Middle East And Africa Pet Food Market Size, Share, Trends & Growth Forecast Report By Ingredient, Animal Type, Form and Country (South America, UAE, And Egypt, Nigeria, Kenya, Dubai, Rest Of GCC, Ethiopia and Rest Of MEA) - Industry Analysis (2025 to 2033)

Middle East and Africa Pet Food Market Size

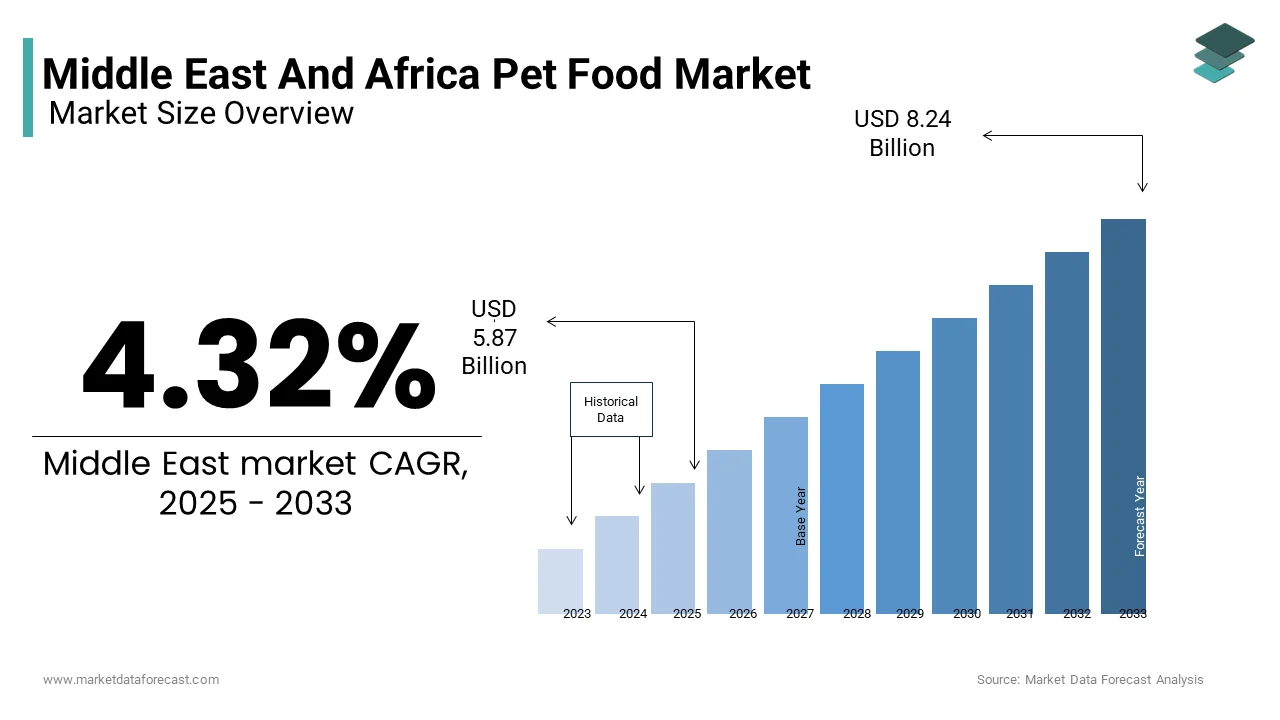

The Middle East and Africa pet food market was expected to be valued at USD 5.63 billion in 2024 and is anticipated to reach USD 5.87 billion in 2025 from USD 8.24 billion by 2033, growing at a compound annual growth rate (CAGR) of 4.32% from 2025 to 2033.

The pet food market in the Middle East and Africa is projected to experience strong growth over the forecast period. This growth is largely driven by the increasing trend of pet humanization in the region. In several countries in the Middle East and Africa, pets are seen as family members and pet owners invest considerably in providing higher-quality and specialized pet products to their pets. The rising urbanization in countries like the UAE and South Africa that is contributing to higher pet ownership and increasing demand for convenient and nutritionally balanced pet foods are boosting the pet food market in the Middle East and Africa. In the recent past, international brands spreading their wings into the MEA market have been noticed, providing a wider variety of premium and therapeutic pet food options to meet specific health needs such as joint care and weight management. Retail infrastructure improvements such as the growth of e-commerce and specialty pet stores are making these products more accessible to a diverse consumer base in this region. The shifts toward online and specialty retail channels have broadened purchasing options and allowed pet owners in both urban and rural areas to access premium pet food.

The rapid expansion of urban populations, especially in countries like the UAE and South Africa is significantly contributing to the regional market growth. In these countries, individuals are adopting pets and viewing them as family members and investing in higher-quality pet food products, which is boosting the demand for pet food products. Premium and super-premium pet food segments are gaining popularity across the region due to the growing awareness of pet health and nutrition. The demand for specialized pet food products, such as those catering to weight management, dental care, and joint health, has led to increased consumer spending on nutritionally balanced, therapeutic pet food options. The regional market has also benefited from the expansion of modern retail channels and e-commerce platforms that make a diverse range of pet food options more accessible to consumers across the MEA region.

Dog food is in promising demand in the MEA region due to the cultural acceptance and rising popularity of dogs as pets across the region. On the other hand, the demand for cat food is gradually growing and is likely to increase demand over the forecast period owing to the increasing cat ownership, particularly in urbanized areas where smaller pets are preferred due to space constraints. The strategic expansions by major international pet food brands, including Mars Incorporated and Nestlé Purina are strengthening their presence through collaborations with local distributors and investments in regional supply chains. This influx of global brands has increased the availability of premium and therapeutic pet food products to address the growing consumer base interested in quality pet care. Additionally, shifts toward online retail for pet food products have enabled customers to access a wider variety of options, especially as e-commerce gains traction in the region.

SEGMENTAL ANALYSIS

By Animal Insights

Based on animals, the dog food segment held 55.8% of the share in the Middle East and Africa pet food market in 2023 due to the growing number of dog owners who prioritize quality nutrition and health-focused products for their pets. This segment is particularly strong in countries like South Africa and the UAE, where consumer spending on pet wellness has been rising. The high cultural acceptance of dogs as pets across the region and increasing investments in premium dog food products are likely to continue to boost the growth of the dog segment in the regional market. Premium dog food offerings that include therapeutic diets for conditions like joint health and weight management are seeing a substantial boost as pet owners become more attentive to their specific dietary needs of the pets.

On the other hand, the cat food segment is projected to grow at the fastest CAGR of 8.1% over the forecast period. This growth is driven by the increasing popularity of cats in urban centers across the MEA, where smaller living spaces make cats a preferred pet choice. Rising awareness of feline dietary needs has led to demand for specialized cat food products that include formulations for dental health, hairball control and specific life stages like kitten and senior cat diets. As cat ownership expands, manufacturers are focusing on this segment with premium and therapeutic options that cater to the needs of an urban, health-conscious and pet-owning population.

By Ingredient Insights

The animal derivatives segment led the pet food market in the Middle East and African market in 2023 due to the high demand for protein-rich and palatable pet food that supports overall health. The appeal of animal derivatives to both pet owners and animals is one of the factors driving the growth of the segment in the regional market. Products using animal-based ingredients like chicken, lamb, and fish are highly preferred, particularly in dog and cat food, as they are rich in essential amino acids, fats, and nutrients that support growth, muscle development, and immune function. The demand for animal derivatives is also bolstered by growing awareness of pet owners of the benefits of high-protein diets for their pets and the trend toward natural and meat-based products across MEA.

On the other hand, the vitamins and minerals segment is expected to grow at the fastest CAGR of 8.4% over the forecast period. This growth is driven by an increased focus on pet health and wellness, with many consumers actively seeking functional pet food that supports specific health outcomes. Vitamins and minerals are essential for maintaining pet immunity, skin and coat health, and overall vitality, especially as pets age. The demand for fortified and functional pet food products, including supplements and therapeutic diets that address issues such as joint health and digestion is increasing in MEA markets like the UAE and South Africa. Additionally, premium brands are enhancing their formulations with balanced vitamin and mineral complexes that are appealing to the health-conscious pet owners of the region.

By Form Insights

The dry pet food segment had the major share of the Middle East and Africa pet food market in 2023 owing to its lower cost relative to wet food and its dental health benefits. The kibble texture of dry pet food can help reduce plaque and tartar buildup in pets. The affordability, convenience, and extended shelf life are further boosting the segmental expansion in the regional market during the forecast period. This segment is particularly popular among dog and cat owners, as dry food is easy to store, measure, and serve, fitting well into the busy lifestyles of many pet owners in urban areas.

On the other hand, the wet/canned segment is experiencing the fastest CAGR over the forecast period owing to the rising consumer interest in high-moisture, palatable, and nutrient-dense food options that are particularly appealing to pets. Wet food is especially popular for cats and senior pets, who may benefit from its softer texture and higher water content, which support hydration and make it easier to chew. Additionally, as pet owners in countries like the UAE and South Africa increasingly prioritize premium and high-quality options, wet food’s reputation for being flavorful and rich in natural ingredients has enhanced its appeal. Many pet owners also opt for mixed feeding approaches, combining dry and wet food to meet both convenience and nutrition goals.

REGIONAL ANALYSIS

The United Arab Emirates (UAE) leads the pet food market in MEA in terms of share. The growth of the pet food market in the UAE is majorly fueled by a robust trend in pet humanization and a strong demand for premium pet products. The UAE has one of the region’s highest rates of pet ownership, particularly in urban centers like Dubai and Abu Dhabi, where pet owners increasingly treat pets as family members. This shift has spurred demand for high-quality and specialized pet food, including premium, organic, and therapeutic options. The growing presence of international brands enhancing product diversity is expected to continue to boost the pet food market in the UAE over the forecast period. E-commerce growth has also significantly expanded access to various pet food products to make premium options more readily available.

Saudi Arabia (KSA) is currently experiencing the fastest growth in the MEA pet food market. This growth is driven by a steady increase in pet adoption, particularly dogs and cats, as cultural shifts and urbanization encourage pet ownership. Government initiatives to boost animal welfare awareness and increase disposable incomes have resulted in greater spending on pet care. Saudi consumers are showing a preference for both premium and health-focused pet foods, including options that cater to dietary sensitivities and specific health conditions, which are further propelling the pet food market growth in Saudi Arabia.

South Africa is another top performer in the Middle East and Africa region. The presence of an established pet culture and increasing demand for both economy and premium pet food options are driving the pet food market in this country. South Africa has one of the largest pet food markets in Africa, with dog and cat food leading sales. The market benefits from the country’s established retail infrastructure, including supermarkets, specialty pet stores, and a growing online sector. While economy options remain popular among middle-income pet owners, there is an increasing trend toward health-focused and natural pet food products among higher-income segments. South Africa’s market is well-supported by both local brands and international players, catering to diverse consumer preferences.

KEY MARKET PARTICIPANTS

Nestlé Purina PetCare, Mars, Inc., Agthia Group, Hill's Pet Nutrition, Armitage Pet Care, Ainawi Group, United Petfood, Provimi Animal Nutrition, Eurovets Veterinary Suppliers, and Vet Products Group. Some major players are involved in the MAE pet food market.

RECENT HAPPENINGS IN THE MARKET

- In October 2023, Colgate-Palmolive’s subsidiary Hill’s Pet Nutrition started its new advanced smart production plant in Kansas to double the manufacturing of its canned pet food.

- In January 2023, a Saudi Arabia-based e-commerce company, Ninja, which also retails pet food products, announced its new mega-seed funding for the last quarter of 2022. Ninja, operating fully in Riyadh, Jeddah, and the Eastern Province of the kingdom, aims to expand its operations and pet food offerings with new investments.

MARKET SEGMENTATION

The market research report on the Middle East Africa pet food market is segmented and sub-segmented into the following categories.

By Animal

- Dogs

- Cats

- Birds

- Fish

- Others

By Ingredient

- Animal derivatives

- Plant derivatives

- Vitamins & Minerals

- Others

By Form

- Dry

- Wet/Canned

By Country

- South Africa

- United Arab Emirates

- Egypt

- Nigeria

- Kenya

- Dubai

- Rest of GCC

- Rest of MEA

Frequently Asked Questions

What Is The Current Size Of MAE Pet Food Market?

The current size of the Middle East and Africa pet food market is USD 5.39 billion in 2023.

What Is The Expected Growth Value Of MAE Pet Food Market?

The Middle East and Africa pet food market is expected to grow to USD 6.46 billion by 2028.

Which Is The Most Dominating Factor In The MAE Pet Food Market?

South Africa dominated the local pet food market owing to the rising consumer spending on healthy foods to improve the health of their companions.

What Are The Key Market Involved In The MAE Pet Food Market?

Nestlé Purina PetCare, Mars, Inc., Agthia Group, Hill's Pet Nutrition, Armitage Pet Care, Ainawi Group, United Petfood, Provimi Animal Nutrition, Eurovets Veterinary Suppliers, and Vet Products Group. Some major players involved in the MAE pet food market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 1600

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]