Global Medical Device Cleaning Market Size, Share, Trends & Growth Forecast Report By Device, Technique, EPA Classification and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), Industry Analysis From 2025 To 2033.

Global Medical Device Cleaning Market Size

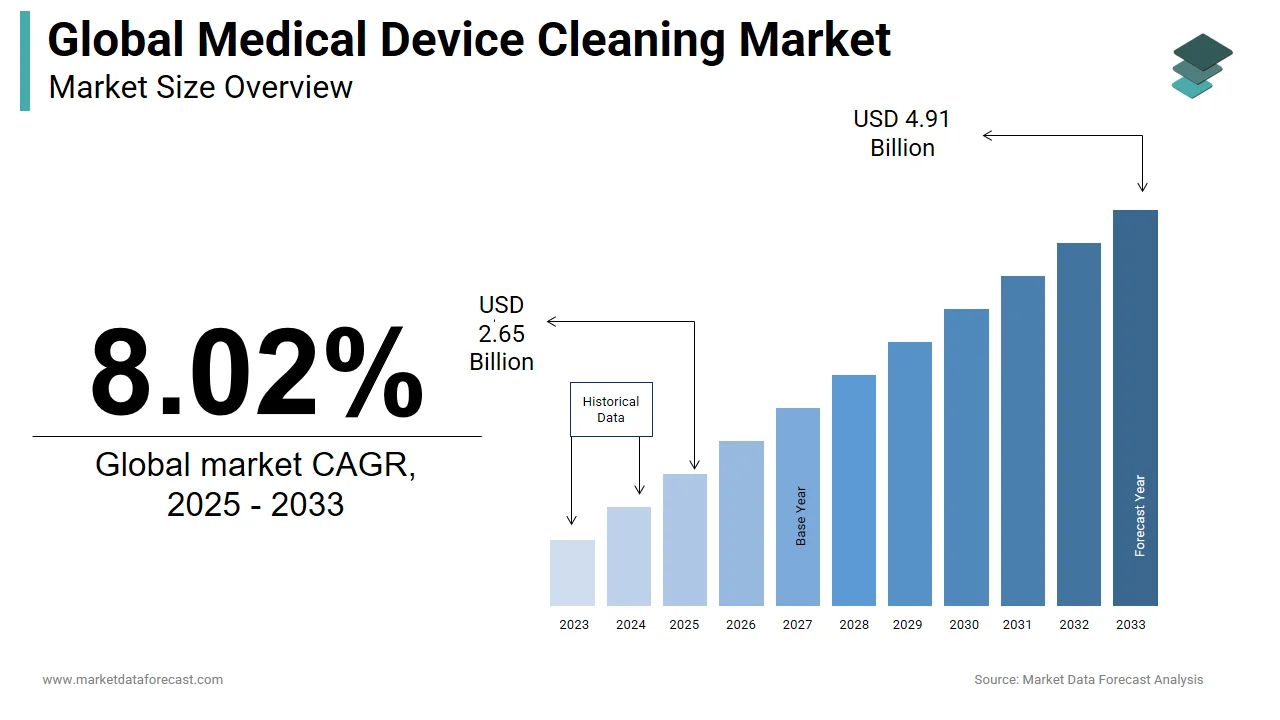

The size of the global medical device cleaning market was worth USD 2.45 billion in 2024. The global market is anticipated to grow at a CAGR of 8.02% from 2025 to 2033 and be worth USD 4.91 billion by 2033 from USD 2.65 billion in 2025.

The Medical Device Cleaning is the process, products, and services dedicated to ensuring the hygienic maintenance of medical instruments and equipment used across healthcare settings. This is important in safeguarding patient safety by mitigating the risk of healthcare-associated infections (HAIs), which remain a significant global concern. According to the Centers for Disease Control and Prevention (CDC), approximately one in 31 hospital patients in the United States contracts at least one HAI daily the necessity stringent cleaning protocols. The World Health Organization (WHO) further estimates that hundreds of millions of patients worldwide are affected annually by HAIs, with improper sterilization being a contributing factor.

Medical device cleaning involves both manual and automated methods by utilizing specialized detergents, disinfectants, and advanced technologies such as ultrasonic cleaners and vaporized hydrogen peroxide systems. Regulatory bodies like the U.S. Food and Drug Administration (FDA) emphasize strict compliance with cleaning standards to ensure devices are free from contaminants, including blood, tissue, and microbial agents. A study published in the Journal of Hospital Infection revealed that over 50% of reusable medical devices harbor residual contamination post-cleaning due to suboptimal procedures, reinforcing the need for improved training and adherence to best practices. The demand for sophisticated cleaning solutions continues to grow as healthcare facilities increasingly adopt minimally invasive surgeries and complex diagnostic tools. This trend aligns with the broader commitment to delivering high-quality care while minimizing infection risks by making the medical device cleaning market an essential component of modern healthcare infrastructure.

MARKET DRIVERS

Increasing Incidence of Healthcare-Associated Infections (HAIs)

The rising prevalence of healthcare-associated infections (HAIs) serves as a significant driver for the medical device cleaning market. HAIs pose a substantial burden on healthcare systems globally, with the Centers for Disease Control and Prevention estimating that approximately 1.7 million HAIs occur annually in U.S. hospitals alone, leading to nearly 99,000 deaths. The World Health Organization highlights that HAIs affect millions more worldwide, particularly in low- and middle-income countries where infection control measures are often inadequate. Contaminated medical devices are a known contributor to these infections, emphasizing the need for rigorous cleaning protocols. For instance, a report by the National Institutes of Health revealed that over 60% of HAIs are linked to improper handling or sterilization of reusable instruments. This alarming connection amplifies the demand for advanced cleaning technologies and stringent compliance with hygiene standards to curb infection rates and improve patient outcomes.

Stringent Regulatory Standards for Medical Device Safety

Stringent regulatory frameworks established by government agencies have become a pivotal driver for the medical device cleaning market. The U.S. Food and Drug Administration mandates that all reusable medical devices undergo validated cleaning and sterilization processes to ensure safety and efficacy. Similarly, the European Medicines Agency mandates manufacturers to offer detailed reprocessing instructions, with non-compliance leading to severe penalties. For example, the Centers for Medicare & Medicaid Services reported that hospitals failing to meet infection control guidelines risk losing federal funding. Furthermore, data from the World Health Organization indicates that adherence to proper cleaning protocols reduces contamination risks by up to 85%. These regulatory pressures compel healthcare facilities to invest in high-quality cleaning solutions are driving innovation and adoption of advanced cleaning technologies while ensuring compliance with global safety benchmarks.

MARKET RESTRAINTS

High Costs Associated with Advanced Cleaning Technologies

The adoption of advanced medical device cleaning technologies is often hindered by the high costs involved, which pose a significant restraint to market growth. According to the World Health Organization, implementing state-of-the-art sterilization systems, such as automated endoscope reprocessors or low-temperature hydrogen peroxide sterilizers, can cost healthcare facilities upwards of $50,000 per unit. According to the U.S. Department of Health and Human Services, ongoing expenses for maintenance, specialized detergents, and staff training further strain budgets, especially for smaller hospitals and clinics. A report by the National Institutes of Health indicates that approximately 30% of healthcare facilities in developing regions delay investments in modern cleaning equipment due to financial constraints. This economic barrier limits access to cutting-edge solutions, forcing some institutions to rely on outdated methods that may compromise infection control efficacy.

Complexity in Cleaning Specialized Medical Devices

The increasing complexity of medical devices presents another major restraint for the medical device cleaning market. The U.S. Food and Drug Administration has identified that intricate designs, such as those found in robotic surgical instruments and flexible endoscopes, make thorough cleaning particularly challenging. A study published by the Centers for Disease Control and Prevention revealed that over 70% of complex devices retain microbial contamination after initial cleaning attempts due to hard-to-reach crevices and delicate components. Furthermore, the World Health Organization notes that insufficiently cleaned devices contribute to nearly 40% of post-surgical infections globally. Healthcare workers often face difficulties adhering to manufacturer-specific cleaning protocols, which vary widely and require extensive training. These complexities not only increase the risk of inadequate sterilization but also create operational inefficiencies, limiting the effectiveness of current cleaning practices and hindering broader market advancements.

MARKET OPPORTUNITIES

Growing Adoption of Minimally Invasive Surgical Procedures

The increasing adoption of minimally invasive surgical procedures presents a significant opportunity for the medical device cleaning market. These procedures rely heavily on specialized instruments such as laparoscopes and arthroscopes, which require meticulous cleaning due to their intricate designs. The Centers for Disease Control and Prevention emphasizes that improper cleaning of such devices can lead to cross-contamination by creating demand for advanced cleaning solutions tailored to these instruments. According to the World Health Organization, hospitals performing high volumes of minimally invasive surgeries are investing in automated cleaning systems to ensure compliance with hygiene standards.

Rising Focus on Sustainable and Eco-Friendly Cleaning Solutions

The shift toward sustainable and eco-friendly cleaning solutions offers another promising opportunity for the medical device cleaning market. The U.S. Environmental Protection Agency reports that healthcare facilities are increasingly prioritizing green practices, including the use of biodegradable detergents and energy-efficient sterilization methods, to reduce their environmental footprint. A study by the National Institutes of Health found that over 60% of hospitals are actively seeking alternatives to traditional chemical-based cleaners, which can be harmful to both the environment and human health. Additionally, the World Health Organization advocates for the adoption of low-temperature sterilization techniques, such as vaporized hydrogen peroxide, which consume less energy while maintaining efficacy. As regulatory bodies push for stricter environmental guidelines, manufacturers have an opportunity to develop innovative, sustainable cleaning products that align with these goals.

MARKET CHALLENGES

Limited Standardization in Cleaning Protocols

The lack of universal standardization in cleaning protocols poses a significant challenge to the medical device cleaning market. This variability arises because manufacturers provide device-specific instructions that may not align with institutional practices or available resources. Furthermore, a report by the National Institutes of Health reveals that over 50% of healthcare workers find manufacturer guidelines difficult to interpret or implement due to their complexity. This lack of clarity increases the risk of improper sterilization is undermines patient safety, and creates operational inefficiencies. Addressing this challenge requires collaborative efforts to establish clear, universally applicable standards.

Rising Concerns Over Antimicrobial Resistance

The growing threat of antimicrobial resistance (AMR) presents another critical challenge for the medical device cleaning market. The U.S. Department of Health and Human Services warns that inadequate cleaning of medical devices can contribute to the spread of resistant pathogens, which already cause over 2.8 million infections annually in the United States alone. The World Health Organization identifies improper disinfection practices as a key factor enabling the proliferation of drug-resistant organisms in healthcare settings. Additionally, a study by the National Institutes of Health indicates that biofilm formation on inadequately cleaned devices is a major contributor to AMR, as these biofilms protect bacteria from both cleaning agents and antibiotics. This challenge is exacerbated by the limited availability of effective cleaning agents capable of breaking down biofilms.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Device, Technique, EPA Classification, and Region. |

|

Various Analyses Covered |

Global, Regional and Country-Level Analysis, Segment-Level Analysis, Drivers, Restraints, Opportunities, Challenges; PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

AT&T, BCE Inc, Charter Communications, Hughes Network Systems, LLC, Comcast, CenturyLink, KT Corp., LG Uplus Corp., Singtel, SK broadband CO.LTD., T‑Mobile USA, Inc., Verizon, Viasat, Inc., and others. |

SEGMENT ANALYSIS

By Device Insights

The critical devices segment held 45.6% of the medical device cleaning market share in 2024. These devices come into direct contact with sterile tissues or the bloodstream with rigorous sterilization to prevent life-threatening infections. According to the World Health Organization, improper cleaning of critical devices contributes to over 30% of post-surgical infections globally. Their dominance arises from the high stakes involved in their usage, stringent regulatory standards, and the increasing volume of surgeries worldwide.

The semi-critical devices segment is projected to grow CAGR of 8.7% during the forecast period. This rapid growth is driven by the rising adoption of minimally invasive procedures, where semi-critical devices like flexible endoscopes are extensively used. The U.S. Food and Drug Administration emphasizes that these devices are prone to biofilm formation, requiring advanced cleaning methods, which fuels demand for innovative cleaning solutions. Additionally, the World Health Organization reports a 50% increase in endoscopic procedures over the past decade, further accelerating segment growth. The semi-critical devices represent a vital focus area is blends technological advancements with critical hygiene needs to meet evolving medical demands.

By Technique Insights

The cleaning segment dominated the global medical device cleaning market with 35.6% of the total share in 2024. According to the Centers for Disease Control and Prevention, enzymatic cleaners are preferred due to their ability to break down organic materials like blood and tissue, which are common contaminants on reusable devices. The World Health Organization highlights that enzymes improve cleaning efficiency by up to 40% compared to traditional detergents, reducing the risk of residual contamination.

The ultraviolet (UV) disinfection segment is likely to grow with a CAGR of 12.8% in the coming years, with the UV technology's ability to achieve high-level disinfection without leaving harmful chemical residues, a key advantage over traditional methods. The U.S. Food and Drug Administration emphasizes that UV systems effectively inactivate pathogens, including drug-resistant bacteria, by disrupting their DNA. Furthermore, the World Health Organization notes that UV disinfection reduces processing times by up to 50% by making it ideal for high-throughput environments. Increasing concerns over antimicrobial resistance and the need for eco-friendly solutions further propel this segment's expansion. Its non-toxic nature and operational efficiency make UV disinfection a pivotal innovation in modern healthcare cleaning practices.

By EPA Classification Insights

The high-level disinfection segment held 45.3% of the global medical device cleaning market share in 2024. This segment is critical for devices that contact mucous membranes or non-intact skin, such as endoscopes and surgical instruments. According to the Centers for Disease Control and Prevention, high-level disinfection effectively eliminates most microorganisms, ensuring compliance with infection control standards. The demand for high-level disinfection remains robust, with over 20 million endoscopic procedures performed annually in the U.S.

The intermediate-level disinfection segment is projected to grow at a lucrative CAGR of 7.8% during the forecast period. This growth is driven by its effectiveness against tuberculosis and other resistant pathogens by making it ideal for non-critical devices like stethoscopes and blood pressure cuffs. The National Institutes of Health notes that intermediate-level disinfectants, such as alcohol-based solutions, are gaining traction due to their cost-effectiveness and ease of use. Additionally, the increasing focus on preventing healthcare-associated infections (HAIs), which affect 1 in 31 patients daily in U.S. hospitals, as reported by the Centers for Disease Control and Prevention.

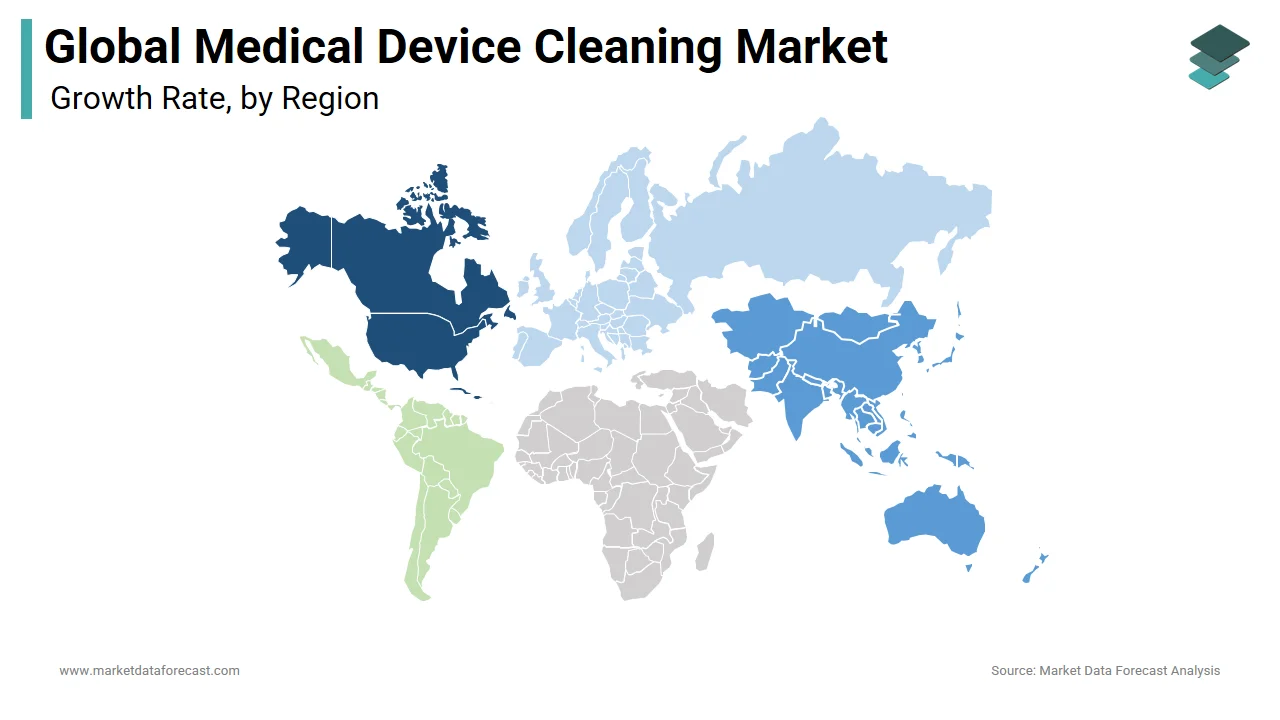

REGIONAL ANALYSIS

North America dominated the medical device cleaning market by accounting for 40.3% of the global share in 2024, with the stringent FDA regulations mandating advanced cleaning protocols and the high prevalence of minimally invasive surgeries, with over 15 million procedures annually in the U.S. alone. As per the National Institutes of Health, North America’s robust healthcare infrastructure and significant investments in infection control technologies further solidify its position. The region prioritizes effective cleaning solutions by making it a critical hub for innovation and adoption of cutting-edge sterilization methods.

Asia-Pacific is deemed to grow with a CAGR of 8.5% in the coming years. This growth is fueled by rapid urbanization, increasing healthcare spending, and rising awareness of infection control measures. Additionally, government initiatives, such as India’s National Health Mission, emphasize improving hygiene standards. The region’s expanding medical tourism industry will further amplify the need for high-quality cleaning practices.

KEY MARKET PLAYERS

Some of the notable players dominating the global medical device cleaning market analyzed in this report are STERIS plc, Advanced Sterilization Products, Getinge AB., 3M Company, Cantel Medical, Cardinal Health, Sotera Health, Tristel Solutions Ltd, Metrex Research, Ecolab, Medline Industries, Inc., Fortive Corporation, GAMA Healthcare Ltd, Oro Clean Chemie AG, and many others.

TOP LEADING KEY PLAYERS IN THE MARKET

STERIS plc is one of the leading players in the global medical device cleaning market, renowned for its comprehensive portfolio of infection prevention solutions. The company provides advanced sterilization and decontamination technologies, including automated endoscope reprocessors and low-temperature sterilization systems. STERIS has established itself as a key contributor to the market through continuous innovation and a strong focus on regulatory compliance by ensuring its products meet the highest standards of safety and efficacy required in healthcare settings.

Advanced Sterilization Products (ASP), a subsidiary of Fortive Corporation, is another prominent player that has significantly shaped the market with its cutting-edge sterilization and high-level disinfection technologies. ASP’s flagship products, such as the STERRAD® system, are widely adopted for their efficiency in addressing complex cleaning needs, particularly for heat-sensitive devices. The company’s emphasis on research and development has enabled it to deliver tailored solutions that cater to the evolving demands of modern healthcare facilities.

Getinge AB. is a global leader in medical device cleaning, offering a wide range of products and services for sterile processing and infection control. The company’s innovative cleaning and sterilization systems, including washer-disinfectors and autoclaves, are integral to maintaining hygiene standards in hospitals and surgical centers. Getinge’s commitment to sustainability and operational efficiency has positioned it as a trusted partner for healthcare providers seeking reliable and eco-friendly cleaning solutions. Together, these top players drive advancements in the industry by shaping the future of medical device cleaning practices worldwide.

TOP STRATEGIES USED BY THE KEY MARKET PARTICIPANTS

Strategic Collaborations and Partnerships

Key players in the medical device cleaning market are increasingly leveraging collaborations and partnerships to enhance their product offerings and expand their global reach. For instance, companies like STERIS plc and Ecolab have formed alliances with healthcare institutions and research organizations to co-develop advanced cleaning technologies tailored to specific needs. Such collaborations enable firms to tap into new markets while ensuring compliance with regional regulations. By partnering with smaller innovators or academic institutions, these companies also gain access to cutting-edge research and development capabilities by allowing them to stay ahead of competitors in delivering innovative solutions.

Investment in Research and Development

Investing heavily in research and development (R&D) is another critical strategy employed by leading players such as Advanced Sterilization Products and Getinge AB. These companies focus on creating next-generation cleaning technologies that address emerging challenges, such as antimicrobial resistance and the need for eco-friendly solutions. By prioritizing R&D, they can introduce products with enhanced efficiency, lower environmental impact, and compatibility with complex medical devices.

Expansion through Acquisitions and Mergers

Acquisitions and mergers are pivotal strategies used by key players like Cantel Medical and Fortive Corporation to consolidate their dominance in the medical device cleaning market. By acquiring smaller companies with niche expertise or complementary product portfolios, these firms expand their service offerings and geographic presence. For example, acquiring companies specializing in low-temperature sterilization or automated cleaning systems allows larger entities to diversify their solutions while eliminating competition. This strategy not only accelerates growth but also enhances operational synergies by enabling companies to deliver comprehensive and integrated cleaning solutions to their clients.

Focus on Sustainability and Eco-Friendly Solutions

A growing emphasis on sustainability has prompted major players such as Metrex Research and GAMA Healthcare Ltd to adopt strategies centered around eco-friendly cleaning solutions. These companies are developing biodegradable detergents, energy-efficient sterilization systems, and recyclable packaging to meet the increasing demand for environmentally responsible products. By aligning with global initiatives to reduce carbon footprints and minimize chemical waste, they appeal to environmentally conscious healthcare providers. This focus on sustainability not only strengthens brand loyalty but also positions these companies as leaders in addressing the dual challenges of infection control and environmental preservation.

COMPETITIVE LANDSCAPE

The global medical device cleaning market is characterized by intense competition, driven by the presence of established players and emerging innovators striving to gain a competitive edge. Leading companies such as STERIS plc, Advanced Sterilization Products, and Getinge AB dominate the market through their extensive product portfolios, cutting-edge technologies, and robust distribution networks. These firms leverage strategies like strategic partnerships, mergers and acquisitions, and significant investments in research and development to maintain their leadership positions. For instance, collaborations with healthcare institutions enable them to tailor solutions to specific regional needs, while acquisitions of niche players expand their technological capabilities and geographic reach.

Despite the stronghold of these key players, the market also witnesses fierce competition from mid-sized and smaller companies like Tristel Solutions Ltd, Metrex Research, and Oro Clean Chemie AG, which focus on innovation and cost-effective solutions. These companies often target underserved markets or specialize in eco-friendly and sustainable cleaning technologies, capitalizing on the growing demand for greener alternatives. Additionally, regulatory pressures and the need for compliance with stringent infection control standards further intensify competition, as companies race to develop products that meet evolving guidelines.

The competitive landscape is also shaped by the increasing adoption of minimally invasive surgeries and complex medical devices, which require advanced cleaning solutions. This dynamic environment fosters continuous innovation by ensuring that companies remain agile and responsive to market demands.

RECENT MARKET DEVELOPMENTS

- In March 2023, Getinge AB acquired Ultra Clean Systems Inc., a U.S.-based manufacturer of ultrasonic cleaning technologies. This acquisition is expected to expand Getinge’s sterile reprocessing portfolio and strengthen its position in the surgical instrument cleaning segment.

- In January 2021, Cardinal Health launched the Smart Compression™ system, a digitally connected solution for compression therapy. This launch was designed to improve patient care and operational efficiency in clinical environments.

MARKET SEGMENTATION

This Europe medical device cleaning market research report is segmented and sub-segmented into the following categories.

By Device

- Non-critical

- Semi-critical

- Critical

By Technique

- Cleaning

- Detergents

- Buffers

- Chelators

- Enzymes

- Others

- Disinfection

- Chemical

- Alcohol

- Chlorine & Chorine Compounds

- Aldehydes

- Phenolics

- Metal

- Ultraviolet

- Others

- Chemical

- Sterilization

- Heat Sterilization

- Ethylene Dioxide (ETO) Sterilization

- Radiation Sterilization

By EPA Classification

- High Level

- Intermediate Level

- Low Level

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

What was the size of the global medical device cleaning market in 2024?

The global medical device cleaning market size was valued at USD 2.45 billion in 2024.

Which region led the medical device cleaning market in 2024?

The North American region accounted for the most significant share of the market in 2024.

Which segment by device accounted for the major share of the market in 2024?

Based on the devices, the semi-critical devices segment led the market with a leading share in 2024.

What are some of the promising companies in the medical device cleaning market?

STERIS plc, Advanced Sterilization Products, Getinge AB., 3M company, Cantel Medical, Cardinal Health, Sotera Health, Tristel Solutions Ltd, Metrex Research, Ecolab, Medline Industries, Inc., Fortive Corporation, GAMA Healthcare Ltd and Oro Clean Chemie AG are a few of the noteworthy players in the medical device cleaning market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]