Global Methanol To Gasoline Market Size, Share, Trends, & Growth Forecast Report Segmented By Feedstock (Natural Gas, Coal, Biomass, Others), Reactor Type, Application, And Region (Latin America, North America, Asia Pacific, Europe, Middle East And Africa), Industry Analysis From 2025 To 2033

Global Methanol to Gasoline Market Size

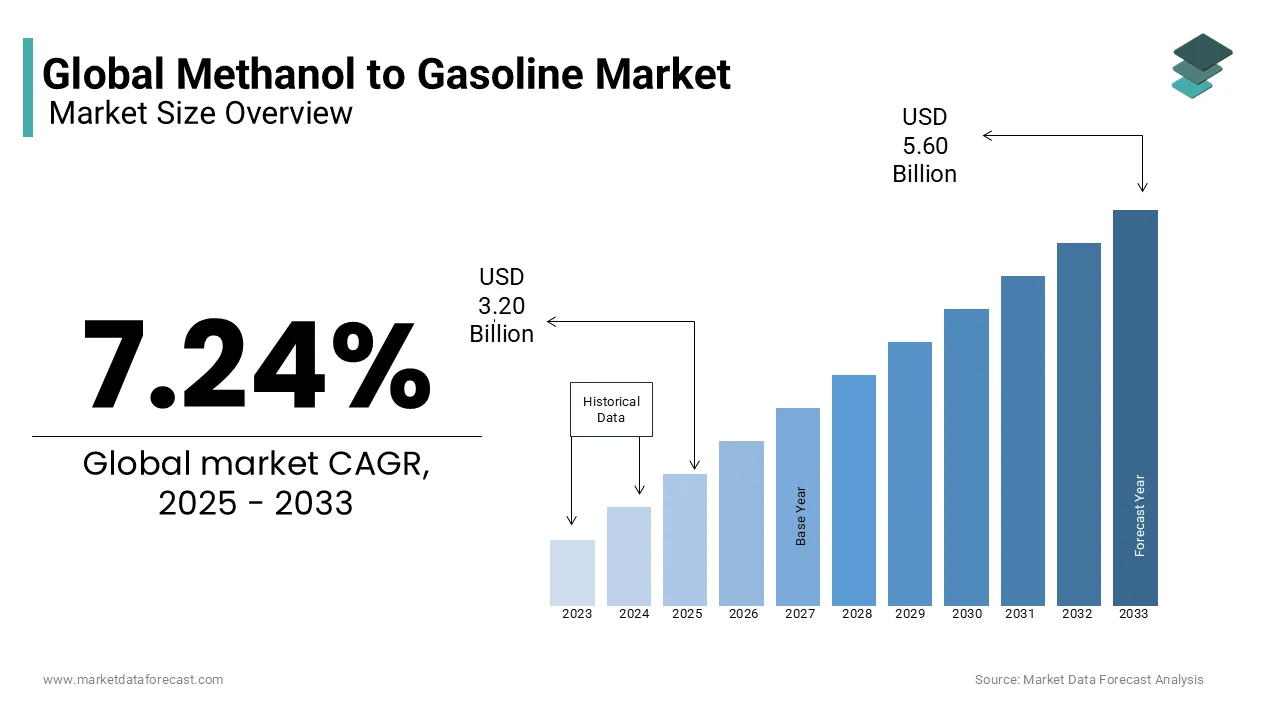

The global methanol to gasoline market size was valued at USD 2.98 billion in 2024 and is expected to reach USD 5.60 billion by 2033 from USD 3.20 billion in 2025. The market is projected to grow at a CAGR of 7.24%.

The methanol to gasoline (MTG) is an innovation within the global energy transition with a pathway to produce synthetic gasoline from methanol that is a versatile chemical derived from natural gas, coal, biomass, or even renewable sources like captured carbon dioxide and green hydrogen. The MTG process has garnered attention to address energy security concerns and reduce reliance on crude oil while enabling cleaner transportation fuels. According to the International Renewable Energy Agency (IRENA), the transportation sector is solely responsible for 38% of global carbon dioxide emissions that is elevating the urgent need for low-carbon fuel alternatives.

Methanol production has seen steady growth over the past decade is driven by its widespread applications in chemicals, energy, and industrial processes. Global methanol production capacity exceeded 110 million metric tons annually in 2021, as per data published by the Global Methanol Industry Association. China remains the dominant player in methanol production by contributing approximately 65% of global output due to its extensive use of coal-based synthesis technologies. However, there is a growing shift toward greener methanol production pathways with projects utilizing renewable energy and carbon capture gaining traction.

Technological advancements have also improved the efficiency of MTG processes. Recent studies, such as those published in Energy & Environmental Science, indicate that modern MTG systems can achieve conversion efficiencies of up to 78%, depending on feedstock quality and reactor design. Furthermore, the integration of renewable methanol into MTG systems could reduce lifecycle greenhouse gas emissions by as much as 90% compared to conventional gasoline. These innovations promote the potential of MTG as a bridge technology in the transition to sustainable mobility solutions.

MARKET DRIVERS

Advantageous Feedstock Availability

The Methanol-to-Gasoline (MTG) market is significantly driven by the accessibility of cost-effective feedstocks. Methanol can be produced from various sources, including natural gas, coal, and biomass, which are abundant in many regions. This versatility ensures a steady supply and offers economic benefits. For instance, the U.S. Government Accountability Office has reported that sufficient economically recoverable coal reserves exist to enable enough methanol production to replace gasoline for about 100 years is even allowing for a doubling of coal demand for other uses. This ensures the importance for methanol production to be both sustainable and economically viable over the long term.

Environmental Considerations and Regulatory Support

Environmental concerns and stringent emission regulations are pivotal drivers for the MTG market. Methanol when used as a fuel combusts more cleanly than conventional gasoline which is resulting in lower emissions of pollutants such as hydrocarbons. The U.S. Environmental Protection Agency notes that methanol offers important emissions benefits compared with gasoline by potentially reducing hydrocarbon emissions by 30 to 40 percent with M85 (a blend of 85% methanol and 15% gasoline) and up to 80 percent with M100 (pure methanol) fuels. This cleaner combustion profile aligns with global efforts to mitigate air pollution and combat climate change which is leading to increased regulatory support for methanol-based fuels.

MARKET RESTRAINTS

Infrastructure Limitations

The expansion of the Methanol-to-Gasoline (MTG) market is constrained by significant infrastructure challenges. Establishing methanol production facilities requires substantial capital investment. For instance, the U.S. Energy Information Administration (EIA) notes that new methanol plants, such as the Big Lake 1 facility in Louisiana are expected to consume approximately 0.15 billion cubic feet per day of natural gas to produce about 3,800 metric tons of methanol daily. Additionally, the distribution infrastructure for methanol-based fuels is underdeveloped compared to conventional fuels. The EIA emphasizes that the development of methanol production capacity and the conversion of the fuel supply and automobile industries present significant challenges, including the need for substantial investments in production facilities, distribution networks, and vehicle modifications to accommodate methanol-based fuels.

Economic Viability and Market Competition

The economic viability of the MTG process faces challenges due to market competition and fluctuating feedstock prices. The U.S. Energy Information Administration reports that natural gas prices are a primary feedstock for methanol production have experienced significant volatility. For instance, in 2018, Permian region natural gas prices averaged $1.98 per million British thermal units (MMBtu), while the Henry Hub national benchmark was $3.15/MMBtu. Such fluctuations can impact the cost-effectiveness of methanol production. Moreover, methanol-derived gasoline must compete with conventional gasoline and other alternative fuels which may benefit from more established infrastructures and economies of scale. This competitive landscape poses a restraint on the MTG market's expansion.

MARKET OPPORTUNITIES

Advancements in Methanol Production Technology

Recent developments in methanol production technology present significant opportunities for the Methanol-to-Gasoline (MTG) market. The U.S. Energy Information Administration reports that new methanol plants are expected to increase industrial natural gas use through 2020. For instance, the Big Lake 1 facility in Louisiana is projected to convert dry natural gas into approximately 3,800 metric tons of methanol daily which can subsequently be transformed into gasoline. Similarly, the Yuhuang St. James 1 methanol plant is anticipated to commence operations in mid-2020, will have a capacity of 4,700 metric tons per day by making it the second-largest methanol facility in the United States. These advancements not only enhance production efficiency but also bolster the economic feasibility of MTG processes.

Potential for Methanol as a Transportation Fuel

The potential for methanol to serve as an alternative transportation fuel offers a promising opportunity for the MTG market. The U.S. Government Accountability Office has reported that methanol could be produced at a cost competitive with gasoline which is an economically viable alternative. Furthermore, methanol is superior to gasoline for environmental and health reasons by emitting fewer pollutants during combustion. The U.S. Environmental Protection Agency has also recognized methanol as a clean-burning, high-octane fuel component which can be blended into motor gasoline to increase combustion efficiency and reduce air pollution. These factors position methanol as a compelling alternative fuel option along with global efforts to reduce environmental impact and enhance energy security.

MARKET CHALLENGES

Energy Density and Fuel Efficiency Challenges

The Methanol-to-Gasoline (MTG) market faces challenges due to methanol's lower energy density compared to conventional gasoline. According to the U.S. Energy Information Administration, gasoline contains approximately 120,214 British thermal units (Btu) per gallon, whereas methanol contains about 56,600 Btu per gallon. This means methanol has less than half the energy content per gallon compared to gasoline. Consequently, vehicles running on methanol would require more frequent refueling or larger fuel tanks to achieve the same driving range as gasoline-powered vehicles.

Environmental and Health Concerns

The combustion of methanol raises environmental and health concerns due to the emission of formaldehyde which is a toxic air pollutant. The U.S. Environmental Protection Agency has identified formaldehyde as a probable human carcinogen that is associated with adverse health effects such as respiratory symptoms and irritation of the eyes, nose, and throat. Exposure to formaldehyde can occur through inhalation of emissions from methanol combustion with stringent control measures to mitigate health risks. These environmental and health considerations require careful management to ensure the safe adoption of methanol as a fuel.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

7.24% |

|

Segments Covered |

By Feedstock, Reactor Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

ExxonMobil, Sinopec Engineering (Group) Co., Ltd., Jincheng Anthracite Mining Group, Ekobenz Sp. z o. o., Mitsui Chemicals, Inc., Methanex Corporation, Carbon Recycling International, Topsoe, Clariant, Zeogas, and DKRW Energy Partners LLC. |

SEGMENTAL ANALYSIS

By Feedstock Insights

The natural gas segment held the leading share of 65.6% of global market share in 2024 owing to its abundance, cost-effectiveness, and lower carbon footprint compared to coal. The U.S. Energy Information Administration (EIA) stated that global natural gas production exceeded 4,000 billion cubic meters in 2022 by ensuring a stable supply for methanol synthesis. Natural gas-based MTG processes produce cleaner synthetic gasoline with reduced sulfur content with stringent emission standards. Its scalability and compatibility with renewable energy systems further enhance its importance that boosts the feedstock for sustainable fuel production.

The biomass segment is estimated to witness a promising CAGR of 12.3% over the forecast period. Factors such as increasing investments in bio-based economies and advancements in technologies like gasification and pyrolysis are propelling the growth of the biomass segment in the global market. Biomass-derived methanol supports circular economy principles by utilizing agricultural residues and organic waste by reducing reliance on fossil fuels. IRENA notes that biomass could meet up to 20% of global energy demand by 2050. The integration of carbon capture further enhances its sustainability with biomass as a transformative solution for decarbonizing transportation fuels and achieving net-zero emissions.

By Reactor Type Insights

The fixed bed segment held the largest share of 65% in the global market in 2024. The domination of the fixed bed segment in the global market is majorly their high efficiency and ability to achieve nearly 90% methanol conversion rates along with cost-effective operations. Fixed bed systems are preferred for large-scale MTG plants due to their robust design and compatibility with advanced catalysts which enhance gasoline yield and quality. According to U.S. Department of Energy, fixed bed reactors reduce operational downtime by up to 30% compared to other types. Their reliability and scalability make them indispensable for industrial applications will anticipate their leadership in the MTG reactor landscape.

The fluidized bed segment is gaining huge traction and is estimated to register a CAGR of 8.5% from 2025 to 2033 due to their superior heat distribution capabilities is enabling higher thermal efficiencies of up to 85% during methanol conversion. Fluidized beds also support continuous operations, reducing maintenance costs by 20-25% compared to fixed bed systems, as noted by the U.S. Energy Information Administration. Their adaptability to renewable methanol feedstocks and integration with carbon capture technologies further enhances their appeal. Fluidized bed reactors are gaining traction for their flexibility and eco-friendly potential by making them a key enabler of the MTG market’s evolution.

By Application Insights

The transportation fuel segment had the leading share of 65.4% of the global methanol to gasoline (MTG) market in 2024. The global reliance on gasoline-powered vehicles is one of the key factors driving the segmental dominance in the global market. Synthetic gasoline produced via MTG offers a cleaner alternative by reducing sulfur content to less than 10 parts per million with stringent emission standards. The IEA (INTERNATIONAL ENERGY AGENCY) studies reports state that road transport accounts for nearly 24% of global CO₂ emissions is driving demand for low-carbon fuels. MTG's ability to produce high-quality gasoline from abundant methanol feedstock ensures its leadership which is pivotal for decarbonizing the transportation sector.

The chemical blending component segment is likely to expand at a CAGR of 8.3% from 2025 to 2033 due to the increasing demand for blended fuels and specialty chemicals which require high-purity synthetic hydrocarbons. The versatility of MTG-derived products allows their integration into petrochemical applications, such as solvents, adhesives, and polymers. Additionally, the Global Methanol Industry Association notes that methanol-based chemical blending reduces dependency on crude oil derivatives by offering cost efficiency and sustainability. Renewable methanol integration further accelerates this segment’s expansion by positioning it as a key driver of innovation in the chemical sector.

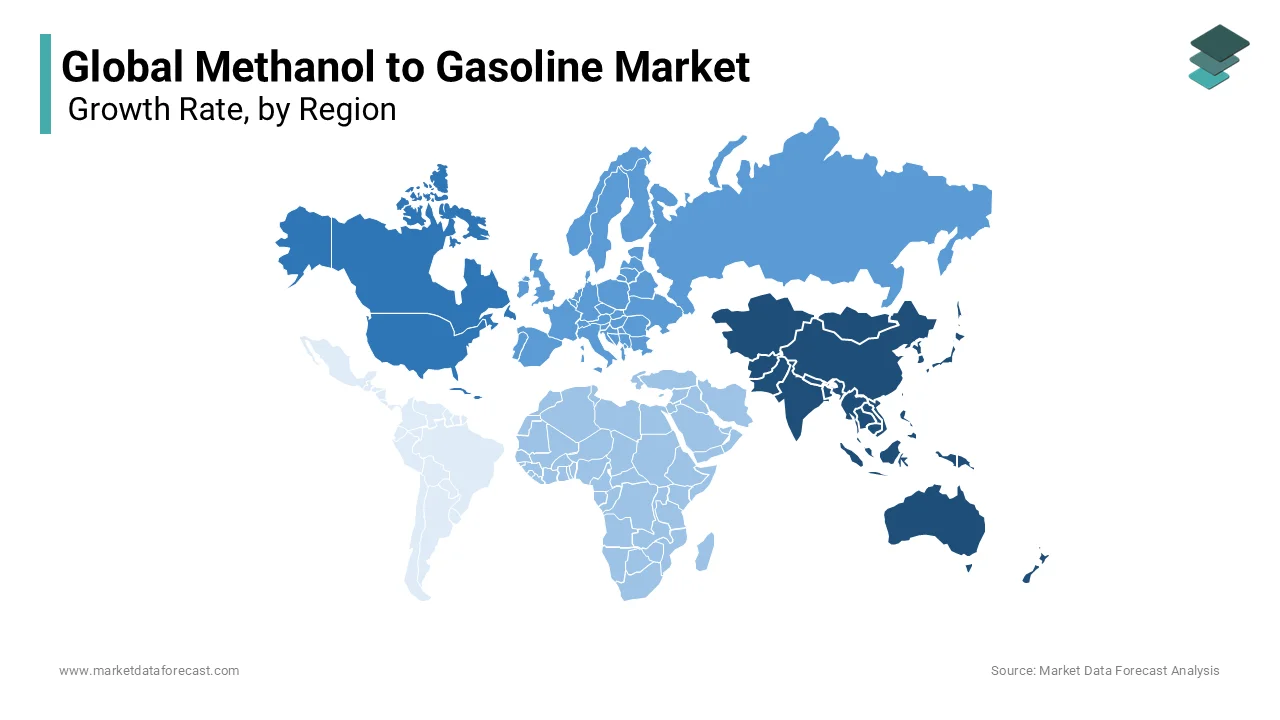

REGIONAL ANALYSIS

Asia-Pacific dominated the methanol to gasoline (MTG) market by accounting for 60.6% of the global market share in 2024. The domination of Asia-Pacific in the global market is driven by China’s massive methanol production capacity, which exceeds 70 million metric tons annually with over 65% of global output. The region's reliance on coal-to-chemical technologies and abundant natural gas reserves in countries like India and Indonesia further bolster its dominance. Additionally, stringent air quality regulations in urban centers are pushing demand for cleaner fuels. According to the IEA (INTERNATIONAL ENERGY AGENCY), Asia-Pacific accounts for nearly 40% of global energy consumption that is encouraging the adopting MTG as a sustainable solution for transportation and industrial needs.

North America is likely to exhibit CAGR of 10.5% from 2025 to 2033 owing to the region's abundant shale gas resources, with natural gas production exceeding 1,000 billion cubic meters annually, as reported by the U.S. Energy Information Administration (EIA). The shift toward cleaner energy solutions, coupled with supportive policies like the Renewable Fuel Standard (RFS), is accelerating MTG adoption. Additionally, advancements in renewable methanol production in the United States and Canada, are driving innovation. The integration of carbon capture technologies further enhances the sustainability of MTG which is adding fuel to the growth rate of the market in North America.

Europe methanol to gasoline market is ascribed to grow steadily in the next coming years. This region is focusing on renewable methanol integration with its Green Deal targets to reduce transport emissions by 55% by 2030. Latin America leverages its bio-based feedstock potential, with Brazil leading innovations in ethanol-to-methanol projects. The Middle East and Africa, despite their vast natural gas reserves, are growing at a slower pace due to limited policy frameworks but show potential for future expansion. According to the African Development Bank, Africa’s urbanization and vehicle fleet growth will drive demand for cleaner fuels. These regions are expected to grow steadily, supported by global energy transition trends and regional sustainability initiatives.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Major players of the global methanol to gasoline market include ExxonMobil, Sinopec Engineering (Group) Co., Ltd., Jincheng Anthracite Mining Group, Ekobenz Sp. z o. o., Mitsui Chemicals, Inc., Methanex Corporation, Carbon Recycling International, Topsoe, Clariant, Zeogas, and DKRW Energy Partners LLC.

The Methanol to Gasoline (MTG) market is characterized by intense competition, driven by the growing demand for cleaner fuels and the global push toward energy diversification. Key players such as ExxonMobil, Sinopec Engineering, and Methanex Corporation are at the forefront, leveraging their technological expertise and strategic initiatives to capture significant market share. ExxonMobil’s proprietary MTG technology and focus on renewable methanol feedstocks position it as a leader in innovation, while Sinopec Engineering dominates through large-scale coal-to-liquids projects in China, supported by its expertise in cost-effective production. Methanex Corporation, as the largest methanol producer globally, ensures a steady supply of high-purity feedstock, enabling scalable MTG operations.

Competition in the MTG market is further intensified by regional players like Jincheng Anthracite Mining Group and Mitsui Chemicals, which cater to localized demand while exploring sustainable practices. Companies are increasingly investing in research and development to enhance process efficiency and reduce environmental impacts, aligning with stringent emission regulations. Strategic collaborations, such as those between Methanex and Carbon Recycling International emphasize the industry's shift toward integrating renewable feedstocks like captured CO₂ and green hydrogen.

Geographically, Asia-Pacific remains a hotspot for MTG adoption due to abundant feedstock availability and supportive government policies, while North America and Europe focus on sustainability-driven innovations. This competitive landscape underscores the importance of technological differentiation, geographic expansion, and sustainability initiatives in shaping the future of the MTG market. As companies vie for leadership, the emphasis on cleaner energy solutions will continue to drive growth and transformation in the sector.

TOP STRATEGIES USED BY THE KEY MARKET PARTICIPANTS

Technological Innovation and R&D Investments

Key players in the Methanol to Gasoline (MTG) market prioritize technological innovation as a core strategy to strengthen their competitive edge. Companies like ExxonMobil and Topsoe are investing heavily in research and development to refine MTG processes, improve catalyst efficiency, and optimize reactor designs. These advancements not only enhance production efficiency but also ensure compliance with global environmental standards. These companies position themselves as leaders in the clean fuel transition by offering scalable and sustainable solutions to meet evolving market demands.

Strategic Partnerships and Collaborations

Strategic alliances are a cornerstone for growth in the MTG market. Methanex Corporation collaborates with renewable energy firms to explore green methanol production using captured carbon dioxide and hydrogen derived from renewable sources. Similarly, Sinopec Engineering works closely with government agencies and private entities in China to scale up coal-to-liquids projects, ensuring cost-effective and large-scale production of synthetic fuels. These partnerships enable companies to share resources, mitigate risks, and tap into new markets by fostering long-term growth and innovation.

Expansion of Production Capacities

Leading players are actively expanding their production capabilities to meet rising demand for cleaner fuels. Sinopec Engineering has established large-scale MTG facilities in regions with abundant feedstock availability, ensuring a steady supply of synthetic gasoline. Methanex Corporation is also scaling up its methanol production infrastructure globally to support MTG operations. This focus on capacity expansion allows companies to achieve economies of scale, reduce costs, and strengthen their presence in key markets.

Focus on Sustainability and Renewable Feedstocks

Sustainability is a major strategic priority for companies like Clariant and Carbon Recycling International. Clariant is advancing technologies that convert agricultural waste into cellulosic ethanol, which can be further processed into methanol for MTG applications. Carbon Recycling International specializes in producing renewable methanol by capturing industrial carbon emissions, aligning with global decarbonization goals. These efforts position companies as pioneers in sustainable fuel production, enhancing their reputation and appeal in an increasingly eco-conscious market.

Geographic Diversification and Market Penetration

Key players are diversifying geographically and targeting emerging markets with high growth potential. Mitsui Chemicals is expanding its footprint in the Asia-Pacific region, leveraging the area's abundant natural gas resources and growing demand for cleaner transportation fuels. ExxonMobil is exploring opportunities in North America and Europe, supported by favorable regulatory frameworks promoting low-carbon energy solutions. This geographic diversification helps companies mitigate regional risks and capitalize on new growth opportunities.

TOP PLAYERS IN THIS MARKET

ExxonMobil

ExxonMobil is a pioneer in the Methanol to Gasoline (MTG) market is leveraging its expertise in advanced refining technologies and synthetic fuels. The company has developed proprietary MTG processes that enable the efficient conversion of methanol into high-quality synthetic gasoline. ExxonMobil’s focus on innovation ensures that its MTG technology aligns with global emission reduction goals by producing cleaner-burning fuels. The company also plays a significant role in advancing renewable methanol initiatives by integrating sustainable feedstocks like captured carbon dioxide and green hydrogen into the MTG value chain. ExxonMobil strengthens its leadership in the global MTG market while supporting the transition to low-carbon transportation fuels.

Sinopec Engineering (Group) Co., Ltd.

Sinopec Engineering is a dominant player in the MTG market, particularly within China, where it operates some of the largest coal-to-liquids (CTL) projects. The company specializes in coal gasification and methanol synthesis technologies, which are critical for cost-effective MTG production. Sinopec Engineering’s large-scale MTG facilities demonstrate its ability to meet growing demand for synthetic gasoline while maintaining operational efficiency. Additionally, the company is investing in carbon capture and storage (CCS) systems to reduce the environmental impact of coal-based MTG processes. Through its technological expertise and commitment to sustainability, Sinopec Engineering contributes significantly to the global adoption of MTG as a viable alternative to conventional gasoline production.

Methanex Corporation

Methanex Corporation plays a foundational role in the MTG market by supplying high-purity methanol feedstock. The company’s focus on expanding its methanol production capabilities ensures a reliable supply chain for MTG operations worldwide. Methanex is also at the forefront of renewable methanol production, collaborating with organizations like Carbon Recycling International to develop methanol from captured CO₂ and renewable energy sources. This emphasis on sustainable feedstocks aligns with global decarbonization efforts, making Methanex a key enabler of environmentally friendly MTG processes. Methanex supports the growth and sustainability of the global MTG market by bridging traditional and renewable methanol production.

RECENT MARKET DEVELOPMENTS

- In September 2023, Methanex Corporation and Carbon Recycling International signed a landmark investment agreement to advance renewable fuel production. This collaboration is anticipated to enable the development of cutting-edge facilities that produce renewable methanol using captured CO₂ and green hydrogen. The agreement is expected to strengthen Methanex's position as a leader in sustainable feedstock solutions for the Methanol to Gasoline (MTG) market while supporting global decarbonization efforts.

- In December 2023, Sinopec completed the construction of China's largest petrochemical industrial base in Zhanjiang, Guangdong Province. This milestone is anticipated to significantly enhance Sinopec's production capacity for methanol and synthetic gasoline, reinforcing its leadership in the Methanol to Gasoline (MTG) market. The new facility is expected to integrate advanced technologies for coal gasification and methanol synthesis, ensuring cost-effective and large-scale production of cleaner fuels while supporting China's energy security goals.

- In September 2024, Cyclic Materials secured USD 53 million in Series B funding to accelerate the global expansion of its rare earth recycling infrastructure. This investment is anticipated to enhance the company's capabilities in recycling critical materials, which are essential for sustainable technologies, including those used in renewable energy and electric vehicles. The move is expected to strengthen Cyclic Materials' market presence and support the transition to a circular economy by reducing reliance on virgin rare earth resources.

- In October 2023, Carbon Recycling International (CRI) was awarded a grant by the European Union to scale its Electrolytic Technology (ETL) for renewable methanol production. This funding is anticipated to enable CRI to expand its production capacity and enhance the efficiency of its ETL technology, which converts captured CO₂ and renewable electricity into sustainable methanol. The initiative is expected to enhance CRI's role as a key innovator in the renewable fuels sector, supporting global efforts to decarbonize transportation and industrial processes.

MARKET SEGMENTATION

This research report on the global methanol to gasoline market has been segmented and sub-segmented based on & region.

By Feedstock

- Natural Gas

- Coal

- Biomass

- Others

By Reactor Type

- Fluidized Bed

- Fixed Bed

- Others

By Application

- Transportation Fuel

- Power Generation

- Chemical Blending Component

- Others

By Region

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Frequently Asked Questions

1. Which industries primarily use methanol-derived gasoline?

The automotive, transportation, petrochemical, and energy industries are the main consumers of methanol-to-gasoline (MTG) products.

2. What factors are driving the growth of the Methanol to Gasoline Market?

Factors such as rising demand for alternative fuels, increasing environmental regulations, and the shift toward cleaner energy sources are driving market growth.

3. How is the Methanol to Gasoline market expected to grow in the future?

The market is expected to grow due to advancements in fuel technology, government support for cleaner energy, and increased adoption of alternative fuel solutions.

4. Who regulates the use of methanol-based fuels?

Government agencies such as the Environmental Protection Agency (EPA), European Chemicals Agency (ECHA), and International Energy Agency (IEA) regulate the use of methanol-based fuels to ensure safety and environmental compliance.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]