Global Lithium Market Size, Share, Trends, & Growth Forecast Report Segmented By Type (Metal, Compound, Alloy), Product, Application, End-use, and Region (Latin America, North America, Asia Pacific, Europe, Middle East and Africa), Industry Analysis from 2025 to 2033

Global Lithium Market Size

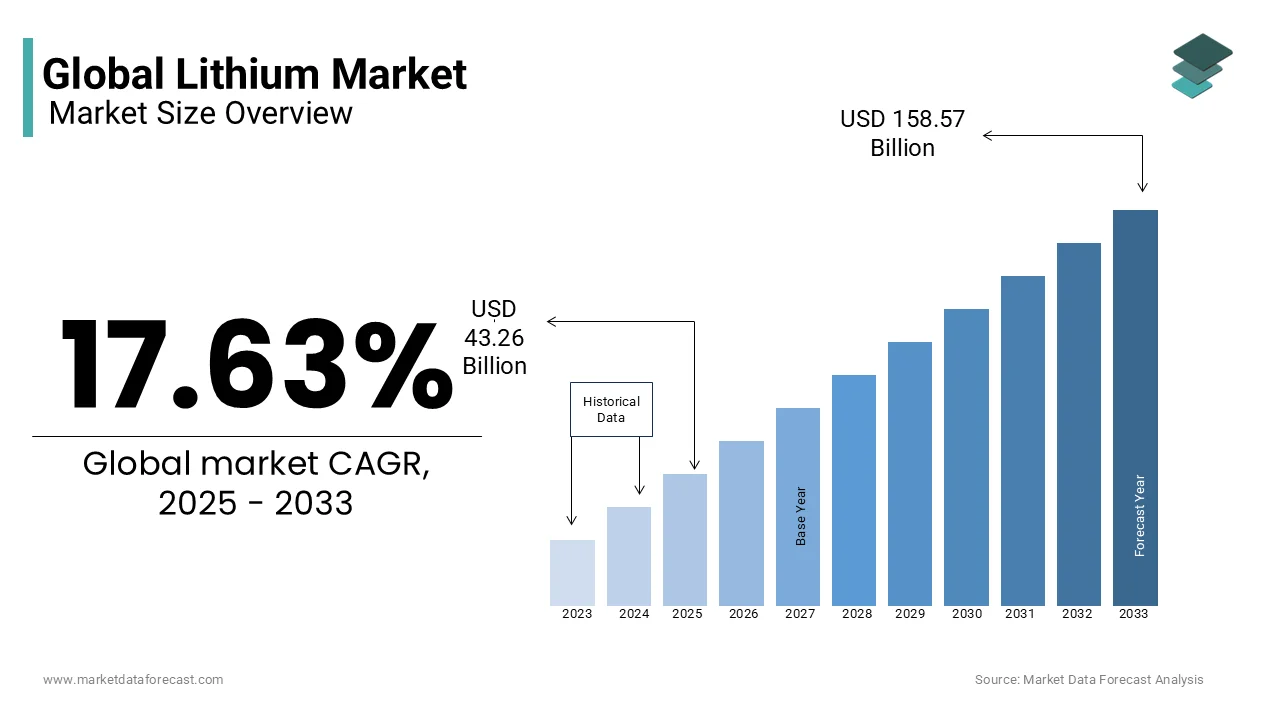

The global Lithium market size was valued at USD 36.78 billion in 2024 and is expected to reach USD 158.57 billion by 2033 from USD 43.26 billion in 2025. The market is projected to grow at a CAGR of 17.63%.

Lithium is a lightweight and highly reactive alkali metal and is an essential resource in modern technology particularly for its role in rechargeable lithium-ion batteries used in electric vehicles (EVs), consumer electronics, and energy storage systems. Beyond batteries, it has applications in glass and ceramics, lubricants, pharmaceuticals, and nuclear energy which is making it a highly valuable industrial material. According to the United States Geological Survey (USGS), the world’s total lithium reserves are estimated to be 28 million metric tons. Chile holds the largest share, with 9.3 million tons, followed by Australia (6.2 million tons), Argentina (2.7 million tons) and China (2 million tons). These reserves are primarily concentrated in the Lithium Triangle (Chile, Argentina, and Bolivia) and that is a region known for its high-quality lithium brine deposits. However, Australia is currently the leading lithium producer and is extracting approximately 55,000 metric tons in 2021 followed by Chile with 26,000 metric tons.

China plays a dominant role in lithium refining and processes around 60% of the world’s lithium into battery-grade materials. Chinese companies have invested approximately $5.6 billion in lithium projects across Chile, Canada, and Australia over the past decade which reinforces their control over the supply chain. To reduce dependence on China, the U.S. and Europe are ramping up investments in domestic lithium mining and refining operations.

Environmental concerns are a growing challenge for lithium extraction. Lithium brine extraction in arid areas such as Chile's Atacama Desert, presents considerable water consumption challenges even though the often-repeated statistic of 500,000 gallons of water per metric ton of lithium may not be entirely accurate. New extraction technologies such as Direct Lithium Extraction (DLE) are being developed to minimize environmental impact and improve efficiency.

MARKET DRIVERS

Advancements in Energy Storage Technologies

The development of energy storage solutions and particularly grid-scale battery storage has notably increased the demand for lithium. The renewable energy sources such as solar and wind become more prevalent so lithium-ion batteries are being used to store surplus energy and ensure grid stability. The U.S. Geological Survey (USGS) reported that global lithium production surged to 107,000 metric tons in 2021 and marked a 29% increase from the previous year largely due to growing energy storage applications. Additionally, lithium-based energy storage systems are playing a vital role in reducing reliance on fossil fuels and enhancing energy security. Governments and industries are investing heavily in advanced battery technologies with research focused on increasing energy density, efficiency, and battery lifespan to support long-term sustainability in energy storage.

Government Policies and Environmental Regulations

Global policies aimed at reducing carbon emissions and transitioning to cleaner energy are majorly elevating lithium demand. Many governments have introduced strict emission regulations, tax incentives, and subsidies to promote electric vehicle (EV) adoption and renewable energy integration. According to the International Energy Agency (IEA), nearly one in five cars sold globally in 2023 was electric, amounting to 14 million new EV registrations. Countries like China, the United States, and members of the European Union are implementing ambitious clean energy policies such as phasing out internal combustion engine vehicles and investing in lithium battery production. These regulatory measures are fostering technological advancements in the lithium industry which is ensuring a sustainable and efficient energy transition for the future.

MARKET RESTRAINTS

Environmental Impact of Lithium Extraction

The extraction of lithium and especially from brine sources and hard rock mining which presents severe environmental concerns including water depletion, soil degradation, and carbon emissions. According to the U.S. Geological Survey (USGS), lithium mining is highly water-intensive with brine extraction requiring approximately 2.2 million liters of water per metric ton of lithium produced. In Chile’s Salar de Atacama, where a significant portion of global lithium is extracted and 65% of the region’s water is used for mining activities which is impacting local agriculture and wildlife. Additionally, mining operations release harmful chemicals such as hydrochloric acid and heavy metals is posing risks to groundwater contamination. These challenges have intensified global scrutiny over sustainable lithium extraction and thereby prompting research into environmentally friendly alternatives like Direct Lithium Extraction (DLE).

Supply Chain Vulnerabilities

The lithium supply chain is highly concentrated and vulnerable to geopolitical and logistical disruptions. The International Energy Agency (IEA) reports that as of 2022, global lithium demand exceeded supply despite a 180% increase in production since 2017. More than 50% of the world’s lithium refining takes place in China and is creating dependencies that could disrupt global supply in case of trade restrictions or political conflicts. Additionally, lithium mining is restricted to a few countries with over 75% of reserves concentrated in Chile, Australia, and Argentina. This uneven distribution increases the risk of market volatility and shortages. To mitigate these challenges, governments and corporations are investing in diversified lithium sources and localized battery production facilities.

MARKET OPPORTUNITIES

Emergence of Domestic Lithium Resources

Recent geological studies have unveiled substantial domestic lithium reserves, presenting a significant opportunity to bolster local supply chains. The U.S. Geological Survey (USGS) estimates that the Smackover Formation in southern Arkansas contains between 5.1 and 19 million metric tons of lithium in brine deposits. If these resources are commercially viable, they could substantially reduce reliance on foreign lithium sources and support the growing demand for electric vehicle batteries. This discovery underscores the potential for developing domestic extraction capabilities to enhance supply chain resilience.

Advancements in Battery Recycling Technologies

Innovations in battery recycling are creating avenues to reclaim valuable materials and consequently lowering environmental impact and dependence on virgin resources. As of 2023, the United States had the capacity to reclaim 35,500 tons of battery materials annually through domestic recycling facilities. Plans are underway to increase this capacity by an additional 76,000 tons in the next two to four years. These advancements not only mitigate waste but also contribute to a more sustainable and secure supply chain for critical materials like lithium.

MARKET CHALLENGES

Technological Challenges in Lithium Extraction

The extraction of lithium and especially from brine and hard rock sources faces grave technological difficulties. According to the U.S. Department of Energy, a major challenge restraining the extraction and processing of lithium is the limited scale-up investment into deployment-ready technologies for separation and purification. This limitation hampers the efficiency and scalability of lithium production and potentially leading to supply constraints. Addressing these technological challenges is crucial for meeting the growing demand for lithium in various applications.

Price Volatility Impacting Investment

Noteworthy price volatility in the lithium market creates challenges for both investment and project development. The International Energy Agency reports that in 2023, battery minerals saw particularly large declines, with lithium spot prices plummeting by 75%. Such volatility can deter investment in new mining and refining projects because investors may be cautious about the economic feasibility amid unpredictable market conditions. This hesitancy can lead to delays in expanding production capacity and probably resulting in supply shortages as demand continues to rise.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

17.63% |

|

Segments Covered |

By Type, Product, Application, End-use, and Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Albemarle Corporation, Ganfeng Lithium Co., Ltd., SQM S.A., Tianqi Lithium Corporation, Livent Corporation, Lithium Americas Corporation, Pilbara Minerals, Orocobre Limited Pty. Ltd., Avalon Advanced Materials, Ganfeng Lithium Co., Ltd., and others |

SEGMENT ANALYSIS

By Type Insights

The compound segment held the most significant share of the global lithium market in 2024. The domination of the compound segment is majorly driven by the widespread use of lithium compounds such as lithium carbonate and lithium hydroxide in the production of lithium-ion batteries. These batteries are essential for electric vehicles (EVs), consumer electronics, and energy storage systems. The U.S. Geological Survey reports that in 2021, global lithium production was approximately 100,000 metric tons with a significant portion utilized in battery manufacturing. The critical role of lithium compounds in energy storage solutions underscores their importance in the market.

The metal segment is anticipated to showcase a CAGR of 20.4% during the forecast period owing to the increasing application of lithium metal in next-generation batteries and particularly solid-state batteries. Solid-state batteries offer higher energy densities and improved safety compared to traditional lithium-ion batteries is making them a focal point for research and development in the automotive and electronics industries. The advancement of electric vehicles and the demand for more efficient energy storage solutions are propelling the growth of the lithium metal segment.

By Product Insights

The carbonate segment led the market by holding 53.2% of the global market share in 2024. The domination of the carbonate segment is majorly due to its comprehensive use in the production of lithium-ion batteries which are essential for electric vehicles (EVs) and portable electronics. According to the U.S. Geological Survey (USGS), the global production of lithium in 2021 was estimated at 107,000 metric tons with a significant portion utilized in battery manufacturing. Additionally, lithium carbonate serves as a precursor for lithium hydroxide and is utilized in pharmaceuticals for treating bipolar disorder and consequently showing its versatility and critical role in various industries.

The hydroxide segment is anticipated to grow at the highest CAGR of 20.69% over the forecast period due to the growing application in high-performance batteries and particularly those using nickel-cobalt-aluminum (NCA) and high-nickel cathodes which offer higher energy densities and longer lifespans. The increasing demand for electric vehicles and energy storage systems is propelling the need for lithium hydroxide as it enhances battery performance and efficiency. Its importance in advancing battery technology contributes to its accelerated market growth.

By Application Insights

The battery segment dominated the lithium market by capturing the most significant share of the global market in 2024. The widespread adoption of lithium-ion batteries in electric vehicles (EVs), consumer electronics, and energy storage systems is majorly boosting the domination of the battery segment in the global market. The International Energy Agency (IEA) reported that in 2023, global electric car sales exceeded 10 million units which is reflecting a 35% increase from the previous year. This surge in EV adoption has substantially driven the demand for lithium-ion batteries and is underscoring the critical role of the battery segment in the lithium market.

The glass and ceramics segment is estimated to exhibit a CAGR of 5.12% over the forecast period. Factors such as the increasing use of lithium compounds in the production of glass and ceramics where they enhance properties such as thermal shock resistance and strength are driving the expansion of the glass and ceramics segment in the global market. The U.S. Geological Survey (USGS) indicates that lithium consumption in glass and ceramics applications has been steadily rising, driven by demand in sectors like construction and consumer goods. The unique properties imparted by lithium additives make them indispensable in manufacturing high-quality glass and ceramic products, contributing to the segment's rapid expansion.

By End-Use Insights

The automotive segment led the market by holding 38.1% of global market share in 2024 due to the widespread adoption of electric vehicles (EVs) which rely on lithium-ion batteries for energy storage. The International Energy Agency (IEA) reported that global electric car sales surpassed 10 million units in 2022, reflecting a 55%% increase from the previous year. This surge in EV adoption has significantly driven the demand for lithium is underscoring the automotive sector's leading position in the market.

The energy storage segment is anticipated to register the fastest CAGR of 22.1% over the forecast period. The growing deployment of renewable energy sources such as solar and wind power which require efficient storage solutions to manage intermittent generation is majorly boosting the growth of the energy storage segment in the global market. The U.S. Department of Energy noted that grid-scale energy storage installations in the United States reached over 1,000 megawatts in 2020, a significant increase from previous years. Lithium-ion batteries are favored in these applications due to their high energy density and efficiency, making them integral to modern energy storage systems. As the global emphasis on renewable energy and grid stability intensifies, the energy storage segment's importance and growth trajectory in the lithium market are expected to continue rising.

REGIONAL ANALYSIS

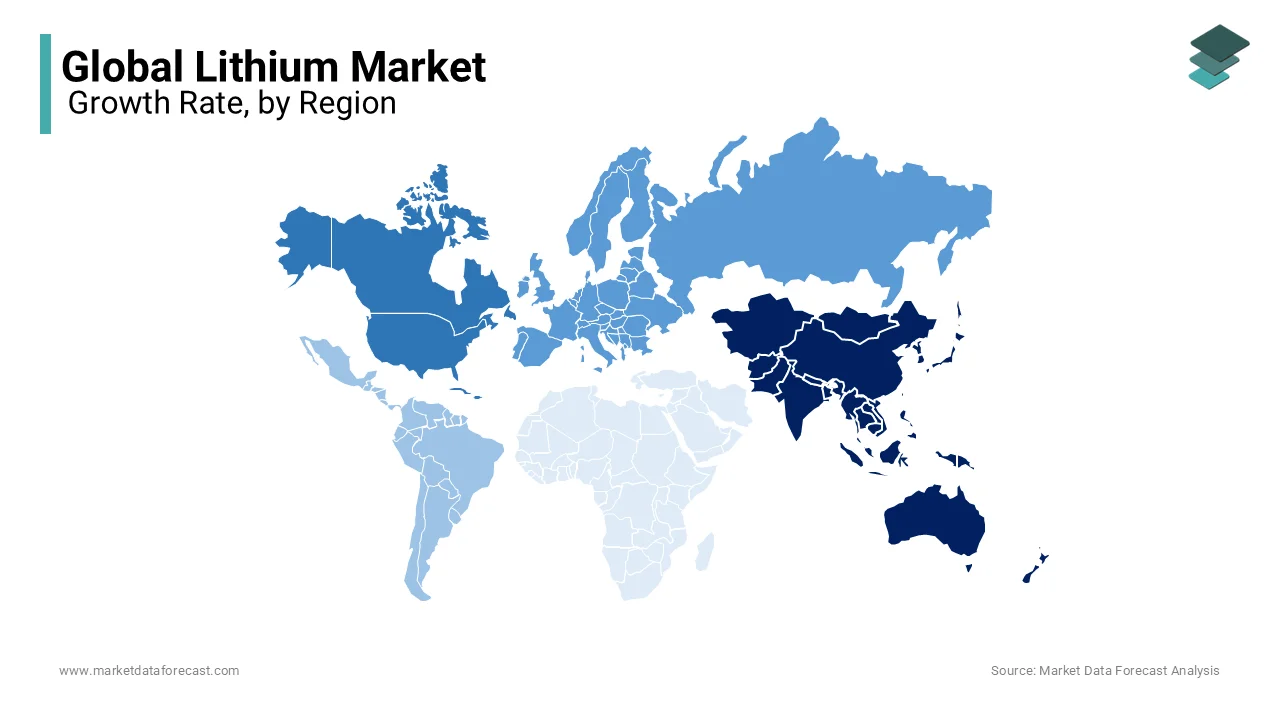

The Asia-Pacific region led the global lithium market by accounting for 60.2% of global lithium consumption. This position in the market is largely due to China's major role in lithium processing and battery manufacturing. According to the International Energy Agency (IEA), China is responsible for over 70% of global battery production capacity which is underscoring its central position in the lithium-ion battery supply chain. The region's leadership is further bolstered by substantial investments in electric vehicle (EV) production and renewable energy initiatives and is fueling continuous demand for lithium.

North America exhibits the highest growth rate in the lithium market with an estimated CAGR of 25.5%. This acceleration is influenced by increased investments in domestic lithium mining and refining, as well as the expansion of electric vehicle (EV) manufacturing. The U.S. Geological Survey (USGS) reports that the United States is ramping up efforts to develop its lithium resources to reduce dependence on foreign sources. Government incentives and policies promoting clean energy and transportation are further propelling market growth in the region.

The European lithium market is projected to grow notably due to the European Union's Green Deal and Battery Regulation policies which aim to reduce reliance on imported lithium and establish a domestic supply chain. According to the European Commission, Europe’s demand for lithium is expected to increase eighteen-fold by 2030. Countries like Germany and France are investing heavily in gigafactories, while lithium extraction projects in Portugal, Spain, and Finland are being developed to supply regional battery production. The rise in EV sales, energy storage projects, and government mandates on carbon neutrality will continue driving lithium demand across the continent.

Latin America and particularly the "Lithium Triangle" (Chile, Argentina, and Bolivia) holds substantial portion of the world’s identified lithium resources. Chile is the world’s second-largest lithium producer by extracting 26,000 metric tons in 2021. Argentina is rapidly increasing its lithium production with multiple projects in development while Bolivia is exploring ways to commercialize its vast untapped reserves. The region is expected to play a key role in global lithium supply with growing foreign investments from China, the U.S., and European nations. However, political instability and regulatory uncertainties pose challenges to production growth.

The Middle East and Africa currently play a minor role in the global lithium market but exploration activities are increasing. Zimbabwe is the leading lithium producer in Africa with the Bikita and Arcadia lithium mines contributing to regional supply. Namibia and the Democratic Republic of Congo (DRC) are also emerging as potential sources of lithium. According to the U.S. Geological Survey (USGS), African nations hold significant untapped lithium reserves, and China has heavily invested in African lithium projects to secure long-term supply. As global demand rises, the Middle East & Africa could become more important players in the lithium supply chain in the coming years.

KEY MARKET PARTICIPANTS AND COMPETITIVE LANDSCAPE

Albemarle Corporation, Ganfeng Lithium Co., Ltd., SQM S.A., Tianqi Lithium Corporation, Livent Corporation, Lithium Americas Corporation, Pilbara Minerals, Orocobre Limited Pty. Ltd., Avalon Advanced Materials, Ganfeng Lithium Co., Ltd. are playing dominating role in the global lithium market.

The lithium market is becoming increasingly competitive as global demand surges, driven by the rapid adoption of electric vehicles (EVs), renewable energy storage, and consumer electronics. The industry is dominated by a few key players, including Albemarle (U.S.), SQM (Chile), and Tianqi Lithium (China), which control a significant portion of global lithium production. However, emerging players such as Ganfeng Lithium, Livent, and Pilbara Minerals are intensifying the competition by expanding production and securing new lithium reserves.

The competition is centered around cost efficiency, production capacity, technological advancements, and sustainability. Companies are racing to increase lithium extraction and refining capacity, particularly for battery-grade lithium hydroxide, which is preferred for high-performance EV batteries. Additionally, vertical integration has become a crucial strategy, with lithium producers forming direct partnerships with automakers and battery manufacturers to secure long-term supply contracts.

Geopolitical factors also play a role, with China controlling a major share of lithium refining capacity, while the U.S. and Europe push for local supply chain independence. The market is further shaped by government policies, environmental regulations, and new lithium discoveries, making competition fierce as companies strive to dominate the future of the battery supply chain.

TOP 3 PLAYERS IN THE MARKET

Albemarle Corporation (U.S.)

Albemarle Corporation is the largest lithium producer globally, controlling 20-25% of the market. The company operates lithium brine extraction in Chile’s Salar de Atacama and co-owns the Greenbushes lithium mine in Australia, the world’s most productive hard rock lithium source. Albemarle also has lithium processing plants in China, the U.S., and Europe, allowing it to supply key battery makers such as Tesla, Panasonic, and LG Energy Solution. The company is actively expanding lithium hydroxide processing in the U.S. to strengthen North America's EV supply chain. Additionally, Albemarle is investing in lithium recycling initiatives to create a sustainable supply loop and reduce reliance on new mining.

SQM (Sociedad Química y Minera de Chile) (Chile)

SQM, headquartered in Chile, is one of the largest lithium brine extractors, supplying approximately 18-20% of the global lithium market. Its key operations are centered in Chile’s Salar de Atacama, which has some of the world's highest lithium concentrations. The company primarily produces lithium carbonate and lithium hydroxide, essential for EV battery production. SQM is a critical supplier to BYD, CATL, and LG Chem, major battery manufacturers driving the global EV boom. The company is investing heavily in sustainable lithium extraction, focusing on reducing water consumption and environmental impact in the Atacama Desert while expanding lithium hydroxide production to meet rising demand.

Tianqi Lithium (China)

Tianqi Lithium is a dominant player in the lithium industry, holding around 15-18% of the global lithium supply. It has a majority stake in Australia’s Greenbushes mine, the largest and most efficient hard rock lithium mine in the world. The company has extensive lithium refining operations in China and Australia, supporting China’s battery industry and leading EV battery maker CATL. Tianqi also holds a 22% stake in SQM, strengthening its control over lithium resources in South America. With China being the largest EV market, Tianqi plays a key role in lowering EV production costs by ensuring a steady lithium supply for domestic and international battery manufacturers.

STRATEGIES USED BY THE MARKET PLAYERS

Expansion of Production Capacity

To meet the surging global demand for lithium, major players are aggressively expanding their mining and refining operations. Albemarle is investing in new lithium processing plants in the U.S. and Australia, particularly focusing on battery-grade lithium hydroxide, which is essential for high-performance EV batteries. SQM is ramping up its lithium carbonate and hydroxide production in Chile’s Salar de Atacama, aiming to double its output by 2025 to meet the growing demand from Asian and European battery makers. Meanwhile, Tianqi Lithium is enhancing its refining capabilities in China and Australia, ensuring a consistent supply to major battery producers like CATL and BYD. By increasing production capacity, these companies strengthen their control over the global lithium supply chain and remain competitive in the fast-growing EV and battery industries.

Vertical Integration & Strategic Partnerships

Leading lithium producers are securing their market position by integrating operations across the supply chain and forming key partnerships. Albemarle has entered into long-term supply agreements with major automakers such as Tesla, Ford, and Panasonic, ensuring a stable customer base. SQM has partnered with South Korean and Chinese battery manufacturers to enhance its refining capabilities and gain access to new markets. Tianqi Lithium, on the other hand, holds a 22% stake in SQM, allowing it to secure Chilean lithium resources while expanding its foothold in South America. Through vertical integration and strategic collaborations, these companies mitigate risks associated with price volatility and supply chain disruptions, ensuring long-term profitability and growth.

Focus on Sustainability & ESG Initiatives

With increasing environmental concerns and regulatory pressure, major lithium companies are prioritizing sustainable extraction and processing methods. Albemarle is investing in lithium recycling technologies, aiming to create a circular economy and reduce reliance on newly mined lithium. SQM is focusing on reducing water usage in Chile’s Salar de Atacama, where lithium extraction has raised environmental concerns due to excessive water consumption. Tianqi Lithium is working towards carbon-neutral lithium production, aligning with global sustainability goals and attracting ESG-focused investors. By adopting environmentally friendly practices, these companies enhance their corporate reputation, comply with tightening regulations, and secure a long-term social license to operate.

RECENT HAPPENINGS IN THE MARKET

- In October 2024, Rio Tinto announced its intention to acquire Arcadium Lithium for $6.7 billion. This strategic move aims to position Rio Tinto as a leading lithium producer, capitalizing on the growing demand for electric vehicle (EV) batteries. The acquisition is expected to be finalized by mid-2025.

- In November 2024, Australia's Sayona Mining agreed to merge with U.S.-based Piedmont Lithium in an all-stock deal, creating a combined entity valued at approximately $623 million. This merger consolidates their Canadian operations and strengthens their presence in the North American EV market. The combined company will focus on projects in Quebec, North Carolina, and Ghana.

MARKET SEGMENTATION

This research report on the global lithium market has been segmented and sub-segmented based on type, product, application, end-use, and region.

By Type

- Metal

- Compound

- Alloy

By Product

- Carbonate

- Hydroxide

By Application

- Battery

- Pharmaceuticals

- Glass / Ceramics

- Polymers

- Others

By End-use

- Industrial

- Consumer Electronics

- Automobile

- Energy Storage

- Medical

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

1. What is the projected market size for the lithium industry in the coming years?

The market is expected to reach USD 43.26 billion in 2025 and is projected to grow to USD 158.57 billion by 2033.

2. Which segment held the largest share of the lithium market in 2024?

The compound segment dominated the global lithium market in 2024. This is primarily due to the widespread use of lithium compounds like lithium carbonate and lithium hydroxide in lithium-ion battery production, which is essential for electric vehicles (EVs), consumer electronics, and energy storage systems.

3. Which region leads the global lithium market?

The Asia-Pacific region led the global lithium market, accounting for 60.2% of global lithium consumption. This dominance is driven by China's leading role in lithium processing and battery manufacturing, which accounts for over 70% of global battery production capacity, according to the International Energy Agency (IEA).

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]