Global Milk Powder Market Size, Share, Trends, & Growth Forecast Report - Segmented By Type (Dry Buttermilk, Dry Whey Products, Dry Whole Milk, Dry Dairy Blends And Non-Fat Dry Milk), Application (Infant Formulas, Nutritional Formulas, Confectionaries And Baked Sweets And Savouries), Function (Foaming, Emulsification, Flavouring And Thickening), And Region (North America, Europe, Asia Pacific, Latin America, And Middle East & Africa) - Industry Analysis (2025 To 2033)

Global Milk Powder Market Size

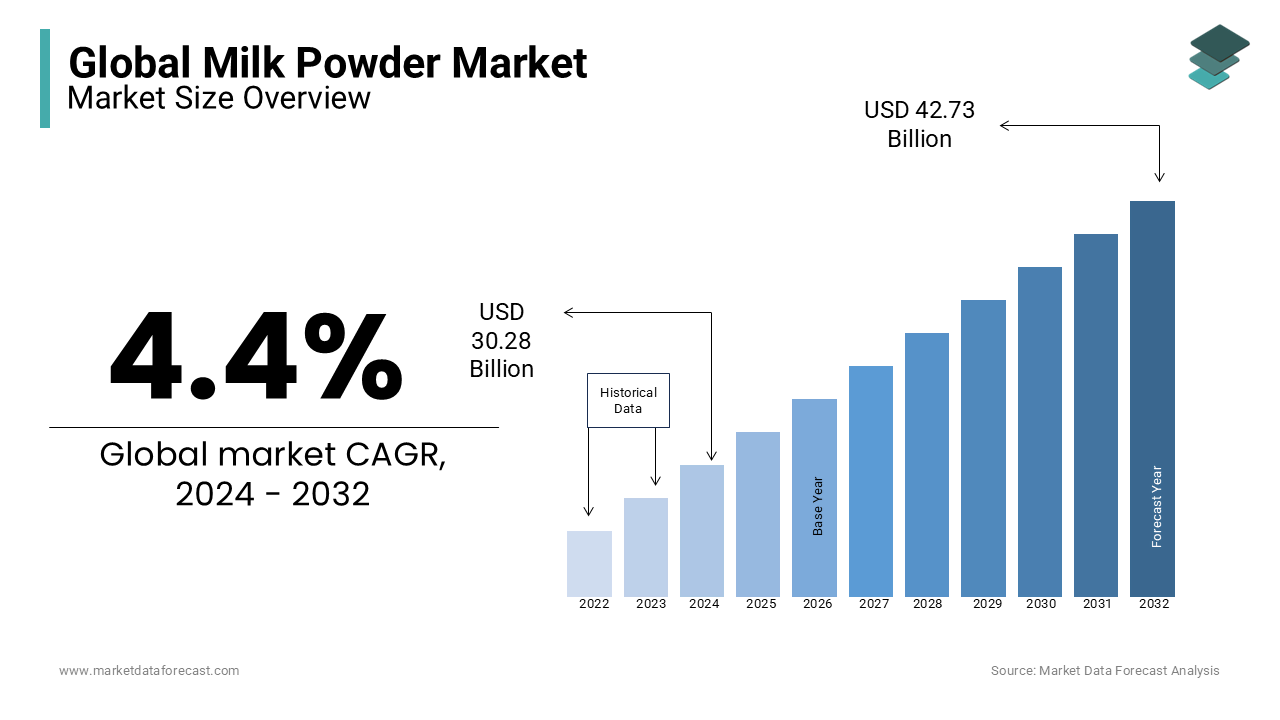

The global milk powder market size was calculated to be USD 30.28 billion in 2024 and is anticipated to be worth USD 44.61 billion by 2033 from USD 31.61 billion In 2025, growing at a CAGR of 4.40% during the forecast period. Because powdered milk has a low moisture content, it has a longer shelf life than liquid milk, leading to the growth of the market.

Milk powder is a dry dairy product that is made by dehydrating milk by evaporation. The purpose of producing milk powder is to increase the shelf life of milk without using a refrigerator. Various types of milk powder include whole milk powder, skim milk powder and bleach. It is widely consumed worldwide due to the nutritional benefits applied to infant formulas, confectionery, baked desserts, and salty products. Powdered milk is a healthy food because it has many micro and macronutrients. Powdered milk contains a significant amount of protein, contains remarkable amounts of vitamin C, B12, calcium, and other essential nutrients, and does not require individual containers for storage, making it a more convenient option than regular milk. Many countries have failed to meet the growing demand for milk, and the need for milk powder has increased, depending on imported milk, which is generally purchased in the form of powder.

MARKET DRIVERS

Milk Powder contains nicotine amide riboside, a micronutrient that can help prevent obesity, improve muscle performance, improve energy consumption, and avoid diabetes.

These factors drive the growth of the global milk powder market. The main advantage of milk powder is that it has a low moisture content, which increases the shelf life. Longer service life is desirable in places with high temperatures and inadequate transportation facilities. The reduction in transportation and storage costs associated with milk powder is driving the growth of the worldwide milk powder market. The demand for infant formula is also expected to increase as disposable income for the population living in emerging countries increases and adoption as an alternative to increasing milk. As concerns about UHT milk grow, the growth of the worldwide milk powder market is supposed to be obstructed. As milk powder has diversified its fields of application in the food and beverage industry, the continued growth of this industry has positively contributed to stimulating demand, especially in emerging regions such as China, India, and Brazil.

Milk Powder provides nutritional value and is being used in sports nutrition products, including dietary bars and beverages. The increasing demand for these products due to an increase in knowledge of physical fitness is driving the milk powder market. With the advent of globalization, people are becoming busier. Their way of life has changed, and the amount of time allotted for tasks like cooking has been dramatically reduced. The shortage of such quality time is pushing consumers to look out for other alternative products to quicken their regular household tasks. Consumers have adopted packaged and processed foods and convenient meals to reduce the time required to prepare food. By finding a suitable alternative, this factor paved the way for milk formula worldwide.

In addition, the shelf life of powdered milk is longer than that of ordinary milk, so the demand for powdered milk increases more than that of regular products. Also, the increase in the number of working women encourages the adoption of milk powder, promoting the growth of the milk powder market worldwide. Besides, the introduction or development of new products, such as flavored milk powder or lactose-free milk powder, is assumed to accelerate the growth of the milk powder market in the future.

MARKET RESTRAINTS

However, milk powder often contains emulsifiers. Emulsifiers are additives made from vegetable, animal, and synthetic raw materials to help milk powder and similar processed products achieve a smooth texture, prevent separation, and extend shelf life. There is a regular review of the safety of allowed additives by the FDA, which is based on scientific information and decides the continuity or withdrawal of such additives. This is a healthy alternative, which can affect the popularity of milk powder and limit the growth of the global milk powder market. Furthermore, strict regulations regarding milk powder have been developed in many countries, including China, because of the Chinese milk powder scandal, where hundreds of babies died from the consumption of soymilk powder. These regulations regarding declining dairy prices worldwide represent a challenge for manufacturers, hindering the growth of the global market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

4.4% |

|

Segments Covered |

By Type, Application, Function, And Region |

|

Various Analyses Covered |

Global, Regional and Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Nestle, Danone, Lactalis, Frieslandcampina, Fonterra, Dean Foods, Arla Foods, Dairy Farmers Of America, Kraft Foods, and Saputo |

SEGMENTAL ANALYSIS

Global Milk Powder Market Analysis By Type

The dry buttermilk segment is esteemed to have a significant share of the milk powder market. The liquid buttermilk is condensed at a temperature of 165F for 15 seconds to make it dry without destroying any kind of nutritional value. It has more than 30% of protein with no added preservatives or any other neutralizing agents. The overall process is confined to making high-quality dry buttermilk products with various flavors according to the interests of the consumers. Many search studies reveal that these products are completely safe, especially for those people who seek high nutritional products in their regular diet options.

The dry whey products segment is deemed to have the highest CAGR by the end of the forecast period. The rising number of fitness enthusiasts and their focus on prominent diet factors are escalating the growth rate of the market. It is important to store the products for many years without using any chemicals, but pasteurizing is likely to fuel the growth rate of the market.

Global Milk Powder Market Analysis By Application

The infant formula segment has substantially held the largest share of the milk powder market for many years and is forecasted to continue with the same flow during the forecast period. The rising awareness of giving infants proper nutrition-based milk if the mother is unable to breastfeed is likely to elevate the growth rate of this segment. Due to lifestyle changes and other factors, many women are unable to breastfeed their babies, which makes them choose the best infant formula to provide the same nutritional value.

The baked sweets and savories segment is another segment that is likely to have the fastest growth rate during the forecast period. The rising interest in eating different varieties of bakery items is showcasing huge opportunities to adopt milk powder that has a longer shelf life.

Global Milk Powder Market Analysis By Function

The emulsification segment is gearing up to have the highest share of the milk powder market. This function is highly needed to prepare any food that brings out the proper texture and taste. The quality of the food also depends on the nature of the emulsifier used and other attributes, which greatly influence the importance of using milk powder in various food products. The thickening segment is expected to have the largest growth rate in the market.

REGIONAL ANALYSIS

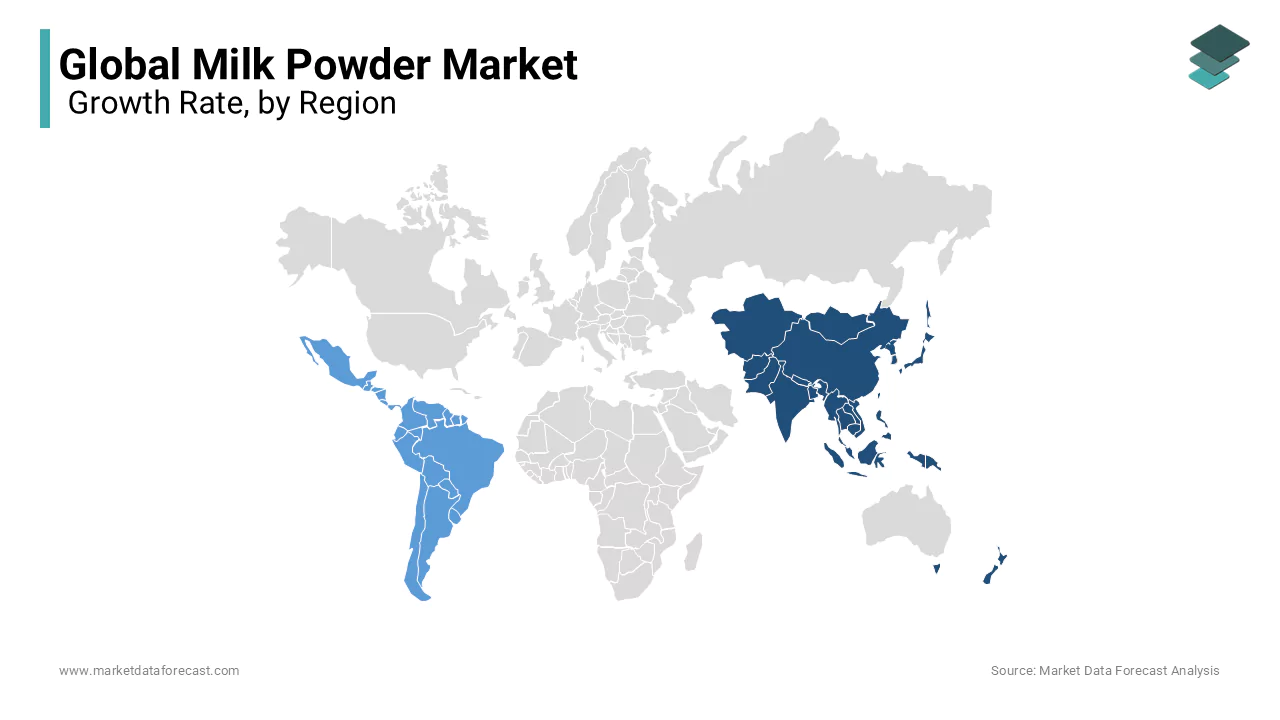

The main regions in the global milk powder market are Asia Pacific, Europe, North America, and the rest of the world (RoW). Globally, New Zealand is a significant exporter of milk powder. The United States is a major producer of milk powder, but much of its mass production is consumed domestically. China and France are also among the largest markets for infant formula. The milk powder market in the Asia-Pacific region is fueled by lifestyle changes due to globalization and an increase in the workforce, and countries such as Indonesia, Malaysia, the Philippines, and Thailand see a growing supply of modern retail chains. Due to the increase in the wealthy population and the increasing penetration of the Internet and social networks, the consumption of processed and packaged foods has increased, which makes it suitable for the packaging of products in the region.

On the other hand, in LAMEA, the market for powdered milk continues to multiply due to changes in consumption activities and lifestyles. As a result, people in the region have been encouraged to start with packaged foods. Moreover, the demand for infant formula in the area has increased as consumption of infant formula has expanded.

KEY PLAYERS IN THE GLOBAL MILK POWDER MARKET

Major Key Players in the Global Milk Powder Market are Nestle, Danone, Lactalis, Frieslandcampina, Fonterra, Dean Foods, Arla Foods, Dairy Farmers Of America, Kraft Foods, and Saputo

RECENT HAPPENINGS IN THE MARKET

- In March 2019, Yili Company acquired the Westland Milk Products business. The acquisition allowed Yili to expand its business worldwide, expand its product portfolio and take full advantage of Westland Milk Products' expertise.

- In May 2017, Ausnutria signed a favorable contract to acquire the entire Australian Dairy Park (ADP) business. This acquisition includes R&D activities, as well as complete commercial operations, including the production, packaging, and sale of dairy and milk powder.

- In November 2017, Dairy Farmers of America Inc. opened a new milk powder plant in Garden City, Kansas, announcing a desire to support the growing demand for domestic and international milk powder and industrial growth in the region.

- In October 2017, Saputo Inc. announced the acquisition of the dairy food company Murray Goulburn Co-Operative Co Limited to add and complement the activities of the company's dairy business (Australia).

DETAILED SEGMENTATION OF GLOBAL MILK POWDER MARKET INCLUDED IN THIS REPORT

This research report on the global milk powder market has been segmented and sub-segmented based on type, application, function, & region.

By Type

- Dry Buttermilk

- Dry Whey Products

- Dry Whole Milk

- Dry Dairy Blends

- Non-Fat Dry Milk

By Application

- Infant Formulas

- Nutritional Formulas

- Confectionaries

- Baked Sweets and Savouries

By Function

- Foaming

- Emulsification

- Flavoring

- Thickening

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

1. What are the factors driving the growth of the milk powder market?

Factors driving the growth of the milk powder market include the increasing demand for dairy products, especially in developing countries with rising populations and incomes. Additionally, milk powder's longer shelf life and convenience compared to liquid milk make it a popular choice in certain situations.

2. What are some challenges faced by the milk powder market?

The milk powder market challenges include fluctuations in milk prices, competition from alternative dairy products, and regulatory issues related to food safety and quality standards. Environmental concerns, such as the carbon footprint of dairy production, are also becoming more significant.

3. What are the key trends shaping the milk powder market?

Some key trends in the milk powder market include the growing popularity of organic and specialty milk powders, packaging and processing technology innovations to improve shelf life and convenience, and increased focus on sustainability and ethical sourcing practices.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]