Global Mobile Wallet Market Size, Share, Trends, & Growth Forecast Report By Type (Proximity Type And Remote Type), Mode Of Payment (Remote And NFC Payment), Technology (QR Code, Near Field Communication, Text Based/ Short Message Service, And Digital Only), Industry Vertical (Hospitality And Transportation, Media And Entertainment, Energy And Utilities, IT And Telecom, Healthcare, Retail, Education, Government And Defense, Financial Services, Banking, Insurance And Other Verticals) & Region, Industry Forecast From 2024 to 2033

Global Mobile Wallet Market Size

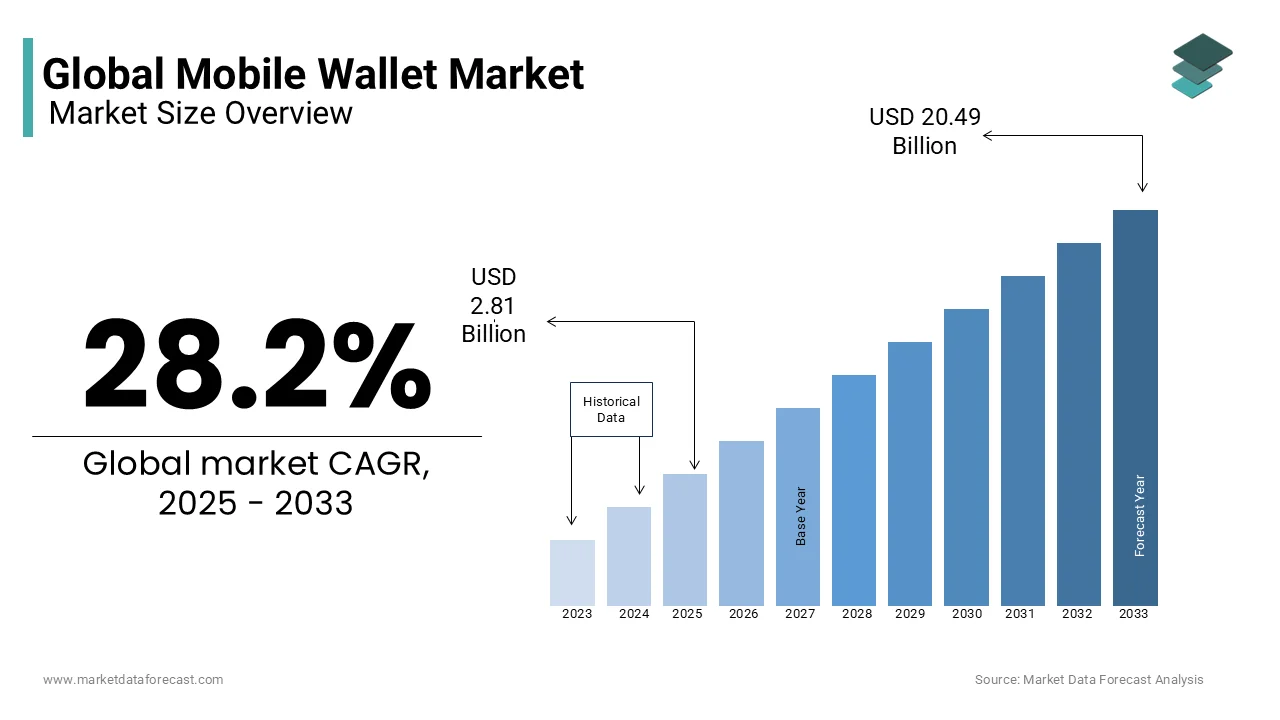

The global mobile wallet market was worth USD 2.19 billion in 2024. The global market is predicted to reach USD 2.81 billion in the year 2025, and it is estimated to reach a valuation of USD 20.49 billion by the end of 2033, expanding at an annual growth rate of 28.2% during the forecast period 2025 to 2033.

In general, the Mobile Wallet is also known as mWallet or eWallet which is a virtual wallet that stores the payment and information on a mobile devices. The mobile wallet is a digital form of debit card, credit card or the prepaid card information which is used to send or receive the payment and also to make an online money transaction, these mobile wallets are delivered through a number of payment processing models including mobile billing, SMS based transactions, mobile web payments and near field communications.

MARKET DRIVERS

The increasing use of mobile and increased penetration of internet in various industries is a factor that is expected to lead the Mobile Wallet market during the forecast period.

Several benefits such as ability of mobile wallet to provide online bill payment options and other money facilities easily and securely, user friendly interface facilitates ease of transaction during travel is expected to play an essential role in the growth of market of Mobile Wallet across the globe. Another factor such as various modules of mobile are being developed to enhance the security which influence the growth of Mobile Wallet market during the forecast period. Furthermore, growing use of smartphones across the globe, growing of e-commerce industry in various countries across the globe, increasing of consumer preference for cash less payments and online transactions, rising initiatives by governments for the development of smart cities in various countries across the world are some of the major driving factors which promotes the growth of the revenue rate of Mobile Wallet market during the forecast period.

MARKET RESTRAINTS

Growing concerns regarding data security and data breaches are some of the important barriers to market growth. Also, the lack of awareness about the usage of these mobile wallets especially in rural areas acts as an important deterrent to the growth of the Mobile Wallet market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

28.2% |

|

Segments Covered |

By Type, Mode Of Payment, Technology, Industry Vertical, and Region. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Alipay.com, AT&T Inc., Google Inc., Mastercard Incorporated, PayPal Holdings, Inc., Amazon Web Services Inc., American Express Banking Corp., Apple Inc., Samsung Electronics Co., Ltd., and VISA Inc and Others. |

SEGMENTAL ANALYSIS

By Type Insights

the Mobile Wallet Market is divided into two types, proximity type and remote type. Among these segments, the proximity types segment holds the major share of the market and this proximity type segment is expected to hold the dominance during the forecast period. The Remote type segment is also expected to increase the market value in the upcoming years.

By Mode of Payment Insights

the Mobile Wallet Market is bifurcated into two types namely, remote and NFC payment whereas the NFC payment is further bifurcated into NFC handsets, NFC reader, NFC chips and tags, NFC micro SD and NFC SIM/UICC card. The NFC handsets segment holds the major share of the market and will hold the dominance during the outlook period.

By Technology Insights

the Mobile Wallet Market is divided into QR code, near field communication, text based/ short message service, and digital only. The QR code segment is expected to hold the dominance during the forecast period since now a day’s most of the customers are using cashless payments through QR code to eradicate the problem of shortage of cash.

By Industry Vertical Insights

the Mobile Wallet Market is divided into hospitality and transportation, media and entertainment, energy and utilities, IT and telecom, healthcare, retail, education, government and defense, financial services, banking, insurance and other verticals. The media and entertainment segment held prominent share of the market among the other segments.

REGIONAL ANALYSIS

On the basis of region, the Mobile Wallet market is segmented into North America region, Asia Pacific region, Europe region, Latin America region and Middle East and Africa region.

Europe region hold the prominent share of the market due to the factors such as this region is known to have one of the most advanced digital banking convenient for customers since open mobile wallet is a type of virtual wallet with the help of which one can make payments, withdraw money and also conduct several other transactions. Furthermore, higher convenience and transparency in operations, wide variety of channels to make payments especially in some of the countries in the region such as UK, Germany and Brazil is also one of the major factor which promotes the growth of the market in the region. The Europe region is expected to hold the dominance during the forecast period.

North America region is also expected to increase the market growth due to the growing use of smartphones across the globe, growing of e-commerce industry in various countries across the region especially in some of the countries such as US, Canada and Mexico promotes the growth of the market during the forecast period.

Asia Pacific region will improve the revenue rate of the market followed by Europe region, North America region due to the presence of major key players and also increasing of investments for R & D activities helps the growth of the market in Asia Pacific region. Furthermore, increased demand for digitalization in some of the countries such as India, China and Japan promotes the growth of the Mobile wallet market during the outlook period.

KEY PLAYERS IN THE MARKET

Key market participants of Mobile Wallet market are Alipay.com, AT&T Inc., Google Inc., Mastercard Incorporated, PayPal Holdings, Inc., Amazon Web Services Inc., American Express Banking Corp., Apple Inc., Samsung Electronics Co., Ltd., and VISA Inc.

MARKET SEGMENTATION

This research report on the global mobile wallet market has been segmented and sub-segmented based on the type, mode of payment, technology, industry vertical, and region.

By Type

- Proximity Type

- Remote Type

By Mode Of Payment

- Remote

- NFC Payment

By Technology

- QR Code

- Near Field Communication

- Text-Based/ Short Message Service

- Digital Only

By Industry Vertical

- Hospitality And Transportation

- Media And Entertainment

- Energy And Utilities

- IT And Telecom

- Healthcare

- Retail

- Education

- Government And Defense

- Financial Services

- Banking

- Insurance

- Other Verticals

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

Frequently Asked Questions

What are the key drivers of growth in the global mobile wallet market?

Key drivers include the increasing adoption of smartphones, growing internet penetration, enhanced security features in mobile wallets, the convenience of cashless transactions, and supportive government policies promoting digital payments.

What role do fintech companies play in the mobile wallet market?

Fintech companies are crucial in driving innovation and competition in the mobile wallet market. They provide advanced technology solutions, user-friendly interfaces, and additional services such as loyalty programs and financial management tools, enhancing the overall user experience.

How do mobile wallets impact traditional banking and financial services?

Mobile wallets are disrupting traditional banking by providing more convenient and often cheaper alternatives for transactions, remittances, and financial management. They also promote financial inclusion by reaching unbanked and underbanked populations with mobile access.

What are the future trends expected in the mobile wallet market?

Future trends include the integration of artificial intelligence and machine learning for personalized services, expansion of blockchain technology for enhanced security, increased adoption of QR code payments, and greater interoperability between different mobile wallet systems and financial services.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]