Middle East & Africa In-Vitro Diagnostics (IVD) Market Size, Share, Trends & Growth Forecast Report By Product (Instruments, Reagents and Kits, Software By Technology, Clinical Chemistry, Hematology, Immunoassays, Coagulation and Hemostasis, Molecular Diagnostics, Microbiology, Other IVD technologies), Technology, Application and Country (KSA, UAE, Israel, Rest of GCC countries, South Africa, Ethiopia, Kenya, Egypt, Sudan and Rest of MEA) – Industry Analysis (2024 to 2032)

Middle East and Africa IVD Market Size

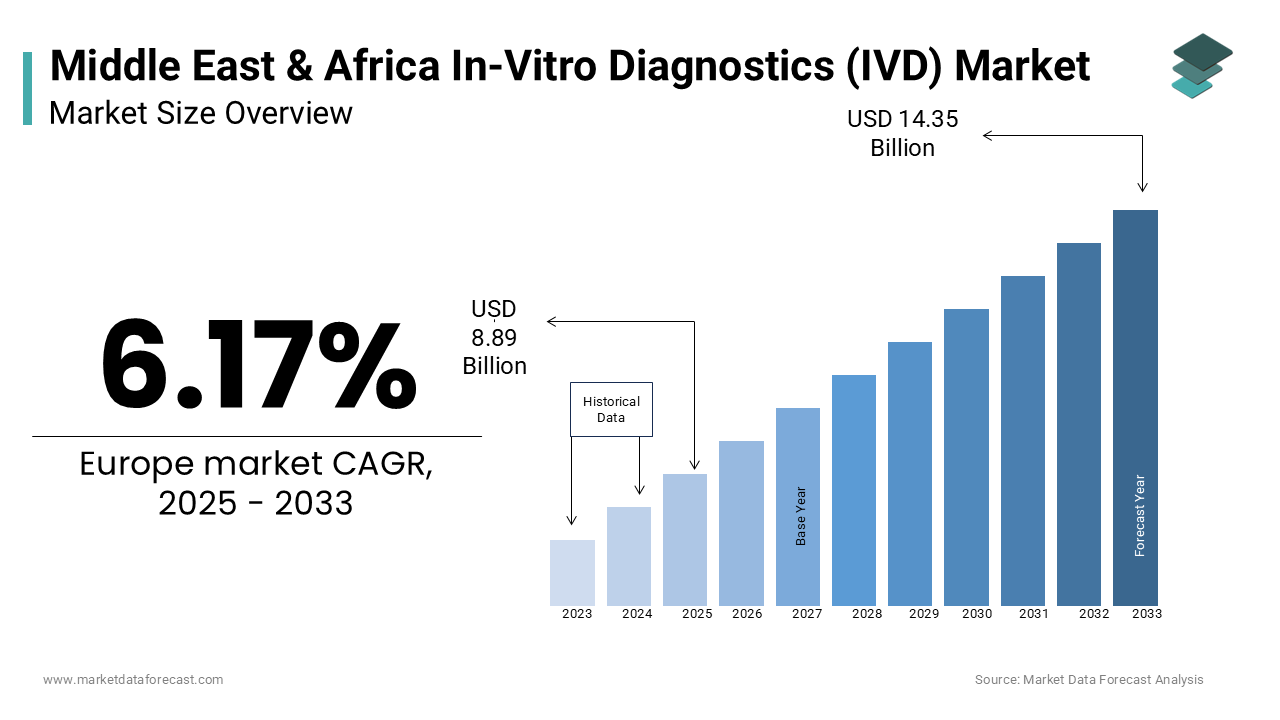

The in-vitro diagnostics market (IVD) size in the Middle East and Africa was valued at USD 8.37 billion in 2024. The MEA market is expected to grow at a CAGR of 6.17% from 2025 to 2033 and be worth USD 14.35 billion by 2033 from USD 8.89 billion in 2025.

The In Vitro Diagnostics (IVD) market in the Middle East and Africa (MEA) is growing quickly owing to the improvements in healthcare and a greater need for early disease detection. Countries such as Saudi Arabia, the UAE, and South Africa are investing heavily in upgrading their healthcare systems. For example, Saudi Arabia has committed over $27 billion to healthcare as part of its Vision 2030 plan, aiming to make healthcare more accessible and improve diagnostic services. As chronic diseases like diabetes (affecting 13.7% of adults in the GCC region) and heart disease become more common, the need for diagnostic tools is increasing. The rise of infectious diseases, particularly during the COVID-19 pandemic, has also driven the demand for faster and more reliable tests. Innovations in technology, such as molecular diagnostics, point-of-care testing, and lab automation, are playing a big role in the market's growth. For example, during the COVID-19 pandemic, the UAE became one of the countries with the highest per capita testing, showing how quickly diagnostic tests are being adopted. Additionally, countries like the UAE and South Africa are focusing on local production of diagnostic products to meet rising demand, with South Africa’s local IVD production expected to grow by 5-7% annually. These trends suggest the MEA IVD market will continue to grow, supported by strong investments in healthcare and the need for better diagnostics.

MARKET DRIVERS

Rising Prevalence of Chronic Diseases

The increasing burden of chronic diseases such as diabetes, cardiovascular diseases, and respiratory conditions is a major driver of the IVD market in the Middle East and Africa (MEA). For example, diabetes is prevalent in the GCC countries, with an estimated 13.7% of adults affected, which is among the highest rates globally. As these diseases require continuous monitoring and management, the demand for diagnostic tools, particularly for early detection, is expanding. This trend contributes to a growing need for IVD solutions, especially those focused on chronic disease management and monitoring.

Government Investments in Healthcare Infrastructure

Governments across the MEA region are making substantial investments to modernize healthcare infrastructure, which is fueling the growth of the IVD market. Saudi Arabia’s Vision 2030 plan allocated over $27 billion to healthcare modernization, emphasizing the expansion of diagnostic services. The UAE, Qatar, and South Africa are also prioritizing healthcare development, including the enhancement of diagnostic testing capabilities. These investments are improving access to advanced diagnostic technologies and fostering local manufacturing, positioning the region as a growing hub for in vitro diagnostics.

MARKET RESTRAINTS

High Cost of Diagnostic Devices

The high cost of advanced in vitro diagnostic (IVD) devices is a significant restraint for the Middle East and Africa (MEA) market. Many diagnostic technologies, especially molecular diagnostics and high-end analyzers, come with substantial upfront costs, making them less accessible for smaller healthcare providers and rural areas. For instance, the price of advanced IVD systems can range from $50,000 to $100,000, limiting their adoption, especially in lower-income countries. Despite growing healthcare investments, affordability remains a barrier to the widespread adoption of cutting-edge diagnostic tools across the region.

Regulatory Challenges and Lack of Standardization

Regulatory hurdles and the lack of standardization in the MEA region are limiting the growth of the IVD market. Different countries have varying regulatory requirements for IVD products, making it difficult for manufacturers to navigate and obtain approval quickly. For example, South Africa’s regulatory process for IVDs can take several months, which delays market entry. Moreover, inconsistent standards across the region create challenges for manufacturers seeking to streamline operations, increasing costs and regulatory compliance efforts.

MARKET OPPORTUNITIES

Growing Demand for Point-of-Care Testing (POCT)

Point-of-care testing (POCT) presents a significant opportunity in the Middle East and Africa (MEA) IVD market. As healthcare systems modernize, there is a growing push for diagnostic solutions that can be conducted quickly at the patient's location, reducing the need for centralized lab facilities. The COVID-19 pandemic accelerated the adoption of POCT, and it continues to expand.

Expansion of Local Manufacturing Capabilities

The push toward local manufacturing of IVD products in the MEA region offers a growing opportunity for companies. Countries like the UAE, South Africa, and Egypt are increasingly focusing on building local production capabilities to reduce dependency on imports and strengthen their healthcare systems. For example, IVD production in South Africa is expected to grow substantially over the forecast period due to the rising demand for diagnostic tools. This shift presents a lucrative opportunity for both local and international companies to invest in manufacturing plants and create tailored solutions for regional needs.

MARKET CHALLENGES

Limited Healthcare Access in Rural Areas

A significant challenge in the Middle East and Africa (MEA) IVD market is the limited access to healthcare, particularly in rural and underserved areas. Despite increasing investments in healthcare infrastructure, a substantial portion of the population in remote regions still lacks access to diagnostic services. In countries like Sudan and parts of sub-Saharan Africa, the healthcare infrastructure remains underdeveloped, limiting the reach of advanced IVD technologies. This discrepancy creates a gap in the availability of timely diagnostics, hindering the market's overall growth potential, particularly for costly, high-tech diagnostic devices.

Shortage of Skilled Labor

The shortage of skilled healthcare professionals, particularly lab technicians and medical personnel trained in the use of advanced diagnostic equipment, is another critical challenge in the MEA IVD market. According to the World Health Organization (WHO), many countries in the region face a lack of adequately trained medical personnel, which impacts the efficient use and implementation of advanced diagnostic tools. This skill gap could slow the adoption of newer IVD technologies, limiting their effectiveness and availability, especially in more rural or economically disadvantaged areas.

SEGMENTAL ANALYSIS

By Product Insights

The reagents and kits segment had the dominating share of the MEA IVD market in 2024. This segment is critical because reagents and kits form the backbone of diagnostic tests across various healthcare applications, including clinical chemistry, microbiology, and immunoassays. These kits contain necessary substances for performing diagnostic tests, enabling the detection of diseases like cancer, diabetes, and infections. Reagents and kits are widely used in both clinical labs and point-of-care settings, and their demand is fueled by the growing focus on early disease detection and the increasing prevalence of chronic diseases globally. The consistent demand for these products stems from their essential role in ensuring accurate and efficient diagnostic results, especially with the rise in non-communicable diseases. Furthermore, the increased adoption of advanced testing techniques, including molecular diagnostics and immunoassays, also bolsters the demand for specialized reagents and kits.

The molecular diagnostics segment is the fastest-growing segment in the Middle East and Africa IVD market. This segment is growing rapidly due to the increasing use of advanced genetic testing methods, such as PCR (Polymerase Chain Reaction), which allow for highly accurate and early detection of diseases at the molecular level. The rise in demand for personalized medicine, alongside advancements in gene sequencing technologies, is a major driver of this growth. Molecular diagnostics are particularly important in detecting infectious diseases, genetic disorders, and cancers. The COVID-19 pandemic has also accelerated the adoption of molecular diagnostic tests, such as PCR and next-generation sequencing (NGS), to identify viral infections. The segment is expected to continue growing rapidly due to expanding applications in oncology, infectious diseases, and prenatal diagnostics. Additionally, the precision and high accuracy of molecular tests are pushing healthcare providers to adopt these technologies, further driving their market growth.

By Application Insights

The infectious diseases segment had 33.8% of the MEA market share in 2024. This segment is crucial due to the high prevalence of infectious diseases worldwide and the demand for accurate, rapid diagnostic tests for conditions like COVID-19, tuberculosis, HIV, and malaria. The ongoing global focus on controlling infectious diseases, particularly post-pandemic, has heightened the need for advanced diagnostic tools that provide quick and reliable results. The importance of infectious disease diagnostics is underscored by the increasing burden of infectious outbreaks and emerging diseases. For instance, the WHO reports that infectious diseases remain one of the leading causes of morbidity and mortality, with conditions like pneumonia and influenza contributing to millions of deaths globally each year. The ability to diagnose infections rapidly can significantly improve patient outcomes and reduce the spread of diseases, making the Infectious Diseases segment the largest and most vital in the IVD market.

The oncology/cancer segment is the fastest-growing segment in the MEA IVD market. This rapid growth is driven by the increasing incidence of cancer worldwide, the rising demand for early-stage cancer detection, and advancements in personalized medicine. Early detection through advanced molecular diagnostics and biomarkers has become a cornerstone in cancer treatment, enabling earlier interventions and improving survival rates. As of 2023, cancer is responsible for an estimated 9.6 million deaths globally, according to the World Health Organization. Diagnostic tools such as liquid biopsy and next-generation sequencing (NGS) are being increasingly adopted to detect various forms of cancer, including breast, lung, and prostate cancer. This growing focus on cancer diagnostics and the shift toward more precise, targeted therapies are significant drivers for the growth of the oncology segment in the IVD market. The ability to detect cancer biomarkers early and monitor treatment responses has revolutionized oncology care, positioning this segment for robust and sustained growth.

REGIONAL ANALYSIS

The Middle East and Africa IVD market accounted for a moderate global market share in 2024. However, this regional market is anticipated to showcase lucrative growth during the forecast period owing to the increasing prevalence of chronic diseases, growing healthcare expenditure, increasing adoption of the latest technological advancements, and increasing government initiatives. As a result, countries such as Saudi Arabia, UAE, and Qatar are expected to hold the leading share in the MEA IVD market during the forecast period. Saudi Arabia is a promising market for IVD in the Middle East and Africa and is expected to hold a considerable share of the region during the forecast period.

Saudi Arabia accounted for the largest share of the regional market in 2024. South Arabia is focused on healthcare reforms under its Vision 2030 plan. With increased investment in both public and private sectors, Saudi Arabia is seeing a surge in demand for IVD technologies, especially in the fields of diabetes, cardiovascular diseases, and infectious diseases.

The UAE is also a key player, with a robust healthcare infrastructure, an emphasis on point-of-care diagnostics, and a thriving medical tourism industry. The growth of the IVD market in the UAE is driven by the government's push for innovation and investments in medical technology.

In South Africa, the largest IVD market in Sub-Saharan Africa, there is increasing demand for diagnostic solutions due to the high burden of HIV, TB, and chronic diseases. As the government continues to expand healthcare access, the South African market is expected to register a healthy CAGR.

KEY MARKET PLAYERS

Companies playing a prominent role in the in-vitro diagnostics market in the MEA region include

Abbott Laboratories, Johnson and Johnson, Siemens Healthcare, Becton Dickinson, Roche Diagnostics, Beckman Coulter Inc., Biomérieux, Ortho Clinical Diagnostics, Inc., Bio-Rad Laboratories, Inc., Danaher Corporation, Sysmex Corporation, Thermo Fisher Scientific, Inc. are some of the key market players.

RECENT HAPPENINGS IN THE MARKET

-

In March 2024, Roche Diagnostics expanded its diagnostic offerings in Saudi Arabia by opening a new distribution center. This expansion is expected to enhance Roche's market reach and improve supply chain efficiency to meet the growing demand for IVD solutions in the region.

- In February 2024, Abbott Laboratories partnered with a local healthcare provider in the UAE to deliver advanced point-of-care testing solutions. This partnership aims to increase Abbott's market share by providing more accessible diagnostic tools in the rapidly growing healthcare sector.

- In January 2024, Siemens Healthineers launched a new digital pathology service in South Africa. The service is expected to improve diagnostic efficiency and accuracy, positioning Siemens as a leader in the region's digital health transformation.

- In December 2023, Thermo Fisher Scientific invested in a local production facility in Egypt. This investment aims to produce diagnostic reagents and kits locally, helping to meet rising demand while reducing costs associated with imports.

- In November 2023, Danaher Corporation acquired a South African diagnostics company, expanding its presence in the regional molecular diagnostics market. This acquisition is expected to strengthen Danaher's capabilities to offer advanced and localized testing solutions.

- In October 2023, Bio-Rad Laboratories introduced a new autoimmune disease testing solution in the Middle East. This launch aims to address the growing demand for autoimmune diagnostics, particularly in the UAE and Saudi Arabia.

- In September 2023, Becton Dickinson (BD) launched a new mobile diagnostic platform in the Middle East. The mobile platform is expected to offer point-of-care testing for infectious diseases, helping to meet the urgent demand for rapid diagnostics in remote areas.

- In August 2023, Qiagen partnered with a major UAE hospital network to deploy its PCR-based testing solutions. This collaboration is expected to enhance the availability of molecular diagnostics and improve early disease detection across the UAE.

- In July 2023, Ortho Clinical Diagnostics opened a new regional office in South Africa. This expansion is part of Ortho's strategy to strengthen its presence in Sub-Saharan Africa and meet the growing demand for blood typing and immunoassay solutions.

- In June 2023, Cepheid signed a distribution agreement with a leading healthcare provider in the UAE. The agreement is expected to expand Cepheid's market footprint in the Middle East by providing easy access to its rapid diagnostic tests, including COVID-19 and tuberculosis testing solutions.

MARKET SEGMENTATION

This research report on the Middle East and Africa IVD market has been segmented and sub-segmented into the following categories.

By Product:

- Instruments

- Reagents and Kits

- Software

- By Technology

- Clinical Chemistry

- Hematology

- Immunoassays

- Coagulation and Hemostasis

- Molecular Diagnostics

- Microbiology

- Other IVD technologies

By Application

- Diabetes

- Infectious Diseases

- Oncology/Cancer

- Cardiology

- Nephrology

- Autoimmune Diseases

- Drug Testing

- HIV

By Country

- KSA

- UAE

- Israel

- Rest of GCC countries

- South Africa

- Ethiopia

- Kenya

- Egypt

- Sudan

- Rest of MEA

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 1600

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com