Global Mobile Games Market Size, Share, Trends, & Growth Forecast Report – Segmented by Device (Smartphones and Tablets); Operating System (Android, Windows, iOS) & Region - Industry Forecast From 2024 to 2032

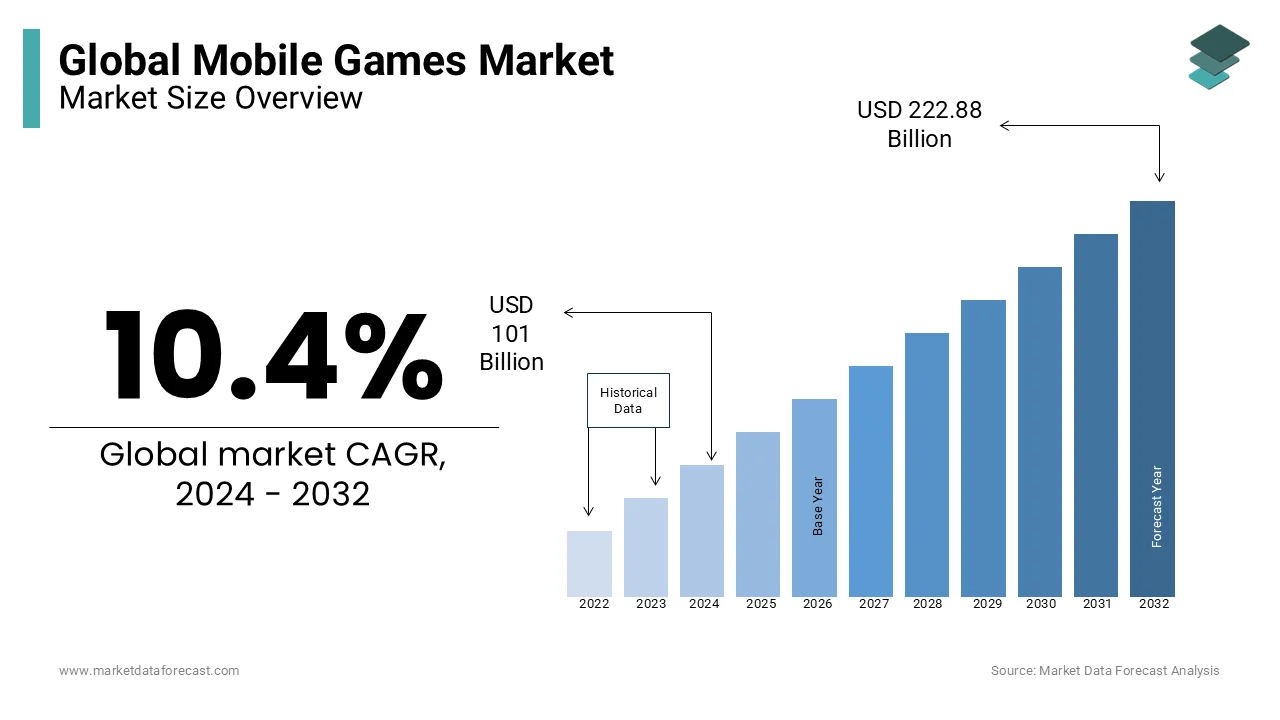

Global Mobile Games Market Size (2024 to 2032)

The global mobile games market was worth USD 91.49 billion in 2023. The global market is predicted to reach USD 101 billion in 2024 and USD 222.88 billion by 2032, growing at a CAGR of 10.4% during the forecast period. Mobile games have skyrocketed in last few years with the increasing penetration of smartphones and the availability of internet data at affordable prices.

Current Scenario of the Global Mobile Games Market

Innovative technologies like the VR and AR are foreseen to become crucial in the global mobile gaming market in future. Games like Niantic Lab's Pokemon Go and Harry Potter: Wizards Unite are location-based games that are based on augmented reality and use Google Maps to augment a mythical world into the reality. Players search for hidden characters on their mobile screen, and in the real world they end up walking several kilometers, which is reflected in their Google Fit app, which helps players track distance and steps. This development is known to create immense growth potential for the development of the target market.

MARKET TRENDS

-

Free-to-play is the pricing model preferred by most mobile game developers due to its unlimited potential and can be downloaded free of charge. This allows players to try out a game before deciding whether they want to spend time or money, and they tend to generate higher income.

-

Games like Pokémon GO follow a free game model and, according to Bank of America, in the United States in 2016, 27 million users played it, and it is estimated that it will exceed 67 million by 2020. And In the region of Asia and the Pacific, the number of players is expected to increase from 84 million to 311 million in the same time period. Therefore, the growing number of users must have a positive view of the market.

-

Additionally, Hyper Casual games are primarily monetized through advertising and captured over half of all game app downloads for 2017. Focusing on the future of these games, Zynga purchased Gram Games for around USD 250 million in 2018, and in the same period, Goldman Sachs invested over USD 200 million in Voodoo.

-

In addition, this model should evolve with the development of technologies such as augmented reality and 5G. With the rollout of 5G, coupled with faster download speeds, advertising videos are hoping for increased quality and engagement.

-

For example, in April 2019, Hatch, along with Samsung, launched 5G cloud games in the United States with the launch of the Hatch app for Samsung. With Samsung's first 5G flagship phone, the Galaxy S10 5G, customers were able to play popular games like Hitman GO, Monument Valley, and Arkanoid Rising instantly via streaming.

Therefore, due to the factors mentioned above, the free pricing model is expected to play a pivotal role in the mobile gaming market in the future.

MARKET DRIVERS

The global mobile games market is expected to experience substantial growth during the forecast period due to the expected change of players from pre-installed consoles and computer games to games on smartphones and tablets. The increasing popularity of online games on mobile platforms is expected to gain importance at the expense of online computer games. While there is a short-term improvement this year due to blocking measures, next-gen consoles and related content are essential to start a new phase of growth in this segment. However, the mobile gaming market is seasonal in nature, which means that the popularity of games is fading with the days; therefore, the demand for new games is difficult to predict, which helps to boost market growth.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024 to 2032 |

|

CAGR |

10.4% |

|

Segments Covered |

By Device, Operating System, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Tencent Holdings, Electronic Arts, Activision Blizzard, Nintendo, Ubisoft, Zynga, and TakeTwo Interactive and Others. |

SEGMENTAL ANALYSIS

Global Mobile Games Market By Devices

REGIONAL ANALYSIS

The United States, Brazil and Mexico in the Americas region are foreseen to become lucrative markets for online and mobile games in terms of growth and monetization potential. The Asia-Pacific regional market is supposed to witness an increase in the number of players during the outlook period. The regional markets of Europe and the Middle East are also estimated to show high growth potential.

In addition, China is home to many mobile game publishers, such as Tencent Holdings Ltd. Tencent Holdings is one of the largest games companies in the world and is primarily active in the mobile gaming arena. In March 2019, the company invited developers to create games on its social media and messaging app WeChat.

KEY PLAYERS IN THE GLOBAL MOBILE GAMES MARKET

Major players in the global mobile games market include Tencent Holdings, Electronic Arts, Activision Blizzard, Nintendo, Ubisoft, Zynga, and TakeTwo Interactive.

RECENT HAPPENINGS IN THE GLOBAL MOBILE GAMES MARKET

-

In November 2018, Rovio Entertainment Corp. acquired PlayRaven Oy. This acquisition strengthens Rovio's expansion in mobile strategy games.

-

In November 2018, Jam City announced a multi-year mobile game development partnership with Disney. Jam City with this deal obtains the right to create new games that are based on iconic characters from Pixar and Walt Disney Animation Studios. The first game the companies plan to implement are based on Disney’s animation movie Frozen.

DETAILED SEGMENTATION OF THE GLOBAL MOBILE GAMES MARKET INCLUDED IN THIS REPORT

This research report on the global mobile games market has been segmented and sub-segmented based on the device, operating system, and region.

By Devices

- Smartphones

- Tablets

By Operating System

- Android

- iOS

- Windows

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

Frequently Asked Questions

What are the key factors driving the growth of the mobile games market in emerging economies?

Factors such as increasing smartphone penetration, improved internet infrastructure, and rising disposable incomes contribute to the growth of the mobile games market in emerging economies, particularly in regions like Southeast Asia, Latin America, and Africa.

What are the emerging trends shaping the future of the global mobile games market?

Augmented reality (AR), virtual reality (VR), cloud gaming, and cross-platform integration are among the emerging trends that are expected to redefine the mobile gaming experience and drive market growth in the coming years.

What are the challenges faced by mobile game developers in entering new markets?

Challenges include navigating diverse regulatory environments, understanding local consumer preferences, competition from established local developers, and optimizing monetization strategies to align with market expectations.

How does the increasing popularity of esports impact the mobile games market globally?

The rise of mobile esports, fueled by games like PUBG Mobile and Honor of Kings, has led to a surge in competitive gaming events, sponsorships, and streaming platforms, further expanding the reach and revenue potential of the mobile games market worldwide.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]