Global Marine Engine Market Research Report – Segmented By Power (<1K, 1K-5K, 5K-10K, 10K-20K & >20K), Vessel (Commercial and Offshore), Fuel (Heavy, Intermediate, Marine Diesel and Gasoline), Engine (Propulsion & Auxiliary) and Regional - (2024 to 2032)

Global Marine Engine Market Size (2024 to 2032)

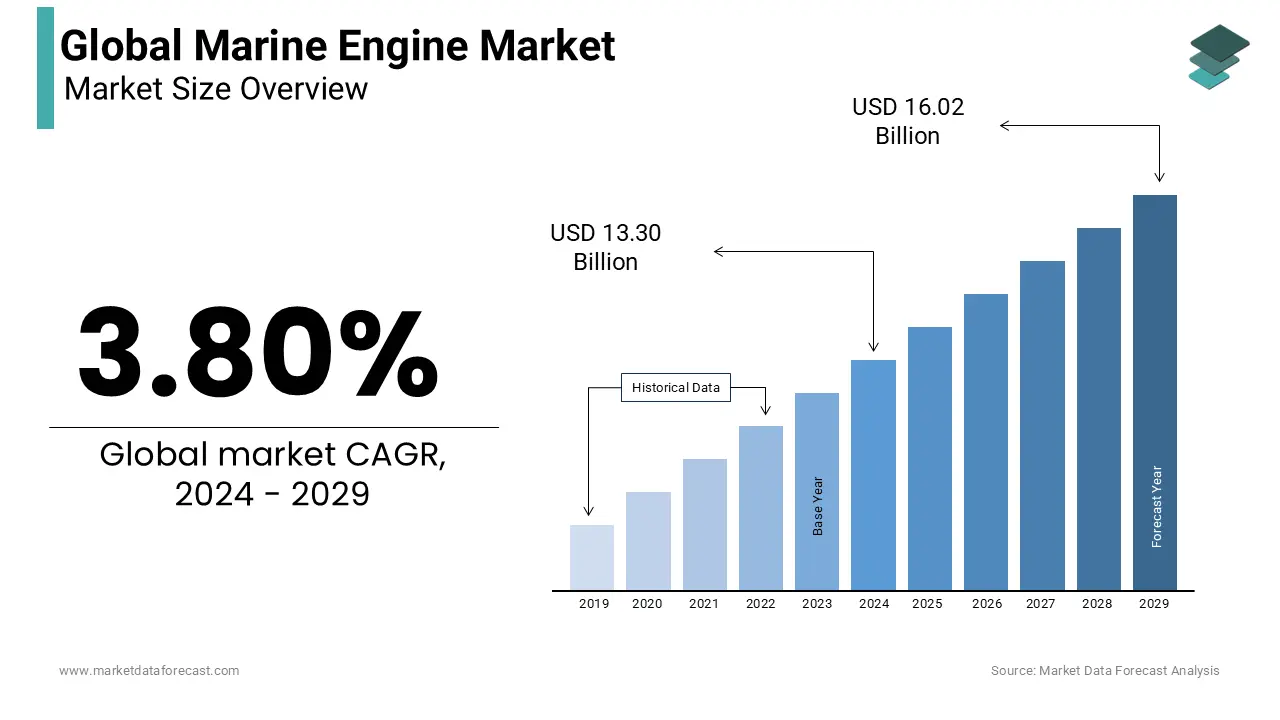

The Global Marine Engine Market is predicted to grow from USD 12.81 billion in 2023 and is projected to reach a valuation of USD 17.92 billion by 2032 from USD 13.30 billion in 2024, growing at a compound annual growth rate (CAGR) of 3.80% between 2024 and 2032.

Current Scenario of the Global Marine Engine Market

Key drivers for the expansion of the marine engine market include the expansion of international shipping of goods, the growth of maritime tourism, and the escalating adoption of awareness of smart motors and security. Marine engines are machines that are employed to power marine vessels, such as commercial vessels, offshore support vessels, and other vessels. These engines are made up of components such as the crankshaft, sleeve, pistons, base plate, and head. These components are constructed of anti-corrosion materials and their seals and bearings are specifically designed for the offshore operating environment. The development of new technologies and manufacturing processes in the marine engine market has addressed environmental regulations related to the marine engine. Features such as fuel consumption, ease of maintenance, high performance, durability, quiet operation, and low harmful emissions make marine engines the ideal solution for marine applications.

MARKET DRIVERS

Shipping is considered the backbone of international trade. According to data published by the International Chamber of Shipping (United Kingdom), around 90% of the worldwide volume of merchandise trade is carried out by sea, since this channel is cheaper than rail and road transport.

The countries of Asia and the Pacific have become the main suppliers of manufactured products. Thus, the call for container ships is significantly high in this region, due to the increase in exports of goods. Most shipbuilding companies, including powertrain and engine manufacturers, are located in the Asia Pacific. Therefore, the call for shipping services and the expansion of the shipping industry in Asia-Pacific have contributed to the growing call for marine engines.

MARKET RESTRAINTS

Environmental subsidy regulations, policies, and systems vary from country to country depending on the intensity of emissions caused by harmful gases such as SOx, NOx, and CO2.

For example, MARPOL Annex VI guidelines published by the International Maritime Organization (UK) in 2005 set limits for NOx emissions and mandated the use of low-sulfur fuels. These guidelines apply to ships and vessels operating in US waters and within 200 nautical miles of the North American coast, also known as the North American Emission Control Area (ECA). Ship component manufacturers are focused on developing marine propulsion systems that comply with various environmental regulations issued by governments of countries around the world.

MARKET OPPORTUNITIES

Today, many companies are investing in engine research and development to achieve maximum mileage and power at the lowest cost.

Alternative fuel is also required to run an engine due to the higher cost and low availability of petroleum fuel (diesel and gasoline). Many engines are developed that can run on alternative fuel. It uses gaseous fuel as the main fuel and diesel fuel as the pilot fuel. Heavy fuel oil and marine gas/diesel are the 2 most employed fuels simultaneously. In general, when sailing offshore, heavy oil is employed due to its low cost. On the other hand, marine diesel is employed when sailing close to land. Almost all new engines are made to handle both fuels. This hybrid system provides an economical option for boat operators to meet emission standards.

MARKET CHALLENGES

Excess shipping capacity refers to the excess supply of ships over call. The anticipation of a continuous expansion of commercial activities, for which new vessels are ordered to meet the predicted calls, is one of the main factors that has led to excess navigation capacity. New energy-efficient vessels are being developed to replace the old ones. However, some of the older ships were not scrapped due to their low scrap value. These vessels are sold on the market, adding more tonnage to the already surplus market. Overcapacity in the shipping industry has led to a drop in the number of new ship orders, despite the expansion in international maritime freight traffic. Therefore, the reduction in new shipbuilding orders is predicted to be a major challenge for the expansion of the marine engine market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024 to 2032 |

|

CAGR |

3.80% |

|

Segments Covered |

By Power, Vessel, Fuel, Engine, and Region. |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Hyundai Heavy Industries (South Korea), Caterpillar (US), MAN SE (Germany), Volvo Penta (Sweden), Rolls-Royce (UK), Mitsubishi Heavy Industries (Japan), Cummins (US), Wartsila (Finland), GE Transportation (US), Deutz AG (Germany), and Others. |

SEGMENTAL ANALYSIS

Global Marine Engine Market Analysis By Power

The 5,001-10,000 segment is predicted to lead the marine engine market from 2024 - 2032. This segment is driven by use in mid-size commercial passenger ferries, military patrol boats, and marine tourism.

Global Marine Engine Market Analysis By Vessel

The commercial segment is likely to represent the largest size of the marine engine market in 2023, and this trend is predicted to continue throughout the foreseen period. This expansion is attributed to the increase in international freight trade and cargo movements thanks to the installation of advanced electrical appliances due to ageing infrastructure.

Global Marine Engine Market Analysis By Fuel

The heavy fuel oil segment of the marine engine market accounted for the largest share in 2019, and this trend is predicted to continue over the foreseen period. The expansion of the heavy fuel oil segment is attributed to its use in medium and low-speed engines in the marine engine market.

REGIONAL ANALYSIS

Asia-Pacific is predicted to be the largest marine engine market during the foreseen period. Asia-Pacific includes China, Japan, South Korea, India, Australia, and the rest of Asia-Pacific.

Asia-Pacific is predicted to dominate the marine engine market during the foreseen period. Countries in the region such as China, Japan, and South Korea are considered major marine engine manufacturing centres and offer great expansion opportunities for the marine engine market. Escalating investments in shipbuilding and commercial cargo transportation in key markets provide great expansion opportunities for the marine engine market in the Asia Pacific.

KEY PLAYERS IN THE GLOBAL MARINE ENGINE MARKET

Companies playing a prominent role in the global marine engine market include Hyundai Heavy Industries (South Korea), Caterpillar (US), MAN SE (Germany), Volvo Penta (Sweden), Rolls-Royce (UK), Mitsubishi Heavy Industries (Japan), Cummins (US), Wartsila (Finland), GE Transportation (US), Deutz AG (Germany), and Others.

RECENT HAPPENINGS IN THE GLOBAL MARINE ENGINE MARKET

- Caterpillar Marine launches a new C32B engine. The company noted that the new C32 largely retains the same footprint and connection points as the existing C32 engine.

- Mahindra Powerol launches a new line of Seahawk marine engines. Mahindra Powerol, a business unit of the $ 20.7 billion Mahindra Group, announced its debut in the marine engine segment with its new Seahawk series.

DETAILED SEGMENTATION OF THE GLOBAL MARINE ENGINE MARKET INCLUDED IN THIS REPORT

This global marine engine market research report has been segmented and sub-segmented based on power, vessel, fuel, engine and region.

By Power

- <1K

- 1K-5K

- 5K-10K

- 10K-20K

By Vessel

- Commercial

- Off-Shore

By Fuel

- Heavy

- Intermediate

- Marine Diesel

- Gasoline

By Engine

- Propulsion

- Auxiliary

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Frequently Asked Questions

What are the key drivers of growth in the marine engine market?

The primary drivers include the growth of international trade, the development of autonomous ships, increasing demand for cleaner propulsion technologies, and rising investments in naval defense. Regulatory mandates for reducing emissions also push advancements in eco-friendly marine engines.

What types of marine engines are most in demand globally?

Four-stroke marine engines are highly in demand due to their versatility and efficiency, particularly in medium-sized ships. Two-stroke engines dominate large vessels such as cargo ships and tankers, while dual-fuel and hybrid engines are gaining traction for meeting stricter environmental standards.

What industries are the largest consumers of marine engines?

The cargo shipping industry is the largest consumer of marine engines, followed by passenger ferries, offshore vessels, and naval ships. Offshore energy exploration and the cruise industry are also significant contributors to the demand for advanced marine engines.

What challenges does the global marine engine market face?

Key challenges include high initial costs of advanced engines, fluctuating fuel prices, and compliance with stringent environmental regulations. Additionally, geopolitical tensions and supply chain disruptions pose risks to the market’s steady growth.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]