Global Medical/Hospital Beds Market Size, Share, Trends & Growth Forecast Report By Usage, Power, End-Users and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), Industry Analysis From 2025 to 2033.

Global Hospital Beds Market Size

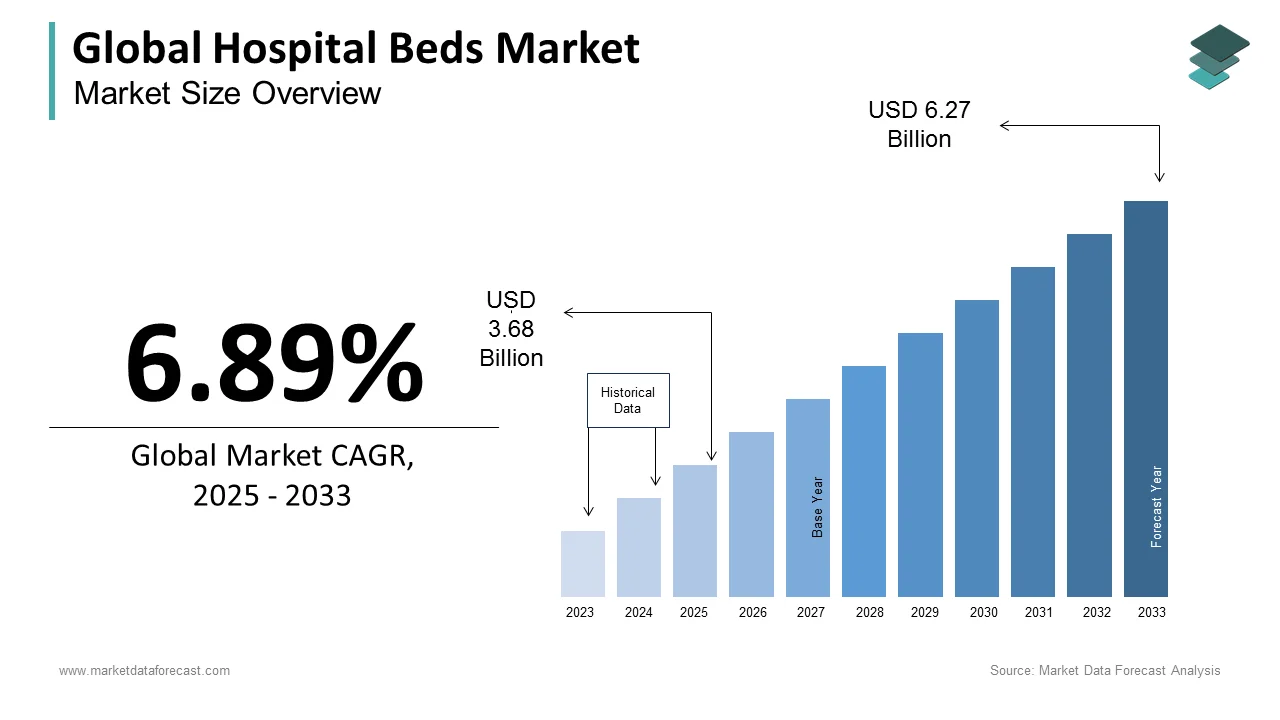

The size of the global hospital beds market was worth USD 3.44 billion in 2024. The global market is anticipated to grow at a CAGR of 6.89% from 2025 to 2033 and be worth USD 6.27 billion by 2033 from USD 3.68 billion in 2025.

Hospital beds are specially designed for use in hospitals and other healthcare settings. Curative (or acute) nursing beds, rehabilitative care beds, long-term care beds, and other hospital beds are examples of hospital beds. Hospital beds are the most key element of a hospital for treating patients. Since not all patients are mobile, hospital beds are used to treat them. These beds are specially built to provide both patients and caregivers with comfort and protection. Some beds are equipped with bars on both sides to prevent patients from collapsing. Hospital beds also aid in the patient transition from one location to another with little disruption to the patients. These beds are also used in home healthcare.

MARKET DRIVERS

The increased hospitalization rate is the major driver for the global hospital beds market.

Increased hospitalizations rate and health coverage support have also contributed to the rise of the hospital bed industry. People's lives change as their lifestyles, and environmental circumstances change. People are becoming more concerned with their health due to the outbreak of diseases such as smallpox and swine flu. If someone becomes ill with even a minor fever, they seek medical attention as soon as possible to prevent any complications. As a result, hospitalizations have increased from the previous decade. Besides, a variety of private and public sector organizations provide healthcare coverage to those who are hospitalized. In this insurance, the hospitalization bill is compensated. Some firms also make reimbursement for employers and their families mandatory. As a result, the number of hospitalizations rises, accelerating the growth of the global hospital beds growth.

Increasing healthcare spending leads to improvement, which leads to a rise in demand. According to the National Health Expenditure Accounts (NHEA), healthcare expenditures in the United States would rise by up to 4.6 % to $3.8 trillion in 2019. They spentabout $1.3 trillion for hospital care alone. As a result, there were around 1 million hospital beds available in the United States. While in 2019, Sweden spent around 11% of GDP and followed by Germany spend nearly 11.7% of GDP on healthcare. Hence, ttotal number of hospital beds per 100,000 inhabitants was 491, varying from 244 in Sweden to 813 in Germany.The growing number of chronic cases and surgeries has also expanded the hospital beds market.

Chronic conditions necessitate long-term treatment, and certain patients, such as cancer patients, must stay in the hospital for an extended time. As a result of the beds used by these patients, the hospital demands additional beds for other patients. In the case of surgery, some patients are mobile, while others need full bed rest for a specific period. In some of these cases, the patient's family chooses home nursing facilities for long-term treatment and in surgery to ensure good hygiene and care. As a result, the need for hospital beds grows in recent years. Because the number of chronic illnesses and surgeries has increased in recent years and continues to rise, so requires hospital beds.

MARKET RESTRAINTS

High investment for hospital beds decreases the demand for the global hospital beds market.

The high initial cost of hospital beds is limiting the market growth. In low- and middle-income countries, patients avoid choosing hospital beds as these hospital beds come with a huge investment. For ICU beds, the patient also has to charge a huge amount daily. According to the Times of India, each patient is paid an average ICU bed fee ranging from Rs 10,000 to Rs 14,000 per day, or even more in certain cases. As a result, the demand for hospital beds declined.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Usage, Power, End-Users, And Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, Drivers, Challenges, Opportunities, Challenges, PESTLE Analysis, Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Market Leader Profiled |

Invacare Corporation, Paramount Bed Holdings Co. Ltd., Gendron Inc., Medline Industries Inc. |

SEGMENTAL ANALYSIS

By Usage Insights

Based on the usage, the acute care beds segment accounted for the largest market share in 2024 and is expected to grow at a healthy rate due to more accidents due to increasing traffic and population. It is primarily attributed to the greater adoption of medical/hospital beds to curative acute and chronic illnesses.

The Long-term beds segment held the second largest market share among all other segments in 2024 and is expected to grow faster. Long prevailing chronic illness is a significant factor in driving the growth of this market.

By Power Insights

Based on the end-user, the semi-electric bed had the largest market share among others in 2024 and is expected to grow at a reasonable rate during the forecast period. The growth can be attributed to technological advancement and more awareness about quality healthcare facilities.

The electric bed accounted for the second-largest market share in 2024 and is expected to grow at the fastest rate among all the other segments. The large share of these beds is primarily attributed to technological advancements, easy patient handling, and advanced powered beds. Governments and private companies invest more in providing quality healthcare to patients who will drive the market's growth.

The manual bed was the third-leading segment in 2024, and the growth is expected to decline during the forecast period. The main reason for the decreasing growth rate can be the increasing adoption of powered beds by health institutions. Lack of advanced features like powered beds is also a reason why manual beds are not preferred now.

By End-User Insights

Based on the end-user, the Hospital segment is expected to rule the global hospital beds market during the forecast period. As more hospitals get established, more beds will be needed to handle more patients. The hospitals now built are mostly multi-specialty hospitals and thus will be able to cater to more patients and drive the growth of the hospital bed market.

The Clinics segment is estimated to be the second-largest segment and is expected to grow at a prominent rate. As the population increases, there will be more illness among people; thus, there will be rising demand from clinics to treat this patient, thus boosting the hospital bed market. Although clinics' requirements for hospital beds are significantly less than hospitals, they can still match hospitals with a rising number of clinics.

The Ambulatory services segment is forecasted to grow at a reasonable rate from 2025 to 2033. The development of quality healthcare services is a significant factor responsible for the growth of this sub-segment.

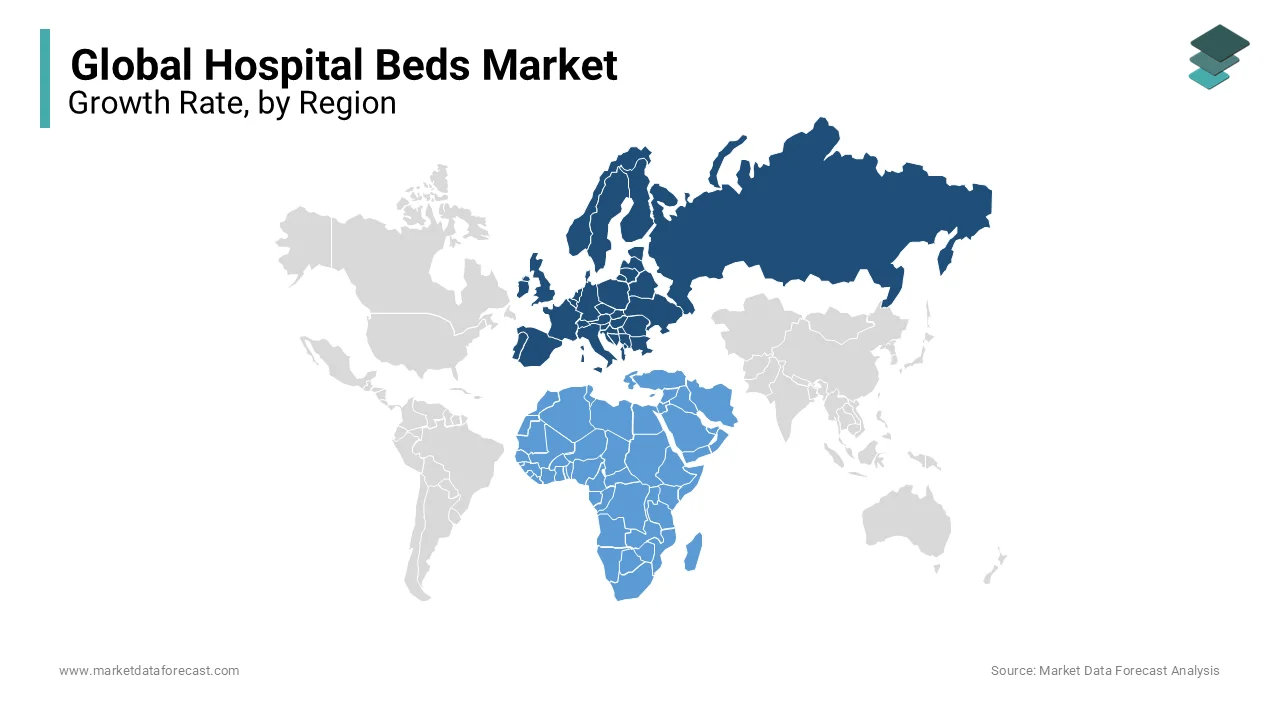

REGIONAL ANALYSIS

Regionally, Europe dominates the global hospital beds market owing to the high healthcare spending, favorable reimbursement policies, well-developed healthcare sector, and increasing government support. Countries like Germany and France have the most extensive healthcare budgets among all other countries, with approximately USD 321 billion and USD 237 billion dedicated to the healthcare budget. The Americas has the second-largest market, and the Asia Pacific follows. A well-developed healthcare system, huge geriatric population, and growing investment in healthcare research & development have paved the way for the American hospital beds market to expand. The Asia Pacific is the fastest-growing world market for hospital beds.

The presence of a vast population base with a growing geriatric population, increasingly rising hospital numbers, and growing government funding for research & development has driven market growth. Also, the continuous development of the hospital system would fuel demand over the forecast period. The Middle East & Africa showed a limited increase due to low healthcare spending and limited technologies' availability. The Middle East region holds a significant share in the regional market.

KEY MARKET PLAYERS

Companies like Invacare Corporation, Paramount Bed Holdings Co. Ltd., Gendron Inc., Medline Industries Inc., LINET spol. S r.o., Savaria Corporation, Savion Industries, Hill-Rom Holdings Inc., Stryker Corporation, and Getinge Group are some promising companies in the global hospital beds market.

MARKET SEGMENTATION

This research report on the global Hospital Beds Market has been segmented and sub-segmented based on usage, power, end-users, and region.

By Usage

- Acute care beds

- Long-term care beds

- Psychiatric care beds

- Others (maternity, etc.)

By Power

- Electric Bed

- Semi-Electric Bed

- Manual Bed

By End-User

- Hospitals

- Clinics

- Ambulatory services

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- The Middle East and Africa

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com