Middle East & Africa Diagnostic Imaging Market Research Report By Type, Application & Country (KSA, UAE, Israel, rest of GCC countries, South Africa, Ethiopia, Kenya, Egypt, Sudan, rest of MEA), Industry Analysis From 2025 to 2033

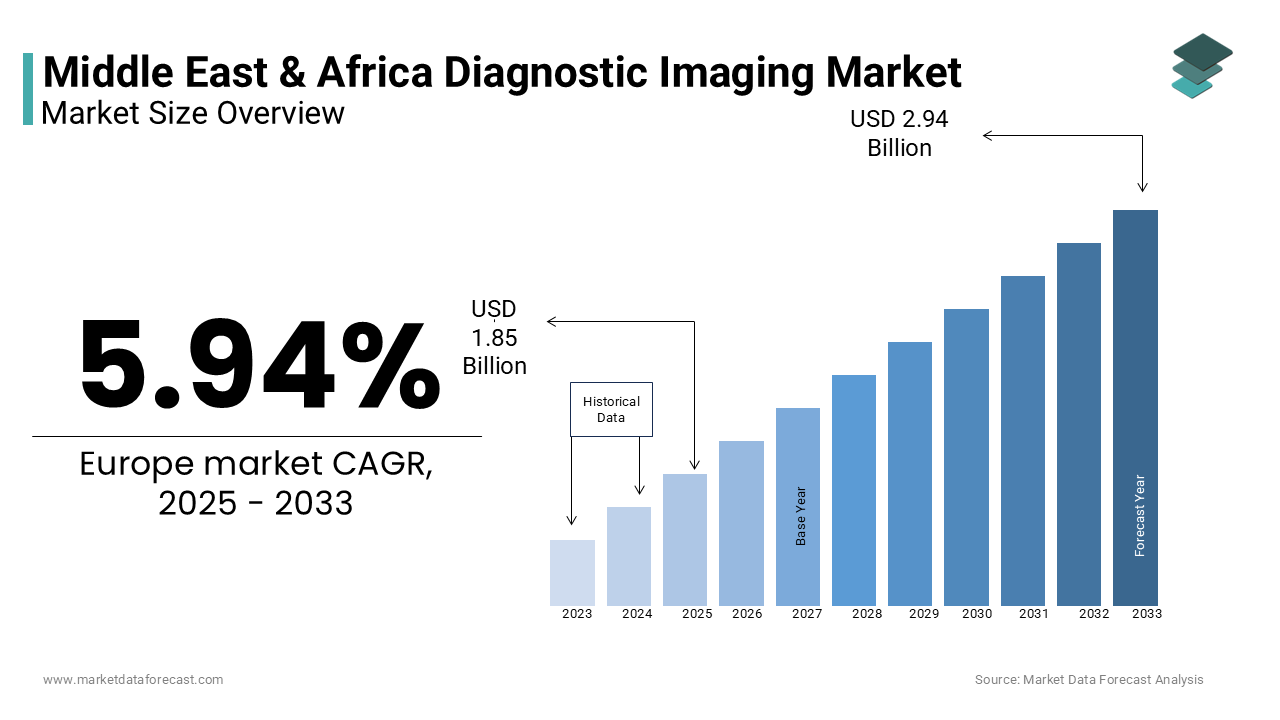

Middle East & Africa Diagnostic Imaging Market Size

The size of the diagnostic imaging market in the Middle East & Africa was worth USD 1.75 billion in 2024. The MEA market is estimated to be growing at a CAGR of 5.94% from 2025 to 2033 and be worth USD 2.94 bn by 2033 from USD 1.85 bn in 2025.

Diagnostic imaging involves the use of advanced technologies such as X-rays, ultrasound, MRI, CT scans, and nuclear imaging to visualize and diagnose medical conditions to enable timely and accurate treatment. The increasing burden of chronic diseases, such as cardiovascular conditions, cancer, and diabetes, is a major factor driving demand for diagnostic imaging services in this region. According to the World Health Organization, non-communicable diseases account for over 70% of deaths in the Middle East and Africa. Additionally, government initiatives, such as Vision 2030 of Saudi Arabia, prioritize the modernization of healthcare facilities, including the integration of cutting-edge imaging technologies. Countries such as South Africa, Saudi Arabia, and the United Arab Emirates lead the market due to their well-established healthcare systems and investments in medical technology. Furthermore, international manufacturers are increasingly partnering with regional healthcare providers to enhance accessibility.

MARKET DRIVERS

Increasing Prevalence of Chronic Diseases

The growing burden of chronic diseases in the Middle East and Africa is a significant driver of the diagnostic imaging market. Conditions such as cardiovascular diseases, diabetes, and cancer are becoming increasingly prevalent due to lifestyle changes and aging populations. According to the World Health Organization, non-communicable diseases account for over 70% of deaths in the region, with cardiovascular diseases alone responsible for 37%. This rising prevalence underscores the critical need for early detection and monitoring, driving demand for diagnostic imaging technologies such as CT scans, MRIs, and ultrasounds. Enhanced imaging capabilities enable accurate diagnosis, facilitating timely treatment and improving patient outcomes.

Government Investments in Healthcare Infrastructure

Significant government investments in healthcare infrastructure are propelling the adoption of diagnostic imaging technologies across the region. Initiatives such as Saudi Arabia’s Vision 2030 and the United Arab Emirates National Agenda 2021 prioritize the modernization of healthcare facilities and the integration of advanced medical technologies. The Saudi Ministry of Health allocated over $11 billion to healthcare development in 2022, emphasizing diagnostic advancements. Similarly, South Africa’s National Department of Health has increased funding for public hospitals, promoting access to imaging services. These investments not only enhance diagnostic capabilities but also improve healthcare access, fostering growth in the diagnostic imaging market across the Middle East and Africa.

MARKET RESTRAINTS

High Costs of Diagnostic Imaging Equipment and Procedures

The high costs associated with diagnostic imaging equipment and procedures pose a significant restraint in the Middle East & Africa market. Advanced imaging technologies like MRIs and PET scans require substantial investment in equipment, maintenance, and skilled personnel. According to the World Bank, many low-income countries in Africa allocate less than 5% of their GDP to healthcare, limiting their ability to procure such costly technologies. Additionally, patients often face out-of-pocket expenses for diagnostic services in regionswith limited insurance coveraged, reducing accessibility and utilization. These financial barriers hinder the widespread adoption of diagnostic imaging, particularly in underserved areas.

Shortage of Skilled Professionals

A shortage of skilled radiologists and technicians in the Middle East and Africa significantly restrains the growth of the diagnostic imaging market. The World Health Organization reports that Africa has only 0.8 healthcare workers per 1,000 people, far below the recommended threshold. In many countries, the availability of trained radiologists and imaging technicians is even more limited, impacting the effective use of diagnostic imaging systems. This gap leads to longer waiting times for patients and underutilization of advanced imaging technologies. Addressing this challenge requires investments in education and training programs to build a skilled workforce capable of meeting the region’s diagnostic needs.

MARKET OPPORTUNITIES

Adoption of Artificial Intelligence in Diagnostic Imaging

The integration of artificial intelligence (AI) into diagnostic imaging systems offers immense growth opportunities in the Middle East & Africa market. AI enhances imaging accuracy, automates image analysis, and aids in early disease detection. According to the International Telecommunication Union, AI adoption in healthcare across the region is projected to grow by 18% annually through 2025. Governments and healthcare providers in countries like Saudi Arabia and the UAE are investing in AI-driven imaging technologies to improve efficiency. For example, AI-enabled solutions can reduce diagnostic time for complex conditions, making advanced healthcare more accessible and fostering innovation in the diagnostic imaging sector.

Expansion of Telemedicine and Remote Diagnostics

The growing adoption of telemedicine and remote diagnostics presents a significant opportunity for the diagnostic imaging market. These solutions address geographic and infrastructural challenges, particularly in remote areas with limited access to healthcare facilities. The World Health Organization reports that telemedicine usage in Africa increased by 30% during the COVID-19 pandemic, highlighting its potential. Portable and cloud-enabled diagnostic imaging devices facilitate remote consultations, enabling specialists to interpret images from distant locations. Investments in telehealth infrastructure by countries like South Africa and Kenya further enhance access to diagnostic imaging services, offering substantial opportunities for market expansion across underserved regions.

MARKET CHALLENGES

Limited Healthcare Infrastructure in Rural Areas

The lack of adequate healthcare infrastructure in rural areas poses a significant challenge to the Middle East & Africa diagnostic imaging market. Many rural regions lack essential facilities, including diagnostic centers equipped with advanced imaging technologies. According to the World Health Organization, approximately 50% of the population in sub-Saharan Africa has limited access to basic healthcare services, including diagnostic imaging. This disparity results in delayed diagnoses and inadequate disease management, contributing to poorer health outcomes. Expanding healthcare infrastructure in underserved areas requires substantial investment, creating logistical and financial barriers that limit the market’s growth potential.

Dependence on Imported Equipment

The heavy reliance on imported diagnostic imaging equipment challenges the affordability and availability of these technologies in the region. Many countries in the Middle East and Africa lack domestic manufacturing capabilities for high-end imaging devices such as MRIs and CT scanners. According to the African Development Bank, import duties and fluctuating exchange rates increase the costs of medical equipment by up to 30%, making it challenging for healthcare providers to procure and maintain such systems. This dependence on foreign suppliers limits access to advanced diagnostic technologies, particularly in economically constrained nations, hindering the broader adoption of imaging solutions.

REGIONAL ANALYSIS

Saudi Arabia is the leading regional segment in the Middle East & Africa diagnostic imaging market. The substantial healthcare investments under Vision 2030 is one of the key factors propelling the Saudi Arabian diagnostic imaging market. The Saudi Ministry of Health allocated over $11 billion to healthcare modernization in 2022, focusing on advanced medical technologies, including imaging systems. With an aging population and a growing burden of chronic diseases like diabetes and cardiovascular conditions, the demand for diagnostic imaging continues to rise. The country’s well-established healthcare infrastructure and partnerships with global medical device manufacturers position Saudi Arabia as a key player in adopting cutting-edge imaging technologies across the region.

The UAE is a prominent performer in this regional market and the market growth is majorly driven by its advanced healthcare infrastructure and strategic government initiatives. The UAE’s National Agenda 2021 emphasized the adoption of modern healthcare technologies, leading to widespread deployment of MRI, CT, and ultrasound systems in hospitals and clinics. The UAE’s robust medical tourism sector also drives demand for diagnostic imaging, attracting patients from neighboring countries. According to the UAE Ministry of Health, healthcare spending reached $20 billion in 2022, with significant allocations for digital and imaging technologies, solidifying the country’s leadership in the regional diagnostic imaging market.

South Africa leads the diagnostic imaging market in Africa due to its developed healthcare infrastructure and focus on combating chronic diseases. The South African National Department of Health highlights that non-communicable diseases account for 57% of total deaths, driving demand for early diagnostic solutions. The country’s public and private healthcare sectors are adopting advanced imaging technologies, such as CT and PET scanners, to address growing healthcare needs. Additionally, South Africa’s role as a regional hub for medical training and innovation further enhances its market position, making it a critical contributor to diagnostic advancements in the Middle East & Africa.

KEY MARKET PLAYERS

A few of the dominating companies operating in the MEA Diagnostic Imaging Market profiled in this report are GE Healthcare, Siemens Healthcare, Toshiba Medical Systems Corporation, Hitachi Medical Corporation, Hologic Inc., Fujifilm Corporation & Shimadzu Corporation.

MARKET SEGMENTATION

This research report on the Middle East & Africa diagnostic imaging market is segmented and sub-segmented into the following categories.

By Type

- X-Rays

- Portable

- Handheld

- Nuclear Medicine

- Scintigraphy

- PET Imaging

- SPECT Imaging

- Ultrasound

- 2D

- 3D

- 4D

- Doppler Imaging

- MRI

- Tomography

- Photoacoustic Imaging

- Thermography

- Tactile Imaging

- Elastography

- Functional Near-Infrared Spectroscopy

- Echocardiography

By Application

- Cardiology

- Oncology

- Neurology

- Orthopedics

- Gastroenterology

- Gynecology

- Others

By Country

- KSA

- UAE

- Israel

- rest of GCC countries

- South Africa

- Ethiopia

- Kenya

- Egypt

- Sudan

- rest of MEA

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 1600

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]