Middle East and Africa Chromatography Market Size, Share, Trends & Growth Forecast Report By Type, Product, End-User & Country (KSA, UAE, Israel, rest of GCC countries, South Africa, Ethiopia, Kenya, Egypt, Sudan & Rest of Middle East and Africa), Industry Analysis From 2024 To 2032

Middle East & Africa Chromatography Market Size

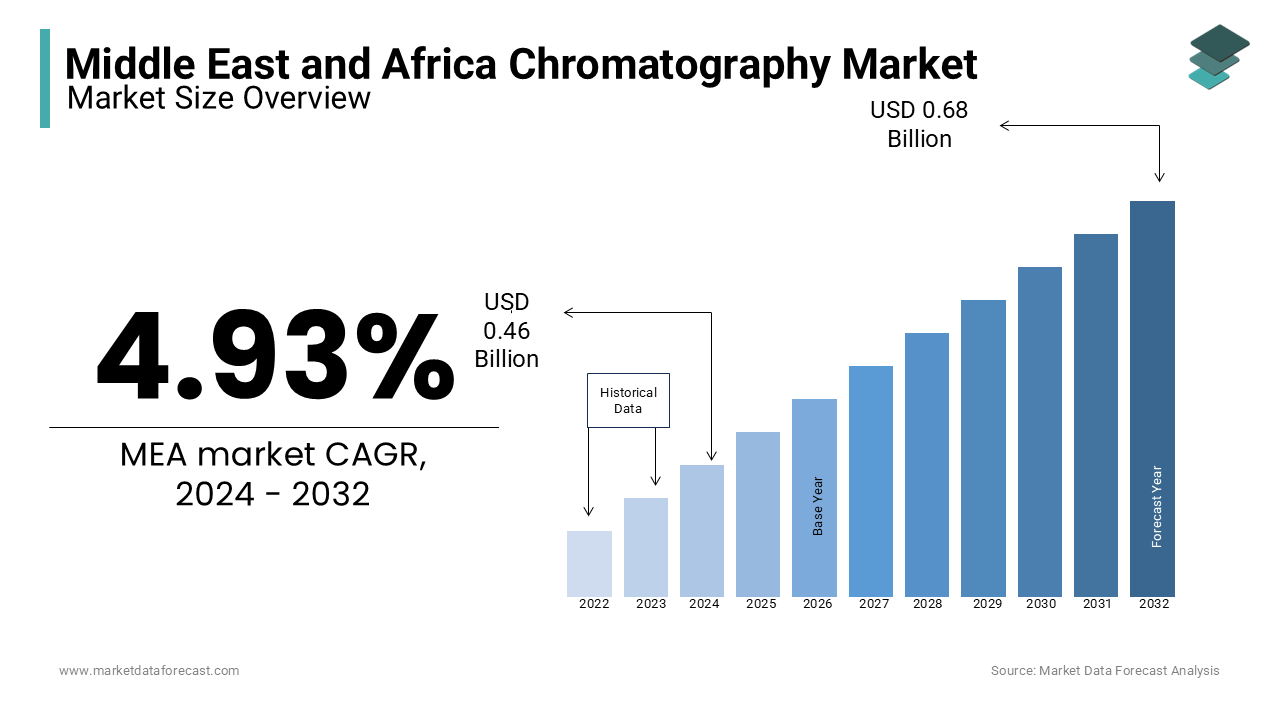

The chromatography Market size in the Middle East & Africa was estimated at USD 0.48 Billion in 2023 and is projected to reach USD 0.67 Billion by 2032 from USD 0.5 billion in 2024, growing at a CAGR of 3.75% from 2024 to 2032.

Chromatography plays a crucial role in ensuring the quality and safety of products, particularly in the pharmaceutical sector, in which, more than 50% of global drug quality assessments involve chromatographic techniques. The growing investments from the governments of the Middle East and African countries in healthcare infrastructure and regulatory mandates for stringent quality control are boosting demand for chromatography systems in the region. For example, South Africa and Saudi Arabia are enhancing pharmaceutical production capacities to promote the need for high-precision analytical tools like chromatography. Additionally, the food safety sector in the Middle East and Africa is expanding due to growing concerns over contamination and adulteration. The rising adoption of advanced chromatography techniques, such as gas chromatography (GC) and high-performance liquid chromatography (HPLC) are resulting in the growing demand for chromatography.

MARKET DRIVERS

Growing Pharmaceutical and Biotechnology Sectors

The expanding pharmaceutical and biotechnology industries in this region are propelling the Middle East and Africa chromatography market growth. The growing local drug manufacturing and R&D initiatives in countries such as South Africa and Saudi Arabia require advanced analytical tools for quality assurance and regulatory compliance. For example, Vision 2030 plan of Saudi Arabia includes a focus on boosting pharmaceutical production and create a strong demand for high-performance liquid chromatography (HPLC) systems. Globally, chromatography is used in over 50% of drug development processes, which is emphasizing its critical role in ensuring safety and efficacy and aligns with the growing focus on healthcare advancements in this region.

Rising Food Safety and Environmental Testing Requirements

Growing concerns over food safety and environmental contamination are propelling the adoption of chromatography techniques in Middle East and Africa. Governments are enforcing stringent regulations to control contaminants in food and monitor environmental pollutants. For instance, Africa faces significant challenges with pesticide residues and promoting the use of gas chromatography (GC) for detection. Additionally, according to a 2022 UN report, foodborne diseases affect 91 million people annually in Africa, which is driving the need for advanced analytical tools like chromatography to ensure food safety and meet export standards.

Expansion of Pharmaceutical Manufacturing in MEA

The push of the Middle East and Africa to localize pharmaceutical production presents significant growth opportunities for chromatography. Countries such as Saudi Arabia, under Vision 2030, aim to increase domestic drug manufacturing to reduce reliance on imports. This initiative creates a demand for advanced analytical tools like chromatography for quality control and regulatory compliance. The African Medicines Agency also supports harmonized drug regulations across the continent, which is driving investments in analytical laboratories. By 2025, pharmaceutical sales in this region are expected to rise by 30%. This fuels the need for robust chromatography solutions in manufacturing and R&D.

Adoption of Green Chromatography Techniques

The global shift toward sustainable practices is encouraging the adoption of eco-friendly chromatography methods in the Middle East and Africa. Innovations like supercritical fluid chromatography (SFC) and water-based systems minimize the use of harmful solvents and align with environmental goals. For instance, South Africa is increasingly implementing green analytical technologies in compliance with international sustainability standards. According to a 2023 report, 20% of MEA labs are adopting environmentally friendly chromatographic methods to reduce waste and operational costs. This trend offers manufacturers an opportunity to develop and offer green solutions tailored to the growing focus on sustainability in this region.

MARKET RESTRAINTS

High Equipment and Maintenance Costs

The high cost of chromatography systems and their maintenance is a significant restraint in the Middle East and Africa market. Advanced systems such as high-performance liquid chromatography (HPLC) and gas chromatography (GC) require substantial upfront investment and often exceeding $50,000 per unit. Additionally, ongoing costs for consumables like columns and reagents and skilled operator requirements add to the financial burden. Many laboratories in developing nations across Africa and the Middle East face budget constraints, which limits their ability to adopt these technologies. According to a 2023 survey, 40% of small and mid-sized labs in Africa cited cost as a barrier to upgrading analytical tools.

Limited Technical Expertise and Training

A shortage of skilled professionals to operate and maintain chromatography systems restricts market growth in Middle East and Africa. Chromatography techniques require specialized training to ensure accurate results, yet many laboratories, especially in developing nations lack access to such training. For instance, only 25% of laboratories reported having certified chromatographic technicians in 2022 in Sub-Saharan Africa. This skills gap results in inefficient use of equipment and delays in implementing new technologies. Additionally, reliance on external expertise for servicing and troubleshooting further hampers the adoption and effective utilization of chromatography systems in the region.

Inconsistent Supply Chains for Equipment and Consumables

The Middle East and Africa faces significant challenges in maintaining consistent supply chains for chromatography equipment and consumables such as columns, reagents, and solvents. This inconsistency often leads to delays in research and quality control processes. Countries in Sub-Saharan Africa are particularly affected, where 60% of laboratories reported disruptions in acquiring essential chromatographic supplies in 2022. Limited regional manufacturing capacities and dependence on imports exacerbate the issue, increasing costs and reducing operational efficiency. Such logistical hurdles hinder the expansion of chromatography applications across pharmaceutical, environmental, and food safety sectors in the region.

Regulatory and Standardization Challenges

The lack of harmonized regulatory frameworks across MEA countries poses a significant challenge for the chromatography market. Diverse standards and certification requirements create complexities for manufacturers and laboratories and slow the adoption of advanced chromatography systems. For instance, only 40% of MEA countries currently have standardized guidelines for food safety testing using chromatography. This lack of uniformity limits cross-border collaborations and the growth of industries reliant on chromatographic quality control. Efforts to establish unified regulations, such as those by the African Medicines Agency, are still in the early stages, and this leaves significant gaps in regulatory cohesion.

SEGMENTAL ANALYSIS

By Type Insights

The liquid chromatography (LC) segment dominated the market in this region and accounted for 40.2% of the regional market share. LC dominates due to its versatility and broad applications in industries such as pharmaceuticals, biotechnology, environmental analysis, and food safety. For instance, in pharmaceutical applications, HPLC is extensively used for drug formulation and stability testing and this is critical for regulatory compliance. In food safety, LC is used to detect contaminants such as mycotoxins and regulations in regions like the EU requiring testing of food samples down to levels as low as 2 parts per billion (ppb). Advanced techniques like High-Performance Liquid Chromatography (HPLC) and Ultra-High-Performance Liquid Chromatography (UHPLC) have further enhanced sensitivity and allow for the detection of impurities in concentrations as low as 0.1% in active pharmaceutical ingredients (APIs). This capability makes LC indispensable in ensuring safety, efficacy, and compliance across these critical industries.

However, the gas chromatography (GC) segment is projected to be the fastest growing segment in the Middle East and African market and register a CAGR of 6.8% over the forecast period. GC is widely adopted in petrochemical analysis and is used to test hydrocarbon compositions, such as monitoring benzene content in gasoline to comply with regulatory limits (often set at below 1%). In environmental testing, GC is essential for analyzing pollutants, including volatile organic compounds (VOCs) like benzene and toluene, which are often detected in air and water samples at trace levels below 0.5 ppb, meeting stringent environmental regulations from agencies such as the U.S. Environmental Protection Agency (EPA). Additionally, GC’s high speed and precision allow for comprehensive testing of complex sample matrices in under an hour, making it a vital tool in time-sensitive industrial applications. These capabilities underscore its growing adoption and critical importance in addressing industrial, regulatory, and environmental challenges.

By Product Insights

The instruments segment led the regional market, accounting for 60.8% of the regional market share in 2023. The domination of the instruments segment in the regional market is primarily driven by the rising demand for consumables like columns, syringe filters, vials, and tubing, which are essential for chromatography workflows. Chromatography columns, especially those used in High-Performance Liquid Chromatography (HPLC), are widely adopted for separating and analyzing mixtures in industries like pharmaceuticals, biotechnology, and food safety. According to projections, reverse-phase HPLC columns are the most commonly used and support around 40% of pharmaceutical testing globally.

The accessories segment is estimated to experience a CAGR of 7.2% over the forecast period. Accessories such as detectors and autosamplers are in high demand because they improve accuracy and automate processes. Mass spectrometry (MS) detectors can identify compounds at trace levels, such as parts per trillion (ppt), and are widely used in environmental testing to monitor pollutants and in pharmaceutical R&D to analyze complex samples. For example, MS detectors are critical in detecting volatile organic compounds (VOCs) in environmental studies, where limits are often as low as 0.5 ppb. Autosamplers are increasingly used in drug development, where they automate sample injection, reducing errors and increasing productivity by up to 30%.

By End-User Insights

The pharmaceutical and biotechnology companies segment held 52.2% of the regional market share in 2023. This is because chromatography is a critical tool in drug development, quality control, and regulatory compliance. It is extensively used for analyzing and purifying active pharmaceutical ingredients (APIs), ensuring their safety and efficacy. For example, more than 70% of chromatography-based applications in the pharmaceutical sector were related to quality assurance and impurity profiling in 2022. The biotechnology industry relies on chromatography to analyze proteins, peptides, and other biomolecules, particularly in biologics and biosimilar development. Regulatory requirements, such as those from the FDA and EMA, mandate chromatography.

The food and beverage sector is the fastest-growing segment and is projected to account for a substantial share of the regional market over the forecast period. This growth is driven by the increasing focus on food safety and regulatory compliance to detect contaminants, toxins, and adulterants. Chromatography is essential for testing pesticide residues, food additives, and natural toxins, with methods capable of detecting contaminants at levels as low as 0.01 ppm (parts per million). For example, the European Union and U.S. FDA have strict guidelines for testing aflatoxins and other mycotoxins in food products and resulting in the increased adoption of chromatography techniques. The rising demand for processed and packaged foods globally also requires extensive testing for preservatives and nutritional components, further boosting the demand for chromatography in the food and beverage industry.

REGIONAL ANALYSIS

Saudi Arabia and the United Arab Emirates (UAE) are the leading countries in the Middle East and Africa chromatography market. The domination of Saudi Arabia is primarily attributed to its substantial investments in healthcare infrastructure and increasing research and development (R&D) initiatives. These efforts have led to the adoption of advanced chromatography techniques for pharmaceutical quality control, drug discovery, and environmental testing. For example, Vision 2030 of Saudi Arabia is focusing on expanding healthcare and life sciences and fostering the growth of analytical tools like chromatography.

The UAE is also a significant player in the MEA chromatography market. The advancements in technology and increased funding for research activities are driving the chromatography market in the UAE. The UAE has prioritized innovation in analytical methods to enhance food safety, environmental monitoring, and clinical diagnostics. Initiatives such as the establishment of advanced research centers in Dubai and Abu Dhabi are supporting the adoption of chromatography techniques for testing contaminants in food and analyzing water quality, contributing to the market growth in the UAE.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Companies playing a key role in the Middle East and Africa chromatography market include Agilent Technologies, Inc., Thermo Fisher Scientific, Inc., Waters Corporation, Shimadzu Corporation, PerkinElmer, Inc., Danaher Corporation, Bio-Rad Laboratories, Inc., Merck KGaA, GE Healthcare and Hitachi High-Tech Corporation.

The chromatography market in the Middle East and Africa (MEA) is moderately competitive. Key players such as Agilent Technologies, Thermo Fisher Scientific, Shimadzu Corporation, and Waters Corporation dominate the region by offering advanced chromatography systems, consumables, and services. These companies leverage their global expertise to meet the growing demand for high-performance liquid chromatography (HPLC), gas chromatography (GC), and related accessories in MEA countries. The regional competition is intensifying as local players and distributors cater to specific needs, such as cost-effective systems for smaller laboratories and industry-focused solutions. Countries like Saudi Arabia and the UAE are central to the market due to their robust industrial base and increasing focus on research and development. For example, chromatography plays a vital role in petrochemical analysis in Saudi Arabia and food safety testing in the UAE.

Competitive strategies include collaborations with local distributors, partnerships with research institutions, and participation in government-driven healthcare initiatives like Saudi Vision 2030. Moreover, the growing adoption of automation and digital solutions, coupled with an increased focus on green chromatography techniques, further accelerates innovation and intensifies market competition across the MEA region.

RECENT HAPPENINGS IN THE MARKET

- In June 2022, Agilent Technologies, a leading provider of analytical instrumentation, launched new liquid and gas chromatography-mass spectrometers. This initiative is expected to enhance system diagnostics and uptime, strengthening their market presence.

- In November 2021, Thermo Fisher Scientific, a global leader in laboratory solutions, acquired PharmaFluidics, a company specializing in micro-chip-based chromatography products. This acquisition is anticipated to advance Thermo Fisher’s liquid chromatography capabilities and expand its product offerings.

- In 2024, Waters Corporation, a leading developer of analytical technologies, reported a 17% sales increase for its ACQUITY UPLC systems. This growth reflects the rising demand for high-quality analytical testing solutions.

- In October 2023, Shimadzu Corporation, a provider of scientific instruments, launched advanced gas chromatography systems. This development aims to meet the needs of pharmaceutical and biotechnology applications, strengthening their market foothold.

- In February 2023, PerkinElmer, a global analytical solutions provider, expanded its chromatography consumables line. This move is expected to address diverse analytical needs, enhancing customer satisfaction.

- In June 2023, Danaher Corporation (Phenomenex), a biopharmaceutical solutions provider, introduced innovative chromatography resins. These are anticipated to cater to the growing demand for biopharmaceutical purification, bolstering their market position.

- In May 2023, Bio-Rad Laboratories, a life sciences company, launched new chromatography resin technologies. These are designed to improve the separation of complex biomolecules, enhancing their applications in biopharmaceutical processes.

- In August 2023, Merck KGaA (MilliporeSigma), a global pharmaceutical and life sciences company, expanded its chromatography resin production capacity. This expansion is expected to meet the increasing global demand in the pharmaceutical and biotechnology sectors.

- In September 2023, GE Healthcare (Cytiva), a leader in bioprocessing solutions, introduced advanced chromatography systems for large-scale biologics production. This innovation is aimed at strengthening their role in biopharmaceutical manufacturing.

- In November 2023, Hitachi High-Tech Corporation, a scientific instrument manufacturer, launched new liquid chromatography instruments with improved sensitivity and speed. This development is designed to address the need for environmental and food safety testing.

MARKET SEGMENTATION

This research report on the Middle East and Africa chromatography market is segmented and sub-segmented into the following categories.

By Type

- Liquid Chromatography

- High-pressure Liquid Chromatography

- Ultra-pressure Liquid Chromatography

- Flash Chromatography

- Others

- Gas Chromatography

- Thin-layer Chromatography

- Others

By Product

- Instruments

- Consumables

- Columns

- Syringe Filters

- Vials

- Tubing

- Others

- Accessories

- Detectors

- Autosamplers

- Pumps and flow meters

- Fraction Collectors

- Others

By End User

- Pharmaceutical & Biotechnology Company

- Academic & Research Institutes

- Food & Beverage Company

- Others

By Country

- KSA

- UAE

- Israel

- rest of GCC countries

- South Africa

- Ethiopia

- Kenya

- Egypt

- Sudan

- Rest of MEA

Frequently Asked Questions

What factors are driving the growth of the chromatography market in the Middle East & Africa?

Factors include rising investments in research, technological advancements in chromatography techniques, increased demand in food safety testing, pharmaceutical analysis, and environmental testing.

Who are the major players in the Middle East & Africa Chromatography Market?

Major players include global companies like Agilent Technologies, Thermo Fisher Scientific, PerkinElmer, Waters Corporation, and Shimadzu Corporation, as well as regional distributors and service providers.

What is the future outlook for the chromatography market in the Middle East & Africa?

The market is expected to grow due to increasing research activities, rising healthcare expenditure, and the adoption of advanced technologies in chromatography.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 1600

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]