Global Meat Snacks Market Size, Share, Trends, & Growth Forecast Report – Segmented By Product (Jerky, Meat Sticks, Pickled Sausages, Ham Sausages, Pickled Poultry Meat And Others), Meat Type (Poultry, Beef, Pork, Others), Flavours (Original, Peppered, Teriyaki, Smoked, Others), Distribution Channel (Convenience Stores, Supermarket & Hypermarkets, Grocery Stores, Restaurants And Others), And Region (North America, Europe, Asia Pacific, Latin America, And Middle East & Africa) - Industry Analysis (2025 To 2033)

Global Meat Snacks Market Size

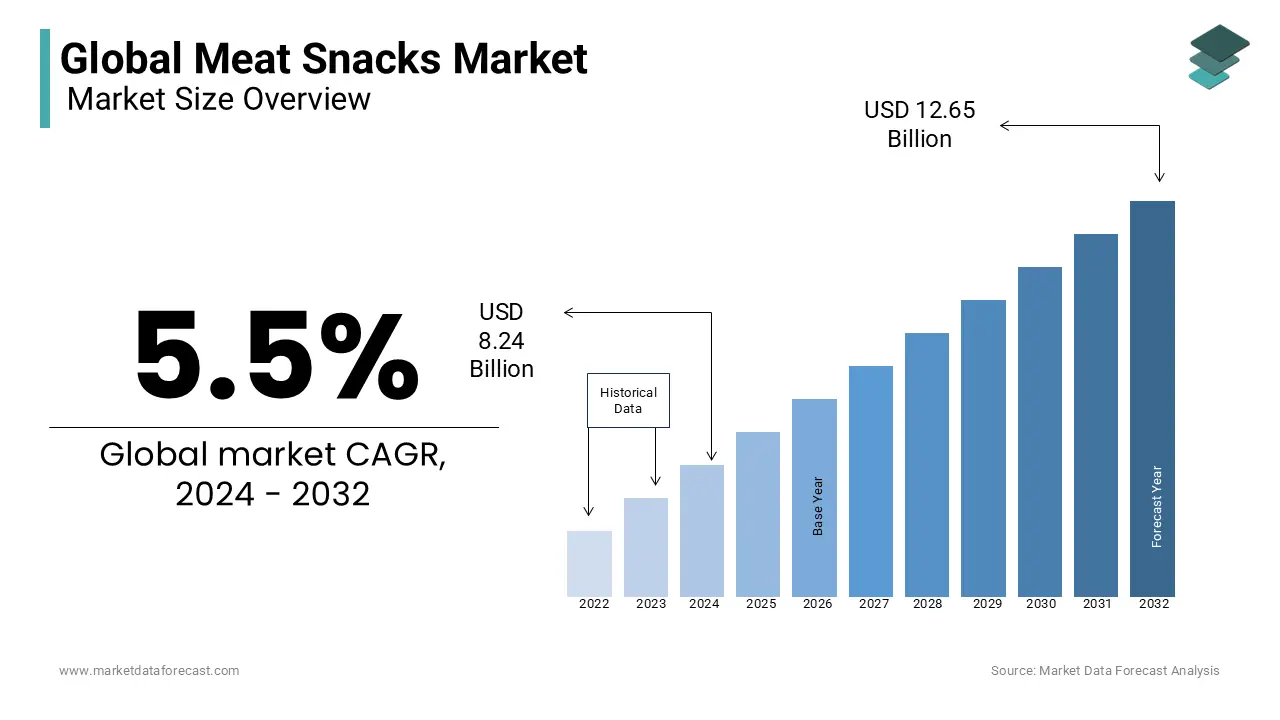

The global meat snacks market size was calculated to be USD 8.24 billion in 2024 and is anticipated to be worth USD 13.34 billion by 2033 from USD 8.69 billion In 2025, growing at a CAGR of 5.50% during the forecast period. Meat snacks have become popular due to the demand for available high-protein snack products.

Meat snacks are food products made from processed meat along with other ingredients. More excellent specific flavor, nutrition and shelf life are the main focus these days for the making of these snacks. Processing includes soaking the meat in solution and drying it for some time. Meat snacks are available in dried meat, sticks, sausages, and other types sold in convenience stores, supermarkets, hypermarkets, online retailers, etc. This product is often available in a variety of flavors, depending on the taste of the consumer. The surge in disposable income of consumers in emerging nations is a significant driving force for market growth.

Current Scenario of the Global Meat Snacks Market

Presently, the meat snacks market maintains a strong growth momentum. Despite that there is a great demand from the buyers for more variety, with chicken stands as the most prevalent protein, implying pork is a comparatively untapped opportunity. Several companies and brands are trying to bridge this void in the market with a handy, accessible and tasty choice that delivers all the functional advantages of being protein-loaded, consequently holding customers feeling satiated longer, and at the same time, ensuring an excellent texture. In addition, the meat, salty, and sweet types continue to show robust performance at convenience stores and supermarkets regardless of inflation’s firm grip on these categories.

MARKET DRIVERS

The increasing demand for healthy snacks that taste familiar and are suitable for daily consumption is expected to drive market growth.

Meat snacks are a healthier alternative to the regular snack products that are available. The awareness among consumers regarding the nutritional ingredients that are being added to the snack products and the rigorous branding efforts by leading manufacturers of meat snacks are increasing the popularity of these products worldwide. The increasing emphasis on high levels of protein intake among millennial generations is assumed to be a major driving force for increased demand. Progress in R&D activities for developing new flavors that are extracted from natural ingredients is supposed to promote demand for these products in the coming days. The market is presumed to be boosted by introducing new fragrances without including fresh ingredients.

Unstable prices for raw materials, such as beef, pork, and poultry, challenge manufacturers of products that influence their purchasing decisions. The rapid development of new products can lead to many products, which can give consumers too many options. As competition grows fierce, manufacturers must ensure product positioning and innovative marketing strategies to maintain the industry's competitive edge. Sales channels play a vital role in the industrial supply chain, where meat snacks are mass-produced items. Product demand is usually high due to easy access, which is the main differentiator for manufacturers. The global meat snack market is expected to be heavily influenced by the increased use of social media. This scenario in the meat snack market is due to a change in consumer awareness that accompanies the widespread use of smart technology.

Consumer buying patterns may be associated with increased promotion and marketing of new and innovative meat products on online social media platforms in most eye-catching ads. These new products are packaged and advertised in the most attractive way to appeal to the younger generation, who are the most enthusiastic whenever they try new products. Also, these snacks are alleged to be natural and healthy with the addition of protein and omega-3s, which is anticipated to increase sales of meat snack products in the global market. Consumers recognize safe and healthy premiums and premium products produced in a safe environment with the least potential for fraud or food congestion. In regions like MEA, Latin America and the Asia Pacific, sales of meat products are increasing due to premium features.

Additionally, sales are rising due to the convenience of meat snack products. The convenient packaging of meat snacks packed in small envelopes is associated with the growth of sales of meat snacks worldwide. Due to competitive work and social life, most people lead an accelerated lifestyle and prefer ready-to-eat products that are very convenient in nature. As a result, manufacturers are launching products with the highest expected comfort to lead the global meat snack market. According to consumer psychological analysis, health and wellness are key factors that consumers should consider when purchasing food. In addition to health and wellness, flavor and taste are also important factors influencing the sale of meat snacks. Herbs and ethnic characteristics are the most preferred flavors on the market.

MARKET RESTRAINTS

Wellness and health concerns are restraints for the growth of the meat snacks market. In the last few years, there has been a significant change in customer preferences and habits for healthier light meal choices. This inclination has posed an obstacle to standard and meat snack producers, who frequently depend on ingredients that may not fulfil the demands of health-aware customers. Today, makers are dealing with sourcing fitter or wholesome input materials and reformulating recipes while preserving texture and flavour.

Another factor impeding the market growth is transparency and clean label. Modern customers are more keen than ever before to learn about the elements in their food.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

5.5% |

|

Segments Covered |

By Product, Meat Type, Flavours, Distribution Channel And Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC; PESTLE Analysis. Porter’s Five Forces Analysis, Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Jack Link’s, Conagra foods, Meat snacks Group, Hormel Foods, King Elite Snacks, Marfood USA, and Tyson Foods |

SEGMENTAL ANALYSIS

Global Meat Snacks Market Analysis By Product

Jerky is the most popular category under this segment of the meta snacks market and is believed to maintain its position during the forecast period. It is among those snacks that has continued to be embedded in global and American culture. It is a ageless item that was once an important tool for endurance and is presently rapidly emerging as a go-to option for several customers. Moreover, the segment’s market share is on the rise because they fulfil hunger urges, helping them to be full for longer time. Furthermore, easy to carry is another aspect expanding its market size. Beef jerky and sticks are ideal travel refreshments since they are grab and go packs and simple to fit in the bag.

Global Meat Snacks Market Analysis By Meat Type

Pork is the top most type under this segment of the meat snacks market and is expected to remain on the growth course throughout the estimation period. There are two reasons behind its consumption pattern around the world, including it has greater amount of myoglobin as compared to fish and poultry, which gives it a little pink or red colour, and pigs, similar to lamb and beef, are regarded as livestock and all there are deemed as red meat. Also, as per the United Nations, more than 30 per cent of all the meat consumption in the world is pork meat and it provides a different nutrient profile, it is abundant with B-complex vitamins, superior-quality protein, and vital minerals like iron and zinc.

Global Meat Snacks Market Analysis By Flavours

The original segment is anticipated to have a wider appeal among the consumers in the meat snacks market. Their familiarity and simplicity is one the key factors fuelling the market share of this segment. According to a survey, savory and salty snacks, comprising meat ones, are most favoured in the evening (26 per cent) and afternoon (31 per cent). This severs an opportunity for companies and brands for flavour development that matches these day parts. Another survey by the Jerkybrands.com, ‘regular’ flavoured meat snacks are the top choices, teriyaki at second place, peppered at third and then spicy. Followed by smoked or mesquite, barbecue and hickory.

Global Meat Snacks Market Analysis By Distribution Channel

Convenience store is the highly preferred segment of the meat snacks market and is likely to grow steadily during the forecast period. Today, the operators of these stores are following the trends in this market at large to ensure the freshness of the category, and at the same time, increasing value for price-sensitive consumers. Apart from this, C-stores are an essential distribution channel for meat-based snacks, which represents more than 25 per cent of total retail sales in the United States in 2022, and is expanding its market size yearly. Furthermore, retailers in the last few years have been witnessing the surgance of bold novel flavour trends in this market.

REGIONAL ANALYSIS

North America dominated the meat snacks market and held the largest share of the global market in 2023. The increase in snack consumption, the rise in demand for prepared foods, and the increase in national and international manufacturers have boosted growth in market value sales in the region. In 2018, American families spent an average of $ 25.81 per year on meat snacks. Products like jerky, meat sticks and popcorn are very popular in this area. As the demand for the meat snack market increases, manufacturers come up with strategies to improve customer-delivered product delivery. Therefore, in recent years, the free form of meat snacks has maintained a high level of traction among customers.

Europe holds a notable position in the meat snacks market. In recent years, the region is seeing a change in its eating habits and is gradually shifting towards healthy foods and snacking options. In addition, Spain, Portugal, and Iceland are the biggest meat consumers in the whole of Europe and are positioned closely after Hong Kong (i.e. 55 kg) with comparable figures of consumption of pork. Besides these, sausages are a popular item in the light meal category.

Asia Pacific is experiencing a rapidly rising in the meat snacks market and is estimated to register sustained growth rate in the estimation period. China is the largest consumers in the APAC region. Moreover, customers are searching for beyond standard barbeque tastes, which is shaping this market. In addition, there is a surging demand for Asian-inspired snack flavours, and at the same time, a revival of interest in BBQ tastes is contributing to the expansion of the APAC market. Also, today, the majority of inventions in the sphere of field of snack is based upon generic western BBQ flavour.

South America is growing meat snacks market. It holds a descent share of this market and is expected to drive forward during the estimation period. The consumption of meat has been rising within the middle classes of this region, as per the report by the OECD. It further stated that the protein intake is anticipated to surge by 4 per cent and is estimated to reach 89 grams per individual per day by 2031, fuelled by higher consumption of dairy items. And, that of meat is predicted to augment by more than 3 per cent to 63.4 kg per capita per year in 2031.

Middle East and Africa established a distinguished position in the meat snacks market. It is believed to advance despite multiple ongoing armed conflicts in the region and fragile regional economy. The report by OECD forecasted the meat per person food accessibility to rise by 6.1 per cent to 25.7 kg per capita in 2031 from 24.2 kg per capita in 2019-2021. In addition, the increase in production of poultry meat is largest of all meat types (i.e. 3.1 per cent boost per annum), and then bovine meat with 1.6 growth per annum. Ovine production is estimated to continue to be broadly unchanged.

KEY PLAYERS IN THE GLOBAL MEAT SNACKS MARKET

Jack Link’s, Conagra Foods, Meat Snacks Group, Hormel Foods, King Elite Snacks, Marfood USA, and Tyson Foods are some of the major companies in the global meat snacks market.

RECENT HAPPENINGS IN THE MARKET

- In October 2024, Conagra Brands Inc., a branded food company, at the 2024 NACS Show displayed its newly introduced meat snacks. NACS Show is the biggest convenience store expo in the United States and signifies the beginning of the most recent addition to the Conagra Brands line-up, Fatty Smoked Meat Sticks, purchased in August 2024. The latest offering from Fatty involves Buffalo style smoked Chicken Sticks and the 1.6-ounce Honey BBQ. Moreover, FATTY develops on the rising number of better-for-you snacking options. Together with Duke’s and Slim Jim, it presents a formidable trio of meat snack choices for C-store consumers and patrons.

- In October 2024, Pork Farms introduced Meateors ready-to-eat port meatballs, a new brand of meat snacking. The producer states its latest brand was launched to satisfy the escalating demand for on-the-go and high-protein meat snacks, and fills the void for customers looking for substitute of chicken. The company introduces with three 100 per cent recipes of pork meatball, including Sweet BBQ Meateors, Italian Style Herb Meateors, and Spicy Fajita Meateors. In addition, this snacking type is maintaining a strong growth momentum.

DETAILED SEGMENTATION OF GLOBAL Meat Snacks Market INCLUDED IN THIS REPORT

This research report on the global meat snacks market has been segmented and sub-segmented based on product, meat type, flavors, distribution channel & region.

By Product

- Jerky

- Meat Sticks

- Pickled Sausages

- Ham Sausages

- Pickled Poultry Meat

By Meat Type

- Poultry

- Beef

- Pork

- Others

By Flavours

- Original

- Peppered

- Teriyaki

- Smoked

- Others

By Distribution Channel

- Convenience Stores

- Supermarket & Hypermarkets

- Grocery Stores

- Restaurants

- Others

By Region

- North America

- Europe

- Asia and Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

1. What are the key drivers of growth in the meat snacks market?

Factors driving growth include increasing consumer preference for protein-rich snacks, rising demand for convenient and healthy on-the-go snacks, innovation in flavors and product formulations, and marketing efforts highlighting the nutritional benefits of meat snacks.

2. What are the challenges facing the meat snacks market?

Challenges include competition from alternative protein snacks (e.g., plant-based snacks), concerns about high sodium or preservative content in some meat snacks, and continuous innovation to meet changing consumer preferences and dietary trends.

3. What are the packaging trends in the meat snacks market?

Packaging trends include convenient single-serve packs, resealable pouches for freshness, transparent packaging to showcase product quality, eco-friendly packaging materials, and labeling that highlights nutritional information and certifications (e.g., organic, gluten-free).

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]