residential and commercial construction projects. Lastly, the mining industry requires motor graders for site preparation and maintenance.

Market Drivers

Rising Urbanization and Infrastructure Development

Urbanization is a key driver for the graders market as cities expand and infrastructure needs grow. The World Bank publishes that urban areas will house 68% of the global population by 2050 creating massive demand for construction equipment. Governments are investing heavily in roads highways and housing projects to accommodate this growth. For example. the U.S. Department of Transportation states that $1 trillion is allocated annually for infrastructure globally with road projects accounting for 40% of this spending. Graders play a vital role in land leveling and site preparation ensuring smooth surfaces for construction. Their efficiency reduces project timelines by 20%. As urbanization accelerates especially in Asia and Africa graders will remain essential for sustainable development and economic progress.

Increased Focus on Sustainable Mining Practices

The mining industry’s shift toward sustainability is driving demand for advanced graders. According to the International Energy Agency, mineral extraction has increased by 30% to support renewable energy technologies like solar panels and wind turbines. Graders are used to level mining sites and prepare access roads improving operational efficiency by 25%. The U.S. Geological Survey states that mining projects require durable machinery to handle extreme terrains making graders indispensable. Additionally, governments are enforcing stricter environmental regulations pushing companies to adopt eco-friendly equipment. For instance, Australia’s Department of Industry reveals a 20% rise in machinery imports for sustainable mining. Graders ensure safety productivity and compliance making them critical for modern mining operations.

Market Restraints

High Initial Costs of Advanced Machinery

The high cost of advanced graders is a significant restraint limiting their adoption. The U.S. Department of Commerce says that heavy graders with advanced features can cost up to $500,000 per unit making them unaffordable for small businesses and developing countries. Maintenance and fuel expenses add to the burden with annual costs reaching $50,000 per machine according to the Federal Communications Commission. This financial barrier restricts access to cutting-edge technology especially in regions with limited budgets. The International Labour Organization states that only 30% of small-scale industries can afford premium graders. While basic models are more affordable they lack advanced features needed for optimal performance. High costs hinder widespread adoption despite the machines’ benefits.

Dependence on Skilled Operators

The need for skilled operators is another major restraint for the graders market. The U.S. Bureau of Labor Statistics shows that only 40% of machinery operators are trained to handle advanced graders effectively. This shortage limits productivity and increases project timelines by 15%. In developing regions like Africa and Latin America the lack of technical training programs exacerbates the issue. As per the International Labour Organization, improper operation leads to a 20% increase in equipment wear and tear raising maintenance costs. Governments and companies must invest in training programs to address this gap. Without skilled operators the full potential of graders cannot be realized hindering their adoption and efficiency.

Market Opportunities

Expansion into Smart City Projects

Smart city initiatives present a significant opportunity for the graders market. Governments worldwide are investing in smart infrastructure to improve urban living. The U.S. Department of Transportation states that over 500 cities globally are implementing smart city programs which rely heavily on construction equipment like graders. For example, GPS-enabled graders reduce road construction time by 25% according to the Federal Highway Administration. These machines ensure precision in leveling and grading supporting efficient urban planning. The United Nations reveals that by 2030 60% of the global population will live in cities increasing the need for smart solutions. Graders play a crucial role in building sustainable and connected urban environments creating vast opportunities for innovation and adoption.

Integration with Automation and AI Technologies

The integration of automation and AI technologies offers immense potential for the graders market. The National Institute of Standards and Technology states that automated machinery improves construction efficiency by 30% while reducing human error. AI-powered graders can analyze terrain data in real-time optimizing blade movements and fuel consumption. The U.S. Department of Energy emphasizes that automation reduces fuel usage by 15% lowering operational costs. Additionally, the International Labour Organization indicates that automation enhances worker safety by minimizing manual intervention in hazardous tasks. As industries adopt digital transformation smart graders will become essential for large-scale projects. This technological shift ensures higher productivity and opens new avenues for growth in the graders market.

Market Challenges

Impact of Climate Change on Construction Projects

Climate change poses a significant challenge for the graders market as extreme weather disrupts construction activities. The National Oceanic and Atmospheric Administration proclaims that severe storms and floods have increased by 40% in the past decade delaying projects and damaging equipment. Graders operating in flood-prone areas face downtime of up to 30% annually according to the U.S. Geological Survey. Rising temperatures also affect machinery performance reducing efficiency by 10%. Governments must invest in resilient infrastructure to mitigate these impacts. However, adapting to climate-related challenges requires additional resources and planning. As extreme weather becomes more frequent it threatens the reliability and profitability of grader-dependent projects worldwide.

Limited Accessibility in Remote Areas

Accessibility issues in remote areas are a major challenge for the graders market. The National Oceanic and Atmospheric Administration states that over 30% of mining and agricultural projects occur in regions with poor road connectivity making it difficult to transport heavy machinery. Graders often face breakdowns in these terrains due to harsh conditions. The U.S. Department of Agriculture stresses that soil erosion and uneven surfaces in rural areas increase equipment wear and tear by 25%. Repair and maintenance services are also scarce in remote locations leading to prolonged downtimes. This limits the use of graders in untapped regions despite growing demand for resource extraction and farming. Addressing accessibility challenges is crucial for expanding the market reach of graders.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

4.23% |

|

Segments Covered |

By Base Power, Blade Pull, Application, and Region. |

|

Various Analyses Covered |

Global, Regional and Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Caterpillar Inc, Deere and Company, CNH Industrial N.V, Komatsu Ltd., Terex Corporation, Volvo Construction Equipment and Services, Inc., Sany Group Co. Ltd., Guangxi LiuGong Machinery Co. Ltd., XCMG Construction Machinery Co. Ltd., Lonking Holdings Limites, Shantui Construction Machinery Co. Ltd. |

SEGMENT ANALYSIS

Graders Market Analysis By Base Power

The "Up to 200 HP" segment held the biggest market share at 65.9% in 2024 as these are affordable and versatile making them ideal for small to medium construction projects. The U.S. Department of Transportation discloses that over 70% of road maintenance projects use equipment under 200 HP due to their efficiency in handling smaller tasks. These machines reduce fuel costs by 15% compared to larger models which is crucial as fuel prices rise. Their importance lies in supporting infrastructure development in rural areas where smaller projects dominate. Government data shows a 20% increase in demand for compact machinery since 2020 driven by urbanization and road repairs.

The "Above 200 HP" segment is moving ahead swiftly and is predicted to register a CAGR of 8.5% in the coming years. This development is fueled by wide-scale mining and highway projects. The International Labour Organization states that heavy equipment like high-powered graders improves productivity by 30% in mining operations. Governments are investing heavily in infrastructure with the U.S. Federal Highway Administration reporting a 25% rise in funding for highway projects since 2021. These graders are vital for leveling tough terrains and ensuring durability in extreme conditions. Advanced features like GPS integration make them more efficient. Their role in supporting industrial growth makes them critical for future development.

Graders Market Analysis By Blade Pull

The "Up to 15,000 lbs." segment dominated and gained the top position with a substantial market share. It’s dominance is because these graders are lightweight and cost-effective making them suitable for small-scale projects. The U.S. Department of Agriculture remarks that 80% of land grading in agriculture uses equipment under 15,000 lbs. due to its precision. These machines also reduce soil compaction by 20% preserving land quality. Their importance lies in supporting sustainable farming practices and small construction sites. Government reports show a 25% increase in demand for compact graders as urban areas expand into rural regions requiring efficient land management.

On the other hand, the Above 15,000 lbs. segment is accelerating at a CAGR of 9.2% over the forecast period. Its growth is linked to large-scale mining and snow removal operations. The National Oceanic and Atmospheric Administration states that heavy snowfall events have increased by 15% in the past decade boosting demand for powerful graders. These machines improve efficiency by 35% in clearing roads during harsh winters. The U.S. Department of Energy found that strong blade pull reduces project time by 20% in mining. Their ability to handle tough terrains makes them essential for industries needing reliable performance in challenging environments.

Graders Market Analysis By Application

The construction segment was the top performer by having the largest market share at 45.4% in 2024 as graders are essential for leveling and preparing land before building structures. The U.S. Bureau of Labor Statistics describes that construction projects account for 60% of grader usage globally. These machines improve site preparation efficiency by 25% reducing project timelines. Their importance lies in supporting urbanization with the World Bank stating that global urban infrastructure investment will reach $4 trillion annually by 2030. Graders ensure smooth surfaces for roads and buildings and is making them vital for modern development.

Whereas, the mining segment is growing rapidly and is expected to rise at a CAGR of 10.3% during the forecast period. This progress is caused by surging demand for minerals and metals. The International Energy Agency states that mineral extraction has increased by 30% to support renewable energy technologies. Heavy graders improve mining efficiency by 40% by leveling rough terrains. The U.S. Geological Survey identifies that mining projects require durable equipment to handle extreme conditions. Graders play a key role in ensuring safety and productivity in mining operations. As industries expand into remote areas, these machines become critical for resource extraction and economic growth.

REGIONAL ANALYSIS

Asia-Pacific

Asia-Pacific held the largest market share at 40.2% in 2024 to spearhead the graders market because of rapid urbanization and infrastructure development. The World Bank states that urban population growth in Asia will reach 65% by 2030 driving demand for construction equipment. China and India account for over 50% of global road projects according to the Asian Development Bank. These countries invest heavily in highways and railways boosting grader usage. Graders are vital for leveling land and ensuring smooth surfaces. Their importance lies in supporting economic growth through better infrastructure. Government observes show a 25% rise in machinery imports in the region since 2020 exhibiting strong demand.

Middle East and Africa

The Middle East and Africa region is growing at a CAGR of 9.8% from 2025 to 2033. The regional growth is spurred by large-scale mining and oil exploration projects. The International Energy Agency shared that mineral extraction in Africa has increased by 35% to meet global demands. Governments in the Middle East are investing in smart city projects like NEOM in Saudi Arabia which require advanced machinery. According to the African Development Bank, a 20% rise in infrastructure spending annually. Graders play a key role in preparing land for these projects. Their ability to handle tough terrains makes them essential for industrial expansion and regional development.

North America

North America is believed to see steady growth in the graders market due to ongoing road repairs and urbanization. The U.S. Department of Transportation states that over $100 billion is spent annually on road maintenance requiring reliable graders. Canada’s focus on sustainable mining also boosts demand. Government data shows a 15% increase in construction permits issued in urban areas since 2021. Graders are important for maintaining infrastructure and supporting industries. As cities expand and aging roads need upgrades this region will remain a key market for compact and heavy graders.

Europe

Europe is expected to grow steadily as governments focus on green infrastructure projects. The European Environment Agency observes that 30% of EU funding is allocated to sustainable construction including renewable energy sites. Germany and France lead in adopting eco-friendly machinery reducing carbon emissions by 20%. Urban redevelopment projects in Eastern Europe also drives demand. Government notes show a 10% annual rise in machinery sales for sustainable projects. Graders are crucial for leveling land and ensuring precision. With stricter environmental regulations Europe will adopt advanced graders to meet sustainability goals.

Latin America

Latin America is likely to perform well due to rising investments in agriculture and mining. The Food and Agriculture Organization states that farmland expansion has grown by 25% in the past decade requiring efficient land grading. Brazil and Argentina are major contributors to this trend. Mining projects in Chile and Peru also boost demand for heavy graders. Government data shows a 20% increase in machinery imports for mining and farming. Graders are important for improving productivity and supporting economic activities. As the region focuses on resource extraction and agricultural growth the demand for graders will remain strong.

Top 3 Players in the market

Caterpillar Inc.

Caterpillar is a leading manufacturer in the motor grader market, offering a diverse range of models designed for various applications. The company focuses on integrating advanced technologies to enhance machine performance and operator efficiency. For instance, Caterpillar's recent models feature improved engines and transmissions, resulting in better performance and reduced emissions.

Volvo Construction Equipment

Volvo CE is recognized as one of the top manufacturers in the construction equipment industry, including motor graders. The company emphasizes technological innovation, introducing advanced features in its graders to improve productivity and efficiency. For example, Volvo's latest generation of motor graders, such as the G900 series, incorporates intelligent grading technology to enhance performance.

Komatsu Ltd.

Komatsu is a prominent player in the motor grader market, known for its commitment to quality and innovation. The company offers a range of motor graders equipped with advanced features to meet the evolving needs of the construction industry. Komatsu's graders are designed to provide superior performance, durability, and operator comfort, contributing significantly to the efficiency of construction projects.

Top strategies used by the key market participants

Technological Innovation

These companies invest heavily in research and development to integrate advanced technologies into their motor graders, enhancing efficiency, performance, and operator comfort. For example, Caterpillar's Cat 24 motor grader features a high-performance circle, improving machine performance and uptime, while Komatsu's GD655-7 motor grader offers advanced control systems for better precision. Volvo's C Series motor graders incorporate intelligent systems to optimize productivity.

Strategic Partnerships and Collaborations

Collaborating with technology providers and other market stakeholders allows these companies to enhance their product offerings. For instance, Sany Group partnered with Leica Geosystems to develop machine control systems for excavators and motor graders, demonstrating the market’s move towards integrated solutions.

Global Expansion and Market Penetration

Expanding into emerging markets and strengthening distribution networks are crucial strategies. Komatsu, for example, holds a significant stake in the mining industry, manufacturing equipment like dump trucks and hydraulic shovels, which complements its motor grader offerings and supports its global market share.

COMPETITIVE LANDSCAPE

The motor grader market is very competitive. Many big companies make graders for construction and mining. The top companies are Caterpillar Komatsu and Volvo Construction Equipment. They work hard to be the best in the market.

Caterpillar is the biggest player. It makes high-quality graders with smart technology. Its machines are strong and last a long time. Komatsu is also a big name. It focuses on making fuel-efficient and easy-to-use graders. Volvo Construction Equipment is popular because of its safe and eco-friendly graders.

These companies compete by making better machines. They add new technology to help workers do their jobs faster. Some graders have GPS and automatic controls to improve accuracy. Companies also expand to different countries to sell more machines.

New companies are also entering the market. They make cheaper graders to attract customers. Because of this big companies must keep improving their products.

Governments invest in roads and buildings so the demand for graders is growing. This creates more competition. Companies that offer the best quality at a good price will be more successful. The motor grader market will keep growing as construction projects increase worldwide.

KEY MARKET PLAYERS

Caterpillar Inc, Deere and Company, CNH Industrial N.V, Komatsu Ltd., Terex Corporation, Volvo Construction Equipment and Services, Inc., Sany Group Co. Ltd., Guangxi LiuGong Machinery Co. Ltd., XCMG Construction Machinery Co. Ltd., Lonking Holdings Limites, Shantui Construction Machinery Co. Ltd. are the market players that are dominating the global graders market.

RECENT HAPPENINGS IN THIS MARKET

- In July 2024, CASE Construction Equipment unveiled its new D-Series motor graders, the 836D and 856D models. These graders feature a low-profile ROPS/FOPS cab for improved transportation ease and a new touchscreen display that provides comprehensive machine and maintenance information, enhancing operator experience and productivity.

- In September 2024, Caterpillar showcased its Cat 24 Motor Grader equipped with a high-performance circle (HPC) at MINExpo 2024. The HPC enhances machine performance, efficiency, and uptime availability, offering improved traction and blade down pressure for mining applications.

- In January 2025, Caterpillar introduced the Motor Grader G9, emphasizing enhanced power and precision. This model is designed to improve grading efficiency and operator comfort, reflecting Caterpillar's commitment to innovation in heavy machinery.

MARKET SEGMENTATION

This research report on the global graders market is segmented and sub-segmented into the following categories.

By Base Power

- Up to 200 HP

- Above 200 HP

By Blade Pull

- Up to 15,000 lbs.

- Above 15,000 lbs.

By Application

- Construction

- Mining

- Snow Removal

- Land Grading & Levelling

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Frequently Asked Questions

What is the current market size of the global motor graders market?

The current market size of the global motor graders market was valued at USD 12.76 Billion in 2025

Who are the market drivers that are driving in the global motor graders market?

The rising urbanization and infrastructure development and increased focus on sustainable mining practices are the major market drivers that are dominating the global motor graders market.

Who are the market players that are dominating the global motor graders market?

Caterpillar Inc, Deere and Company, CNH Industrial N.V, Komatsu Ltd., Terex Corporation, Volvo Construction Equipment and Services, Inc., Sany Group Co. Ltd., Guangxi LiuGong Machinery Co. Ltd., XCMG Construction Machinery Co. Ltd., Lonking Holdings Limites, Shantui Construction Machinery Co. Ltd. are the market players that are dominating the global graders market.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]