Global Luxury Cosmetics Market Size, Share, Trends and Growth Forecast Report - Segmented By Product Type (Skin Care, Hair Care, Make-up and Others), Distribution Channel (Hypermarkets & Supermarkets, Specialty Stores, Online Stores and Others), End User (Female and Male), and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa) - Industry Analysis (2024 to 2032)

Global Luxury Cosmetics Market Size (2024 to 2032)

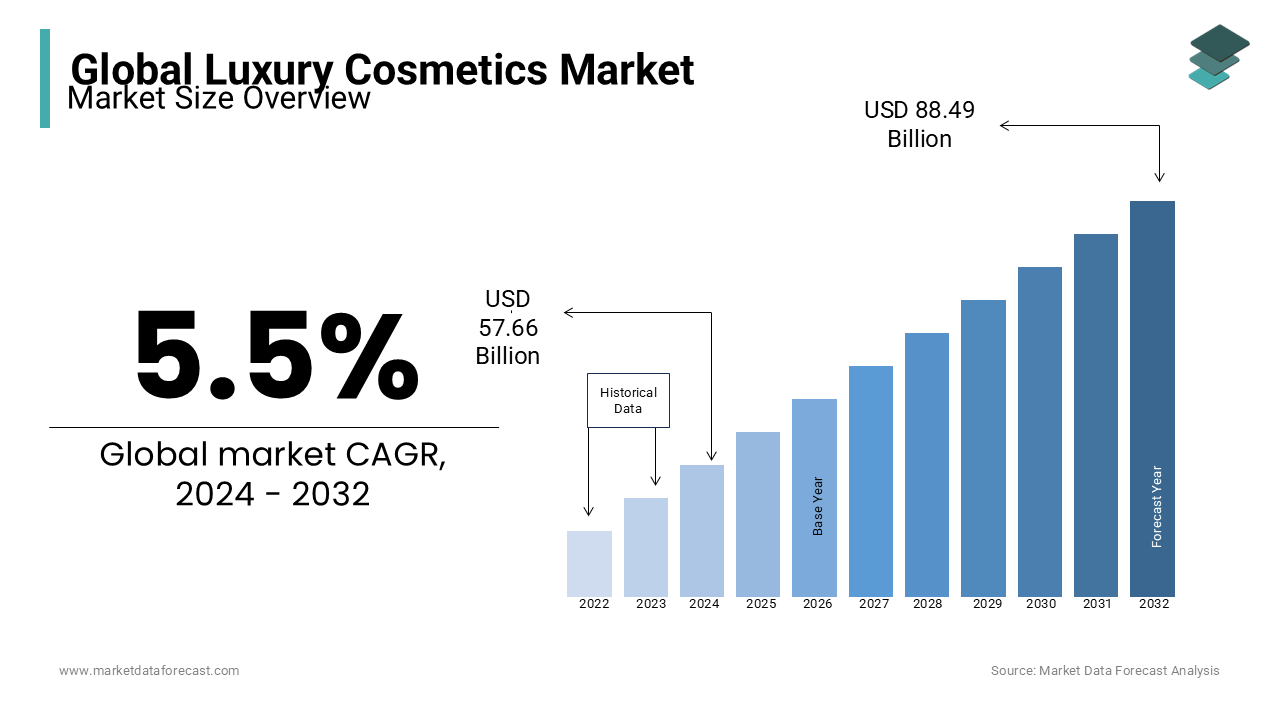

The Global luxury cosmetics market was valued at USD 54.65 billion in 2023. The global market size is expected to grow at a CAGR of 5.5% from 2024 to 2032 and be worth USD 88.49 billion by 2032 from USD 57.66 billion in 2024.

Current Scenario of the Global Luxury Cosmetics Market

Luxury cosmetics are those that are made with organic and high-quality components and are sold at a greater price than their drugstore counterparts. Skincare, makeup, hair care, and perfumes are all included in luxury cosmetics. Because of expanding consumer purchasing power, the demand for luxury personal care and cosmetics has increased in recent years. The rise in demand for such products is mostly due to a shift in consumer lifestyles, particularly in developing nations such as the Asia Pacific. The trend of purchasing high-end cosmetics is especially strong in developed economies such as those in North America and Europe.

MARKET DRIVERS

Due to rising disposable income and increased awareness of skin and hair care, demand for luxury cosmetics has increased in developing nations such as India and China in recent years. Previously, luxury goods were only targeted at an affluent and privileged customer class; however, this has recently changed. The growing disposable income among the urban populations of developing nations and rising health concerns have resulted in an increase in demand for luxury goods made with organic and high-quality ingredients. This consumer behavior trend has largely fuelled the global rise of the luxury cosmetics market. Moreover, the increase of e-commerce as a result of internet adoption has aided the growth of the luxury cosmetics business, as it provides convenient worldwide reach and allows consumers to choose from a diverse range of products at the same time.

MARKET RESTRAINTS

The availability of counterfeit products, on the other hand, is a key impediment to the global luxury cosmetics sector. Consumer acceptance and demand for halal cosmetics are increasing around the world. Side effects of the chemicals used in cosmetics by some of the manufacturers create negative consumer views towards luxury cosmetics. Consumer perception of not spending a high amount on cosmetics is another challenge for the market. Increasing fake products in the market is creating a negative impact on the luxury cosmetic market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024 to 2032 |

|

CAGR |

5.5% |

|

Segments Covered |

By Product Type, End-User, Distribution Channel, and Region |

|

Various Analyses Covered |

Global, Regional, and country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

L’Oréal Shiseido Company Limited Christian Dior Puig, Coty Inc. Kao Corporation Revlon, Inc. The Estée Lauder Companies Inc. Oriflame Cosmetics AG KOSÉ Corporation. |

SEGMENTAL ANALYSIS

Global Luxury Cosmetics Market By Product Type

Due to a wide variety of skincare cosmetics such as skin tone boosters, moisturizers, skin lightening, and others, the skincare category is likely to hold a significant portion of the market, resulting in higher revenues. Furthermore, the growing popularity of anti-aging skincare products is projected to boost the expansion of such a market.

Global Luxury Cosmetics Market By End-User

Females are more worried about their appearance and appearance, which leads to a higher demand for cosmetics among these customers. As a result, women account for a significant portion of the market. In addition, the increased number of women in the workforce is expected to promote segmental growth.

Global Luxury Cosmetics Market By Distribution Channel

Users can purchase such luxury items as well as a variety of other daily-use grocery items from hypermarkets and supermarkets, which are likely to hold a significant portion of the market. Furthermore, the availability of discounts and coupons by these stores is likely to entice customers to purchase cosmetics from them, resulting in segmental expansion. Because of the wide variety of brands, discounts, and ease of use for consumers, online distribution channels are expected to increase at the strongest rate.

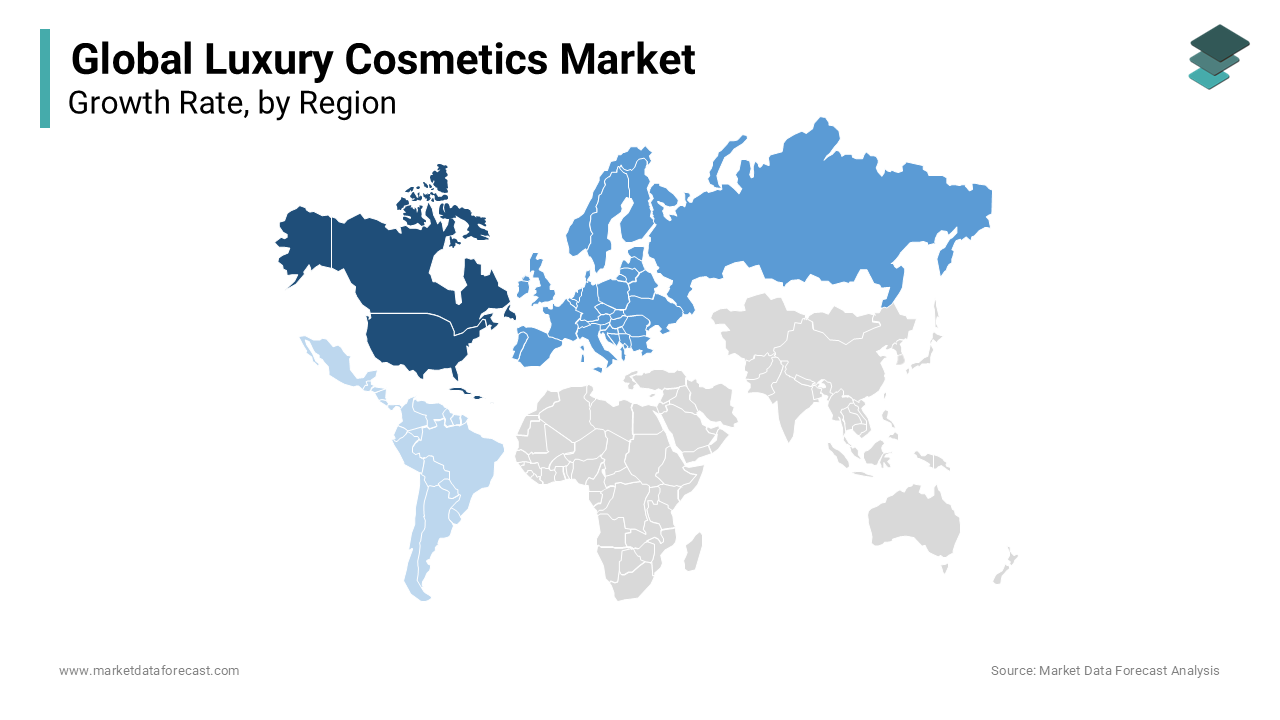

REGIONAL ANALYSIS

Due to their considerable consumer purchasing power, consumers from developed nations such as North America and Europe have been the primary consumers of luxury cosmetics. However, due to rising disposable income and increased awareness of skin and hair care, demand for luxury cosmetics has increased in developing nations such as India and China in recent years.

Europe, particularly in the skincare area, was the largest luxury cosmetics market by region in 2018. Consumers in this region are cautious when it comes to skincare regimens and choose products made with high-quality components.

The Asia-Pacific area, on the other hand, is predicted to grow rapidly, with a CAGR of 7.9% over the projection period. The Asia Pacific region's highest share is due to the region's population's widespread adoption of high-quality personal care products. Additionally, companies involved with cosmetics, such as The Proctor & Gamble Co., Puig, Alfred Dunhill Ltd., and others, are expanding their operations in countries such as China and India, which is propelling the market in the Asia Pacific area.

In Latin America, the Middle East, and the Africa region, growing online shopping and growing demand for organic personal care and cosmetic products indicate that the market has a lot of room to grow in the coming years. Urbanization in the region is accelerating, which helps the growth of the luxury cosmetics market.

KEY MARKET PLAYERS

L’Oréal, Shiseido Company Limited, Christian Dior, Puig, Coty Inc., Kao Corporation, Revlon, Inc., The Estée Lauder Companies Inc., Oriflame Cosmetics AG and KOSÉ Corporation are some of the notable companies in the global luxury cosmetics market. Large competition from local industry competitors is projected to create a threat to the business expansion of renowned businesses. To separate themselves from competitors and better cater to customers, companies are concentrating on developing hyper-personalized services.

RECENT HAPPENINGS IN THE MARKET

-

The COVID-19 pandemic has advanced once marginal technology, such as virtual try-on features, AI-enabled skincare analysis, and “waterless” cosmetic products. Beauty brands have had to develop from a one-dimensional industry to something more holistic and inclusive as the focus on health and wellness has increased.

-

Major beauty players trying to appeal to an increasingly eco-conscious society have prioritized sustainability and a focus on environmental impact. Some companies, such as L'Oréal and Estée Lauder, have set targets to become carbon neutral, while others have started experimenting with reusable packaging and refillable business models. Synthetic beauty elements are gaining popularity as well.

- Perso, L'Oréal's AI-powered device for formulating and dispensing customized skincare, lipstick, and foundation, was unveiled recently. The Perso app uses data from an uploaded selfie, location data, and user-inputted skincare issues to deliver personalized formulae through the device.

DETAILED SEGMENTATION OF THE GLOBAL LUXURY COSMETICS MARKET INCLUDED IN THIS REPORT

This research report on the global luxury cosmetics market has been segmented and sub-segmented into the following categories.

By Product Type

- Skin Care

- Hair Care

- Makeup

- Others

By End-User

- Female

- Male

By Distribution Channel

- Hypermarkets & Supermarkets

- Specialty Stores

- Online Stores

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

Frequently Asked Questions

What is the expected growth rate of the luxury cosmetics market?

The global luxury cosmetics market is estimated to grow at a CAGR of 5.5% from 2023 to 2028.

What are the key factors driving the growth of the luxury cosmetics market?

Factors such as rising disposable income, brand loyalty, and a growing focus on personal grooming and appearance are driving the growth of the luxury cosmetics market.

Which regions are the primary contributors to the luxury cosmetics market share?

Europe and North America are the leading regions in terms of market share, with Asia-Pacific showing significant growth potential.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]