Global Microneedle Market Size, Share, Trends, & Growth Forecast Report – Segmented By Product Type (Solid Microneedles, Hallow Microneedles, Dissolving Microneedles, Hydrogel-Forming Microneedles and Coated Microneedles), Application, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) - Industry Analysis (2024 to 2032)

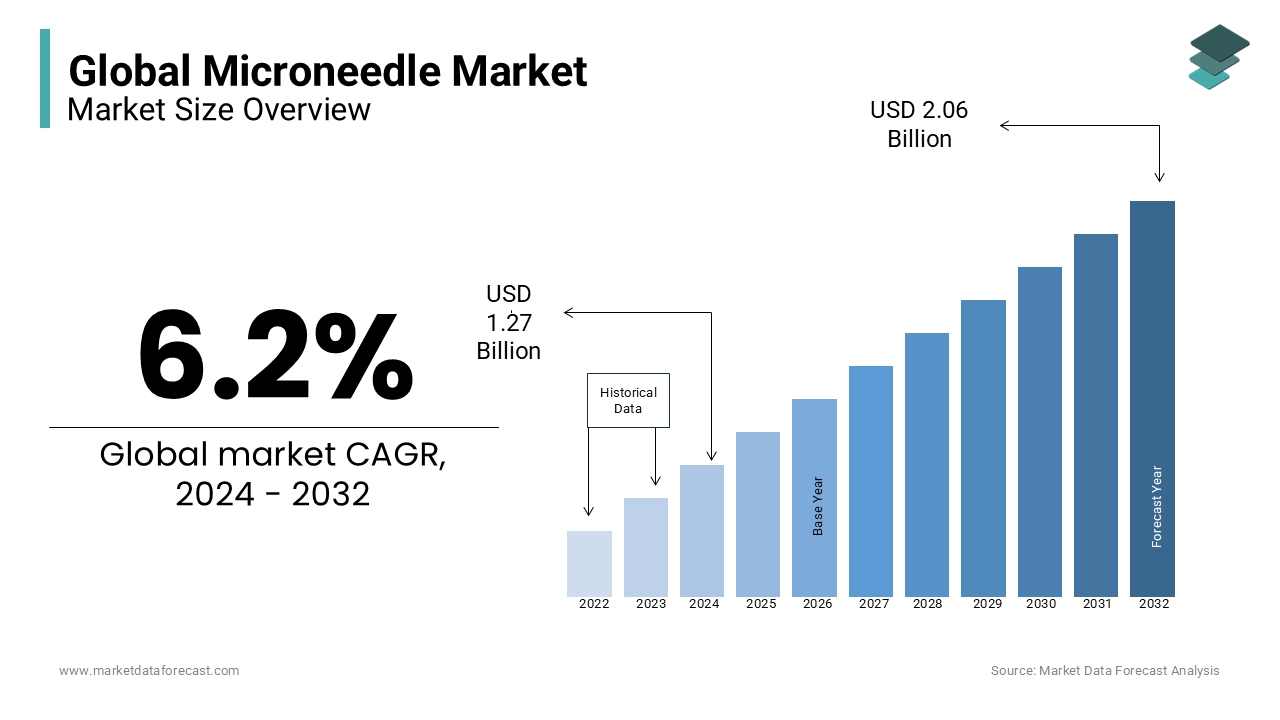

Global Microneedle Market Size (2024 to 2032)

The global microneedle market is estimated to be USD 2.06 billion by 2032 and USD 1.27 billion in 2024, growing at a CAGR of 6.2% during the forecast period.

Current scenario:

The microneedle market focuses on the use of microscopic needles for transdermal drug delivery, diagnostics, and cosmetic applications. These needles, typically crafted from materials like silicon, polymers, or metals, penetrate the outer skin layer without causing pain or damage, providing a minimally invasive alternative to traditional injections. Microneedles have broad applications in the pharmaceutical, cosmetic, and biotechnology sectors, primarily enhancing drug absorption by bypassing the digestive system. This technology plays a critical role in modern healthcare by improving patient compliance and outcomes.

Importance in Drug Delivery and Other Applications

Microneedles have revolutionized the administration of medications and vaccines by offering painless and efficient delivery methods. Their key advantage is providing a solution for needle-phobic patients, resulting in better compliance. Beyond drug delivery, microneedles are extensively used in cosmetic treatments like anti-aging and skin rejuvenation, as well as in diagnostic applications such as glucose monitoring. This versatility highlights their growing importance across healthcare and beauty industries.

Market Drivers

Rising Demand for Minimally Invasive Procedures

The growing preference for minimally invasive treatments is driving demand for microneedle technologies. As patients seek safer and more comfortable alternatives to traditional injections, microneedles are increasingly used in drug administration and vaccine delivery, particularly in dermatology.

Increasing Prevalence of Chronic Diseases

Chronic diseases such as diabetes, cardiovascular conditions, and cancer continue to rise globally, creating a demand for innovative drug delivery systems. For instance, the International Diabetes Federation reported over 537 million adults living with diabetes in 2021, a number projected to rise to 643 million by 2030. Microneedles offer an effective and less painful solution for delivering medications like insulin, improving patient adherence.

Growth in Cosmetic and Skincare Treatments

The global cosmetic and skincare market is expanding as consumers increasingly opt for non-invasive procedures. Microneedle patches, delivering active ingredients such as hyaluronic acid and peptides, have gained popularity in skin treatments. The skincare market was valued at $145.3 billion in 2022 and is expected to grow at a 4.6% CAGR through 2030, further driving demand for microneedle technology in the beauty sector.

Technological Advancements in Microneedle Design and Materials

Ongoing technological innovations in microneedle development have broadened their application scope. Innovations such as dissolvable microneedles, 3D-printed devices, and sensor-equipped smart microneedle systems are improving the safety and effectiveness of drug delivery. These advancements enhance reliability and make microneedles suitable for a wide range of applications, from medical to cosmetic.

Favorable Regulatory Landscape

Regulatory bodies such as the U.S. FDA and European Medicines Agency (EMA) have increasingly supported microneedle-based products. With several microneedle patches already approved for vaccine delivery and dermatological treatments, regulatory agencies are fostering confidence in this technology. Favorable policies that streamline the approval process for combination drug-device products are expected to further accelerate market growth.

Opportunities:

Expanding Use in Personalized Medicine

Microneedle technology presents significant opportunities in personalized medicine, allowing for precise drug delivery tailored to the individual’s genetic makeup, lifestyle, and health conditions. Microneedles offer the advantage of localized delivery and precise dosing, crucial for personalized treatments of conditions such as cancer, diabetes, and autoimmune diseases. As healthcare shifts towards individualized therapies with fewer side effects, the adoption of microneedles in this domain is expected to expand significantly, driving growth within the market.

Growing Adoption in Developing Countries

Microneedle technology is gaining traction in developing countries due to its potential for affordable and easy-to-administer healthcare solutions. In areas where access to healthcare professionals is limited, microneedle patches for vaccine delivery and chronic disease management offer a convenient solution that requires minimal training. The World Health Organization reports that around 30% of individuals in low- and middle-income countries lack access to essential medicines, presenting a strong opportunity for microneedles to bridge this gap. Self-administration and cost-effective production methods further enhance the appeal of this technology in resource-limited regions.

Potential in Vaccine Delivery for Pandemic Preparedness

The COVID-19 pandemic underscored the importance of efficient vaccine delivery systems. Microneedle patches provide a scalable, painless alternative to traditional vaccines, eliminating the need for cold storage and complex logistics. These patches can be administered without healthcare professionals, making them ideal for mass vaccination efforts. A 2021 Lancet study found microneedle patches to be as effective as traditional vaccines, with fewer side effects and higher patient satisfaction. This positions the microneedle market to play a critical role in future pandemic preparedness efforts.

Market Restraints

High Production and Development Costs

Developing and manufacturing microneedles involves significant costs due to complex design and material requirements. Producing microneedles, which require advanced materials such as silicon, metals, and biodegradable polymers, is capital-intensive. A 2022 study estimated that developing a microneedle-based drug delivery system can cost between $10 million and $40 million, depending on the application. Such high production costs limit the accessibility of this technology, particularly in smaller markets.

Challenges in Mass Production

Scaling up microneedle production to meet global demand poses considerable challenges. Manufacturing microneedles requires high precision, specialized equipment, and rigorous quality control processes. Any inconsistency in production can result in defective batches that affect treatment efficacy, hindering wider market adoption, particularly in regions lacking advanced manufacturing infrastructure.

Skin Barrier Issues Affecting Efficacy in Some Treatments

Microneedles are designed to bypass the outer skin layer (stratum corneum) for drug delivery. However, varying skin thickness, hydration levels, and conditions like eczema or psoriasis can reduce their efficacy. A 2021 study reported that microneedle efficacy may drop by 20-30% in patients with certain skin disorders, limiting the technology’s adoption in dermatology for some individuals. These skin-related challenges result in inconsistent outcomes, posing a barrier to broader use in specific therapeutic areas.

Challenges:

Regulatory Hurdles

Microneedles face regulatory challenges due to their classification as both a medical device and a drug delivery system. This duality requires extensive clinical trials and approvals from agencies like the U.S. FDA and the European Medicines Agency. A 2022 report noted that approval times for combination products are, on average, 30% longer than for standard medical devices. This extended regulatory process, combined with high compliance costs, presents a challenge, particularly for smaller companies trying to enter the market.

Patient Compliance and Application Challenges

While microneedles are designed for ease of use, ensuring proper application remains a challenge. Incorrect placement or incomplete application can reduce the efficacy of the drug, limiting absorption. A 2021 study revealed that 15% of patients using microneedles for chronic disease management encountered difficulties with correct application. Self-administered treatments face the added challenge of patient education, underscoring the need for improved design and clear instructions to enhance compliance.

Supply Chain and Production Scalability

As demand for microneedles rises across sectors, from pharmaceuticals to cosmetics, production scalability becomes a pressing issue. Challenges include securing raw materials, precision manufacturing, and maintaining high-quality standards. A 2023 industry report noted that 22% of companies in the microneedle market faced production delays due to material shortages. For continued growth, companies will need to invest in advanced manufacturing technologies and secure resilient supply chains capable of supporting large-scale production.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024 to 2032 |

|

Segments Covered |

By Product Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis, Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leader Profiled |

Vaxess Technologies Inc., BD (Becton, Dickinson and Company), Clearside Biomedical, Nanopass, TheraJect Inc., Candela Corp., Cutera, LTS Lohmann Therapie-Systeme AG, Debiotech SA, Micropoint Technologies. |

SEGMENTAL ANALYSIS

By Product Type

Solid Microneedles

Solid microneedles are widely used in dermatology and cosmetic treatments, such as anti-aging and scar reduction, where they create micro-channels to enhance absorption of topically applied products. This segment represents around 25% of the global microneedle market, with growth driven by the rising demand for minimally invasive cosmetic procedures. However, limited drug delivery capabilities have capped its growth potential, with a projected CAGR of 5%. Despite these limitations, solid microneedles remain a cost-effective solution for cosmetic applications.

Hollow Microneedles

Hollow microneedles, which allow for precise liquid injection, hold the largest share of the market at approximately 30%. These microneedles are essential in drug delivery systems, particularly for conditions like diabetes and in vaccine administration. The rising demand for painless drug delivery is expected to drive a CAGR of 9%. Increased prevalence of chronic conditions and the growth of self-administered treatments are significant factors fueling this segment’s expansion.

Dissolving Microneedles

Dissolving microneedles, made from biodegradable materials, are gaining popularity due to their safety and convenience in single-use applications, such as vaccine delivery and diabetes management. They account for about 20% of the market and are expected to grow at a robust CAGR of 12%, driven by increasing demand for sustainable healthcare solutions and the growing need for pandemic preparedness.

Hydrogel-Forming Microneedles

Hydrogel-forming microneedles are designed for sustained drug release, making them an ideal option for chronic disease management. This segment currently holds approximately 10% of the market and is projected to grow at a CAGR of 10%. The growing demand for continuous drug delivery systems, particularly for cancer and cardiovascular disease treatments, supports the growth of this segment.

Coated Microneedles

Coated microneedles, which are used for delivering small doses of potent drugs like vaccines or hormones, represent around 15% of the market. Although limited by their dosage capacity, advancements in coating technologies could drive future growth. The segment is expected to grow at a moderate CAGR of 6%, with increased adoption in targeted therapies within the pharmaceutical industry.

By Application

Disease Treatment

The disease treatment segment holds the largest share, accounting for approximately 40% of the global microneedle market. This growth is driven by the increasing use of microneedles for delivering medications to treat chronic conditions such as diabetes and cardiovascular diseases. The demand for pain-free, self-administered treatments continues to rise, with microneedles enabling precise, controlled drug delivery, making them suitable for long-term management of chronic illnesses. This segment is projected to experience a compound annual growth rate (CAGR) of 10%, fueled by the need for more patient-friendly drug delivery solutions.

Immunological Administration

Accounting for around 25% of the market, immunological applications—particularly in vaccine delivery—have seen rapid growth, especially during the COVID-19 pandemic. The ability of microneedles to be administered by non-professionals without the need for extensive medical training has proven crucial in immunization campaigns. With global focus on pandemic preparedness and improving vaccine distribution methods, this segment is expected to witness a strong CAGR of 12%.

Disease Diagnosis

Microneedles are increasingly being employed for diagnostic purposes, such as glucose monitoring for diabetes patients. This segment comprises about 15% of the market and is anticipated to grow at a CAGR of 8%. The rise in demand for minimally invasive diagnostic tools, which can provide real-time health data for chronic disease management, is a key driver for this segment's growth.

Dermatology Applications

Dermatology applications, including non-invasive cosmetic treatments like anti-aging and scar removal, account for approximately 20% of the microneedle market. Microneedles are gaining popularity in the beauty industry for their ability to enhance the absorption of skincare products while providing painless treatments. This segment is expected to grow at a CAGR of 9%, driven by the increasing demand for advanced cosmetic procedures that offer quick recovery times and minimal discomfort.

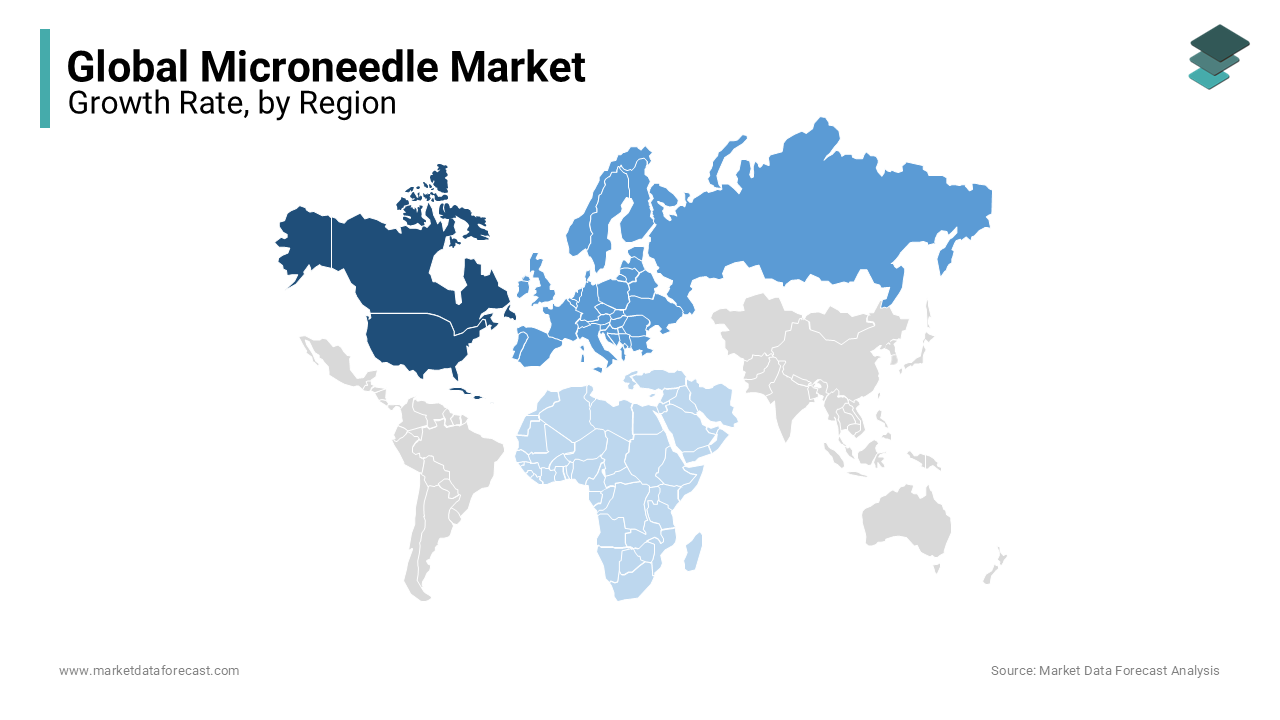

Regional Analysis

North America

North America dominates the global microneedle market, holding around 35% of the market share. The region's well-established healthcare infrastructure, along with the high adoption of advanced drug delivery systems, contributes to its leading position. The U.S., in particular, benefits from strong investments in research and development, along with growing consumer demand for cosmetic microneedle applications. Furthermore, the increasing prevalence of chronic diseases like diabetes, which affects over 37 million Americans, continues to drive the demand for microneedle-based drug delivery systems.

Europe

Europe holds approximately 30% of the global microneedle market. The region is experiencing significant growth, driven by advancements in healthcare technology, a rise in cosmetic procedures, and strong government support for innovative drug delivery methods. Countries like Germany and the UK are leading the adoption of microneedle patches for vaccine delivery and chronic disease treatment. The European market is expected to grow at a CAGR of 8%, supported by the rising prevalence of chronic conditions and the growing adoption of microneedles in dermatological treatments.

Asia-Pacific

Asia-Pacific represents the fastest-growing region in the microneedle market, driven by a large population base, increasing healthcare expenditure, and growing demand for minimally invasive treatments. Countries such as China, Japan, and South Korea are at the forefront of adopting microneedle technology for both medical and cosmetic applications. The region's focus on drug delivery innovations, along with the increasing prevalence of diabetes and cardiovascular diseases, is propelling market growth at an accelerated pace.

Latin America

The Latin America microneedle market is seeing steady growth, driven by improved healthcare access and growing awareness of advanced drug delivery technologies. Brazil and Mexico are leading the region in the adoption of microneedles, particularly for dermatology and cosmetic treatments. As healthcare infrastructure continues to advance and demand for innovative treatments rises, the market is poised for expansion in the coming years.

Middle East and Africa (MEA)

The MEA region’s microneedle market growth is primarily fueled by increased healthcare investments and a rising demand for innovative drug delivery systems. Countries such as Saudi Arabia and the UAE are taking the lead in adopting microneedles for vaccination programs and chronic disease management. However, the region faces challenges including limited access to healthcare technology and lower public awareness of microneedle applications, which are restraining overall market growth.

Key Market Players:

1. Vaxess Technologies Inc.

2. BD (Becton, Dickinson and Company)

3. Clearside Biomedical

4. Nanopass

5. TheraJect Inc.

6. Candela Corp.

7. Cutera

8. LTS Lohmann Therapie-Systeme AG

9. Debiotech SA

10. Micropoint Technologies

Recent Market Happenings:

- In March 2024, Vaxess Technologies Inc. launched its MIMIX™ vaccine patch platform. This launch is expected to revolutionize vaccine delivery, particularly for pandemic preparedness, by eliminating the need for refrigeration, improving global distribution scalability.

- In February 2024, BD (Becton, Dickinson and Company) expanded its partnership with biotechnology companies to develop next-generation microneedle systems for vaccines and chronic disease management. This expansion aims to enhance BD’s role in global immunization programs and chronic care solutions.

- In January 2024, Clearside Biomedical completed Phase 3 trials of its microneedle-based treatment for macular edema. This milestone is anticipated to solidify Clearside’s position in the ophthalmic drug delivery sector.

- In November 2023, Nanopass entered a collaboration with a leading vaccine manufacturer to develop intradermal delivery systems using its microneedle technology. This partnership is expected to improve the efficiency of vaccine administration and expand Nanopass’s market reach.

- In October 2023, TheraJect Inc. partnered with a pharmaceutical company to develop biodegradable microneedle patches for cancer immunotherapy. This collaboration is likely to enhance TheraJect’s position in the oncology treatment market.

- In December 2023, Candela Corp. launched an upgraded microneedle device for skin rejuvenation and acne scar treatments. This new product is expected to increase Candela’s presence in the cosmetic dermatology market.

- In September 2023, Cutera introduced a new microneedle RF device for skin tightening treatments. This launch is anticipated to strengthen Cutera’s position in the growing non-invasive cosmetic procedure market.

- In August 2023, LTS Lohmann Therapie-Systeme AG expanded its production capacity for microneedle patches to meet the rising demand for transdermal drug delivery systems. This expansion is expected to reinforce LTS’s leadership in hormone therapy and pain management.

- In October 2023, Debiotech SA developed a microneedle-based insulin patch targeting diabetes management. This innovation is likely to solidify Debiotech’s role in chronic disease treatment.

- In November 2023, Micropoint Technologies advanced its diagnostic microneedle platform for real-time health monitoring in diabetes care. This development is anticipated to integrate microneedle technology into telemedicine solutions, expanding Micropoint’s market presence.

DETAILED SEGMENTATION OF THE GLOBAL MICRONEEDLE MARKET INCLUDED IN THIS REPORT

This research report on the global microneedle market has been segmented and sub-segmented based on Product type, Application and region.

By Product Type

- Solid Microneedles

- Hallow Microneedle

- Dissolving Microneedles

- Hydrogel-Forming Microneedles

- Coated Microneedles

By Application

- Disease Treatment

- Immunological Administration

- Disease Diagnosis

- Dermatology Applications

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

What is the future outlook for the microneedle market?

The market is expected to witness strong growth, driven by advancements in transdermal drug delivery technology, increased demand for pain-free alternatives to injections, and expanding cosmetic applications. The integration of microneedles with wearable devices for continuous monitoring and drug administration also represents a promising future trend.

What is driving the growth of the microneedle market?

The growth of the microneedle market is being driven by increasing demand for pain-free and efficient drug delivery systems, a rising preference for minimally invasive cosmetic procedures, advancements in vaccine delivery following the COVID-19 pandemic, and expansion in the biopharmaceutical industry.

What are the challenges facing the microneedle market?

Despite its growth, the microneedle market faces several challenges, including the high cost of development and production, regulatory hurdles for the approval of microneedle-based products, limited awareness among healthcare professionals and patients, and safety or stability concerns associated with certain microneedle designs.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com