Global Low Sulfur Fuel Oil Market Research Report - Segmentation By Range (2,000 PPM and 2,500 PPM), By Application (Marine Industry and Energy Firms) and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa) – Industry Analysis (2024 to 2032).

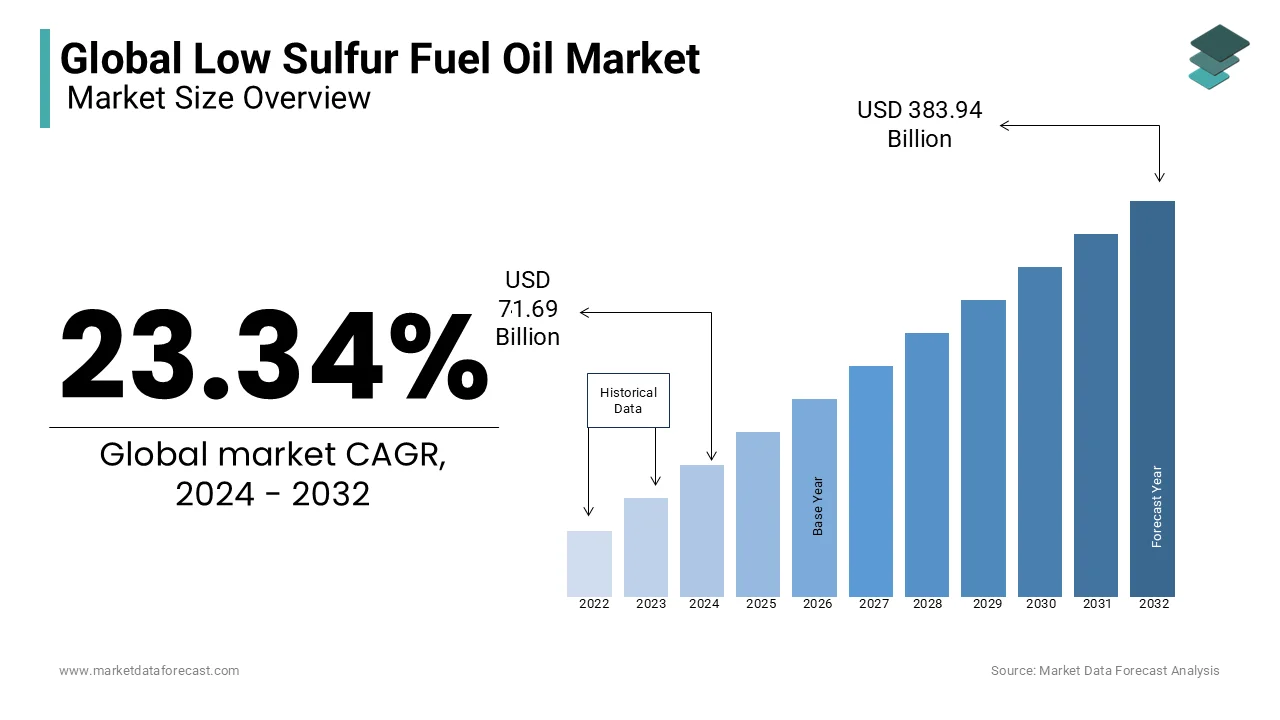

Global Low Sulfur Fuel Oil Market Size (2024 to 2032):

The Global Low Sulfur Fuel Oil Market was worth US$ 58.12 billion in 2023 and is anticipated to reach a valuation of US$ 383.94 billion by 2032 from US$ 71.69 billion in 2024 and is predicted to register a CAGR of 23.34% during 2024-2032.

Current Scenario of the Global Low Sulfur Fuel Oil Market

The low-sulfur fuel oil market recently observed a big push from processing rules in the seawater industry. Most of the companies selling coal and ice started to become heating oil retailers and eventually, the industry started to grow steadily, A large proportion of these oil companies were family-owned and had been around for a long time. Due to this characteristic, the fuel oil industry occupies a unique position in the US market.

Residential fuel oil is a middle distillate petroleum product similar to jet fuel and kerosene. In recent years, fuel oil and diesel were considered equal. The same refined petroleum product was bought and sold at service stations as highway fuel and fuel oil by distributors. The shipping industry has persisted as a substantial advocate for sulfur in the habitat, with the potential for sulfur dioxide in the climate. Sulfur dioxide presentation is linked to an unfavourable health exam. Apparently, enforcement of the rules will cover the way at a low sulfur stage and likely cause industry disruptions in planning not so far away. Rapid advances have been made in marine energy blending technology. This will allow the shipping industry around the world to accelerate change. A growing number of features that have effectively educated offshore and onshore workers to understand low-sulfur fuel oil holdings will open a new movement for market expansion.

MARKET TRENDS

After framing the decisions, there was an air of unpredictability in energy costs for the marine industry. This guided a growing number of subsequent agreements between the shipping industry and energy companies, mainly in advanced areas. This has encouraged commercial enterprises in low-sulfur marine energy, thus raising expectations in the low-sulfur fuel oil market. The move towards cleaner energies is one of the main players in the market. The seawater industry is paying escalating attention to methods that can help you donate to reduce air pollution. The escalating concentration of countries considered oil trading centres greatly expands market prospects. One rally point is the low sulfur seawater energy fuel exchange that is being enhanced by emerging Asian nations.

MARKET DRIVERS

The global low-sulfur fuel oil market has recently seen a massive boost in regulatory developments in the marine industry.

The recent momentum is driven by the momentum generated by the regulations of the new International Maritime Organization (IMO) which call for reducing the highest percentage of sulfur that marine fuels can contain. The rules will come into effect next year, that is, in 2023. This has now started to encourage the shipping industry to switch to low-sulfur fuel oil. Without a doubt, the industry has remained the largest contributor of sulfur to the environment, escalating the risk of sulfur dioxide in the atmosphere. Exposure to sulfur dioxide is associated with health problems. Apparently, the implementation of the regulations will pave the way for low-sulfur fuel oil and is likely to cause disruption to the industry in the not-too-distant future.

MARKET RESTRAINTS

Less knowledge among people about low-sulfur oil may hamper the expansion of the market in the near future.

MARKET OPPORTUNITIES

Fast developments have been made in marine fuel blending technology.

This will allow the shipping industry around the world to accelerate the transition. An escalating number of trials that have successfully trained marine and coastal personnel to understand the properties of low-sulfur fuel oil will open new trends that support market expansion. After the regulations were drafted, an air of uncertainty was generated in fuel prices for the maritime industry. This has led to an escalating number of forwarding contracts between shipping and energy companies, especially in developed countries. This has boosted business in low-sulfur marine fuels, thus escalating prospects in the global low-sulfur fuel oils market. One of the main drivers of the market is the shift towards cleaner fuels. The maritime industry is becoming more and more aware of ways that can help it reduce air pollution. The escalating attention from countries considered oil trading centres greatly expands the market potential. The low-sulfur marine fuel trade supported by developed countries in Asia is a good example. Advances in technology offer new opportunities for the global low-sulfur fuel oil market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024 to 2032 |

|

CAGR |

23.34% |

|

Segments Covered |

By Range, Application, and Region. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Neste Oil, Exxon Mobil Corporation, Marathon Petroleum Company LP, R.W. Davis Oil Company, Whiteley Fuel Oil Company, Lehigh Fuels LLC, Chevron Corporation, United Metro Energy Corp, and Others. |

SEGMENTAL ANALYSIS

Global Low Sulfur Fuel Oil Market Analysis By Range

Heating oil companies have a significant frequency of distributing the consequences of heating and aid, mainly in the systematic USA. For these obvious reasons, it has been employed extensively in the United States and around the world. Much of this petroleum profession was run by the family and has survived throughout the years. Due to this attribute, the fuel oil company had a distinctive location in the US market. Although the sulfur content of the diesel in the transmission was reduced, there was little influence on the sulfur content of the heating oil. Moderate products for fuel oil are probably in the range of 2000 ppm to 2500 ppm.

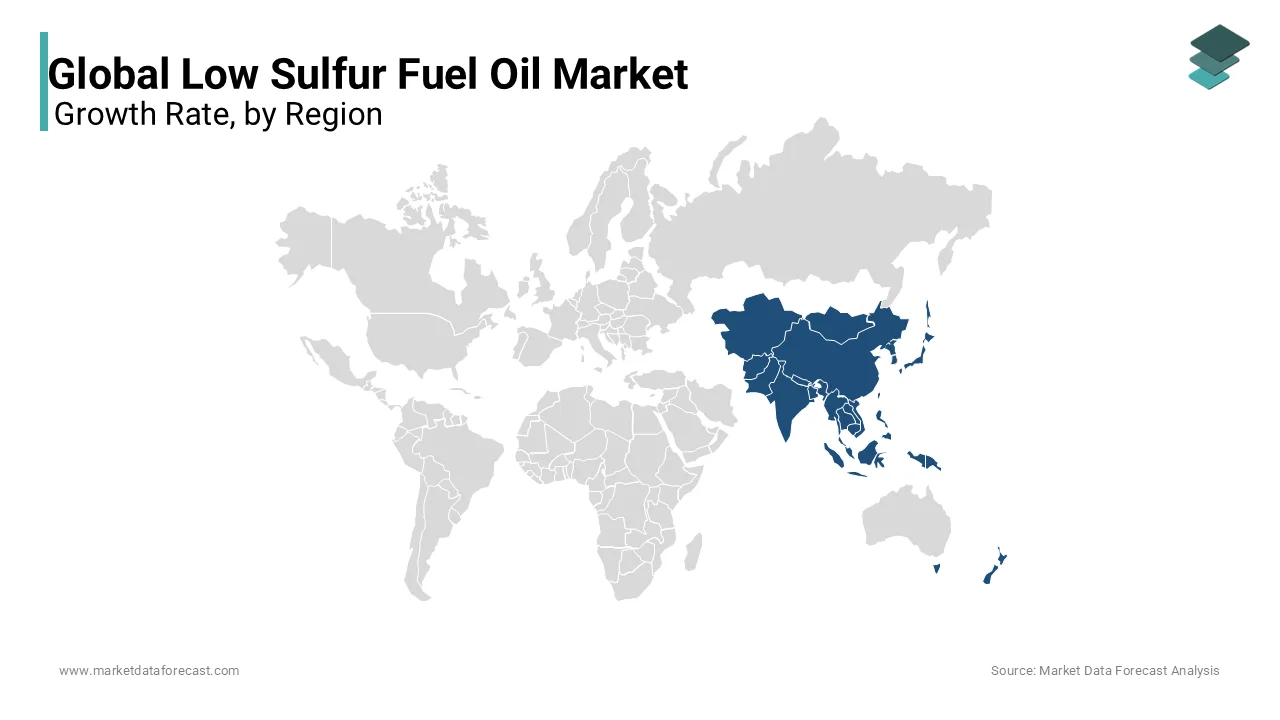

REGIONAL ANALYSIS

Asia-Pacific is supposed to be the dominant region in the low-sulfur fuel oil market.

Asia-Pacific is estimated to be the highest area segment and accounts for approximately 46% of total revenue in 2020. Increased sulfur manufacturing from Japan and China is likely to increase the contribution of sulfuric acid in this area. The growing need for sulfuric acid from Indonesia and the Philippines is predicted to increase the Asia-Pacific market over the projected period. The cost of sulfuric acid is nutritious due to the growing need for the consequences in the Asia Pacific. The rising call to increase phosphate manure manufacturing due to increased compost areas and strict environmental regulations regarding the production of environmentally friendly products is anticipated to increase the market in the near future. The escalating needs of the manufacturing and phosphoric acid areas due to increased crop improvements and excessive crop production are foreseen to further the development of the market in China. Increased transportation from India to China and the Philippines is believed to promote zonal market development. The increasing distribution of sulfuric acid products from Saudi Arabia and Morocco is likely to increase the market during the conjecture period.

KEY PLAYERS IN THE GLOBAL LOW SULFUR FUEL OIL MARKET

Companies playing a prominent role in the global low sulfur fuel oil market include Neste Oil, Exxon Mobil Corporation, Marathon Petroleum Company LP, R.W. Davis Oil Company, Whiteley Fuel Oil Company, Lehigh Fuels LLC, Chevron Corporation, United Metro Energy Corp, and Others.

RECENT HAPPENINGS IN THE GLOBAL LOW SULFUR FUEL OIL MARKET

- The Singapore-based Asia Pacific Stock Exchange (APEX) will launch a Low Sulfur Fuel Oil (LSFO) futures contract to help transportation and energy companies manage price fluctuations and enforce stricter worldwide rules on marine fuels.

- The Shanghai International Energy Exchange introduced its low-sulfur fuel oil futures contract.

DETAILED SEGMENTATION OF THE GLOBAL LOW SULFUR FUEL OIL MARKET INCLUDED IN THIS REPORT

This research report on the global low sulfur fuel oil market has been segmented and sub-segmented based on range, application, and region.

By Range

- 2,000 PPM

- 2,500 PPM

By Application

- Marine Industry

- Energy Firms

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]