Middle East and Africa Baking Enzymes Market Size, Share, Trends & Growth Forecast Report By Type (Carbohydrase, Protease, Lipase and Others), Application (Bread, Biscuits & Cookies, Cake & Pastry), And Country (KSA, UAE, Israel, Rest Of GCC Countries, South Africa, Ethiopia, Kenya, Egypt, Sudan And Rest Of MEA), Industry Analysis From 2025 To 2033

Middle East and Africa Baking Enzymes Market Size

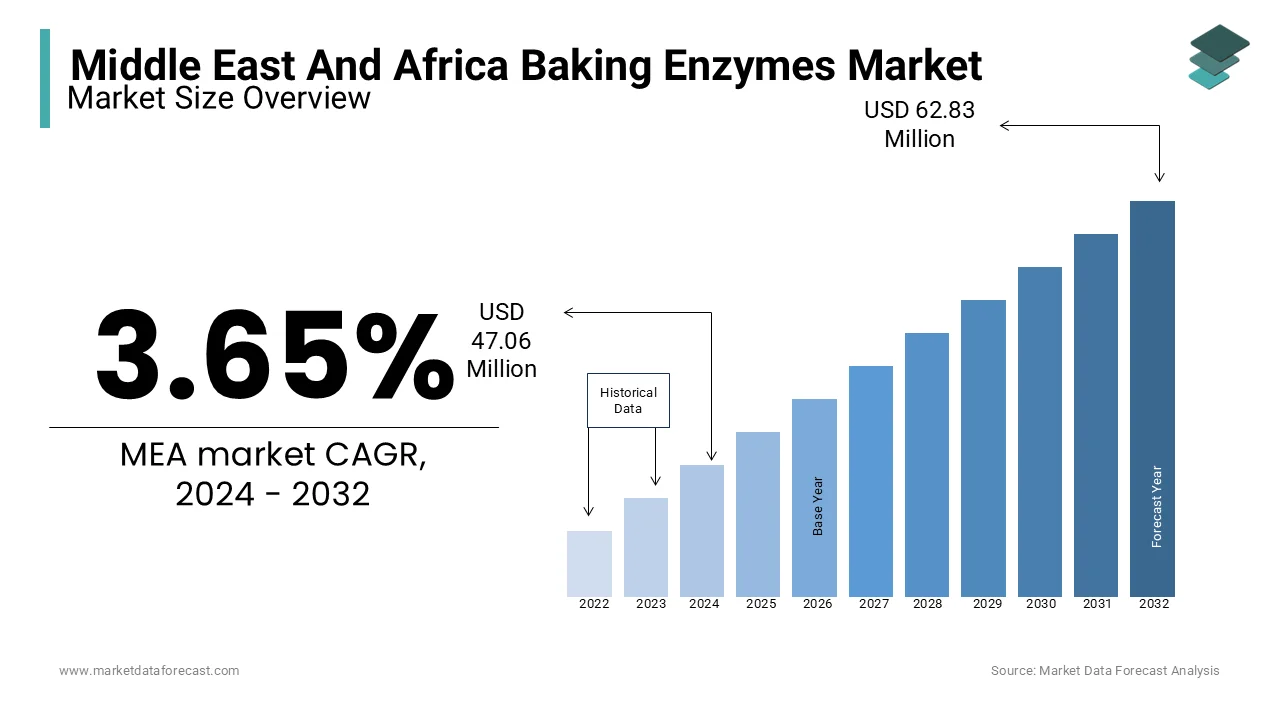

The size of the Middle East and Africa baking enzymes market was valued at USD 47.06 million in 2024. The regional market size is expected to be worth USD 48.78 million in 2025 and USD 64.98 million by 2033, growing at a CAGR of 3.65% from 2025 to 2033.

Baking enzymes are natural catalysts used in the production of bread, pastries, and other bakery products to enhance texture, flavor, and shelf life. Common enzymes such as amylases, proteases, and lipases are increasingly employed to improve dough stability, reduce production time, and create consistent results in large-scale baking processes.

The growing population and urbanization in the Middle East and Africa have fuelled demand for convenient and ready-to-eat baked goods. According to the World Bank, the population of the Middle East and North Africa (MENA) region reached approximately 472 million in 2022, and significant growth is expected in urban centers. This demographic trend drives the adoption of modern bakery solutions, in which enzymes play a crucial role in meeting large-scale production demands. The rising awareness of clean-label products is a notable trend in the Middle East and Africa baking enzymes market. Consumers are seeking healthier options with fewer additives and baking enzymes, being natural and non-toxic, which aligns with this trend. South Africa and Saudi Arabia lead the regional market due to their robust food processing sectors.

MARKET DRIVERS

Rising Demand for Convenience Foods

The increasing urbanization and fast-paced lifestyles in the Middle East and Africa have led to a growing demand for convenience foods, including baked goods. According to the reports of the World Bank, urbanization in the Middle East and North Africa reached 64% in 2022, while Sub-Saharan Africa saw significant growth of more than 41%. This trend drives the need for efficient bakery solutions as enzymes play a crucial role in enhancing the texture, shelf life, and quality of products like bread and pastries. Enzymes such as amylases and lipases help manufacturers meet these demands by improving production efficiency and ensuring consistent product quality for large-scale operations.

Shift Toward Clean-Label and Healthy Products

The growing awareness of health and wellness in the Middle East and Africa has fuelled demand for clean-label and natural products. According to the Food and Agriculture Organization, consumers in the Middle East and Africa are increasingly seeking baked goods with minimal artificial additives. Baking enzymes are natural catalysts and are used to replace chemical additives while maintaining product quality. For instance, proteases improve dough handling without synthetic agents. This shift toward healthier, clean-label baked goods creates opportunities for enzyme manufacturers to cater to evolving consumer preferences while adhering to regulatory and quality standards.

MARKET RESTRAINTS

High Costs of Enzyme Production and Adoption

The production and application of advanced baking enzymes require sophisticated technology and infrastructure and are resulting in high costs. For small and medium-sized bakeries that dominate the market in the Middle East and Africa, these costs can be prohibitive. According to the Food and Agriculture Organization, over 80% of food production enterprises in Sub-Saharan Africa are small-scale operations and often lack the capital to invest in advanced enzyme technologies. This financial barrier limits the widespread adoption of baking enzymes, particularly in price-sensitive markets, and restricts innovation and scalability among regional manufacturers.

Lack of Awareness and Technical Expertise

Limited awareness about the benefits of baking enzymes and insufficient technical expertise among local bakeries constrain the regional market growth. As per the World Bank, access to education and specialized training in the food processing sector remains low in many parts of Africa and the Middle East. This knowledge gap reduces the willingness of small-scale bakers to adopt enzyme-based solutions, as they may lack confidence in handling these products or understanding their long-term benefits. Moreover, inadequate training infrastructure prevents the effective dissemination of information, hindering the adoption of baking enzymes across the region.

MARKET OPPORTUNITIES

Growing Bakery Industry in Urban Areas

Urbanization is significantly driving the expansion of the bakery industry in the Middle East and Africa and creating a demand for innovative solutions such as baking enzymes. According to the World Bank, urbanization in the Middle East and North Africa reached 64% in 2022 and contributing to the growth of bakery chains and modern retail outlets. Countries such as South Africa and the UAE are witnessing an increasing demand for diverse baked goods, including artisanal and specialty bread. Enzymes, such as amylases, help bakeries enhance efficiency and product quality and enable them to meet urban consumer expectations for fresh and high-quality baked goods.

Expansion of Halal and Gluten-Free Product Lines

The rising demand for specialty baked goods, such as halal and gluten-free products, presents a lucrative opportunity for enzyme manufacturers. The Islamic Food and Nutrition Council of America estimates that the global halal food market, including baked goods, is growing by over 7% annually, with the Middle East being a primary consumer. Baking enzymes help improve the quality and texture of gluten-free and halal-certified products that cater to a niche yet growing demographic. This trend allows manufacturers to innovate and diversify their offerings while meeting regulatory standards and satisfying consumer preferences for specialty bakery items.

MARKET CHALLENGES

High Dependency on Imports

The reliance of the Middle East and Africa on imported baking enzymes creates supply chain vulnerabilities and cost fluctuations. According to the World Bank, most countries in Sub-Saharan Africa and the Middle East import over 70% of their food processing ingredients, including enzymes. This dependency makes the market susceptible to disruptions caused by global trade issues, rising transportation costs, and fluctuating exchange rates. For instance, the COVID-19 pandemic exposed weaknesses in supply chains, leading to delays and increased costs for imported food-grade enzymes. These challenges hinder the affordability and availability of baking enzymes, particularly for small and medium-sized bakeries.

Inconsistent Regulatory Frameworks

The lack of harmonized regulatory standards for food processing enzymes across the region poses a significant barrier to market growth. According to the Food and Agriculture Organization, varying food safety and labeling regulations in Middle Eastern and African countries create compliance challenges for manufacturers. For example, while Gulf Cooperation Council countries adhere to specific guidelines for enzyme usage, Sub-Saharan nations often lack clear policies. This inconsistency increases the burden on enzyme producers, who must navigate different regulatory landscapes to ensure market entry. The resulting delays and costs impede innovation and slow the adoption of enzyme-based baking solutions.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

3.65% |

|

Segments Covered |

By Type, Application, And Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

KSA, UAE, Israel, Rest of GCC countries, South Africa, Ethiopia, Kenya, Egypt, Sudan, and Rest of MEA |

|

Market Leaders Profiled |

Novozymes, AB Enzymes, DSM, Advanced Enzymes, Amano Enzyme Inc, Stern Enzymes, Dydaic International Inc, Engrain, Maps Enzyme Limited, E.I. Dupont De Nemours & Company, Aumenzymes, and Puratos Group N.V |

REGIONAL ANALYSIS

Saudi Arabia led the baking enzymes market in the Middle East and Africa in 2023 and is estimated to continue its leading position in this regional market throughout the forecast period. The thriving bakery industry and strong economic infrastructure in Saudi Arabia are driving the bakery enzymes market. According to the Saudi General Authority for Statistics, the population of Saudi Arabia exceeded 36 million in 2022. The growing urban population that accounts for over 84% drives the adoption of modern baking technologies. The widespread consumption of traditional baked goods, such as flatbreads and the increasing influence of Western bakery trends are further boosting the market expansion in Saudi Arabia.

The UAE is a prominent player in the Middle East and Africa baking enzymes market. The advanced food processing sector and high per capita income are contributing to the baking enzymes market growth in the UAE. As per the reports of the Dubai Statistics Center, more than 86% of the UAE population resides in urban areas, which drives the demand for premium bakery products. The strong tourism and hospitality industries further boost bakery consumption in the UAE, particularly in metropolitan hubs like Dubai and Abu Dhabi.

South Africa holds a notable position in the regional baking enzymes market due to its well-established bakery industry and large consumer base. According to Statistics South Africa, bread is a staple food, with annual bread consumption exceeding 2.8 billion loaves. The diverse bakery sector of South Africa, which encompasses artisanal, industrial, and in-store bakeries, drives demand for baking enzymes to enhance efficiency and quality. Government initiatives promoting local food production and economic development also support enzyme adoption. As a hub for innovation in the region, South Africa plays a crucial role in shaping the growth of the Middle East and African baking enzymes market.

KEY MARKET PLAYERS

Major Key players in the MEA baking enzymes market are Novozymes, AB Enzymes, DSM, Advanced Enzymes, Amano Enzyme Inc, Stern Enzymes, Dydaic International Inc, Engrain, Maps Enzyme Limited, E.I. Dupont De Nemours & Company, Aumenzymes, and Puratos Group N.V

MARKET SEGMENTATION

This research report on the Middle East and Africa baking enzymes market is segmented and sub-segmented into the following categories.

By Type

- Carbohydrase

- Protease

- Lipase

- Others

By Application

- Bread

- Biscuits & Cookies

- Cake

- Pastry

By Country

- KSA

- UAE

- Israel

- rest of GCC countries

- South Africa

- Ethiopia

- Kenya

- Egypt

- Sudan

- Rest of MEA

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 1600

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]