Global Mobile Phone Insurance Market Size, Share, Trends, & Growth Forecast Report By Coverage (Physical Damage, Failure Of Internal Components, Protection Against Theft and Loss, Virus Protection, and Others); Phone Type (Budget Phones, Mid & High-End Smartphones, Premium Smartphones) & Region (North America, Europe, Asia-Pacific, Latin America, Middle East & Africa), Industry Analysis 2024 to 2033

Global Mobile Phone Insurance Market Size

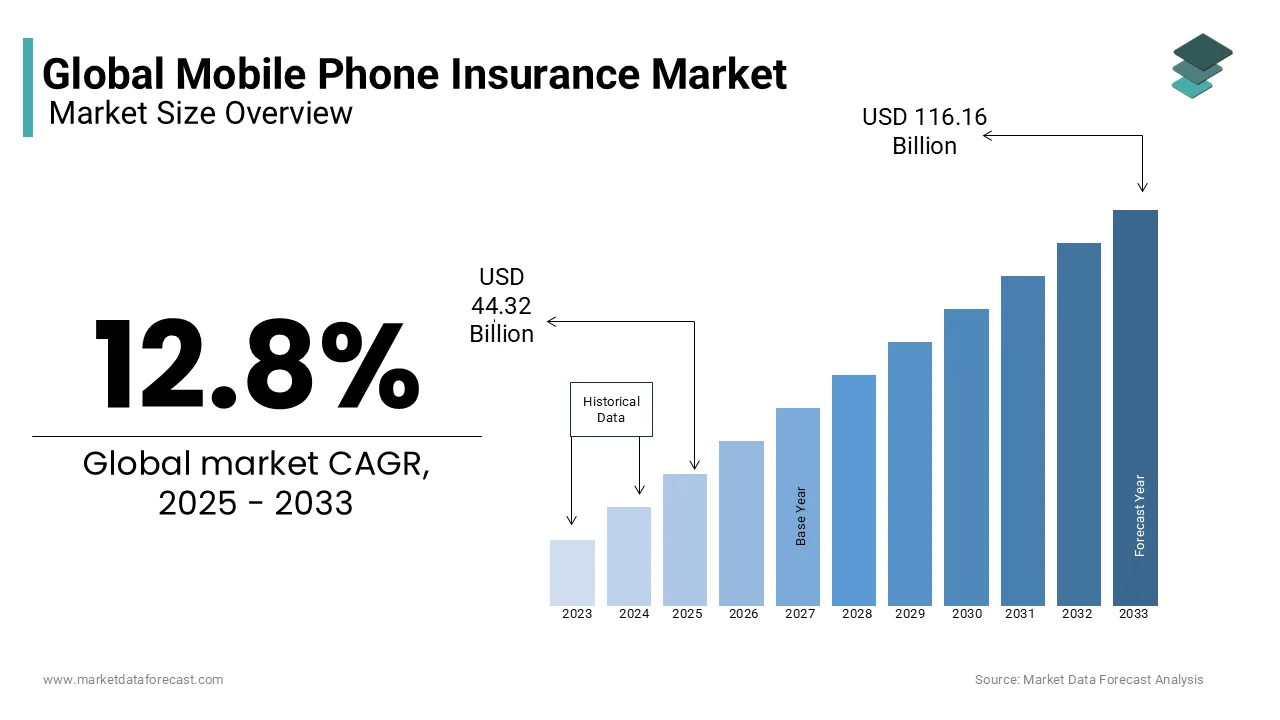

The size of the global mobile phone insurance market was valued at USD 39.29 billion in 2024. The global market is predicted to reach USD 44.32 billion in 2025 and USD 116.16 billion by 2033, growing at a CAGR of 12.8% during the forecast period 2025 to 2033.

Insurance is protection offered against financial loss. If an individual purchases a good or service, he is eligible for coverage for the designated products/services, protecting him from damage due to various circumstances. The insurance buyer must pay a defined premium to obtain insurance services. The dividend is an amount of money collected by the insurer from the policyholder for the cover provided by the insurance policy.

In the recent past, the global mobile phone insurance market has experienced substantial growth and is anticipated to record promising growth during the forecast period. The costs of high-end mobile devices and the reliance of people on smartphones for daily activities have considerably grown in recent years, which has resulted in the adoption of mobile phone insurance. Consumers have increasingly learned about the benefits of mobile phone insurance policies, such as theft, loss, accidental damage, and technical malfunctions, which have been offering peace to consumers in the digital era. This has also resulted in the increasing adoption of these services. As per the United Kingdom’s Home Office, in the past 12 months between March 2024 and March 2023, there were over 200 cases per day of phones or bags snatched from throughout England and Wales. Also, only 0.8 percent of theft from the person led to a charge, and about 82 percent of investigations by the police were concluded before a criminal was found.

The United States, the United Kingdom, Japan, and South Korea are currently playing a leading role in the global market as these countries have a high penetration of smartphones, and the costs associated with repairing in these countries are substantial. For instance, the average cost per iPhone screen repair is USD 200 to USD 300 and USD 150 to USD 250 for Samsung Galaxy repairs in the authorized service centers in the U.S. These factors are anticipated to continue to contribute to the mobile phone insurance market and aid the global market to register a prominent growth rate during the forecast period.

MARKET DRIVERS

Rising Penetration of Smartphones In Emerging Nations

The growing penetration of smartphones in developing countries and the rapid adoption of mobile phone insurance worldwide are primarily driving the global market's growth. According to Statista, by 2024, roughly 4.88 billion are expected to own a smartphone, which is a rise of 635 million new smartphone customers within the last year. The number of people owning smartphones has been growing dramatically worldwide, and this trend will undoubtedly accelerate further in the coming years. As of 2023, there were an estimated 6.8 billion smartphone users worldwide. The growing reliance and dependency on smartphones are making people consider purchasing mobile phone insurance to get protection against potential damages and losses. The penetration of smartphones is increasing rapidly in developing countries such as India. For instance, the smartphone penetration rate in India grew from 33% in 2018 to 48% in 2020. The rapid penetration of smartphones is very likely to boost the adoption of mobile phone insurance policies and contribute to the global market growth.

YoY Growth in the Incidence of Phone Theft or Loss

The incidents of theft and loss of mobile phones have become very common due to their essential nature, which is further driving the need for mobile phone insurance. For instance, more than 1.7 million smartphones were stolen as per the reports in the U.S. in 2020, and on average, an estimated 113 smartphones go missing every 1 minute in the U.S. in the current times. Due to such incidents, consumers have been increasingly adopting mobile phone insurance to protect themselves from damage caused by theft and loss. Furthermore, the theft incidents rate of mobile phones is continuously growing worldwide and is fuelling the need for protective measures such as mobile phone insurance. According to the data shared by Ukraine’s Ministry of Internal Affairs (MIA), over 6600 mobile phones of Ukrainian people have previously been lost in the First 4 months of 2024. In contrast, more than 29 thousand phones were snatched or looted in Ukraine in 2023. IPhone, Samsung, and Xiaomi were the brands that were often lost.

High Costs Associated with the Repair and Replacement of Smarphones

Owing to the advanced technologies that are being used in the manufacturing of smartphones and the high costs of the devices, the repair and replacement costs have also increased considerably to the consumers. The average repair cost for screens is from USD 100 to USD 300, batteries range from USD 50 to USD 100, and full replacement costs range from USD 1000 to more. These high costs have been motivating consumers to opt for a mobile phone insurance policy to stay safe from damage, theft, and loss situations. Factors such as Y-o-Y growth in the awareness among consumers regarding insurance options, the rapid expansion of online and digital insurance platforms, innovations in the insurance products and coverage plans, Y-o-Y growth in the sales of mobile phones, and growing disposable income of people in the emerging countries are supporting the growth of the mobile phone insurance market. Partnerships between insurers and mobile manufacturers, improvements in claim processing and customer service, increasing concerns around data security and cyber threats, and flexibility in policy customization are further promoting the growth of the mobile phone insurance market.

MARKET RESTRAINTS

High premiums and deductibles are a significant impediment to the growth of the mobile phone insurance market. Limited coverage options, difficulties in the claim processes, the distrust of consumers in insurance providers, and the availability of cheaper repair services are further hampering the growth of the global market. Lack of awareness about insurance benefits, high rate of insurance fraud, and competition from warranty programs offered by manufacturers and retailers are also showcasing negative impacts on the growth of the global mobile phone insurance market.

MARKET OPPORTUNITIES

Asia Pacific presents potential opportunities for the expansion of the mobile insurance market. China, India, and Japan are the key markets to look for owing to the increased governmental assistance, extensive acceptance of cloud-based services, swift development, and economic progress. All these factors are creating a favorable scenario for the market. Moreover, the digital insurance landscape in China is quickly evolving. It is presently witnessing big growth and has increased twofold in size, valued at over 1 trillion yuan. India, on the other hand, is seeing rapid digital transformation in both urban and rural areas. However, this rapid progress has also widened its threat vector, especially in cybersecurity. As the country’s rural regions progressively adopt digital technology, cybersecurity is becoming the most crucial concern. As per the Indian Computer Emergency Response Team (CERT-In), rural and farmland areas are not protected against cybersecurity, adding to a small but rising proportion of the overall cyber cases reported across the nations. It is projected that around 10 percent of online security attacks reported included victims belonging to these backward areas, an amount which is increasing with the rising digital penetration.

MARKET CHALLENGES

Problems in executing a connected ecosystem are one of the challenges for companies operating in the mobile phone insurance market. Turning into a true virtual business is challenging. Insurance providers must prioritize making a connected ecosystem that can maintain its pace with the fast-moving developments or shifts that digitalization requires while still providing a superior experience for employees, agents, customers, and other business associates. Moreover, the absence of digital agility also affects market growth. As the dynamics of insurance change, the market players should become more nimble, quick, and productive to catch on the industry’s increased pace. For instance, the a lack of flexible pricing programs, such as pay-per-use, without applying online claim processing or improving the overall consumer experience. As per Novaria’s report, however, 93 percent of carriers still face problems delivering assistance online or through virtual initiatives.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

12.8% |

|

Segments Covered |

By Coverage, Phone Type, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

AmTrust International, Assurant Inc., Asurion AT&T Inc., Brightstar Corp, GoCare Warranty Group, Revolut Ltd., SquareTrade Inc., Taurus Insurance Services Limited, Vodafone Limited, and Others. |

SEGMENTAL ANALYSIS

By Coverage Insights

The physical damage segment accounted for the largest share of 30% of the global market in 2024 and is expected to be the fastest-growing segment in the global market during the forecast period. Protection against physical damage is the essential protection plan as mobile phones are much more prone to physical harm, such as cracks in the circuit board and damage to the screen. Due to these reasons, several mobile phone insurance companies have initiated offering insurance coverage plans for such losses as part of physical damage plans to help users avoid paying substantial sums for repair and maintenance. The domination of the physical damage segment is primarily driven by the high incidence of accidental damage, the increasing value of smartphones, and the rising preference from consumers for protection plans. According to reports, physical damage accounted for more than 60% of mobile phone insurance claims in 2024.

The failure of the internal components segment occupied a substantial share of the global market in 2024 and is expected to progress considerably during the forecast period. Manufacturing defects, wear and tear over time, and the increasing complexity and sophistication of smartphone technology are contributing to the expansion of this segment in the global market.

The protection against theft and loss segment is expected to register a notable CAGR during the forecast period. Factors such as the growing incidents of smartphone theft, the high cost of replacing lost or stolen devices, and the rising adoption of smartphones in high-crime areas are propelling the growth of this segment in the global market.

The virus protection segment is predicted to register a promising CAGR in the global market during the forecast period. The growing prevalence of mobile malware and cybersecurity threats, as well as the rise in remote work and digital payments, are propelling the segment's growth.

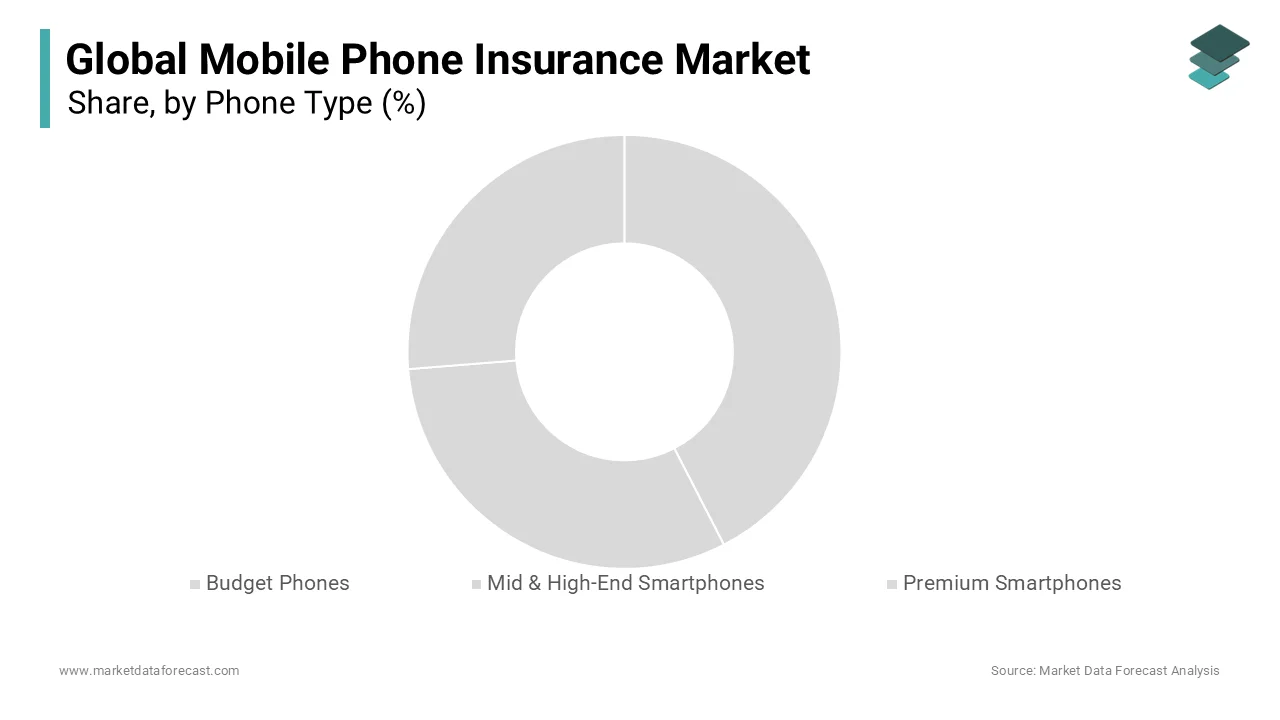

By Phone Type Insights

The mid and high-end smartphone segment had 51.9% of the global market share in 2024 and is expected to dominate the global market throughout the forecast period. The lead of the mid and high-end smartphones segment is majorly driven by Y-o-Y growth in the sales of mid-range and high-end smartphones and improved insurance offerings that cover a wide range of risks. More than 150 million mid- and high-end smartphones were insured worldwide in 2023, and this trend is likely to grow further during the forecast period and boost segmental expansion.

The budget phones segment is also a major segment and had a substantial share of the worldwide market in 2024. The rising penetration of budget smartphones in emerging markets and the rising awareness of the benefits of mobile insurance are driving the growth of the budget phones segment in the worldwide market. Affordable premiums and the high volume of budget phone sales are further boosting the growth rate of the budget phone segment in the global market.

REGIONAL ANALYSIS

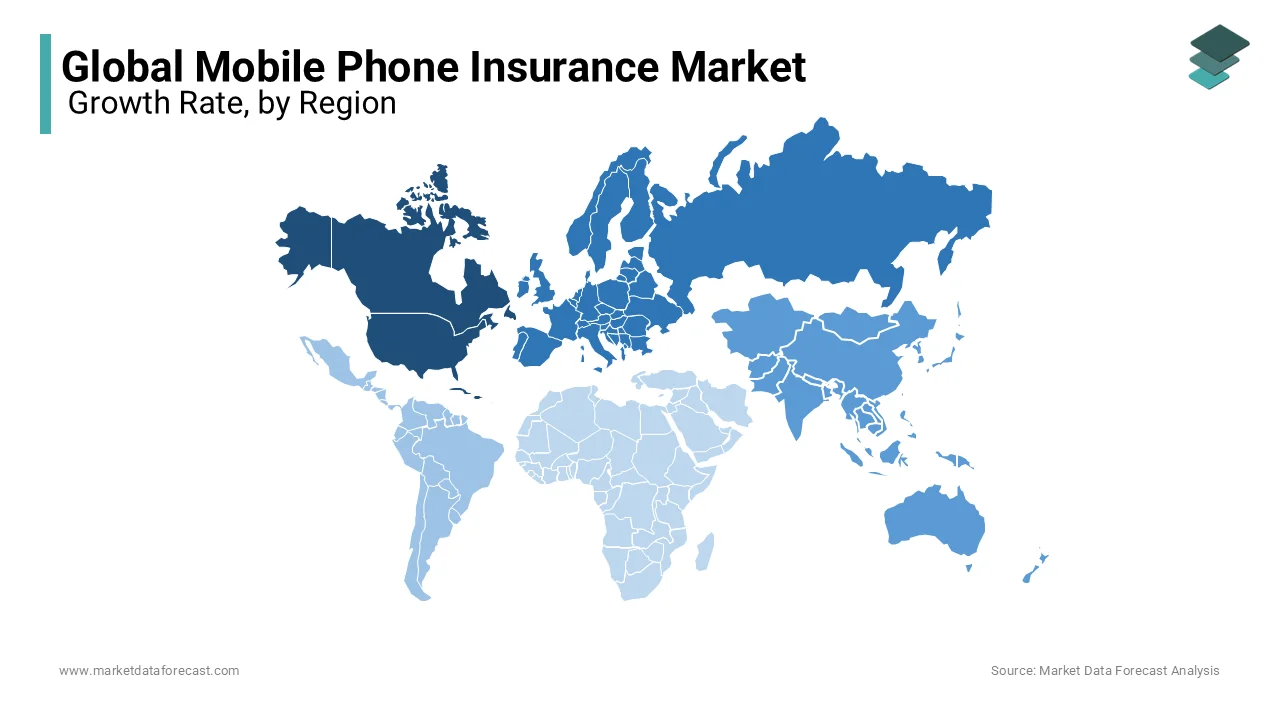

North America captured 33.8% of the worldwide market share in 2024 and was the largest regional segment for mobile phone insurance in the worldwide market. The supremacy of North America is expected to continue in the global market throughout the forecast period owing to the presence of several notable market participants, high awareness of the benefits of mobile phone insurance policies among people in the North American region, and high penetration of smartphones, as per the reports. An estimated 100 million smartphone users have opted for mobile phone insurance in North America in 2023. AT&T, Verizon, and SquareTrade are currently playing a leading role in the North American market. The U.S. held the largest share of the North American market in 2023 and is expected to continue to lead the regional market during the forecast period owing to the increasing number of incidents of mobile phones being stolen in the U.S. An estimated 113 smartphones are being stolen in the U.S. per every one minute.

Europe is a lucrative regional segment for mobile phone insurance in the worldwide market and is estimated to account for a substantial share of the global market during the forecast period. Y-o-Y growth in smartphone usage in Europe, stringent consumer protection laws, and the availability of diverse insurance offerings are primarily boosting the growth of the European market. The United Kingdom, Germany, and France are the major players in the European market. Besides these, insurance in these regional countries is significantly more willing to share data to improve the overall service quality than commonly believed by the industry. Hence, this also contributes to the growth of its market share. A survey by Sollers revealed that Polish insurance clients are highly receptive to sharing information to get superior discounts. About 41.25 percent of participants stated they were enthusiastic about this choice, Germany with 36 percent, and the United Kingdom with 32.75 percent.

The Asia-Pacific is predicted to showcase rapid growth during the forecast period and be the fastest-growing regional segment in the worldwide market. Factors such as the Y-o-Y growth in the sales of smartphones, increasing disposable income, and rising awareness of device protection are majorly driving the mobile phone insurance market in the Asia-Pacific region. China, Japan, and India are expected to hold the largest share of the Asia-Pacific market during the forecast period. According to the National Retail Federation, a US-based industry body, the average shrink rate due to theft and inventory loss in Asia in 2022 rose to 1.6 percent compared to 1.4 percent in 2021. Apart from these, some of the nations in the APAC region are among the most targeted by fraudsters and cyber attackers, including India, South Korea, Japan, etc. So, the demand for cyber insurance is escalating in the region.

KEY MARKET PLAYERS

Companies playing a key role in the global mobile phone insurance market include AmTrust International, Assurant Inc., Asurion AT&T Inc., Brightstar Corp, GoCare Warranty Group, Revolut Ltd., SquareTrade Inc., Taurus Insurance Services Limited and Vodafone Limited. Mobile phone insurers are focusing on collaborating with telecom operators to increase their regional presence.

RECENT HAPPENINGS IN THE MARKET

- In July 2024, Scrilla, a unique mobile insurance company for smartphones, announced that it has entered into a partnership with SalesPlat Technologies to provide its services to businesspeople and industrialists taking part in the Business accelerator program in the Ondo State. This partnership comes under the multi-partner project by SalesPlat, which also includes TradeFlow Africa, Peppa, Sterling, and Others. This program intends to encourage entrepreneurship and economic progress in Ondo using extensive funding, mentorship, and training opportunities.

- In April 2024, Spectrum introduced two new features: Anytime Upgrade and Mobile Repair and Replacement Plan. The company wants to give its mobile consumers greater peace of mind, control, and value. Anytime Upgrade is now added to the Spectrum Mobile Unlimited Plus data plan at zero additional cost. Moreover, the Mobile Repair and Replacement Plan provides users with device protection at a cost-effective price than others.

MARKET SEGMENTATION

The global mobile phone insurance market is segmented and sub-segmented based on the coverage, phone type, and region.

By Coverage

- Physical Damage

- Failure of Internal Components

- Protection Against Theft and Loss

- Virus Protection

By Phone Type

- Budget Phones

- Mid & High-End Smartphones

- Premium Smartphones

By Region

- North America

- Europe

- Latin America

- Asia Pacific

- Middle East & Africa

Frequently Asked Questions

What types of coverage are typically offered in mobile phone insurance policies globally?

Mobile phone insurance policies commonly offer coverage for accidental damages, including screen breakage and liquid damage, theft, loss, and malfunction due to hardware or software issues. Some policies may also include coverage for accessories and provide optional add-ons such as extended warranty and data protection.

What are the emerging trends shaping the future of the mobile phone insurance market on a global scale?

Emerging trends in the global mobile phone insurance market include the integration of advanced technologies such as artificial intelligence and telematics for risk assessment and claims processing, the introduction of innovative insurance models like on-demand and peer-to-peer insurance, and partnerships between insurers and mobile device manufacturers to offer bundled insurance solutions.

How does the global mobile phone insurance market respond to evolving consumer preferences and behaviors?

Insurers in the global mobile phone insurance market continuously monitor consumer preferences and behaviors to tailor insurance products and services accordingly. This includes offering flexible coverage options, personalized pricing, and value-added services such as remote tech support and device upgrade programs to meet the evolving needs of customers.

How does the global mobile phone insurance market contribute to the sustainability and circular economy initiatives?

The global mobile phone insurance market promotes sustainability by encouraging device repair and refurbishment instead of premature disposal. Many insurers offer repair services and incentives for recycling old devices, contributing to the circular economy and reducing electronic waste. Additionally, the provision of digital insurance documents and paperless claim processes further supports environmental conservation efforts.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]