Global Milk Replacers Market Size, Share, Trends & Growth Forecast Report By Type (Medicated, And Non-Medicated), Livestock (Ruminants, And Swine), Source (Milk-Based, Non-Milk-Based, And Blended), Form (Powdered, And Liquid), And Region (North America, Europe, APAC, Latin America, Middle East And Africa), Industry Analysis From 2025 To 2033

Global Milk Replacers Market Size

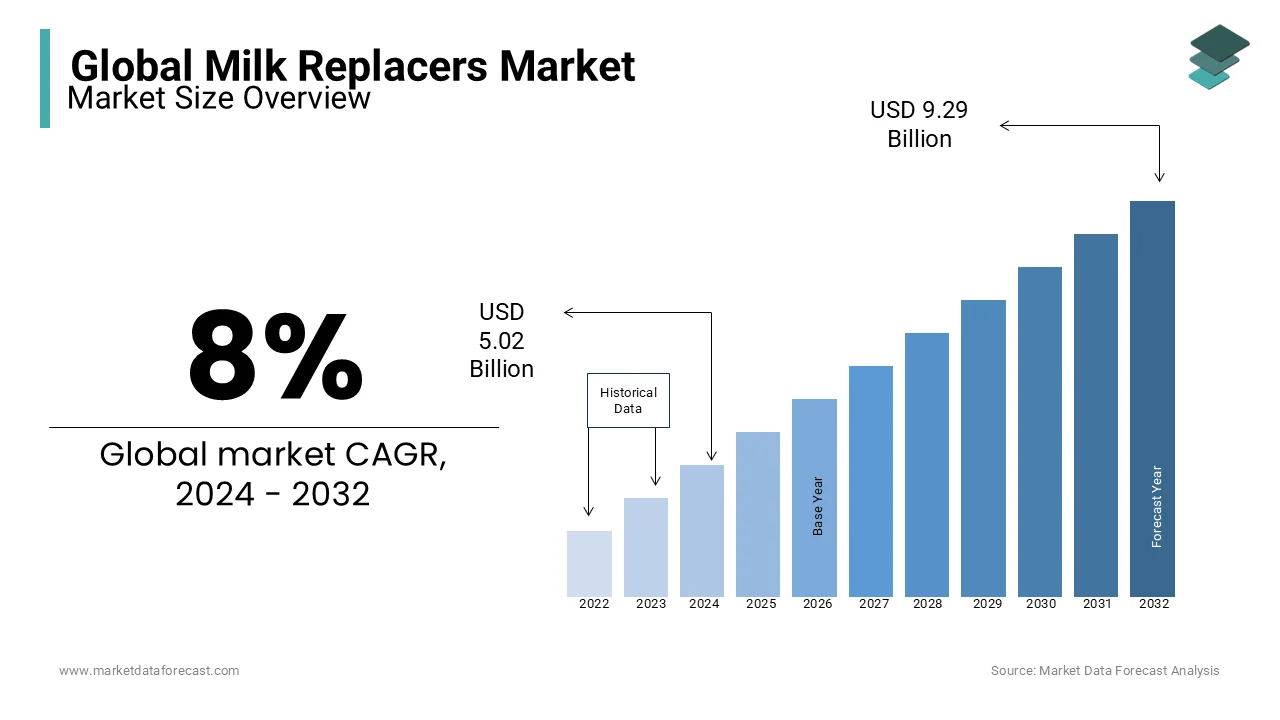

The global milk replacers market size was valued at USD 5.02 billion in 2024. The global market is further expected to grow from USD 5.42 billion in 2025 to USD 10.03 billion by 2033, expanding at a CAGR of about 8% over the forecast period.

Milk replacers, widely known as milk substitutes, are made using various raw materials, mimic the nutritional value of cattle milk, and are supplied to young calves when natural milk is not adequate. These milk replacers play an essential role in improving and maintaining health in the early stages of the calf. Milk replacers also help milk producers lower costs by maximizing the benefits of milk production, as they see a drop in the cost of raw materials used worldwide. Milk-based replacers are considered ideal since the digestive system of their offspring is adapted to act on milk, helping to absorb the maximum amount of nutrients from milk-based replacers. This alternative is mainly used in developed countries due to the high awareness of livestock keepers about the benefits of milk-based alternatives. Milk replacers are less fatty than whole milk and rich in minerals, vitamins, and other nutrients. Veal milk substitutes are available in liquid and powder form, and the product is available in powder form, making it easy to use. The powder can be combined with water or whole milk before feeding and storing. Milk replacers also have an extended shelf life compared to whole milk.

MARKET DRIVERS

Milk replacers across the world have been growing in recent years. The growing market for dairy farmers is increasingly aware of its potential, and the market for replacing beef milk is growing. Milk replacer manufacturers are designing products supporting calf intestines and general health early in life. The milk replacers market is expected to show an outstanding CAGR while achieving rapid growth during the forecast period. Milk replacers are cheaper than cow's milk and have a high market growth rate. Manufacturers are investing in research and development to develop technologies that provide products that support intestinal health and improve immunity. Milk replacers also offer protein, fortified vitamins, organic selenium, and trace minerals necessary for optimal absorption and usage. Young calves can grow well when fed as a milk substitute, and the rumen can develop just as it does when whole milk is consumed. Milk replacers help prevent digestive problems and the risk of redness. It also reduces the risk of disease transmission from cows to calves. The milk changer is best suited for automatic calf-feeding systems. Awareness, prosperity, enormous purchasing power, and the more significant nature of the animal products industry are critical drivers of market demand.

The global milk replacers market is determined to record moderate growth in the future, as the market has witnessed a drastic increase in recent years. The manufacturers are focusing on innovative formulations that provide the animal infants with complete nutritional value, majorly boosting the market growth opportunities. The growing awareness regarding the benefits of milk substitutes and the need for healthy growth of pets and cattle is accelerating the adoption of milk replacers, leading to the expansion of market revenue. The escalating demand for ready-to-consume nutritional products in animals is majorly driving the milk replacers market growth. The milk replacers benefit the livestock bearers by reducing the cost of feeding the offspring. The milk replacers are cost-effective compared to whole milk, which fuels growth opportunities.

The global increase in the consumption of animal products is positively affecting the growth of the milk substitute market. While global demand for beef-based foods and milk-based products increases, significant growth can also be seen in livestock farming. From the birth of the calf, the quality of the final livestock product must be guaranteed, which is why we are increasingly focusing on the offspring's diet. Cow's milk is sold as a base product and used as a raw material for many milk-based products, so the calf must supply a milk substitute. Developed countries worldwide are developing and following established processes to pressure dairy and meat products to improve agricultural quality and prevent the spread of disease caused by unregulated diets. Organized dairy producers are also emerging in developing countries. These factors drive the overall demand for milk replacers in the global market. The leading players in the market for veal milk replacers focus on improving brands and promoting their products on various platforms. Manufacturers also strive to increase the product's popularity among consumers by raising awareness and providing knowledge. Additionally, major companies are investing heavily in the research and development process to launch new products with new goals.

MARKET RESTRAINTS

The increasing demand for the product's nutritional value by the people is making the market players constantly add supplements in the milk replacers to enhance the nutritional value, which is expected to be a significant challenge for the manufacturers to expand their portfolio. The high costs associated with the encapsulation technologies, which further increase the final product price, are estimated to limit the market growth. Another factor restraining the market is that using waste or trans-species milk as alternatives will hamper the global market by limiting the adoption rate. One of the significant concerns regarding milk replacers is the inclusion of antibiotics, which need to be more regulated in underdeveloped regions, impeding the market growth opportunities. The presence of varied strict regulations in different regions regarding milk replacers will require more work from manufacturers to expand the milk replacers market worldwide.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

8% |

|

Segments Covered |

By Type, Livestock, Source, Form, And Region |

|

Various Analyses Covered |

Global, Regional and Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Bewital Agri GmbH & Company Kg, Cargill (U.S.), Archer Daniels Midland Company (U.S.), CHS Inc. (U.S.), Land O’ Lakes (U.S.), Lactalis Group (France), Glanbia, VanDrie Group (Netherlands), FrieslandCampina (Netherlands), Nutreco N.V. (Netherlands), Alltech (U.S.) |

SEGMENTAL ANALYSIS

By Type Insights

The non-medicated segment held the largest share in the global milk replacers market and is estimated to maintain the domination during the forecast period. The increased demand for non-medicated milk replacers is due to their lower costs than medicated ones. The Livestock owners in various regions like India, China, and Brazil are becoming cost-conscious, enhancing the demand for non-medicated milk replacers and leading to market revenue growth.

The medicated segment is expected to grow moderately during the forecast period. It provides high nutrition to cattle by boosting the animals' immune systems.

By Livestock Insights

The ruminants segment dominated the global market revenue with a significant market share. The primary requirement of the livestock is the healthy growth of the calves, as they are in high demand in dairy and meat production, which is the primary factor driving the segment growth. The growing calf population and the increased consumption of whole milk in the dairy sector are accelerating the demand for ready-to-consume calf milk replacers, which fuels segmental growth. The calf milk replacer is low cost compared to the whole cow's milk, which is raising the demand for milk replacers among the ruminants. The ruminants include cattle, sheep, goats, antelopes, deer, and others.

The swine segment is estimated to grow prominently with a moderate CAGR in the coming years, which will mark substantial growth.

By Source Insights

The milk-based segment held the greatest market share in global market revenue as it is used to feed livestock offspring. The livestock offspring's digestive system is designed to function with milk, which is raising the demand for milk replacers as alternatives to whole milk to provide nutrition to the offspring.

The blended segment is expected to grow fastest in the coming years as these are formulated using multiple ingredients from various sources, such as dairy proteins, plant-based proteins, and other essential nutrients.

By Form Insights

The powdered segment dominated the global market with the highest CAGR and is projected to grow significantly during the forecast period. Powdered milk replacers are cost-effective compared to whole milk, enhancing demand and leading to segment growth. The ease of availability, effective storage conditions, and handling of powders are accelerating their adoption, driving segment growth.

REGIONAL ANALYSIS

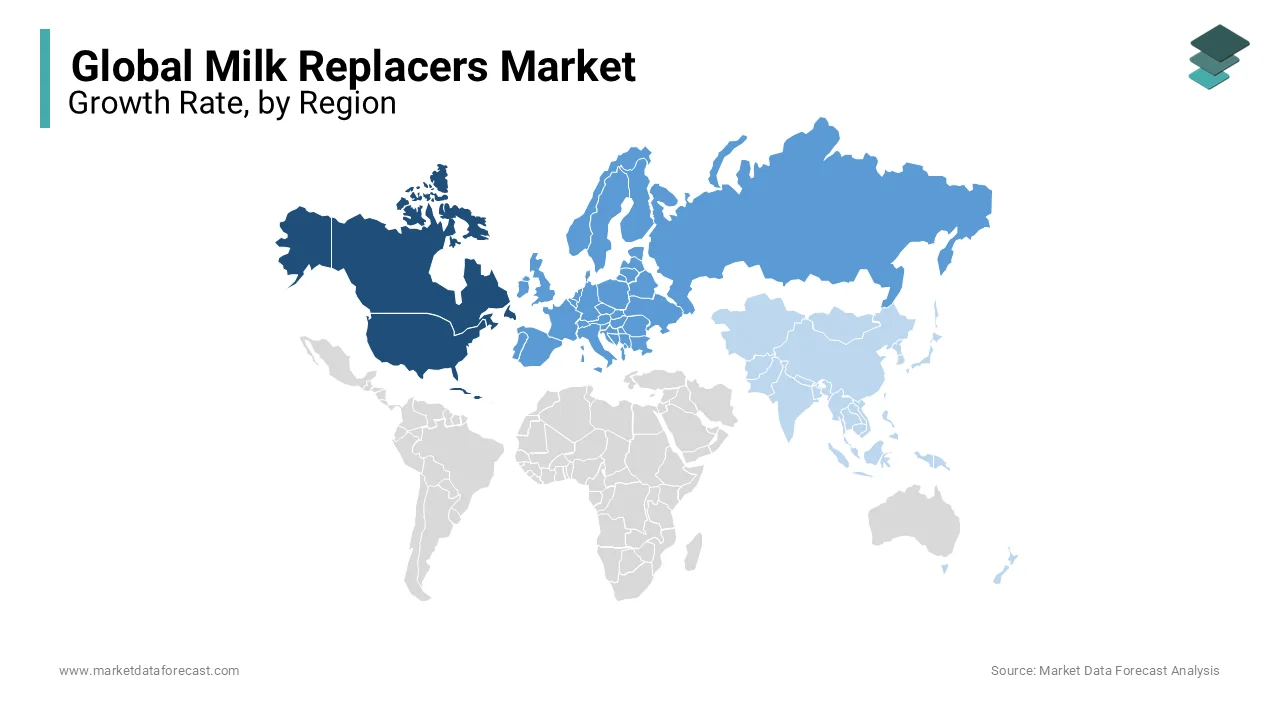

Geographically, the worldwide market for liquid milk alternatives finds market coverage in North America, Europe, Asia Pacific, Latin America, the Middle East, and Africa. The North American milk replacer market is expanding in a remarkable way over the next few years. This regional growth is due to the increased interest in R&D activities to develop innovative products throughout the region. In addition, milk substitutes are the primary substitute for livestock feed. Europe is dominating the market due to the region's high consumption of substitutes for liquid milk. The European Commission focuses on the health and nutrition of animals in the early stages of growth. According to European law, all calves must be able to communicate with their mother for at least two weeks after birth to consume colostrum. It is then transferred to a calf farm to provide milk substitutes to replace milk. Additionally, livestock keepers have used liquid milk substitutes in their breeding systems as dairy use increases.

The Asia Pacific region is projected to have the fastest growth during the forecast period due to progressive urbanization and rising demand for quality animal products. Livestock producers are focusing on nutritional value supplements with cost benefits in various countries like China and India, which is boosting the regional market growth.

KEY MARKET PLAYERS

Bewital Agri GmbH & Company Kg, Cargill (U.S.), Archer Daniels Midland Company (U.S.), CHS Inc. (U.S.), Land O’ Lakes (U.S.), Lactalis Group (France), Glanbia, VanDrie Group (Netherlands), FrieslandCampina (Netherlands), Nutreco N.V. (Netherlands) and Alltech (U.S.) are a few of the key players in the global milk replaces market.

RECENT HAPPENINGS IN THE MARKET

- In November 2022, Archer Daniels Midland Company established a new research laboratory in Switzerland. The company intends to enhance its research activities on science-based feed additives to meet the needs of livestock and pet food customers.

- Pet-Ag Inc. launched goat's milk Esbilac Liquid Milk Replacer through its retail and distribution partners. The new product is formulated with goat's milk to suit puppies' sensitive digestive systems.

- In 2021, Denkavi, a Dutch company, acquired the animal nutrition division of FrieslandCampina. This division included milk replacer brands like Porcolac, Kalvolac, Serolat, and others, and it produces around 80,000 metric tons of animal feed.

- In October 2019, Royal Friesland Campina N.V. announced that it had signed a contract to expand the production and supply of mozzarella cheese with Royal A-ware. In addition to milk supply and recipes, the former company is also well-known for its sales of mozzarella cheese.

- Cargill announced a reorganization of the animal nutrition business in September 2019 as animal health and animal health issues increased.

- In June 2019, Land O'Lakes, Inc. made a deal with the Royal Agrifirm Group, a firm in the Netherlands, to develop Agrilakes, a Chinese-based joint venture for dairy animal food.

MARKET SEGMENTATION

This research report on the global milk replacers market has been segmented and sub-segmented based on type, livestock, source, form, & region.

By Type

- Medicated

- Non-Medicated

By Livestock

- Ruminants

- Swine

By Source

- Milk-based

- Non-milk-based

- Blended

By Form

- Powdered

- Liquid

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

1. What are the current trends driving growth in the milk replacers market?

Several trends are influencing the milk replacers market, including the increasing demand for alternatives to natural milk, rising adoption of precision livestock farming practices, advancements in formulation technology, and a growing focus on animal welfare and health.

2. What are some key factors contributing to the increasing adoption of milk replacers?

Factors contributing to the increasing adoption of milk replacers include improving productivity and efficiency in livestock production, mitigating the impact of factors such as drought and disease outbreaks on natural milk supply, reducing production costs, and enhancing animal health and welfare.

3. What role do technological advancements play in the growth of the milk replacers market?

Technological advancements play a crucial role in the growth of the milk replacers market by enabling the development of more efficient production processes, innovative formulation techniques, and precision feeding solutions. Automation, data analytics, and digital technologies are increasingly utilized to optimize feed formulations, monitor animal health and performance, and improve overall productivity.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com