Global Medical Dynamometer Market Size, Share, Trends & Growth Forecast Report Segmented By Technology (Electronic Dynamometer and Mechanical Dynamometer), Product Type (Handheld Dynamometer, Pinch Gauges, Push-Pull Dynamometer, Squeeze Dynamometer and Others), Application, End-User and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), Industry Analysis (2025-2033)

Global Medical Dynamometer Market Size

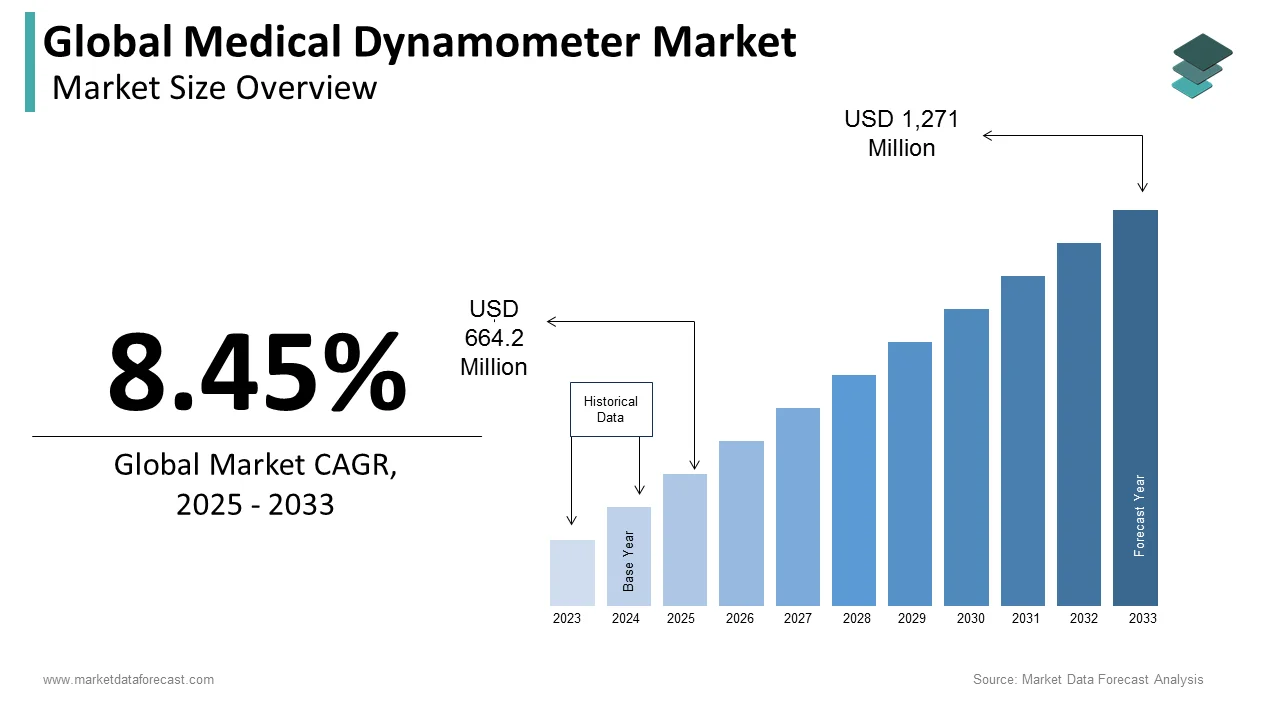

The global medical dynamometer market size was worth USD 612.5 million in 2024. The global market is estimated to grow at a CAGR of 8.45% from 2025 to 2033 and be worth USD 1,271 million by 2033 from USD 664.2 million in 2025.

Medical dynamometers serve as essential diagnostic and monitoring tools for evaluating muscle strength in patients with musculoskeletal conditions. These instruments measure isometric muscle strength, enabling healthcare professionals to accurately diagnose conditions such as muscle atrophy, arthritis, carpal tunnel syndrome, and stroke-related disabilities. In addition to diagnostics, dynamometers are integral to physical therapy and rehabilitation, as they facilitate the tracking of muscle recovery progress over time. Their application in sports medicine is also significant, aiding in the assessment of athletic performance and the early detection of potential injuries. The growing importance of dynamometers in healthcare stems from their ability to provide objective, quantifiable data, thereby enhancing the reliability and consistency of patient evaluations across various healthcare settings.

TECHNOLOGICAL INNOVATIONS IN DYNAMOMETERS

-

Digital and Wireless Dynamometers

Recent advancements in digital and wireless dynamometry have revolutionized the field, offering enhanced precision, user convenience, and superior data collection capabilities. These modern devices are equipped with Bluetooth technology and cloud-based systems, enabling clinicians to gather real-time data and remotely monitor patient progress. A 2022 study published in BMC Musculoskeletal Disorders demonstrated a 30% increase in diagnostic accuracy with wireless dynamometers, attributed to their ability to deliver continuous, uninterrupted data. Furthermore, these devices often feature LCD screens, facilitating the immediate interpretation of muscle strength measurements by both patients and clinicians. The electronic storage and sharing of data have streamlined rehabilitation protocols, significantly reducing the time and effort needed for manual data entry and analysis.

-

Integration with Software

Software advancements have further expanded the capabilities of medical dynamometers by integrating them with patient management systems, mobile applications, and AI-powered diagnostic tools. Companies such as JTECH Medical and Biodex Medical Systems have pioneered the development of dynamometers equipped with built-in data analytics, enabling the tracking of patient recovery and the generation of detailed reports on muscle performance. These reports can be seamlessly integrated into Electronic Health Records (EHR), offering healthcare providers a comprehensive overview of patient progress. Additionally, mobile applications allow patients to use handheld dynamometers at home, transmitting real-time data to healthcare professionals for continuous monitoring. AI-driven algorithms further enhance these systems by detecting subtle variations in muscle strength, providing early indicators of muscular degeneration and improving preventive care strategies.

MARKET DRIVERS

-

Aging Population

The global aging population is a significant driver of the medical dynamometer market. By 2050, the United Nations projects that the population of individuals aged 65 years and older will nearly double, reaching approximately 1.5 billion worldwide. This demographic shift is associated with an increase in age-related musculoskeletal disorders, including osteoporosis, arthritis, and sarcopenia. Consequently, there is rising demand for diagnostic and monitoring tools, such as dynamometers, to address these conditions. Europe, which has one of the world's highest elderly populations, has seen a corresponding increase in the use of dynamometers within hospitals and rehabilitation centers, as healthcare systems prioritize early diagnosis and the prevention of musculoskeletal disorders.

-

Rising Healthcare Expenditure

The steady rise in global healthcare expenditure is another key factor driving the growth of the dynamometer market. In 2023, global healthcare spending was estimated to surpass $10 trillion, with a substantial portion allocated to rehabilitative care and physical therapy. In North America, which accounts for a significant share of this expenditure, dynamometers are widely utilized in physiotherapy clinics, sports medicine, and home-based care. Countries such as the United States and Germany are experiencing heightened demand for these devices due to increasing healthcare budgets and a focus on advanced diagnostic and rehabilitative technologies.

-

Technological Advancements

Continuous advancements in medical technology, particularly in the realm of digital health, are propelling the dynamometer market forward. Smart dynamometers, which integrate with mobile applications and cloud-based systems, are enhancing patient care by enabling remote monitoring and delivering more precise muscle strength measurements. Companies such as BTE Technologies and Hoggan Scientific LLC have introduced handheld digital dynamometers with heightened sensitivity, capable of detecting minor variations in muscle force. These innovations are particularly valuable in telemedicine and home healthcare, where ongoing monitoring is crucial for effective rehabilitation.

MARKET RESTRAINTS

-

High Costs

Despite their benefits, the high cost of advanced digital and wireless dynamometers remains a significant barrier to widespread market adoption. These devices, which offer superior accuracy and efficiency, can range in price from $2,000 to $5,000, limiting their accessibility to smaller clinics, particularly in developing regions. According to a 2023 MarketWatch report, over 30% of small to medium-sized clinics in emerging markets continue to rely on manual strength measurement tools due to their affordability, despite their lower accuracy. The high cost of these devices also hinders their adoption in public healthcare systems, particularly in countries with constrained healthcare budgets.

-

Lack of Awareness in Developing Regions

In many developing countries, there is limited awareness of the importance of diagnostic tools like dynamometers for musculoskeletal health. A 2021 report by the World Health Organization (WHO) revealed that up to 60% of healthcare facilities in low-income nations lack access to essential diagnostic devices, including dynamometers. This gap is particularly pronounced in regions such as Sub-Saharan Africa and parts of South Asia, where patients frequently go undiagnosed for musculoskeletal conditions due to the absence of adequate diagnostic infrastructure. While governments and international health organizations are working to increase awareness and accessibility, adoption rates remain relatively low in these areas.

MARKET OPPORTUNITIES

Telemedicine Integration

The increasing prevalence of telemedicine offers a substantial growth opportunity for the dynamometer market. The demand for remote healthcare services surged during the COVID-19 pandemic, driving the need for tools that facilitate remote monitoring, such as digital dynamometers. In 2022, the American Telemedicine Association reported a 40% increase in the use of remote monitoring devices in rehabilitation. Portable, wireless dynamometers are now commonly integrated with telemedicine platforms, enabling physicians to monitor muscle recovery in real-time, without requiring patients to visit healthcare facilities. This development is particularly beneficial for patients in rural or underserved areas, as well as those with mobility challenges, enabling access to consistent, high-quality care.

Portable Devices

The rising demand for portable dynamometers is another key market opportunity, driven by the growing trend of home-based rehabilitation. These devices are smaller, more affordable, and user-friendly, making them ideal for use in home settings. Companies such as Performance Health and Camry Electronic Co. Ltd. have developed lightweight, battery-operated dynamometers that allow patients to perform strength measurements independently, with progress remotely tracked via mobile applications.

Customization and Specialized Products

There is increasing demand for disease-specific dynamometers designed to cater to particular conditions such as stroke recovery, arthritis, and Parkinson’s disease. These specialized devices provide more precise and relevant data for specific muscle groups affected by these conditions. For instance, Hoggan Scientific LLC has developed a line of dynamometers specifically tailored for arthritis patients, offering highly sensitive force measurement tools that monitor the gradual degradation of muscle strength over time. This growing niche market for specialized dynamometers is particularly promising in regions with aging populations, where the demand for targeted rehabilitation tools is on the rise.

MARKET CHALLENGES

-

Regulatory Approvals

The stringent regulatory approval processes for medical devices present another challenge for the dynamometer market. Devices must undergo rigorous evaluations, such as obtaining FDA clearance in the United States and CE marking in the European Union, to ensure their safety and efficacy. However, these processes can be lengthy and costly. According to a 2022 report by MedTech Europe, the approval timeline for new medical devices can range from 12 to 24 months, significantly slowing down the introduction of new innovations into the market. This delay poses a particular challenge for smaller companies, which may lack the resources to navigate the complex regulatory landscape, further limiting their competitiveness.

-

Competition from Alternative Methods

The market for medical dynamometers faces growing competition from alternative muscle strength measurement tools, such as hand-grip strength testers and isokinetic machines. Although these alternatives are generally less precise than dynamometers, they are often more affordable and easier to use. A 2023 survey by Physiotherapy Review found that 30% of physical therapists in Latin America prefer hand-grip testers due to their lower costs and simplicity. This trend is particularly evident in low-income regions, where healthcare providers face budget constraints and limited access to advanced medical technologies, further challenging the expansion of the dynamometer market.

IMPACT OF COVID-19 ON THE MEDICAL DYNAMOMETER MARKET

The COVID-19 pandemic had a mixed impact on the medical dynamometer market. In 2020 and 2021, supply chain disruptions temporarily halted the production of many medical devices, including dynamometers, leading to delays in distribution and a decline in sales. However, the pandemic also accelerated the adoption of telemedicine and remote monitoring technologies, boosting demand for digital and wireless dynamometers. The telemedicine segment of the market grew by 40% during the pandemic, as patients sought to maintain their rehabilitation and physical therapy routines remotely. The need for remote patient monitoring drove innovations in digital dynamometers that integrate with telehealth platforms, enabling patients to use these devices at home and share real-time data with their healthcare providers. This trend is expected to continue as telemedicine becomes a more permanent feature of post-pandemic healthcare systems. The convenience of remote monitoring, combined with the technological advancements in wireless dynamometers, positions the market for continued growth in the evolving healthcare landscape.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

8.45% |

|

Segments Covered |

By Technology, Product Type, Application, End-User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Herkules Kunststoff Oberburg AG, Hoggan Scientific LLC., 3B Scientific GmbH, Biodex Medical Systems Inc., Biometrics Ltd., BTE Technologies, Jtech Medical Industries Inc., Kern & Sohn GmbH, Lafayette Instrument Co., Charder Electronics Co. Ltd., Fabrication Enterprises Inc., JLW Instruments, Marsden Group, North Coast Medical Inc., Performance Health, Vernier Science Education and Zhongshan Camry Electronic Co. Ltd. |

MARKET SEGMENTATION

This research report on the global medical dynamometer market is segmented and sub-segmented based on technology, product type, application, end-user, and region.

Global Medical Dynamometer Market By Technology

- Electronic Dynamometer

- Mechanical Dynamometer

The electronic dynamometers segment dominated the market and captured 65.3% of the total market share in 2023, primarily due to their precision, ease of use, and integration with digital systems. These devices are increasingly preferred in clinical environments because they provide accurate measurements and offer data storage and transmission capabilities, improving efficiency and minimizing human error. The global market for electronic dynamometers is projected to grow at a CAGR of 7.5% from 2024 to 2033, driven by rising demand for advanced diagnostic tools in physical therapy and rehabilitation.

Global Medical Dynamometer Market Analysis By Product Type

- Handheld Dynamometer

- Pinch Gauges

- Push-Pull Dynamometer

- Squeeze Dynamometer

- Others

The handheld dynamometers are the most widely used product type and had 40% of the global market share in 2023. Their portability, affordability, and user-friendly design make them a popular choice in both clinical and home-based rehabilitation settings. These devices are particularly favored in outpatient care, where frequent muscle strength assessments are required for patients recovering from musculoskeletal injuries. With growing demand for home-use and telehealth-compatible devices, the handheld dynamometer segment is likely to witness prominent growth in the coming years.

Global Medical Dynamometer Market Analysis By Application

- Orthopaedics

- Medical Trauma

- Cardiology

- Neurology

- Others

The orthopedics segment led the market and held 45.6% of total market share in 2023. This is largely due to the high prevalence of musculoskeletal disorders such as arthritis, fractures, and osteoporosis, all of which require continuous muscle strength assessments for effective treatment. According to the World Health Organization (WHO), musculoskeletal conditions are the leading cause of disability worldwide, creating a strong demand for accurate diagnostic tools like dynamometers in orthopedic care. As global populations age, particularly in regions like North America and Europe, this segment is poised for sustained growth.

Global Medical Dynamometer Market Analysis By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

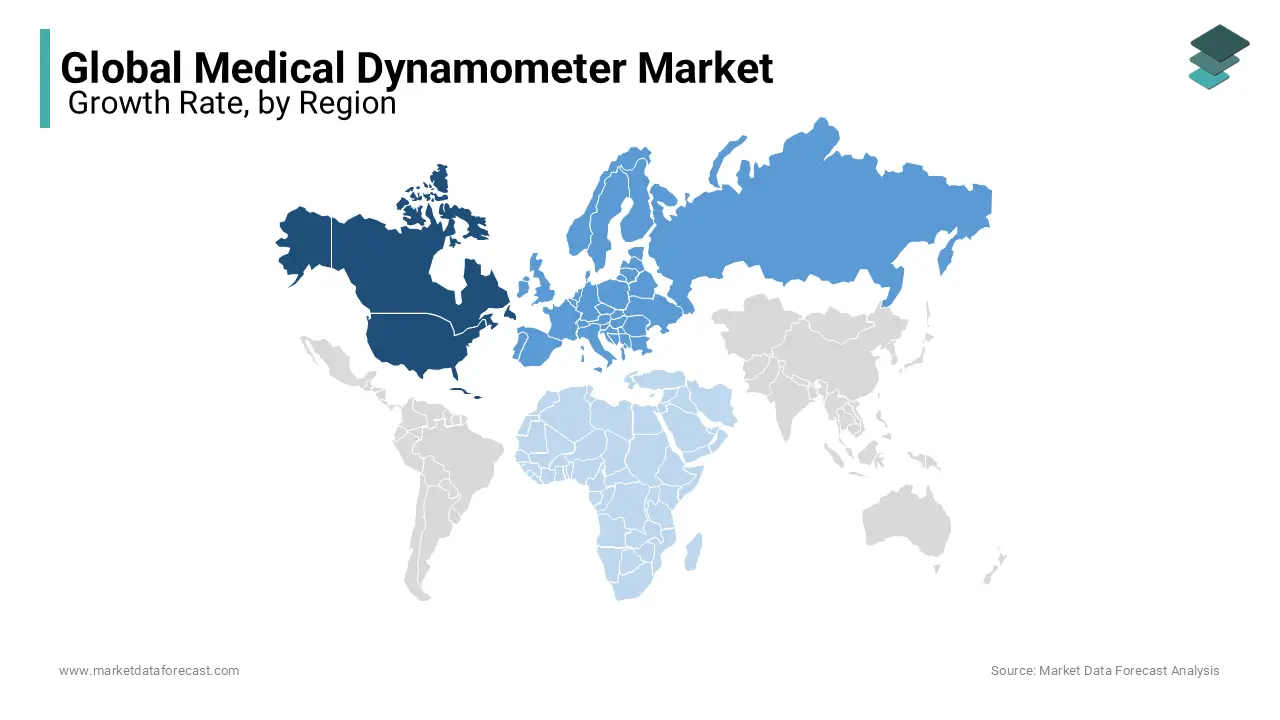

North America occupied 40.8% of global market share in 2023. The region’s dominance is attributed to its advanced healthcare infrastructure, high healthcare spending, and widespread adoption of rehabilitation technologies. The United States is the largest market within this region, driven by its aging population and the increasing incidence of musculoskeletal disorders. The Centers for Disease Control and Prevention (CDC) reports that nearly 54 million adults in the U.S. suffer from arthritis, fueling demand for dynamometers in both orthopedic and physiotherapy settings.

Europe is the second-largest medical dynamometer market, bolstered by an aging population and significant healthcare investments. Key markets include Germany, France, and the United Kingdom, where robust healthcare systems and a focus on preventive care and rehabilitation services drive demand for dynamometers. Eurostat data shows that over 20% of the European population is aged 65 or older, amplifying the need for tools to manage age-related musculoskeletal conditions. The European market is forecast to grow at a noteworthy CAGR during the forecast period, supported by strong government initiatives to integrate AI and telemedicine into post-surgery rehabilitation.

The Asia-Pacific region is emerging as a high-growth market for medical dynamometers due to improving healthcare infrastructure and increasing demand for rehabilitation services. Countries such as China, India, and Japan are witnessing rising healthcare expenditures and growing awareness of the role of physical therapy in post-surgical recovery. The market in this region is expected to expand at a promising CAGR through 2033, with Japan leading the way due to its rapidly aging population. Meanwhile, China and India are upgrading their healthcare systems to accommodate a rising patient base, further driving demand for dynamometers.

Latin America Latin America represents a smaller share of the global medical dynamometer market but is experiencing steady growth, driven by increasing healthcare investments in countries like Brazil and Mexico. The improving healthcare infrastructure and a growing emphasis on musculoskeletal rehabilitation are further contributing to the expansion of the market in Latin America. In Brazil, the expanding middle class has led to higher demand for physiotherapy services, while Mexico is focusing on enhancing its healthcare system through both public and private investments.

The Middle East & Africa region holds a smaller share of the global market, with growth limited by constrained healthcare resources. However, rising awareness of musculoskeletal disorders and increasing healthcare investments in countries like Saudi Arabia and South Africa are driving demand for rehabilitation tools. The region is expected to grow at a CAGR of 5.8% through 2030, supported by Saudi Arabia’s Vision 2030 initiative, which aims to modernize the country’s healthcare system. Despite challenges such as limited access to advanced medical technologies, there is a growing focus on improving care for chronic musculoskeletal conditions.

COMPETITIVE LANDSCAPE & KEY MARKET PLAYERS

The global medical dynamometer market is highly competitive, with several key players dominating various regional and product segments. 3B Scientific GmbH, Biodex Medical Systems Inc., and Biometrics Ltd. These firms are prominent in global markets, supplying a range of dynamometers for hospitals, rehabilitation centers, and research institutions. Hoggan Scientific LLC and JTECH Medical Industries Inc. hold strong positions in the U.S. market, while Charder Electronics Co. Ltd. and Performance Health have a strong presence in Europe and Asia. Kern & Sohn GmbH and Lafayette Instrument Co. are key players in the European market, focusing on portable solutions for muscle strength testing.

List of key participants in the global medical dynamometer market include

- Herkules Kunststoff Oberburg AG

- Hoggan Scientific LLC.

- 3B Scientific GmbH

- Biodex Medical Systems Inc.

- Biometrics Ltd.

- BTE Technologies

- Jtech Medical Industries Inc.

- Kern & Sohn GmbH

- Lafayette Instrument Co.

- Charder Electronics Co. Ltd.

- Fabrication Enterprises Inc.

- JLW Instruments

- Marsden Group

- North Coast Medical Inc.

- Performance Health

- Vernier Science Education

- Zhongshan Camry Electronic Co. Ltd.

RECENT MARKET DEVELOPMENTS

- 3B Scientific expanded its portfolio with the acquisition of CardioMetrix in February 2024, adding AI-driven muscle strength testing devices.

- Biodex Medical Systems partnered with RehabCorp in April 2023 to develop portable dynamometers for home use, tapping into the telemedicine market.

- Biometrics Ltd. launched a new line of digital dynamometers with real-time analytics in September 2023, enhancing its offerings for physiotherapists.

- Charder Electronics merged with MedTech Solutions in July 2023, expanding its reach across Europe.

- JTECH Medical introduced an AI-powered dynamometer in January 2024 to improve precision and ease of use in rehabilitation centers.

- Marsden Group expanded its presence in Asia by acquiring Dynatronics Medical in March 2024.

- Hoggan Scientific LLC launched a customizable dynamometer for arthritis patients in October 2023.

- Lafayette Instrument Co. partnered with TeleHealth Tech in November 2023 to integrate its dynamometers with telehealth platforms for remote patient monitoring.

- Performance Health acquired Dynatech Medical Devices in July 2023, enhancing its muscle strength testing portfolio.

- Zhongshan Camry Electronic Co. Ltd. partnered with Medix Technologies in December 2023 to expand its presence in the Middle East.

Frequently Asked Questions

How big is the medical dynamometer market?

The global medical dynamometer market was valued at USD 612.5 Mn in 2024.

What is the projected CAGR of the medical dynamometer market?

Between 2025 to 2033, the global market is expected to grow at a CAGR of 8.45%.

Which region is likely to dominate the medical dynamometer market in the future?

Currently, North America is dominating the market. However, the Asia-Pacific region is picking up nicely and has the highest chances to register the domination over the forecast period.

Who are the key players in the market?

Companies playing a major role in the market include Herkules Kunststoff Oberburg AG, Hoggan Scientific LLC., 3B Scientific GmbH, Biodex Medical Systems Inc., Biometrics Ltd., BTE Technologies, Jtech Medical Industries Inc., Kern & Sohn GmbH, Lafayette Instrument Co., Charder Electronics Co. Ltd., Fabrication Enterprises Inc., JLW Instruments, Marsden Group, North Coast Medical Inc., Performance Health, Vernier Science Education and Zhongshan Camry Electronic Co. Ltd.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]