Global Loan Origination Software Market Size, Share, Trends & Growth Forecast Report By Type (Cloud and On-premise), Application (Banks, Credit Unions, Mortgage Lenders, Mortgage Brokers and others) & & Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa), Industry Analysis From 2024 to 2033

Global Loan Origination Software Market Size

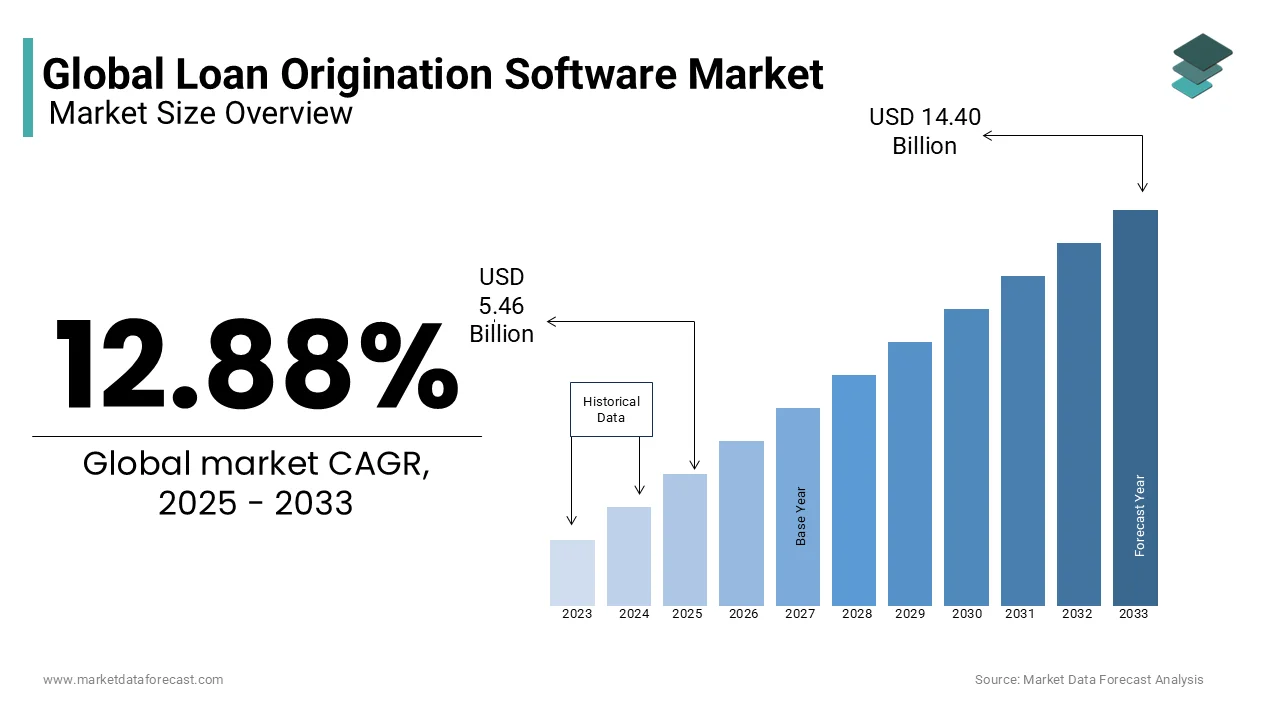

The global loan origination software market was worth USD 4.84 billion in 2024. The global market is expected to be worth USD 14.40 billion by 2033 from USD 5.46 billion in 2025, growing at a CAGR of 12.88% during the forecast period 2025 to 2033.

The global loan origination software market has experienced exponential growth in the recent past due to factors such as the increasing digitization of financial services, the rise of online lending platforms, and the demand for streamlined loan processing workflows. The global market for loan origination software market is expected to expand promisingly during the forecast period. Financial institutions have been increasingly focussing on automating and optimizing their loan origination processes, reducing manual errors, improving efficiency and enhancing customer experiences. Currently, loan origination software solutions have become essential tools for banks, credit unions, and online lenders as these offer end-to-end loan processing capabilities ranging from application intake to underwriting and closing. The coming few years are anticipated to be lucrative for loan origination software market due to the ongoing technological advancements, increasing demand for digital lending solutions and regulatory initiatives promoting financial inclusion and innovation in lending practices. Top of Form

MARKET DRIVERS

The Shift of the Financial Industry towards Digitalization

Lenders are swiftly embracing technology to overhaul and automate their operations and loan origination software stands at the forefront of this transformative wave. Loan origination software catalyzes the digitalization of the complete loan application and approval lifecycle, offering an agile solution to minimize paperwork and enhance overall operational efficiency. By leveraging digital platforms, financial institutions can streamline traditionally cumbersome processes, accelerating the speed of loan origination while simultaneously improving accuracy and reducing manual errors. As the demand for streamlined, tech-driven solutions intensifies, loan origination software continues to play a pivotal role in reshaping the industry landscape, aligning with the evolving needs of lenders navigating the digital era.

The transformative shift with the integration of cutting-edge technologies such as artificial intelligence (AI) and machine learning (ML) is playing pivotal roles in the loan origination software market by revolutionizing decision-making processes, risk assessment, and fraud detection within the loan origination landscape. These advancements empower financial institutions with sophisticated tools to analyze vast datasets, enabling more accurate credit assessments and efficient processing. AI-driven algorithms enhance the precision of risk evaluations, ensuring lenders make informed decisions while minimizing exposure. Additionally, the integration of machine learning algorithms aids in proactive fraud detection, bolstering the security of lending operations. As the industry embraces these technological innovations, the loan origination software market continues to evolve, offering lenders the tools needed to navigate the complexities of modern finance and meet the growing demands for efficiency and compliance.

MARKET RESTRAINTS

Security and Privacy Concerns

The sensitive nature of financial data demands robust measures, and financial institutions approach LOS implementation cautiously, driven by fears of potential data breaches and non-compliance with stringent privacy regulations. The need for secure storage, transmission, and processing of confidential borrower information poses a challenge for LOS providers in establishing and maintaining airtight security protocols. Addressing these concerns is pivotal for fostering trust among financial institutions, assuring them that adopting LOS won't compromise data integrity. As the Loan Origination Software market advances, a key focus must be on reinforcing cybersecurity frameworks and ensuring compliance with evolving privacy standards, thereby alleviating apprehensions and facilitating the seamless integration of these technologies into the financial landscape.

The loan origination software (LOS) market faces a notable challenge due to upfront costs linked to implementation. This financial barrier poses a challenge, especially for smaller financial institutions operating within constrained budgets. The encompassing expenses, which include software licensing, customization, and training, can strain resources, impeding the seamless adoption of LOS solutions. While larger institutions may absorb these costs more easily, smaller players may find it prohibitive, limiting their ability to leverage advanced technologies for streamlined loan processes. As the LOS market continues to evolve, addressing this challenge is crucial. LOS providers must explore cost-effective models, offer scalable solutions, and provide flexible pricing structures to democratize access, ensuring that financial institutions of all sizes can benefit from the efficiency gains and digital advancements that LOS systems bring to the lending landscape.

MARKET OPPORTUNITIES

Emerging technologies, like advantages analytics and artificial intelligence, are set to provide further opportunities for the expansion of the loan origination software market. Cloud computing, machine learning, blockchain integration, digital lending and eClosing, and cloud-based platforms are some of the major trends that are expected to revolutionise the market further. The incorporation of machine learning and AI depicts a critical juncture in the lending industry. These technologies authorize digital loan origination systems to automate operations, analyze information, and give predictive insights. From accelerating procedures and underwriting to improving compliance and risk management, AI-powered digital loan origination software is transforming how lenders function.

- According to a study published in Business Next, more than 30% of financial establishments have reported improved productivity and precision in load approval workflows via the integration of machine learning in lending.

The market players are also expected to benefit from the automated document analysis. AI algorithms can examine documents like bank statements to check borrower details, speed up the underwriting process, tax returns, pay stubs, and assess creditworthiness. Further, models based on machine learning can analyze previous loan data to determine trends and patterns, allowing lenders to reduce risk effectively and make more precise credit decisions.

Low Code No Code Development platforms are set to revolutionize the lending industry. This is another factor providing potential opportunities for market expansion. In the past few years, the industry has experienced significant transitions in all aspects and the rise of the fintech has exerted considerable pressure on the market players. By making application development accessible to all, LCNCPC platforms enable financial establishments to make customized solutions that cater to evolving market requirements, encouraging actual innovation and operational productivity. Also, Low-code and no-code platforms capitalize on modern technologies such as artificial intelligence (AI), automation, and machine learning (ML) to streamline the development procedure, empowering non-technical consumers to make applications with ease.

MARKET CHALLENGES

Lack of customization and limited scalability are decreasing the growth rate of the loan origination software market. Several LOS products sold in the advanced software market are plug-and-play models with a restricted spectrum of modifications. They can barely be refined and calibrated to satisfy innovative business objectives. Existing systems are hardly or not often built for large amounts of loan applications and have a rather small scope. So, this limited scalability hampers the development of the market. Insufficient control over the LOS also makes it tough for the lenders to make timely changes or scale up the software operations as per their requirements, which ultimately hinders the development of the market. This shows that dependence on third-party providers can seriously affect the reliability and performance of mortgage lenders.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

12.88% |

|

Segments Covered |

By Application, Type, Organization Size, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Ellie Mae (United States), Calyx Software (United States), FICS (United States), Fiserv (United States), Byte Software (United States), Mortgage Builder Software (UnitedStates), Mortgage Cadence ( Accenture) (UnitedStates), Wipro (India), Tavant Tech (United States), D + H Corp (Canada), Lending QB (United States), Black Knight (United States), ISGN Corp (United States), Pegasystems (USA), Juris Technologies (Malaysia), Axcess Consulting Group (Australia), Turnkey Lender (USA) and Others. |

SEGMENTAL ANALYSIS

By Type Insights

The mortgage segment was the biggest segment of all and captured 38.8% of the global market share in 2024. Mortgage is anticipated to have the dominant market share as the intricate nature of mortgage origination, involving extensive documentation, compliance checks, and property assessments, necessitates robust LOS solutions. Mortgage lenders prioritize LOS to streamline processes, ensuring efficient and accurate management of mortgage applications.

The personal loan segment was the second largest segment in the global market in 2023 and is estimated to grow at a CAGR of 8.82% during the forecast period. Personal loans, being versatile and widely sought, are crucial in the LOS market. LOS helps financial institutions automate the approval process, assess creditworthiness, and manage the documentation associated with personal loans. Its relevance lies in enhancing the speed and accuracy of decision-making.

By Application Insights

The bank segment held the leading spot in the global market, accounting for 41.7% of the worldwide market share in 2023. Banks are prominent users of the Loan Origination Software Market due to their extensive lending operations. The robust capabilities of LOS, such as automated processing and risk assessment, align with the high-volume requirements of banks, making it a dominant application. The comprehensive features of LOS are well-suited to meet the diverse lending needs of banks, from personal loans to mortgages.

The credit unions segment is projected to witness a CAGR of 6.6% during the forecast period. Credit unions benefit from the automation and efficiency gains that the loan origination software market offers, enabling them to provide competitive lending services. However, credit unions may face budget constraints, influencing the degree of LOS adoption compared to larger banks.

By Organization Insights

The SMEs segment is expected to grow at a CAGR of 11.44% during the forecast period. In recent years, SMEs have shown a growing interest in the adoption of the Loan Origination Software Market. SMEs are increasingly recognizing the importance of streamlined loan processes for business growth. Cost-effective and scalable LOS solutions cater to the specific needs of SMEs, making them more accessible and relevant for these businesses.

Large enterprises, particularly financial institutions with extensive lending operations, often act as the second leading segment of the Loan Origination Software Market. The complex nature of their lending portfolios, including various loan types and a high volume of transactions, demands sophisticated LOS solutions. Large enterprises benefit from the scalability and comprehensive features of LOS to handle diverse lending activities efficiently.

REGIONAL ANALYSIS

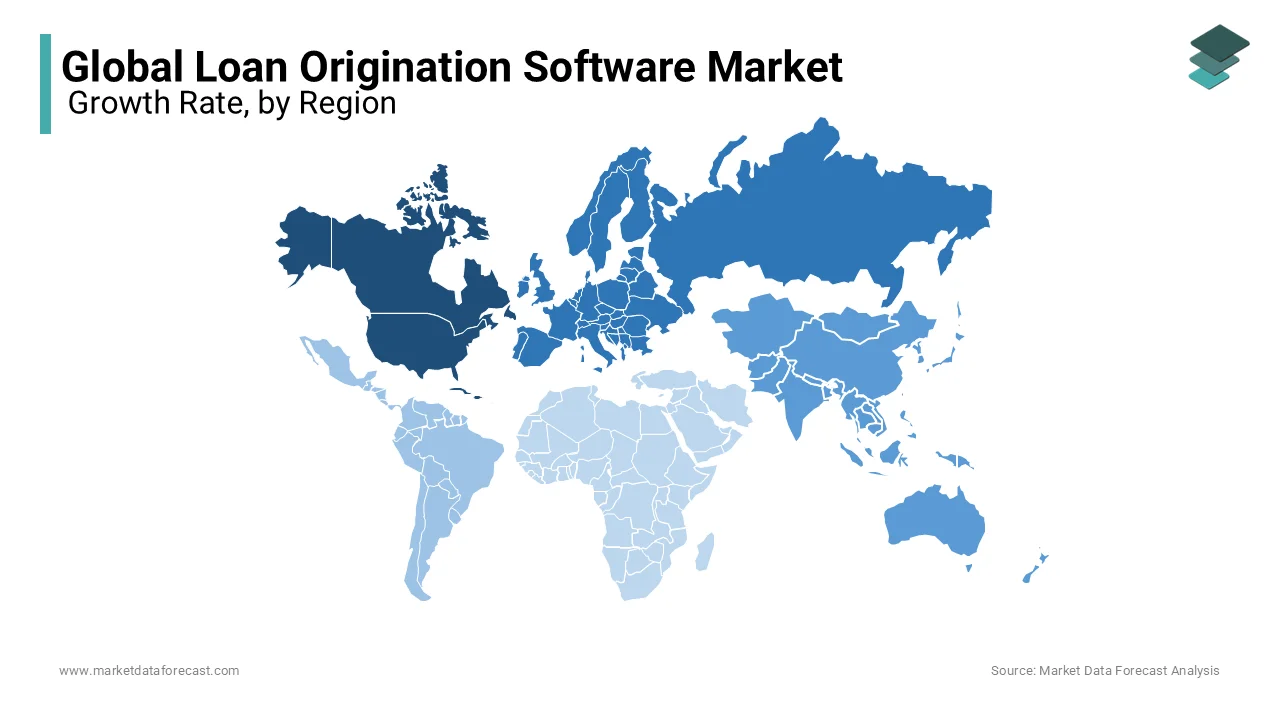

Geographically, North America outranked all the regions and stood as the top-performing regional segment in 2024 and the domination of the North American region in the global market is likely to continue throughout the forecast period. North America captured a share of 43.7% of the global market in 2024 and is predicted to grow at a notable CAGR in the coming years. The United States has been the largest consumer of loan creation software in North America and the world in recent years and will continue to grow in the years to come. The United States, Canada, the United Kingdom, Ireland, Australia, France and Norway are now the leading developers of loan origination software across the globe. There are sellers of inferior quality products in China, but the market in this area is still tiny. And we believe that China will maintain a high growth rate in this industry in the years to come.

Europe follows closely behind North America in the adoption of loan origin software market growth. The Region's diverse financial markets and regulatory environments necessitate adaptable LOS solutions. As digital transformation gains momentum in European financial institutions, LOS becomes increasingly relevant for optimizing lending operations. However, the adoption rate may vary among European countries based on their economic conditions and maturity in the financial industry.

The Asia-Pacific region is also experiencing a surge in the global loan origination software market as countries within the region undergo rapid economic development and digital transformation. Growing populations, increasing access to financial services, and government initiatives to promote digital finance contribute to the rising relevance of LOS in Asia-Pacific.

Latin America occupied a considerable share of the global market in 2023 and is projected to witness a steady CAGR during the forecast period. Latin America is witnessing a growing relevance of LOS as financial institutions seek to modernize lending processes. The region's diverse economies and regulatory landscapes influence the pace of LOS adoption, with some countries leading the way in embracing digital lending solutions.

Middle East and Africa varies across countries. In more economically developed nations, financial institutions are more likely to adopt LOS to enhance operational efficiency and meet regulatory requirements.

KEY MARKET PLAYERS

Some of the leading players in the global loan origination software market are Ellie Mae (United States), Calyx Software (United States), FICS (United States), Fiserv (United States), Byte Software (United States), Mortgage Builder Software (United States), Mortgage Cadence (Accenture) (United States), Wipro (India), Tavant Tech (United States), D + H Corp (Canada), Lending QB (United States), Black Knight (United States), ISGN Corp (United States), Pegasystems (USA), Juris Technologies (Malaysia), Axcess Consulting Group (Australia) and Turnkey Lender (USA). All the leading companies and new entrants are focused on improving their product portfolio and customer reach by implementing several growth strategies like new product launches, updates, security, and so on. They are also focusing on mergers, acquisitions, collaborations, and joint ventures to improve their market presence.

RECENT HAPPENINGS IN THE MARKET

- In June 2024, Salesforce introduced digital lending for India for load origination, and the press released its forthcoming availability. This will offer lenders and banks a platform or stage for digitally approaching consumer lending while decreasing expenses and pressure to maintain obsolete and disconnected solutions or platforms. Digital Lending for India is based on the Financial Services Cloud platform of Salesforce and will solely cater the clients in the nations. India is a fast-growing economy and this will assist the company in further strengthening its position in the market.

- In September 2024, Simplist Technologies introduced Sonar which is a mortgage lending solution that merges loan origination system (LOS) and point-of-sale (POS) into a single, optimized, and AI-enhanced platform. This integration into Sonar offers mortgage professionals an extensive, all-in-one or multipurpose solution to transform this process from first to last. Moreover, the launch of the latest solution follows a thriving beta stage with more than 200 mortgage companies.

- In March 2024, Bain Capital Tech Opportunities, a prominent worldwide software investor, reported that it has come to terms with having the most investment in finova which is another leading mortgage and savings origination and servicing software provider in the United Kingdom. It will also take over the ownership of the U.K. Mortgage Sales and Originations software business of Iress (MSO).

MARKET SEGMENTATION

This research report on the global loan origination software market has been segmented and sub-segmented based on the type, application, organization, and region.

By Type

- Mortgage Loan

- Personal Loan

- Business Loan

- Auto Loan

- Student Loan

- Others

By Application

- Banks

- Credit Unions

- Mortgage Lenders

- Mortgage Brokers

- Others

By Organization

- SMEs

- Large enterprise

By Region

- North America

- Asia Pacific

- Latin America

- Europe

- Middle East & Africa

Frequently Asked Questions

What are the key drivers of growth in the global Loan Origination Software market?

The global Loan Origination Software market is driven by several factors, including the growing demand for automation in financial services, increased digitalization, the need for enhanced customer experience, regulatory compliance requirements, and the rising adoption of cloud-based solutions. Additionally, the expanding fintech sector and the need for cost-effective lending solutions are contributing to market growth.

How is cloud-based Loan Origination Software impacting the market?

Cloud-based Loan Origination Software is having a significant impact on the market by offering scalable, cost-effective, and flexible solutions. These platforms allow financial institutions to reduce their IT infrastructure costs, enhance data security, and improve the speed and efficiency of loan processing. The shift to cloud-based solutions is also facilitating easier integration with other financial technologies and services.

How is the rise of fintech influencing the Loan Origination Software market?

The rise of fintech is significantly influencing the Loan Origination Software market by driving innovation, increasing competition, and expanding access to credit. Fintech companies are leveraging advanced technologies to offer more user-friendly, efficient, and flexible loan origination solutions. This is pushing traditional financial institutions to adopt more sophisticated LOS platforms to stay competitive and meet changing customer expectations.

What is the future outlook for the global Loan Origination Software market?

The future outlook for the global Loan Origination Software market is positive, with continued growth expected due to ongoing digital transformation in the financial sector, increased adoption of AI and cloud technologies, and the expanding role of fintech. The market is also likely to see further consolidation as larger players acquire smaller, innovative companies to enhance their offerings and market presence. Additionally, regulatory developments and changing consumer behavior will continue to shape the market's evolution.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]