Global Medical Flexible Packaging Market Size, Share, Trends & Growth Forecast Report By Application (Medical Devices, Implants, IVD, Medical Equipment and Contract Packaging), Material (Paper, Non-woven Fabric, Polymer, Aluminum and Plastics), Packaging Type (Trays, Boxes, Pouches, Bags, Lids, Labels, High Barrier Films and Seals) and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), Industry Analysis From 2025 To 2033.

Global Medical Flexible Packaging Market Size

The global medical flexible packaging market was worth US$ 50 billion in 2024 and is anticipated to reach a valuation of US$ 82.35 billion by 2033 from US$ 52.85 billion in 2025, and it is predicted to register a CAGR of 5.7% during the forecast period 2025-2033.

MARKET DRIVERS

The demand for flexible medical packaging is significantly growing in the medical device manufacturing and pharmaceutical industries.

The key factor driving the market growth is its ability to reduce the overall packaging weight by about 70%. Also, additional benefits include ease of identification and branding, superior product protection, ease of transportation, and increased health and hygiene values. Furthermore, there has been a massive increase in the usage of disposable medical products over the past few years, which has augmented the necessity of flexible packaging even more. Also, there has been quite a lot of innovation in producing eco-friendly material that can be utilized for flexible packaging. Therefore, it is expected to impact the market in the coming years positively. In addition, developing countries' growing economies can also play a crucial role in enhancing the market as they will import large quantities of packaging to meet their needs.

An increase in environmental and health issues because of the collection of non-biodegradable waste and rising demand from pharmaceutical companies and medical device manufacturing companies surge the growth in the market. The flexible packaging can minimize the gross weight by 70%, which is projected to demand market growth in the region. In addition, growing demand in end-user industries like food, beverage, cosmetic and personal care, and pharmaceutical, a rise in high consumer revenue, and a surge in e-commerce activities, specifically in existing economies, bolstered the growth in the medical flexible packaging market.

MARKET RESTRAINTS

Fluctuations in the cost of raw materials are anticipated to hinder the market's growth rate. In addition, strict rules and guidelines by the government related to the polymers and reprocessing of packaging materials may hamper the escalation of the growth in the global medical flexible packaging market.

Impact of COVID-19 on the Global Medical Flexible Packaging Market

COVID-19 vaccination campaigns throughout the world are driving demand for rapid-response packaging. Tubs, lids, trays, and inserts that help distribute coronavirus vaccinations and test kits are manufactured at breakneck speed by manufacturers in the healthcare packaging market. Companies in the healthcare packaging industry are ramping up their production of COVID-19 vaccination vials. They're stepping up their efforts to provide vials to vaccine producers as fast as possible and in an easy-to-use format for filling procedures. Pharmaceutical filling operations receive vials in plastic tubs from packaging manufacturers. Demand for PPE, face masks for medical and consumer markets, gauze, bandages, wound products, surgical sponges, and other similar items soared in the medical device and life sciences industry. As a result, the medical flexible packaging market has had favorable growth during this pandemic.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

5.7% |

|

Segments Covered |

By Application, Material, Packaging, and Region. |

|

Various Analyses Covered |

Global, Regional, and country-level analysis; Segment-Level Analysis, DROC; PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Winpak Ltd., Sealed Air Corporation, Huhtamaki Oyj, Amcor, Daetwyler Holding, Catalent Pharma Solutions, Mondi Group, Westrock Company, Aptar Group, Berry Plastics Group, and Becton Dickinson & Company., and Others. |

SEGMENTAL ANALYSIS

By Application Insights

Based on the application, the medical devices segment accounted for the leading share of the market in 2024. The largest segment is medical device manufacturing, which has seen a surge in product demand, particularly since the pandemic. In addition, increased healthcare expenditures worldwide and innovation support the segment's growth.

On the other hand, the contract packaging segment is expected to be the fastest-growing market during the forecast period. In emerging nations, firms are taking advantage of considerable packaging cost benefits. Such methods have aided the expansion of the contract packaging business. Therefore, emerging economies are promising locations for expanding contract packaging services.

By Material Insights

Based on the material, the plastics segment will dominate the global medical flexible packaging market during the forecast period. This is because plastics have a more comprehensive range of applications and a better tensile strength than metals, which is expected to fuel segment expansion during the forecast period. In addition, the availability of many production facilities and advancements in extrusion technology has increased demand for plastics and opened the path for new product development in medical packaging.

The paper material category is expected to grow the fastest in the coming years. Over the forecast period, the segment is anticipated to be driven by innovations in the paper industry and the development of eco-friendly paper. Furthermore, the benefits of paper materials, such as product safety, cleanliness, dependability, and simplicity of use, are expected to drive up demand. As a result, this type of packaging is becoming more popular since it is a key element of its branding strategy.

By Packaging Insights

Based on packaging, the pouches and bags segments are estimated to account for the most significant share of the global medical flexible packaging market during the forecast period. A wide range of medical goods is packaged in pouches and bags. Amcor is a prominent manufacturer and supplier of pouches and bags in the healthcare business. Over the forecast period, the market will likely be driven by the development of customized pouches and bags with high-barrier packaging.

Lids and labels are primarily used to prevent contamination, tampering, and spoiling medical devices and medications. These items can be used as primary or secondary packing. Because of the rules governing the labeling of medical equipment, labeling has become an essential element of packaging. Therefore, over the forecast period, demand for lids and labels is predicted to rise considerably.

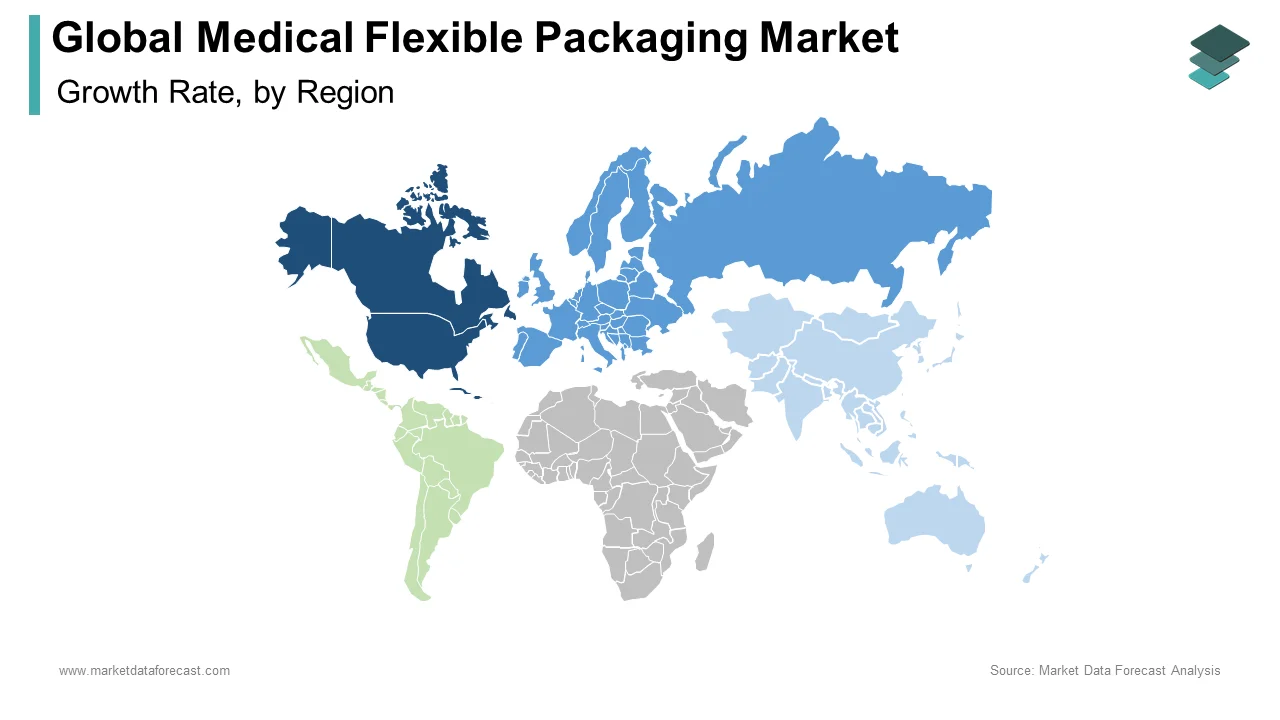

REGIONAL ANALYSIS

Among all the regions, most of the share was controlled by the North American region in 2024. The North American medical flexible packaging market is further anticipated to dominate globally throughout the forecast period. The key factor behind this projection is the strict regulations by agencies such as the FDA in the United States of America, which compel the necessity for more innovative ways of packaging. In addition, a better economic outlook and increased innovation in reinforcement materials drive product demand in the North American region. Furthermore, large firms like Amcor and Bemis are projected to boost regional growth during the forecast period.

The Asia Pacific medical flexible packaging market accounted for a substantial share of the global market in 2024 and registered the highest growth rate among all the regions during the forecast period due to the rising product demand from emerging economies like India and China. In addition, the increasing healthcare business and rising per capita income are expected to influence market development positively. Furthermore, over the forecast period, contract manufacturing will be one of the main end-use sectors in the area. Therefore, it is projected to provide attractive growth opportunities for medical flexible packaging manufacturers.

The growth of the European medical flexible packaging market is majorly driven by the growing healthcare spending on medical technology and a trend toward smart packaging of medical equipment. Furthermore, the industry is expected to grow in line with Europe's growing medical device market. However, due to the coronavirus pandemic, there are rising concerns about cleanliness and safety, which may lead to the use of plastic packaging solutions in Europe. In addition, the increased need for single-use packaging because of the surge in medical device distribution has affected the demand for polystyrene, polyethylene, and plastic packaging materials.

The Latin American medical flexible packaging market is estimated to grow at a CAGR of 4.9% during the forecast period.

The MEA is expected to have steady growth and is predicted to hike at a generous rate during the forecast period. The factors responsible for the development of MEA are enhancements made in the pharmaceutical industries and a surge in healthy consumption and government assistance. UAE is anticipated to dominate the medical flexible packaging market throughout the region regarding revenue. The appearance of a few local key players manufacturing raw materials and investments made in research and development across the UAE helps the market have better growth. South Africa followed after UAE in ruling the medical flexible packaging market due to innovations and technologies allowing manufacturers to improve packages, provide safe food, and expand their lifespan. Israel is stimulated to have the highest growth due to consumers spending more on products enhancing the population's lifestyle. Africa is expected to quickly catch the market with investments from vital foreign players. Growing demand for packaged foods and requirements to reduce the costs and investments in food processing impels the medical flexible packaging market in the Middle East and Africa region. Africa's GDP growth rate escalated from 4.7% to 5.2% from 2013 to 2014, and FDI growth of 16%, reaching USD 43 billion in 2014, has a positive revenue trend.

KEY MARKET PLAYERS

Some of the prominent companies operating in the global medical flexible packaging market profiled in this report are Winpak Ltd., Sealed Air Corporation, Huhtamaki Oyj, Amcor, Daetwyler Holding, Catalent Pharma Solutions, Mondi Group, Westrock Company, Aptar Group, Berry Plastics Group, and Becton Dickinson & Company.

RECENT MARKET DEVELOPMENTS

- Berry Global Group Inc. announced in May 2020 that it would collaborate with long-time customer Mondelez International to deliver Philadelphia, the world's most popular cream cheese, using packaging made from recycled plastic.

MARKET SEGMENTATION

This research report on the global medical flexible packaging market has been segmented and sub-segmented based on the application, material, packaging, and region.

By Application

- Medical devices

- Implants

- IVD'S

- Medical equipment

- Contract packaging

By Material

- Paper

- Non-woven fabric

- Polymer

- Aluminum

- Plastics

- Polyethylene

- Polypropylene

- Polyethylene Terephthalate

- Polyvinyl Chloride

- Others

By Packaging

- Trays

- Boxes

- Pouches

- Bags

- Lids

- Labels

- High barrier films

- Seals

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

What was the size of the medical flexible packaging market worldwide in 2024?

The global medical flexible packaging market size was valued at USD 50 billion in 2024.

What is the growth rate of the medical flexible packaging market?

Between 2024 to 2032, the global medical flexible packaging market is anticipated to be growing at a CAGR of 5.7%.

Which segment by packaging led the medical flexible packaging market in 2024?

Based on packaging, the pouches and bags segment accounted for the major share in the market in 2024.

Who are some of the prominent companies in the medical flexible packaging market?

Winpak Ltd., Sealed Air Corporation, Huhtamaki Oyj, Amcor, Daetwyler Holding, Catalent Pharma Solutions, Mondi Group, Westrock Company, Aptar Group, Berry Plastics Group, and Becton Dickinson & Company are a few of the leading players in the medical flexible packaging market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]