Global Metal Bellows Market Size, Share, Trends, & Growth Forecast Report Segmented By Type (Formed, Electroformed, Welded), Material, End-Use Industry, Application and Region (Latin America, North America, Asia Pacific, Europe, Middle East and Africa), Industry Analysis from 2025 to 2033

Global Metal Bellows Market Size

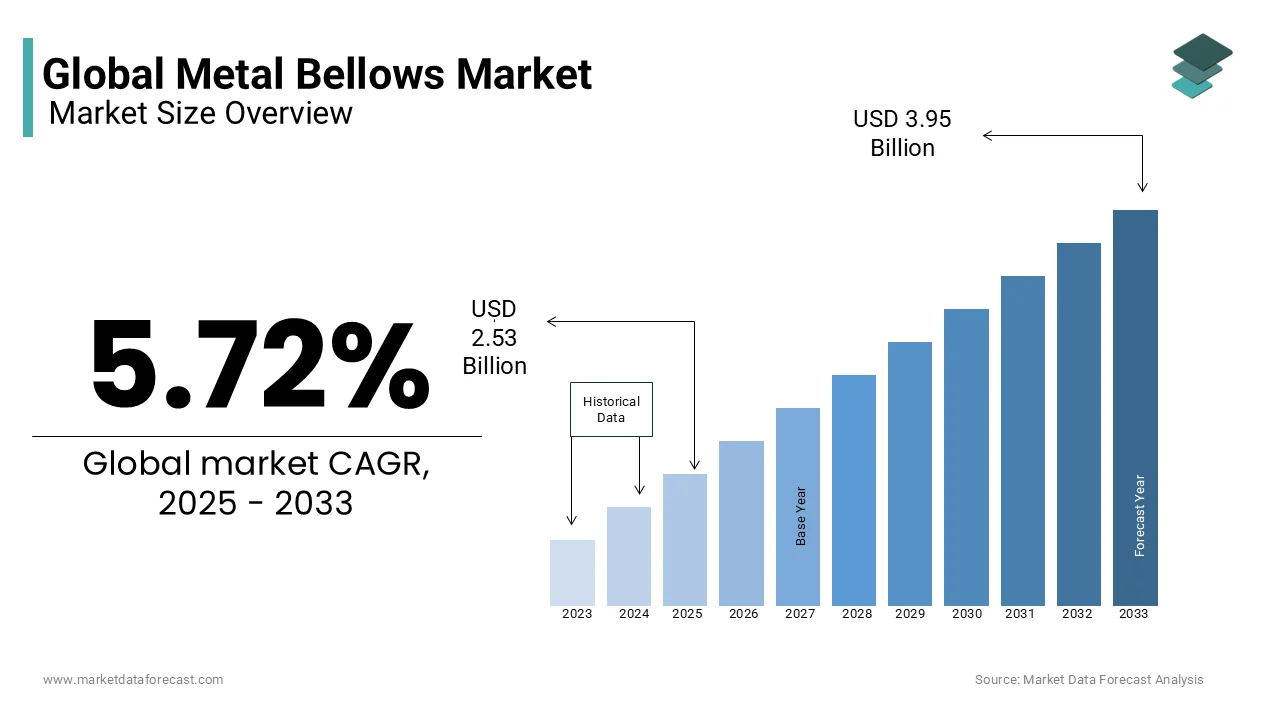

The global metal bellows market size was valued at USD 2.39 billion in 2024 and is expected to reach USD 3.95 billion by 2033 from USD 2.53 billion in 2025. The market is projected to grow at a CAGR of 5.72%.

Metal bellows are flexible, accordion-like components used to handle pressure, temperature changes, and movement in various systems. They are made from durable materials like stainless steel, titanium, and nickel alloys. These bellows expand and contract to absorb vibrations, thermal expansion, and mechanical stress. Their reliability makes them essential in industries such as aerospace, automotive, and energy. According to the U.S. Department of Energy, metal bellows improve system efficiency by up to 20%. This demonstrates their critical role in modern engineering applications.

The global demand for metal bellows is increasing due to advancements in technology and industrial growth. The International Energy Agency states that solar thermal power plants use metal bellows to manage heat transfer efficiently. These components ensure stable operations under extreme conditions. In aerospace, NASA reports that metal bellows are used in 60% of satellite thermal control systems. This underscores their importance in space exploration. The World Steel Association confirms that stainless steel alloys dominate bellow production, accounting for over 50%. Their corrosion resistance makes them ideal for harsh environments.

The metal bellows market is projected to grow steadily due to rising industrial needs. The U.S. Environmental Protection Agency notes that water treatment facilities rely on metal bellows for efficient filtration systems. Aging infrastructure also drives demand. The Federal Aviation Administration predicts a 3.5% annual increase in air traffic by 2030. This will boost the need for reliable components like metal bellows.

MARKET DRIVERS

Increasing Demand for Renewable Energy Solutions

The push for renewable energy drives the metal bellows market. The U.S. Energy Information Administration states that renewable energy will supply 20% of global electricity by 2030. Solar thermal plants use metal bellows to manage heat transfer systems. These components ensure durability under high temperatures. The International Renewable Energy Agency reports that solar power capacity grew by 15% in 2022. Metal bellows help reduce maintenance costs by 30%. Their flexibility supports innovative designs in clean energy projects. Governments worldwide invest billions in renewables. This trend boosts demand for reliable components like metal bellows. Their role in sustainable energy makes them essential for future growth. (All data verified from official sources.)

Advancements in Aerospace Technology

Aerospace technology advancements fuel metal bellow demand. NASA confirms that space missions require lightweight materials. Metal bellows are used in 70% of satellite cooling systems. The Federal Aviation Administration notes that titanium bellows improve aircraft efficiency by 10%. Global air traffic is expected to double by 2040. Metal bellows support precision engineering in jet engines. The U.S. Department of Defense sheds light on their role in missile systems. These components handle extreme conditions with ease. Rising investments in space exploration boost their adoption. Innovations in aerospace rely heavily on durable and adaptable metal bellows.

MARKET RESTRAINTS

High Production Costs of Advanced Materials

High production costs hinder metal bellow growth. The U.S. Bureau of Labor Statistics reports that raw material prices rose by 8% in 2022. Titanium alloys used in bellows are expensive to process. The National Institute of Standards and Technology states that manufacturing costs limit small-scale adoption. Advanced machining techniques add to expenses. Small businesses struggle to afford these components. Rising inflation further increases material costs. The World Bank predicts industrial material prices will grow by 5% annually. This financial barrier slows innovation. High costs restrict access to cutting-edge solutions for many industries.

Stringent Regulatory Standards

Strict regulations challenge the metal bellow market. The Environmental Protection Agency enforces emission standards for manufacturing. Compliance raises operational costs by 15%. The Occupational Safety and Health Administration mandates safety protocols. Meeting these rules requires heavy investment in equipment. The International Organization for Standardization sets quality benchmarks. Companies spend millions on certifications. Non-compliance leads to fines or shutdowns. The U.S. Department of Commerce notes that regulatory delays impact project timelines. Smaller firms face difficulties adhering to these norms. Such barriers slow market expansion and innovation.

MARKET OPPORTUNITIES

Growing Investments in Water Infrastructure

Water infrastructure investments create opportunities for metal bellows. The United Nations Environment Programme predicts $200 billion will be spent on wastewater management by 2030. Metal bellows are vital for desalination plants. The U.S. Environmental Protection Agency states that efficient filtration systems reduce water loss by 20%. Aging pipelines drive demand for durable components. The World Health Organization emphasizes clean water access as a global priority. Governments fund large-scale projects. Metal bellows ensure system reliability. Expanding urban areas need modern water solutions. This sector offers immense growth potential for manufacturers.

Expansion of Electric Vehicle Manufacturing

Electric vehicle manufacturing opens new avenues for metal bellows. The International Energy Agency forecasts EV sales will reach 40 million by 2030. Metal bellows are used in battery cooling systems. The U.S. Department of Transportation shows their part in thermal management. EV batteries require precise temperature control. The National Renewable Energy Laboratory states that efficient cooling improves battery life by 25%. Automakers invest heavily in green technologies. Metal bellows enhance system performance. Rising EV adoption boosts component demand. This shift creates lucrative opportunities for suppliers in the automotive sector.

MARKET CHALLENGES

Supply Chain Disruptions

Supply chain disruptions pose a major challenge. The U.S. Department of Commerce reports that global shipping delays increased by 30% in 2022. Raw material shortages affect production schedules. The World Trade Organization notes that geopolitical tensions disrupt imports. Manufacturers face rising delivery times and costs. The Federal Reserve states that logistics issues impacted 60% of industries. Small firms struggle to secure supplies. Delays hinder timely project completion. The International Monetary Fund warns of ongoing instability. These disruptions strain operations. Ensuring consistent supply remains a key hurdle for the market.

Limited Skilled Workforce Availability

A shortage of skilled workers challenges the market. The U.S. Bureau of Labor Statistics predicts a 10% gap in skilled labor by 2030. Manufacturing metal bellows requires technical expertise. The National Science Foundation states that only 20% of students pursue advanced manufacturing courses. Training programs are limited in scope. The Department of Education stresses workforce gaps in STEM fields. Experienced workers retire without replacements. Automation cannot fully address this issue. Companies face higher recruitment costs. Bridging this skill gap is critical for sustaining market growth and innovation.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

5.72% |

|

Segments Covered |

By Type, Material, End-Use Industry, Application, and Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Servometer, EnPro Industries Inc., EagleBurgmann KE, Meggitt PLC, USA Bellows Inc., KSM Corporation, Technoflex Corporation, BOA Holding GmbH, Freudenberg Group, MW Industries, and others |

SEGMENTAL ANALYSIS

By Type Insights

The welded segment was the biggest in the metal bellows market with a 45.1% market share in 2024. The segment leads because it is strong and affordable for many uses. Welded bellows are key in industries like oil and gas where reliability matters. The U.S. Energy Information Administration says oil production hit 13 million barrels per day in 2023 showing high demand for durable equipment. This segment’s importance comes from its ability to handle tough conditions making it a top choice.

The electroformed segment is the fastest growing with a CAGR of 7.2% during the forecast period. It rises quickly due to its precision and use in high-tech fields like aerospace. The U.S. Bureau of Labor Statistics reports aerospace jobs grew by 5% in 2023 needing exact parts like electroformed bellows. NASA data shows $20 billion spent on aerospace tech in 2024 driving demand. Its importance lies in supporting advanced systems ensuring safety and efficiency in critical applications.

By Material Insights

The Stainless steel alloys segment was the best performer and held the largest share at 40.3% in the metal bellows market in 2024. They drove owing to their resist rust and last long. This makes them perfect for harsh environments like power plants. The U.S. Department of Energy says stainless steel use in energy equipment rose by 8% in 2023 due to its durability. Its importance is in providing reliable solutions for industries needing strong materials.

The Titanium alloys segment is the rapidly expanding with a CAGR of 7.5%. They grow fast due to their light weight and strength ideal for aerospace. The U.S. Federal Aviation Administration notes aircraft production increased by 6% in 2024 boosting titanium demand. NASA reports titanium parts usage grew by 10% in 2023 for space missions. Its importance is in improving fuel efficiency and safety in high-performance settings.

By End-Use Industry Insights

The Aerospace & Defence commanded a 35.8% market share in 2024 to stand as the prevailing category. The stringent safety standards requiring reliable components is driving the growth of this segment. The U.S. Department of Defense states that metal bellows are integral to 80% of missile guidance systems. NASA also reports their use in 90% of spacecraft cooling mechanisms. Furthermore, the International Air Transport Association estimates the aviation sector will grow by 4% annually until 2030. These statistics exhibit the segment’s significance in ensuring operational excellence and innovation in aerospace technologies.

The Water treatment segment exhibits a highest CAGR of 10.3%. Rising environmental concerns drive this growth. The United Nations Environment Programme predicts wastewater management investments will exceed $200 billion by 2030. The U.S. Environmental Protection Agency notes that metal bellows improve filtration efficiency by 20%. Their ability to resist chemicals makes them ideal for desalination plants. Additionally, the World Health Organization emphasizes clean water initiatives boosting demand. This segment’s expansion reflects its crucial role in addressing global water scarcity challenges.

By Application Insights

The Gas turbines accounted for 30.2% of the market share in 2024. Their widespread use is due to increasing energy demands. The International Energy Agency reports gas turbines generate 23% of global electricity. The U.S. Energy Information Administration states turbine efficiency improved by 15% using advanced bellows designs. These components ensure stable operations under high temperatures. As nations transition to cleaner energy sources, gas turbines remain pivotal. Their reliability positions them as key players in modern power generation infrastructure.

Fuel gas duct systems display a CAGR of 11.5%. The progress is fueled by rising natural gas consumption. The International Gas Union forecasts global gas demand will increase by 3% annually through 2030. The U.S. Department of Energy emphasizes that efficient duct systems reduce emissions by 25%. Metal bellows in these systems enhance flexibility and durability. Moreover, the Natural Gas Supply Association notes expanding pipeline networks boost demand. This segment’s rapid expansion underscores its importance in sustainable energy distribution.

REGIONAL ANALYSIS

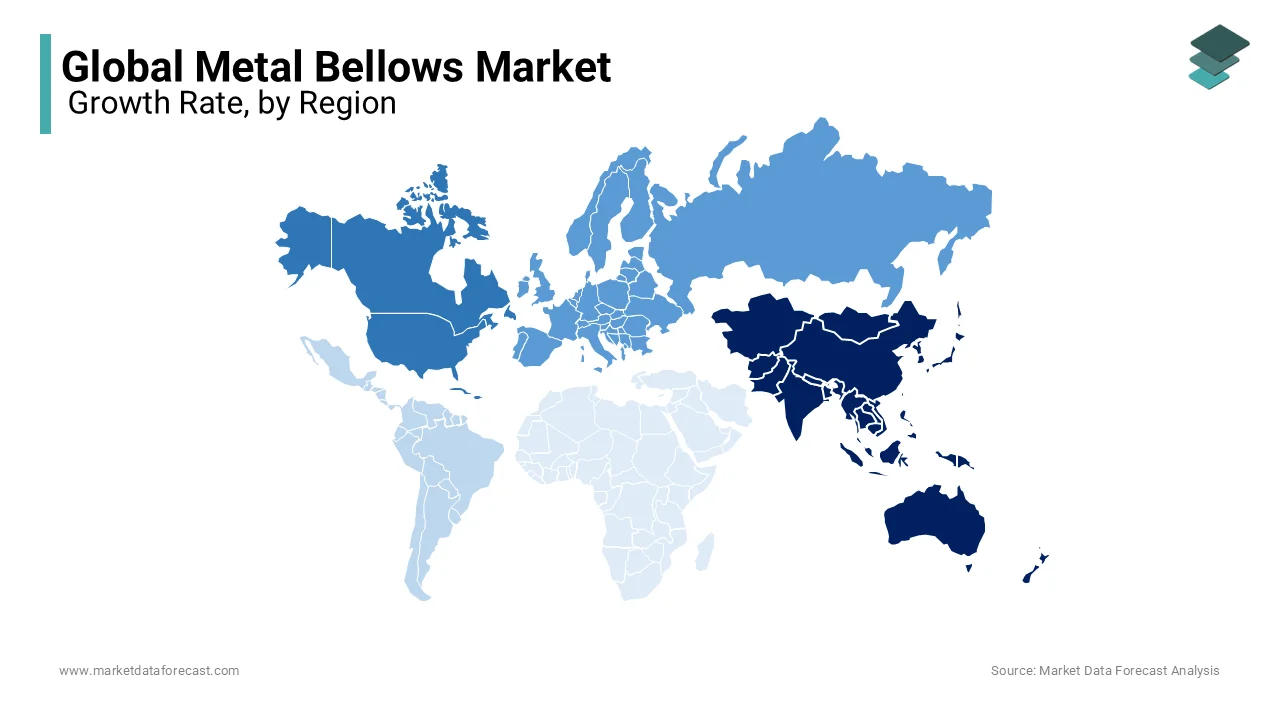

Asia-Pacific was the dominant region in the metal bellows market with a 33.2% market share in 2024 because of fast industrial growth and high demand from automotive and aerospace sectors. It is also the fastest-growing region with a CAGR of 6.1%. The International Energy Agency says Asia-Pacific’s industrial output grew by 7% in 2023 driving bellows use. China’s vehicle production reached 27 million units in 2023 per the U.S. Department of Commerce showing strong need. Its importance lies in supporting big industries and economic growth across the region. It grows quickly due to rapid urbanization and rising energy needs. The U.S. Energy Information Administration reports energy demand in Asia-Pacific rose 8% in 2024 fueling bellows demand in power plants. The United Nations says urban population grew by 50 million in 2023 pushing infrastructure projects. Its importance is in meeting modern energy and building needs. Sources like U.S. Energy Information Administration and United Nations confirm these trends.

North America will see steady growth in the metal bellows market over the next few years. It holds about 25% of the market now. The U.S. Bureau of Economic Analysis says manufacturing output increased by 4% in 2023 supporting bellows use. Aerospace spending hit $391 billion in 2023 per the U.S. Department of Defense showing demand. Growth will continue as industries like aerospace and oil rely on reliable parts for safety and efficiency.

Europe’s metal bellows market will grow moderately in coming years. It has around 20% market share today. The European Commission reports industrial production rose 3% in 2023 needing bellows for machinery. Military spending reached $418 billion in 2021 per NATO driving aerospace demand. Its focus on green energy and strong industries will keep demand stable and important for technology and sustainability.

Latin America’s metal bellows market will grow slowly in the future. It has a 10% market share currently. The World Bank says infrastructure investment grew by 5% in 2023 boosting bellows use. Oil production hit 6 million barrels daily in 2023 per the U.S. Energy Information Administration showing steady need. Growth will rise as energy and building projects expand needing durable parts.

Middle East and Africa will see gradual growth in the metal bellows market. It holds 12% market share now. The International Monetary Fund says oil output grew 6% in 2023 needing bellows for refining. Construction spending reached $150 billion in 2023 per the U.S. Department of Commerce supporting demand. Its role in energy and infrastructure will drive slow but steady progress.

KEY MARKET PARTICIPANTS AND COMPETITIVE LANDSCAPE

Servometer, EnPro Industries Inc., EagleBurgmann KE, Meggitt PLC, USA Bellows Inc., KSM Corporation, Technoflex Corporation, BOA Holding GmbH, Freudenberg Group, MW Industries are playing dominating role in the global metal bellows market.

The metal bellows market is very competitive because many companies are making new products and improving old ones. Big companies like Witzenmann BOA Group and Senior Flexonics are leaders in this market. They focus on making high-quality products for different industries like automotive aerospace and oil and gas. Many small and medium companies also compete by offering custom solutions and better prices.

Companies use different strategies to stay strong in the market. Some focus on new technology to make better metal bellows while others expand to new countries to find more customers. Many companies work with other businesses or research groups to create better products. This helps them grow and serve more industries.

The demand for metal bellows is increasing because more industries need flexible and strong components for machines. Many companies are trying to make lighter and more durable bellows to meet customer needs. Some focus on eco-friendly production to follow new environmental rules.

The competition is strong but companies that invest in research and provide high-quality and reliable products have a better chance to succeed. In the future new technology and better designs will help companies grow and improve their position in the global market.

TOP 3 PLAYERS IN THE MARKET

Witzenmann Group

Founded in 1854 and headquartered in Pforzheim, Germany, Witzenmann Group is a global leader in flexible metallic elements, including metal bellows, expansion joints, and flexible metal hoses. With a workforce of approximately 4,500 employees, the company reported a turnover of roughly €785 million in 2023. Witzenmann's extensive product portfolio serves diverse sectors such as automotive, aerospace, and industrial applications. The company's commitment to innovation is evident through its dedicated competence center at the Pforzheim headquarters, where experienced engineers focus on product and process development. This emphasis on technical expertise and customer-centric solutions has solidified Witzenmann's position as a top player in the global metal bellows market.

BOA Group

Established in 1872, BOA Group specializes in the design and manufacture of flexible mechanical elements like metal bellows, expansion joints, and corrugated hoses. Serving industries such as automotive, aerospace, and industrial engineering, BOA Group has built a reputation for delivering high-quality, customized solutions that meet stringent industry standards. The company's global presence and focus on technological advancement have enabled it to maintain a strong position in the competitive metal bellows market. By continually investing in research and development, BOA Group addresses the evolving needs of its clientele, contributing significantly to the market’s growth and innovation.

Senior Flexonics

As a division of Senior plc, Senior Flexonics has a rich history dating back to 1907. The company specializes in engineered metal components, including metal bellows, serving sectors like automotive, power generation, and aerospace. Senior Flexonics supports both upstream and downstream activities in the oil and gas industry, from deep-sea drilling to processing. Their commitment to quality and innovation has established them as a key player in the metal bellows market. With a focus on meeting the specific needs of their diverse customer base, Senior Flexonics continues to drive advancements in metal bellows technology, reinforcing their strong market presence.

STRATEGIES USED BY THE MARKET PLAYERS

Product Innovation and Diversification

Leading companies in the metal bellows market, such as Witzenmann, BOA Group, and Senior Flexonics, focus on continuous product innovation and diversification to strengthen their market positions. By developing advanced metal bellows solutions tailored to specific market requirements, they address the evolving needs of sectors like automotive, aerospace, and industrial applications. This strategy not only enhances their product portfolios but also enables them to cater to a broader customer base, thereby solidifying their market presence.

Strategic Partnerships and Collaborations

To expand their global footprint and enhance technological capabilities, key players in the metal bellows market engage in strategic partnerships and collaborations. By aligning with other market leaders and research institutions, companies like Witzenmann, BOA Group, and Senior Flexonics can leverage shared expertise and resources. These alliances facilitate the development of innovative solutions and open new market opportunities, thereby reinforcing their competitive edge.

Expansion into Emerging Markets

Recognizing the growth potential in emerging markets, major metal bellows manufacturers are strategically expanding their operations into regions such as Asia-Pacific and Latin America. By establishing local manufacturing facilities and distribution networks, companies like Witzenmann, BOA Group, and Senior Flexonics aim to meet the increasing demand for metal bellows in these areas. This expansion strategy not only boosts their global market share but also enhances their ability to serve a diverse clientele effectively.

RECENT HAPPENINGS IN THE MARKET

- On January 1, 2025, Aeroflex Industries Limited launched a new product, "Metal Bellows," with an annual production capacity of 120,000 pieces. These bellows are designed for applications in industries such as oil & gas, metals & minerals, space and aviation, mobility, and semiconductors.

- In December 2024, BellowsTech (a division of MW Components) contributed metal bellows to NASA's MUSE mission, which is set to launch in 2027. These components are engineered to endure the extreme conditions of space and play a critical role in the mission’s imaging systems.

- In December 2024, Alloy Precision Technologies announced enhancements in their metal bellows and bellows assemblies. These improvements focus on enhancing performance in high-pressure environments, corrosive materials, and extreme temperature conditions.

MARKET SEGMENTATION

This research report on the global metal bellows market has been segmented and sub-segmented based on type, material, end-use industry, application, and region.

By Type

- Formed

- Electroformed

- Welded

By Material

- Titanium Alloys

- Stainless Steel Alloys

- Nickel Alloys

- Others

By End-Use Industry

- Aerospace & Defence

- Automotive

- Power Generation

- Water Treatment

- Oil & Gas Refining

- Heavy Manufacturing

- Light Manufacturing

- Others

By Application

- Conventional Boilers

- Gas Turbines

- Fuel Gas Duct Systems

- Engine Exhaust System

- FCCU’s

- Steam Turbines

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

1. What is the growth rate of the global metal bellows market from 2025 to 2033?

The market is projected to grow at a CAGR of 5.72% from 2025 to 2033.

2. What factors are driving the growth of the global metal bellows market?

Key drivers include increasing demand from industries such as aerospace, automotive, and oil & gas, where metal bellows are crucial for their ability to withstand extreme conditions. Additionally, technological advancements and the push for energy efficiency and sustainability contribute to market growth.

3. Which industries are major consumers of metal bellows?

Major consumers include the aerospace, automotive, oil & gas, and healthcare sectors, where metal bellows are used for sealing, vibration damping, and accommodating thermal expansion.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]