Global Maize Market Size, Share, Trends & Growth Forecast Report – Segmented By Type (Field Maize, Sweet Maize, Popcorn and Indian Maize), End Use Industry (Chemical, Food & Beverages, Animal Feed and Pharmaceutical), Distributional Channel (B2B and B2C), And Region (North America, Europe, Asia Pacific, Latin America, Middle East & Africa) - Industry Analysis From (2025 to 2033)

Global Maize Market Size

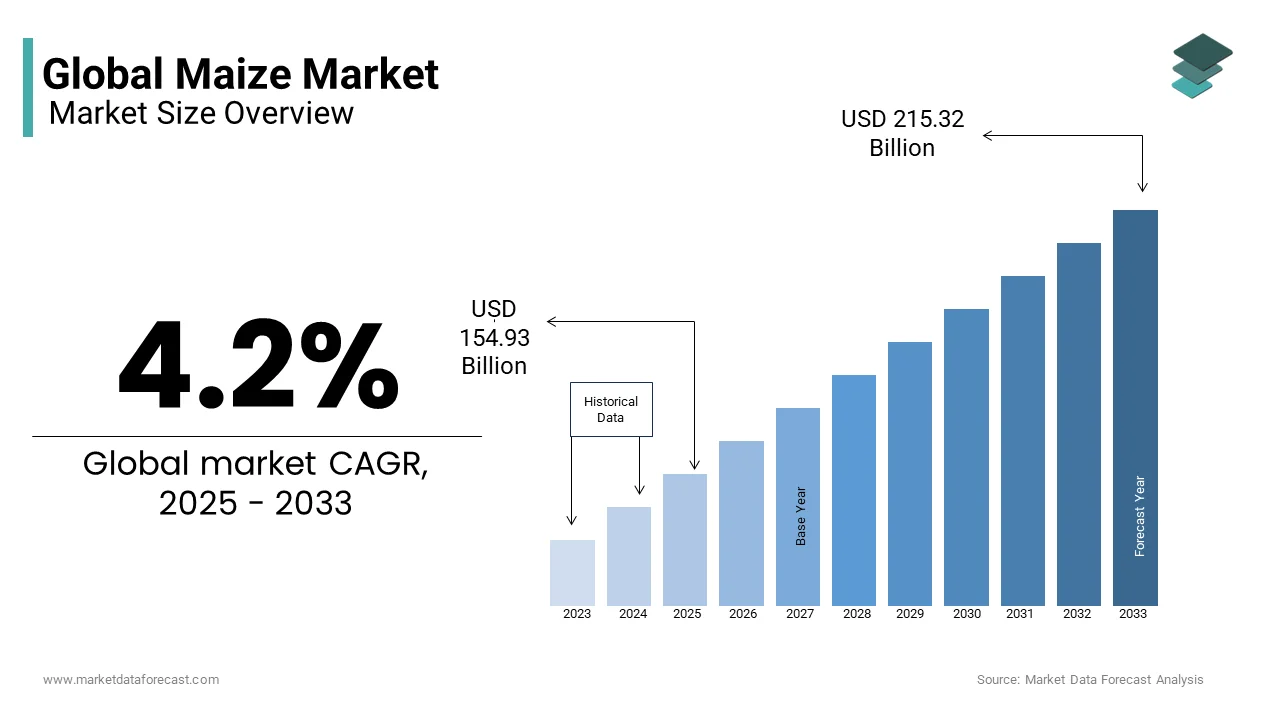

The global maize market was valued at USD 148.69 billion in 2024 and is anticipated to reach USD 154.93 billion in 2025 from USD 215.32 billion by 2033, growing at a CAGR of 4.2% during the forecast period from 2025 to 2033.

CURRENT SCENARIO OF THE GLOBAL MAIZE MARKET

Organic corn is a delicious and nutritious supplement to a diet rich in natural foods. As a result, demand for organic maize in the feed business is increasing, opening up profitable potential in the growth of the global maize market size.

Maize, commonly known as corn in some parts of the world, is a cereal grain renowned as the "Queen of Cereals." It belongs to the Ponceau family of grasses. Maize is an annual plant with a high productivity rate and an outstanding key trait of geographic adaptability, which has aided the development of maize farming all over the world. Maize production is the third highest of all crops, and maize has become the most widely cultivated crop in several countries. Although maize is one of the most important crops, only a small portion of it is consumed directly by people; the majority of maize is consumed as animal feed. Maize is used in a variety of industries, including the chemical, pharmaceutical, food, and animal feed industries.

The globe is shifting away from renewable energy sources and toward conventional energy sources. Plants with a lot of starch or sugar are fermented to make ethanol, which can be used as a direct alternative to gasoline and diesel. Because of its high starch content, maize is the most common source of ethanol. Ethanol distillation and fermentation are used to make corn ethanol. The market is growing due to the increased use of maize in the manufacturing of biofuels. Although corn is a fantastic source of protein and a healthy food, too much of it can cause health issues such as allergic responses, bloating, and gas, and is dangerous for diabetics.

MARKET DRIVERS

According to the Organization for Economic Co-operation and Development (OECD), poultry meat consumption per capita in 2018 was 14.3 kg, rising to 14.87 kg in 2020.

Global livestock consumption has increased as a result of population growth, rising incomes in developing countries, and urbanization. The consumption of milk, meat, and eggs, which is increasing at the expense of staple foods, has been proven to be closely associated with income and population increase. As a result, the livestock industry has been under growing pressure in recent years to supply increased demand for meat and high-value animal protein. In India, for example, dairy farmers are progressively replacing low-yielding local dairy bovine breeds with higher-yielding crossbred cows and buffaloes to boost milk output. Since, maize has been an important component of practically every type of compound feed for ruminants, poultry, swine, and aquaculture animals. As a result, increased demand for animal-based protein sources is expected to drive global maize trade and market.

MARKET RESTRAINTS

Constant price fluctuations in maize, as well as growing consumer concern about genetically modified maize, have resulted in a demand for the separation of non-GM crops from GM crops, resulting in an additional cost to the total supply chain, limiting the global maize market growth. Moreover, complications related to harvesting and growing the crop are also hindering the increase in the global maize market size.

REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

4.2% |

|

Segments Covered |

By Type, End-User Industry, By Distribution Channel, and Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Louis Dreyfus Company, COFCO Group, Bunge Limited, Archer Daniels Midland Company, Glencore plc, Maize Suppliers, SATAKE CORPORATION, DowDuPont Inc., Limagrain Group Holding, Bayer AG |

SEGMENTAL ANALYSIS

Global Maize Market By Type

For the forecast period 2022 to 2027, the demand for field maize is expected to be the highest. This demand is attributed to growth in livestock population and their requirement for food.

Global Maize Market By End Use Industry

As the world is moving towards sustainability, the search for alternative fuel options is rapidly increasing. Maize is one source for producing ethanol. Because of this, it is expected that in the forecast period, the chemical industry will be a dominant player in increasing global maize market volume, followed by animal feed.

Global Maize Market By Distribution Channel

Maize is frequently purchased for producing chemicals and making livestock food. Thus, it is sold to the respective manufacturers, who then transform it into the desired form and sell it to the final consumers. This means that the B2B channel is dominant in the global maize market industry for the forecast period 2022 to 2027.

REGIONAL ANALYSIS

Over the period 2022 to 2027, because of the high output of maize crops and its use as animal feed, North America is predicted to be the largest market for maize over the projection period, followed by Asia-Pacific. According to the Food and Agricultural Organization (FAO), the United States is the world's greatest producer of maize, accounting for 360,251 thousand metric tons in 2020, or 30.99 percent of total worldwide production, and maize is the country's economic engine. The majority of maize used in the region is utilized as the primary source of energy for livestock feed, followed by sorghum and wheat. Maize is also used to make cereals, alcohol, sweeteners, and byproduct feed, among other foods and industrial items.

The United States is the world's greatest maize producer, followed by China, and is predicted to contribute the most money in the near future. However, Asia Pacific is expected to increase rapidly during the projection period.

In 2020, global maize exports increased by 6.4 percent to 169 million tons, a significant increase over the previous year's total. Supplies were valued at $36.4 billion dollars. The four main maize exporters, notably the United States, Brazil, Argentina, and Ukraine, accounted for more than two-thirds of global volume. Romania (5.7 million tons), France (4.5 million tons), Hungary (4 million tons), and Bulgaria (2.6 million tons) accounted for a small portion of overall exports.

In terms of value, the United States ($9.6 billion), Argentina ($6.4 billion), and Brazil ($5.9 billion) were the countries with the largest levels of supplies in 2020, accounting for 60 percent of global exports. Ukraine, France, Romania, Hungary, and Bulgaria came in second and third, respectively, with 24 percent and 24 percent.

KEY MARKET PLAYERS

Louis Dreyfus Company, COFCO Group, Bunge Limited, Archer Daniels Midland Company, Glencore plc, Maize Suppliers, SATAKE CORPORATION, DowDuPont Inc., Limagrain Group Holding, Bayer AG. Some of the market players dominate the global maize market.

RECENT HAPPENINGS IN THIS MARKET

- Ukraine, one of the largest exporter of corn witnesses a drastic fall in export volume as a consequence of the Russia – Ukraine War. Exports of grains are currently capped at 500,000 tons per month, down from as high as 5 million tons prior to the war, resulting in a $1.5 billion loss.

- Following the introduction of early maturing, hybrid variety maize seeds in Taita-Taveta County, hundreds of farmers in the Taita highlands are looking for improved harvests.

MARKET SEGMENTATION

This research report on the global maize market is segmented and sub-segmented based on By Type, End-Use Industry, Distribution Channel, and Region.

By Type

- Field Maize

- Sweet Maize

- Popcorn

- Indian Maize

By End-Use Industry

- Chemical

- Food & Beverages

- Animal Feed

- Pharmaceutical

By Distribution Channel

- Business to Business (B2B)

- Business to Customer (B2C)

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East And Africa

Frequently Asked Questions

What is the time period for this study?

The forecast period for the study of the Global Maize Market is 2025 to 2033.

Mention the market which has the largest share in the maize market?

In 2020, North America will have the largest market share of the global maize market.

Name any three maize market key players?

Louis Dreyfus Company, COFCO Group, Bunge Limited are the three maize key players.

What is the rate of global maize market growth?

The global maize market is anticipated to grow with a CAGR of 4.2%.

Which is the highest growing market in the global maize market industry?

Asia Pacific region is expected to have the highest growth rate.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]