Global Membranes Market Size, Share, Trends & Growth Forecast Report - Segmentation By Type (Polymeric, Ceramics and Others), Technology (Ultrafiltration (UF), Reverse Osmosis (RO), Gas Separation, Nanofiltration (NF), Pervaporation, Microfiltration (MF) and Others), Application (Water & Wastewater Treatment, Food & Beverages, Medical & Pharmaceuticals, Industrial Gas Processing and Others) and Region (North America, Europe, Asia Pacific, Latin America, Middle East, and Africa) - Industry Analysis (2024 to 2032)

Global Membranes Market Size (2024 to 2032)

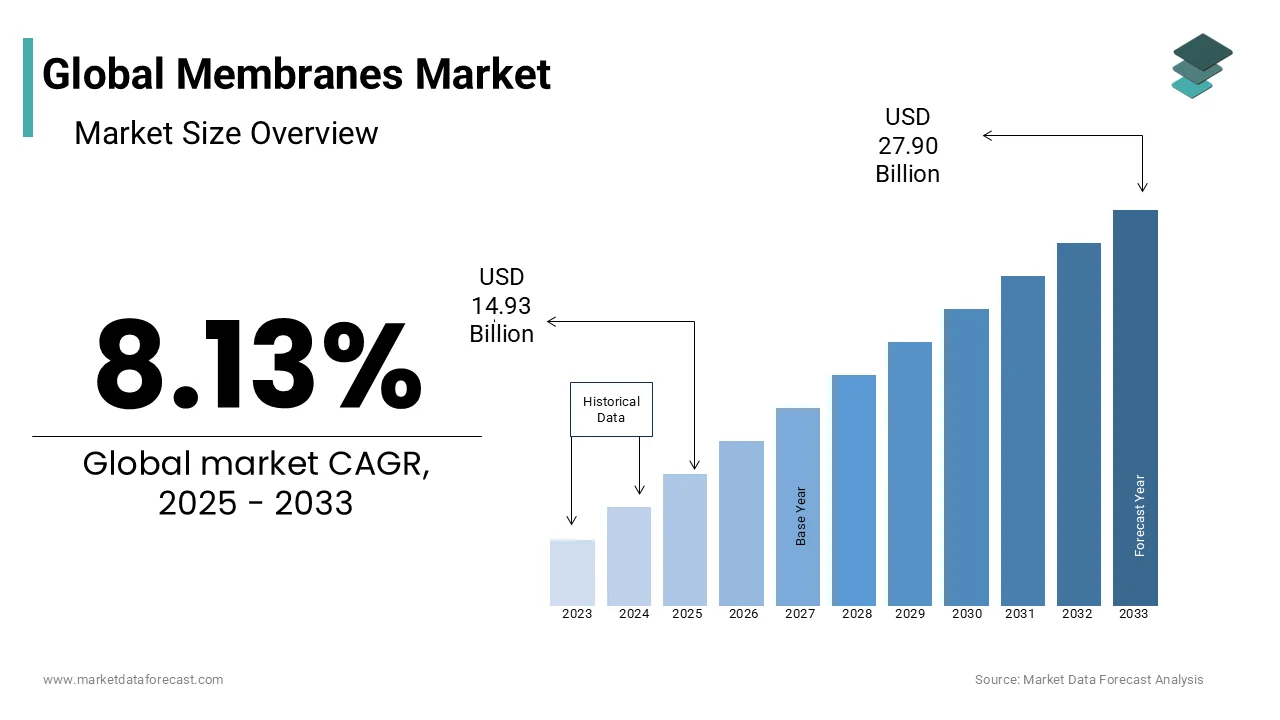

The global membranes market size is expected to be worth USD 13.81 billion in 2024 and USD 25.81 billion by 2032, growing at a CAGR of approximately 8.13% during the forecast period 2024 to 2032.

Current Scenario of the Global Membranes Market

Membrane companies remain appealing to water technology investor who continue to fund due to local demands and worldwide issues. There is strong indication that these financiers are searching for opportunities to expedite the accessibility of unique membrane technologies. Moreover, recently made technologies in this field may vary in method and usage, yet they all have common objectives of lowering costs and consumption, at the same time, increasing quality and ensuring availability of water without affecting groundwater.

The market saw the latest series of funding exhibits that water investors continue to be eager to invest in membrane technology organizations. Alongside financial returns, many sponsors consider this technology as a viable solution to the water scarcity challenges that will increasingly impact communities and industries globally.

The United Nations anticipates 2.2 billion individuals do not have access to carefully manged drinking water services. It is estimated that by 2050, 50 per cent of the world’s population could be living in areas facing water stress. Several industries already function within storage basin catchment zones are suffering from significant water shortages. As demand continues to rise, freshwater sources are becoming increasingly strained.

MARKET DRIVERS

The escalating population worldwide and the increasing water crisis demand purified and fresh water, which is contributing majorly to the global membranes market's growth.

There is a growing demand for fresh drinking water, as drinking water is essential for the survival of human life. The rising advancements in technology are playing a crucial role in water filtration as the advancements in membrane designs and effectiveness are enhancing the conversion of seawater into potable water, which is fueling the adoption of membranes by enhancing market growth. People from the Middle East and Africa widely depend on desalination plants for many activities such as farming, industrial, and daily requirements. This dependency is increasing the adoption of membranes for filtration, which augments the global market revenue. The increasing awareness about wastewater treatment and the water conservation process due to rising water crises across the world is accelerating the membrane filtration process by increasing the market share of membranes. The growing demand for membranes for water treatment due to shifting towards physical water treatment rather than chemical treatment methods for maintaining water quality standards positively impacts the market expansion worldwide.

Stringent rules and regulations by regulatory authorities in maintaining the quality of water and water treatment procedures are propelling the adoption of membrane filtration procedures by enhancing market revenue. The increasing demand for treated water in emerging economies is expected to expand the market size in the forecast period.

MARKET RESTRAINTS

Fabrication issues are impeding the growth of the membranes market. The choice of materials is important in manufacturing because it influences the chemical and physical qualities of the final product. Normal materials comprise of additives, solvents, and polymers. The application of non-degradable plastics and possibly harmful chemicals raises issues about ecological sustainability and individual health. In addition, picking appropriate matter that gives the required electrical strength and chemical resistance is crucial for applications in harsh environments.

Problems also persist in this market regarding the selective transport of particular species, including the extraction of Li+ from brine. The commercially accessible membranes utilized in pressure-driven processes like NF and RO do not have the ability to attain such specific selectivity owing to the dense polymer layer is devised to restrict the movement of most solutes, permitting only water molecules to flow through. In the same way, the majority of IEX membranes in electrodialysis (ED) procedures are incapable of selectively distinguishing between ions with the same charge or handling neutral solutes.

MARKET OPPORTUNITIES

The increasing water crisis in most developing and underdeveloped countries is estimated to provide significant market growth opportunities due to the adoption of membrane filtration for water recycling and conservation in the coming years. The increasing global water pollution, which is impacting freshwater availability, is enhancing the demand for filtration methods and fuels the market value. Growing environmental concerns are accelerating the regulatory bodies to frame stringent regulations for discharging industry waste into the water. The implementation of zero discharge is new, and membranes play a crucial role in meeting the goal of zero liquid discharge, which is expected to propel the market growth during the forecast period.

MARKET CHALLENGES

The major challenge for market expansion in the coming years is the life span and efficiency of membranes. The membranes used in the separation process should be replaced after 2 to 5 years. During the water treatment process, certain components present in the water, such as microorganisms, colloids, or proteins, form a layer on the surface. Fouling and scaling of these particles on the membrane surface decreases the efficiency of the membranes, which hampers their adoption.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024 to 2032 |

|

CAGR |

27.30% |

|

Segments Covered |

By Type, Technology, Application, and Region. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Dow Chemical Company (U.S.), LG Water Solutions (U.S.), Merck Millipore (Germany), Pentair plc (U.K.), Toray Industries (Japan), Koch Membrane Systems, Inc. (U.S.), Carlisle SynTec Systems (U.S.), Asahi Kasei Corporation (Japan), Danaher Corporation (U.S.), Firestone Building Products Company, LLC (U.S.), GE Water & Process Technologies (U.S.), Hydranautics (U.S.), and Others. |

SEGMENTAL ANALYSIS

Global Membranes Market Analysis By Type

The polymeric sector leads the global membranes market due to its extensive usage in wastewater treatment in industries. However, ceramic membrane technology has witnessed an increase in applications in various work fields, thus making it the fastest-growing industry in the forecast period. Moreover, ceramic film technology shows exceptional stability in both thermal and chemical situations, displays a tendency of low fouling, and provides long-term application, giving it of paramount significance in the treatment of polluted water. Additionally, the segment witnessed its market size expanding as many countries, comprising Singapore, Japan, the United States, and the United Kingdom, have developed extensive treatment plants to harness the potential of ceramic membrane technology in the field of water and impure water processing or management

Global Membranes Market Analysis By Technology

Among the mentioned variety of technologies, the RO sector has accounted for the maximum market share in 2023, as it is cost-effective in nature. However, the nanofiltration sector is estimated to grow with the highest growth rate in the forecast period, owing to the increasing NF technology usage in the separation of tiny salt particles from wastewater. Further, between distinct technologies, NF films manufactured using interfacial polymerization have been getting interdisciplinary attraction because of their simple change, comparative ease, and affordability.

Global Membranes Market Analysis By Application

In 2023, the water & wastewater treatment segment had the highest share in the global market applications. The increased demand for water desalination units led to this application dominating the market. The medical & pharmaceutical sector of application is expected to grow with the maximum growth rate, owing to the increasing number of end-user industries worldwide.

REGIONAL ANALYSIS

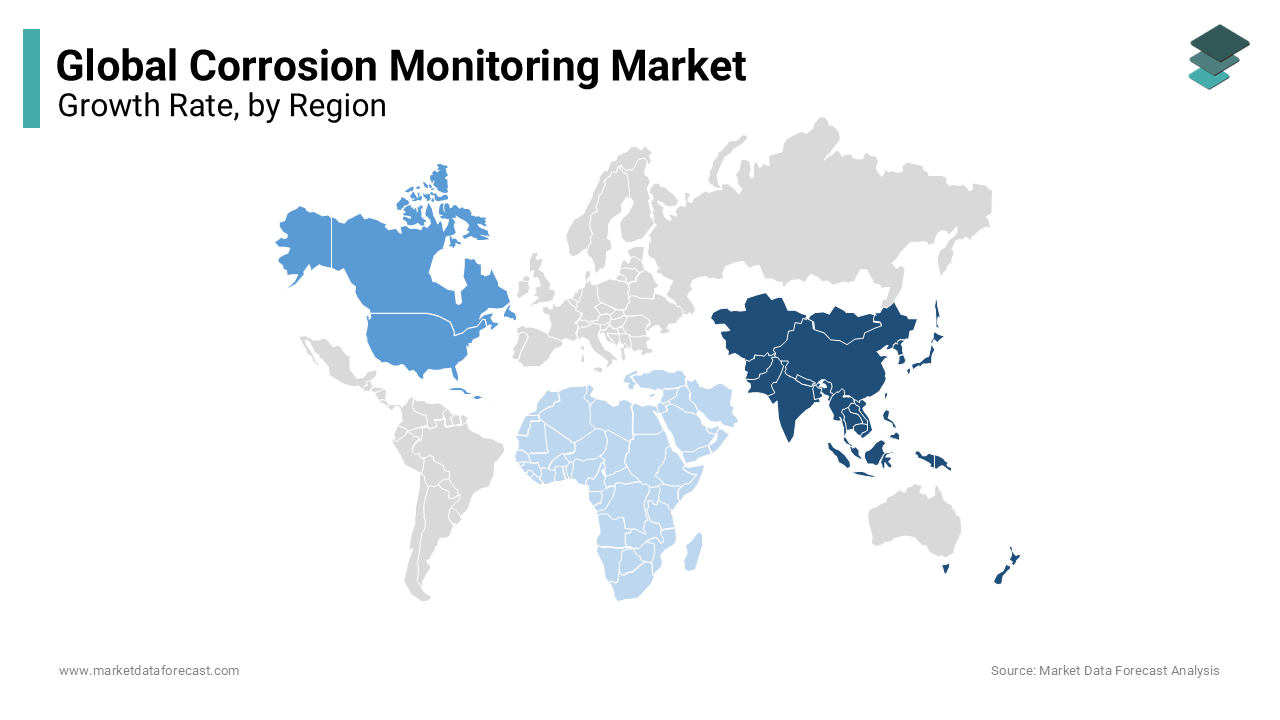

Asia Pacific had the largest global market share in 2023 and is expected to be the fastest-growing market in the forecast period due to its high CAGR, increasing demand for growing industries, and the scope of future opportunities, mainly in developing countries like Japan, India, and China.

The market value of Europe and North America are next in the lead, following the Asia Pacific. The regional advantages offered, like cheap labor and ease of resource availability, make the global market concentrated in the Asia Pacific, making North America and Europe slow-growth markets.

The Middle East & Africa and Latin America regions, being in the low developing countries due to low GDP countries' contribution, have fewer chances for industry growth. Hence, the membrane market in these regions is slow to grow.

KEY PLAYERS IN THE GLOBAL MEMBRANES MARKET

Companies playing a prominent role in the global membranes market include Dow Chemical Company (U.S.), LG Water Solutions (U.S.), Merck Millipore (Germany), Pentair plc (U.K.), Toray Industries (Japan), Koch Membrane Systems, Inc. (U.S.), Carlisle SynTec Systems (U.S.), Asahi Kasei Corporation (Japan), Danaher Corporation (U.S.), Firestone Building Products Company, LLC (U.S.), GE Water & Process Technologies (U.S.), Hydranautics (U.S.), and Others.

RECENT HAPPENINGS IN THE MARKET

- In December 2024, an academic explorer at the University of Texas at El Paso (UTEP) reported the success in the development of a technique of brine desalination. With this method, it can transform 90 per cent of salt water into fresh water, and at the same time, retrieving more valuable materials compared to the traditional procedures that depend exclusively on Reverse Osmosis (RO). Currently, she pursuing a doctorate particularly designed and proposed a salt-free electrodialysis metathesis method which is an innovative approach for desalinating brine or saline water. This technique is outlined in the December 2024 issue of Desalination and contrasts with RO.

- In November 2024, a study published in Nature Communications indicated that TPM1 nanoparticles are capable of binding to PD-L1 located on the cell membranes of diverse tumor cells with elevated PD-L1 levels. It leads to the formation of fibrillar networks on the cell surface triggered by this binding, including in cases of lung, hepatocellular, and breast cancer cells. Moreover, TPM1 nanoparticles showed sustained retention on cell membranes. They were taken up by cells exhibiting low levels of PD-L1 protein through micropinocytosis-, caveolae- or clathrin-dependent endocytosis. Similarly, TPM3 and TPM2 nanoparticles were absorbed by tumor cells displaying high PD-L1 levels and were primarily degraded within lysosomes.

DETAILED SEGMENTATION OF MEMBRANES MARKET INCLUDED IN THIS REPORT

This research report on the global membranes market has been segmented and sub-segmented based on type, application, and region.

By Type

- Polymeric

- Ceramics

- Others

By Technology

- Ultrafiltration (UF)

- Reverse Osmosis (RO)

- Gas Separation

- Nanofiltration (NF)

- Pervaporation

- Microfiltration (MF)

- Others

By Application

- Water & Wastewater Treatment

- Food & Beverages

- Medical & Pharmaceuticals

- Industrial Gas Processing

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Frequently Asked Questions

1. What is the membranes market growth rate during the projection period?

The global membranes market is expected to grow with a CAGR of 8.13% between 2024-2029.

2. What can be the total membranes market value?

The global membranes market size is expected to reach a revised size of US$ 18.88 billion by 2029.

3. What are the top 5 key players in the membranes market?

Koch Membrane Systems, Inc. (U.S.), Carlisle SynTec Systems (U.S.), Asahi Kasei Corporation (Japan), Danaher Corporation (U.S.), and Firestone Building Products Company, LLC (U.S.) are top key players in the membranes market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]