Global Missiles Market Size, Share, Trends, & Growth Forecast Report By Component (Guidance System, Propulsion System, Warhead, Airframe, Launch System, and Others), Launch Mode, Range, End-use, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa), Industry Analysis From 2024 to 2033

Global Missiles Market Size

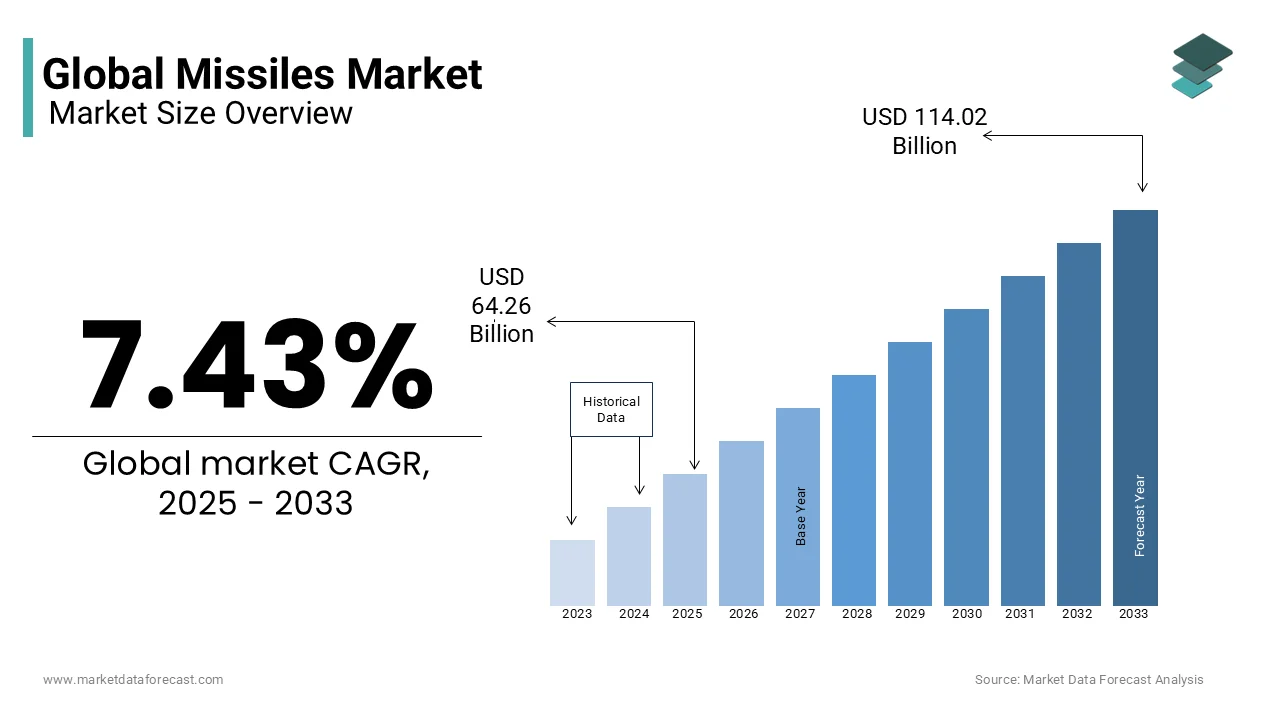

The global missiles market was worth USD 59.82 billion in 2024. The global market is expected to reach USD 114.02 billion by 2033 from USD 64.26 billion in 2025, rising at a CAGR of 7.43% from 2025 to 2033.

The missiles market covers a wide range of missile systems, including tactical, strategic, and cruise missiles.The market is experiencing significant growth, driven by increasing geopolitical tensions, modernization of military capabilities, and advancements in missile technology.

The demand for precision-guided munitions and the development of hypersonic missiles are key trends shaping the market. Countries are investing heavily in missile defense systems to counter emerging threats, with the U.S., Russia, and China leading in missile technology advancements. For instance, the U.S. Department of Defense allocated over $20 billion for missile defense programs in its 2024 budget, reflecting the strategic importance of missile systems in national defense.

Moreover, the proliferation of missile technology among various nations is raising concerns about regional stability and security. As nations seek to enhance their deterrence capabilities, the missiles market is poised for continued expansion, making it a focal point for defense policymakers and industry stakeholders alike.

MARKET DRIVERS

Increasing Geopolitical Tensions

One of the primary drivers of the missiles market is the escalating geopolitical tensions among nations. Conflicts in regions such as the Middle East, Eastern Europe, and the Asia-Pacific have prompted countries to enhance their military capabilities. For instance, military spending in Asia is projected to reach $500 billion by 2025, with a significant portion allocated to missile development and procurement. The ongoing arms race, particularly between the U.S. and China, has led to increased investments in advanced missile systems. In 2022, China’s military budget was approximately $230 billion, with a focus on modernizing its missile arsenal to counter U.S. influence in the region, as per the Stockholm International Peace Research Institute. This trend underscores the urgent need for nations to bolster their defense capabilities.

Technological Advancements

Technological advancements in missile systems are another significant driver of the missiles market. Innovations such as precision-guided munitions, hypersonic missiles, and advanced missile defense systems are transforming military strategies. . Countries are investing heavily in research and development to enhance the accuracy, speed, and lethality of their missile systems. For example, the U.S. Army's Long Range Precision Fires program aims to develop next-generation artillery and missile systems, with a budget of over $1.5 billion allocated for 2024, according to the U.S. Army. These advancements are crucial for maintaining strategic superiority in modern warfare.

MARKET RESTRAINTS

Economic Uncertainty

Economic uncertainty is a significant restraint on the missiles market, as fluctuating economic conditions can lead to reduced defense budgets. Many countries are facing economic challenges, including inflation and rising debt levels, which can force governments to prioritize spending in other areas over military expenditures. For instance, the global defense spending growth rate was projected to slow to 2.5% in 2023, down from 4.5% in 2022, due to economic pressures. This slowdown can lead to delays in missile procurement programs and hinder investments in research and development.

Technological Obsolescence

Technological obsolescence poses another challenge for the missiles market. Rapid advancements in technology can render existing missile systems outdated, necessitating continuous investment in upgrades and new developments. For example, the lifespan of missile systems can be significantly affected by the introduction of new countermeasures and defense technologies, such as advanced radar systems and electronic warfare capabilities. The U.S. Department of Defense has noted that maintaining the relevance of missile systems in the face of evolving threats requires substantial ongoing investment, which can strain budgets.

MARKET OPPORTUNITIES

Increased Focus on Missile Defense Systems

The growing emphasis on missile defense systems represents a significant opportunity for the missiles market. As nations face threats from ballistic and cruise missiles, there is a heightened demand for advanced missile defense technologies. For instance, the demand for missile defense around the world is projected to grow substantially, driven by investments in systems like the Aegis Ballistic Missile Defense and Terminal High Altitude Area Defense (THAAD). Countries such as Israel and the United States are leading the way in developing sophisticated interception technologies. This focus on defense systems not only enhances national security but also opens avenues for collaboration between governments and defense contractors, fostering innovation and technological advancements in missile defense.

Growing Demand for Dual-Use Technologies

The increasing demand for dual-use technologies, which can serve both military and civilian purposes, presents a unique opportunity for the missiles market. As nations seek to enhance their technological capabilities, there is a growing interest in developing systems that can be adapted for various applications, including surveillance, reconnaissance, and disaster response. For example, advancements in drone technology and satellite systems can be integrated into missile systems for improved targeting and intelligence gathering. According to a report by the International Data Corporation. This trend allows defense manufacturers to diversify their product offerings and tap into new markets.

MARKET CHALLENGES

Cybersecurity Threats

One of the major challenges facing the missiles market is the increasing threat of cyberattacks on missile systems and defense infrastructure. As missile technology becomes more sophisticated and interconnected, the risk of cyber vulnerabilities grows. A report by the U.S. Department of Defense highlighted that cyber threats could compromise the integrity of missile systems, potentially leading to catastrophic failures or unauthorized launches. This challenge necessitates significant investments in cybersecurity measures to protect sensitive technologies and data. Defense contractors must prioritize the development of robust cybersecurity protocols, which can increase costs and extend project timelines, ultimately impacting the overall efficiency of missile programs.

Environmental Regulations and Sustainability Concerns

Environmental regulations and sustainability concerns are emerging challenges for the missiles market. As global awareness of climate change and environmental impact grows, defense manufacturers are facing pressure to adopt more sustainable practices. The production and testing of missile systems can have significant environmental repercussions, including pollution and resource depletion. According to a report by the United Nations, the defense sector is responsible for approximately 5% of global greenhouse gas emissions. As governments and organizations push for greener practices, missile manufacturers may need to invest in cleaner technologies and sustainable materials, which can increase production costs and complicate compliance with new regulations. This shift towards sustainability may reshape the landscape of the missiles market in the coming years.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

7.43% |

|

Segments Covered |

By Component, Launch Mode, Range, End-use, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Airbus SE, Honeywell International Inc., Lockheed Martin Corporation, Northrop Grumman, Thales Group, BAE Systems Inc., Israel Aerospace Industries Ltd. (IAI), ISRO, RTX Corporation, and The Boeing Company. |

SEGMENT ANALYSIS

By Component Insights

The guidance system segment remained the largest by holding 35.4% of the total market share in 2024. This segment is crucial as it ensures that missiles hit their intended targets accurately. The demand for advanced guidance systems, such as GPS and inertial navigation, is increasing as countries seek to improve their military effectiveness. In 2022, the U.S. Department of Defense reported that precision-guided munitions accounted for over 90% of all munitions used in combat, drawing attention to the importance of guidance systems in modern warfare.

The fastest-growing category in the missiles market is the propulsion system, with a projected CAGR of 7.5% during the forecast period owing to the advancements in propulsion technologies, such as solid and liquid fuels, which enhance missile speed and range. Countries are investing in more efficient propulsion systems to improve their military capabilities. For example, the U.S. Air Force has allocated over $1 billion for research into next-generation propulsion technologies in its 2024 budget (U.S. Air Force). As nations focus on developing faster and more reliable missile systems, the propulsion segment is expected to expand rapidly.

By Launch Mode Insights

The launch mode dominated is the surface-to-surface missiles which accounted for 40.4% of the market share in 2024 since these are widely used for strategic strikes and ground-based operations. Countries like the United States and Russia have invested heavily in these systems, with the U.S. Army's Long Range Precision Fires program receiving over $1.5 billion in funding for 2024. The effectiveness of surface-to-surface missiles in various military operations underscores their significance in modern warfare.

The air-to-surface missiles predicted to witness the highest CAGR of 8.2% from 2025 to 2033. This expansion is caused by the increasing use of air-to-surface missiles in combat operations, as they provide flexibility and precision in targeting ground-based threats. The U.S. Department of Defense has reported that air-to-surface missiles are becoming essential for modern air forces, with a focus on enhancing strike capabilities. In 2023, the U.S. allocated over $2 billion for the development of advanced air-to-surface missile systems, reflecting the growing importance of this segment in military strategy.

By Range Insights

The range is short-range missiles led the market by capturing a 45.3% of the total market share in 2024 owing to the short-range missiles are widely used for tactical operations and are easier to deploy. They are effective in various military scenarios, including battlefield support and quick response to threats. According to the U.S. Department of Defense, short-range missiles are crucial for ground forces, allowing them to engage targets within a range of 300 kilometers effectively. Their versatility and rapid deployment capabilities make them essential for modern military strategies.

The long-range missiles is anticipated to witness the fastest CAGR of 9.0%. This growth is driven by the increasing need for countries to strike targets at greater distances, enhancing their strategic capabilities. Long-range missiles allow for precision strikes without the need for ground troops, making them valuable in modern warfare. The U.S. Department of Defense has invested heavily in long-range strike capabilities, with a budget of over $1.2 billion allocated for the development of advanced long-range missile systems in 2024. This focus on long-range capabilities reflects the changing nature of military engagements and the importance of maintaining a strategic advantage.

By End-use Insights

The largest segment in the missiles market by end-use is the air segment, which captured for 50.5% in 2024 as these are essential for air superiority and ground attack missions. Countries like the United States and Russia have invested heavily in air-to-air and air-to-ground missile systems. The U.S. Air Force reported that air-launched missiles are critical for modern combat operations, with over 70% of air missions involving precision-guided munitions. This highlights the importance of the air segment in achieving military objectives and maintaining operational effectiveness.

The swiftly rising category in the missiles market is the navy segment, with a projected CAGR of 8.5% from 2025 to 2033 due to the increasing need for naval forces to enhance their strike capabilities and protect maritime interests. As tensions in various regions rise, countries are investing in advanced naval missile systems to ensure maritime security. The U.S. Navy has allocated over $3 billion for the development of new naval missile technologies in its 2024 budget, reflecting the growing importance of naval capabilities in modern warfare. This investment underscores the strategic role of naval forces in global security and defense operations.

REGIONAL ANALYSIS

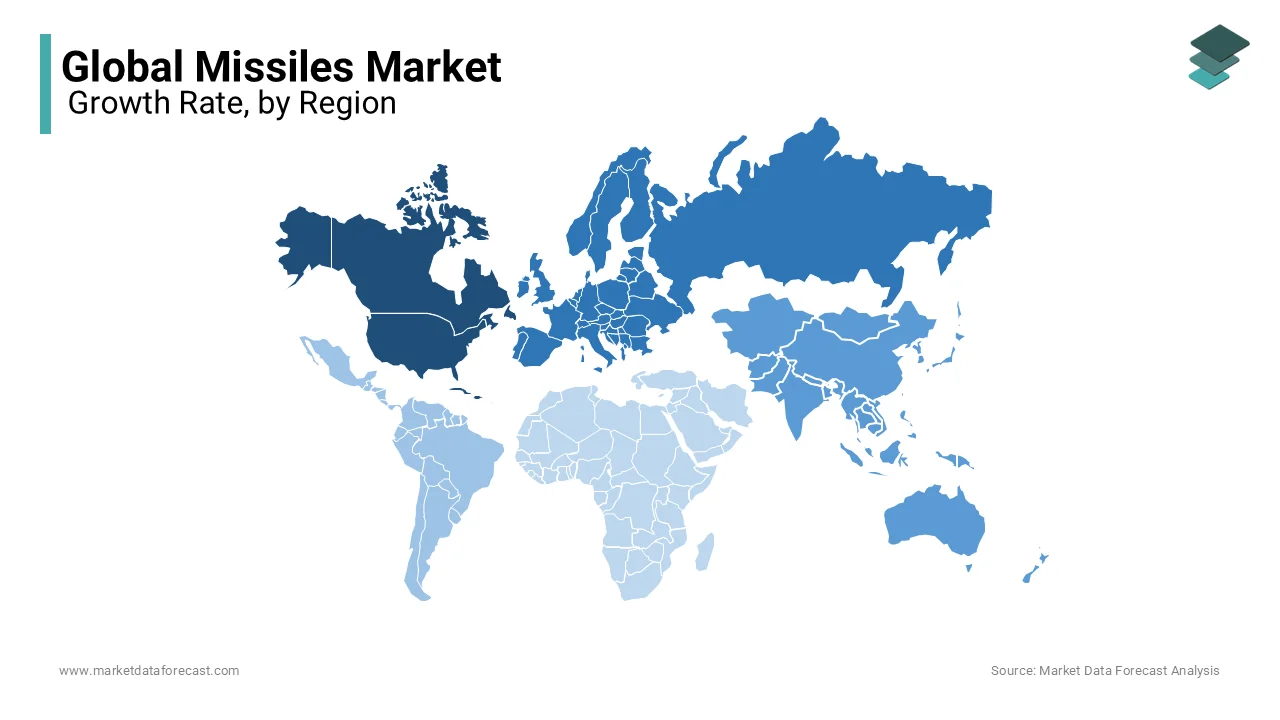

North America is primarily driven by the United States and dominates the missiles market by accounting for 40.3% of the global market share in 2024owing to the substantial defense budgets, advanced technology, and a robust defense industrial base. The U.S. invests heavily in missile defense systems, including THAAD and Aegis, enhancing national security and global military presence. Additionally, partnerships with NATO allies and ongoing modernization programs further solidify North America's position. The region's focus on innovation and research and development ensures it remains at the forefront of missile technology advancements.

Europe is witnessing a resurgence in missile capabilities which is propelled by increasing defense budgets and geopolitical tensions. The region's missile market is expected to grow significantly, with countries like France, Germany, and the UK enhancing their military capabilities. In 2023, European defense spending reached approximately USD 300 billion, reflecting a 5% increase from the previous year, as per the European Defence Agency. This growth is fueled by the need to address emerging threats and enhance collective security. Collaborative projects, such as the European Defence Fund, aim to foster innovation and interoperability among member states, positioning Europe as a key player in the global missiles market.

The Asia Pacific region is rapidly expanding its missile market, with a projected CAGR of 8.05% from 2025 to 2033 because of the rising defense budgets and regional security concerns. Countries like China and India are significantly increasing their military expenditures, with China's defense budget projected to reach USD 250 billion by 2025 as reported by the Stockholm International Peace Research Institute. This growth is fueled by territorial disputes and the need for advanced military capabilities. Additionally, the region is investing in indigenous missile development programs, enhancing self-reliance and technological advancements. The strategic importance of Asia Pacific in global geopolitics further underscores its role in the missiles market, attracting international partnerships and investments.

Latin America is emerging as a growing market for missiles, with countries like Brazil and Argentina increasing their defense spending. In 2023, the region's defense expenditure reached approximately USD 60 billion, reflecting a 3% increase from the previous year, according to the SIPRI. This growth is driven by concerns over regional security and the need to modernize military capabilities. Collaborative efforts among Latin American nations to enhance defense cooperation and technology sharing are also gaining momentum. As geopolitical dynamics evolve, Latin America is positioning itself as a potential market for missile systems, attracting interest from global defense manufacturers.

The Middle East and Africa are critical regions for the missiles market, characterized by ongoing conflicts and security challenges. The defense spending in the Middle East is projected to reach USD 100 billion by 2025, with countries like Saudi Arabia and the UAE leading the way. The demand for advanced missile systems is driven by regional tensions and the need for enhanced defense capabilities. Additionally, partnerships with global defense contractors are facilitating technology transfers and local production. The strategic importance of the region in global energy markets further amplifies its significance in the missiles market, attracting international attention and investment.

KEY MARKET PLAYERS

The major players in the global missiles market include Airbus SE, Honeywell International Inc., Lockheed Martin Corporation, Northrop Grumman, Thales Group, BAE Systems Inc., Israel Aerospace Industries Ltd. (IAI), ISRO, RTX Corporation, and The Boeing Company.

TOP 3 PLAYERS IN THE MARKET

Lockheed Martin Corporation

Lockheed Martin Corporation is a dominant player in the global missiles market, recognized for its innovative missile systems such as the Javelin and Hellfire missiles. These systems are essential for both ground and air operations, providing precision strike capabilities. Lockheed Martin holds a significant market share, contributing to over 30% of total missile sales globally. Their focus on research and development ensures that they remain at the forefront of missile technology, enhancing military effectiveness and operational readiness. The company’s commitment to advancing missile capabilities through continuous innovation and strategic partnerships with government agencies further solidifies its leadership position in the global defense landscape.

Raytheon Technologies Corporation

Raytheon Technologies Corporation is a key contributor to missile defense and precision-guided munitions. The company specializes in advanced missile systems, including the Tomahawk cruise missile and the Patriot missile system, which are vital for national defense strategies. Raytheon's commitment to advancing missile technology through continuous innovation and partnerships with government agencies strengthens its position in the market. Their focus on developing cutting-edge solutions not only enhances military capabilities but also plays a crucial role in global defense initiatives, making Raytheon a significant player in the missiles market.

Boeing

Boeing is instrumental in the missiles market, with a market share of around 20%. The company develops a range of missile systems, including the Harpoon anti-ship missile and advanced missile defense technologies. Boeing's focus on integrating cutting-edge technology into its missile systems enhances military capabilities worldwide. Their strategic partnerships and contracts with various defense organizations further solidify their role in shaping the future of missile technology and defense solutions. By investing in research and development, Boeing continues to innovate and adapt to the evolving needs of modern warfare, ensuring its relevance in the global missiles market.

TOP STRATEGIES USED BY THE KEY MARKET PARTICIPANTS

Research and Development (R&D)

Continuous investment in R&D is crucial for developing advanced missile technologies. Companies focus on creating precision-guided munitions, hypersonic missiles, and missile defense systems. This innovation not only meets the evolving demands of modern warfare but also ensures compliance with international defense standards. By prioritizing R&D, firms can stay ahead of competitors and respond effectively to emerging threats, thereby solidifying their market position.

Strategic Partnerships and Collaborations

Forming alliances with government agencies, defense contractors, and technology firms is a key strategy. These partnerships facilitate knowledge sharing, resource pooling, and access to new markets. Collaborations often lead to joint ventures that enhance product development and distribution capabilities. By leveraging each other's strengths, companies can accelerate innovation and improve their competitive stance in the global market.

Expansion of Product Offerings

To cater to diverse defense needs, key players focus on expanding their product portfolios. This includes launching new missile systems, upgrading existing technologies, and diversifying into related areas such as unmanned aerial vehicles (UAVs) and cyber defense. By broadening their offerings, companies can attract a wider customer base and adapt to changing geopolitical landscapes, ensuring sustained growth and relevance in the market

COMPETITIVE LANDSCAPE

The missiles market is characterized by intense competition driven by technological advancements and geopolitical tensions. Key players are investing heavily in R&D to develop hypersonic and precision-guided munitions, while strategic partnerships enhance innovation and market access. Additionally, the expansion of product offerings allows companies to adapt to diverse defense needs, ensuring relevance in a rapidly evolving landscape. Emerging trends, such as missile defense systems and international collaborations, further shape the competitive dynamics, highlighting the importance of agility and foresight in this critical sector. The missiles market is highly competitive, with many countries and companies striving to gain an edge. One interesting perspective is the role of emerging technologies, such as artificial intelligence and machine learning, in missile systems. These technologies can improve targeting accuracy and decision-making speed, making missiles more effective in combat situations.

Another insight is the increasing focus on sustainability. As environmental concerns grow, companies are exploring ways to make missile production and operation more eco-friendly. This shift could lead to new materials and processes that reduce the carbon footprint of missile systems.

Additionally, the rise of non-state actors and asymmetric warfare is changing the landscape. Traditional missile manufacturers must adapt to the needs of smaller, agile forces that may not require large-scale missile systems. This could open up new markets and opportunities for innovation in missile design and functionality, catering to a broader range of customers.

RECENT MARKET DEVELOPMENTS

- In January 2025, the U.S. Navy awarded Lockheed Martin a $383 million contract for the development of the next generation of the Trident II D5 missile, ensuring continued sea-based strategic deterrence.

- In February 2025, Lockheed Martin began construction on an advanced missile production facility to support evolving strategic deterrence missions and modern digital manufacturing capabilities.

- In March 2025, Raytheon Technologies secured a $450 million contract from the U.S. Department of Defense to develop and produce next-generation missile defense systems, enhancing national security.

- In February 2025, Northrop Grumman successfully tested a new hypersonic missile prototype capable of traveling at speeds greater than Mach 5, marking a significant advancement in missile technology.

- In October 2024, MBDA conducted a successful live-firing test of the SPEAR 3 missile at Sweden's Vidsel test range, demonstrating its high-speed, high-altitude capabilities and long-range precision targeting.

MARKET SEGMENTATION

This research report on the global missiles market is segmented and sub-segmented into the following categories.

By Component

- Guidance System

- Propulsion System

- Warhead

- Airframe

- Launch System

- Others

By Launch Mode

- Surface-to-surface

- Surface-to-air

- Air-to-surface

- Air-to-air

By Range

- Short Range

- Medium Range

- Long Range

By End-use

- Air

- Navy

- Ground

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

What growth rate is projected for the global missile market in the coming years?

The global missile market is expected to grow at a compound annual growth rate (CAGR) of 7.43% from 2025 to 2033.

What factors are driving the growth of the missile market?

Increasing defense expenditures, development of advanced missile technologies, and a growing focus on national security are key drivers.

How is the adoption of hypersonic missile systems shaping the market?

The rise in hypersonic missile development offers lucrative growth opportunities, as nations invest in these advanced systems to enhance military capabilities.

How are technological advancements influencing missile development?

Innovations in materials, propulsion systems, and manufacturing techniques are enabling the development of more capable and cost-effective missile systems.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]