Global Medical Aesthetic Devices Market Size, Share, Trends & Growth Forecast Report – Segmented By Product Type (Energy-Based Devices, Implants and Anti-wrinkle Products), Procedures (Cosmetic Procedures and Reconstruction Procedures), End Users & Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa) - Industry Analysis (2025 to 2033)

Global Medical Aesthetic Devices Market Size

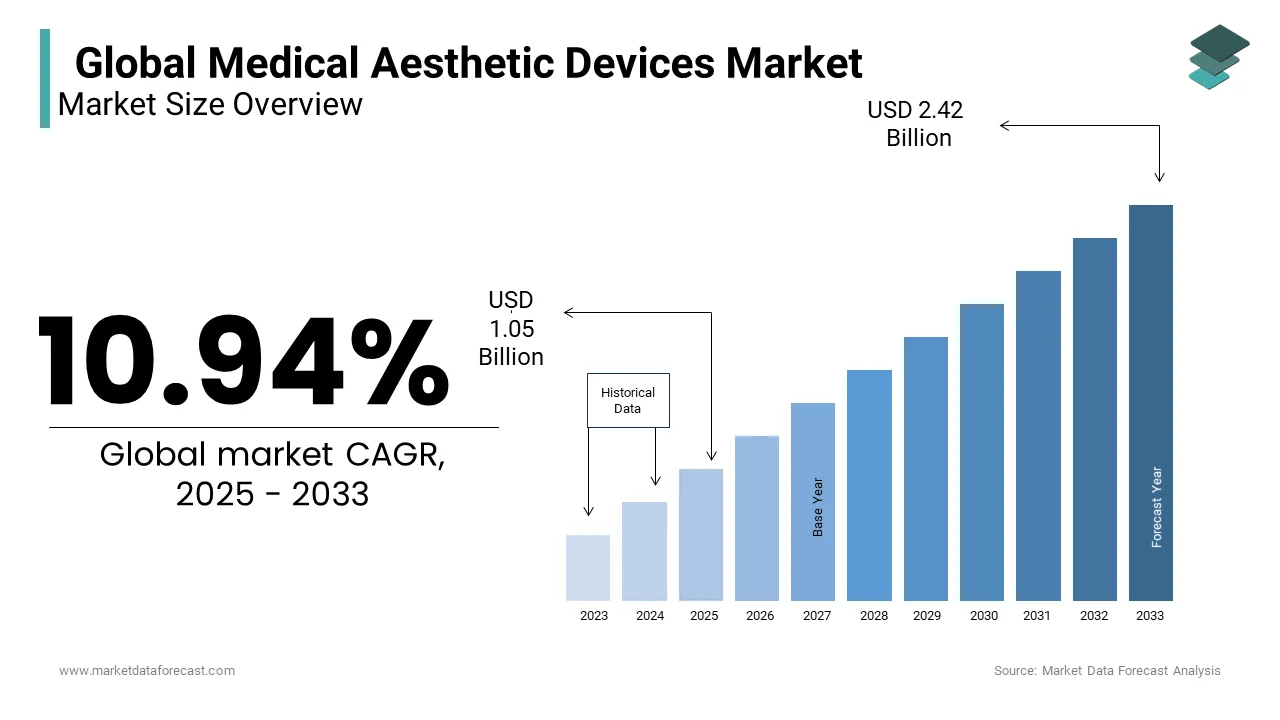

The global medical aesthetic devices market size was valued at USD 0.95 billion in 2024. The medical aesthetic devices market size is expected to have 10.94% CAGR from 2025 to 2033 and be worth USD 2.42 billion by 2033 from USD 1.05 billion in 2025.

Medical aesthetic devices enhance cosmetic appearance by undergoing surgeries or treatments for conditions such as scars, wrinkles, moles, excess fat, unwanted hair, liver spots, and skin discoloration. Generally, medical aesthetics involves surgeries and treatments like plastic surgery, dermatology, radiofrequency ablation, chemical peel, maxillofacial surgery, oral surgery, liposuction, breast implants, and reconstructive surgery. In addition, many people consider medical aesthetics to improve their quality of life and enhance their social engagement and psychological well-being.

MARKET DRIVERS

The growing number of people concerned about physical appearance and signs of aging is one of the key factors propelling the medical aesthetic devices market.

In addition, the availability of technologically advanced products and treatment methods and the increasing disposable income of people leading to rising demand for cosmetic surgeries in developed and developing countries are some of the key factors driving the global medical aesthetic devices market. People also opt for advanced techniques such as radiofrequency and laser treatments, ensuring effective and satisfactory results. Furthermore, the rise in the population between 30 and 65 leads to increased demand for various medical aesthetic treatments and surgeries. This trend is expected to continue during the forecast period offering lucrative growth opportunities for the key players in the global medical aesthetics market.

The influx of advanced medical aesthetic techniques and practices with significant results creates growth opportunities for market participants.

Furthermore, increasing investments to escalate research and development activities to offer advanced treatment devices and surgical procedures regarding cosmetics are expected to create lucrative growth opportunities for the people involved in the global medical aesthetic devices market.

MARKET RESTRAINTS

High Cost of Treatments and Devices

The high cost of medical aesthetic devices and treatments limits market growth, particularly for advanced technologies like laser and radiofrequency systems. The U.S. Bureau of Labor Statistics reported the median annual wage for U.S. workers in 2023 was $58,260, while a single laser skin resurfacing session can exceed $2,000, straining affordability. In Brazil, the Brazilian Institute of Geography and Statistics found that in 2022, 58.7% of households earned less than $1,000 monthly, making such treatments inaccessible to most. These costs deter smaller clinics from investing in equipment and patients from seeking procedures, constraining market expansion, especially in economically challenged regions.

Risk of Side Effects and Complications

Safety concerns from potential side effects of aesthetic procedures hinder market growth by reducing consumer trust. The U.S. Food and Drug Administration recorded 5,486 adverse event reports for cosmetic devices in 2022, reflecting risks like infections or scarring. The World Health Organization estimated in its 2021 Global Patient Safety report that unsafe medical procedures contribute to 2.6 million annual complications worldwide, including cosmetic interventions. These statistics, amplified by visible social media reports, increase public caution, lowering demand. As safety remains a priority, unregulated or poorly executed treatments continue to challenge the medical aesthetic devices market’s expansion.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Product Type, Procedure, End-User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis; Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Allergan, Cynosure, Johnson & Johnson, LCA Pharmaceutical, Galderma Pharma, Solta Medical, Cutera, Focus Medical, Human Med Ag, Genzyme Corporation, Alcon Inc., and Alma Lasers. |

SEGMENTAL ANALYSIS

By Product Type Insights

The anti-wrinkle products segment is estimated to show considerable growth during the forecast period due to the complete accessibility of these products, immediate and continual results, and deteriorating costs.

However, the implants segment dominated the medical aesthetic devices market in 2024.

On the other hand, the energy-based devices segment is also expected to gain a substantial share in the market during the forecast period due to the increasing demand for minimally invasive and non-invasive techniques for various purposes like body contouring, skin tightening, skin resurfacing, etc.

By Procedure Insights

The minimally invasive and non-surgical procedures led the market in 2024 and are anticipated to continue leading the market during the forecast period due to the rising demand for these procedures in the aesthetic industry. In addition, populations prefer to reduce fat, use anti-aging procedures, and even reshape faces with natural techniques without surgery.

However, the reconstruction procedures segment is expected to have a promising share of the global medical aesthetic devices market during the forecast period due to more people opting for changing their facial structures and due to increased cases of disfiguration due to accidents.

By End-User Insights

The clinics and beauty centers segment is anticipated to account for a dominating share of the global market during the forecast period and grow at a high pace due to a rise in the number of clinics and medical spas, increasing investments for providing better infrastructure and resources in hospitals, and the availability of skilled professionals. In addition, trained staff to operate aesthetic procedures increased the adoption rate of technologically advanced devices.

However, the home use segment is expected to witness growth during the forecast period due to the increasing interest in home care services, especially after the pandemic. As a result, more people are now opting for the comfort of having services provided to them at home.

REGIONAL ANALYSIS

The Asia-Pacific market held the leading share of the worldwide market in 2024 and the lead of the Asia-Pacific region is expected to continue throughout the forecast period owing to many surgical procedures performed in developing countries like South Korea, Japan, and China each year. Furthermore, increasing disposable income and a large working population create demand for aesthetic procedures in these countries. Additionally, the lower costs for procedures and the hike in medical tourism systems support the market's growth. Furthermore, the growing geriatric pool of the region needing personal care services promotes market growth. In addition, rising advances in the medical industry, along with the growing awareness regarding better healthcare services in the area, promote growth.

The North American region contributes substantially to the global market. It is expected to witness growth during the forecast period due to increasing treatment procedures and adopting novel and advanced technologies. Additionally, key market players in the region established healthcare infrastructures, and increasing interest in personal care in countries like the U.S. and Canada are expected to help market growth.

The European market held a moderate share of the global market in 2024 and is predicted to grow at a healthy CAGR during the forecast period.

Latin America and the MEA are anticipated to grow at a CAGR of 11.17% and 10.46%, respectively, during the forecast period.

KEY MARKET PLAYERS

The global medical aesthetic devices market is highly fragmented, with many local players competing with international players. Some of the notable participants dominating the global medical aesthetic devices market are Allergan, Cynosure, Johnson & Johnson, LCA Pharmaceutical, Galderma Pharma, Solta Medical, Cutera, Focus Medical, Human Med Ag, Genzyme Corporation, Alcon Inc., and Alma Lasers.

RECENT HAPPENINGS IN THE MARKET

- In November 2024, a leader in medical aesthetic technology, Venus Concept Inc., recently released its financial results for the three- and nine-month period ending September 30, 2024. Total revenue of $21.5 million was down $3.0 million, or 12%, from last year's period. U.S. revenue was also down 4%. However, cash system sales increased 30% from the same period, accounting for around 59% of total systems and subscriptions revenue, up from 39%.

- In November 2024, Global consumer wellness company Sisram Medical Ltd. (the "Company" or "Sisram," stock code 1696. HK collectively referred to as the "Group") is pleased to announce that the event "Alma Academy," attended by more than 500 doctors from 47 different nations, was successfully held in Dubai, United Arab Emirates, from November 10th through the 13th, 2024. Alma Academy is a cutting-edge method for closely connecting with the market that enables the company to influence public opinion in favor of Sisram's mission and solutions.

- In October 2024, Aesthetics Biomedical, a provider of medical aesthetics products, services, and devices, today announced that the FDA had approved the use of its Vivace Ultra device for electrocoagulation and hemostasis in dermatologic and general surgical procedures. The system includes various RF options and a HIPAA-compliant patient data-tracking system that gathers information about the patient's numerous treatment regions below the skin to create an effective treatment plan.

- In October 2024, Flawless Beauty & Skin and Med Pen Concepts received warning letters from the US FDA for allegedly marketing noncompliant medical equipment. The Aesthetic Guide also recognized Crown Aesthetics' SkinPen Precision as "Best in Industry-Nonsurgical Innovation."

MARKET SEGMENTATION

This research report on the global medical aesthetic devices market has been segmented and sub-segmented based on the product type, procedure, end-user, and region.

By Product Type

- Energy-Based Devices

- Aesthetic Laser Devices

- Body Contouring Devices

- Microdermabrasion

- Ultrasound

- Implants

- Anti-Wrinkle Products

- Botulinum toxin

- Dermal Fillers

- Chemical Peel

By Procedure

- Cosmetic Procedures

- Minimally Invasive

- Surgical Procedures

- Reconstruction Procedures

By End Users

- Home Use

- Clinics and Beauty Centers

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

What was the size of the global medical aesthetic devices market in 2024?

The global medical aesthetic devices market was valued at USD 0.95 million in 2024.

Which region occupied major share of the global medical aesthetic devices market in 2024?

Geographically, the North American region accounted for the most significant share of the market in 2024.

Which segment by product dominated the medical aesthetic devices market in 2024?

Based on the product, the anti-wrinkle product segment accounted for the major share of the market in 2024.

Who are some of the notable players in the medical aesthetic devices market?

Allergan, Cynosure, Johnson & Johnson, LCA Pharmaceutical, Galderma Pharma, Solta Medical, Cutera, Focus Medical, and Human Med Ag, Genzyme Corporation, Alcon Inc., and Alma Lasers are some of the key players in the medical aesthetic devices market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]