Middle East And Africa Bakery Ingredients Market Size, Share, Trends & Growth Forecast Report By End-Products (Breads, Cookies & Biscuits, Cakes & Pastries, Pies And Rolls, And Other Items), Ingredient Type (Leavening Agent, Sweeteners, Food Colors, Enzymes, And Flavors Emulsifiers Preservatives, And Other Segments), And Country (KSA, UAE, Israel, Rest Of GCC Countries, South Africa, Ethiopia, Kenya, Egypt, Sudan And Rest Of MEA), Industry Analysis (2025 To 2033)

Middle East & Africa Bakery Ingredients Market Size

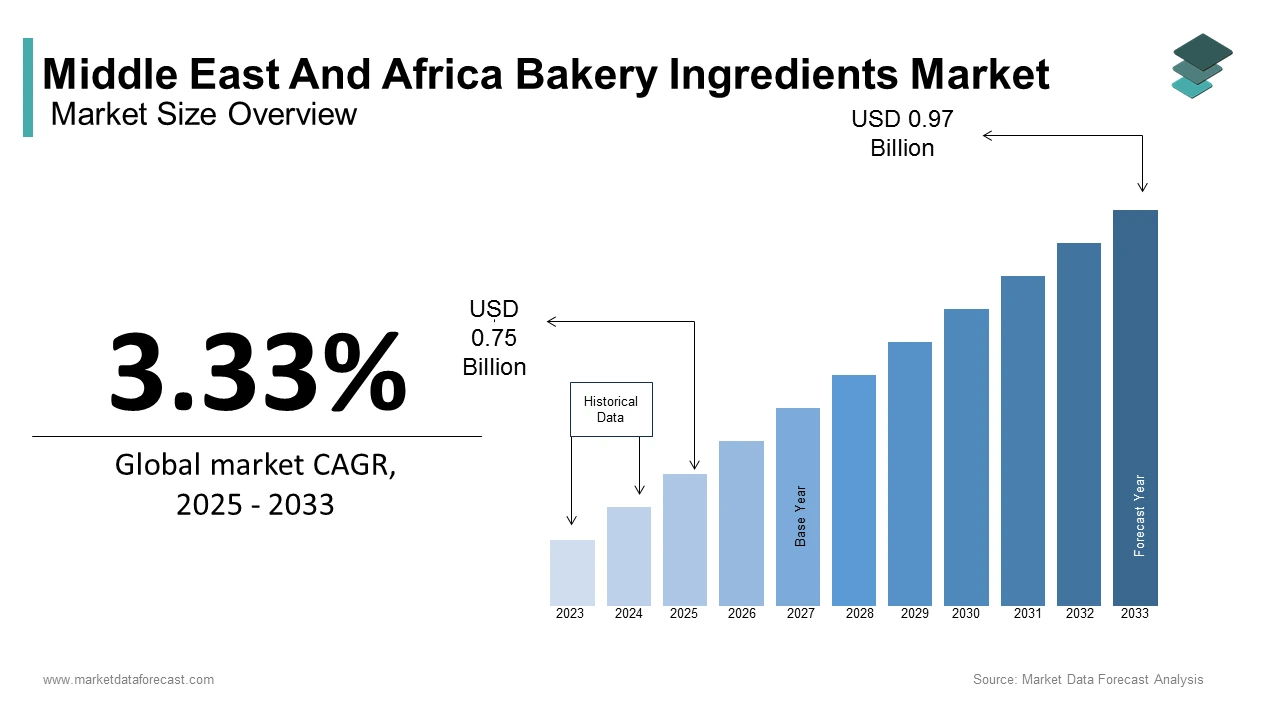

The bakery ingredients market size in the Middle East and Africa was valued at USD 0.73 billion in 2024. This regional market is further estimated to be worth USD 0.75 billion in 2025 and USD 0.97 billion by 2033, exhibiting a CAGR of 3.33% from 2025 to 2033.

Bakery ingredients, including flour, sugar, emulsifiers, enzymes, and flavor enhancers, are essential components in producing bread, cakes, pastries, and other confectionery products. The rising urban population and changing dietary preferences are key factors fuelling the demand for bakery ingredients. According to the Food and Agriculture Organization, bread remains a staple food in many Middle Eastern and African countries, accounting for a large share of daily calorie intake. Additionally, the United Nations projects that the urban population in Africa is expected to reach 60% by 2050, contributing to the increased demand for convenience foods, including baked goods. The growing influence of Western dietary trends and the expansion of retail bakeries in countries such as Saudi Arabia, the UAE, and South Africa further drive the adoption of bakery ingredients.

MARKET DRIVERS

Rising Urbanization and Changing Lifestyles

Urbanization in the Middle East and Africa is driving significant growth in the bakery ingredients market as busy lifestyles lead to increased demand for convenience foods. The United Nations estimates that by 2050, over 60% of the African population will reside in urban areas, creating a shift towards readily available, affordable baked goods. In countries like South Africa and Nigeria, the rise of dual-income households has fueled the consumption of packaged bread and pastries. This demand directly impacts the use of bakery ingredients like emulsifiers and preservatives, which extend shelf life and improve product quality. Urbanization's influence on consumer behavior is a key driver of growth in this market.

Growing Demand for Functional and Specialty Ingredients

The increasing focus on health and wellness in the Middle East and Africa is driving demand for functional and specialty bakery ingredients. According to the World Health Organization, the prevalence of non-communicable diseases, such as diabetes and obesity, is rising in the region, prompting consumers to seek healthier alternatives. This has led to the adoption of gluten-free, low-sugar, and high-fiber baked goods, boosting the demand for innovative ingredients like natural sweeteners, whole grain flour, and dietary fibers. As consumer awareness of nutrition grows, manufacturers are leveraging functional ingredients to meet evolving preferences, contributing significantly to market expansion.

MARKET RESTRAINTS

High Cost of Specialty Ingredients

The elevated cost of specialty bakery ingredients, such as gluten-free flours, natural sweeteners, and clean-label emulsifiers, is a major restraint in the Middle East and Africa bakery ingredients market. The World Bank reports that many African nations face high food import costs due to limited local production of specialized ingredients, leading to inflated prices for end consumers. This cost barrier disproportionately impacts lower-income households, limiting the adoption of premium and health-oriented baked goods. Additionally, high production and transportation costs further hinder market accessibility, posing challenges for manufacturers aiming to cater to diverse consumer segments across the region.

Inadequate Infrastructure and Supply Chain Challenges

Weak infrastructure and supply chain inefficiencies significantly constrain the bakery ingredients market in the Middle East and Africa. According to the United Nations Economic Commission for Africa, inadequate transportation networks and poor storage facilities contribute to high spoilage rates and inconsistent ingredient supply. These issues are particularly pronounced in rural and remote areas, where logistical hurdles limit the availability of quality ingredients. Seasonal disruptions and reliance on imported goods exacerbate the problem, making it challenging for manufacturers to maintain steady production. Resolving these infrastructure gaps is critical for ensuring a reliable supply chain and supporting market growth in the region.

MARKET OPPORTUNITIES

Expansion of Retail and Artisan Bakeries

The rapid growth of retail and artisan bakeries in the Middle East and Africa presents a significant opportunity for the bakery ingredients market. According to the Food and Agriculture Organization, bread and bakery products remain staples in the diet of many countries in the region, driving demand for diverse ingredients. The rise of specialty bakeries, particularly in urban areas of countries like Saudi Arabia, South Africa, and Egypt, has created a need for innovative ingredients such as flavor enhancers, preservatives, and natural coloring agents. As disposable incomes increase and consumer preferences evolve, the expansion of retail bakeries is expected to bolster the adoption of advanced bakery ingredients.

Growing Demand for Plant-Based and Clean-Label Products

The rising demand for plant-based and clean-label baked goods in the Middle East and Africa offers a lucrative opportunity for bakery ingredient manufacturers. The World Health Organization highlights increasing health concerns related to non-communicable diseases, such as diabetes and heart conditions, which has prompted consumers to seek healthier food options. Ingredients like plant-based proteins, organic flours, and natural emulsifiers are gaining traction, catering to health-conscious and vegan consumers. Countries like the UAE and South Africa are leading this shift as awareness campaigns emphasize sustainable and health-focused eating habits. This trend enables manufacturers to innovate and capture market share through clean-label and plant-based ingredient offerings.

MARKET CHALLENGES

Food Security and Dependency on Imports

A major challenge facing the Middle East and Africa bakery ingredients market is food insecurity and a heavy reliance on imported raw materials. The Food and Agriculture Organization states that over 80% of wheat, a key ingredient in baked goods, is imported in countries like Egypt and Saudi Arabia. This dependency makes the market vulnerable to global supply chain disruptions, price volatility, and geopolitical tensions. Additionally, many African nations struggle with low domestic agricultural productivity, which exacerbates ingredient shortages. These challenges limit the availability of affordable bakery ingredients, constraining market growth and impacting the overall food sector's resilience.

Regulatory and Quality Compliance Issues

Navigating diverse and often inconsistent regulatory frameworks across the Middle East and Africa poses a significant challenge for bakery ingredient manufacturers. According to the World Health Organization, inadequate food safety standards and enforcement mechanisms in some countries lead to the circulation of substandard or adulterated products. This lack of uniformity in quality assurance creates barriers for international ingredient suppliers attempting to enter these markets. Furthermore, varying labeling requirements and import regulations increase compliance costs, particularly for manufacturers of specialty or clean-label ingredients. Addressing regulatory inconsistencies is essential for fostering a reliable and competitive bakery ingredients market in the region.

SEGMENTAL ANALYSIS

By Ingredient Type Insights

Out of these, Food Colors and Flavors is both the largest and the fastest-growing segment, registering a market share of over 25% in 2023. This part is expected to expand at a CAGR of 7.3% during the forecast period due to the demand for food products that appear and smell good.

By End-Products Insights

Out of these, the Cakes and Pastries segment holds the majority of the market share with over 20%. Many restaurants and coffee shops nowadays offer Cakes and Pastries as deserts for the sweet and pleasant ending experience. Bread is growing at a considerable CAGR of 7.2%, which can be attributed to interest in bread and other Western food products in middle-class families in Middle Eastern and African countries.

REGIONAL ANALYSIS

Saudi Arabia leads the Middle East and Africa bakery ingredients market due to its high consumption of bakery products and robust food processing industry. According to the Saudi Food and Drug Authority, bread is a staple food item, contributing significantly to daily caloric intake. The government's Vision 2030 initiative, focusing on food security and manufacturing, further supports the bakery sector. The expanding retail and artisan bakery market also increases demand for premium bakery ingredients, making KSA a key market.

South Africa is a major player in the bakery ingredients market, driven by its well-established bakery industry and high bread consumption rates. The Food and Agriculture Organization highlights that bread is a staple for 85% of South African households. Government efforts to ensure food affordability through subsidies on staple products have strengthened the demand for bakery ingredients.

Egypt ranks among the top contributors to the regional market, with bread being a dietary cornerstone. The Food and Agriculture Organization reports that Egypt is the world’s largest wheat importer, supporting its vast bakery sector. Government initiatives to subsidize bread production for low-income populations further drive demand for affordable and high-quality bakery ingredients, ensuring Egypt's market leadership.

KEY MARKET PLAYERS

Cargill Inc., Kerry Group, Associated British Foods, DSM, DuPont Dawn Foods Ltd, Taura Natural Ingredients Limited, Muntons PLC, Corbion N.V, and British Bakels Limited are some of the notable players in the Middle East and Africa bakery ingredients market.

RECENT HAPPENINGS IN THE MARKET

Major Players in the MEA bakery ingredients market include Cargill, a market giant that, in January 2018, invested in the Middle East for the first time with a partnership with Aramco, a regional market player. This investment is formed to facilitate meeting the growing demands of the region’s food needs.

MARKET SEGMENTATION

This research report on the Middle East and African bakery ingredients market is segmented and sub-segmented into the following categories.

By End Products

- Cookies & Biscuits

- Cakes & Pastries

- Bread

- Pies

- Rolls

- Other items

By Ingredient Type

- Enzymes

- Sweeteners

- Leavening Agent

- Emulsifiers

- Preservatives

- Food Colors

- Flavors

- Other Segments

By Country

- KSA

- UAE

- Israel

- Rest of GCC countries

- South Africa

- Ethiopia

- Kenya

- Egypt

- Sudan

- Rest of MEA

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 1600

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]