Global Maritime Situational Awareness Systems Market Size, Share, Trends, & Growth Forecast Report – Segmented by Component (Displays and notification Systems, Sensors, Others), Type (Command and Control, RADARs, SONARs, Optronics), & Region - Industry Forecast From 2024 to 2032

Global Maritime Situational Awareness Systems Market Size (2024 to 2032)

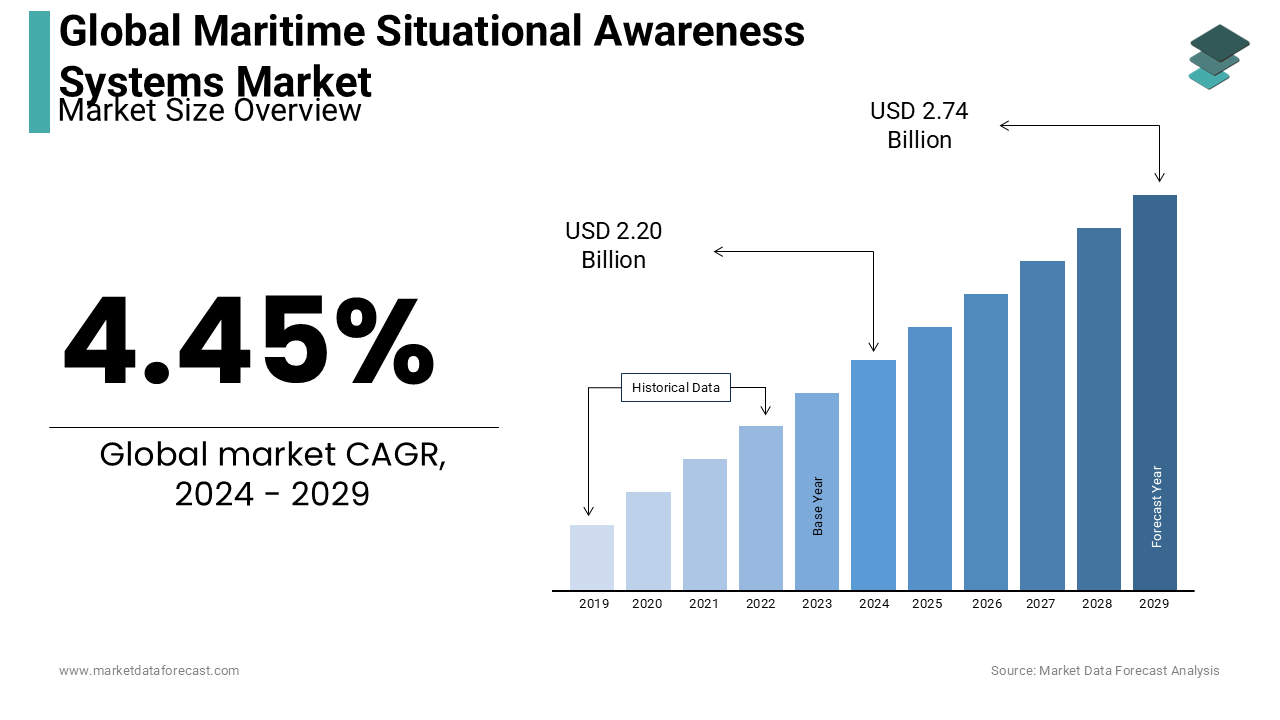

The global maritime situational awareness systems market was worth USD 2.11 billion in 2023. The global market is predicted to reach USD 2.20 billion in 2024 to USD 3.12 billion by 2032, growing at a CAGR of 4.45% during the foreseen period.

The tremendous growths of situational awareness in cyber security to provide significant situational awareness are the major factors increasing the maritime situational awareness system market demand.

A maritime situational awareness system utilizes information from the automatic identification system (AIS), applies anomaly detection algorithms, and provides maritime surveillance. The technology detects and communicates any unusual activity that obstructs the course of naval ships. Maritime situational awareness systems are equipment utilized by the military and the commercial sector. As tensions between sea boundaries, disputes, and lawbreakers rise, awareness systems are deployed to mitigate any potential threat. Manufacturers of maritime situational awareness systems are concentrating their efforts on research and development and integrating new technologies into the maritime sector. Maritime situational awareness systems are increasing steadily due to growing concerns about maritime safety and security.

MARKET DRIVERS

The growing importance of situational awareness in cyber security to provide significant situational awareness is the primary reason driving the maritime situational awareness system market growth.

The maritime situational awareness system market is growing due to the large growth of situational awareness in naval defenses and the employment of awareness systems to better navy tactical operations. With the integration of new products and equipment ready to be commissioned into the naval forces, such as network sensors, proximity sensors, temperature sensors, and gyroscopes, the maritime situational awareness market has seen growing demand. In many regions, technological developments and the deployment process of those technologies to clients drive the maritime situational awareness system market. The market for maritime situation awareness systems is predicted to grow due to the rising need for security and surveillance systems for early identification of problems, increased public safety concerns, and smart infrastructure development. In addition, as the demand for maritime situational awareness systems for cyber security grows, the market for situation awareness systems is likely to expand.

However, high implementation costs are expected to hamper market growth during the forecast period.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024 to 2032 |

|

CAGR |

4.45% |

|

Segments Covered |

By Component, Type, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Lockheed Martin Corporation, BAE Systems PLC, Leonardo S.P.A., Elbite Systems Limited, Thales Group, Honeywell International Inc., Raytheon Technologies Corporation, Rheinmetall AG, CMRE, Hexagon Geospatial, and others |

SEGMENTAL ANALYSIS

Global Maritime Situational Awareness Systems Market Analysis By Component

Based on components, the sensors segment is anticipated to hold the largest share in the maritime situational awareness systems market in the next six years. The sensors segments are required for intelligence, surveillance, platform survivability, targeting, and advanced weapon operation across all operating scenarios. In addition, they are in charge of transforming physical occurrences into amounts that data-acquisition devices can measure.

Global Maritime Situational Awareness Systems Market Analysis By Type

The command and control segment is anticipated to have the highest growth rate in the maritime situational awareness systems market. Moreover, the market for command and control systems is predicted to grow in response to the growing demand for coordination between different fighting assets during war. To improve situational awareness, navies throughout the globe are investing considerably in creating new warships and outfitting them with cutting-edge battle management software and equipment. Western naval powerhouses are putting more emphasis on frigate construction and investing in frigate command and control systems. For example, the US Naval Sea Systems Command stated in July 2019 that Lockheed Martin would get USD 15.7 million to continue developing the Frigate Combat Management System based on COMBATSS-21 for the upcoming guided-missile frigate FFG (X). In addition, the United Kingdom's navy is working on creating new command and control systems based on smaller platforms that will communicate information over virtual networks, are resilient to cyber-attacks, and are not reliant on space-based networks as their size and capabilities grow. The factors and examples stated above are driving the development of marine command and control systems all around the globe.

REGIONAL ANALYSIS

Asia-Pacific region is anticipated to be the fastest-growing in the maritime situational systems market, and it is predicted to increase at a CAGR of 4% during the forecast period. Countries such as China, India, Australia, Japan, South Korea, and others in the Asia-Pacific region dramatically increase their spending on the development and procurement of maritime situational awareness systems to improve their battle preparedness at sea. For example, China has accelerated the integration of its electro-optical sites, surface wave radars, and missile defense systems, a move that will significantly increase its maritime situational awareness capabilities. In addition, Saab and Luerssen Australia signed a 12-year deal in 2018 to deliver situational awareness equipment for the Royal Australian Navy's 12 Offshore Patrol Vessels (OPV). Such circumstances are fueling the Asia-Pacific market for maritime situational awareness systems.

North America region is anticipated to experience the largest share in the maritime situational awareness systems market during the forecast period. The increasing use of situational awareness in military and defense, maritime security, homeland security, and aviation applications is credited with the expansion. In addition, the presence of prominent manufacturers like Lockheed Martin Corporation, Boeing Company, General Electric, Microsoft, L3Harris Technologies, Inc., Honeywell International Inc., and others supports the situational awareness market's growth throughout the area.

Europe region is estimated to have a significant maritime situational awareness systems market share over the forecast period. The presence of important players such as Airbus SAS, BAE Systems, Robert Bosch GmbH, and others drives the market growth of marine situational awareness systems in Europe. In addition, the rising demand for enhanced security and surveillance systems is propelling market expansion in the remainder of the world.

KEY MARKET PARTICIPANTS

- Lockheed Martin Corporation

- BAE Systems PLC

- Leonardo S.P.A.

- Elbite Systems Limited

- Thales Group

- Honeywell International Inc.

- Raytheon Technologies Corporation

- Rheinmetall AG

- CMRE

- Hexagon Geospatial

RECENT HAPPENINGS IN THE MARKET

Honeywell launched a new security approach in September 2020 that gives users total situational awareness. Pro-Watch Integrated Security Suite is a software platform that helps secure people and property while maximizing productivity and responding to industry regulations. The platform provides a total view of all connected systems, and the software's scalability makes it simple to scale to meet a company's changing demands. Pro-Watch Intelligent Command is a web-based user interface that provides businesses with complete situational awareness of their security systems, ensuring the safety of people, property, and assets. The compliance-driven enterprise security software platform integrates access control, video surveillance, intrusion detection, and other business-critical services into a single user interface, helping companies improve productivity and reduce costs. In addition, it is simple to deploy and allows end customers to grow their enterprise security solutions effortlessly.

Raytheon Intelligence and Space Maritime Surveillance Systems for Japan Coast Guard Flight Tested on GA-ASI Sea Guardian in March 2021. Raytheon Intelligence & Space offers customers advanced technology in order to taste success in a particular domain and be able to face hurdles.

DETAILED SEGMENTATION OF THE GLOBAL MARITIME SITUATIONAL AWARENESS SYSTEMS MARKET INCLUDED IN THIS REPORT

This research report on the global maritime situational awareness systems market has been segmented and sub-segmented based on the component, type, and region.

By Component

- Displays and notification systems

- Sensors

- Others

By Type

- Command and Control

- RADARs

- SONARs

- Optronics

By Region

- North America

- Asia-Pacific

- Europe

- Latin-America

- Middle-East-Africa

Frequently Asked Questions

What technologies are commonly used in MSA systems?

MSA systems commonly use a combination of technologies such as Automatic Identification Systems (AIS), radar, satellite imaging, sonar, GPS, and data analytics. These technologies help in tracking vessels, monitoring marine traffic, and detecting potential threats.

What is driving the growth of the global MSA systems market?

The growth of the global MSA systems market is driven by increasing maritime trade activities, rising security concerns, technological advancements in surveillance and monitoring, and stringent regulations for maritime safety and security.

What are the key challenges facing the MSA systems market?

Key challenges include high implementation and maintenance costs, the complexity of integrating various technologies, data privacy and security concerns, and the need for international cooperation to address transnational maritime threats.

How does the MSA systems market benefit from advancements in AI and big data analytics?

Advancements in AI and big data analytics enhance the capabilities of MSA systems by providing real-time data processing, predictive analytics, anomaly detection, and automated decision-making. These technologies enable more accurate and timely responses to maritime incidents.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com