Global Microfluidics Market Size, Share, Trends & Growth Forecast Report By Product, Industry, Material, Application, and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), Industry Analysis From 2025 To 2033.

Global Microfluidics Market Size

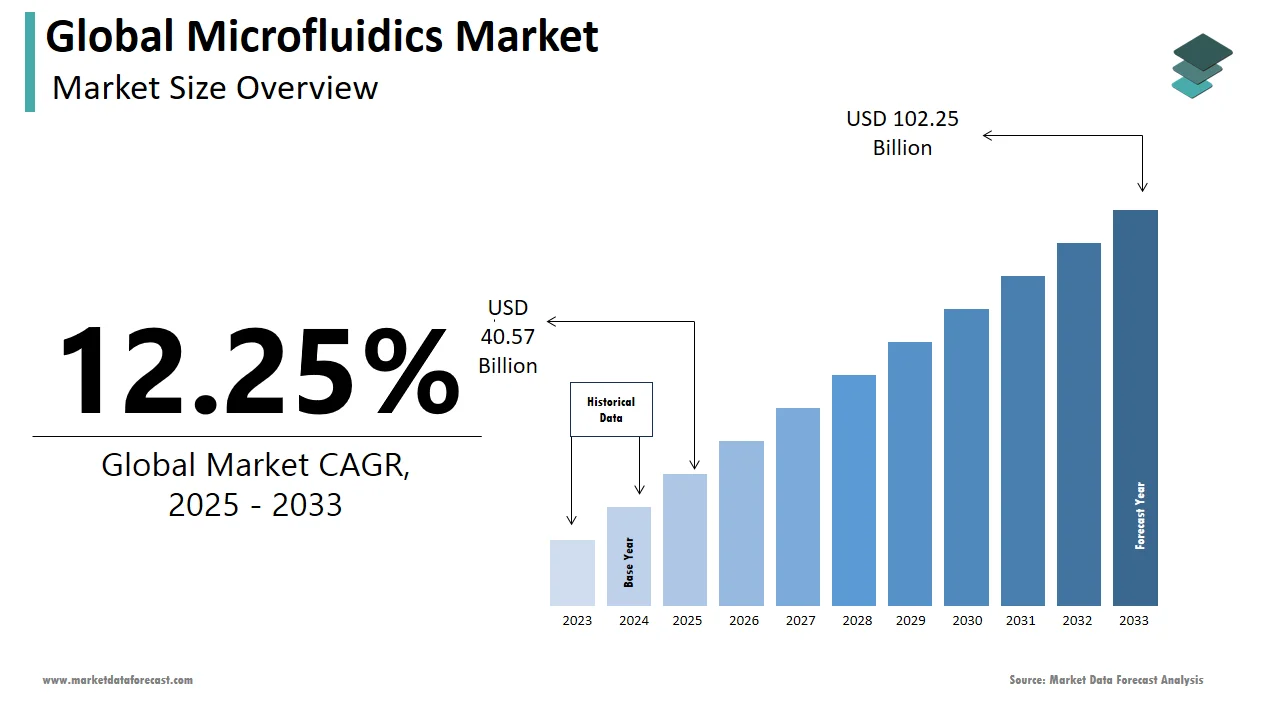

The global microfluidics market was worth US$ 36.14 billion in 2024 and is anticipated to reach a valuation of US$ 102.25 billion by 2033 from US$ 40.57 billion in 2025, and it is predicted to register a CAGR of 12.25% during the forecast period 2025-2033.

Microfluidics is a branch that studies fluid movement through microscopic channels such as chips, nozzles, and pumps. Microfluidics-based materials range from tens to hundreds of micrometers and track and control fluids at the atomic level. Since its inception in the early 1990s, this discipline has developed at a rapid pace. It is regarded as a critical tool for research in life sciences and other significant biotechnology fields. Microfluidics is most widely used and represented in "organ on a chip" and "lab on a chip" technologies. It can, however, be applied to a wide range of fields, including pharmaceuticals (drug discovery), cosmetics (emulsions and formulations), chemistry, wellness, electricity (plasma confinement EOR models), and biology (cell culture and genetics).Microfluidics is focused on the design, manufacture, and formulation of devices and assays that deal with minimal volumes of fluids, typically in the microliter (10-6) to picoliter (10-6) scale (10-12). The global microfluidics industry is being driven forward by a boom in demand for point-of-care testing instruments. Because of the geriatric population, rising healthcare consciousness, rising chronic and lifestyle conditions, technical advancements for multiple home use applications, and more robust insurance infrastructure services, the Americas dominate the global microfluidics devices market.

MARKET DRIVERS

The rising need for technological diagnostic devices is one of the main factors fuelling the growth of the microfluidics market and is expected to do so during the forecast period.

During the forecast period, there is also likely to be significant demand for low-volume sample analysis, invitro diagnostic testing, high throughput screening technologies, and the development of advanced lab-on-a-chip. The deployment of point-of-care testing is made possible by the advancement in microfluidics that led to the development of a cost-effective mass production process for devices and smartphones when combined with microfluidics. This has expanded the applications of microfluidics devices and is anticipated to continue to do so in the future. The growing business is focused on creating important technologies and gadgets and expanding the adoption of different strategic initiatives anticipated to accelerate market growth. Technology-advanced systems, like implanted drug delivery systems, can offer significant growth opportunities. Insulin pumps are the most popular microfluidics-based drug delivery devices, and several related strategies are currently being developed for these devices, which is anticipated to accelerate the market's growth throughout the forecast period.

Another factor influencing the growth of the microfluidic market is the increasing prevalence of chronic diseases. The market is expected to expand as a result of the ability of this technology to provide high-throughput screening for diseases like cancer and diabetes. According to the WHO, there were approximately 19,282,900 new cases of cancer worldwide in 2021, and this number is projected to increase to 28,898,940 cases by 2040. The concept of using microfluidics in diseases further opens the new perspective for a wider range of disease treatment, which can lead to new advancement in therapeutics techniques and boost research. The expected rise in the number of people with diabetes raises the need for novel porous microcapsules encapsulating cells for diabetes treatment using microfluidic electrospray technology, increase market growth during the projection timeframe.

The increased demand for point-care testing is another significant element propelling the microfluidics market's expansion. In the future years, it is anticipated that the rising demand for PoC diagnostics will demonstrate the market's lucrative growth potential. This rise is mostly attributable to the increased prevalence of infectious and lifestyle-related disorders as well as the growing preference for at-home treatment. Point-of-care diagnostics uses various application like molecular diagnostic, infectious disease, chronic diseases enable early disease detection, which improves diagnosis, monitoring, and management, and aids healthcare professionals in making quick medical decisions regarding patients. As a result, the demand for point-of-care molecular diagnostics is anticipated to rise in the future, driving market growth.

A few of the major factors propelling the growth of the microfluidics market include technological advancement, new drug delivery platforms, rising technological advancement in diagnostic devices, improved portability of devices, significant investment in research and development activities, and rapid demand for microfluidics platforms for early disease detection and pathogen identification.

MARKET RESTRAINTS

Even though the microfluidics market has several important driving forces that create new opportunities and spur market expansion, some factors are limiting the market's expansion.

The lengthy and complicated regulatory approval process is a significant market barrier that prevents the microfluidics business from expanding. Medical device manufacturers must adhere to stringent regulatory regulations to ensure the marketing and sales of their goods in foreign markets. The US acts as a significant manufacturing hub for microfluidics devices because the majority of the main worldwide firms are based there. To guarantee the safety and effectiveness of medical devices, the FDA in the US has established strict regulatory criteria and recommendations. However, during the past few years, the FDA approval process for medical devices has become more drawn-out and difficult. When launching innovative new products in the US, businesses must overcome this huge barrier. The integration of microfluidics technology with current workflows and low acceptance in developing countries due to high costs are expected to restrain market growth throughout the projection period. The healthcare research sector in underdeveloped nations is changing quickly. The development of the worldwide microfluidics market may be constrained by the lack of adequate research infrastructure in the healthcare sector in emerging nations. Clinical practice guidelines have not been properly prepared or implemented in several developing nations.

Microfluidic devices' limited scalability and standardization are obstacles to their wide implementation. Numerous microfluidic devices are created and manufactured for particular uses, which might lead to a lack of standardization between various platforms. The development of large-scale systems and applications is hampered by the difficulty of integrating many microfluidic devices from various manufacturers due to the lack of standardization. Market expansion may be hampered by regulatory obstacles and a lack of uniform regulations for microfluidic devices and applications. Different countries and regions may have differing regulatory environments for microfluidic devices, which might cause delays in getting the required permissions and certifications. In sectors like healthcare and diagnostics, the lack of precise norms and standards can also breed ambiguity and impede the growth of commercial applications.

Impact of COVID-19 on the Global Microfluidics Market

The pandemic scenario has significantly impacted the entire healthcare industry. Because of the strong demand for quick tests during the pandemic, diagnostic companies were forced to adapt their existing systems to find ways to detect the SARC-CoV-2vVirus. As a result, numerous microfluidics technologies have made it possible to either develop quick tests for point-of-care settings or high throughput solutions for centralized labs. Millions of tests were required each month due to the rising need for these tests, which has helped to increase the demand for the microfluidics industry. There was an increasing need for home-based quick tests for the diagnosis of infections as a result of quarantine, social isolation, and lockdown. As a result, respiratory testing firms have installed numerous testing machines at both new and current customer sites and sold a significant volume of test kits, which has caused a revenue rise in quarantine 1 2020 and a bigger spike in quarantine 2 and 3. We've learned from the pandemic crisis that we need more effective diagnostic tools. Testing for infectious diseases must be quick, affordable, and widely available if we are to handle this difficult situation. The pandemic crisis has helped the microfluidics market to comprehend its significance and new business opportunities better. Because of the microfluidics market, a test device that runs a disposable cartridge and displays the results at the customer's location, including a hospital or urgent care center, was developed. Due to new opportunities opening up for manufacturers of point-of-care diagnostic tests and the quick, miniature microfluidics technologies employed here, the pandemic scenario has slowed down business growth in many fields but has benefited the microfluidics market to accelerate growth. Rapid passenger screening in airports and rapid visitor or employee screening in workplaces became necessary to stop the spread of the virus. This increased the demand for microfluidics technology and the pandemic situation also helped to learn that these microfluidics technologies are promising during such a serious crisis as Covid-19.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

12.25% |

|

Segments Covered |

By Technology, Industry, Material, Application, and Region. |

|

Various Analyses Covered |

Global, Regional, and country-level analysis; Segment-Level Analysis, DROC; PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Agilent Technologies, Inc., Abbott Laboratories, Fluidigm Corporation, Qiagen N.V., Thermo Fischer Scientific, Illumina, Inc., Perkinelmer, Inc., Life Technologies Corporation, Danaher, Bio-Rad Laboratories, Inc., Hoffmann-La Roche Ltd., and Micronit Micro Technologies B.V., and Others. |

SEGMENTAL ANALYSIS

By Technology Insights

Medical technology, which dominates the industry, has the highest revenue and fastest CAGR of technology throughout the forecast period. With an 86% revenue share in 2024, the medical technology category dominated the worldwide microfluidics market. A significant amount of microfluidics technology was used during the pandemic for the early detection of diseases, and it will continue to expand during the forecast period because so many people now rely on digital technologies for remote patient monitoring and other tests. As a result, the medical technology segment will control the market during the forecast period.As microfluidics is frequently used in chemical and biological research because it offers precise control over fluid flow, reaction kinetics, and sample manipulation, the non-medical technology is also anticipated to favor the market's expansion throughout the forecast period. In disciplines like forensic science, environmental monitoring, water quality testing, and food safety analysis, these methods are used. Microfluidics has been applied to a variety of industrial processes, including chemical synthesis, microreactors, and process optimization. Increased output, less waste, and improved safety are just a few advantages of micro-scale controlled reactions and process monitoring. Therefore, it is anticipated that during the forecast period, this category would also rule the market

By Industry Insights

According to the industry, over 54% of the market is anticipated to be held by the life science research and in-vitro diagnostics sectors in 2024, and this trend is anticipated to continue during the forecast period. Microfluidics technology is being used to conduct an increasing number of experiments in the life science research sector, and this trend is anticipated to last throughout the projection period. The in-vitro diagnostic industry and life-science research are anticipated to dominate the market over the forecast period as a result of the rising number of disorders and in-vitro diagnostic testing.The usage of microfluidics in clinical diagnostic testing is increasing as a consequence of its promise to offer quicker and more precise results, reduce costs, and improve patient care. The clinical diagnostic industry will also fuel market expansion over the forecast period. Thanks to continuing advancements in microfluidic technology, governmental approvals, and growing consumer demand, the microfluidics market is witnessing a growth in clinical diagnostic applications. With a CAGR of 5.8%, it is projected to have increased to USD 105.80 billion.

By Material Insights

In terms of revenue, the polydimethylsiloxane (PDMS)-based microfluidic chips segment led the global microfluidics market in 2024 and is forecast to increase at the quickest rate over the study period. Microfluidic devices that require rapid prototyping frequently use the polymer PDMS. These are widely utilized in the academic world due to how simple and inexpensive they are to produce. However, because these polymers are hydrophobic, it is challenging to operate micro channels in aqueous solutions. To solve the problems caused by hydrophobicity, novel PDMS surface changes are proposed.In addition, polymer-based microfluidic devices outperformed glass and silicon-based microfluidic devices in terms of performance. In comparison to silicon and glass materials, polymer-based materials are more readily available, durable, and require quick production methods. As a result of the employment of soft lithography, casting, injection molding, and hot embossing processes, polymers are one of the most significant materials utilized in microfluidic chips for mass production. During the projected period, this market category is anticipated to develop the largest CAGR.

By Application Insights

The microfluidics market is divided into point-of-care testing, clinical diagnostic, drug delivery, and analytical testing based on the application. The segment with the highest CAGR during the forecast period is point-of-care testing, which is also the fastest-expanding segment. In terms of application, point-of-care testing is projected to command 32.9% of the market in 2024. The fields of genomics and proteomics have a lot of potential for point-of-care testing technologies. To identify the DNA of germs that cause various diseases, for instance, and to analyze proteins. Because of their compactness, disposability, and integration of complicated processes, these devices can be used at the bedside, in hospitals, in the delivery room, in critical care units, and in other locations. As more end companies adopt point-of-care testing equipment over the projection period, it is projected that the point-of-care testing segment will expand.The clinical diagnostic segment is anticipated to support market expansion throughout the projection period in addition to the point of care testing segment. Diagnostics command a sizable portion of the market. Benefits of microfluidic-based diagnostic devices include multiplexing ability, quick and sensitive detection, and the integration of numerous test stages into a single device. Applications include molecular diagnostics, cancer detection, infectious disease testing, and immunoassays. Clinical diagnostics had a market value of USD 68.20 billion in 2024, and by 2033 it is anticipated to have grown to USD 105.80 billion, with a CAGR of 5.8%

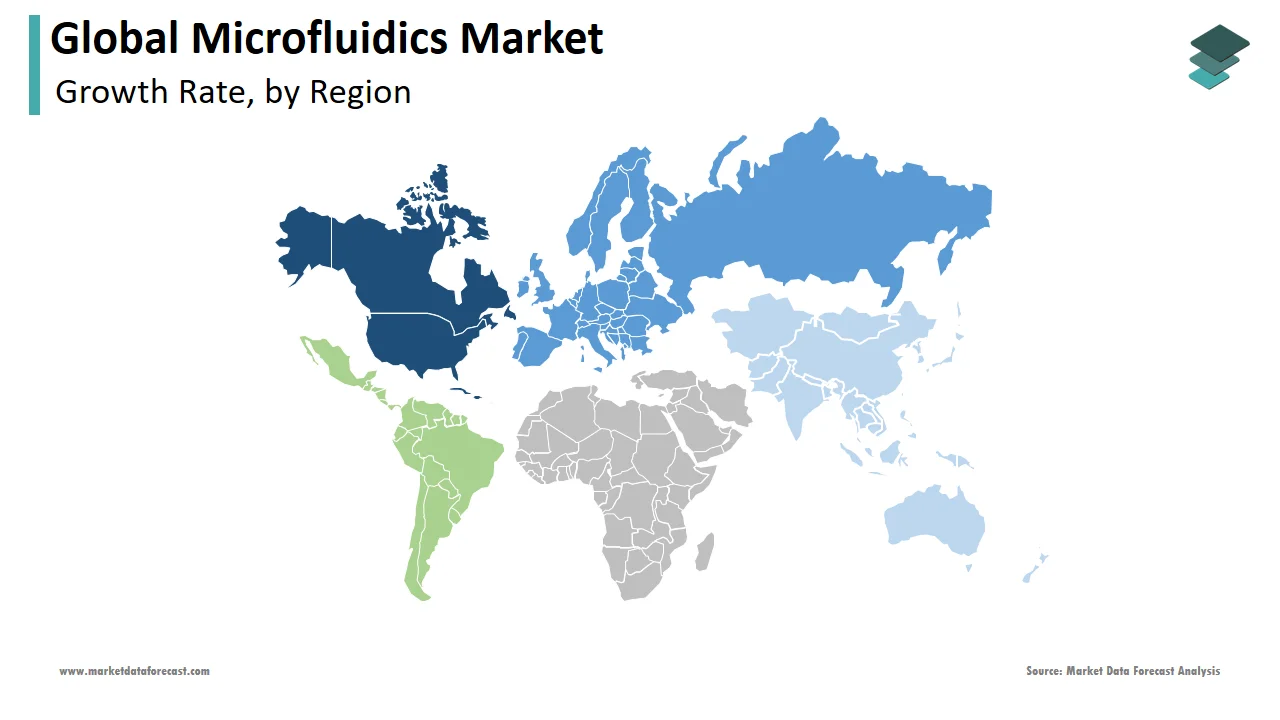

REGIONAL ANALYSIS

Geographically, the North American continent is anticipated to lead the market. The United States is predicted to control 63.5% of the North American microfluidics market in 2024. The high prevalence and rising incidence of numerous diseases, as well as government financing for clinical trials and research at major US universities, will aid in market expansion. Additionally, rising government and non-government funding for drug discovery research as well as substantial advancements in the pharmaceutical and biotechnology industries are all assisting in the expansion of the market in the area.

In 2024, the UK is anticipated to represent 19.3% of the European market. Due to the involvement of numerous research institutions in the creation of cutting-edge microfluidic devices, the UK currently controls the majority of the Western European microfluidics market. The rise of the microfluidics market will also be fueled by the existence of significant players throughout the forecast period.

The use of microfluidic platforms, accessible labor, and excellent research infrastructure have made the Asia Pacific the region with the fastest market growth. Additionally, several international businesses have expressed an interest in entering this undeveloped market. China's microfluidics market is anticipated to expand in Asia Pacific at a CAGR of 18.6% over the course of the forecast year. Expanded infrastructure and ownership of intellectual property rights have considerable support from the Chinese government. Thus, the microfluidics industry is anticipated to have significant growth. Throughout the projected period, demand for microfluidics in India is anticipated to grow at a remarkable CAGR of 17.0%. The market in India is expanding as a result of the increase in R&D activities there and the quick development of point-of-care medical equipment.

During the projected period, the Latin American microfluidics market is anticipated to expand at a consistent CAGR. The market in Latin America is primarily driven by the rise in the number of cell therapy clinical trials, as well as by the accelerating need for methods for high throughput detection, low volume sample analysis, and in-vitro diagnostics.

During the projection period, it is expected that the microfluidics market in the Middle East and Africa would expand at a strong CAGR. The market for microfluidic devices is anticipated to grow at a solid CAGR throughout the forecast period as a result of the increased need for quicker, less expensive, decentralized diagnostics and their expanding application in molecular diagnostics.

KEY MARKET PLAYERS

The worldwide microfluidics market tries to be extremely competitive in nature because of the significant efforts that market participants make in the development of new products and research. Companies like Agilent Technologies, Inc. dominate the global Microfluidics market. Abbott Laboratories, Fluidigm Corporation, Qiagen N.V., Thermo Fischer Scientific, Illumina, Inc., Perkinelmer, Inc., Life Technologies Corporation, Danaher, Bio-Rad Laboratories, Inc., Hoffmann-La Roche Ltd., and Micronit Micro Technologies B.V.

KEY MARKET HAPPENINGS

-

In June 2022, Devices called lab-on-a-chip, which combine many laboratory activities onto a single chip, have made considerable strides. These tools make it possible to automate and miniaturize laboratory procedures, which boosts productivity, lowers costs, and speeds up analysis.

-

In March 2022, The Creoptix WAVE system ushers in a new era for binding kinetic research by fusing no-clog microfluidics with patented grating-coupled interferometry (GCI). Our novel method enables you to collect high-quality data from even the most difficult sample types because it provides greater resolution in both signal and time compared to previous types of label-free detection.

- In September 2021, SCHOTT secured a contract to buy Arizona-based applied microarrays Inc., a provider of microarray solutions. This will increase the company's visibility in the USA and boost its bioscience capabilities.

- In November 2021, A new biomark X micro fluid platform was introduced by Fluidigm. Biomark X accelerates results with more data per run while streamlining operations to save hands-on time.

MARKET SEGMENTATION

This research report on the global microfluidics market has been segmented and sub-segmented based on the product, industry, material, application, and region.

By Technology

- Non-Medical

- Medical

- Gel-electrophoresis

- PCR and RT-PCR

- ELISA

- Microarrays

- Others

By Industry

- Pharmaceuticals

- In-vitro diagnostics

- Environmental research

- Life science research

- Clinical diagnostic

By Material

- Polymer

- Polyvinyl Chloride (PVC)

- Non-polyvinyl Chloride

- Glass

- Silicon

- Metal

- Ceramics

- PDMS

By Application

- Point of care testing

- Clinical Diagnostics

- Drug Delivery

- Analytical Testing

- Genomics

- Proteomics

- Cell based Analysis

- Others.

By Region

- North America

- Europe

- the Asia Pacific

- Latin America

- The Middle East and Africa

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]