Middle East And Africa Commercial Greenhouse Market Size, Share, Trends & Growth Forecast Report By Equipment, Type, Crop Type, And By Country (KSA, UAE, Israel, South Africa, And Ethiopia, Kenya, Egypt, Sudan, Rest of GCC Countries, and Rest of MEA) - Industry Analysis From (2024 to 2032)

Middle East and Africa Commercial Greenhouse Market Size (2024 to 2032)

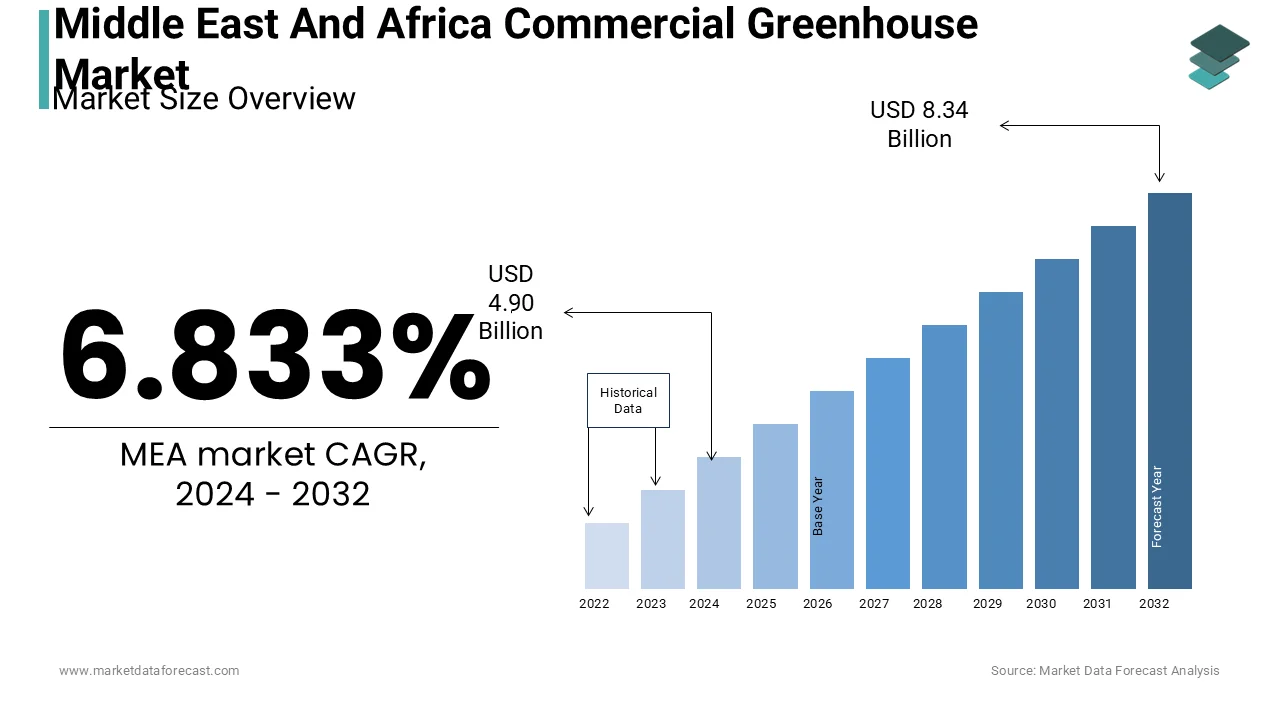

The Middle East and Africa commercial greenhouse market was expected to be valued at USD 4.6 billion in 2023 and is anticipated to reach USD 4.90 billion in 2024 from USD 8.34 billion in 2032, growing at a CAGR of 6.833% from 2024 to 2032.

The commercial greenhouse market in the Middle East and Africa is poised for notable growth over the forecast period. The adoption of advanced greenhouse technologies has surged in the recent past in this region due to the increasing number of food security concerns, the growing urban population, and the limited arable land in this region. Controlled-environment agriculture (CEA) has enabled year-round production of high-value crops, particularly fruits, vegetables, and flowers to address the needs of the Middle East and African region. Notable market participants such as Certhon and Richel Group are entering the MEA market with innovations in climate control and irrigation systems that optimize resource use. The technology-driven greenhouse model is especially critical in desert areas, which is extremely crucial for a region like MEA. Countries such as the UAE are currently leading in high-tech greenhouse projects to reduce dependency on food imports. This transition has been fueled by government incentives and policies promoting sustainable agriculture despite challenges like high initial setup costs and the need for skilled personnel to manage these systems.

The rising demand for sustainable agriculture and food security in the face of regional aridity and limited arable land is majorly driving the commercial greenhouse market growth in MEA. The ability of commercial greenhouses to enable year-round crop production and to shield crops from extreme temperatures, an essential feature given the harsh climate of the region are further propelling the regional market expansion. Countries like the UAE and Saudi Arabia are spearheading high-tech greenhouse projects to meet local demand for fresh produce in order to reduce dependence on imports. These greenhouses utilize advanced technologies such as climate control, irrigation systems, and LED lighting to optimize conditions for crop growth. In 2023, the adoption of smart greenhouse technologies that integrate IoT and AI-driven systems surged. This allowed the farmers to monitor and control environmental variables remotely.

On the other hand, high initial setup costs for greenhouse infrastructure and the need for skilled labor to manage complex climate systems are challenging regional market growth. However, the governments of the MEA countries are helping the farmers mitigate these challenges through incentives and subsidies. For example, the Saudi government has been actively funding greenhouse projects under its Vision 2030 initiative to promote sustainable agriculture and food independence. Global companies such as Certhon and Argus Control Systems have also expanded their operations in the MEA region, which is further providing more opportunities in this regional market. These companies provide turnkey solutions that incorporate renewable energy and resource-efficient technologies, aligning with global trends toward eco-friendly farming. Furthermore, in early 2024, Eden Green Technology invested significantly in increasing lettuce production capacity in the UAE, which indicates strong commercial interest in expanding greenhouse operations across the region.

This research report on the Middle East And Africa commercial greenhouse market is segmented and sub-segmented based on Equipment, Type, Crop, And Country.

Middle East and Africa Commercial Greenhouse Market By Equipment

- Heating systems

- Cooling systems

- Others

In 2023, the cooling systems segment accounted for 52.88% of the regional market share and emerged as the most dominating segment in the MEA market. The dominance of the segment is majorly credited to the increasing demand for effective temperature regulation in high-tech greenhouses. In the Middle East and Africa commercial greenhouse market, cooling systems lead the equipment segment due to the region's high temperatures and harsh climate conditions. Cooling systems are essential for maintaining optimal growing conditions within greenhouses, allowing for the consistent production of fruits, vegetables, and flowers year-round. As temperatures in this region often exceed thresholds suitable for many crops, robust cooling systems have become indispensable.

On the other hand, the heating systems segment is expected to grow at the fastest CAGR of 7.5% over the forecast period. This growth is spurred by the increasing expansion of greenhouse operations in subtropical and high-altitude areas within the region, such as parts of South Africa and mountainous areas in North Africa. In these cooler regions, heating systems are crucial to extending the growing season and supporting off-season production. The rising adoption of energy-efficient and renewable-powered heating technologies is further bolstering this segment's growth as governments and private investors prioritize sustainable and eco-friendly agricultural solutions. Additionally, advancements in heating technologies, such as geothermal and solar-powered systems, are attracting investments due to their potential to reduce operational costs over the long term.

Middle East and Africa Commercial Greenhouse Market By Type

- Glass greenhouse

- Plastic greenhouse

- Others

The plastic greenhouses segment accounted for 60.9% of the MEA market share in 2023 due to their ease of installation and lower maintenance costs compared to glass. The cost-effectiveness and durability of the plastic greenhouses are further significantly contributing to the segment register dominance among other types. Plastic greenhouses use materials such as polyethylene and polycarbonate and offer flexibility and affordability, making them accessible for a wide range of agricultural producers across the region. The lightweight and shatter-resistant properties of polycarbonate, in particular, make it an ideal material in areas prone to high winds and temperature fluctuations.

Conversely, the glass greenhouse segment is expected to grow at the fastest CAGR of 8.2% from 2024 to 2032. This growth is primarily driven by the superior light transmission qualities of glass, which supports high-yield crop production by enhancing photosynthesis and overall plant growth. The demand for glass greenhouses is particularly notable in the UAE and Saudi Arabia, where government-backed agricultural programs prioritize advanced greenhouse technologies for high-value crop production. Additionally, glass greenhouses are increasingly integrated with climate control and automation systems, which optimize growing conditions, further driving investment in this segment. While the initial setup cost for glass greenhouses is higher than for plastic ones, their durability and enhanced growing environment have led to rising adoption rates in high-tech agricultural projects across the region.

Middle East and Africa Commercial Greenhouse Market By Crop

- Fruits and vegetables

- Flowers and ornamentals

- Nursery crops

- Others crops

The fruits and vegetables segment occupied 55% of the share in the Middle East and Africa commercial greenhouse market and stood as the most dominating segment in 2023. The growth of the segment is primarily driven by the increasing focus of governments and private investors on projects that have focused on reducing food imports. The growing demand for locally sourced, fresh produce throughout the year is further boosting the growth rate of the fruits and vegetables segment in the regional market. This segment benefits from the focus of the region on food security, with greenhouse-grown produce such as tomatoes, cucumbers, and peppers catering to both local consumption and export.

The flowers and ornamentals segment is projected to experience the fastest CAGR of 7.8% from 2024 to 2032. This growth is largely fueled by the rising demand for ornamental plants and cut flowers, particularly in the UAE and Saudi Arabia, where greenhouses support the flourishing horticultural industry. In these markets, demand for luxury landscaping and decorative plants has increased alongside developments in urban and commercial real estate. Additionally, advanced greenhouse technologies, including climate-controlled environments and precision irrigation, enable year-round cultivation of high-value ornamental crops that require specific growing conditions.

Middle East and Africa Commercial Greenhouse Market By Country

- KSA

- UAE

- Israel

- rest of GCC countries

- South Africa

- Ethiopia

- Kenya

- Egypt

- Sudan

- rest of MEA

The United Arab Emirates (UAE) led the commercial greenhouse market in the Middle East and Africa in 2023 owing to the extensive government initiatives and private investments to boost food security and reduce dependence on food imports. The controlled-environment agriculture sector of the UAE has rapidly expanded through high-tech greenhouse projects focused on water efficiency and yield optimization, which is essential in a region with limited arable land and water scarcity. In UAE, greenhouse farms have been increasingly adopting IoT and AI-driven climate control systems to enhance productivity. Notably, partnerships with technology companies have enabled the integration of renewable energy sources, which is further driving greenhouse adoption in the UAE.

Saudi Arabia is predicted to be growing at the fastest-growing country in this region and is likely to register a CAGR of 9%% over the forecast period. The Kingdom’s Vision 2030 plan has accelerated greenhouse investment to focus on achieving self-sufficiency in fruit and vegetable production. The agricultural sector of Saudi Arabia benefits from substantial government funding, and recent projects are also emphasizing advanced hydroponics and aquaponics systems to maximize space and resource use. The harsh climate has also encouraged investment in greenhouse cooling technologies that allow consistent year-round production to reduce reliance on imported fresh produce. As a result, Saudi Arabia’s greenhouse market is expected to expand rapidly over the forecast period.

Israel ranks among the top performers in the MEA commercial greenhouse market due to its established expertise in agricultural innovation. Israel has pioneering technologies in drip irrigation, precision agriculture and climate control systems and the greenhouses of Israel support a high yield of crops, including premium fruits, vegetables and flowers. The extensive R&D investments of Israel in sustainable farming solutions and export-oriented production are further strengthening Israel's position in the MEA greenhouse market.

KEY MARKET PLAYERS

The top players in the market include Richel Group SA (France), Certhon (U.S.), Argus Control Systems Ltd. (U.S), Logiqs (The Netherlands), Lumigrow (U.S.), Keder Greenhouse (UK), Agra Tech, Inc (U.S.), Hort Americas, LLC (U.S.), Rough Brothers Inc. (U.S.), and Heliospectra AB (Sweden). Most of these companies have been exploring new regions through agreements & contracts across the world to give a competitive advantage through combined synergies. LumiGrow is one of the important companies doing business in the commercial greenhouse market. It increases its customers with partnership agreements and contracts.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 1600

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]