Global Magnesium Market Size, Share, Trends, & Growth Forecast Report Segmented By Application (Aluminum Alloying, Die casting, Desulfurization, Metal Reduction, and Others), and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa), Industry Analysis From 2024 to 2033

Global Magnesium Market Size

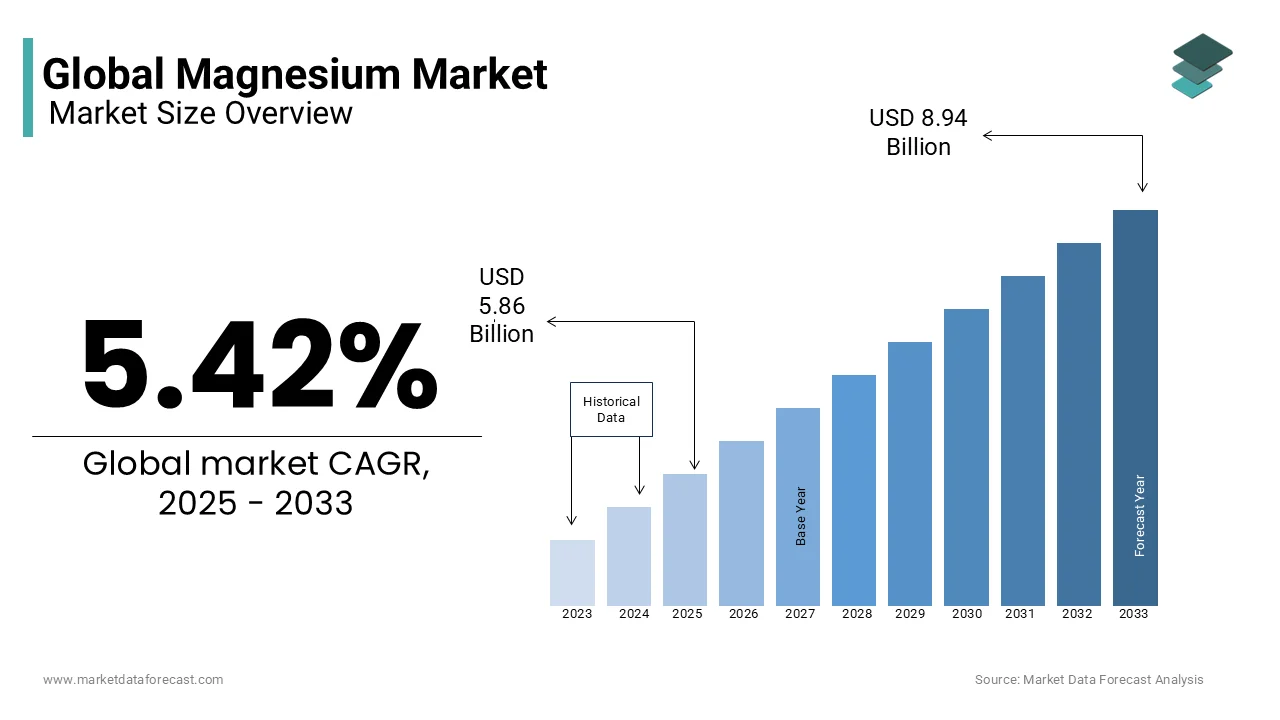

The global magnesium market was worth USD 5.56 billion in 2024. The global market is projected to reach USD 8.94 billion by 2033 from USD 5.86 billion in 2025, growing at a CAGR of 5.42% from 2025 to 2033.

Magnesium (Mg) is a lightweight and silvery-white metal known for its exceptional strength-to-weight ratio and excellent machinability. In industrial applications, magnesium alloys are highly valued for their lightweight and high-strength properties. For instance, magnesium components in the automotive industry can be up to 75% lighter than steel and 33% lighter than aluminium and is contributing to improved fuel efficiency and reduced emissions. The aerospace sector also utilizes magnesium alloys to enhance aircraft performance due to their favorable mechanical properties.

Globally, China is the leading producer of magnesium and is accounting for approximately 85% of the world's supply, as stated by the U.S. Geological Survey. This dominance is attributed to China's abundant mineral resources and cost-effective production methods. Other countries contributing to global magnesium production include Russia, the United States, and Israel.

MARKET DRIVERS

Advancements in Automotive and Aerospace Industries

The automotive and aerospace industries are increasingly adopting magnesium alloys to enhance performance through weight reduction. According to the U.S. Geological Survey, in 2022, approximately 45% of primary magnesium consumption in the United States was attributed to castings which is primarily for the automotive industry. This trend underscores the metal's significance in manufacturing lightweight components that contribute to improved fuel efficiency and reduced emissions. In aerospace, magnesium's high strength-to-weight ratio makes it ideal for critical structural applications and is supporting the industry's pursuit of enhanced performance and fuel economy.

Essential Role in Human Health

Magnesium is vital for numerous physiological processes including muscle and nerve function, blood glucose control, and bone development. According to the World Health Organization, magnesium deficiency can lead to various health issues which is emphasizing the importance of adequate intake. This recognition of magnesium's health benefits drives demand in the pharmaceutical and nutraceutical sectors where it is utilized in supplements and fortified foods to address deficiencies and promote overall well-being.

MARKET RESTRAINTS

Environmental Impact of Production Processes

The extraction and processing of magnesium and particularly through the Pidgeon process have significant environmental implications. This method is predominantly used in China involves the thermal reduction of dolomite using ferrosilicon as a reducing agent. According to the European Environment Agency, magnesium production processes emit various pollutants including particulate matter and greenhouse gases is contributing to environmental degradation. Additionally, the process generates magnesium slag which is a byproduct that poses disposal challenges due to its detrimental effects on plant life when deposited on soil. These environmental concerns necessitate the implementation of more sustainable production methods and effective waste management strategies to mitigate the ecological footprint of magnesium manufacturing.

Corrosion Susceptibility Limiting Applications

Magnesium and its alloys are highly susceptible to corrosion especially in chloride-rich environments which restricts their use in certain applications. The ASM International found that the electrochemical activity of magnesium makes it prone to rapid degradation when exposed to such conditions. This vulnerability necessitates the development and application of protective coatings and alloying techniques to enhance corrosion resistance. However, these additional processes can increase production costs and complexity and thereby limiting the widespread adoption of magnesium in industries where long-term durability is critical.

MARKET OPPORTUNITIES

Growing Demand for Lightweight Materials in Transportation

The transportation sector is increasingly prioritizing fuel efficiency and emission reductions, leading to a heightened demand for lightweight materials. Magnesium being 75% lighter than steel and 33% lighter than aluminum offers significant advantages in vehicle weight reduction. Incorporating lightweight materials like magnesium alloys can improve fuel economy by up to 6% for every 10% reduction in vehicle weight. This potential for enhanced efficiency positions magnesium as a critical material in the development of next-generation transportation solutions.

Advancements in Sustainable Production Technologies

Innovations in magnesium production are paving the way for more sustainable and energy-efficient methods. The U.S. Department of Energy identifies significant energy-saving opportunities in secondary magnesium processing and extrusion and thereby estimating potential annual savings of 17 billion British thermal units (BBtu) and 6 BBtu. These advancements not only reduce the environmental footprint of magnesium production but also lower operational costs which is making magnesium more competitive against alternative materials. As industries increasingly adopt sustainable practices, the development and implementation of such technologies present substantial growth opportunities within the magnesium market.

MARKET CHALLENGES

Supply Chain Vulnerabilities

The magnesium market is greatly affected by supply chain vulnerabilities due to its heavy reliance on limited global production sources. According to the U.S. Geological Survey, China dominates magnesium production by accounting for approximately 85% of the world's supply. This concentration poses risks of supply disruptions from geopolitical tensions, trade policies, or production challenges. The U.S. Department of Energy's 2023 Critical Materials Assessment identifies magnesium as a material with a high risk of supply disruption and is emphasizing the need for diversified sourcing and the development of domestic production capabilities to enhance supply chain resilience.

Energy-Intensive Production Processes

The production of primary magnesium is notably energy-intensive which is leading to higher operational costs and environmental concerns. The U.S. Department of Energy noted that current domestic magnesium production facilities often employ processes that are both energy-intensive and environmentally taxing. This energy demand not only increases production costs but also contributes to greenhouse gas emissions which is posing challenges in an era of stringent environmental regulations and sustainability goals. Addressing these issues requires the development of more energy-efficient and environmentally friendly production technologies to ensure the magnesium industry's long-term viability.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

5.42% |

|

Segments Covered |

By Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

U.S. Magnesium LLC, Mag Specialties Inc., RIMA Group, China Magnesium Corporation Ltd., Taiyuan Tongxiangyuan Fine Material Co., Ltd., POSCO Magnesium Corporation, Norsk Hydro ASA, Dead Sea Magnesium Ltd., Wenxi YinGuang Magnesium Industry (Group) Co., Ltd., and Yinguang Magnesium Industry (Group) Co., Ltd. |

SEGMENTAL ANALYSIS

By Application Insights

The aluminum alloying segment led the magnesium market by holding 30.3% of the global market share in 2024. Magnesium enhances the strength and lightness of aluminum alloys and is making them indispensable in industries like automotive and aerospace. The USGS notes that magnesium's addition can reduce structural weight and thereby improving fuel efficiency. For instance, the U.S. Environmental Protection Agency emphasized on lightweight materials help vehicles achieve an average 6-8%% improvement in mileage that is aligning with global emission reduction goals such as those outlined in the Paris Agreement.

The die casting segment is another major segment and is anticipated to register a CAGR of 6.8% during the forecast period owing to the rising demand for lightweight components in electric vehicles (EVs) with the International Energy Agency reporting EV sales surged by over 60% in 2022 alone. Magnesium die-cast parts are favored for their excellent thermal conductivity and dimensional stability which are critical for electronics and EV battery housings. Magnesium’s use in die casting reduces material usage by up to 25% compared to traditional metals, promoting sustainability. Additionally, the European Commission emphasizes magnesium’s role in advancing circular economy goals due to its recyclability.

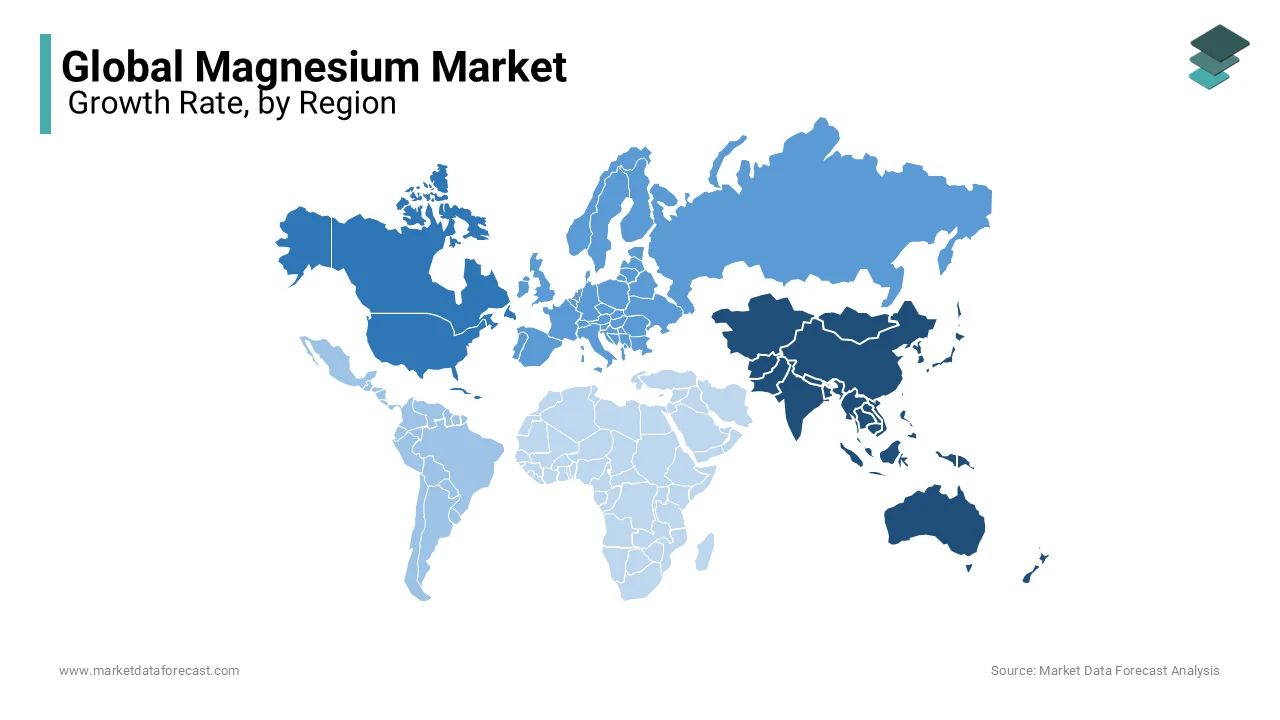

REGIONAL ANALYSIS

Asia-Pacific was the leading region in the global magnesium market by capturing 45.4% of market revenue. The substantial production capacity of China that contributes significantly to the output of the Asia-Pacific is one of the key factors driving the domination of Asia-Pacific in the global market. China is the world's largest producer of magnesium which is yielding an estimated 800,000 metric tons annually. The region's position is further bolstered by the increasing demand for lightweight materials in automotive and aerospace industries where magnesium alloys are extensively utilized to enhance fuel efficiency and performance.

North America is anticipated to exhibit a CAGR of 5.7% over the forecast period. The growth of North America in the global market is attributed to the rising adoption of magnesium alloys in the automotive sector to reduce vehicle weight and improve fuel efficiency. Reducing a vehicle's weight by 10% can lead to improvement in fuel economy which is underscoring the importance of lightweight materials like magnesium in achieving energy efficiency goals.

Europe holds a significant position in the global magnesium market. The region's prominence is driven by the automotive industry's focus on reducing vehicle weight to meet stringent emission standards. The European Environment Agency emphasizes the necessity for lightweight materials to achieve fuel efficiency and lower CO₂ emissions. Consequently, magnesium alloys are increasingly utilized in vehicle manufacturing to enhance performance and comply with environmental regulations.

The Latin America magnesium market is experiencing positive growth. The region is poised for growth due to ongoing infrastructure development and urbanization in emerging economies. The United Nations Industrial Development Organization observed that industrial initiatives in countries like Brazil and Mexico are expected to boost demand for magnesium in construction and manufacturing sectors, contributing to the market's expansion in the coming years.

The Middle East and Africa magnesium market is experiencing moderate growth with specific segments like magnesium hydroxide growing at a faster pace. Future growth in this region is anticipated to be influenced by rising investments in the manufacturing sector. The United Nations Industrial Development Organization points out that industrialization efforts in nations such as South Africa and the United Arab Emirates are likely to increase the demand for magnesium-based products which is particularly in construction and automotive industries and thereby enhancing the region's market share.

KEY MARKET PLAYERS & COMPETITIVE LANDSCAPE

The major players in the global magnesium market include U.S. Magnesium LLC, Mag Specialties Inc., RIMA Group, China Magnesium Corporation Ltd., Taiyuan Tongxiangyuan Fine Material Co., Ltd., POSCO Magnesium Corporation, Norsk Hydro ASA, Dead Sea Magnesium Ltd., Wenxi YinGuang Magnesium Industry (Group) Co., Ltd., and Yinguang Magnesium Industry (Group) Co., Ltd.

The global magnesium market is highly competitive, with key players vying for market dominance through innovation, strategic partnerships, and expansion initiatives. China leads the industry, accounting for over 80% of global magnesium production, making Chinese manufacturers dominant in supply and pricing. Major companies such as Nanjing Yunhai Special Metals and Shanxi Yinguang Huasheng Magnesium hold a significant market share due to their large-scale production capacity and extensive distribution networks.

North America and Europe also have key players like US Magnesium LLC, which focuses on sustainable and high-quality magnesium production. These companies compete by investing in advanced technologies, improving efficiency, and adhering to strict environmental regulations.

Competition in the magnesium market is driven by increasing demand from industries such as automotive, aerospace, and electronics, where magnesium's lightweight and high-strength properties are highly valued. With sustainability concerns rising, companies are also focusing on eco-friendly production methods and magnesium recycling to gain a competitive edge.

Top 3 Players in the Market

Nanjing Yunhai Special Metals Co., Ltd.: Based in China, Nanjing Yunhai Special Metals is a leading producer of magnesium alloys. The company specializes in the development and manufacturing of high-performance magnesium products, serving industries such as automotive and electronics.

Shanxi Yinguang Huasheng Magnesium Co., Ltd.: Also located in China, Shanxi Yinguang Huasheng Magnesium is a major player in the magnesium industry. The company focuses on the production of pure magnesium and magnesium alloys, supplying materials for various applications, including aerospace and automotive sectors.

US Magnesium LLC: As the primary producer of primary magnesium in the United States, US Magnesium operates a facility in Utah, extracting magnesium from the Great Salt Lake. The company supplies high-quality magnesium for use in industries such as automotive, aerospace, and electronics.

TOP STRATEGIES USED BY THE KEY MARKET PARTICIPANTS

Product Innovation and Development

Companies focus on developing new magnesium alloys and products with enhanced properties to meet the evolving demands of industries such as automotive, aerospace, and electronics. This includes creating lightweight, high-strength materials that improve fuel efficiency and performance. For instance, advancements in magnesium alloys have led to their increased adoption in automotive applications to reduce vehicle weight and emissions.

Strategic Partnerships and Collaborations

Forming alliances with other companies, research institutions, and industry stakeholders allows for shared resources, knowledge exchange, and accelerated innovation. These partnerships can lead to the development of new applications for magnesium and expansion into emerging markets. Collaborations also help in pooling expertise to overcome technical challenges and enhance product offerings.

Geographical Expansion and Market Penetration

Expanding operations into new regions and increasing market presence in existing ones enable companies to tap into growing demand for magnesium products globally. This strategy involves establishing new production facilities, enhancing distribution networks, and tailoring products to meet regional market needs. For example, companies may invest in production facilities in regions with high demand for lightweight materials in the automotive sector.

RECENT HAPPENINGS IN THE MARKET

- In October 2024, the European Commission authorized the use of magnesium L-threonate in food products across the EU, recognizing it as a highly bioavailable form of magnesium. This approval grants AIDP Inc. exclusive rights to market the compound in the EU for five years.

MARKET SEGMENTATION

This research report on the global magnesium market is segmented and sub-segmented into the following categories.

By Application

- Aluminum Alloying

- Die casting

- Desulfurization

- Metal Reduction

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

What are the key drivers of the global magnesium market?

The primary drivers include rising demand from the automotive, aerospace, and electronics industries, increased use in lightweight materials, and growing applications in aluminum alloys, die casting, and healthcare.

Which industries are the largest consumers of magnesium?

The automotive, aerospace, construction, electronics, and healthcare sectors are the biggest consumers due to magnesium’s lightweight properties and its role in producing strong yet light alloys.

How does magnesium compare to aluminum in industrial applications?

Magnesium is lighter than aluminum and offers better machinability, but aluminum is stronger and more corrosion-resistant, making both materials essential for different applications.

How is the magnesium market expected to evolve in the coming years?

The market is expected to grow due to increasing demand from emerging industries, technological advancements, and efforts to develop more sustainable and cost-effective production methods.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]