Global Millet Market Size, Share, Trends, & Growth Forecast Report - Segmented By Type (Pearl Millet, Finger Millet, Proso Millet, Foxtail Millet And Others), Application (Bakery Products, Infant Food, Steam Cooked Products, Porridges, Breads, Breakfast Food, Beverages, And Fodder), Distribution Channel (Supermarket, Trade Associations, Online Stores And Traditional Grocery Stores), And Region (North America, Europe, APAC, Latin America, Middle East And Africa) – Industry Analysis From 2025 To 2033

Global Millet Market Size

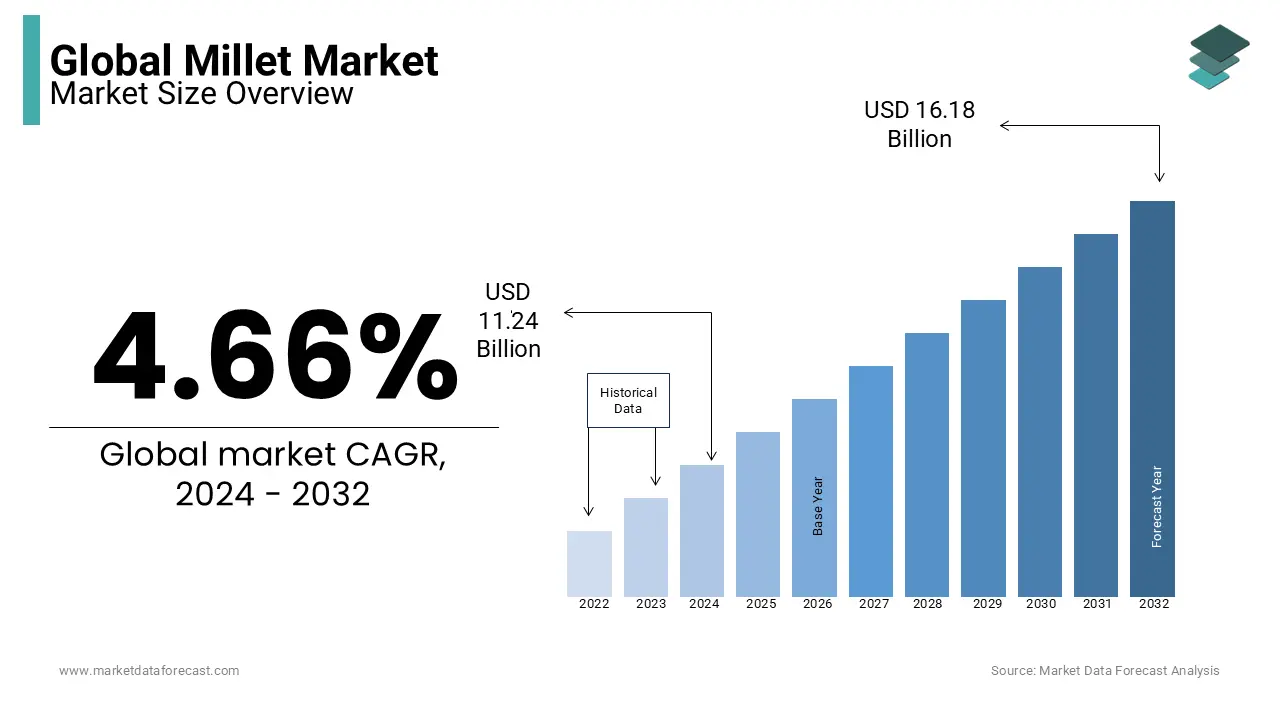

As per our analysis report, the global millet market was expected to be worth USD 11.24 billion in 2024 and is anticipated to be worth USD 16.93 billion by 2033 from USD 11.76 billion in 2025, growing at a CAGR of 4.66% during the forecast period.

Millet is usually a small seed crop and is known for its high nutritional value. All over the world, there are varieties of millet of various colors, such as white, gray, pale yellow, and red. They outperform mainstream grains such as rice and wheat in terms of nutrition. The trend of interest in reactivating the consumption of millet in several countries favors the growth prospects of this market in recent years. There are several plans to improve the cultivation and consumption of millet to reduce the health risks from diabetes, obesity, and cardiovascular disease. Millet plays an important role in many countries in Africa and Asia when it comes to food security and the economy. It is gaining popularity in Europe and North America due to its gluten-free and hypoglycemic properties. Millet is a small grain seed that retains its excellent nutritional properties. In terms of nutritional properties, it is superior to certain high-consumption grains such as rice and wheat. Despite its excellent nutritional properties, millet received less attention than the main grain. An increased awareness of the urban population about the health benefits associated with the consumption of millet will drive the growth of the global millet market during the forecast period.

MARKET DRIVERS

Changes in lifestyle and eating habits have led to a number of diseases, including cardiovascular problems such as diabetes, obesity, myocardial infarction, coronary artery disease, and arrhythmia.

Millet is rich in minerals and proteins, such as calcium and iron, which can help prevent these diseases. Growing consumer preferences for healthy bakery preparations motivate producers to use natural and gluten-free ingredients that provide the same flavor and consistency without high concentrations of saturated and Trans fats. Adoption of healthy eating habits and a greater tendency to switch to low-calorie alternatives can increase the market share of millet. Millet business is expected to show large gains during the forecast period due to important factors, including climate change. But millet will be a more important solution for farmers. Millet is the last crop of the drought and endures extremely high temperatures. Also, due to its great properties, such as gluten-free, ancient grains, superfoods, good for weight loss, and low glycemic index, millet is now suitable for the biggest global health food trends, so it is important to capitalize now to boost the market and research. With the increasing demand in the Asia Pacific countries, mainly China and India, farmers have started to float towards growing millet through wheat and rice.

Various diseases, such as diabetes, obesity, and cardiovascular problems, such as heart attack and coronary artery disease, have been caused by eating habits associated with the urban lifestyle. Therefore, increasing public awareness of the health benefits associated with consuming millet will stimulate future growth in the industry. However, its gluten-free properties are expected to provide beneficial opportunities for the production of low-GI and gluten-free foods. Many developing countries and federal governments have long-term policies to implement nutrition programs to address malnutrition. The promotion of government initiatives and the inclusion of millet in a variety of foods and beverages will increase the size of the industry. Demand for products increased during the forecast period, with an increase in the urban population, a propensity for healthy foods in the Asia Pacific region, and an increase in the unsustainability of rice and wheat production. Increased water use efficiency in millet production is expected to boost the global millet market in the coming years.

MARKET RESTRAINTS

The high product costs associated with mainly consumed grains serve to deter the penetration of urbanized food markets.

This price is generally high compared to rice and wheat due to the weakness of the supply chain and lower production in the millet market. Millet has a limited shelf life, which is believed to hamper market growth. Difficult handling is a major challenge that hampers consumer demand and increases the potential for minority accounting. Various interventions can be made to give entities in the value chain access to processing plants on the one hand and to facilitate consumer access to processed millet products on the other. Local producers have to carry their products remotely, as there is no suitable processing unit near the millet. The high prices of products compared to mass consumption grains play an important role in impeding the penetration of urban food markets.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

4.66% |

|

Segments Covered |

By Type, Application, Distribution Channel, and Region |

|

Various Analyses Covered |

Global, Regional and Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Archer Daniels Midland Company, Cargill, Inc., Brett-Young Seeds Limited, E.I. DuPont De Nemours and Company, Wise Seed Company, Inc., Ernst Conservation Seeds, Bayer Crop Science AG, and Roundstone Native Seed Company |

SEGMENTAL ANALYSIS

Global Millet Market Analysis By Type

Pearl sorghum adapts well to hot climates and is resistant to drought. It grows better than other grains in warm, dry areas. Pearl sorghum does well on sandy soils where most other crops fail. Proso millet is mainly suitable for a drier continental climate than most other millets. Also known as regular millet, it requires the least amount of water.

Global Millet Market Analysis By Application

Porridge and steamed dishes have been some of the main products traditionally cooked in millet. They are mainly consumed in India and other parts of Africa. It is a food that is commonly prepared with oat millet. Sorghum and other sorghum-producing countries generally consume thick, tough porridge. Bakery products, including packaged cookies, are becoming increasingly important as they are easily accessible in supermarkets, hypermarkets, and e-commerce sites, especially in Asia Pacific countries.

Global Millet Market Analysis By Distribution Channel

Online stores or e-commerce sites are emerging as viable distribution channels for product processors and are likely to show promise. Average growth rate of more than 3% or more per year by 2025. It is one of the best-known channels for canned millet brands and helps processors create their own supply chains that provide services such as door-to-door delivery. It also reduces dependency on third-party retailers and traditional grocery stores.

REGIONAL ANALYSIS

North America is estimated to establish itself as the largest market for millet, followed by Asia Pacific, excluding Japan (APEJ), in terms of sales. North American and APEJ millet sales revenue will account for more than one-third of the total market during the forecast period. Europe will also continue to be a lucrative market for millet, which is expected to post a CAGR similar to the APEJ by 2026. Africa and Asia Pacific are the main regions where almost all varieties of millet are produced. The arid climate regions of the country in this sub-region of Africa are conducive to millet production. India produces all kinds of products and processed forms, which are attracting the attention of the country's urban population. Nigeria is a renowned producer of pearl and dog grass products. The governments of these countries also understood the importance of the products in terms of food safety and environmental sustainability. Therefore, they are slowly taking steps to increase yields and introduce products to the population through various forms of processing. Latin America is expected to show steady expansion in the world millet market, but sales in this region are expected to maintain a low share of market revenue.

KEY PLAYERS IN THE GLOBAL MILLETS MARKET

Major Key Market Players in the Global millet market are Archer Daniels Midland Company, Cargill, Inc., Brett-Young Seeds Limited, E.I. DuPont De Nemours and Company, Wise Seed Company, Inc., Ernst Conservation Seeds, Bayer Crop Science AG, Round stone Native Seed Company.

DETAILED SEGMENTATION OF GLOBAL MILLET MARKET INCLUDED IN THIS REPORT

This research report on the global millet market has been segmented and sub-segmented based on type, application, distribution channel, & region.

By Type

- Pearl millet

- Finger millet

- Proso millet

- Foxtail millet

- Others

By Application

- Bakery products

- Baby food

- Steamed products

- Porridge

- Bread

- Breakfast foods

- Beverages

- Animal feed

By Distribution Channel

- Supermarkets

- Trade associations

- Online stores

- Traditional grocery stores

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

1. What are the nutritional benefits of consuming millets?

Millets are rich in nutrients such as protein, fiber, vitamins, and minerals. They are gluten-free and have a low glycemic index, making them suitable for people with dietary restrictions and those managing blood sugar levels.

2. What are the current trends in the millet market?

Some current trends in the millet market include increasing consumer demand for gluten-free and nutritious food options, growing interest in ancient grains and traditional foods, and expanding millet-based products in the global market due to their health benefits and versatility.

3. What factors are driving the growth of the millet market?

Several factors are driving the growth of the millet market, including rising consumer awareness about the health benefits of millet, increased demand for gluten-free and whole grain products, the growing popularity of plant-based diets, and government initiatives promoting millet cultivation and consumption.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]