Global Livestock Monitoring System Market Size, Share, Trends, And Growth Forecasts Report - Segmented By Offering (hardware, Software, And Services), Application (milk Harvesting Management, Breeding Management, Feeding Management, Heat Stress Management, Animal Comfort Management, Behaviour Monitoring And Control, And Others), Species (cattle, Poultry, Swine, Equine And Others), By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa) – Industry Analysis From 2025 to 2033

Global Livestock Monitoring System Market Size

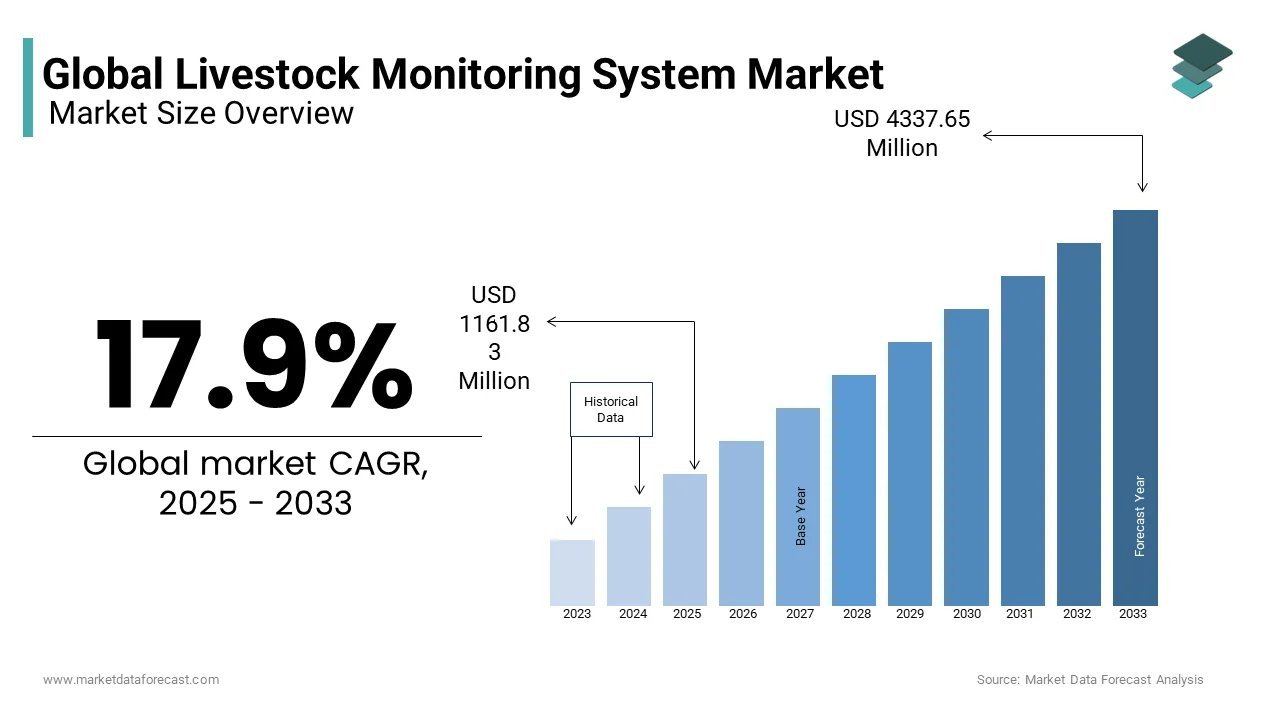

The global livestock monitoring system market was valued at USD 985.44 million in 2024 and is anticipated to reach USD 1161.83 million in 2025 from USD 4337.65 million by 2033, growing at a CAGR of 17.9% during the forecast period from 2025 to 2033.

CURRENT SCENARIO OF THE GLOBAL MONITORING SYSTEM MARKET

These days, animals are produced intensively and maintained under proper conditions for growth and production within current technological limits. A large number of animals are restrained within a building or stockyard. Since they are prevented from foraging for their food, the owner of livestock has to cater to all aspects of their farming. Thus, management and monitoring related to the environment, reproduction, feeding, marketing, transport, health, growth, and quality becomes the responsibility of the farmer. Livestock monitoring systems monitor the entire livestock environment 24/7 and alert the user by text, phone, or email if the system alters from a pre-set parameter for a prompt response. In addition, these systems are utilized to monitor tack rooms and sick animals and observe animals in the trailer in case of travel. Currently, the livestock monitoring systems market is experiencing the gradual adoption of integrated monitoring systems, in which information from databases, sensors, and other knowledge bases are combined, interpreted, and analyzed. Many systems containing a few of the elements of an integrated monitoring system are available commercially for cattle, broiler, swine, and milk production.

MARKET DRIVERS

Key factors driving the demand for livestock monitoring systems are an increase in the size and number of dairy farms, new product launches for livestock management, the development of sensors that can gather a wide range of information, and demand for cost savings associated with livestock monitoring & management. Steady sensor technology growth makes available large amounts of information relevant to monitoring animals and their environment, thereby, their production, health, and growth. With steadily growing demand for large cattle and poultry, advanced techniques are being used to aid the monitoring and tracking of animals. The utilization of systems for weighing and identifying animals is already pronounced worldwide, and it is anticipated that systems for tracking animals, monitoring essential health-related factors such as body temperature and heart rate, and assessing body conformation, will witness a high acceptance rate in the future.

The rising production of livestock farming owing to an escalation in the consumption of meat globally is increasing the demand for efficient monitoring systems for the health and well-being of animals, which is predicted to influence the market expansion positively. The increased penetration of IoT in the industry is crucial to market growth. The increased prevalence of zoonotic diseases influences farmers to adopt effective monitoring systems, boosting market revenue.

MARKET RESTRAINTS

Cattle, poultry, and other animals require optimal conditions to stay healthy and maximize their yield.

Equipment failures such as circulation fans, ventilation systems, heaters, and air conditioners can endanger their health and can create problems if not handled promptly. Numerous costs involved in the livestock monitoring system's production are depreciation, raw materials, labor, and other costs. These are the primary restraints of market growth. The absence of trained professionals is the secondary restraint on the growth of the livestock monitoring market. The industry needs more trained professionals to cater to the rising demand for livestock. As per the United States Department of Labour (USDA), employment of dairy farm workers is estimated to decrease by 6% from 2014 to 2024. Likewise, as per a report of the working group on Animal Husbandry & Dairying,

MARKET OPPORTUNITIES

The increasing concerns regarding the safety and quality of food products demand the integrity and traceability of animal products throughout the supply chain process, which is estimated to enhance market growth opportunities. The rising adoption of tracking and monitoring systems among farm-to-table livestock is boosting market growth. The growing adoption of precise livestock farming among farmers involves advanced technologies and real-time data, which helps in animal feed and water control; this is expected to influence market growth positively. The rise in government support initiatives for the quality health of animals is enhancing the adoption of advanced technologies for monitoring livestock, which drives market expansion in the coming years.

MARKET CHALLENGES

There are various challenges regarding the complexity of the technologies as advanced technological products such as advanced sensors, data analytics software, and others are challenging for farmers with limited knowledge to manage and utilize. Most remote rural regions have low connectivity and accessibility to advanced technologies is difficult, which may hinder market expansion opportunities. The rising concerns regarding the privacy and security of the stored data have higher chances of data breach and authorization access, which is a significant obstacle to market growth.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

17.9% |

|

Segments Covered |

By Offering, Application, Species and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Afimilk Ltd. (Israel) BouMatic LLC (U.S.) SCR Dairy, Inc. (Israel) DeLaval (Sweden) GEA Group AG (Germany), DairyMaster (Ireland) SUM-IT Computer Systems, Ltd. (U.K.) Valley Agriculture Software (U.S.) |

SEGMENT ANALYSIS

Global Livestock Monitoring System Market Analysis By Offering

The hardware segment dominated the livestock monitoring system market and is estimated to maintain the domination during the forecast period. The hardware segment consists of sensors, GPS, and RFID, along with other hardware products widely adopted among farmers to monitor the animals, boosting the segment's growth rate. The growing demand for livestock animals' productivity and the need to lower the incidence of zoonotic diseases is escalating the farmers to implement effective and efficient methods that fuel segment growth. The hardware products are low invasive and effective, driving the segment expansion.

The software segment is projected to grow substantially during the forecast period owing to the increased adoption of cloud-based systems in livestock monitoring. The ease of operation, affordable maintenance costs, accessibility, and connectivity propel the segment's revenue growth.

Global Livestock Monitoring System Market Analysis By Application

The milk harvesting management segment held the most significant global market share. The growing demand for dairy products and increased revenue dominate the segment. The escalation in technological advancements includes the introduction of automated milking systems, and improvements in data analytics are enhancing farming management with effective monitoring, increasing the segment revenue growth. The rising investments in the segment due to growing demand for premium dairy products and scalability enhance the market revenue.

The behavioral monitoring segment is predicted to enlarge at the highest CAGR during the forecast period. The rising awareness among the people regarding the importance of veterinary health and the importance of monitoring the behavior of animals is fueling the segment's growth. The growing incidence of various diseases that massively impact the behavior of animals is augmenting the requirement for behavioral monitoring, leading to segment growth.

Global Livestock Monitoring System Market Analysis By Species

The cattle segment accounts for the highest market share in the global market and is anticipated to continue its domination during the forecast period. The rising consumption of beef and dairy products worldwide is enhancing farmers' focus to implement safety measures for avoiding the spread of diseases and boosting the segment growth. The rising awareness among the farmers, the growing investments in dairy animals, and the incidence of zoonotic diseases are escalating the market growth.

The poultry segment is projected to record a notable CAGR during the forecast period due to the vast consumption of global poultry products. The rising awareness among people regarding the health benefits of consuming poultry products is escalating the demand for poultry, contributing to segment growth opportunities in the coming years.

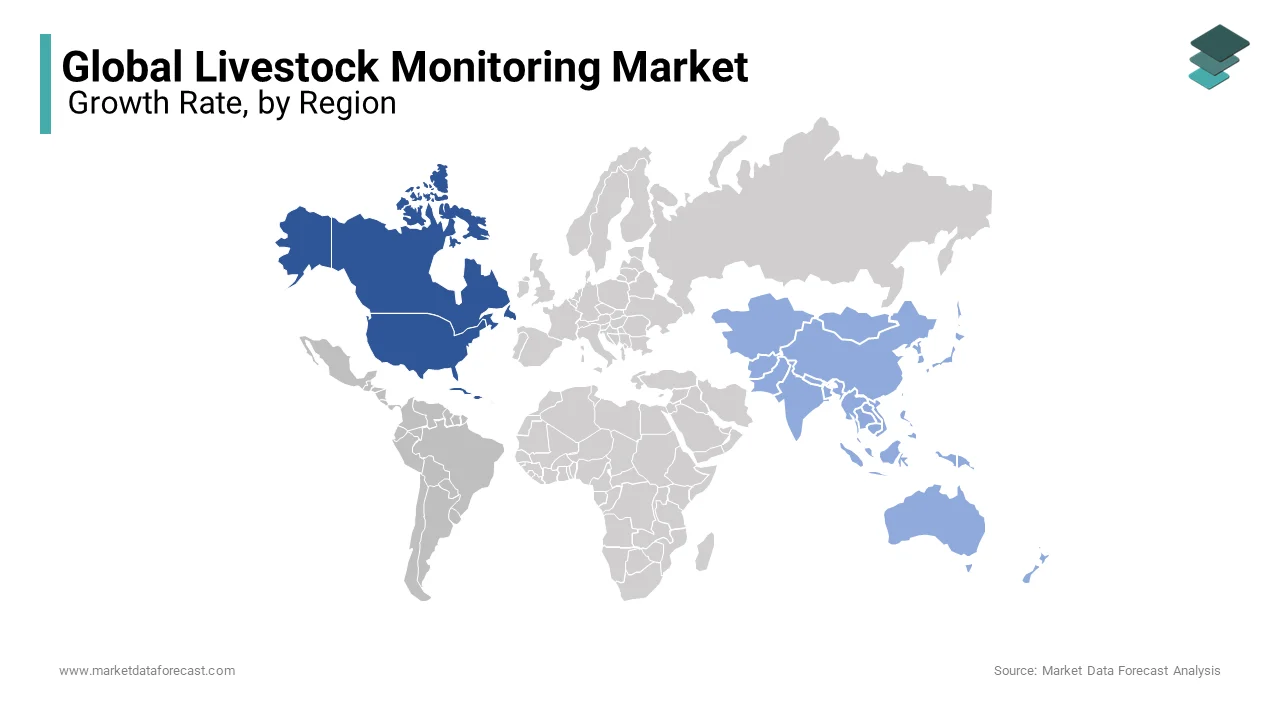

REGIONAL ANALYSIS

The North American region dominated the global livestock monitoring system market with a dominant market share and is expected to record a prominent growth rate during the forecast period. The increased adoption of advanced technologies, the expanding livestock industry, and the rising prevalence of zoonotic diseases are a few primary factors contributing to the regional market growth. The increasing animal healthcare expenditure and growing demand for monitoring production animals are propelling the United States market. According to the data provided by the National Beef Wire in 2024, the United States is the top producer of bovine meat worldwide, as it holds the share of 18% of the world's production in 2023.

The Asia Pacific region is estimated to record the fastest growth during the forecast period owing to its growing population and rapid urbanization. The rising disposable incomes of the people and growing consumption of livestock across the region are boosting the market expansion in the region. The region held the most significant profit from the historical period and is estimated to continue during the forecast period. The increased livestock production across the region, where around 30% of the cattle are found in China and India, contributes to the regional market share growth.

The European region is expected to grow considerably in the coming years with notable growth rates. The growing vegan population across the region is enhancing the demand for milk-producing cattle, and the rising demand for milk and its derivatives is augmenting the regional market growth. Germany holds the largest share of the European market revenue owing to its increased animal adoption, escalating the growth opportunities during the forecast period.

KEY MARKET PLAYERS

Afimilk Ltd. (Israel), BouMatic LLC (U.S.), SCR Dairy, Inc. (Israel), DeLaval (Sweden), GEA Group AG (Germany), DairyMaster (Ireland), SUM-IT Computer Systems, Ltd. (U.K.), Valley Agriculture Software (U.S.). Some of the market players dominating the global livestock monitoring system market.

RECENT HAPPENINGS IN THIS MARKET

- In July 2024, Fancom BV announced its collaboration with OptiFarm to develop novel, innovative livestock management software AI models. The product tests are estimated to be at the selected locations across the Netherlands.

- In April 2024, Merck announced the launch of Sensehub Dairy Youngstock, which has the activity to monitor and is widely utilized for the cattle population.

- In January 2024, Nikon introduced NiLIMO, an AI platform that supports farmers monitoring livestock animals for 24 hours and completing the tasks 365 days a year. Even the claving period of the livestock is notified to the owners by the AI system, which is gaining traction.

- In January 2024, Practo India announced the launch of Verdant Impact, an animal husbandry platform for livestock consisting of RFID-based health monitoring and telemedicine facilities.

MARKET SEGMENTATION

This research report on the global livestock monitoring system market is segmented and sub-segmented into the following categories.

By Offering

- Hardware

- Software

- Services

By Application

- Breeding management

- Feeding management

- Milk harvesting management

- Heat stress management

- Animal comfort management

- Behavior monitoring

- Control

- Other applications

By Species

- Poultry

- Swine

- Cattle

- Equine

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

What is the current market size of the global livestock monitoring market?

The current market size of the global livestock monitoring system market was valued at USD 1161.83 million in 2025

What are the market drivers that are driving the global livestock monitoring market?

Livestock monitoring systems are an increase in the size and number of dairy farms, and new product launches for livestock management are the major market drivers that are driving the global livestock monitoring market.

What are the market restraints in the global livestock monitoring market?

Cattle, poultry, and other animals require optimal conditions to stay healthy and maximize their yield.

What are the market opportunities in the global livestock monitoring system market?

The rising adoption of tracking and monitoring systems among farm-to-table livestock is boosting market growth.

Who are the market players that are dominating the global livestock monitoring system market?

Afimilk Ltd. (Israel), BouMatic LLC (U.S.), SCR Dairy, Inc. (Israel), DeLaval (Sweden), GEA Group AG (Germany), DairyMaster (Ireland), SUM-IT Computer Systems, Ltd. (U.K.), Valley Agriculture Software (U.S.).

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]