Global Liquid Feed Market Size, Share, Trends, & Growth Forecast Report, Segmented By Type (Protein, Minerals, Vitamins And Others), Ingredients (Molasses, Corn, Urea And Others), Livestock (Ruminants, Poultry, Swine, Aquaculture and Others), and Region (North America, Europe, Asia-Pacific, Latin America, Middle East And Africa), Industry Analysis Forecast From 2025 to 2033

Global Liquid Feed Market

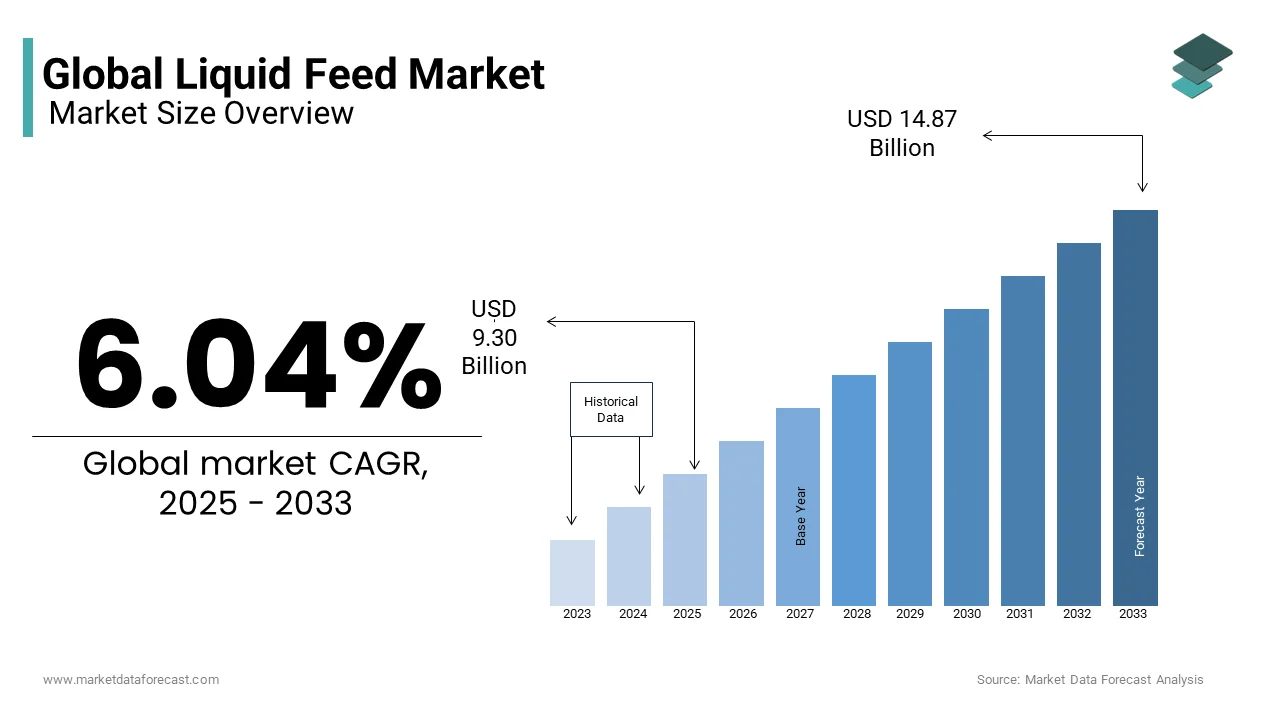

The size of the global liquid feed market was valued at USD 8.77 in 2024 and is anticipated to reach USD 9.30 billion in 2025 from USD 14.87 billion by 2033, growing at a CAGR of 6.04% during the forecast period from 2025 and 2033.

The liquid feed is a mixture of raw materials that are extracted from either plants or animals or various sources and used as by-products and fed to the livestock. The liquid feed contains minerals, proteins, vitamins, and other nutritional elements, which increase digestion and enhance the appetite of the livestock. Also, the liquid feed can help in the growth and development of the tissue in the livestock. Liquid feed is a flowing form of feed that is used as a supplement and mixed in the dry feed of animals, which provides essential nutrients and energy to livestock. The liquid feed is applicable for ruminants, swine, aqua animals, poultry and others. Moreover, liquid feed also enhances dairy and meat production, which makes profits for livestock farmers. The demand for liquid feed is increasing in order to meet the growing demand for protein-rich products.

Current Scenario Of The Global Liquid Feed Market

The liquid feed market is presently growing due to the rising consumption of animal-based food products, specifically dairy and meat, as customer preferences shift to superior quality products. Currently, the market is also dealing with rising inflation. It is impacting the raw material costs which further challenges its availability. The market is witnessing an intense demand for specific feed ingredients like whey and molasses because of competition from non-feed sectors, especially energy, which can lead to elevated costs than livestock breeders can afford.

Moreover, the animal feed trade is changing, propelled by developing customer demand, adjusting favourites, legal changes, and revolutionary advancements in ingredients and feed technology. According to the United Nations, food cultivation from animals and plants will necessitate a rise of 60 percent by 2050, in contrast to 2009, to satisfy surging food demand. This shows the need for changes in the market to make sure this is handled sustainably. In addition, there is a growing requirement for ethically and sustainably sourced raw materials for animal feed.

MARKET DRIVERS

The rising demand for products derived from livestock, such as dairy, eggs, and meat, is primarily propelling the growth of the liquid feed market.

The rising concern of the population towards the consumption of protein-rich food is driving the growth of the liquid feed market. Liquid feed helps increase digestion as well as productivity in animals. It helps in the growth and development of animal tissue; therefore, livestock farmers prefer liquid feed as a nutrient in animal feed and liquid feed is easily digestible. In addition, the demand for export-quality meat is increasing, further encouraging livestock farmers to give liquid feed to the livestock to enhance the quality of the meat, which is fuelling the growth of the liquid feed market. Also, the rising awareness among livestock farmers about the benefits of liquid feed is attributed to the growth of the market.

Moreover, the stringent regulations imposed by the governments of several nations to provide bio-based liquid feed, particularly in Europe, are driving the growth of the liquid feed market in the forecast period. The global liquid feed market is highly fragmented, with the presence of many international players and several small players, resulting in intensified competition within the industry and leading to more R&D and innovation of more liquid feed solutions in the market, which further will boost the growth of the liquid feed market in the coming years.

MARKET RESTRAINTS

There are different regulatory structures and interventions in different countries worldwide associated with the usage of liquid feed supplements in ruminants and the loss of synthetic amino acids during the storage of liquid feed is restraining the growth of the liquid feed market.

The lack of awareness among consumers about the advantages and safety is restricting the growth of the liquid feed market. This understanding, especially concerning packaging and sustainability, plays a considerable part in their adoption and market potential. Although a preference for sustainable options, several customers don’t have detailed knowledge regarding recycling and the ecological impact of various packing materials. So, this confusion can impede their capability to make informed decisions.

Additionally, market growth is also affected by the different regulatory structures and interventions in countries worldwide. It is associated with the usage of liquid feed supplements in ruminants, and the loss of synthetic amino acids during the storage of liquid feed, which is restraining the growth of the liquid feed market. Also, the laws relating to this change throughout regions and nations, make it tough for producers to adhere to several sets of regulations at the same time. For instance, the United States and Europe have different legal frameworks for granting permission for ingredients and feed additives.

Another factor affecting the market is supply chain constraints for many liquid feed ingredients. The supplies and costs of raw materials are elevated because of the increasing demand from the non-feed sectors like energy, where organizations can pay higher than the majority of cattle breeders can spend.

MARKET CHALLENGES

The growth of the liquid feed market is hindered by geopolitical tensions or conflicts and a shortage of drivers. As per the annual Liquid Feed Symposium of AFIA, the Ukraine-Russia war has significantly affected the world markets for farming commodities and has lasting problems with cultivating and keeping a consistent workforce for trucking. It stresses how reporting ecological data and tracking will be progressively vital for downstream consumers. This has substantially the supply of many ingredients for liquid feed to countries where agriculture contributes majorly to its economy. Geopolitical occurrences are dragging us around, and elevating inflation rates all over the globe are key obstacles to the market. In addition, difficult climatic conditions, involving severe droughts every year, will affect the production of crops and future markets which is only adding fuel to the worsening situation. This is expected to result in an extreme decline in protein and subsequently breed fewer animals to get the feed prices to fall, causing a decrease in protein supplies worldwide.

Apart from these, the shortage of trucking drivers is also hurting the market. The trucking workforce experienced little relief immediately after the pandemic, however, there continues to be an approaching danger of hiring labourers for the coming years. As per the FeedNavigator, the United States will require 1.1 million new drivers in the coming ten years to fulfil the necessity. Also, the older generation of truckers will retire which creates a shortage of drivers. Ultimately impacting the supply and cost of liquid feed worldwide.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024 to 2032 |

|

CAGR |

6.04% |

|

Segments Covered |

By Type, Ingredients, Livestock, and Region |

|

Various Analyses Covered |

Global, Regional, and Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Archer Daniels Midland Company (U.S.), Cargill Incorporated (U.S.), GrainCorp Ltd. (Austria), Land O’ Lakes (U.S.), BASF SE, BEC Feed Solutions (Australia), DLG Group (Denmark), Liquid Feeds International, Midwest Liquid Feeds, Cattle- Lac Liquid Feed. |

SEGMENTAL ANALYSIS

By Type Insights

The protein segment is expected to dominate the market in the forecast period. Proteins are the essential nutrient required for the proper nutrition of all animals. Most animal tissues and organs require proteins and other elements as their building blocks. Therefore, protein plays a vital role in animal nutrition and the growth and regeneration of tissues. However, protein is the most expensive nutrient in the animal diet, and it cannot be replaced with any other nutrient or element.

By Ingredients Insights

The molasses segment is going to dominate the market during the forecast period, as when molasses is added to animal feed, it increases the palatability of the feed and has a high bioavailability. Therefore, the manufacturers prefer molasses to be included in the liquid feed to enhance palatability as well as cost reduction. Additionally, molasses improves digestion of the pastures, helps in maintaining body condition and appetite and increases milk productivity. Owing to these factors, the molasses segment will drive the growth of the global liquid feed market in the coming years.

By Livestock Insights

The ruminant segment is estimated to dominate the market in the forecast period, followed by the poultry segment due to increasing demand for dairy as well as meat products. The increasing demand for export quality meat is also driving the demand for liquid feed in the ruminants and poultry segment, which further propels the growth of the market soon.

The aquaculture segment will also witness steady growth in the projected period.

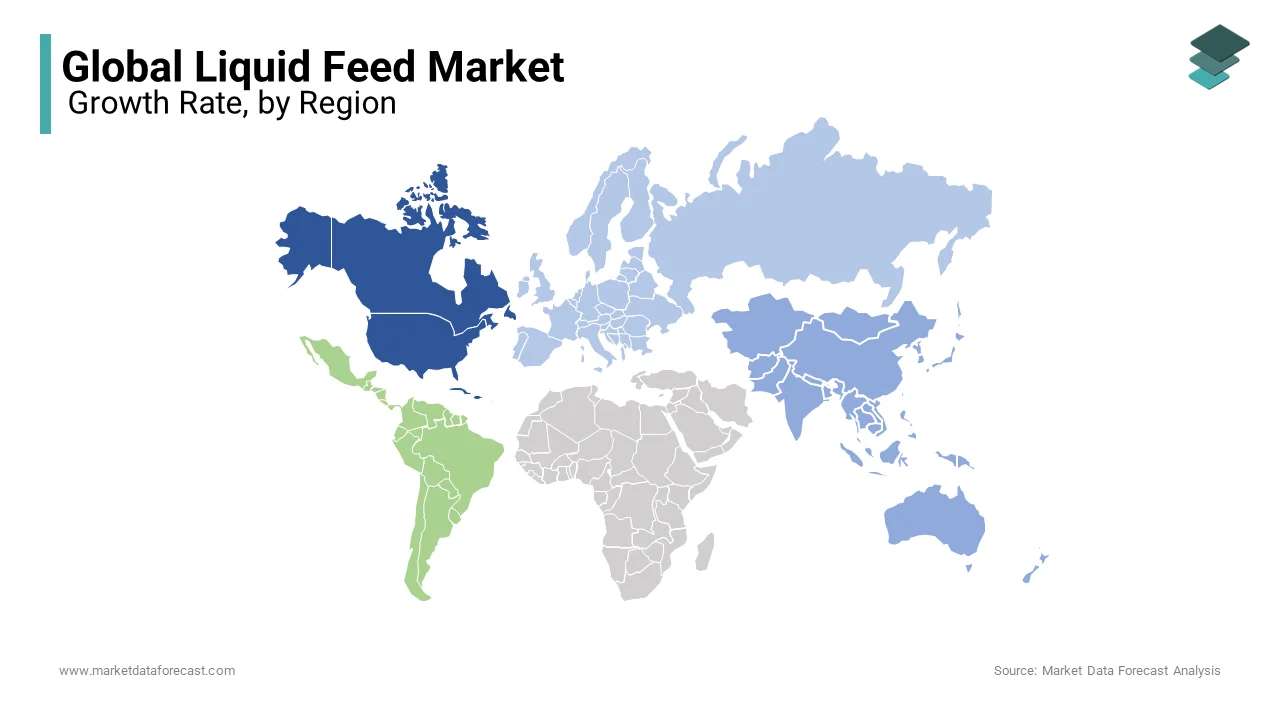

REGIONAL ANALYSIS

North America holds the largest share of the global liquid feed market due to increased consumption of meat and meat products. In this region, the demand for liquid feed for ruminants is increasing, which is driving the market. Moreover, the easy availability of raw materials helps the manufacturer maintain a steady supply and increases the production capacity of liquid feed in the market. Owing to the above factors, the demand for liquid feed will continue to grow in this region during the forecast period.

Asia-Pacific is estimated to register a profitable CAGR of over 7% during the forecast period due to the growing aqua-feed market in India and China, along with strict government regulations for providing sustainability in fish production. Moreover, the increasing demand for protein rich products such as dairy and meat is driving the demand for liquid feed in the market in order to produce improved quality dairy and meat products.

Europe's liquid feed market is expected to grow with a 5.5% CAGR during the forecast period due to strict regulations towards the banning of synthetic ingredients as a promoter in animal feed that has surged the demand for natural feed additives for growth performance and feed efficiency. Additionally, the rising demand for poultry and swine in the European region is likely to accelerate the market growth of the market as poultry feed is the business of one-third of the European compound feed industry.

KEY MARKET PLAYERS

Some of the leading companies operating in the global liquid feed market are Archer Daniels Midland Company (U.S.), Cargill Incorporated (U.S.), GrainCorp Ltd. (Austria), Land O’ Lakes (U.S.), BASF SE, BEC Feed Solutions (Australia), DLG Group (Denmark), Liquid Feeds International, Midwest Liquid Feeds, Cattle- Lac Liquid Feed.

RECENT HAPPENINGS IN THIS MARKET

- In July 2021, Cargill announced an investment in Animalbiome which is an Oakland, California-based startup using the latest microbiome science in order to restore pet digestive and skin issues.

- In Dec 2019, the Bidco Land O’ Lakes officially opened its new state–of–the–art manufacturing animal feed plant in Nakuru. Land-O-Lakes is one of America's largest farmer-owned cooperatives as well as a leader in global animal nutrition and Bidco Africa is one of East Africa’s leading consumer product companies that have invested an estimated amount of USD 12 million in this plant.

MARKET SEGMENTATION

This research report on the global liquid feed market is segmented and sub-segmented based on type, ingredients, livestock, and region.

By Type

- Protein

- Minerals

- Vitamins

- Others

By Ingredients

- Molasses

- Corn

- Urea

- Others

By Livestock

- Ruminants

- Poultry

- Swine

- Aquaculture

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

What is the current size of the Global Liquid Feed Market?

The global liquid feed market is worth at USD 8.268 billion in 2023.

Which regions contribute significantly to the Global Liquid Feed Market share?

North America, Europe, Latin America, Asia-Pacific, Middle East And Africa.

what is the estimated market share of liquid feed market in Asia-Pacific?

Asia-Pacific is estimated to register a profitable CAGR of over 7% during the forecast period.

what is the market share of liquid feed market in Europe?

Europe's liquid feed market is expected to grow with a 5.5% CAGR during the forecast period 2023 to 2028.

what are the challenges faced by the global liquid feed market ?

The global liquid feed market has been significantly impacted by the COVID-19 outbreak due to the lockdown the production and supply chain have been disrupted which, in turn, affected the global trade of liquid feed.

What factors are driving the growth of the Feed Premix Market?

The driving force of the liquid feed market is the increasing demand for products driven from livestock such as dairy, eggs and meat.

what are the key market players involved in the global liquid feed market?

Some of the leading companies operating in the global liquid feed market are Archer Daniels Midland Company (U.S.), Cargill Incorporated (U.S.), GrainCorp Ltd. (Austria), Land O’ Lakes (U.S.), BASF SE, etc...

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]