Global Microbiological Testing in Beverages Market Size, Share, Trends & Growth Forecast Report - Segmented By Product Type, Test Type, Application, End Users, And Region (North America, Europe, APAC, Latin America, Middle East And Africa) – Industry Analysis From 2024 To 2032

Global Microbiological Testing in Beverages Market Size

The global microbiological testing in beverages market size was calculated to be USD 4.80 billion in 2023 and is anticipated to be worth USD 9.80 billion by 2032 from USD 5.20 billion In 2024, growing at a CAGR of 8.25% during the forecast period.

The manufacturers of beverages are adopting advanced microbiological testing techniques to identify and control pathogens, spoilage microorganisms, and other contaminants due to the rising emphasis of people towards health and safety. Technological advancements, such as polymerase chain reaction (PCR) and next-generation sequencing (NGS), have revolutionized testing and enabled faster and more accurate results. For instance, PCR can detect microorganisms within hours, significantly reducing production delays caused by traditional culture methods. Regulatory frameworks worldwide mandate stringent quality controls for beverage products, pushing manufacturers to invest in robust testing solutions. The European Food Safety Authority (EFSA) and the U.S. Food and Drug Administration (FDA) impose rigorous standards for microbiological limits in beverages.

MARKET DRIVERS

Rising Consumer Demand for Food Safety and Quality

The rising awareness among consumers regarding health and safety is a key driver for microbiological testing in beverages. Approximately 70% of consumers prioritize purchasing beverages that meet stringent safety standards, particularly in premium and organic categories. High-profile contamination incidents have increased scrutiny and compelling manufacturers to adopt advanced microbiological testing. For instance, rapid testing methods such as PCR and immunoassays allow timely detection of harmful microorganisms, ensuring product integrity. As consumers demand greater transparency and assurance, companies are investing in sophisticated testing technologies to meet these expectations and maintain brand trust.

Stringent Regulatory Frameworks

Government regulations mandating compliance with microbiological safety standards significantly drive the global market expansion. Regulatory bodies such as the FDA, EFSA, and WHO enforce strict guidelines to minimize risks associated with microbial contamination in beverages. For example, the FDA requires periodic testing for pathogens such as E. coli and Salmonella in bottled water and juices. These regulations push manufacturers to adopt cutting-edge technologies such as next-generation sequencing (NGS) and automated systems to meet compliance, reduce recalls, and avoid penalties. Compliance with these regulations not only ensures safety but also opens export opportunities, making it a vital driver for the market.

MARKET RESTRAINTS

High Costs of Advanced Testing Technologies

The implementation of advanced microbiological testing methods, such as polymerase chain reaction (PCR) and next-generation sequencing (NGS), involves significant costs. These expenses include specialized equipment, reagents, and skilled personnel. For instance, approximately 35% of small and medium-sized beverage manufacturers cite high costs as a barrier to adopting cutting-edge testing solutions. This limitation forces smaller companies to rely on traditional methods, which are slower and less precise. The financial burden associated with maintaining testing facilities and complying with stringent standards further adds to operational challenges, particularly for budget-constrained producers.

Lack of Standardization Across Regions

The absence of globally unified microbiological testing standards creates challenges for beverage manufacturers operating in multiple markets. Different countries have varying microbial limits and compliance requirements, complicating production and testing processes. For instance, while the FDA mandates specific pathogen testing in the U.S., European regulations prioritize broader microbial safety metrics. This inconsistency requires companies to tailor their testing protocols for each region, increasing complexity and costs. According to surveys, 25% of beverage exporters face delays due to discrepancies in international standards, underscoring the need for harmonized global testing guidelines.

MARKET OPPORTUNITIES

Adoption of Automation and AI in Testing Processes

The integration of automation and artificial intelligence (AI) in microbiological testing offers significant growth opportunities. Automated systems can handle high volumes of samples, reducing human error and accelerating testing processes. AI-driven predictive analytics can identify contamination patterns, enabling preventive measures. According to reports, 30% of large beverage manufacturers are implementing automated testing systems to enhance efficiency and compliance. These technologies not only improve accuracy but also lower operational costs over time, making them an attractive investment for companies aiming to streamline quality control.

Expansion of Functional and Organic Beverage Segments

The growing popularity of functional and organic beverages creates a demand for rigorous microbiological testing to meet consumer expectations for purity and safety. Products like kombucha, cold-pressed juices, and herbal teas require specialized testing to ensure microbial stability without compromising nutritional value. According to surveys, 60% of organic beverage producers prioritize microbiological testing as a critical aspect of their production process. This trend provides opportunities for testing service providers to develop targeted solutions for niche beverage categories, capitalizing on the increasing consumer preference for health-focused drinks.

MARKET CHALLENGES

Complexity of Testing for Emerging Beverage Categories

New beverage categories, such as plant-based drinks, kombucha, and probiotics, pose unique microbiological challenges due to their complex formulations and fermentation processes. Testing these products requires specialized methods to identify a broader range of microbes, including beneficial strains and potential contaminants. According to recent reports, 25% of manufacturers struggle to find tailored testing solutions for their niche products, leading to delays in production and market entry. This complexity increases the demand for advanced and adaptable testing protocols, which can be costly and time-intensive to develop.

Skilled Workforce Shortage

The lack of trained professionals in microbiological testing is a persistent challenge in the industry. Advanced testing methods, such as polymerase chain reaction (PCR) and next-generation sequencing (NGS), require expertise in handling sophisticated equipment and interpreting results. According to latest surveys, 40% of beverage manufacturers report difficulties in hiring and retaining skilled technicians. This workforce shortage slows testing processes and limits the adoption of cutting-edge technologies, particularly for smaller companies without the resources to provide extensive training or competitive compensation.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024 to 2032 |

|

CAGR |

8.25% |

|

Segments Covered |

By Product Type, Test Type, Application, End-Users and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis; Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

3M Company, Thermo Fisher Scientific Inc., Merck KGaA, bioMérieux SA, Danaher Corporation (Cepheid), Agilent Technologies, Inc., Neogen Corporation, Bio-Rad Laboratories, Inc., Romer Labs Division Holding GmbH, and PerkinElmer, Inc. |

SEGMENTAL ANALYSIS

By Product Type Insights

The reagents and consumables segment led the microbiological testing in beverages market in 2023. The dominance of the segment is attributed to the recurring need for these products in every testing procedure, ensuring accurate and reliable results. Consumables such as culture media, reagents, and disposables are essential for sample preparation and analysis, leading to consistent demand. The high consumption rate of these items, coupled with the expansion of testing services across various industries, reinforces their leading position in the market.

On the other hand, the software segment is predicted to witness the fastest CAGR in the global market over the forecast period. This rapid expansion is driven by the increasing adoption of laboratory information management systems (LIMS) and data analytics tools that enhance efficiency and accuracy in microbiological testing. Software solutions facilitate automation, data management, and compliance with regulatory standards, making them indispensable in modern laboratories. The growing emphasis on digitalization and the need for streamlined laboratory workflows contribute to the accelerated growth of this segment.

By Test Type Insights

The bacterial testing segment dominated the global market, accounting for approximately 60% of all tests conducted globally in the beverage sector. This focus is due to the high prevalence of bacterial pathogens such as E. coli, Salmonella, and Listeria, which can severely impact consumer health and lead to costly recalls for manufacturers. In the U.S., the FDA mandates routine bacterial testing for bottled water, juices, and other beverages, highlighting its critical importance. Additionally, bacterial contamination was responsible for 70% of global foodborne illness outbreaks, underscoring the need for rigorous bacterial testing protocols.

The viral testing segment is expected to exhibit the fastest CAGR in the global market during the forecast period. As advancements in diagnostic technologies make testing more accessible and efficient. Recent outbreaks of waterborne viruses such as Hepatitis A and Norovirus have heightened awareness of the risks posed by viral contamination in beverages. Molecular testing methods, like PCR, enable faster detection of viral pathogens, ensuring better prevention strategies. According to a 2023 WHO report emphasized the increasing need for viral testing, as 30% of global waterborne illnesses were attributed to viral infections, further driving demand in this segment.

By Application Insights

The food and beverage testing segment held the largest share of the worldwide market in 2023 owing to the stringent safety regulations and the growing focus on ensuring product quality. Microbiological testing is essential for detecting pathogens, spoilage microorganisms, and contaminants in beverages such as water, juices, and carbonated drinks. According to reports, 55% of microbiological tests globally are conducted in the food and beverage sector. Regulatory agencies like the FDA and EFSA mandate regular testing to prevent contamination, reduce recalls, and protect consumer health, making this segment critical in the overall market landscape.

The pharmaceutical testing segment is estimated to register the highest CAGR in the global market. The rising complexity of pharmaceutical formulations and the need to meet rigorous safety and sterility standards are driving the pharmaceutical testing segment in the worldwide market. Microbiological testing ensures the absence of harmful microorganisms in drugs, vaccines, and biologics, which is critical for patient safety. The rising demand for injectable drugs and biologics, particularly in oncology and immunology, has further increased the focus on microbiological testing in this segment, driving its rapid expansion.

By End Users Insights

The food and beverages companies segment captured the leading share of the global market in 2023 due to the critical need for ensuring the safety and quality of consumable products. These companies rely on testing to identify pathogens, spoilage microorganisms, and contaminants to comply with stringent global safety regulations. A 2023 study found that 60% of microbiological tests conducted worldwide are driven by the food and beverage sector. Leading regulatory bodies like the FDA and EFSA mandate rigorous testing protocols to avoid product recalls and protect public health, solidifying this segment’s dominance in the market.

The biotechnology and pharmaceutical companies segment is anticipated to witness the fastest CAGR in the global market over the forecast period. The increasing development of biologics, vaccines, and cell-based therapies necessitates robust microbiological testing to ensure sterility and safety. Advanced therapies, such as gene editing and personalized medicine, demand precise contamination control, driving growth in this segment. A 2023 report noted that 35% of biotechnology firms have increased their testing budgets, reflecting the rising importance of microbiological testing in pharmaceutical innovation and production.

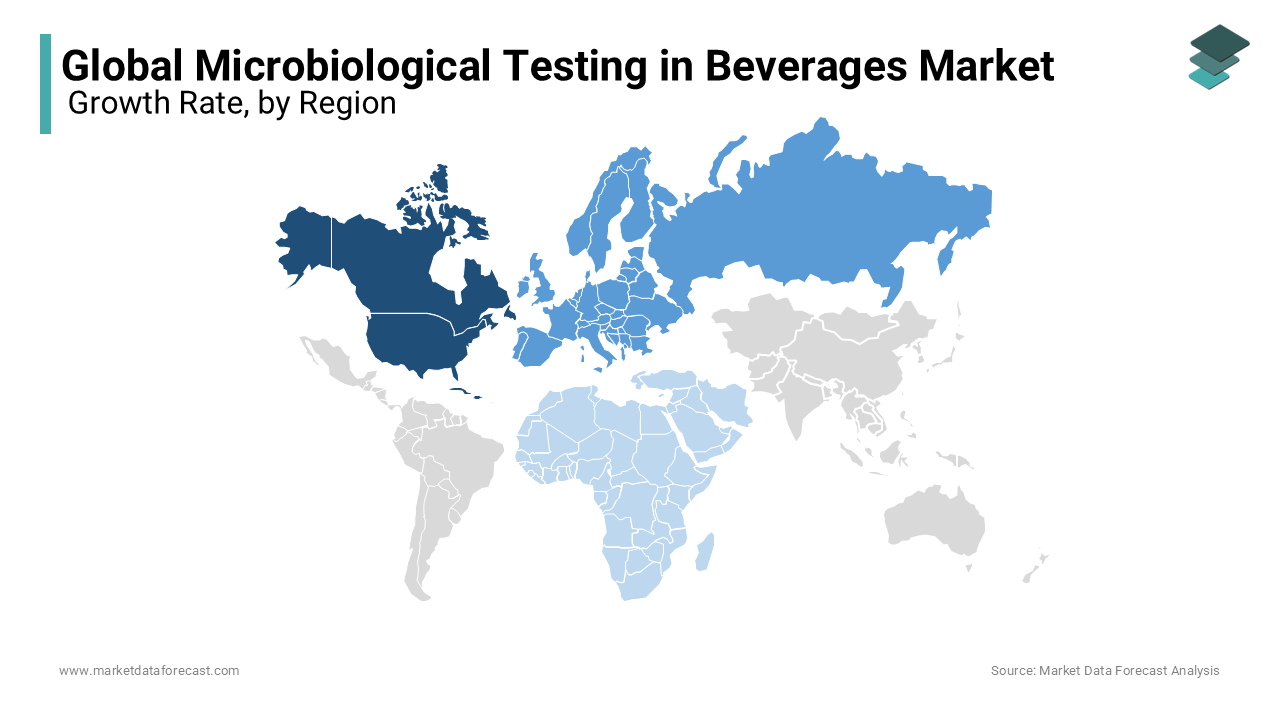

REGIONAL ANALYSIS

North America led the market and accounted for 30.8% of the global market share in 2023. The dominance of North America is majorly driven by the strict food safety regulations enforced by agencies like the FDA, requiring regular microbiological testing for beverages. The U.S. leads in this region, supported by advanced testing infrastructure and the adoption of cutting-edge technologies like PCR and next-generation sequencing. Canada also contributes significantly, focusing on quality assurance for bottled water and functional beverages. The increasing demand for clean-label and organic beverages is further boosting the regional market expansion.

Europe is a promising regional segment in the global market. The UK, Germany & France are playing a key role in the European market. The strict compliance with EFSA regulations in the UK is propelling the UK market growth. The focus of Europe on premium beverages, such as wine, craft beer, and flavored water, drives demand for high-precision microbiological testing. For example, Germany’s large beer market adheres to stringent purity laws, requiring regular microbiological assessments. The rise of sustainable and eco-friendly production practices has also increased the adoption of advanced testing technologies.

Asia-Pacific had a substantial share of the worldwide market in 2023 and is predicted to be the fastest growing regional segment in the global market during the forecast period. Rapid urbanization, industrialization, and increasing consumer awareness of food safety drive growth in countries like China, India, and Japan. The region’s booming functional and health beverage sectors also require extensive microbiological testing to ensure safety and compliance. India, for example, has seen a surge in bottled water consumption, necessitating frequent microbiological testing.

Latin America is growing steadily, with growth primarily driven by Brazil and Mexico. These countries are key exporters of beverages such as coffee, juices, and alcoholic drinks, necessitating adherence to international safety regulations. Investments in testing facilities are increasing, with local manufacturers focusing on compliance and quality improvements to compete globally.

The expanding beverage manufacturing industry of Middle East and Africa in countries such as South Africa and the UAE is driving demand for microbiological testing. Efforts to improve food safety infrastructure, particularly in water testing and carbonated beverages, support steady growth. The increasing focus on international trade and exports from this region also pushes manufacturers to comply with global safety standards.

KEY MARKET PLAYERS

Companies playing a major role in the global microbiological testing in beverages market include 3M Company, Thermo Fisher Scientific Inc., Merck KGaA, bioMérieux SA, Danaher Corporation (Cepheid), Agilent Technologies, Inc., Neogen Corporation, Bio-Rad Laboratories, Inc., Romer Labs Division Holding GmbH, and PerkinElmer, Inc.

COMPETITIVE LANDSCAPE

The microbiological testing in beverages market is highly competitive, driven by the increasing focus on beverage safety and regulatory compliance. Key players like 3M Company, Thermo Fisher Scientific, and Merck KGaA dominate the market with comprehensive portfolios that include advanced instruments, reagents, and test kits. These companies leverage cutting-edge technologies such as polymerase chain reaction (PCR) and next-generation sequencing (NGS) to offer rapid and precise testing solutions, ensuring compliance with global safety standards.

Emerging players and regional companies compete by focusing on niche markets and cost-effective solutions tailored to local regulations. Companies like Neogen Corporation and Romer Labs offer specialized kits for bacterial and fungal testing, targeting small and medium-sized beverage manufacturers.

The competition is also shaped by the increasing adoption of automation and artificial intelligence (AI) in laboratory workflows. Firms like Danaher Corporation invest heavily in automation to enhance efficiency and accuracy, differentiating themselves in a crowded market.

Moreover, collaborations with beverage manufacturers and regulatory bodies further strengthen market positions. The rising demand for organic and functional beverages creates opportunities for companies offering targeted testing solutions. Innovation, sustainability, and adherence to evolving regulatory frameworks remain critical factors driving competition in this dynamic market.

MARKET SEGMENTATION

This research report on the global microbiological testing in beverages market has been segmented and sub-segmented based on product type, test type, application, end users, and region.

By Product Type

- Instruments

- Reagents and Consumables

- Test Kits

- Software

By Test Type

- Bacterial Testing

- Fungal Testing

- Viral Testing

By Application

- Clinical testing

- Food and Beverage Testing

- Pharmaceutical Testing

- Environmental Testing

- Others

By End Users

- Hospitals and Diagnostics

- Laboratories

- Academic and Research Organizations

- Biotechnology and Pharmaceutical Companies

- Food and Beverages Companies

- Others

By Region

- North America

- Europe

- The Asia Pacific

- Latin America

- The Middle East and Africa

Frequently Asked Questions

1. What are the market opportunities for microbiological testing in beverages?

The testing methods are bacterial testing leads the market, accounting for approximately 60% of tests conducted globally, and Viral Testing is expected to grow rapidly due to advancements in diagnostic technologies.

2. How does microbiological testing benefit beverage manufacturers?

It ensures product safety, extends shelf life, maintains regulatory compliance, and enhances consumer trust by preventing contamination.

3. Which beverages are most susceptible to microbial contamination?

Juices, dairy-based drinks, plant-based beverages, and low-alcohol drinks are particularly susceptible due to their nutrient-rich composition and storage conditions.

4. Who is responsible for microbiological testing in beverage production?

Food safety specialists, microbiologists, and quality control teams in beverage companies are responsible for conducting and monitoring these tests.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]