Global Metal Injection Molding Market Size, Share, Trends & Growth Forecast Report – Segmented By Material Type (Stainless Steel, Low Alloy Steel, Soft Magnetic Material and Others), End-use Industry (Electrical & Electronics, Automotive, Consumer, Industrial, Medical & Orthodontics and Firearms & Defense) and Region (North America, Latin America, Europe, Asia Pacific, Middle East & Africa) - Industry Analysis (2024 to 2032)

Global Metal Injection Molding Market Size (2024 to 2032)

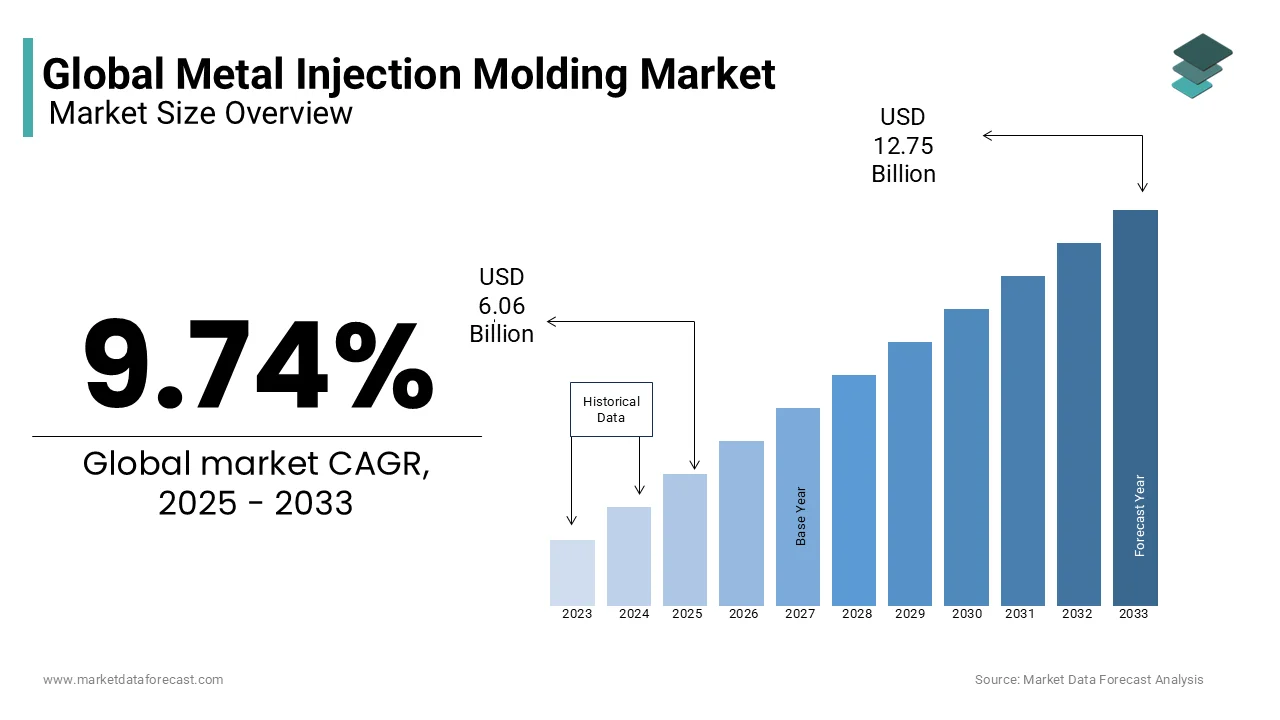

The Global metal injection molding market is expected to grow from USD 5.52 billion in 2024 to USD 11.61 billion in 2032, with a CAGR of 9.74% between 2024 and 2032.

Current Scenario of the Global Metal Injection Molding Market

Today, Metal injection molding (MIM) is an established technology. It is frequently employed in medical devices and other purposes for making large amount and highly reproductible cycles of metal elements necessitating intricate geometries, strict tolerance and superior performance benchmarks. This is because it gets over the design constraints of other metal fabrication processes and can make micro-sized, unique-shaped and thin-walled elements. Its greater manufacturing efficiency decreases operation expenses, and at the same time, regularly creating premium-quality components.

Moreover, the market also holds a notable share in the watchmaking industry since many decades, settling itself as an affordable production technology for ground-breaking watch designs. These can start from daily stainless steel watches to extravagance or luxury and diamond clad timepieces. One of the leading users of MIM is Casio watch company. In addition to watchmaking , MIM technology, to a lesser degree, along with casting have been the preferred techniques for bulk manufacturing in jewellery industry, however, both approaches have natural restrictions that constrain design possibilities.

Additionally, throughout the last decade, MIM has been recognised as a notably competitive technology for the production of small steel components of extreme precision and complication, which would be very expensive to make by other procedures.

MARKET DRIVERS

The growing demand for metal injection molding products from the healthcare industry, rising technological developments and the increasing demand lightweight & smaller automotive parts are the key driving factors for the metal injection molding market expansion.

The ability to manufacture large volumes of accurate components utilizing metal injection molding has seen its employment rise across the medical segment in past years. The Metal injection molding capacity tends to make the features for ongoing unique medical devices. The worldwide metal injection molding market is driven by less cost of raw materials, quick urbanization & industrialization, and a rise in investment in the manufacturing businesses. MIM technology is used in a broad range of segments like aerospace, automotive, telecommunications, optical, medical, and watch businesses. The metal injection molding market has been segmented into distinct applications, out of which, firearms have shown high expansion potential. The escalating call for lightweight & tiny automotive parts is also generating great opportunities for the MIM market.

Furthermore, the digitalization of manufacturing components worldwide is estimated to offer new opportunities in the market. An increasing call for miniaturized composite elements, which are employed as a high-performance material in many end-use businesses, is one of the major factors that is driving the expansion of the metal injection molding market during the estimated period. Furthermore, increasing calls for different medical equipment is also responsible for boosting the demand for metal injection molding. These metal injection moldings are employed in the manufacturing of medical micro-parts to be used in many medical techniques and processes. Some vascular therapies and some other medical processes like intravenous therapy, invasive surgery, and advanced drug delivery need correct devices that are made by utilizing the method of position of the art. Specialized manufacturing methods are needed to give intricate shapes to medical equipment. Metal injection molding has the ability to give such shapes that allow the expansion of the metal injection molding industry.

MARKET RESTRAINTS

The rising costs and side effects of raw materials derail the growth trajectory of the metal injection molding market. Moreover, the lack of trained professionals and strict laws and regulations are further obstructing market growth. Apart from this, flow lines, sink marks, surface delamination, weld lines, short shots, wrapping and jetting are the other technical challenges decreasing the expansion of the industry. Flow lines are made by shots of molten plastic coming at various speeds over the injection mold. This eventually leads to the formation of resin at several rates. In addition, the uneven internal contraction during the cooling procedure causes unintended bends or twists. Also, this increases the rejection rate of products, leading to monetary, material, and company image loss. Hence, the market is restricted by all these factors.

MARKET CHALLENGES

The metal injection molding market faces multiple challenges impeding its progress. MIM procedure is a complicated multi-stage production system that constitutes explicit technical issues at every stage. Complete planning and accurate control of each level is important to make sure of the final product’s quality .

In addition, this technology is perfect for small and medium-sized components, but not for the production of bigger parts because of the technical restrictions, especially with regards to the shedding of basic binders in the infused components. The option of material is also more constrained than those of other manufacturing techniques, since not all alloys and metals are appropriate for the MIM process.

MARKET OPPORTUNITIES

Circular economy and sustainability is believed to provide potential opportunities for the expansion of the metal injection molding market. In the age of green awareness, MIM emerges as an eco-friendly alternative to conventional or standard production methods. It lowers the overall carbon emissions, energy consumption, and material waste makes this market as a partner in the circular economy. In the coming years, the MIM is all set to experience an amplifying attention to maximising procedures to reduce trash or garbage and looking for environment-friendly materials, alluring ecologically-aware customers and industries.

Apart from this, automation adoption is another factor holding immense calibre to skyrocket the market growth rate. Automation is progressively gaining traction in almost every production technique, comprising metal injection molding and is anticipated to persistently follow this trend. More market players will accept these machine-driven or robotic processes.

Additionally, escalating requirement for compact or tiny and more accurate parts propel the advancement of micro-molding technologies, which will ultimately accelerate the market growth in the coming years. These components are used in wearable electronics and smaller appliances.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024 to 2032 |

|

CAGR |

9.74% |

|

Segments Covered |

By Material, End-user and Region. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa. |

|

Market Leaders Profiled |

Indo-MIM (India), Dynacast International (US), ARC Group Worldwide (US), Smith Metal Products (US), NetShape Technologies (US), Husky Injection Molding Systems Ltd, Injectamax International, LLC, Tanfel Metal, D&K ENGINEERING, Reaux Medical Molding, Mahler GmbH, BMI Fours Industriels, and Others. |

SEGMENTAL ANALYSIS

Global Metal Injection Molding Market Analysis By Material

The stainless-steel segments account for the biggest portion of close to 40 per cent of the metal injection molding market. It is widely used in several industries and will only grow with time fuelling the segment’s market demand. Moreover, companies have introduced MIM for mixing stainless with the least corrosion and high resistance for medical tools and equipment, firearms and other defence products, industrial equipment, automotive, consumer electronics, etc.

Global Metal Injection Molding Market Analysis By End-user

The automotive segment is the dominant category because of the heightening demand and extensive use of lightweight parts. The metal injection molding (MIM) method has gained traction due to the rising demand for high-strength and heavy components for electronic systems, lock mechanisms, transmission gears, steering systems, and turbochargers. For instance, Germany’s Schunk GmbH manufactures the rocker arms for MIM which are part of BMW engines. The electrical and electronics segment is also a major contributor to the metal injection molding market growth.

REGIONAL ANALYSIS

South America metal injection molding market is expected to grow at a moderate pace. This can be attributed to the fluctuating economic performance, and limited technological proves. Moreover, the expansion of the region’s market size is believed to be led by Brazil due to its growing automotive industry. According to the Anfavea, the production of automotive is anticipated to surge by 6.8 per cent in 2025 compared to 2024, reaching to total 2.75 million units. Another factor elevating its market share is the quicker deterioration of vehicles and requiring more components for regular maintenance owing to the absence of organised flow of traffic, inferior and in effective public transportation, heavy traffic, and poor situation of roads.

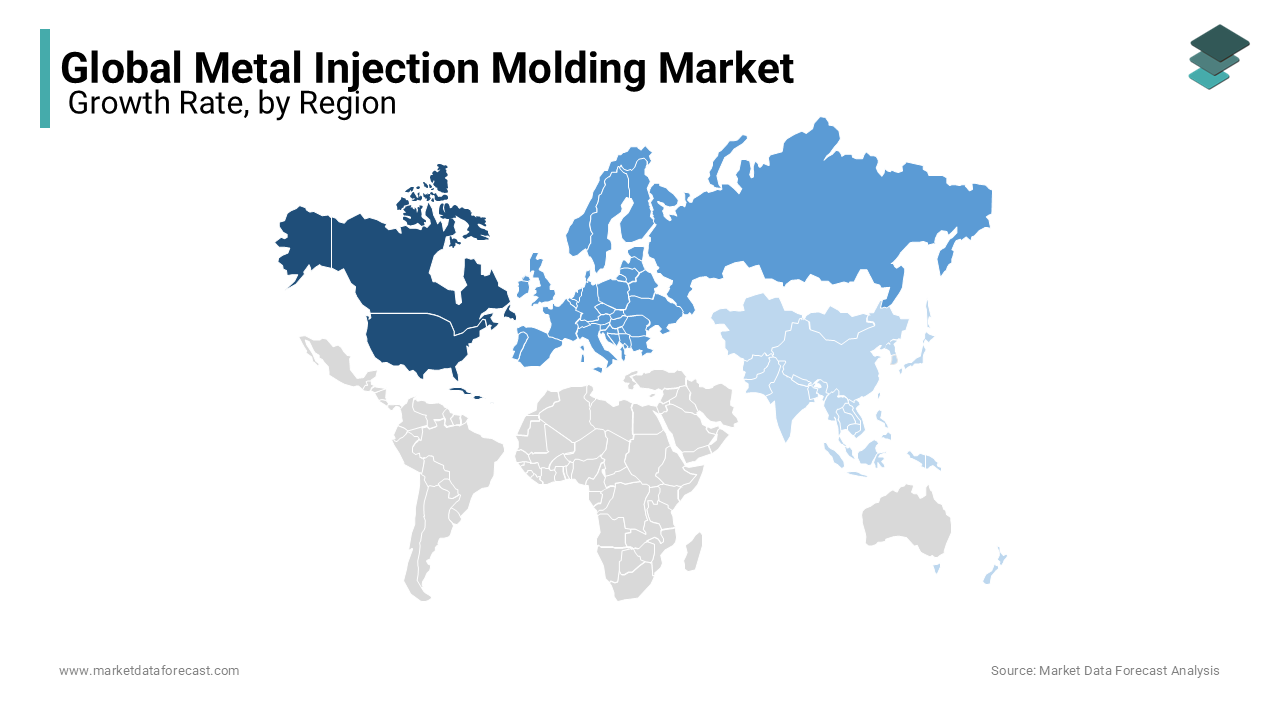

North America metal injection molding market is anticipated to expand at a faster rate in the coming years. The growing demand across different industries, but it is particularly high in healthcare, electronics, automotive, and electricals, driving the regional industry. Moreover, the rising application of lightweight materials in automobiles and technological developments are fuelling the NA’s market share. Europe holds a significant share of the metal injection molding market. The regional trend of a robust manufacturing ecosystem of consumer goods, medical tools, and defense items is propelling the industry forward. However, high energy prices and logistics expenses are key challenges for European companies. Asia Pacific is the fastest growing region which is led by India, China and Vietnam. The rising sale of consumer electronics, conventional fuel-based cars, and electric vehicles, and ease of doing business are boosting the regional demand. On the other hand, the Chinese metal injection molding industry had a tough year in 2023.

KEY PLAYERS IN THE GLOBAL METAL INJECTION MOLDING MARKET

Companies playing a prominent role in the global metal injection molding market include Indo-MIM (India), Dynacast International (US), ARC Group Worldwide (US), Smith Metal Products (US), NetShape Technologies (US), Husky Injection Molding Systems Ltd, Injectamax International, LLC, Tanfel Metal, D&K ENGINEERING, Reaux Medical Molding, Mahler GmbH, BMI Fours Industriels, and Others.

RECENT HAPPENINGS IN THE MARKET

- In December 2024, Mebus MIM-Technik, located in Neuhausen (Germany), press released that it has been purchased by the Medtech division, based in Develier (Switzerland) of Acrotec Group. Its product line comprises small and single-use premium surgical items, like forceps for endoscopic and laparoscopic instruments, screws for orthodontic treatment, or parts for waterjet surgery. Moreover, the clients base is from aerospace, mechanical engineering and other microtechnology industries. Besides, the purchase of Mebus is an ideal match for the enlarge the skills of Acrotec Medtech with actual experts in their domain.

- In December 2024, Tokyo (Japan) based Casio Computer Co Ltd launched a metal injection moulded ring watch to commemorate the 50th anniversary of Casio Watch. The recently created CRW-001-1JR miniature watch is the company’s first operational model in a ring size, measuring approximately ten times smaller than a traditional watch.

- In October 2024, Biomerics, the prominent contract manufacturer of integrated medical device in the market for interventional device, reported the introduction of its vertically integrated metal injection molding (MIM) services. With their latest MIM Center of Excellence, the company further improves its dedication to contract design and production merit in the metals sphere. Moreover, uniting MIM with their other premier micro metals processing abilities, Biomerics’s vertically aligned Micro Metals Division strengthens its manufacturing capabilities aiming to create an entire array of highly specialised and complicated interventional medical components and devices.

DETAILED SEGMENTATION OF THE METAL INJECTION MOLDING MARKET INCLUDED IN THIS REPORT

This research report on the global metal injection molding market has been segmented and sub-segmented based on material, end-use, and region.

By Material

- Stainless steel

- Low alloy steel

- Soft magnetic materials

- Others

By End-use

- Electrical and electronics

- Automotive

- Consumer

- Industrial

- Medical and orthodontics

- Firearms and Defense

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]