Middle East and Africa Veterinary Vaccines Market Size, Share, Trends & Growth Forecast Report By Type (Livestock Vaccines, Companion Vaccines), Technology and Country (KSA, UAE, Israel, rest of GCC countries, South Africa, Ethiopia, Kenya, Egypt, Sudan and Rest of Middle East and Africa), Industry Analysis From 2025 to 2033

Middle East & Africa Veterinary Vaccines Market Size

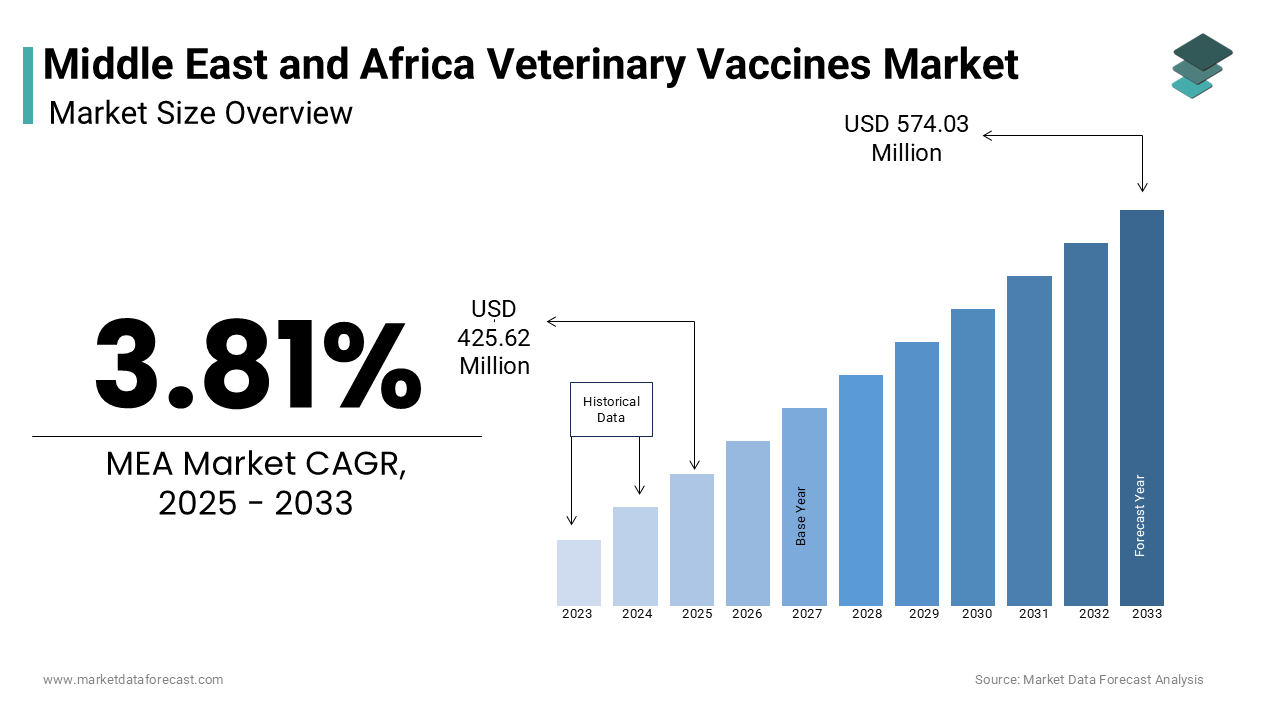

The veterinary vaccines market size in the Middle East and Africa was valued at USD 410.00 million in 2024. The regional market size is poised to reach USD 574.03 million by 2033 from USD 425.62 million in 2025, growing at a CAGR of 3.81% from 2025 to 2033.

Veterinary vaccines are biological preparations that provide immunity to animals against various infectious diseases, enhancing their health and productivity. The reliance of the Middle East and Africa on livestock for food production and economic sustenance has elevated the demand for veterinary vaccines in this region. According to the Food and Agriculture Organization, livestock contributes over 40% of agricultural GDP in Africa. Government initiatives and international partnerships are fostering regional market growth. For instance, the World Organisation for Animal Health collaborates with regional governments to improve vaccine accessibility and disease surveillance. South Africa and Kenya are prominent markets for veterinary vaccines in this region.

MARKET DRIVERS

Government Initiatives and International Collaborations

The active involvement of governments and international organizations in disease control and vaccination programs is a major driver of the Middle East & Africa veterinary vaccines market. For instance, the World Organisation for Animal Health works with regional governments to implement programs targeting diseases like foot-and-mouth disease and avian influenza. The Pan-African Vaccine Centre of the African Union produces over 25 million doses of animal vaccines annually to support disease prevention efforts. These initiatives ensure better accessibility to vaccines, particularly in rural areas, and strengthen surveillance systems. Such collaborations are crucial in mitigating the impact of livestock diseases on food security and the agricultural economy of this region.

Technological Advancements in Vaccine Development

Advancements in veterinary vaccine technologies, including recombinant DNA vaccines and subunit vaccines are driving market growth in the Middle East & Africa. These innovations enable more effective and targeted prevention of diseases and reduce the economic burden of outbreaks. According to the World Health Organization (WHO), emerging vaccine technologies can enhance the efficacy and safety of immunization programs, particularly for diseases like Rift Valley fever and Newcastle disease. Additionally, local manufacturing initiatives, such as South Africa’s Onderstepoort Biological Products are adopting advanced production techniques to meet regional demand. These technological advancements improve disease prevention capabilities and support the market expansion in this region to address evolving animal health challenges.

MARKET RESTRAINTS

Inadequate Cold Chain Infrastructure

The lack of robust cold chain infrastructure is a significant restraint in the Middle East & Africa veterinary vaccines market. Many vaccines require strict temperature-controlled storage and transportation to maintain efficacy. According to the World Organisation for Animal Health, over 50% of rural regions in Africa face challenges in maintaining cold chain systems due to inadequate infrastructure. This results in vaccine spoilage, reducing their effectiveness and increasing financial losses. Countries with vast rural areas such as Sudan and Ethiopia are particularly affected, which is limiting vaccine accessibility for livestock farmers. This logistical challenge hampers the widespread adoption of veterinary vaccines in the region.

High Costs of Veterinary Vaccination Programs

The high costs associated with vaccination programs pose a major barrier to market growth, particularly in low-income countries across the region. As per the Food and Agriculture Organization, the per-dose cost of vaccines with distribution expenses often exceeds the financial capacity of small-scale farmers. Additionally, government subsidies for animal vaccination programs remain insufficient in many countries and leaving farmers to bear the expenses. This economic constraint discourages regular vaccination and increases the risk of disease outbreaks.

MARKET OPPORTUNITIES

Expansion of Livestock Farming and Commercialization

The growing commercialization of livestock farming in the Middle East & Africa creates significant opportunities for the veterinary vaccines market in this region. According to the Food and Agriculture Organization, livestock farming contributes more than 40% of the agricultural GDP of Africa. As demand for animal-derived products such as meat, milk, and wool rises, commercial farms are investing in preventive healthcare measures, including vaccination. For instance, Kenya has experienced a 20% annual increase in dairy production over the last decade due to modern farming practices. This shift toward organized farming practices fosters greater adoption of veterinary vaccines to improve animal health and productivity and ensure a stable and profitable supply chain for livestock-derived products.

Development of Local Vaccine Manufacturing Facilities

The establishment of local vaccine production facilities in the Middle East & Africa presents a significant opportunity for market expansion. Countries such as South Africa and Kenya are investing in local manufacturing to reduce dependence on imports and improve vaccine accessibility. Onderstepoort Biological Products of South Africa produces millions of doses annually for regional distribution to support efforts to combat diseases like foot-and-mouth disease and Rift Valley fever. According to the African Union, localized manufacturing can reduce vaccine costs by up to 30% by eliminating import tariffs and transportation expenses. These facilities also ensure a consistent supply of vaccines, particularly in rural and underserved areas, and drive the regional market growth.

MARKET CHALLENGES

Limited Veterinary Healthcare Workforce

The shortage of trained veterinary professionals in the Middle East & Africa is a major challenge to the Middle East & African veterinary vaccines market. According to the World Organisation for Animal Health, there is an average of fewer than 1 veterinarian per 100,000 livestock units in many African countries, which is far below the recommended levels. This workforce gap limits the ability to diagnose, administer vaccines, and manage livestock health effectively. Countries such as Ethiopia have one of the largest livestock populations in Africa and still struggle to provide adequate veterinary care due to insufficient personnel and training facilities. This challenge reduces vaccination coverage and increases vulnerability to disease outbreaks.

Weak Disease Surveillance Systems

Inadequate disease surveillance systems pose a significant barrier to the growth of the veterinary vaccines market in the region. Effective vaccination programs depend on accurate and timely data about disease prevalence and outbreaks. However, the African Union notes that only 30% of countries in Africa have functional surveillance systems for animal diseases. This lack of real-time data hinders targeted vaccination efforts and results in inefficient resource allocation. For example, the delayed detection of Rift Valley fever outbreaks has led to significant livestock losses and economic disruption in East Africa. Strengthening disease monitoring infrastructure is essential to improving vaccine distribution and reducing the impact of livestock diseases.

REGIONAL ANALYSIS

Saudi Arabia led the veterinary vaccines market in the Middle East and Africa in 2024 and the domination of Saudi Arabia is estimated to continue throughout the forecast period owing to the extensive livestock industry of Saudi Arabia and government-backed animal health initiatives. According to the Saudi Arabia Ministry of Environment, Water, and Agriculture, the Kingdom has a livestock population exceeding 8.5 million, and it requires robust vaccination programs to prevent diseases such as foot-and-mouth disease and brucellosis. Additionally, the government’s Vision 2030 includes initiatives to enhance food security and agricultural productivity is further boosting demand for veterinary vaccines in Saudi Arabia. The advanced infrastructure of Saudi Arabia and partnerships with global vaccine manufacturers position it as a key player in the regional market to ensure the health and productivity of its livestock.

South Africa is also a dominant player in the African veterinary vaccines market. Onderstepoort Biological Products, a state-owned entity, produces millions of doses annually to combat diseases like Rift Valley fever and Newcastle disease. According to the South African Department of Agriculture, Forestry, and Fisheries, livestock contributes over 48% of the country’s agricultural GDP. The strong research institutions of South Africa and proactive disease surveillance systems ensure effective vaccination coverage, which makes it a central hub for veterinary vaccine innovation and distribution in Africa.

Kenya is a notable market for veterinary vaccines in Africa. As per the Kenyan Ministry of Agriculture, Livestock, and Fisheries, livestock contributes approximately 12% of Kenya's GDP and supports the livelihoods of over 10 million people. Diseases such as East Coast fever and foot-and-mouth disease are prevalent in Kenya and need widespread vaccination efforts. The partnerships of Kenya with international organizations such as the World Organisation for Animal Health have strengthened its capacity for vaccine distribution. Additionally, the investments in veterinary extension services of the government of Kenya to ensure better vaccine accessibility, particularly in rural areas, are favoring the veterinary vaccines market in Kenya.

KEY MARKET PLAYERS

Companies playing a prominent role in the MEA veterinary vaccines market profiled in this report are Bayer HealthCare AG, Bioniche Animal Health Canada, Sanofi Animal Health Inc., Biogenesis Bago SA, Heska Corporation, Indian Immunologicals Ltd., Boehringer Ingelheim GmbH, Zoetis, Novartis Animal Health Inc., Merck & Co Inc., and Protein Sciences.

MARKET SEGMENTATION

This research report on the Middle East and Africa veterinary vaccines market is segmented and sub-segmented into the following categories.

By Type

- Livestock Vaccines

- Bovine

- Porcine

- Ovine

- Poultry

- Equine

- Companion Vaccines

- Feline Vaccines

- Canine Vaccines

By Technology

- Live Attenuated Vaccines

- Inactivated Vaccines

- Recombinant Vaccines

- Toxoid Vaccines

- Subunit Vaccines

- DNA Vaccines

- Conjugate Vaccines

By Country

- KSA

- UAE

- Israel

- rest of GCC countries

- South Africa

- Ethiopia

- Kenya

- Egypt

- Sudan

- rest of MEA

Frequently Asked Questions

What are the key trends influencing the veterinary vaccines market in Africa?

Increasing adoption of companion animals, rising awareness about animal health, and the prevalence of infectious diseases are driving the growth of the veterinary vaccines market in Africa.

Which countries contribute significantly to the veterinary vaccines market in the Middle East?

Saudi Arabia, UAE, and Egypt are among the leading contributors.

Who are the key players in the veterinary vaccines market in the Middle East?

Bayer HealthCare AG, Bioniche Animal Health Canada, Sanofi Animal Health Inc., Biogenesis Bago SA, Heska Corporation, Indian Immunologicals Ltd., Boehringer Ingelheim GmbH, Zoetis, Novartis Animal Health Inc., Merck & Co Inc., and Protein Sciences are some of the major players in the MEA veterinary vaccines market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 1600

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]