Middle East & Africa Dental Consumables Market Size, Share, Trends & Growth Forecast Report By Type(Dental burs, Whitening Materials, Dental Anesthetics, Dental Biomaterials, Dental Syringes, Dental Prosthetics, Endodontics), End Users and Country (KSA, UAE, Israel, rest of GCC countries, South Africa, Ethiopia, Kenya, Egypt, Sudan and Rest of MEA), Industry Analysis From 2025 to 2033

Middle East and Africa Dental Consumables Market Size

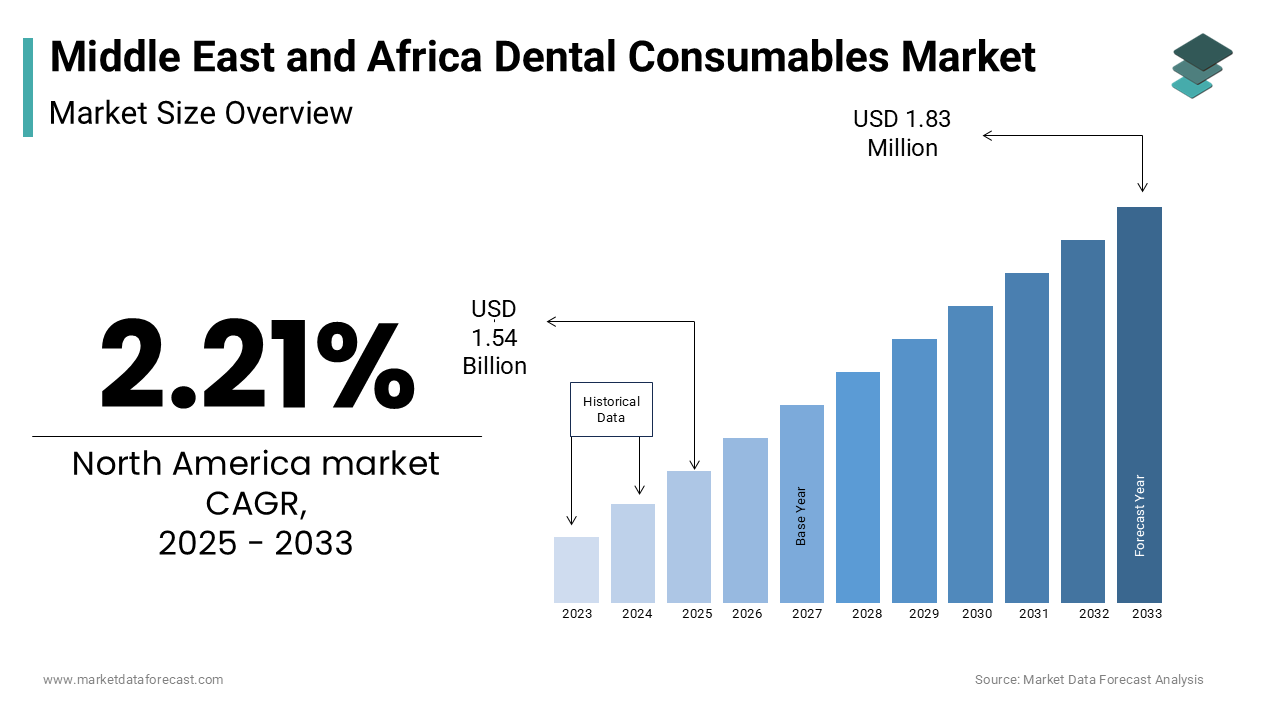

The dental consumables market size in the Middle East & Africa was worth USD 1.51 billion in 2024. The MEA market is poised to reach USD 1.83 bn by 2033 from USD 1.54 bn in 2025, growing at a CAGR of 2.21% during the forecast period.

Dental consumables include materials such as implants, prosthetics, crowns, bridges, orthodontic supplies, and adhesives that are essential for performing dental procedures ranging from preventive care to restorative and cosmetic dentistry. Middle East and Africa face significant oral health challenges. According to reports from the World Health Organization (WHO), untreated dental caries affect 44% of children and 35% of adults in the Middle East and Africa. Additionally, the rising prevalence of periodontal diseases and tooth loss because of the high rates of tobacco use and poor oral hygiene are fuelling the demand for dental consumables. South Africa and the Gulf Cooperation Council (GCC) countries are among the leading markets in this region.

MARKET DRIVERS

Rising Prevalence of Dental Diseases in the Middle East & Africa

The increasing prevalence of dental diseases is a significant driver of the Middle East & Africa dental consumables market. According to the World Health Organization, untreated dental caries impact 35% of adults and 44% of children in the region, making it a major public health concern. Periodontal diseases are also widespread, affecting over 25% of adults, often due to poor oral hygiene and high tobacco consumption rates. The Gulf Cooperation Council countries, particularly Saudi Arabia and the UAE, report growing demand for restorative dental procedures to address these conditions. This surge in dental issues has directly elevated the demand for consumables like crowns, adhesives, and implants.

Expanding Dental Care Infrastructure

The expansion of dental care infrastructure across the Middle East and Africa is driving the growth of dental consumables. Governments in countries like South Africa, Saudi Arabia, and the UAE are investing in healthcare development to increase access to dental services. For instance, Saudi Vision 2030 includes initiatives to improve healthcare accessibility, leading to a rise in dental clinics and specialized centers. According to the South African Dental Association, the country has seen a 20% increase in private dental practices over the last five years. These developments are boosting the demand for advanced dental materials and technologies, catering to the region’s growing population and evolving oral health needs.

MARKET RESTRAINTS

Limited Access to Dental Care in Rural Areas

A significant restraint for the Middle East & Africa dental consumables market is the limited access to dental care in rural and underserved regions. According to the World Health Organization, over 50% of the population in sub-Saharan Africa lacks access to basic oral healthcare services. This disparity is primarily due to inadequate infrastructure, a shortage of dental professionals, and economic constraints. In South Africa, for example, the Health Professions Council reported that less than 20% of registered dentists serve rural areas. This lack of accessibility restricts the adoption of dental consumables in these regions, hindering market growth despite increasing demand for oral health services.

High Costs of Dental Procedures and Consumables

The high cost of dental procedures and consumables remains a significant barrier in the Middle East & Africa. Many countries in the region have limited insurance coverage for dental treatments, leaving patients to bear the financial burden. The South African Dental Association notes that the cost of dental implants ranges between $1,500 and $3,000 per tooth, making them inaccessible to a large segment of the population. In addition, imported dental materials, which dominate the market, face high tariffs and logistical expenses. These cost barriers reduce the adoption of advanced dental technologies, particularly in low-income and middle-income countries, limiting the market's growth potential.

MARKET OPPORTUNITIES

Growth of Medical Tourism in the Middle East

The rapid expansion of medical tourism in the Middle East offers a significant opportunity for the dental consumables market. Countries like the UAE and Turkey have become hubs for dental treatments due to their state-of-the-art facilities and relatively lower costs compared to Europe and North America. According to the Dubai Health Authority, dental services account for over 10% of the medical tourism revenue in Dubai, which saw more than 630,000 medical tourists in 2022. These visitors frequently seek procedures like dental implants, veneers, and orthodontic treatments, driving the demand for high-quality dental consumables. The rise in medical tourism positions the region as a lucrative market for global dental product manufacturers.

Adoption of Advanced Dental Technologies

The increasing adoption of advanced dental technologies in the Middle East and Africa represents a substantial opportunity for the dental consumables market. Technologies such as computer-aided design and manufacturing (CAD/CAM) systems, 3D printing, and minimally invasive procedures are gaining traction, particularly in developed markets like the UAE and Saudi Arabia. The Saudi Dental Society reports that the adoption of CAD/CAM systems grew by 25% between 2020 and 2022, improving the efficiency and precision of dental restorations. Additionally, 3D printing is transforming the production of dental prosthetics, reducing manufacturing time and costs. These advancements are expected to boost the demand for specialized consumables and drive market growth across the region.

MARKET CHALLENGES

Shortage of Skilled Dental Professionals

A major challenge in the Middle East & Africa dental consumables market is the shortage of skilled dental professionals. The World Health Organization has highlighted that many countries in sub-Saharan Africa and the Middle East have fewer than five dentists per 100,000 population, well below the global average. For example, Kenya and Nigeria face significant gaps in their healthcare workforce, with rural areas being disproportionately affected. This shortage limits the ability to perform complex dental procedures, reducing the demand for advanced consumables like implants and prosthetics. Furthermore, the reliance on expatriate dental professionals in Gulf countries increases costs, creating additional challenges for market scalability.

Economic Instability and Low Healthcare Spending

Economic instability and low healthcare spending in several Middle Eastern and African countries hinder the growth of the dental consumables market. The World Bank reported that healthcare expenditure as a percentage of GDP remains below 5% in countries like Nigeria and Sudan, limiting investments in oral healthcare infrastructure. Additionally, political instability and fluctuating currencies in nations such as Libya and Zimbabwe further exacerbate these challenges. Patients in low-income regions often prioritize basic healthcare over dental treatments, reducing the adoption of advanced consumables. The high cost of imported dental materials adds to the financial burden, restricting access and impeding market expansion in economically disadvantaged areas.

REGIONAL ANALYSIS

The UAE held the major share of the dental consumables market in the Middle East and Africa in 2023. The dental consumables market growth in the UAE is attributed to its advanced healthcare infrastructure and growing medical tourism sector. According to the Dubai Health Authority, Dubai alone attracted over 630,000 medical tourists in 2022, with dental treatments being one of the most sought-after services. The UAE's high per capita income and increasing adoption of advanced dental technologies, such as CAD/CAM systems and 3D printing, further strengthen its position. Government initiatives, including the Dubai Health Strategy 2021, emphasize enhancing healthcare services, contributing to a rise in dental clinics and demand for consumables like implants, crowns, and orthodontic supplies.

Saudi Arabia is another major market for dental consumables in this region. The expansion of its healthcare sector under Vision 2030 is favoring the dental consumables market in Saudi Arabia. The Saudi Dental Society notes that dental care accounts for a significant portion of outpatient services, with over 2,500 dental clinics established nationwide. Rising awareness of oral health and the availability of insurance coverage for dental procedures are fueling demand for consumables such as veneers and adhesives. Additionally, Saudi Arabia’s population, with over 70% under the age of 40, according to the General Authority for Statistics, presents a growing consumer base for cosmetic and preventive dental treatments, solidifying its market position.

South Africa is playing a prominent role in the Middle East and African dental consumables market. The well-established private healthcare sector of South Africa is a key factor driving the South African market growth. The South African Dental Association reports a 20% growth in private dental practices over the past five years, particularly in urban areas. The country also leads in oral health awareness initiatives, such as National Oral Health Month, which promotes preventive care. Despite economic challenges, demand for dental implants and orthodontic products is increasing, driven by a middle-class population with rising disposable incomes. South Africa’s role as a regional hub for dental education and innovation further enhances its significance in the market.

KEY MARKET PLAYERS

A few of the prominent companies operating in the MEA dental consumables market profiled in this report are DENTSPLY International Inc., Biomet 3I, 3M ESPE Dental Solutions, Henry Schein, Inc., Kerr Corporation/Sybron Dental Specialties, Nobel Biocare, Patterson Companies, Inc., Septodont, Zimmer Dental, Straumann, Danaher, Sirona, GC Corporation, Heraeus Dental and Align Technology.

MARKET SEGMENTATION

This research report on the Middle East & Africa dental consumables market is segmented and sub-segmented into the following categories.

By Type

- Dental burs

- Whitening Materials

- Dental Anesthetics

- Dental Biomaterials

- Dental Syringes

- Dental Prosthetics

- Endodontics

By End Users

- Hospitals

- Research and Academic Institutes

- Forensic Labs

By Country

- KSA

- UAE

- Israel

- Rest of the GCC countries

- South Africa

- Ethiopia

- Kenya

- Egypt

- Sudan

- Rest of MEA

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 1600

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]