Global Medium and Heavy-Lift Helicopters Market Size, Share, Trends, & Growth Forecast Report by Point of Sale (OEM and Aftermarket), Number of Engines (Single engine and Twin Engine), Type (Medium-lift and Heavy-lift), Application (Military, Civil and Commercial) & Region, Industry Forecast From 2024 to 2033

Global Medium and Heavy-Lift Helicopters Market Size

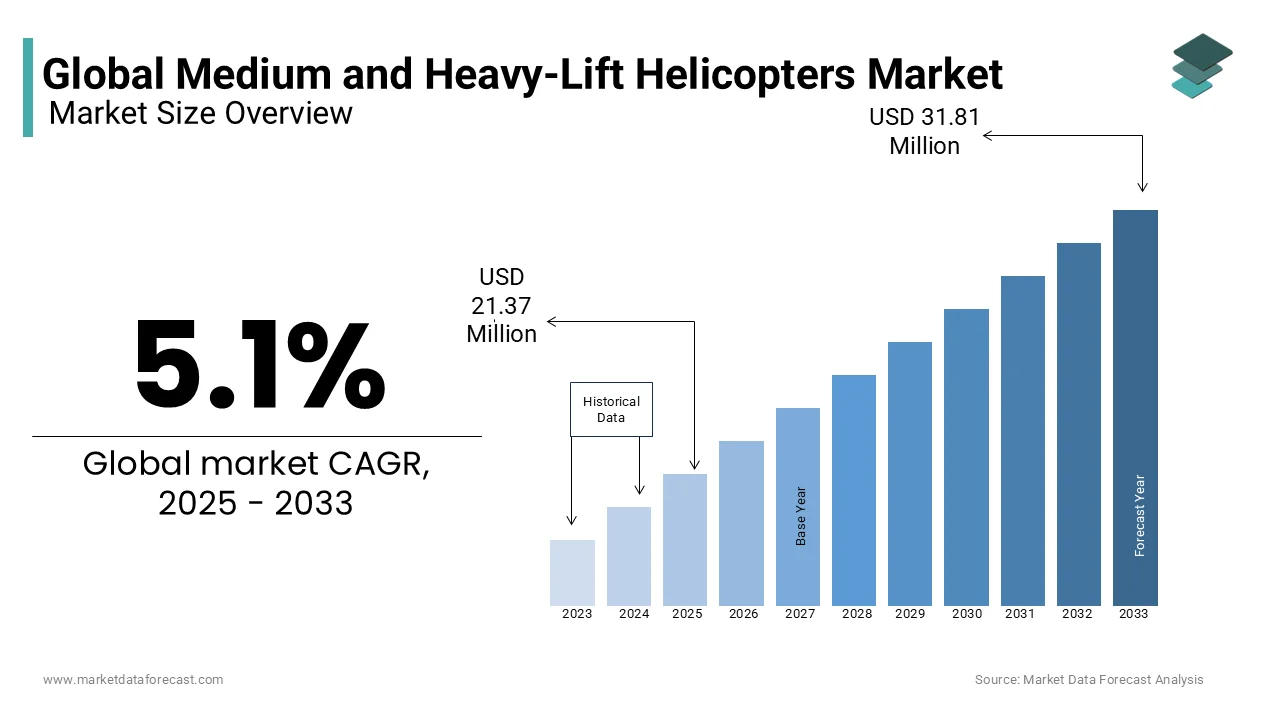

The global market for medium and heavy-lift helicopters was worth USD 20.33 billion in 2024. The global market is predicted to reach USD 21.37 billion in 2025. It is estimated to reach a valuation of USD 31.81 billion by the end of 2033, expanding at an annual growth rate of 5.1% during the forecast period 2025 to 2033.

The medium and heavy-lift helicopters market is currently seeing significant activity across both military and commercial sectors. Defense forces globally are prioritizing these helicopters for their ability to transport heavy loads and operate in challenging environments, fueling market growth. Leading manufacturers, such as Boeing, Lockheed Martin, and Airbus, are investing in upgrades that enhance payload capacity, range, and fuel efficiency, aligning with evolving operational requirements. For example, the Boeing CH-47 Chinook and Sikorsky CH-53K King Stallion remain popular choices due to their heavy-lift capabilities and reliability in critical missions.

In the commercial arena, industries like oil and gas, construction, and emergency services are increasingly relying on these helicopters to access remote sites and carry substantial equipment. Regions such as Asia-Pacific and the Middle East are experiencing heightened demand, largely due to expanding infrastructure and energy projects. This demand for versatile, powerful helicopters has also driven technological advancements, including improved avionics and reduced noise levels to support environmental compliance.

While COVID-19 initially slowed production, the market has rebounded, supported by strong defense budgets and infrastructure investments worldwide. The medium and heavy-lift helicopter market is expected to maintain steady growth, driven by rising procurement from both military and industrial sectors.

MARKET DRIVERS

Increased Defense Spending and Strategic Military Modernization

Rising global defense budgets are a primary driver of demand for medium and heavy-lift helicopters, as military forces seek to enhance their operational mobility and logistics. In 2022, global defense spending reached a record $2.24 trillion, with significant allocations toward helicopter fleet expansion. The U.S. Department of Defense, for instance, has invested over $1 billion in the procurement of the Sikorsky CH-53K King Stallion to replace aging models and improve transport capabilities. Similar efforts are seen in Asia, where nations like India and South Korea are bolstering their fleets to improve readiness for humanitarian assistance, disaster response, and combat missions.

Expansion of Energy and Infrastructure Projects in Remote Locations

The demand for medium and heavy-lift helicopters is also driven by growth in the energy and infrastructure sectors, particularly in remote areas requiring heavy logistical support. In the oil and gas industry, heavy-lift helicopters such as the Airbus H225 Super Puma, which can carry payloads up to 5.5 tons, are increasingly used for transporting equipment to offshore rigs. Asia-Pacific, a growing region in the energy sector, saw an estimated 18% rise in helicopter-based contracts for logistics support between 2021 and 2023. This trend is expected to continue, with the global energy sector projected to grow at 4.5% annually, driving sustained demand for helicopters in rugged and offshore settings.

Rising Defense Expenditure and Fleet Modernization

With increasing defense budgets worldwide, governments are investing heavily in modernizing their helicopter fleets to meet advanced operational demands. For instance, the U.S. allocated $1.1 billion in its 2023 defense budget specifically for procurement of the Sikorsky CH-53K King Stallion, which has a payload capacity of over 16 tons, catering to troop transport and logistical needs. Similar modernization efforts are underway in Europe and Asia-Pacific, as countries like India and Japan increase their medium and heavy-lift helicopter acquisitions to strengthen military capability and enhance regional security.

Growth in Commercial Applications, Especially in Energy and Infrastructure

Demand for medium and heavy-lift helicopters is surging in commercial sectors such as oil and gas, where they are used for transporting equipment to offshore rigs. The Asia-Pacific region alone saw a 15% increase in heavy-lift helicopter contracts for energy projects between 2022 and 2023. With the global energy sector expected to grow at 4.5% annually, helicopters like the Airbus H225 Super Puma, with a capacity of up to 5.5 tons, are essential for operations in remote and offshore locations. Infrastructure and construction projects are also driving demand for these helicopters to transport heavy equipment efficiently.

Technological Advancements for Efficiency and Environmental Compliance

To meet environmental regulations and improve operational efficiency, manufacturers are integrating advanced technologies into new helicopter models. For instance, noise reduction technology and fuel-efficient engines are becoming standard features in models like the Boeing CH-47 Chinook, which saw a 20% improvement in fuel efficiency with its latest variant. Additionally, hybrid-electric propulsion systems are under development, which are expected to reduce emissions by up to 30% by 2030.

MARKET RESTRAINTS

High Acquisition and Maintenance Costs

The high costs associated with purchasing and maintaining medium and heavy-lift helicopters significantly restrain market growth. For instance, the unit cost of a Sikorsky CH-53K King Stallion exceeds $90 million, making large-scale procurement challenging for many countries. Maintenance costs are also substantial, with an estimated average hourly operating cost of $5,000 to $10,000 for heavy-lift models. These costs are often prohibitive for commercial sectors like construction and mining, which rely on cost-efficiency for viability, thereby limiting adoption outside of military and high-budget industrial applications.

Strict Regulatory Standards and Environmental Concerns

Stringent regulatory requirements around noise and emissions are challenging for manufacturers to meet, affecting the deployment of heavy-lift helicopters in civilian applications. Helicopters are subject to strict noise regulations by authorities such as the Federal Aviation Administration (FAA) and the European Union Aviation Safety Agency (EASA). For example, noise emissions standards limit the usage of these helicopters in densely populated areas, constraining the market's growth in urban settings. Environmental regulations further increase operational costs, as companies are required to invest in noise reduction and emissions control technologies, which adds to both acquisition and maintenance expenses.

Supply Chain Disruptions and Component Shortages

Global supply chain disruptions and shortages of critical components have impacted the production and delivery timelines of medium and heavy-lift helicopters. The COVID-19 pandemic initially triggered delays, and ongoing geopolitical tensions have exacerbated these issues. For example, the global shortage of semiconductors has delayed electronic system upgrades essential for new helicopter models. Airbus and Boeing both reported delayed deliveries in 2022 due to these supply constraints, leading to increased production costs and deferred contracts, which ultimately hinder market expansion and increase wait times for customers.

MARKET OPPORTUNITIES

Increased Demand for Disaster Relief and Humanitarian Missions

Medium and heavy-lift helicopters are increasingly utilized in disaster response and humanitarian missions due to their ability to access remote areas with essential supplies and personnel. For example, the United Nations estimates that the demand for aerial logistics in disaster-prone regions could increase by 20% over the next five years, driven by more frequent climate-related events. Helicopters like the Boeing CH-47 Chinook and Airbus H225 Super Puma, with payload capacities exceeding 5 tons, are essential for rapid response, reinforcing the need for versatile aircraft capable of delivering aid in difficult-to-reach areas.

Growing Opportunities in Offshore Wind Energy Projects

The global transition toward renewable energy has led to a surge in offshore wind projects, creating new demand for heavy-lift helicopters to transport equipment and personnel to offshore sites. The offshore wind energy sector is expected to grow at a compound annual growth rate (CAGR) of 15% from 2023 to 2030, particularly in Europe and Asia-Pacific, where governments are heavily investing in sustainable energy infrastructure. Medium and heavy-lift helicopters, such as the Sikorsky S-92 with a payload capacity of up to 5.3 tons, are being increasingly used in these offshore wind installations, offering a critical logistics solution where traditional transport options are limited.

Expansion of Helicopter Leasing Services

As the acquisition costs for medium and heavy-lift helicopters remain high, leasing has emerged as an attractive option for companies looking to manage expenses. The helicopter leasing market, valued at $4.5 billion in 2022, is expected to grow at a 6% CAGR through 2027 as more industries adopt leasing models to gain access to high-performance helicopters without the burden of upfront capital investments. This model allows industries such as construction, mining, and oil and gas to leverage helicopter capabilities for specific projects, thus lowering costs while expanding the market reach of heavy-lift helicopter services.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

5.1% |

|

Segments Covered |

By Point of Sale, Number of Engines, Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Airbus SE, Lockheed Martin Corporation, Textron Inc., Leonardo SpA, Russian Helicopters JSC, Aviation Corporation of China, Sky Aviation, Enstrom Helicopter Corporation, and Erikson Inc. |

SEGMENTAL ANALYSIS

By Type Insights

The medium-lift helicopter segment is primarily led by models like the Airbus H225 Super Puma, with a dominant market share of 60.7% of the global market in 2023. Medium-lift helicopters, with payload capacities ranging from 4 to 10 tons, are highly valued in sectors like offshore oil and gas, emergency medical services, and infrastructure. The growth of the medium-lift helicopter segment is majorly driven by the increasing demand in both civilian and defense applications. For instance, the Asia-Pacific region’s offshore oil and gas sector saw a 15% increase in demand for medium-lift helicopters between 2022 and 2023, supporting the segmental expansion.

Within the heavy-lift segment, helicopters like the Sikorsky CH-53K King Stallion lead the market, captured a substantial share of the worldwide market during the forecast period. Heavy-lift helicopters, capable of lifting over 10 tons, are crucial in military logistics and large-scale infrastructure projects. The rising defense expenditures globally is majorly propelling the expansion of the heavy-lift segment in the global market. For example, the U.S. alone invested over $1 billion in 2023 to procure heavy-lift helicopters for troop and cargo transport, underscoring defense as a key growth driver for this segment.

By Point of Sale Insights

The OEM segment occupied 65.1% of the global market share in 2023. The dominance of the OEM segment is majorly attributed to the rising procurement from defense and commercial sectors. The continuous demand for new, advanced helicopter models is further contributing to the expansion of the OEM segment in the worldwide market. Leading manufacturers like Boeing, Lockheed Martin, and Airbus are consistently innovating to meet operational demands. For instance, Boeing’s CH-47 Chinook and Airbus’ H225 Super Puma are in high demand among defense clients globally, as governments increase investments in fleet modernization. This segment's growth is further supported by a robust global defense budget, which reached $2.24 trillion in 2022.

The aftermarket segment is predicted to register a CAGR of 5.44% during the forecast period. The Aftermarket segment, encompassing maintenance, repair, and overhaul (MRO) services. As fleets age, demand for MRO services increases, particularly in regions like North America and Europe, where many helicopter fleets are over a decade old. This segment is driven by rising MRO contracts as operators prioritize safety and performance. For instance, in 2023, the U.S. military allocated over $500 million to sustain and upgrade its aging helicopter fleet, emphasizing the importance of the aftermarket in supporting fleet longevity.

By Number of Engines Insights

The twin-engine segment accounted for 66.4% of the global market share in 2023. Twin-engine helicopters are preferred in defense, offshore oil and gas, and infrastructure sectors due to their higher power, payload capacity, and enhanced safety in adverse conditions. For example, the Sikorsky CH-53K King Stallion and Airbus H225 Super Puma, both twin-engine models, are widely used in high-stakes military and commercial missions. Additionally, regulatory bodies often require twin-engine helicopters for operations over water or remote areas, supporting this segment’s growth. As offshore energy projects expand, especially in Asia-Pacific, the demand for twin-engine helicopters with high safety standards is projected to remain strong.

The single-engine segment is projected to grow at a moderate CAGR of 3.5% over the forecast period. The growing demand for light-duty transport and applications where fuel efficiency and operational simplicity are priorities is aiding the segmental expansion. The market for single-engine helicopters is expanding in sectors like emergency medical services and law enforcement, especially in rural or less populated areas where cost efficiency is key. Manufacturers like Bell Helicopter have gained traction in this segment, though single-engine models remain more popular in light-duty rather than heavy-lift categories.

By Application Insights

The military segment dominated the market and accounted for 57.5% of the global market share in 2023. This growth is largely driven by increased global defense spending and the demand for versatile helicopters capable of troop transport, cargo movement, and humanitarian missions. Major defense spenders, including the U.S., China, and India, are investing heavily in fleet modernization. For example, the U.S. Department of Defense allocated over $1 billion in 2023 for procuring Sikorsky CH-53K King Stallions, a heavy-lift model designed for military logistics and tactical operations. Additionally, the growing need for rapid deployment and support in humanitarian missions globally is further propelling demand in this segment. As a result, the military segment remains the dominant force in the medium and heavy-lift helicopter market.

The commercial segment is estimated to grow at a compound annual growth rate (CAGR) of 4.6% over the forecast period. Key growth drivers include the increasing use of helicopters in offshore oil and gas operations, construction, and emergency medical services. For instance, the demand for heavy-lift helicopters in offshore oil and gas exploration has grown significantly, especially in the Asia-Pacific and Middle Eastern regions, where energy projects are expanding. Models like the Airbus H225 Super Puma are popular choices in this sector due to their payload capacity and reliability in transporting heavy equipment to offshore rigs. Furthermore, advancements in helicopter technology, such as fuel efficiency and reduced emissions, are making commercial operations more cost-effective, thus supporting this segment’s growth.

REGIONAL ANALYSIS

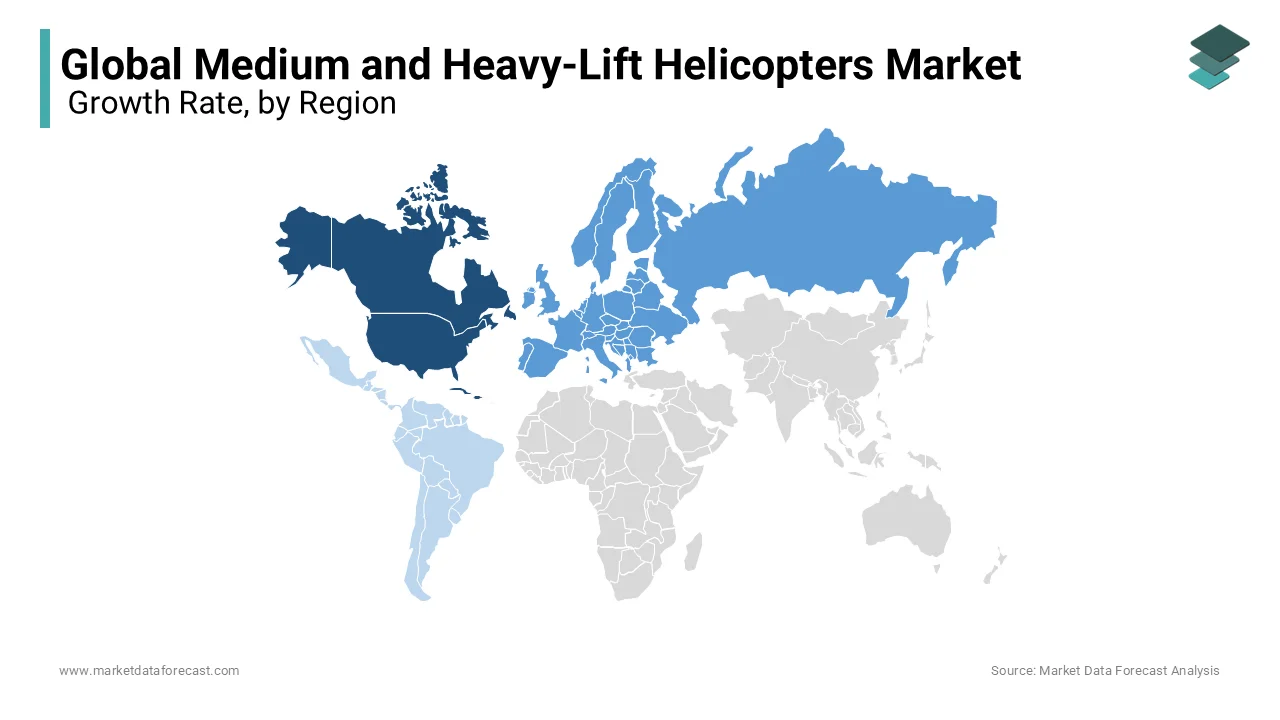

North America had the largest share of the global market, accounting for 35.6% of the global market in 2024. The United States, as a major defense spender, drives regional demand through significant investments in military modernization. In 2023, the U.S. Department of Defense allocated over $1 billion for heavy-lift helicopters like the Sikorsky CH-53K King Stallion to enhance military logistics and transport capabilities. Additionally, the presence of major manufacturers, such as Boeing and Lockheed Martin, supports continuous development and supply of advanced models in the region. The U.S. accounts for most of the regional market, benefiting from extensive defense budgets and commercial applications in offshore oil and gas, construction, and emergency response sectors.

Europe is expected to post a CAGR of 4.1% over the forecast period. The European market is driven by both defense needs and increased offshore energy projects, especially in the North Sea. Countries like the United Kingdom, Germany, and France are expanding helicopter fleets for defense and humanitarian operations. For instance, the European Defence Agency has increased its helicopter procurement budgets, responding to rising regional security concerns. Additionally, European Union environmental regulations are pushing for low-emission models, driving advancements in helicopter technology. The UK and France lead in fleet modernization, with significant defense budgets allocated to expanding medium and heavy-lift capabilities. The UK, in particular, is investing in the modernization of its Chinook fleet, while Germany has shown interest in multi-role helicopters to enhance military and civil operations.

The market in Asia Pacific is expected to grow at a robust CAGR of 5.6% from 2024 to 2032. Rapid economic growth, infrastructure expansion, and regional defense modernization programs are key drivers in this region. Countries like China, India, and Japan are prioritizing helicopter acquisitions for military, disaster relief, and energy projects. For example, the Indian government has been actively procuring medium and heavy-lift helicopters to strengthen its defense capabilities, while China continues to expand its offshore energy exploration, requiring specialized helicopters for remote operations. China and India are the leading markets in this region, focusing on domestic production as well as imports to expand fleet size. Japan also demonstrates significant demand for medium and heavy-lift helicopters, particularly for disaster preparedness and rapid response capabilities.

Latin America accounts for a considerable share of the worldwide market. Latin America’s demand is led by needs in disaster response, commercial operations, and internal security. Brazil, for instance, utilizes medium and heavy-lift helicopters extensively for forest patrol, emergency response, and oil extraction in remote areas. The Brazilian offshore oil industry drives a considerable portion of commercial demand for heavy-lift helicopters capable of transporting equipment to oil rigs. Brazil leads the region in helicopter procurement, followed by Mexico, where defense and anti-narcotics operations require efficient transport capabilities. Limited budgets in some Latin American countries may restrain market expansion, but the need for versatile aircraft remains consistent for various applications.

KEY MARKET PLAYERS

Airbus SE, Lockheed Martin Corporation, Textron Inc., Leonardo SpA, Russian Helicopters JSC, Aviation Corporation of China, Sky Aviation, Enstrom Helicopter Corporation, and Erikson Inc. are some of the prominent companies in the global medium and heavy-lift helicopters market. Boeing had the largest share of the world’s Medium and Heavy-Lift Helicopters in sales revenue.

RECENT MARKET HAPPENINGS

- In March 2023, Airbus SE launched an upgraded version of the H225M multi-role heavy-lift helicopter, enhancing its fuel efficiency and reducing maintenance costs. This move targeted both military and commercial markets, aiming to support complex missions and heavy-duty logistics.

- In January 2023, Lockheed Martin Corporation secured a contract with the U.S. Department of Defense for 10 CH-53K King Stallion heavy-lift helicopters, valued at $1.8 billion. This procurement aligns with Lockheed’s strategy to modernize U.S. Marine Corps capabilities, solidifying its defense market share.

- In September 2022, Textron Inc. acquired Pipistrel, an electric aircraft manufacturer, to expand its technological capabilities in sustainable aviation. This acquisition strengthens Textron’s portfolio and aligns with its commitment to developing eco-friendly helicopter options.

- In July 2022, Leonardo SpA signed a partnership with the Italian Ministry of Defense to upgrade the AW101 medium-lift helicopter fleet, introducing advanced avionics and sensors. This initiative aims to increase Leonardo’s foothold in the European defense sector.

- In October 2021, Russian Helicopters JSC began production on the Mi-26T2V, an advanced heavy-lift helicopter model, tailored for military and commercial use in extreme environments. This model is designed to compete with Western heavy-lift options in emerging markets.

- In February 2022, Aviation Corporation of China (AVIC) launched its AC313A medium-lift helicopter, focusing on the domestic market and designed for emergency response, disaster relief, and transport missions. This launch aligns with China’s growing demand for versatile, medium-lift capabilities.

- In November 2021, Sky Aviation signed a multi-year service agreement with Airbus SE, securing access to maintenance and technical support for its heavy-lift helicopter fleet. This partnership enhances Sky Aviation’s operational reliability, especially in oil and gas logistics.

- In August 2022, Enstrom Helicopter Corporation announced a new training center in Michigan, aimed at providing specialized training for heavy-lift helicopter pilots. This investment strengthens Enstrom’s market presence by supporting skilled labor development for helicopter operations.

- In April 2022, Erikson Inc. upgraded its fleet of S-64 heavy-lift helicopters with enhanced water tanks, boosting their firefighting capabilities. This upgrade positions Erikson as a leader in aerial firefighting, a key market segment for heavy-lift helicopters.

- In December 2022, Airbus SE and Leonardo SpA formed a joint venture for the development of the Next-Generation Rotorcraft, aimed at integrating advanced technologies like hybrid-electric engines. This collaboration reinforces both companies’ focus on innovation and aligns with EU sustainability goals.

MARKET SEGMENTATION

This research report on the global medium and heavy-lift helicopters market has been segmented and sub-segmented based on the type, point of sale, number of engines, applications, and region.

By Type

-

Medium Lift

-

Heavy Lift

By Point of Sale

-

Original Equipment Manufacturer (OEM)

-

After Market

By Number of Engines

-

Single Engine

-

Twin Engine

By Application

-

Commercial

-

Military

By Region

-

North America

-

Europe

-

Asia-Pacific

-

Latin America

-

Middle East and Africa

Frequently Asked Questions

What are the key drivers for the growth of the medium and heavy-lift helicopters market?

Key drivers include increasing defense budgets, rising demand for emergency medical services (EMS) and search and rescue (SAR) operations, growth in the oil and gas sector requiring offshore transportation, and advancements in helicopter technology.

Which sectors are the primary users of medium and heavy-lift helicopters?

The primary users are the defense sector, oil and gas industry, emergency medical services (EMS), search and rescue (SAR) operations, and commercial sectors like construction and transportation.

What are the major challenges facing the medium and heavy-lift helicopters market?

Major challenges include high operational and maintenance costs, stringent regulatory requirements, noise pollution concerns, and competition from emerging technologies such as drones and unmanned aerial vehicles (UAVs).

How is the market for medium and heavy-lift helicopters expected to evolve in the next decade?

The market is expected to see steady growth with increasing demand from the defense and commercial sectors. Innovations in technology, along with the expanding use of helicopters in new applications such as urban air mobility (UAM) and disaster response, will likely drive market evolution.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com