Global Margarine Market Size, Share, Trends & Growth Forecast Report - Segmented By Product (Soft, Hard, Liquid), Application (Commercial And Household), And Region(North America, Europe, Asia-Pacific, Latin America, Middle East And Africa) - Global Industry Analysis, Size, Share, Growth, Trends And Forecast 2025 To 2033

Global Margarine Market Size

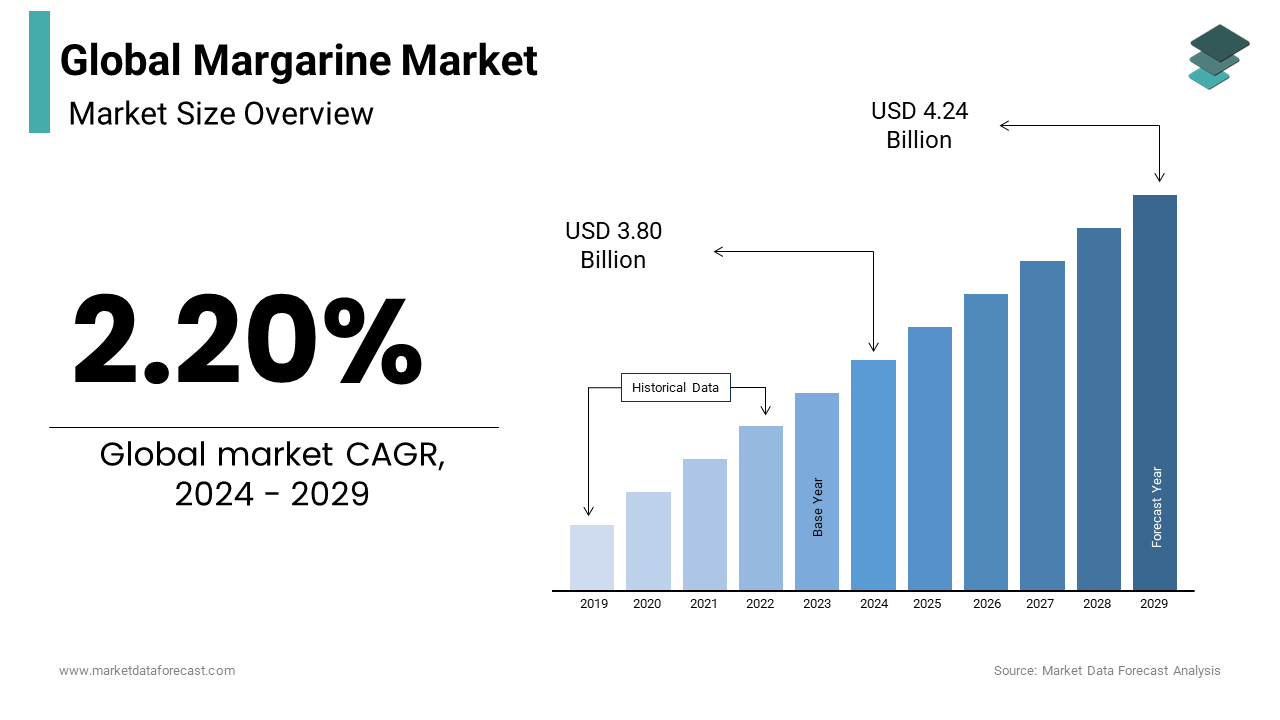

The size of the global margarine market was expected to be worth USD 3.80 billion in 2024 and is anticipated to be worth USD 4.62 billion by 2033 from USD 3.88 billion In 2025, growing at a CAGR of 2.20% during the forecast period.

Margarine is used as a functional and inexpensive butter substitute that provides richness and stability to finished baked goods without compromising taste. Margarine has come a long way since it was first made as a substitute for butter. This is now a high-tech product with various variations and combinations. Currently 10 types of margarine are produced. Standard, whipped, and polyunsaturated margarine is available in both hard and soft forms. There is edible margarine, vegan margarine, and a 60% vegetable oil spread. This margarine is produced from a variety of oils including cottonseed, safflower, soybeans, corn, palm oil, and sunflower oil. These customized products respond to the needs of specific population groups. Generally mixed with coloring substances, vitamins, breakage inhibitors, preservatives, additives, flavor inhibitors and other components, they have a dietary importance and a taste and texture comparable to butter. Existing margarine products in the United States contain at least 80% organic vegetable or animal fat. The increasing adoption of bakery and confectionery products as desserts in all age groups is expected to have a positive impact on the future growth of the global margarine market

MARKET DRIVERS

Growing demand for low-fat foods and beverages due to lifestyle changes and increased health awareness will drive growth in the global margarine market.

Rising stocks of low-calorie foods in supermarkets and significant R&D initiatives by manufacturers to expand their product portfolio and offer improved products at lower prices will further drive market growth. Young consumers increasingly recognize the health benefits of adopting a healthy diet, such as preventing obesity and diabetes. Changes in food preferences, increased disposable income and increased consumption of packaged foods should drive growth in the bakery sector and drive demand for products. Manufacturers focus on innovation to improve product attributes and ensure regulatory compliance that will drive market growth. This product is widely used in croissants, puff pastries, breads, cakes, sweet rolls and cookies. Along with the thriving baked goods sector, increased end-user awareness related to chronic diseases will accelerate market growth during the foreseen period. Obviously, increased health awareness and improved demand for low-calorie foods could create a profitable roadmap for the margarine market for years to come. Also, the huge demand for a low-fat diet driven by changes in consumer preferences and lifestyles will drive the expansion of the margarine business during the forecast period. As a dairy-free vegetable option, the suitability of margarine for lactose intolerant populations is likely to drive future business growth. Bakery products are a mass consumer item given their low price and high nutritional value. This has resulted in numerous small and artisan bakeries around the world.

The industry also believes that margarine provides ideal properties for products, as it helps add texture, volume, and grain to bakery products. Therefore, many bakers choose margarine brands that do not contain trans-fat and are expected to opt for products made with healthy oils such as olive oil to achieve the best baking results and drive market growth in the near future. Consumers' lifestyles and eating habits are changing as they are becoming more aware of fat and calorie intake. The transition from the consumer's diet to natural dairy-free products is clearly observed. In addition, manufacturers are looking to expand their product portfolio through large investments in research and development to offer new functional products at low cost. The hectic lifestyle and growing workforce created a huge demand for packaged foods, which drove the market expansion in the previous years. In hypermarkets and supermarkets that offer freshly baked and pre-cooked products, increased availability of in-store bakeries will drive business growth. The growing demand for margarine and the rise of the confectionery and bakery industry are anticipated to drive the developments in the global margarine market.

MARKET RESTRAINTS

The market is challenged by strict regulations and the growing need to meet international quality standards.

Additionally, a surge in the number of obesity-related health problems and disabilities are encouraging consumers to avoid eating fat. This trend is predicted to hamper the growth of the industry in the coming years. The price of dairy products, especially butter, is expensive and is supposed to rise further. The high price of butter will strengthen the market for margarine, a cheaper alternative to butter. The low price of margarine has increased its application in the butter-only food processing industry. The use of margarine has significantly reduced production costs in these industries, reducing the overall cost of the final product. The availability of margarine and other alternatives to health-related concerns about fat consumption could slow the growth of the industry.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

2.20% |

|

Segments Covered |

By Type of Product, Application and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis; Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Vandemoortele, Adeka Foods, Wilmar International Limited, Currimjee Group, Fuji Oil Co. Ltd, Aigremont NV, Kaneka Corporation, Bunge Limited, Marinfood, EFKO Group, NMGK Group, Gagar Foods, Sime Darby Oils SA and Others. |

SEGMENTAL ANALYSIS

Global Margarine Market Analysis By Type of product

Hard margarine dominated the market with more than 50% of total sales in 2019. Increasing consumption of packaged biscuits and biscuits has led to increased demand for hard margarine among bakers. The liquid segment is estimated to show the fastest growth during the conjecture period. In recent years, liquid margarine has gained considerable popularity among consumers for cooking and baking.

Global Margarine Market Analysis By Application

the commercial applications dominated the margarine market size with more than 80% of total revenue in 2019. Bakery products are gaining considerable popularity as processed or ready-to-eat foods due to their increased acceptability and economy. The home applications segment is expected to show the fastest growth during the forecast period. There have been changes in consumer preference for low-fat spreads in recent years.

REGIONAL ANALYSIS

North America is supposed to dominate the global margarine market demand as adoption of related products increases. Also, changing people's lifestyle can lead to increased problems of high blood pressure, constipation and diabetes. Therefore, manufacturers in the margarine market in the United States are primarily focused on making products that do not contain trans-fat. These are some of the positive factors driving the growth of the North American margarine market.

The European margarine market, led by France, the UK and Germany, is estimated to exceed $ 1.15 billion by the end of the projected period due to the presence of many restaurants serving international cuisine. The growing demand for refrigerated sauces, salad dressings and dressings, as well as significant efforts by manufacturers to develop innovative products such as preservative-free, organic, and low-calorie items will further drive market growth.

Margarine market demand from the Asia-Pacific industry, led by India, Japan and China, will increase by more than 4% by 2025 due to the presence of a significant segment of the young population and the improvement of distribution networks. Several manufacturers in the region offer their products in small packages to attract price-conscious consumers and promote market growth.

KEY PLAYERS IN THE GLOBAL MARGARINE MARKET

Major Key Players in the Global Margarine Market are Vandemoortele, Adeka Foods, Wilmar International Limited, Currimjee Group, Fuji Oil Co. Ltd, Aigremont NV, Kaneka Corporation, Bunge Limited, Marinfood, EFKO Group, NMGK Group, Gagar Foods, Sime Darby Oils SA and Others.

RECENT HAPPENINGS IN THE MARKET

- In March 2020, Wilmar International announced that it would open a new crude vegetable oil refining plant in South Africa. This facility will be used to produce cooking oil, mayonnaise and margarine.

- In December 2019, Bunge Loders Croklaan (BLC) introduced their shea margarine, which is 100% sustainable and non-hydrogenated.

- In December 2019, Upfield Ghana launched a new 10kg catering margarine to its Blue Band portfolio. This margarine is specially formulated with a rich buttery aroma and great taste that provides the texture and flavor needed for baked goods.

DETAILED SEGMENTATION OF THE GLOBAL MARGARINE MARKET INCLUDED IN THIS REPORT

This research report on the global margarine market has been segmented and sub-segmented based on type of product, application and region.

By Type of product

- Liquid

- Hard

- Soft

By Application

- Commercial

- Household

By Region

- North America

- Europe

- The Asia Pacific

- Latin America

- The Middle East and Africa

Frequently Asked Questions

1. What are the trends in the margarine market?

The margarine market has seen trends towards healthier formulations, such as those with lower saturated fat content or containing plant sterols for cholesterol-lowering benefits.

2. What are the uses of margarine in cooking and baking?

Margarine can be used as a spread on bread or toast, for baking (in place of butter), and in cooking (for sautéing or frying).

3. Are there any dietary considerations for margarine consumers?

Individuals with specific dietary needs (e.g., vegan, lactose intolerant) can choose margarine products that do not contain animal products or dairy.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]