Global Methane Sulfonic Acid Market Size, Share, Trends, & Growth Forecast Report Segmented By Industrial Grade (Industrial, Pharmaceuticals), Application, and Region (Latin America, North America, Asia Pacific, Europe, Middle East and Africa), Industry Analysis from 2025 to 2033

Global Methane Sulfonic Acid Market Size

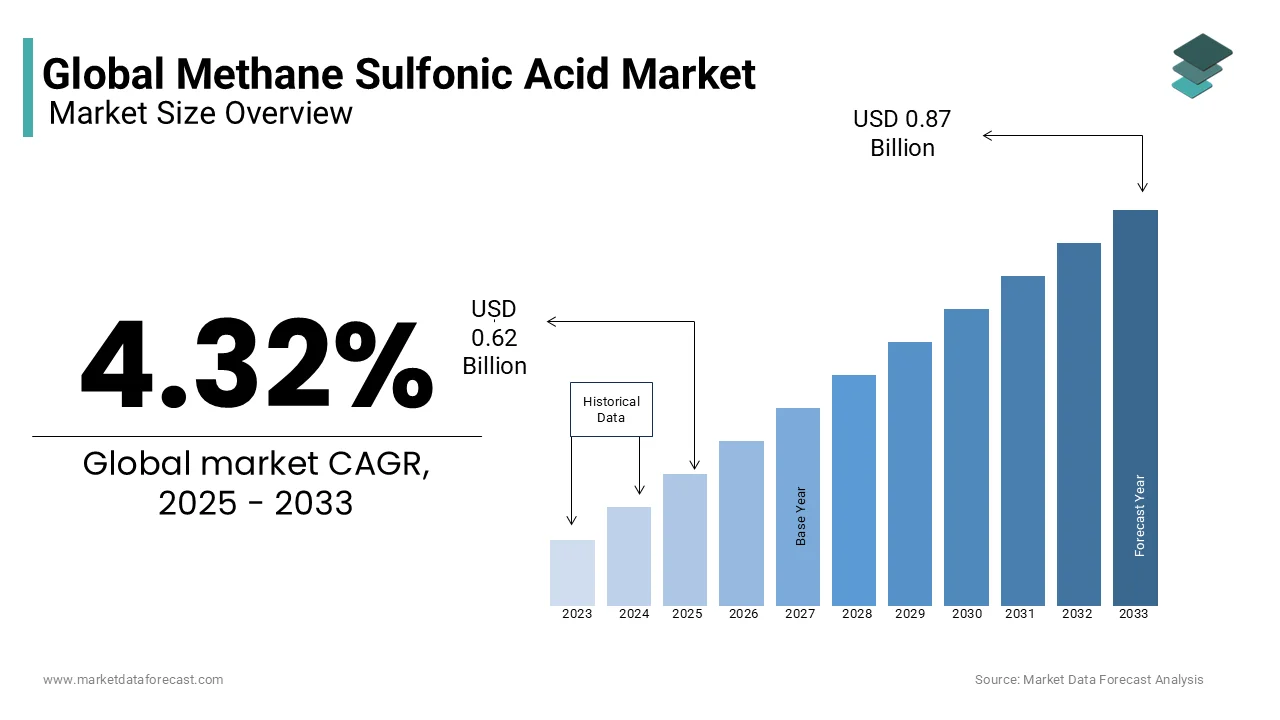

The global methane sulfonic acid market size was valued at USD 0.59 billion in 2024 and is expected to reach USD 0.87 billion by 2033 from USD 0.62 billion in 2025. The market is projected to grow at a CAGR of 4.32%.

Methanesulfonic acid (MSA) is a colorless, odorless, and hygroscopic liquid with the chemical formula CH₃SO₃H. It is the simplest aliphatic sulfonic acid and is known for its strong acidity with a pKa of approximately -1.9. MSA is thoroughly soluble in water and organic solvents and it is non-volatile and non-oxidizing which is making it a versatile acid in various industrial applications. The pharmaceutical sector utilizes MSA as a catalyst in the synthesis of active pharmaceutical ingredients (APIs) and particularly in esterification and alkylation reactions. Its strong acidity and non-oxidizing nature make it suitable for processes requiring precise control and high purity. Also, MSA is employed in industrial cleaning for its effectiveness in removing rust and scale from metal surfaces. Its biodegradability and low corrosivity compared to other strong acids make it an environmentally friendly choice for cleaning applications. The electronics industry benefits from MSA's properties in the manufacturing of printed circuit boards and semiconductors where it is used to clean and prepare metal surfaces without introducing contaminants.

BASF SE is a leading chemical company in terms of production and has expanded its MSA production capacity at its Ludwigshafen site to 50,000 metric tons per year to meet the growing global demand. This expansion reflects the increasing adoption of MSA across various industries due to its unique properties and environmental advantages.

MARKET DRIVERS

Environmental Advantages

Methanesulfonic acid (MSA) is recognized for its environmental benefits but more especially for its biodegradability and low toxicity. According to a study published in Green Chemistry by the Royal Society of Chemistry (RSC), MSA is readily biodegradable that breaks down into non-harmful components and reduces environmental pollution. Additionally, its low toxicity to aquatic life makes it a safer alternative to traditional acids like sulfuric acid. These properties contribute to its adoption in industries aiming to minimize ecological impact.

Industrial Versatility

MSA's unique chemical properties including its strong acidity and non-oxidizing nature makes it extremely versatile across various industrial applications. The RSC Publishing notes that MSA is effectively used in electroplating processes and explicily for tin and lead due to its ability to form extremely soluble metal salts. Furthermore, its great solubility in water and organic solvents enhances its utility in chemical synthesis and industrial cleaning applications. This versatility drives its demand in multiple sectors seeking efficient and adaptable chemical agents.

MARKET RESTRAINTS

Production Challenges

The production of methanesulfonic acid creates substantial problems because of its complex synthesis process. According to the ecoinvent database, MSA is typically produced by the sulfoxidation of methane, a process that requires precise control over reaction conditions to achieve high yields and purity. This complexity can lead to increased production costs and technical difficulties, potentially limiting the scalability of MSA manufacturing. Additionally, the need for specialized equipment and stringent safety measures further complicates the production process, posing barriers to entry for new manufacturers and affecting the overall supply stability of MSA in the market.

Regulatory Constraints

MSA is subject to various regulatory constraints owing to its classification as a hazardous substance. The European Chemicals Agency (ECHA) classifies MSA as causing severe skin burns and eye damage which call for strict handling and storage protocols to make sure of worker safety. These regulations can elevate operational costs for companies involved in the production, transportation, and utilization of MSA. Furthermore, compliance with environmental regulations concerning the disposal and emissions of MSA is mandatory because improper handling can lead to environmental contamination. These regulatory requirements can act as a restraint on the market by imposing additional compliance costs and operational limitations on market participants.

MARKET OPPORTUNITIES

Advancements in Energy Storage Technologies

MSA has shown remarkable ability in improving energy storage systems and especially in redox flow batteries. Research published by the U.S. Department of Energy indicates that MSA-based electrolytes can improve the capacity and cycle life of vanadium–cerium redox flow batteries. This advancement deal with the increasing interest in efficient and durable energy storage solutions and particularly with the rising integration of renewable energy sources into the power grid. The development of MSA-based energy storage systems presents a substantial opportunity for market expansion that is aligning with global efforts to enhance energy efficiency and sustainability.

Innovations in Biodiesel Production

MSA has been identified as an effective catalyst in biodiesel production processes. A study found that the development of a new biodiesel technology utilizing MSA catalysis. This method eliminates the formation of soaps that allows for the use of oils with high free fatty acid content and enhances phase separation of biodiesel and glycerol. These improvements can lead to cost savings and increased efficiency in biodiesel production which is presenting a poetntial prospect for MSA application in the renewable energy sector.

MARKET CHALLENGES

Health and Safety Concerns

MSA has major health and safety challenges as a result of its corrosive nature. Its exposure can lead to serious injuries which requires facilities to implement comprehensive safety measures including personal protective equipment and emergency response plans. These preconditions can increase operational costs and complicate compliance with occupational safety regulations. Additionally, the U.S. Occupational Safety and Health Administration (OSHA) mandates strict guidelines for handling corrosive substances like MSA, further emphasizing the need for rigorous safety practices in workplaces.

Environmental Disposal Regulations

The disposal of MSA is subject to stringent environmental regulations due to its potential impact on ecosystems. The U.S. Environmental Protection Agency (EPA) classifies MSA as a hazardous waste under the Resource Conservation and Recovery Act (RCRA) that is imposing strict guidelines on its disposal. Facilities must ensure that MSA waste is treated and disposed of in accordance with federal and state regulations to prevent environmental contamination. Non-compliance can result in substantial fines and legal liabilities. Moreover, the European Union's Waste Framework Directive mandates that hazardous waste, including MSA, be managed to minimize environmental impact, requiring companies to invest in appropriate waste management systems.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

4.32% |

|

Segments Covered |

By Industrial Grade, Application, and Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

BASF SE (Germany), Arkema SA (France), Varsal (US), TCI Chemicals (India) Pvt. Ltd. (India), Zhongke Fine Chemical Co.Ltd (China), HEBEI YANUO Bioscience Co.Ltd (China), Alfa Aesar (US), Avantor Inc.(US), and others |

SEGMENTAL ANALYSIS

By Industrial Grade Insights

The industrial grade segment captured 55.4% of the global market share in 2024. The extensive use of industrial grade MSA in applications such as electroplating, polymer production, and cleaning agents is majorly propelling the growth of the industrial segment in the global market. According to the American Chemistry Council, the global chemical industry generates over $4 trillion annually and industrial chemicals plays a critical role in this. MSA’s biodegradability and low environmental impact make it a preferred choice for sustainable industrial processes. Its importance lies in enabling cleaner manufacturing practices while meeting rising demand for high-performance chemicals in sectors like automotive and electronics.

On the other hand, the pharmaceutical grade segment is estimated to progress at the fastest CAGR of 8.7% during the forecast period owing to the increasing pharmaceutical production, as global spending on medicines reached $1.27 trillion in 2021, according to the IQVIA Institute for Human Data Science. The U.S. Food and Drug Administration emphasizes green chemistry adoption, favoring non-toxic catalysts like methane sulfonic acid. Additionally, the World Health Organization reports that chronic diseases account for 71% of global deaths annually, driving demand for advanced drug formulations. Methane sulfonic acid’s role in producing high-purity APIs ensures its critical importance in advancing healthcare innovation and sustainability.

By Application Insights

The pharmaceuticals segment dominated the market by capturing 40.3% of the global market share in 2024. The growth of the pharmaceutical segment is majorly driven by the usage of MSA as a catalyst and acidifying agent in drug synthesis. The global pharmaceutical spending reached $1.4 trillion in 2022 with demand rising due to aging populations and chronic diseases. Methane sulfonic acid’s non-oxidizing and biodegradable properties make it ideal for active pharmaceutical ingredient (API) production. The U.S. Food and Drug Administration emphasizes green chemistry adoption, further boosting its usage. Its importance lies in enabling sustainable, high-purity drug manufacturing while meeting stringent regulatory standards.

The electroplating segment is anticipated to expand at a significant CAGR of 8.5% over the forecast period due to the increasing demand for corrosion-resistant coatings in automotive and electronics industries. The International Energy Agency reports that electric vehicle (EV) sales surged by 60% in 2022 which is driving the need for advanced surface treatments using methane sulfonic acid. Methane sulfonic acid’s low toxicity and efficiency enhance its appeal. Its role in supporting cleaner industrial processes underscores its importance in achieving sustainability goals globally.

REGIONAL ANALYSIS

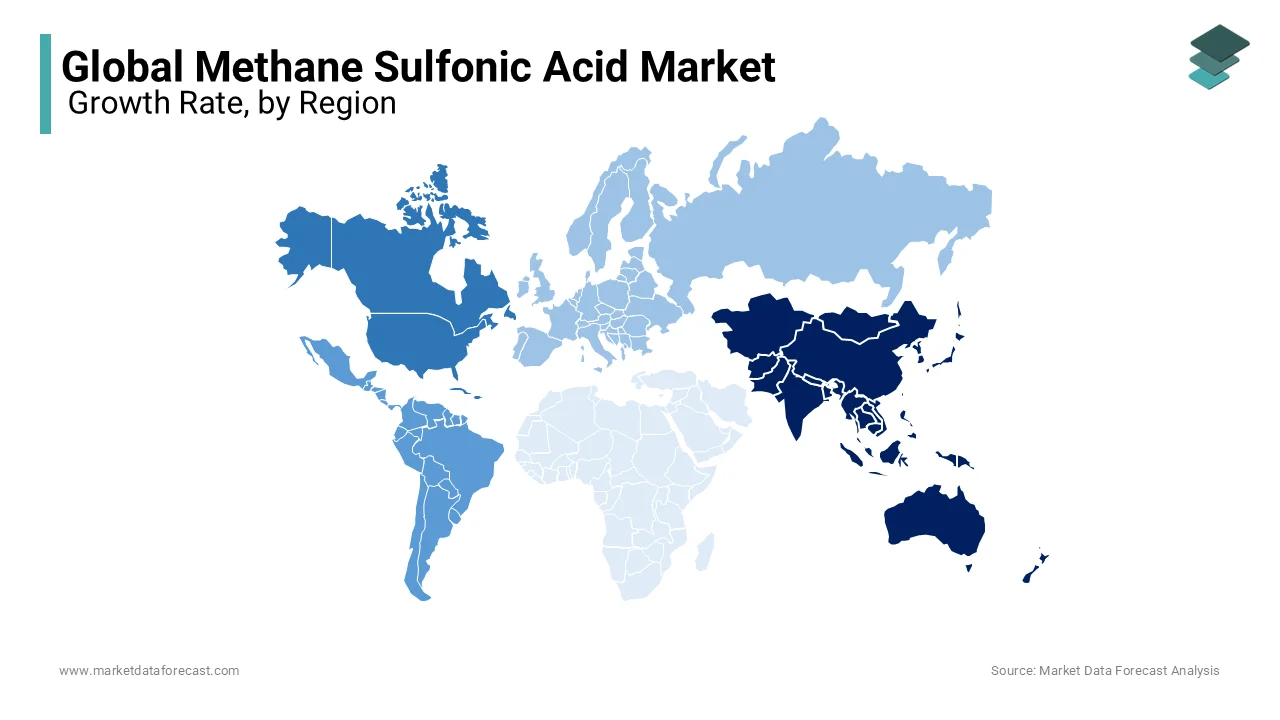

Asia-Pacific ruled the methane sulfonic acid market by holding 45.6% of the global market share in 2024. This is due to the rapid industrialization and particularly in China and India which possess a substantial portion of global chemical production growth (UNIDO). The region's emphasis on green chemistry aligns with methane sulfonic acid’s eco-friendly applications. Additionally, the International Energy Agency reports that Asia-Pacific accounts for a significant portion of global energy consumption that is fueling demand for cleaner alternatives like methane sulfonic acid. Its importance lies in supporting sustainable industrial processes while meeting rising regional demands.

Latin America is rapidly moving forward with a projected CAGR of 7.2% over the estimation years. This growth is fueled by increasing investments in agrochemicals and pharmaceuticals, sectors where methane sulfonic acid plays a critical role as a catalyst. Moreover, Latin America contributes 14% of global agricultural exports creating robust demand for advanced chemicals. Furthermore, the renewable energy projects in the region grew significantly each year between 2019-2022, boosting adoption of environmentally friendly acids. This trend underscores its significance in fostering sustainability and economic diversification.

North America is expected to experience steady growth. The regional development is driven by stringent environmental regulations such as those enforced by the U.S. Environmental Protection Agency (EPA). The region's focus on replacing hazardous chemicals with eco-friendly alternatives supports steady growth. According to the U.S. Department of Energy, renewable energy capacity in North America grew by 15% annually from 2020-2022 which is boosting demand for sustainable catalysts like methane sulfonic acid. While the market is mature, innovations in pharmaceuticals and electronics will sustain moderate growth. The region’s emphasis on sustainability ensures its continued relevance in global chemical advancements.

Europe is projected to witness moderate growth which is supported by strong regulatory frameworks like REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals). Eurostat reports that Europe reduced industrial carbon emissions by 30% since 1990 , driving adoption of green chemicals. The European Commission’s Green Deal aims for climate neutrality by 2050 and thereby further propelling demand. Additionally, Europe’s robust pharmaceutical and agrochemical industries contribute significantly to market stability. Europe will maintain steady growth, balancing innovation with environmental responsibility because of the increasing investments in bio-based products

The Middle East & Africa collectively expected to grow at a gradual pace. The ME region benefits from its petrochemical hubs, while Africa’s urbanization rate exceeds 4% annually which is creating new industrial opportunities. The African Development Bank shows a projected 3% GDP growth in Sub-Saharan Africa by 2024 with fostering infrastructure development and chemical demand. However, limited awareness and high costs hinder rapid adoption. Despite challenges, both regions are expected to witness gradual growth due to rising industrialization, foreign investments, and increasing focus on sustainable practices in manufacturing.

KEY MARKET PARTICIPANTS AND COMPETITIVE LANDSCAPE

BASF SE (Germany), Arkema SA (France), Varsal (US), TCI Chemicals (India) Pvt. Ltd. (India), Zhongke Fine Chemical Co.Ltd (China), HEBEI YANUO Bioscience Co.Ltd (China), Alfa Aesar (US), Avantor Inc.(US) are playing dominating role in the global methane sulfonic acid (MSA) market.

The Methane Sulfonic Acid (MSA) market is highly competitive, with several key players focusing on innovation, capacity expansion, and sustainability to strengthen their market position. Major global chemical companies, including BASF SE, Arkema Group, and Oxon Italia S.p.A., dominate the market, leveraging their expertise in specialty chemicals and large-scale production capabilities.

Competition in the MSA market is driven by product differentiation, where companies aim to develop high-purity and low-corrosion MSA formulations to cater to industries such as electroplating, pharmaceuticals, and biofuels. Companies like Arkema have introduced Methane Sulfonic Acid Low Corrosion (MSA LC) to improve process efficiency in biodiesel production while reducing corrosivity.

Sustainability has become a key factor influencing competition. BASF has focused on green chemistry, producing biodegradable and non-oxidizing MSA to meet rising environmental regulations. Similarly, emerging players and regional manufacturers are entering the market with cost-effective production techniques to challenge established brands.

Additionally, geographic expansion and strategic partnerships are common strategies to enhance market presence. Companies are expanding into Asia-Pacific and Latin America, where demand for eco-friendly industrial chemicals is growing. The MSA market is expected to remain competitive, driven by technological advancements and increasing industrial applications.

TOP 3 PLAYERS IN THE MARKET

BASF SE

BASF SE, a German multinational chemical company, is a major producer of MSA. The company has developed advanced production processes to manufacture high-purity MSA, which is utilized in applications such as electroplating, chemical synthesis, and as a catalyst in organic reactions. BASF's commitment to innovation and sustainability has reinforced its leading position in the MSA market.

Arkema Group

Arkema Group, headquartered in France, has been producing MSA for over 40 years. The company offers a comprehensive range of sulfonyls, including MSA and methane sulfonyl chloride (MSC). Arkema has developed various grades of MSA tailored to specific applications, such as electroplating, catalysis, and fine chemicals. Their MSA products are recognized for high purity and biodegradability, aligning with industry demands for environmentally friendly solutions.

Varsal Inc.

Varsal Inc., based in the United States, is a notable producer of MSA and its derivatives. The company specializes in the production of sulfonyl chemicals, including MSA, which are used in various applications such as electroplating and as intermediates in chemical synthesis. Varsal's focus on quality and customization has enabled it to serve diverse industrial needs effectively.

STRATEGIES USED BY THE MARKET PLAYERS

Capacity Expansion

Companies are investing in increasing their production capacities to cater to the rising demand for MSA across various industries. For instance, in May 2022, BASF announced the startup of a new MSA plant at its Ludwigshafen Verbund site, increasing its production capacity to 50,000 metric tons per year. This expansion aims to support customers' growth in dynamic markets by providing environmentally optimized, high-performance products.

Product Innovation

Developing new formulations and improving existing products allow companies to meet specific market requirements and enhance performance. Arkema, for example, has developed MSA LC (Methane Sulfonic Acid Low Corrosion), a strong acid esterification catalyst that improves yield for biodiesel producers using advantaged feeds, with significantly reduced corrosivity toward stainless steel materials.

Sustainability Initiatives

Emphasizing environmentally friendly production processes and sustainable product offerings aligns companies with global environmental standards and meets the increasing demand for green chemicals. MSA is recognized as a sustainable alternative to conventional acids due to its biodegradability and non-oxidizing nature. For example, BASF's Lutropur MSA is a high-purity methane sulfonic acid that is readily biodegradable and used in various applications ranging from chemical and biofuel synthesis to industrial cleaning and metal surface treatment in the electronics industry.

RECENT HAPPENINGS IN THE MARKET

- In February 2025, researchers from the University of KwaZulu-Natal published a study in ChemSusChem exploring the use of methane sulfonic acid (MSA) as a catalyst in organic synthesis. The research revealed MSA's biodegradability and effectiveness in promoting environmentally friendly chemical reactions, reinforcing its role as a sustainable acid in green chemistry.

- In December 2024, a study titled "Reactive extraction of methanesulfonic acid from wastewater using trioctylamine" was published in Scientific Reports. The research investigates the use of trioctylamine for the extraction of MSA from wastewater, aiming to develop efficient methods for removing MSA from industrial effluents, thereby reducing environmental impact and facilitating the recycling of valuable components.

MARKET SEGMENTATION

This research report on the global methane sulfonic acid market has been segmented and sub-segmented based on industrial grade, application, and region.

By Industrial Grade

- Industrial

- Pharmaceuticals

By Application

- Esterification

- Electroplating

- Pharmaceuticals

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

1. What is the projected market growth for Methane Sulfonic Acid by 2033?

The market is expected to reach USD 0.87 billion by 2033, growing at a CAGR of 4.32% from 2025 to 2033.

2. What are the key drivers of the Methane Sulfonic Acid market?

The key drivers include environmental benefits, industrial versatility, and growing energy storage and biodiesel production opportunities.

3. What are the challenges in the production of Methane Sulfonic Acid?

Production challenges include complex synthesis processes, high production costs, and regulatory constraints regarding its hazardous nature.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]