Global Molecular Diagnostics Market Size, Share, Trends & Growth Forecast Report By Products and Service (Reagents and Kits, Instruments and Software and Service), Technology (Polymerase Chain Reaction (PCR), Isothermal Nucleic Acid Amplification Technology (INAAT)3, DNA Sequencing and NGS, DNA Microarrays, In Situ Hybridization and Other Technologies), End-User and Region (North America, Europe, Asia Pacific, Latin America, The Middle East and Africa), Industry Analysis From 2025 to 2033

Global Molecular Diagnostics Market Size

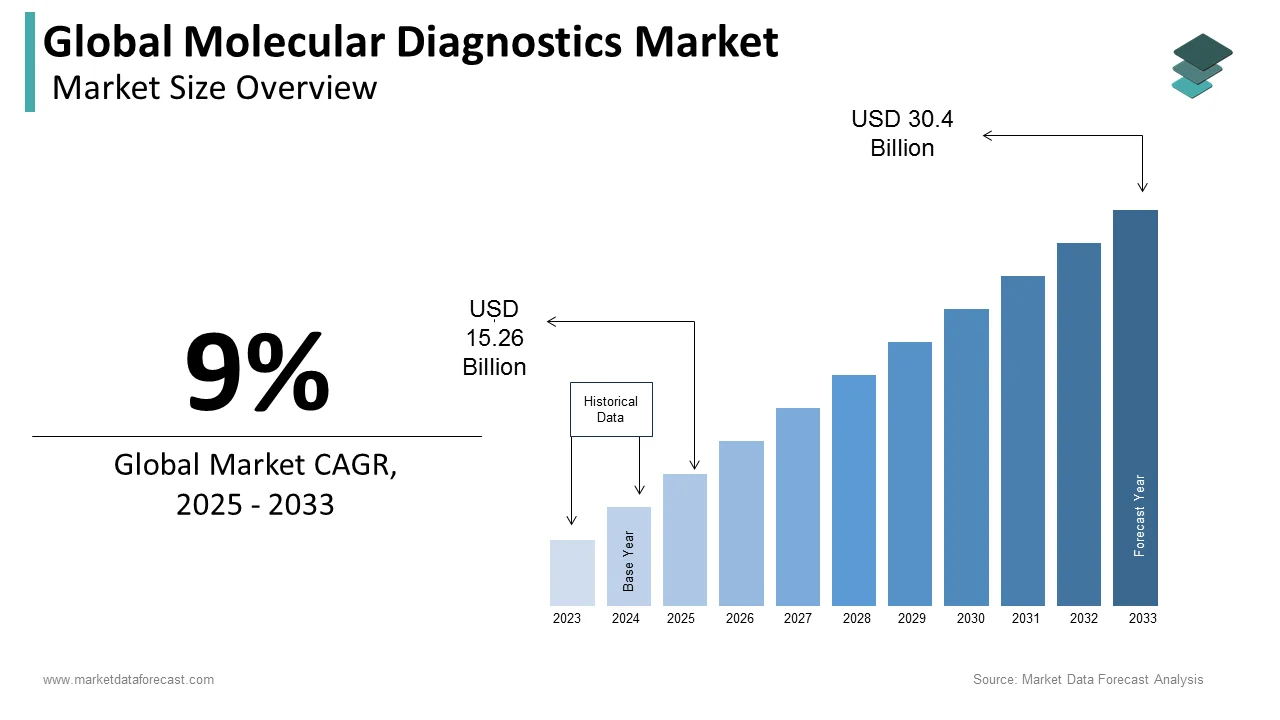

The size of the global molecular diagnostics market was worth USD 14 billion in 2024. The global market is anticipated to grow at a CAGR of 9% from 2025 to 2033 and be worth USD 30.4 billion by 2033 from USD 15.26 billion in 2025.

MARKET DRIVERS

The rising prevalence of infectious diseases is expected to drive the global molecular diagnostics market growth. According to WHO, diarrheal diseases, acute respiratory infections, measles, and vector-borne diseases are the major infectious causes of morbidity and mortality in disasters. Pneumonia accounts for 15% of all deaths in children under the age of 5 years, killing 808,694 children in 2017. The consequences of seasonal influenza epidemics are not well understood in developing countries, but research suggests that 99% of deaths among children under five years of age with influenza-related lower respiratory tract infections occur in developing countries.

The growing usage of molecular diagnostics to identify various diseases at the advanced level, which are very difficult to diagnose is fuelling the growth of the global market growth. Technological advancements in molecular diagnostics have driven the market as the diagnosis has become much cheaper and more accurate. The diagnosis has also been changed to more portable solutions, further boosting the molecular diagnostics market growth.

Additionally, factors such as an increase in the prevalence of infectious diseases and various types of cancer increased awareness and acceptance of personalized medicines, and the growth in biomarker identification diagnostics drives the market growth. Furthermore, growing funding by governments and numerous organizations for R&D in molecular diagnostics is anticipated to drive the demand for molecular testing.

MARKET RESTRAINTS

The lack of a transparent and effective regulatory framework is expected to hamper the growth rate of the global molecular diagnostics market. Most human influenza infections are diagnosed clinically. However, the infection of other respiratory viruses during low influenza activity and outside of outbreak is an influenza-like illness (ILI), rhinovirus, respiratory syncytial virus, parainfluenza, and adenovirus may also occur, making it challenging to identify influenza from other pathogens clinically. The rising diagnostic costs of diseases such as oncology and neurology. With the delay in the approval of experimental tests for molecular diagnosis, regulatory and legal standards are expected to restrict the market growth in molecular diagnostics.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Products and Services, Technology, End-User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis, Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leader Profiled |

Abbott Laboratories, Agilent Technologies, Becton, Dickinson and Company, Biomérieux SA, Danaher Corporation, Diasorin Grifols, Hologic, Illumina, Qiagen, Roche Diagnostics, Siemens Healthineers, and Thermo Fisher Scientific. |

SEGMENTAL ANALYSIS

By Products and Services Insights

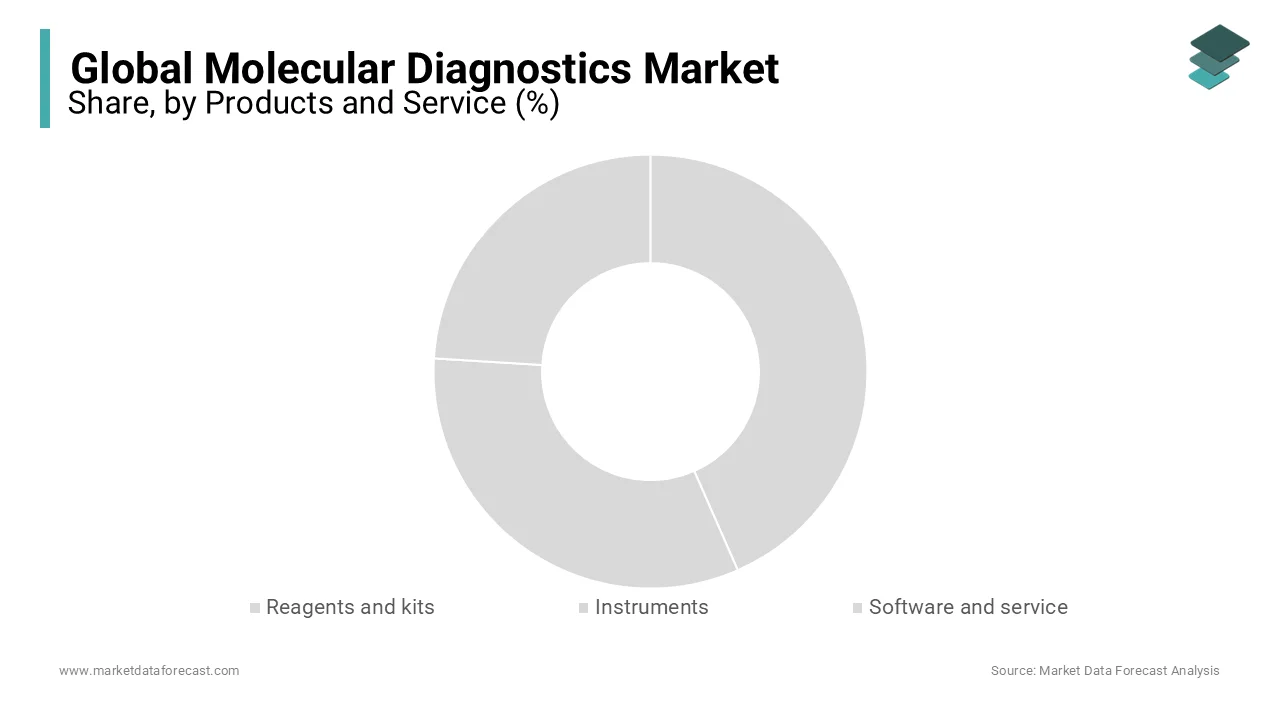

The reagents and kits segment is expected to hold the largest global molecular diagnostics market share during the forecast period. Furthermore, this segment is projected to register the highest CAGR during the forecast period. The availability of a wide range of reagents and kits has driven the growth of this segment. In addition, increasing the use of reagents in different therapeutic areas and increasing basic research and commercial applications have also boosted this growth segment. Easy accessibility to a wide range of reagents is the primary factor supporting the growth of molecular diagnostic reagents and kits.

The instruments segment is predicted to have the second-largest share in the global molecular diagnostics market and are expected to register decent growth during the forecast period. An increase in accessibility for a wide range of instruments has driven the market's development, and market growth has attracted new players and thus reduced the prices.

The software and services segment is predicted to be third among all the segments. The market is expected to grow reasonably as more development is happening in the software industry worldwide. Therefore, the investment is being made to increase the potential.

By Technology Insights

In 2024, the PCR segment dominated the molecular diagnostics market due to the increasing usage of PCR in proteomics and genomics, the automation of PCR instruments, and the emergence of advanced technologies like qRT-PCR. This trend is expected to continue during the forecast period.

However, the DNA sequencing and NGS segments are projected to register the highest growth rate during the forecast period. The increasing incidence of cancer increasing the focus of key market players on developing and launching diagnostic NGS kits and panels drive growth. In addition, other factors, such as growing sequencing applications in genomics research and increased requirement and necessity for molecular-targeted drugs/therapies (personalized medicine), contribute to the segment's growth.

By End-User Insights

The hospital and academic laboratories segment is estimated to account for the largest market share among other segments from 2024 to 2029, mainly due to increased numbers. Now, hospitals have more funding and are expected to provide quality healthcare; thus, there is more advanced technology for molecular diagnosis. The academic laboratories also use it to further technological developments and, in turn, drive market growth.

The reference laboratories have the second largest share and are expected to grow faster due to increased numbers.

REGIONAL ANALYSIS

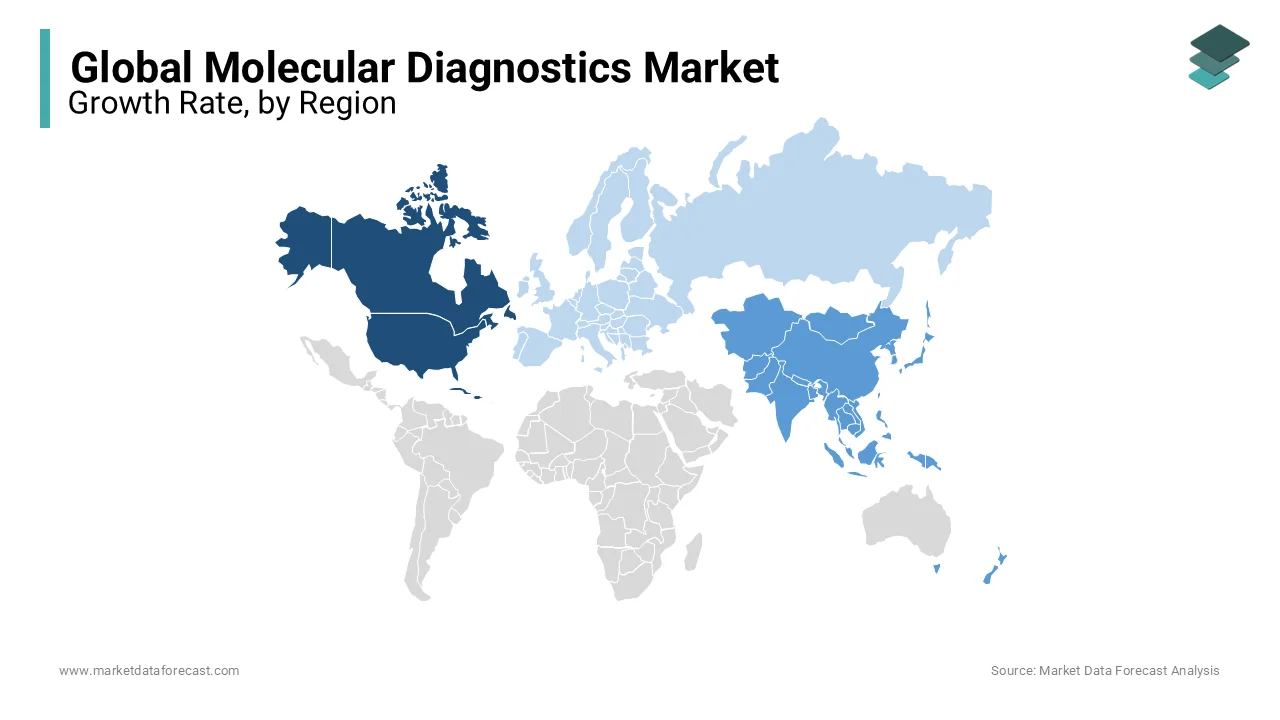

During the forecast period, it is expected that the Americas will lead the global molecular diagnostics market due to the growing geriatric population and the availability of advanced healthcare facilities in the region. However, in the forecast period, the European market for molecular diagnostics could become the second-largest market.

The North American molecular diagnostics market is projected to lead the global market during the forecast period due to the rising population and increasing disposable incomes. The Fed has also invested a lot in healthcare to provide cost-friendly treatment. Progress in technology and increasing awareness of early illness, as well as advances in molecular diagnostic testing, will continue to increase the precision and speed at which microbial pathogens can be identified. A patient's genes can be analyzed and become an integral element of patient-tailored therapies and therapeutics. With the increasing demand for North American diagnosis, North America dominates the molecular diagnostic market due to well-established infrastructure and government initiatives.

The Asia Pacific market is projected to register the highest growth during the forecast period. Growing GDP, a significant rise in disposable income, and increased healthcare spending by a more extensive population base are factors driving the market's growth. The modernization of healthcare infrastructure and the rising penetration of cutting-edge clinical laboratory technologies (especially in rural areas) drive the development of the molecular diagnostics market in the Asia Pacific. Rising demand in the Asia Pacific for POC diagnostics due to the growing geriatric population, lifestyle, and awareness among emerging countries. The proportion of the world's population over 60 years will nearly double from 12% to 22% between 2015 and 2050. In 2050, 80% of older people will live in countries with low and medium incomes, as reported by WHO.

The European region is expected to grow at the third-highest rate, mainly due to the increase in the geriatric population and the improvement in the quality of healthcare services. In addition, there is an increased number of R&D ventures in developed economies such as the Americas, Europe, etc.; according to data from the Global Innovation Index 2019, global R&D investment has continued to increase, more than doubling between 1996 and 2017.

KEY MARKET PLAYERS

In this report, some of the leading competitors that dominate the global molecular diagnostics market are Abbott Laboratories, Agilent Technologies, Becton, Dickinson and Company, Biomérieux SA, Danaher Corporation, and Diasorin Grifols, Hologic, Illumina, Qiagen, Roche Diagnostics, Siemens Healthineers, and Thermo Fisher Scientific.

RECENT HAPPENINGS IN THIS MARKET

- As part of Hologic, Inc.'s expansion into molecular diagnostics, Biotheranostics Inc. (US) was acquired in January 2021.

- Roche Diagnostics acquired Stratos Genomics (US) in May 2020, which supplemented the company's nanopore technology development and offered Roche Diagnostics access to SBX, a proprietary chemical created by Stratos Genomics.

- The ID NOW PoC system was launched by Abbott Laboratories in March 2020.

- Roche and GenMark Diagnostics announced a merger agreement in March 2021 whereby Roche will acquire GenMark. Roche and GenMark Diagnostics agreed to combine in March 2021, with Roche fully acquiring GenMark. In addition, Roche's current molecular diagnostics portfolio will be supplemented with GenMark's syndrome panel testing portfolio, acquired as part of the deal.

- In March 2021, QIAGEN NV unveiled the QIAcube Connect MDx, a customized platform for automated sample processing that will be available to molecular diagnostic laboratories in the United States, Canada, and other global markets.

- In April 2020, BD, a medical technology company, and BioGX Inc., a molecular diagnostics company, announced that they had submitted Emergency Use Authorization requests to the US Food and Drug Administration (FDA) for the approval of a new diagnostic test, which, if approved, would allow hospitals to screen for COVID-19 and receive results in three hours.

- In December 2020, GeneIQ, a Dallas-based molecular diagnostics laboratory, pivoted, like many other firms around the country, to combat the ongoing COVID-19 outbreak with a massive expansion.

- Co-Diagnostics Inc. announced the sale of over 10 million Logix SmartTM COVID-19 test kits to its domestic and international laboratory, hospital, and supplier network in December 2020.

MARKET SEGMENTATION

This research report on the global molecular diagnostics market has been segmented and sub-segmented based on products and services, technology, end-user, and region.

By Products and Service

- Reagents and kits

- Instruments

- Software and service

By Technology

- Polymerase Chain Reaction (PCR)

- Isothermal Nucleic Acid Amplification Technology (INAAT)3

- DNA Sequencing and NGS

- DNA Microarrays

- In Situ Hybridization

- Other Technologies

By End-User

- Hospital and Academic Laboratories

- Reference Laboratories

- Other End-Users

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- The Middle East and Africa

Frequently Asked Questions

What is the projected global market value of molecular diagnostics by 2033?

As per our research report, the global molecular diagnostics market size is estimated to be worth USD 30.4 billion by 2033.

Does this report include the impact of COVID-19 on the molecular diagnostics market?

Yes, in this report, the COVID-19 impact on the global molecular diagnostics market is included.

Which region led the molecular diagnostics market in 2024?

Geographically, the North American regional market dominated the molecular diagnostics market in 2024.

Who are the major players operating in the molecular diagnostics market?

Abbott Laboratories, Agilent Technologies, Becton, Dickinson And Company, Biomérieux SA, Danaher Corporation, and Diasorin Grifols, Hologic, Illumina, Qiagen, Roche Diagnostics, Siemens Healthineers, and Thermo Fisher Scientific are a few of the notable companies operating in the global molecular diagnostics market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]