Global Mattress Market Size, Share, Trends, & Growth Forecast Report Segmented By Type (Innerspring, Foam, Hybrid, and Others), Size, End Use, Distribution Channel, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa), Industry Analysis From 2024 to 2033

Global Mattress Market Size

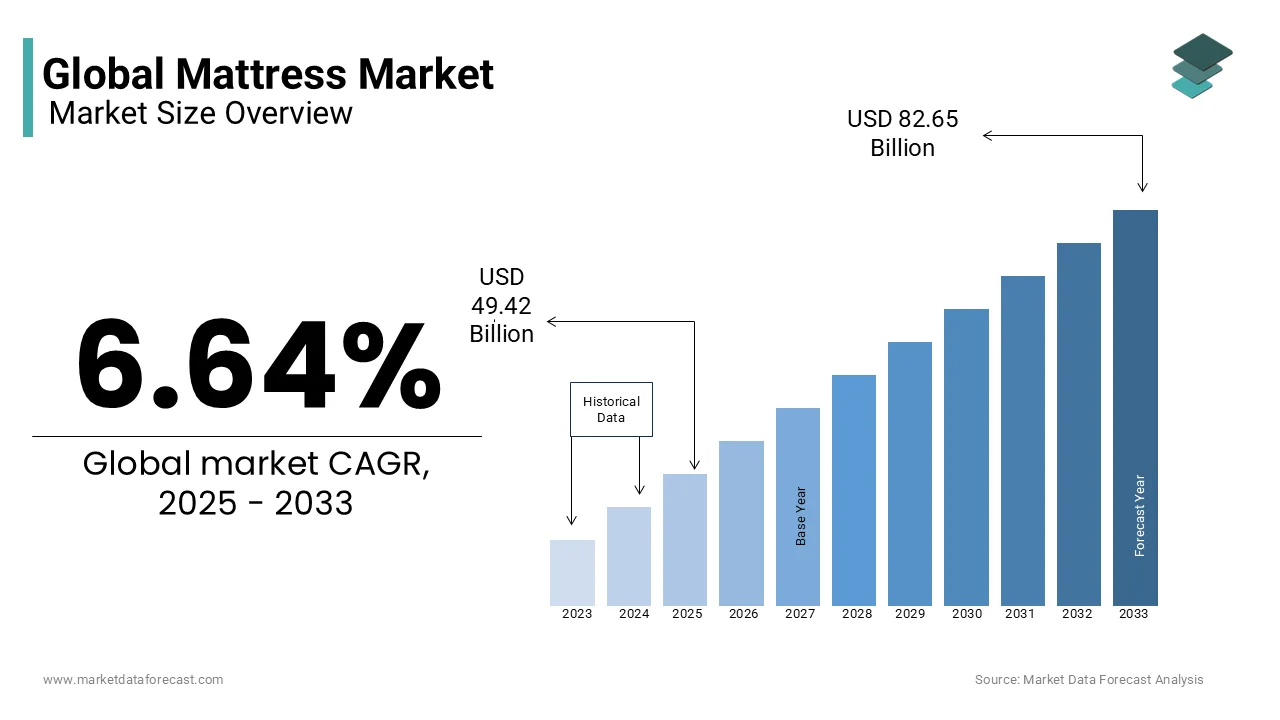

The global mattress market was worth USD 46.34 billion in 2024. The global market is projected to reach USD 82.65 billion by 2033 from USD 49.42 billion in 2025, growing at a CAGR of 6.64% from 2025 to 2033.

Mattress serves as a foundational element of sleep hygiene, designed to provide comfort, support, and alignment for the human body during rest. Beyond its functional purpose, the mattress has evolved into a symbol of personal health investment, with modern consumers increasingly prioritizing sleep quality as part of their daily routines. According to the National Sleep Foundation, adults require between seven to nine hours of sleep per night for optimal health yet studies indicate that nearly 35% of adults report sleeping less than the recommended duration. This growing awareness of sleep's critical role in physical and mental health has elevated the importance of high-quality mattresses.

In addition to sleep-related statistics, research from the American Chiropractic Association highlights that approximately 31 million Americans experience lower back pain at any given time, often exacerbated by inadequate sleep surfaces. This underscores the demand for mattresses that cater to spinal alignment and pressure relief. Furthermore, the World Health Organization emphasizes that chronic sleep deprivation contributes to a host of health issues, including obesity, cardiovascular disease, and impaired cognitive function. These findings have spurred innovation in mattress design, focusing on materials and technologies that enhance sleep outcomes. As consumer priorities shift toward holistic well-being, the mattress industry continues to align itself with these broader societal trends, reinforcing its relevance in fostering healthier lifestyles.

MARKET DRIVERS

Increasing Awareness of Sleep Health

The growing emphasis on sleep health is a significant driver propelling the mattress market forward. The Centers for Disease Control and Prevention (CDC) reports that one in three adults in the United States does not get enough sleep, highlighting a public health concern. This has led to a surge in demand for mattresses designed to improve sleep quality, such as those with ergonomic support and temperature regulation. Additionally, the National Institutes of Health (NIH) states that chronic sleep deprivation affects over 50 million Americans, contributing to conditions like obesity, diabetes, and cardiovascular disease. Consumers are increasingly investing in premium mattresses as part of their wellness routines, with the global wellness industry valued at $4.4 trillion in 2022. This trend underscores how awareness of sleep's role in overall health is reshaping purchasing behaviors and driving innovation in the mattress sector.

Urbanization and Rising Disposable Incomes

Urbanization and rising disposable incomes are pivotal factors fueling the growth of the mattress market. The United Nations Department of Economic and Social Affairs estimates that 56% of the global population resides in urban areas, a figure expected to rise to 68% by 2050. Urban living often correlates with smaller living spaces, prompting demand for compact yet high-quality mattresses. As urban centers expand and economic conditions improve, the mattress market benefits from heightened consumer spending power and the desire for modern, functional living environments.

MARKET RESTRAINTS

High Cost of Premium Mattresses

A major restraint in the mattress market is the high cost associated with premium products, which limits accessibility for certain demographics. According to the U.S. Census Bureau, approximately 37 million Americans live below the poverty line, making luxury mattresses unaffordable for a significant portion of the population. Premium mattresses, often priced between $1,000 and $5,000, cater primarily to middle- and upper-income households, leaving lower-income families reliant on cheaper alternatives. Furthermore, the Federal Reserve reports that 37% of Americans would struggle to cover an unexpected $400 expense, indicating limited financial resilience. This economic disparity restricts market penetration in price-sensitive regions and demographics. While affordability remains a challenge, manufacturers face pressure to balance innovation with cost-effective offerings to reach broader consumer segments.

Environmental Concerns Over Material Usage

Environmental concerns surrounding mattress materials present another restraint for the industry. The Environmental Protection Agency (EPA) estimates that over 50,000 mattresses are discarded daily in the United States, with most ending up in landfills due to limited recycling infrastructure. Traditional mattresses often contain non-biodegradable materials like polyurethane foam and synthetic fibers, contributing to environmental degradation. While there is growing consumer demand for eco-friendly options, the production of sustainable mattresses using organic or recycled materials remains costly and complex. These environmental issues not only strain waste systems but also pose reputational risks for companies failing to adopt greener practices, thereby constraining market expansion.

MARKET OPPORTUNITIES

Growing Demand for Smart Mattresses

The integration of smart technology into mattresses presents a significant opportunity for market growth. In a study conducted by the NSF and the Consumer Electronics Association, 60% of sleep technology users reported increased awareness of their sleep patterns, 51% experienced improved sleep quality, and 49% felt healthier since using these technologies. Smart mattresses, equipped with sensors to monitor sleep patterns, heart rate, and body temperature, align with this trend by offering personalized sleep experiences. The National Sleep Foundation states that 60% of consumers are interested in technology that enhances sleep quality, creating a lucrative niche for innovative products. Furthermore, the Consumer Technology Association reports that 28% of U.S. households own at least one smart home device, indicating a receptive audience for tech-infused mattresses. By leveraging advancements in IoT and AI, manufacturers can tap into this emerging segment, driving both revenue and consumer engagement.

Expansion in Emerging Markets

Emerging markets offer a promising avenue for mattress market expansion, driven by rapid urbanization and improving living standards. The World Bank projects that the global middle class will grow by 160 million people annually through 2030, with much of this growth occurring in Asia and Africa. Countries like India and China are witnessing a surge in disposable incomes, with the Indian Ministry of Statistics reporting a 7% increase in per capita income in 2022. This economic progress fuels demand for home furnishings, including mattresses, as consumers upgrade their living spaces. Additionally, the United Nations notes that urban populations in developing nations are expanding at unprecedented rates, creating opportunities for brands to establish a foothold in untapped regions. By tailoring products to local preferences and affordability levels, companies can capitalize on these demographic shifts to drive long-term growth.

MARKET CHALLENGES

Supply Chain Disruptions

Supply chain disruptions pose a significant challenge to the mattress market, impacting production timelines and costs. These disruptions stem from global events such as the COVID-19 pandemic and geopolitical tensions, which have strained logistics networks. The Federal Maritime Commission highlights that port congestion and shipping delays have further exacerbated the situation, leading to inventory shortages and delayed deliveries. For mattress manufacturers, these challenges result in reduced profit margins and customer dissatisfaction. Smaller companies, in particular, face difficulties in absorbing additional costs, threatening their competitiveness. Addressing these vulnerabilities requires strategic investments in diversified sourcing and localized manufacturing to mitigate future risks.

Regulatory Compliance and Safety Standards

Stringent regulatory requirements and safety standards present another challenge for the mattress market. The Consumer Product Safety Commission (CPSC) mandates that all mattresses sold in the United States meet flammability standards under the Federal Mattress Flammability Standard, adding complexity to the manufacturing process. Additionally, the Occupational Safety and Health Administration (OSHA) enforces workplace safety regulations that require manufacturers to invest in protective equipment and training for employees handling hazardous materials. These regulatory demands increase operational costs and necessitate ongoing monitoring to ensure adherence. For smaller firms with limited resources, navigating this regulatory landscape can be particularly burdensome, potentially stifling innovation and market entry.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

6.64% |

|

Segments Covered |

By Type, Size, End Use, Distribution Channel, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Tempur Sealy International, Inc., Serta Simmons Bedding LLC, Spring Air International, Sleep Number Corp., Kingsdown, Inc., Southerland Sleep, Hästens Ltd, Casper Sleep Inc., Silentnight Group Limited., and Emma. |

SEGMENTAL ANALYSIS

By Type Insights

The foam segment dominated the mattress market by accounting for 45.2% of the global market share in 2024. The affordability, versatility, and ability of foam mattresses to cater to diverse consumer needs, including pressure relief and motion isolation is primarily driving the growth of the segment in the global market. According to the National Sleep Foundation, memory foam mattresses are particularly popular among individuals with chronic back pain, as they are designed to provide pressure relief and support, which many users report improves their overall sleep quality. Additionally, advancements in materials, such as gel-infused foam, address concerns about heat retention, further boosting demand. Foam mattresses are also lightweight and easy to ship, making them ideal for e-commerce platforms. Their widespread adoption underscores their importance as a cornerstone of the mattress market.

The hybrid segment is anticipated to register the highest CAGR of 9.3% over the forecast period owing to their ability to combine the benefits of innerspring support and foam comfort, appealing to consumers seeking premium sleep solutions. The American Chiropractic Association notes that hybrid mattresses provide superior spinal alignment, addressing the needs of the 31 million Americans suffering from lower back pain. Rising disposable incomes and urbanization further fuel demand, particularly in North America and Europe. Additionally, innovations like temperature-regulating layers and eco-friendly materials align with modern consumer preferences. As hybrid mattresses bridge the gap between comfort and durability, they represent a critical area of opportunity for manufacturers aiming to capture high-end market segments.

By Size Insights

The queen-sized segment dominated the market by capturing 40.3% of global market share in 2024. The domination of queen segment in the global market is attributed to their versatility, offering ample space for couples while fitting comfortably in standard bedrooms. Furthermore, their affordability compared to king-sized options enhances their appeal among middle-income families. Queen mattresses also benefit from strong demand in the hospitality sector, where they are widely used in hotels. Their widespread adoption underscores their role as a staple in both residential and commercial settings.

The king-sized segment is predicted to expand at a CAGR of 7.8% over the forecast period owing to factors such as the increasing urbanization and the rise of larger living spaces, particularly in affluent regions like North America and Europe. The National Sleep Foundation states that king-sized mattresses are preferred by notable portion of couples seeking maximum comfort and personal space. Rising disposable incomes and a growing emphasis on luxury lifestyles further drive demand. Additionally, the expansion of the hospitality industry, particularly in emerging markets, boosts commercial adoption. As consumers prioritize spaciousness and comfort, king-sized mattresses are poised to become a key driver of premium market growth.

By End Use Insights

The household segment ruled the market by accounting for 75.3% of the global market share in 2024. The universal need for comfortable sleep solutions in residential settings is primarily driving the domination of the household segment in the global market. The National Sleep Foundation emphasizes that a significant majority of consumers consider sleep quality a top priority when purchasing mattresses, underscoring the household segment's importance in driving demand for innovative and supportive sleep solutions. With rising awareness of sleep health and ergonomic benefits, households are increasingly investing in premium products. Additionally, the proliferation of online retailing has made it easier for consumers to access a wide range of options. The household segment's stability and consistent demand make it a cornerstone of the mattress industry, driving innovation and product development tailored to individual preferences.

The commercial segment is expected to register a CAGR of 8.5% during the forecast period due to factors such as the booming hospitality and healthcare sectors, which require high-quality bedding solutions. According to the World Travel and Tourism Council, the hospitality industry accounts for substantial demand for commercial mattress, as hotels increasingly upgrade their facilities to enhance guest experiences and meet rising consumer expectations for comfort and luxury. Meanwhile, the healthcare sector prioritizes medical-grade mattresses for patient care, as noted by the Centers for Medicare & Medicaid Services. Rising investments in tourism infrastructure, particularly in Asia-Pacific and the Middle East, further boost demand. As commercial applications expand, this segment presents lucrative opportunities for manufacturers specializing in durable and specialized products.

By Distribution Channel Insights

The offline segment held the largest share of 65.7% in the global market in 2024. The domination of the offline segment in the global market is primarily driven by the tactile nature of mattress purchases where consumers prefer testing products in physical stores before buying. Retail chains and specialty stores offer personalized customer service and immediate availability, enhancing the shopping experience. The International Telecommunication Union highlights that offline channels remain crucial in regions with limited internet penetration, such as parts of Africa and Latin America, where only limited percentage of the population have access to the internet. Additionally, offline sales benefit from established brand loyalty and trust. Despite the rise of e-commerce, traditional retail remains a vital component of the mattress market, ensuring accessibility and reliability for diverse consumer bases.

The online segment has been growing rapidly from the last few years and is predicted to showcase the fastest CAGR of 12.4% over the forecast period owing to the convenience and cost-effectiveness of e-commerce platforms, which eliminate the need for physical showrooms. The rise of direct-to-consumer brands like Casper and Purple has revolutionized the industry, offering innovative products with free trials and hassle-free returns. Additionally, the Federal Trade Commission notes that online mattress sales have surged due to increased internet penetration, with majority of Americans now shopping online. The COVID-19 pandemic further accelerated this trend, as consumers shifted to digital channels. As online platforms continue to evolve, they represent a transformative force in the mattress market, reshaping consumer behavior and distribution strategies.

REGIONAL ANALYSIS

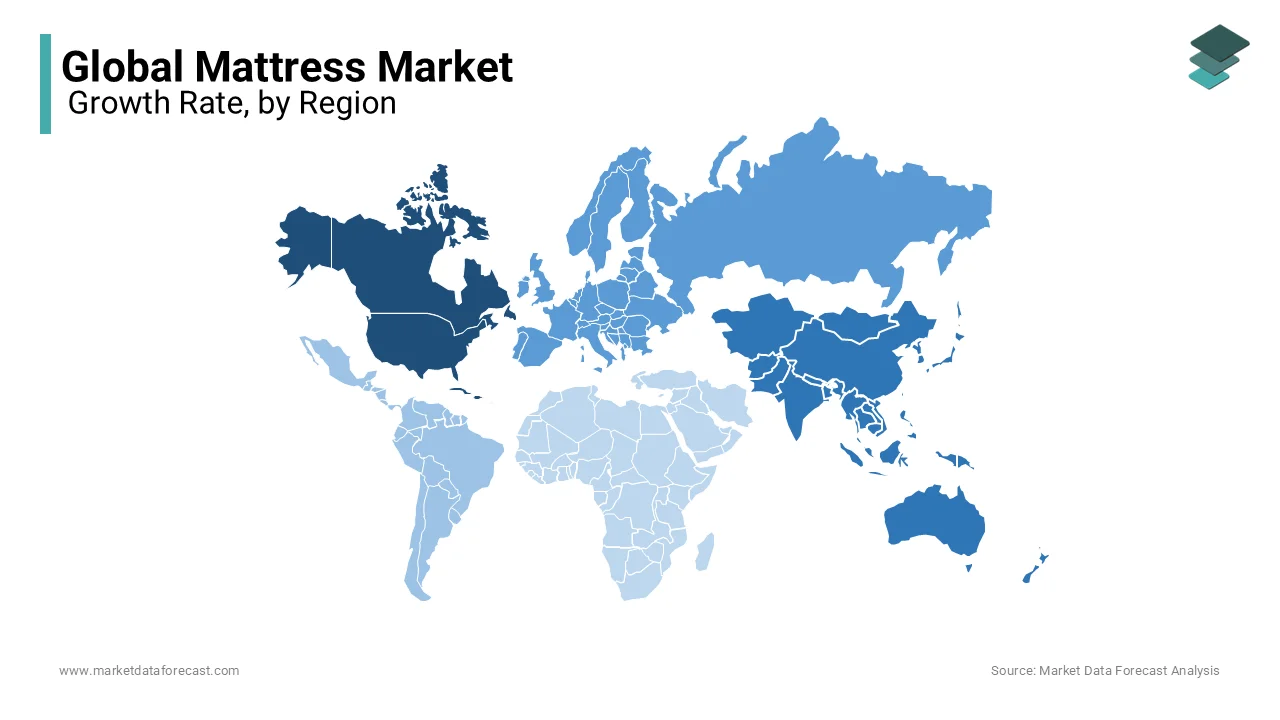

North America dominated the mattress market by accounting for 35.4% of the global market share in 2024. The high consumer awareness of sleep health and strong purchasing power with the average American spending $1,000 annually on sleep-related products are boosting the mattress market growth in North America. The United States alone contributes over 80% of the region’s revenue, driven by demand for premium and smart mattresses. This dominance underscores North America's role as a trendsetter in innovation and consumer preferences. The region's robust e-commerce infrastructure further amplifies accessibility, making it a critical hub for manufacturers.

Asia-Pacific is the fastest-growing region in the mattress market and is projected to expand at a CAGR of 8.2%. This growth is fueled by rapid urbanization, with the United Nations projecting that 50% of Asia’s population will reside in cities by 2030. Rising disposable incomes, particularly in China and India, are driving demand for affordable yet high-quality bedding solutions. The Indian Ministry of Statistics reports a 7% annual increase in per capita income, enabling more households to invest in comfort. Additionally, increasing awareness of ergonomic sleep solutions, supported by government health campaigns, is propelling this growth. The region’s prominence highlights its potential to reshape global market dynamics.

Europe represents a mature and stable segment of the mattress market, characterized by high consumer awareness of sleep health and stringent regulatory standards. According to Eurostat, approximately 20% of Europe's population is aged 65 or older, driving demand for orthopedic and medical-grade mattresses designed to alleviate age-related sleep issues. The region’s emphasis on sustainability also influences purchasing decisions, with the European Environment Agency reporting that eco-friendly products are gaining traction among environmentally conscious consumers. Western European countries, such as Germany and the UK, dominate the regional market due to higher disposable incomes and advanced healthcare systems. While growth may be slower compared to emerging markets, Europe’s focus on quality and innovation ensures its continued significance in the global mattress industry.

Latin America is poised for moderate growth in the mattress market, supported by economic recovery and rising urbanization. The World Bank forecasts a 2.5% GDP growth rate for the region in 2023, which is expected to boost consumer spending on home furnishings. Countries like Brazil and Mexico are leading this trend, driven by increasing middle-class populations and improved living standards. According to the United Nations Economic Commission for Latin America and the Caribbean (ECLAC), urbanization rates in the region exceed 80%, creating demand for modern bedding solutions. However, economic volatility and income inequality remain challenges, limiting the adoption of premium products. Despite these constraints, the region’s growing emphasis on affordable and functional mattresses presents opportunities for market expansion.

The Middle East and Africa represent a nascent but promising segment of the mattress market, driven by rapid urbanization and infrastructure development. The African Development Bank reports a 4% annual urban growth rate, particularly in Sub-Saharan Africa, where rising household incomes are fueling demand for basic and mid-tier mattresses. In the Middle East, countries like the UAE and Saudi Arabia are investing heavily in real estate and tourism, boosting the hospitality sector’s demand for bedding solutions. However, economic disparities and limited access to premium products hinder widespread adoption. The United Nations projects that the region’s population will reach 2.1 billion by 2030, underscoring its long-term potential. Strategic investments in affordability and distribution networks will be crucial to unlocking this region’s growth prospects.

KEY MARKET PLAYERS & COMPETITIVE LANDSCAPE

The major players in the global mattress market include Tempur Sealy International, Inc., Serta Simmons Bedding LLC, Spring Air International, Sleep Number Corp., Kingsdown, Inc., Southerland Sleep, Hästens Ltd, Casper Sleep Inc., Silentnight Group Limited., and Emma.

The global mattress market is highly competitive, driven by evolving consumer preferences, technological advancements, and an increasing focus on sleep health. The industry is dominated by key players such as Tempur Sealy International, Serta Simmons Bedding, and Sleep Number Corporation, which leverage innovation, acquisitions, and aggressive marketing to maintain their leadership. These companies compete across multiple segments, from luxury and smart mattresses to budget-friendly and eco-friendly options, catering to diverse customer needs.

Competition is fueled by product differentiation and technological integration. Brands are investing in AI-driven smart beds, cooling technologies, and pressure-relief materials to enhance sleep quality. Companies like Sleep Number and Tempur Sealy lead the way in smart mattress innovations, while eco-conscious brands such as Avocado Green and Purple compete in the sustainability segment.

E-commerce and direct-to-consumer (DTC) sales have intensified the competition, with digital-first brands like Casper, Purple, and Nectar challenging traditional manufacturers. Online marketplaces, easy financing options, and subscription models are reshaping consumer purchasing behavior.

Additionally, regional expansion and hospitality partnerships play a crucial role in market positioning. As demand grows in Asia-Pacific and Latin America, companies are localizing products to meet cultural and climatic preferences, further intensifying global competition.

Top 3 Players in the Market

Tempur Sealy International, Inc.

Tempur Sealy is recognized as the world's largest bedding provider. The company offers a diverse range of products, including mattresses, pillows, and adjustable bases, under renowned brands such as Tempur-Pedic, Sealy, and Stearns & Foster. Their commitment to innovation is evident in their development of advanced sleep solutions that cater to various consumer preferences. In 2024, Tempur Sealy announced plans to acquire Mattress Firm, a leading mattress retailer, aiming to strengthen its retail presence. To address regulatory concerns, the company agreed to divest certain retail locations and distribution centers.

Serta Simmons Bedding, LLC

Serta Simmons is one of the leading mattress companies in the world, specializing in different types of mattresses such as innerspring, hybrid, and memory foam. The company boasts innovative designs and a range of smart features, including cooling technology, pressure relief, and motion control, catering to diverse consumer needs. Founded in 1870, Serta Simmons has a long-standing reputation for quality and innovation in the mattress industry.

Sleep Number Corporation

Sleep Number is renowned for its innovative Sleep Number beds, which allow users to adjust the firmness and support of the mattress to their individual preferences. The company's commitment to personalized sleep solutions has positioned it as a leader in the premium mattress segment. Sleep Number's focus on integrating technology into their products has resonated with consumers seeking customizable and data-driven sleep experiences.

TOP STRATEGIES USED BY THE KEY MARKET PARTICIPANTS

Product innovation and technology integration are at the core of these companies' strategies. Tempur Sealy continues to invest heavily in research and development (R&D) to improve the quality of its memory foam and hybrid mattresses, focusing on comfort, durability, and cooling technology. Sleep Number stands out with its smart mattresses that integrate sleep-tracking sensors and AI-driven adjustments to enhance sleep quality. Meanwhile, Serta Simmons innovates through its iComfort series, which features gel-infused memory foam for temperature regulation and ergonomic support. By incorporating smart technology and premium materials, these brands cater to a growing demand for advanced sleep solutions.

Mergers, acquisitions, and partnerships play a crucial role in consolidating market share. Tempur Sealy's 2024 acquisition of Mattress Firm is a major move that expands its direct-to-consumer (DTC) reach while strengthening its retail distribution. Serta Simmons has engaged in multiple acquisitions to diversify its brand portfolio and cater to a wide range of price points, from budget-friendly mattresses to high-end luxury models. Additionally, partnerships with hotel chains such as Marriott and Hilton allow these companies to enhance their brand credibility while expanding their presence in the hospitality sector.

Digital transformation and e-commerce growth have become pivotal as consumer purchasing behaviors shift toward online channels. The pandemic accelerated the demand for direct-to-consumer (DTC) sales, leading mattress brands to enhance their online platforms, virtual showrooms, and AI-driven customer support. Sleep Number has revolutionized the industry by integrating AI and IoT into its smart beds, allowing users to adjust firmness and track their sleep through mobile apps. Subscription-based mattress models have also gained traction, allowing customers to lease or upgrade mattresses periodically rather than making one-time purchases.

RECENT HAPPENINGS IN THE MARKET

- In July 2024, H.I.G. Capital, through its portfolio company The Sleep Group, acquired Sleepeezee, a UK-based producer of bespoke and luxury beds and mattresses. This acquisition aims to combine Sleepeezee with Silentnight, another leading UK bed and mattress manufacturer under H.I.G.'s ownership, to enhance market share and operational synergies.

- On May 9, 2024, Tempur Sealy International announced a definitive agreement to acquire Mattress Firm Group for approximately $4 billion. This strategic move aims to integrate Mattress Firm's extensive retail footprint of over 2,300 stores with Tempur Sealy's manufacturing capabilities, enhancing direct-to-consumer reach and operational efficiencies. The acquisition is anticipated to close in late 2024 or early 2025, subject to regulatory approvals.

MARKET SEGMENTATION

This research report on the global mattress market is segmented and sub-segmented into the following categories.

By Type

- Innerspring

- Foam

- Hybrid

- Others

By Size

- Single

- Double

- Queen

- King

By End Use

- Household

- Commercial

By Distribution Channel

- Offline

- Online

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

What are the most popular types of mattresses in the market?

Memory foam, innerspring, latex, and hybrid mattresses are the most popular. Memory foam offers pressure relief, while innerspring provides bounce. Latex is durable and eco-friendly, and hybrids combine the best of all types. The best choice depends on personal preference and sleep needs.

Are organic mattresses worth the investment?

Organic mattresses use natural materials like latex, wool, and cotton, reducing exposure to chemicals. They are hypoallergenic, breathable, and environmentally friendly. While more expensive, they offer better durability and sustainability. They are ideal for eco-conscious and sensitive sleepers.

How does temperature regulation work in mattresses?

Mattresses with cooling gels, breathable covers, and open-cell foam improve airflow. Latex and hybrid mattresses also regulate temperature better than dense memory foam. Heat retention varies based on material composition and design. Choosing a cooling mattress helps hot sleepers rest comfortably.

What factors should I consider when buying a mattress online?

Look for material quality, firmness level, sleep trial periods, and return policies. Check customer reviews and warranty coverage before purchasing. Ensure the mattress suits your sleeping position and body weight. A risk-free trial helps you decide if it’s the right fit.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]