Global Medical Kiosk Market Size, Share, Trends & Growth Forecast Report Segmented By Product Type (Check-In Kiosk, Payment Kiosk, Wayfinding Kiosk, Telemedicine Kiosk, Self-Service Kiosk and Others), End-User and Region (North America, Europe, Asia Pacific, Latin America and Middle East & Africa) - Industry Analysis (2024 to 2032)

Global Medical Kiosk Market Size (2024 to 2032)

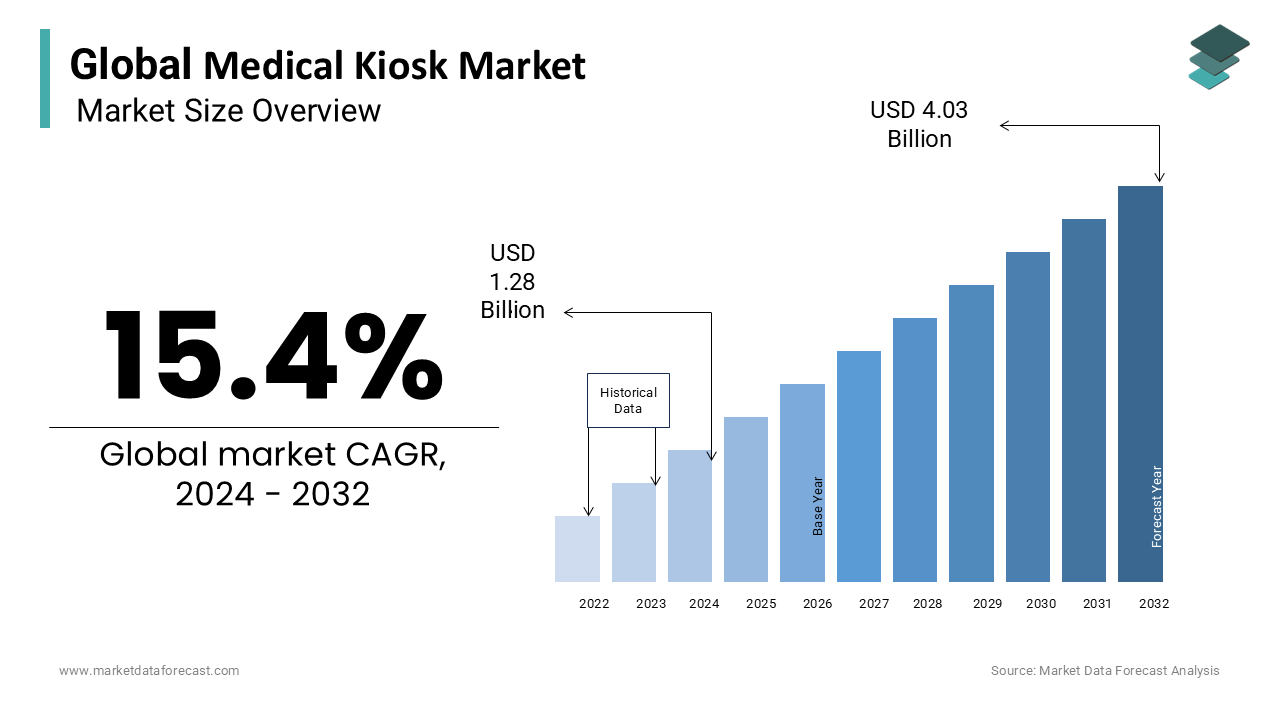

The global medical kiosk market is fast-growing and is expected to be worth USD 4.03 billion by 2032 from USD 1.28 billion in 2024, at a CAGR of 15.4% from 2024 to 2032.

Medical kiosks, self-service touch-screen stations that facilitate access to healthcare services, are becoming an integral part of modern healthcare systems. These kiosks, which are now common in hospitals, pharmacies, and other medical settings, streamline various processes like patient registration, billing, routine health checks, and telemedicine consultations. Offering a convenient, contactless alternative, they reduce wait times and improve operational efficiency, especially in high-traffic or resource-constrained environments. Medical kiosks also contribute to the digital transformation of healthcare, providing an accessible interface that enhances patient engagement while integrating with electronic health records (EHRs) to ensure accurate data management. As digital health solutions continue to evolve, medical kiosks are expected to play an increasingly critical role in bridging the gap between patients and healthcare providers by promoting seamless, efficient workflows.

Global Medical Kiosk Market Trends

AI-driven Kiosks for Predictive Diagnostics

AI-powered kiosks are revolutionizing patient care by facilitating predictive diagnostics and personalized healthcare. These advanced kiosks analyze symptoms, medical history, and real-time health data to offer early insights into potential health risks, supporting preventive care strategies. For instance, AI algorithms can assist in detecting conditions such as diabetes and hypertension based on biometric data. In 2024, the global AI in healthcare market was valued at $16.61 billion, with projections to grow at a CAGR of 49.8% from 2024 to 2032 to reach USD 421.18 billion by 2032. The integration of AI into kiosks not only enhances diagnostic capabilities but also reduces the workload for healthcare professionals, allowing them to focus on more complex cases.

Blockchain for Secure Patient Data Management

Blockchain technology is emerging as a reliable solution for securing patient data in medical kiosks. By using a decentralized ledger system, blockchain ensures data integrity and restricts access to authorized personnel, addressing the growing concerns over healthcare data breaches, which cost the industry $6 billion annually. The global blockchain in healthcare market is forecast to reach USD 8.92 billion by 2028, growing at a CAGR of 72.98%. Medical kiosks equipped with blockchain provide tamper-proof records, ensuring compliance with regulations like HIPAA and GDPR, thereby bolstering data security and transparency in healthcare transactions.

Integration with Telemedicine Platforms

Medical kiosks integrated with telemedicine platforms are enhancing healthcare access, especially in underserved areas. These kiosks enable remote consultations, diagnostics, and prescription management, offering a practical alternative to in-person visits. The telemedicine market, projected to grow from $60.1 billion in 2023 to $309.9 billion by 2032 at a CAGR of 19.98%, is driving the demand for such kiosks. Telemedicine kiosks also promote continuity of care by seamlessly integrating with EHR systems and benefiting from the enhanced speed and reliability provided by the rollout of 5G networks, which allows for real-time consultations and data updates.

Drivers:

Increasing Demand for Patient Self-Service

The demand for self-service options in healthcare is rising as patients seek more autonomy in managing their health. Medical kiosks, offering quick check-ins, appointment scheduling, and access to medical records, cater to this preference. The market growth is driven by the convenience these systems offer, which significantly reduces waiting times and administrative burdens.

Rising Healthcare Costs and Convenience

As global healthcare costs rise, medical kiosks present a cost-effective solution by automating routine tasks. In the U.S., administrative costs exceed $300 billion annually, and kiosks can reduce these expenses by up to 40%. Their availability around the clock also increases convenience for both patients and healthcare providers, streamlining care delivery processes.

Opportunities:

AI and Machine Learning Integration

AI and machine learning integration in medical kiosks can significantly enhance patient interactions and diagnostics. These technologies help kiosks provide personalized health recommendations, symptom checking, and triage services. According to Accenture, AI in healthcare could save the U.S. healthcare system $150 billion annually by 2026, with medical kiosks playing a key role in streamlining services.

5G Networks for Faster Service

The advent of 5G networks provides an opportunity to improve the performance of medical kiosks. With faster, more reliable internet connections, kiosks can provide quicker access to patient data, facilitate smoother video consultations, and ensure real-time updates to EHRs. The capabilities of telemedicine kiosks and supporting more responsive healthcare services with the fastest internet services is attributed to leverage the growth rate of the market.

Restraints:

Cybersecurity Concerns

Given the sensitive nature of healthcare data, cybersecurity remains a major concern. Medical kiosks, which handle personal health information (PHI), are vulnerable to cyberattacks. The average cost of a healthcare data breach in 2023 was $10.93 million. Ensuring compliance with regulations like HIPAA adds to the complexity and costs of implementing these kiosks.

High Initial Setup Costs

While medical kiosks offer long-term cost savings, the initial setup costs can be prohibitive. Depending on the features, a single kiosk can cost between $5,000 and $15,000. For smaller clinics and rural healthcare facilities, this upfront investment may be difficult to justify, especially when considering the additional costs for software and IT infrastructure.

Challenges

Security Vulnerabilities

Medical kiosks, which store and process sensitive patient information such as health records and payment details, are increasingly vulnerable to cyberattacks. With the healthcare sector experiencing an average data breach cost of $10.93 million in 2023, according to IBM’s Cost of a Data Breach Report, the risk is significant. These kiosks, often part of networked systems, are susceptible to hacking, malware, and ransomware attacks. Additionally, the handling of Protected Health Information (PHI) places kiosks under strict regulatory oversight, including HIPAA in the U.S. and GDPR in Europe. A breach can lead to substantial financial losses, regulatory fines, and damage to patient trust. To mitigate these risks, robust encryption, regular software updates, and multi-factor authentication are critical components of kiosk security protocols.

Maintenance and Operational Challenges

The reliable functioning of medical kiosks requires consistent maintenance and operational management, particularly in busy healthcare environments such as hospitals and pharmacies. Though there is rising adoption of the medical kiosk in many healthcare applications, but it also brings challenges related to downtime from equipment malfunctions, software glitches, or connectivity issues. These interruptions can significantly impact patient services and satisfaction. Each kiosk, depending on its complexity, costs between $5,000 and $15,000, and ongoing maintenance increases operational expenses. Furthermore, ensuring that kiosks are compatible with existing IT infrastructure and comply with healthcare regulations adds layers of complexity. Implementing comprehensive maintenance protocols and timely updates is essential to ensure that kiosks remain operational and efficient.

Legal and Regulatory Considerations for Patient Data

Medical kiosks must adhere to stringent legal and regulatory standards concerning the management of patient data. In the U.S., HIPAA governs how patient information is collected, stored, and shared, while the European GDPR imposes rigorous rules on data processing and privacy. Failure to comply with these regulations can result in hefty fines—up to $4.3 million under GDPR and $1.5 million under HIPAA. Kiosks that collect data for check-ins, payments, and diagnostics must implement secure encryption methods and user authentication to prevent unauthorized access. Additionally, maintaining comprehensive audit trails for data access and modifications is critical to ensure regulatory compliance and transparency in data handling processes.

Report Coverage

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024 to 2032 |

|

CAGR |

15.4% |

|

Segments Covered |

Product Type, End-User and Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Meridian Kiosks, NCR Corporation, Phoenix Kiosk, Inc., Olea Kiosks, Inc., Diebold Nixdorf, Inc., HCL Technologies Limited, Advantech Co., Ltd., ZIVELO, Quest Diagnostics, REDYREF Interactive Kiosks, Athenahealth, Inc., Kiosk Information Systems (a division of Posiflex Technologies), Frank Mayer and Associates, Inc., Fabcon LLC, Slabb, Inc., DynaTouch Corporation, Source Technologies, McKesson Corporation, NEXCOM International Co., Ltd., XIPHIAS Software Technologies Pvt. Ltd., Kiosks4business, imageHOLDERS |

SEGMENTAL ANALYSIS

By Product Type:

Check-In Kiosk

Check-in kiosks have emerged as a vital solution for managing patient flow in high-demand healthcare environments. In 2023, these kiosks captured over 30% of the global market share, driven by their ability to reduce wait times and simplify administrative procedures. They allow patients to independently register, verify insurance, and update personal information without the need for staff assistance. Check-in kiosks are becoming increasingly popular in hospitals and large clinics, particularly in North America and Europe, where healthcare systems are rapidly digitalizing. The growing preference for contactless services, particularly post-pandemic, has further accelerated their adoption across healthcare settings, including Asia-Pacific, where modernization efforts are underway.

Payment Kiosk

In 2023, payment kiosks accounted for 20% of the medical kiosk market as healthcare providers prioritize efficiency in billing processes. These kiosks provide self-service options for patients to make payments for services, co-pays, and outstanding balances, significantly improving cash flow for healthcare facilities. With rising healthcare costs, payment kiosks offer a streamlined way to expedite transactions and reduce administrative workloads. The shift toward cashless and contactless payment systems is ascribed to bolster the growth rate of the market. Integration with insurance verification and real-time claims processing adds to their appeal, particularly in markets like North America and Europe.

Wayfinding Kiosk

Wayfinding kiosks is likely to have the significant growth opportunities in the coming years with assist patients and visitors in navigating large healthcare facilities, often sprawling across multi-building campuses. These kiosks feature interactive maps and real-time directions, alleviating stress and confusion, particularly for first-time visitors. The segment’s growth is attributed to the increasing focus on improving patient experiences. Advanced functionalities like voice assistance, multilingual support, and integration with hospital databases further enhance their value. While North America and Europe dominate this segment, rapid adoption is also being observed in Asia-Pacific as healthcare infrastructure expands.

Telemedicine Kiosk

The telemedicine kiosk segment is among the fastest-growing segments globally. These kiosks facilitate remote consultations, enabling patients in rural or underserved areas to access healthcare services without the need for in-person visits. The COVID-19 pandemic drove a significant surge in telehealth demand, boosting the adoption of telemedicine kiosks. These kiosks are becoming crucial in both primary care and emergency settings, where remote consultations are viable alternatives to face-to-face visits. Government initiatives promoting telehealth in countries like the U.S. and Canada are expected to further fuel growth.

Self-Service Kiosk and Others

Self-service kiosks, which support various tasks like symptom checking, form submission, and information retrieval is likely to have the prominent growth rate in next coming years. These kiosks empower patients to manage routine healthcare processes independently, reducing the need for staff intervention. Their convenience, combined with improvements in operational efficiency and error reduction, has made them particularly attractive in busy healthcare settings. Self-service kiosks are being rapidly adopted, especially in the U.S. and Europe, as healthcare providers seek to modernize and automate their administrative operations.

By End-User:

Hospitals

Hospitals, managing high patient volumes, are the largest end-users of medical kiosks, accounting for nearly 45% of the global market in 2023. The automation of administrative tasks like patient check-ins, payments, and telemedicine consultations helps hospitals reduce operational burdens and improve patient flow. The segment is also driven by the need for contactless services and the push for operational efficiency. Early adoption in North America and Europe is paving the way for rapid growth in Asia-Pacific, where healthcare infrastructure is modernizing, supported by increasing government investments in digital healthcare systems.

Clinics

Clinics are anticipated to grow at a CAGR of 11.5%. Though smaller than hospitals, clinics face similar challenges, including managing patient volumes and administrative tasks. Kiosks in clinics streamline processes like patient check-ins, payments, and appointment scheduling, allowing staff to focus more on patient care. The rising demand for telemedicine services is also promoting the use of telemedicine kiosks, particularly in rural and underserved areas. Clinics in North America, Europe, and Asia-Pacific are seeing growing adoption of these technologies as part of broader efforts to reduce costs and improve service quality.

Laboratories

Laboratories segment is deemed to have the dominant CAGR by the end of the forecast period. Kiosks in laboratories help streamline patient data collection, specimen tracking, and test result management, reducing the risk of human error and enhancing efficiency in high-traffic environments. As demand for diagnostic services grows—particularly in the wake of the COVID-19 pandemic—laboratories are increasingly relying on kiosk automation. Leading adoption is seen in North America and Europe, with Asia-Pacific emerging as a key growth market as advanced diagnostics become more accessible.

Pharma Stores

Pharmacy chains are increasingly adopting kiosks to automate prescription processing, payments, and health consultations. These kiosks reduce wait times and enhance customer experience by enabling self-checkout and prescription pick-up. Integration with pharmacy management systems ensures operational efficiency. North America and Europe lead this market segment, with growing adoption in Asia-Pacific, where demand for faster, more convenient services is on the rise.

Others

The "Others" category, comprising facilities like rehabilitation centers, nursing homes, and outpatient clinics. These facilities are turning to kiosks for automating processes like check- rising demand for automation in settings with high patient volumes but fewer resources than larger hospitals is set to elevate the growth rate of the market in the coming years. Both developed and emerging markets are experiencing growth in this area, as healthcare providers increasingly prioritize cost reduction and service improvement.

Regional Analysis

North America

North America led the global medical kiosk market in 2023, capturing over 40% of the market share. The region’s growth is driven by its advanced healthcare infrastructure and early adoption of digital health technologies. Hospitals and clinics in the U.S. and Canada are increasingly integrating check-in and payment kiosks to handle large patient volumes and mitigate rising healthcare costs. The region is expected to grow at a CAGR of 11.5% from 2023 to 2030, supported by a growing preference for self-service options and telemedicine kiosks. Additionally, robust regulatory frameworks like HIPAA ensure the secure management of patient data, further promoting the adoption of these kiosks across healthcare facilities.

Europe

Europe accounted for a projected CAGR of 10.8% during the forecast period. The region is seeing significant growth in medical kiosk adoption, particularly in countries such as the UK, Germany, and France, where healthcare digitalization is a key focus. Efforts to reduce healthcare costs while enhancing patient outcomes are driving demand for check-in, payment, and telemedicine kiosks. Furthermore, the integration of AI technology in healthcare kiosks is becoming more common across Europe, contributing to the market’s expansion as healthcare systems continue to modernize.

Asia-Pacific

Asia-Pacific is emerging as one of the fastest-growing regions in the medical kiosk market. Countries like China, Japan, and India are investing heavily in healthcare infrastructure and digital health solutions, with telemedicine kiosks seeing particularly high demand. Government initiatives to improve healthcare access, especially in rural areas, are playing a pivotal role in this expansion. Additionally, the rapid deployment of 5G networks is enhancing the functionality and reliability of kiosk services across the region.

Latin America

Latin America is likely to have the prominent growth opportunities during the forecast period. Countries such as Brazil, Mexico, and Argentina are increasingly adopting healthcare kiosks in response to rising healthcare costs and the need for more efficient patient management systems. The demand for telemedicine and self-service kiosks is particularly strong in underserved areas where healthcare access remains limited. Although government initiatives are supporting the modernization of healthcare systems, economic constraints in certain areas may challenge the pace of widespread adoption.

Middle East & Africa (MEA)

The Middle East & Africa medical kiosk market growth is driven by significant healthcare infrastructure investments, particularly in Saudi Arabia, the UAE, and South Africa. Government efforts to modernize healthcare services and improve patient care are boosting demand for check-in and telemedicine kiosks. In countries like the UAE and Saudi Arabia, the expansion of telemedicine services is making healthcare more accessible, especially in remote areas. However, adoption in parts of Africa may be hindered by economic challenges and limited infrastructure.

Key Market Players

- Meridian Kiosks

- NCR Corporation

- Phoenix Kiosk, Inc.

- Olea Kiosks, Inc.

- Diebold Nixdorf, Inc.

- HCL Technologies Limited

- Advantech Co., Ltd.

- ZIVELO

- Quest Diagnostics

- REDYREF Interactive Kiosks

- Athenahealth, Inc.

- Kiosk Information Systems (a division of Posiflex Technologies)

- Frank Mayer and Associates, Inc.

- Fabcon LLC

- Slabb, Inc.

- DynaTouch Corporation

- Source Technologies

- McKesson Corporation

- NEXCOM International Co., Ltd.

- XIPHIAS Software Technologies Pvt. Ltd.

- Kiosks4business

- imageHOLDERS

Recent Market Developments

- In January 2024, Meridian Kiosks introduced a new line of healthcare kiosks equipped with temperature scanning and contactless check-in technologies. This launch addresses the growing demand for safe, post-pandemic healthcare solutions, further solidifying Meridian's position in the medical kiosk market.

- In March 2024, NCR Corporation unveiled advanced self-service kiosks designed for pharmacies and laboratories, focusing on automating prescription dispensing and patient data management. This initiative is expected to boost NCR’s presence within the healthcare automation sector.

- In February 2024, Phoenix Kiosk, Inc. partnered with telehealth providers to incorporate telemedicine capabilities into their kiosks, enabling remote consultations in retail clinics. This strategic move expands Phoenix Kiosk’s reach into telehealth-enabled healthcare settings.

- In April 2024, Olea Kiosks, Inc. launched kiosks featuring facial recognition and AI-driven patient tracking systems, aimed at streamlining the check-in process. This innovation is intended to enhance operational efficiency and increase Olea’s market share in the healthcare sector.

- In May 2024, Diebold Nixdorf, Inc. made significant investments in blockchain technology to improve data security within their kiosks, offering a more secure solution for patient data management. This development is expected to strengthen Diebold Nixdorf’s leadership in compliant, secure healthcare technologies.

- In June 2024, HCL Technologies Limited collaborated with healthcare providers to integrate AI-driven diagnostics into their kiosks. This advancement is focused on enhancing predictive analytics in healthcare, positioning HCL as a technological leader in the medical kiosk space.

- In July 2024, Advantech Co., Ltd. launched a new range of 5G-enabled modular kiosks. These kiosks are designed to accelerate data transmission for telemedicine services, reinforcing Advantech’s role in next-generation healthcare technology.

- In August 2024, ZIVELO introduced AI-powered kiosks aimed at reducing patient wait times by automating tasks such as symptom checking and appointment scheduling. This development is set to increase ZIVELO’s footprint in the medical self-service market.

- In March 2024, Quest Diagnostics deployed kiosks in pharmacies and grocery stores to simplify lab test scheduling and result access. This initiative is aimed at enhancing patient accessibility, further cementing Quest Diagnostics' presence in the medical kiosk market.

- In May 2024, REDYREF Interactive Kiosks launched kiosks integrated with electronic health record (EHR) systems, enabling seamless patient data entry. This product introduction is poised to improve record accuracy and strengthen REDYREF’s competitive edge in healthcare technology.

MARKET SEGMENTATION

This research report on the global medical kiosk market is segmented and sub-segmented based on Product type, end-user and region.

By Product Type

- Check-In Kiosk

- Payment Kiosk

- Wayfinding Kiosk

- Telemedicine Kiosk

- Self-Service Kiosk

- Others

By End Users

- Hospitals

- Clinics

- Laboratories

- Pharma Stores

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

How big is the medical kiosk market?

The market is experiencing steady growth and is projected to expand significantly in the coming years due to increasing demand for automation in healthcare and the rise of telehealth services. The exact market size and growth projections can vary, but the market is expected to see a compound annual growth rate (CAGR) in the next five to ten years.

What are the key challenges facing the medical kiosk market?

Key challenges include high initial costs, integration with existing healthcare systems, ongoing maintenance requirements, and data security concerns. These factors can limit market growth in certain regions or for smaller healthcare facilities.

How are medical kiosks changing the healthcare market?

Medical kiosks are transforming healthcare by reducing operational costs, enhancing patient satisfaction, and improving the speed and efficiency of healthcare services. They also enable better access to healthcare in remote areas through telemedicine.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]