Global Medical Exoskeleton Market Size, Share, Trends & Growth Forecast Report By Component, Extremities, End-User and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), Industry Analysis From 2025 To 2033.

Global Medical Exoskeleton Market Size

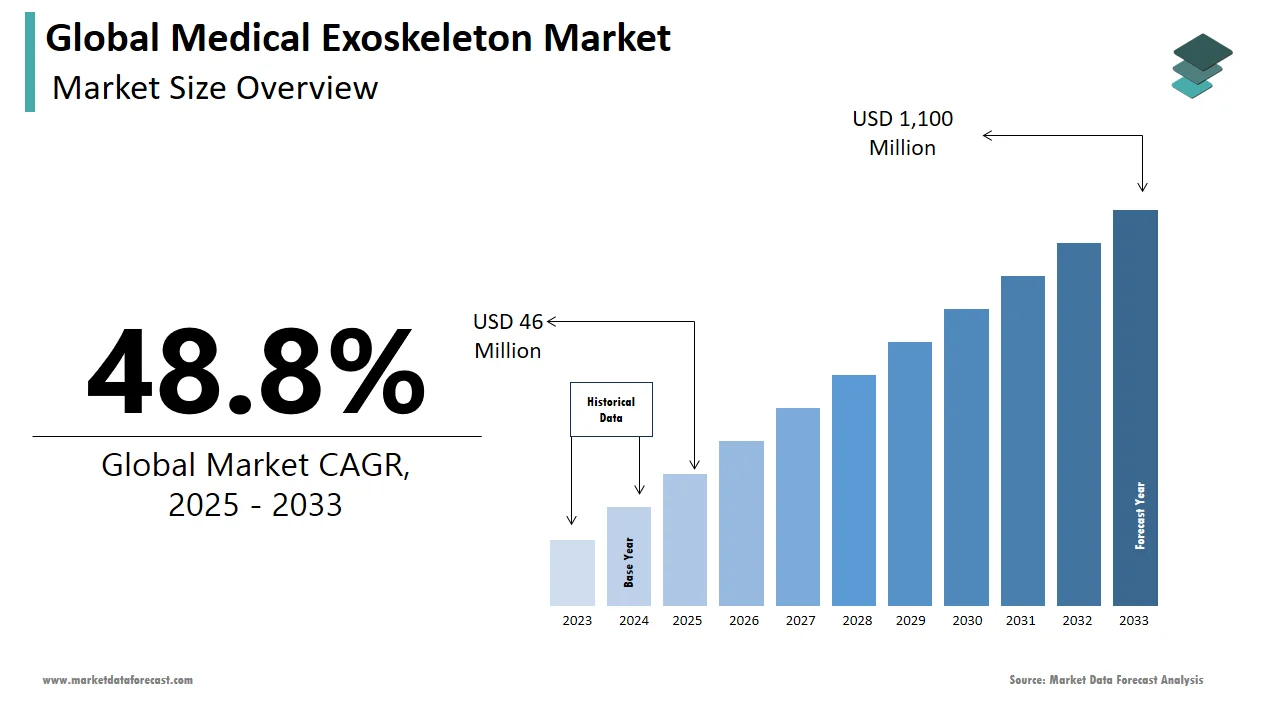

The global medical exoskeleton market was valued at USD 30.77 million in 2024. The global market is projected to grow from USD 46 million in 2025 to reach USD 1,100 million by 2033, exhibiting a compound annual growth rate (CAGR) of 48.8% from 2025-2033.

A wearable hardware-software system called an exoskeleton is intended to help patients with lower limb impairments recover from their injuries. It wholly or partially restores the impaired motor function of the lower limbs. Patients might utilize it as a personal assistant as well. In exoskeletons, a frame encloses a specific area of the user's body. The frame is made of hard or soft material. Some of them contain sensors that monitor and react to wearers' movements which can even help wheelchair patients to get up and walk again since it can provide support and reduce fatigue.

MARKET DRIVERS

The global medical exoskeleton market is rising due to increasing technological advancements.

The new developments in an exoskeleton, such as the stroke and spinal cord injury exoskeleton, have made it easier for patients to stand back on their feet. However, the lives of orthopedic and spine patients differed considerably due to continuous innovations in the exoskeleton. According to the WHO, approximately 20 to 50 million people suffer non-fatal injuries each year, which leads to disability. Thus, medical exosuits supporting physical movement are expected to increase market value. Growing demand for effective rehabilitation approaches to drive medical exoskeleton market growth. The techniques make use of cutting-edge and novel items. This is a promising indicator for expanding the medical exoskeletons industry across all important geographies. The growing number of people with physical disabilities, rising investments in healthcare infrastructure spending, growing research and development activities, and the growing demand for innovative rehabilitation approaches led to increasing adaptation of exoskeleton devices. Additionally, the majority of orthopedic operations performed nowadays are knee and hip arthroplasties. Furthermore, according to WHO statistics published in February 2021, 1.71 billion individuals worldwide are thought to have musculoskeletal problems. As a result, exoskeleton systems are in more demand. Therefore, it is anticipated that the market for medical exoskeletons will grow throughout the forecast period due to the rising number of orthopedic operations.

MARKET RESTRAINTS

High costs associated with the exoskeletons, the stringent licensing requirements put forward by authorities for user safety insurance, and the variations in product testing owing to the technical design expertise and understanding of the manufacturers are some of the factors hampering the growth of the medical exoskeleton market. Also, the users face difficulty wearing and using the exosuit, and sometimes the device's failure can have life-threatening repercussions.

Impact Of Covid-19 On The Global Medical Exoskeleton Market

The outbreak began in early 2020 and continued for over a year. Lockdowns and quarantines have resulted from the coronavirus outbreak. As a result, many businesses suffered losses due to travel restrictions and increasing unemployment. In addition, the financial position has worsened due to the unexpected rise in patients and the acute lack of hospital supplies like oxygen cylinders.The COVID-19 pandemic has had a negative impact on the medical exoskeleton market.In addition, global supply chain disruption has affected the medical refrigeration equipment market share, which directly influences the drift in revenue of the medical exoskeletons market. The Ekso Bionics 2020 Annual Report shows that a considerable reduction in medical device sales caused an overall 36.0% drop in revenue generated in fiscal 2020 compared to fiscal 2019. Thus, major exoskeleton vendors, including Ekso Bionics, ReWalk Robotics, and Hocoma AG, saw a fall in overall sales due to a decline in the market for exoskeleton systems.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

48.8% |

|

Segments Covered |

By Component, Extremity, End-User, and Region. |

|

Various Analyses Covered |

Global, Regional, and country-level analysis; Segment-Level Analysis, DROC; PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Bioness Inc., B-Temia Inc., BIONIK Laboratories Corp, CYBERDYNE INC., Ekso Bionics Holdings, Inc., EXOATLET, GOGOA Mobility Robots, Hocoma AG, Wearable Robotics Srl, Parker Hannifin Corporation, ReWalk Robotics, US Bionics, Inc. and Tyromotion GmbH., and Others. |

SEGMENTAL ANALYSIS

By End-User Insights

Based on the end-user, the healthcare segment is presumed to dominate the medical exoskeleton market due to the rising incidence rate of Spinal Cord Injuries (SCIs). Moreover, widespread adoption of these products and solutions in rehabilitation centers, a growing number of regulatory approvals, a significant surge in treatment numbers, rising awareness towards technologically advanced systems, and a rise in the adoption rate of exoskeleton products are some of the key factors driving the healthcare industry.Due to increasing public awareness of the advantages of exoskeleton technology in many industrial applications and the rising prevalence of work-related injuries, the industry segment is also predicted to experience substantial growth. Additionally, it is anticipated that the industrial segment will grow more quickly due to the spike in demand for breakthrough technologies and their increasing use in various industries, including manufacturing, distribution, and construction.

REGIONAL ANALYSIS

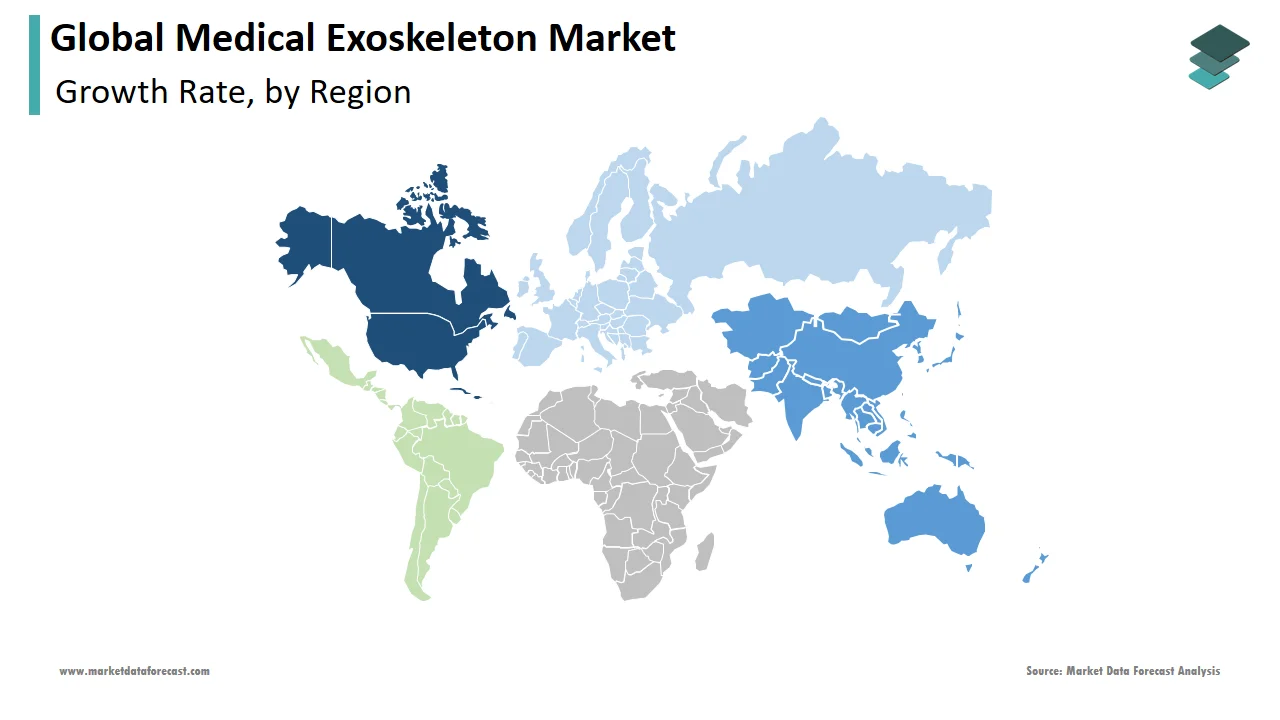

The medical exoskeleton market in North America is expected to dominate by region. An estimated 61 million people in the United States have some disability, and 13.7% of them are suffering from mobility disabilities, as per the data published by the CDC. The North American medical exoskeleton market is further driven by the rising prevalence of chronic illness, rise in the number of rehabilitation centers, increasing elderly population, rise in prescriptions and hospitalization rates, and the increasing number of strokes. In addition, the strong presence of critical medical exoskeleton players, increase in government funding and healthcare expenditure, growing awareness of technological developments, surging demand for self-assist exoskeletons, and increase in the senior population is flourishing the medical exoskeleton market in the North American region.

The medical exoskeleton market in the Asia-Pacific is anticipated to generate the highest CAGR in the global market owing to the growing number of exoskeleton developers actively developing innovative medical exoskeletons at affordable costs. Furthermore, a rise in the manufacture of medical exoskeletons for the defense sector, along with favorable government policies, are some of the factors driving the market. In addition, developing countries like China, Japan, and South Korea are expected to be significant revenue-generating economies.

Europe, Latin America, the Middle East, and Africa are also projected to grow at a lucrative rate due to increased related health conditions, healthcare expenditures, stroke incidence, and a surge in the aging population.

KEY MARKET PLAYERS

Companies playing a notable role in the global medical exoskeleton market profiled in this report are Bioness Inc., B-Temia Inc., BIONIK Laboratories Corp, CYBERDYNE INC., Ekso Bionics Holdings, Inc., EXOATLET, GOGOA Mobility Robots, Hocoma AG, Wearable Robotics Srl, Parker Hannifin Corporation, ReWalk Robotics, US Bionics, Inc. and Tyromotion GmbH.

RECENT MARKET HAPPENINGS

- In September 2022, ReWalk Robotics Ltd., a leading manufacturer of robotic medical technology for people with lower extremity disabilities, engaged with CMS in its commitment to evaluate complexly advanced. The latest step in ReWalk's efforts is to expand access to the Company's exoskeletons for Medicare beneficiaries with SCI.

- In September 2022, HMR's patented and disruptive medical technology dramatically improved mobility-challenged persons' rehabilitation with various distinguishing and innovative features. In addition, the Canadian government has contracted to purchase two units of HMR's next-generation lower-limb exoskeleton, XoMotion, a wearable robot.

MARKET SEGMENTATION

This research report on the global medical exoskeleton market has been segmented and sub-segmented based on component, extremity, end-user & region.

By Component

-

Hardware

- Sensor

- Actuator

- Control System

- Power Source

- Software

By Extremity

- Upper Extremity

- Lower Extremity

By End-User

-

Healthcare

- Industrial

- Military & Defence

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

1. What is the growth rate of the medical exoskeleton market?

Bioness Inc., B-Temia Inc., BIONIK Laboratories Corp, CYBERDYNE INC., Ekso Bionics Holdings, Inc., EXOATLET, GOGOA Mobility Robots, Hocoma AG, Wearable Robotics srl, Parker Hannifin Corporation, ReWalk Robotics, US Bionics, Inc. and Tyromotion GmbH are some of the major companies in the medical exoskeleton market.

2. Who are the leading players in the medical exoskeleton market?

Between 2025 and 2033, the global medical exoskeleton market is forecasted to grow at a CAGR of 48.8%.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]