Global Linen Market Size, Share, Trends, & Growth Forecast Report Segmented By Type (Long Flax Linen and Short Flax Linen), Application (Clothing, Table Linen, Decoration, Bed Linens, and Other), and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa), Industry Analysis From 2024 to 2033

Global Linen Market Size

The global linen market was worth USD 984 million in 2024. The global market is projected to reach USD 2,570 million by 2033 from USD 1,094 million in 2025, growing at a CAGR of 11.26% from 2025 to 2033.\

Linen is woven from the fibers of the flax plant that has been cherished for centuries for its exceptional durability, thermal regulation, and hypoallergenic properties. Beyond its traditional use in clothing and household textiles, the versatility of linen has expanded into niche applications such as upholstery, technical fabrics, and even eco-friendly packaging solutions. The biodegradability of the fabric and low environmental footprint requiring significantly less water and pesticides compared to cotton have further cemented its status as a material aligned with modern sustainability goals.

From an agricultural perspective, flax cultivation occupies a relatively small but impactful footprint globally. Europe leads in flax production, particularly in regions like Normandy, where the soil and climate are uniquely suited to cultivating high-quality flax fibers. Interestingly, the process of transforming flax into linen involves mechanical rather than chemical methods, preserving its natural integrity while generating minimal waste. Reports from the European Confederation of Linen and Hemp indicate that every ton of flax fiber produced captures around 3.7 tons of CO2, underscoring its role in carbon sequestration efforts. Furthermore, the by-products of flax processing, such as linseed oil and flaxseed, contribute to industries ranging from food to cosmetics, highlighting the plant’s multifaceted utility. These attributes position linen not merely as a textile but as a holistic contributor to sustainable ecosystems and innovative material science.

MARKET DRIVERS

Growing Demand for Sustainable Textiles

The global push toward sustainability has emerged as a significant driver for the linen market. Consumers are increasingly prioritizing eco-friendly products, with the United Nations Environment Programme reporting that the textile industry is responsible for approximately 10% of global carbon emissions. Linen, requiring 60% less water than cotton and producing minimal waste during processing, aligns perfectly with these sustainability goals. According to the European Commission, textiles made from natural fibers like linen are seeing a 5% annual increase in demand within the European Union due to stricter environmental regulations. Additionally, the U.S. Environmental Protection Agency highlights that biodegradable fabrics such as linen reduce landfill waste by decomposing within weeks, unlike synthetic alternatives. This growing awareness is driving brands to adopt linen as a core material, particularly in fashion and home textiles, fostering its expansion into mainstream markets.

Rising Popularity of Minimalist and Organic Lifestyles

The global shift toward minimalist and organic lifestyles has significantly bolstered the linen market. The World Health Organization notes that over 70% of consumers in developed economies now prioritize products that promote health and well-being. Linen’s hypoallergenic and breathable properties make it ideal for bedding, clothing, and upholstery, catering to this demand. Furthermore, the International Trade Centre reports that organic lifestyle trends have led to a 12% annual growth in artisanal and handcrafted linen products, particularly in regions like Scandinavia and North America. In India, the Ministry of Textiles highlights that linen-based apparel exports grew by 8% in 2022, driven by urban consumers seeking simplicity and authenticity. As social media platforms amplify the appeal of "slow living," linen's natural aesthetic and timeless appeal continue to resonate, creating a robust demand trajectory.

MARKET RESTRAINTS

High Production Costs

One of the primary restraints in the linen market is the high cost of production, largely due to the labor-intensive nature of flax processing. The International Labour Organization states that transforming flax into linen involves multiple stages, including retting, scutching, and spinning, which require skilled labor and time-consuming techniques. These processes contribute to linen being 3-4 times more expensive than cotton. Additionally, the Food and Agriculture Organization highlights that flax cultivation is limited to specific temperate climates, reducing economies of scale. For instance, only 0.5% of global textile fibers are derived from flax, limiting its availability and increasing costs. The U.S. Department of Agriculture further notes that fluctuations in flaxseed prices, a by-product of linen production, add volatility to the supply chain, making it challenging for manufacturers to maintain consistent pricing structures.

Limited Scalability of Flax Cultivation

Another restraint is the limited scalability of flax cultivation, which restricts the linen market's ability to meet rising global demand. The Food and Agriculture Organization reports that flax accounts for less than 1% of global fiber crops, with cultivation concentrated in Europe and parts of Asia. This geographic limitation poses challenges for scaling production to compete with mass-produced fibers like polyester or cotton. The European Environment Agency highlights that flax requires specific soil conditions and rotational farming practices, making it unsuitable for large-scale monoculture. Moreover, the United Nations Conference on Trade and Development notes that global flax yields average just 1.5 tons per hectare, compared to cotton's 2.5 tons. These constraints not only limit supply but also hinder efforts to reduce costs, ultimately slowing the market's growth potential despite increasing consumer interest.

MARKET OPPORTUNITIES

Expansion into Emerging Markets

A significant opportunity for the linen market lies in its potential expansion into emerging markets, particularly in Asia and Africa. The World Bank reports that urbanization in these regions is growing at a notable rate leading to increased disposable incomes and a burgeoning middle class. This demographic shift is driving demand for premium, sustainable products like linen. Similarly, the African Development Bank highlights that countries like Kenya and Nigeria are witnessing a surge in eco-conscious startups promoting linen-based fashion. With over 60% of the global population residing in Asia and Africa, these regions present untapped potential for linen manufacturers to diversify their customer base and drive revenue growth.

Innovation in Blended Fabrics

Another promising opportunity is the development of innovative blended fabrics that combine linen with other fibers to enhance functionality and affordability. According to the International Trade Centre, the integration of natural fibers like linen with recycled materials supports global sustainability goals and meets evolving consumer preferences for environmentally responsible products. These blends offer improved durability and reduced costs while retaining linen's eco-friendly attributes. The U.S. Department of Energy highlights that blending reduces energy consumption during manufacturing by up to 25%, aligning with global sustainability goals. Additionally, the European Confederation of Linen and Hemp notes that technical advancements in dyeing and finishing processes have expanded linen's applications in activewear and outdoor gear. By leveraging these innovations, manufacturers can cater to diverse industries, from sportswear to automotive interiors, unlocking new revenue streams and broadening linen's market reach.

MARKET CHALLENGES

Competition from Synthetic Fibers

A major challenge facing the linen market is intense competition from synthetic fibers like polyester, which dominate the global textile industry. The International Trade Centre states that synthetic fibers account for majority of global fiber production, overshadowing natural fibers like linen. Polyester's low cost, ease of production, and versatility make it a preferred choice for fast fashion brands, which control approximately 80% of the apparel market. The United Nations Industrial Development Organization highlights that synthetic fibers are often priced 50% lower than linen, posing a significant barrier to market penetration. Furthermore, the U.S. Environmental Protection Agency notes that despite growing awareness of microplastic pollution caused by synthetics, price-sensitive consumers continue to favor them over premium options like linen, creating a persistent challenge for market growth.

Seasonal Demand Fluctuations

Another challenge is the seasonal nature of linen demand, which creates inconsistencies in sales and production planning. The World Meteorological Organization reports that linen products experience peak demand during warmer months due to their breathability and cooling properties, leading to underutilization of resources during off-peak seasons. For instance, the European Confederation of Linen and Hemp notes that linen bedding sales in Europe drop significantly during winter months. Similarly, the Indian Ministry of Textiles highlights that domestic linen apparel sales fluctuate between summer and monsoon seasons. These fluctuations strain supply chains, increase inventory costs, and complicate workforce management. Addressing this challenge requires strategic marketing efforts to promote linen's year-round versatility, alongside diversifying product offerings to mitigate the impact of seasonal demand cycles.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

11.26% |

|

Segments Covered |

By Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Kingdom, Keshan Jinding (China), Huzhou Jinlongma (China), Xinshen Group (China), Haerbin Yanshou (China), Zhejiang Golden Eagle (China), Meriti Group, Huzhou Goldrich Linen Textile (China), Qichun County Dongsheng Textile (China), and Jiangsu Chunlong Flax Textile (China). |

SEGMENTAL ANALYSIS

By Type Insights

The long flax linen segment held the leading share of 65.3% in the global market in 2024. The superior quality, strength, and versatility of long flax linen are making it ideal for high-end applications like apparel and home textiles, which is primarily driving the domination of the segment in the global market. According to the Food and Agriculture Organization, flax cultivation practices play a critical role in determining fiber quality, with long fibers being particularly valued for their smooth texture and longevity in use. Additionally, the demand for sustainable luxury products has bolstered its popularity, particularly in Europe, where consumers prioritize eco-friendly and durable materials. Long flax linen’s prominence is further reinforced by its role in driving innovation and maintaining the industry’s reputation for quality.

The short flax linen segment is anticipated to record a promising CAGR of 5.8% over the forecast period due to factors such as its cost-effectiveness and suitability for blended fabrics, which are increasingly used in affordable yet sustainable textiles. According to the Food and Agriculture Organization, blending short flax fibers with other materials helps optimize resource use and supports sustainable textile production, particularly in markets seeking cost-effective yet eco-conscious solutions. Rising demand for budget-friendly sustainable options, particularly in emerging markets like India and China, is driving this segment’s expansion. Short flax linen’s adaptability to industrial applications, such as technical textiles, further underscores its importance in diversifying the linen market’s reach and accessibility.

By Application Insights

The clothing segment led the market by capturing 40.3% of the global market share in 2024. The breathability of linen, moisture-wicking properties, and hypoallergenic nature make it a preferred choice for summer wear and casual apparel, which is propelling the growth of the clothing segment in the global market. According to the World Health Organization, over half of consumers in developed economies prioritize comfort and health-conscious fabrics, driving demand for linen-based clothing. Additionally, the rise of sustainable fashion has bolstered this segment, with brands emphasizing linen’s biodegradability and low environmental impact. Europe leads in clothing applications and a report by the International Trade Centre (ITC) highlights that European consumers are among the most environmentally conscious with a growing preference for sustainable textiles.

The bed linens segment is estimated to progress at a CAGR of 6.3% over the forecast period owing to the increasing consumer awareness of sleep hygiene and the benefits of breathable, natural fabrics. The National Sleep Foundation reports that a substantial percentage of consumers prefer linen bedding for its thermal regulation and hypoallergenic properties, particularly in warmer climates. Additionally, the growing trend of "slow living" and home décor investments has amplified demand for premium bed linens. The European Environment Agency notes that linen bedding reduces carbon footprints by decomposing naturally, aligning with sustainability goals. As urbanization and disposable incomes rise in Asia-Pacific, this segment’s importance will continue to grow, positioning it as a key driver of market expansion.

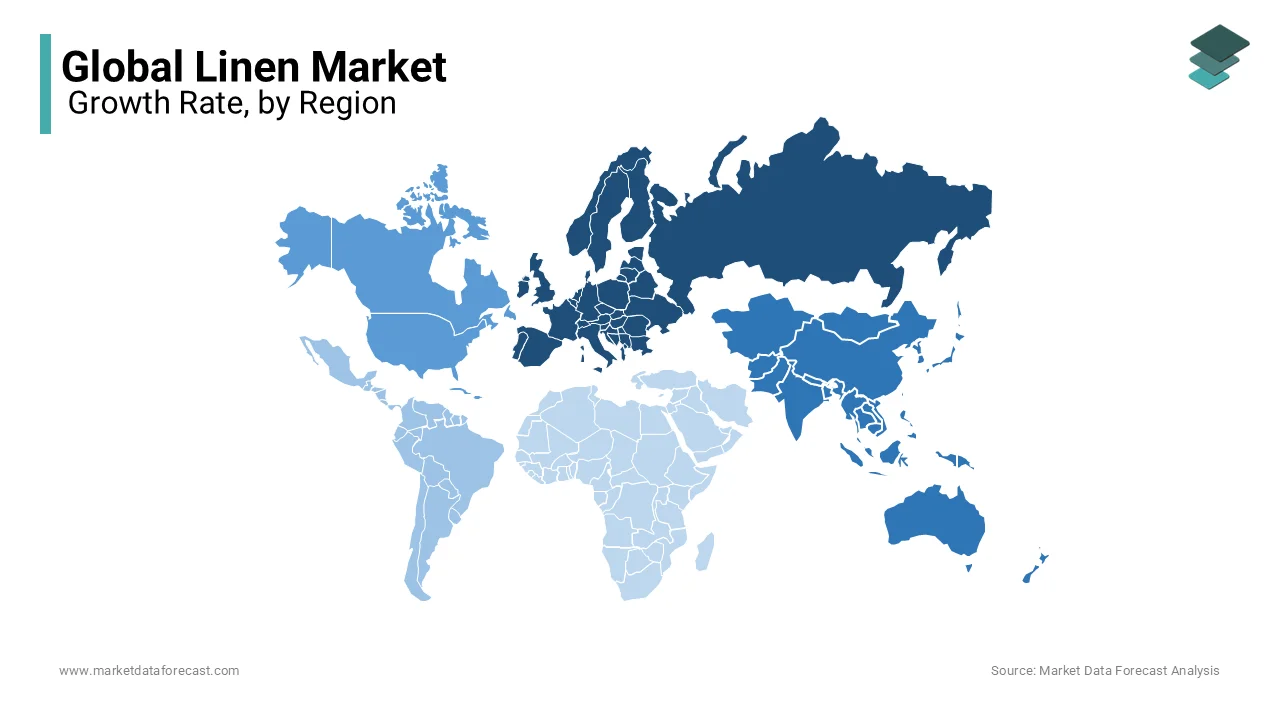

REGIONAL ANALYSIS

Europe dominated the linen market by accounting for 65.3% of the global market share in 2024. The growth of the European region in the global market is driven by favorable climatic conditions in countries like France and Belgium that produce over 80% of the world’s flax fiber. The European Union’s stringent environmental regulations, outlined by the European Environment Agency, further bolster demand for sustainable textiles like linen. Additionally, the region's advanced processing technologies and strong emphasis on eco-friendly fashion contribute to its dominance. With a well-established supply chain and high consumer awareness, Europe remains pivotal in driving innovation and setting benchmarks for quality and sustainability in the global linen industry.

The Asia-Pacific region is the fastest-growing region in the global linen market with a projected CAGR of 6.2% during the forecast period owing to the urbanization and rising disposable incomes, particularly in India and China, where the middle class is expected to grow by 50% by 2030, as per the World Bank. Increasing adoption of sustainable fashion and home textiles, coupled with government initiatives promoting natural fibers, such as India’s Ministry of Textiles’ push for eco-friendly exports, are key drivers. The region’s manufacturing hubs also enable cost-effective production, positioning Asia-Pacific as a critical growth engine for the global linen market.

The linen market in North America is poised for steady growth and is driven by increasing consumer awareness of sustainable and eco-friendly products. The U.S. Environmental Protection Agency highlights that the region’s demand for biodegradable textiles is rising with linen gaining traction in home décor and apparel sectors. The United States accounts for over 80% of the regional market share and is supported by a strong presence of premium brands and retailers emphasizing ethical sourcing. Additionally, government initiatives promoting sustainable practices, such as the USDA BioPreferred Program, are encouraging the adoption of natural fibers like linen.

In Latin America, the linen market is expected to grow steadily, albeit at a slower pace compared to other regions. The Food and Agriculture Organization reports that flax cultivation is gaining attention in countries like Argentina and Brazil due to their favorable agro-climatic conditions. However, limited infrastructure and low consumer awareness about linen’s benefits pose challenges. The Inter-American Development Bank notes that the region’s middle class, projected to grow by 25% by 2030, will drive demand for sustainable fashion and home textiles.

The Middle East and Africa present untapped potential for the linen market, supported by growing interest in sustainable textiles and arid-climate suitability for flax cultivation. The African Development Bank projects an annual increase in flax production, particularly in Egypt and Morocco, where traditional craftsmanship aligns with modern sustainability trends. In the Middle East, rising disposable incomes and luxury retail growth are driving demand for premium linen products, especially in the UAE and Saudi Arabia. According to the United Nations Conference on Trade and Development, the region’s market share is currently around 5%, but strategic investments in textile manufacturing and export-oriented policies could enhance its contribution. As environmental awareness grows, these regions are likely to emerge as key players in the global linen landscape.

KEY MARKET PLAYERS

The major players in the global linen market include Kingdom, Keshan Jinding (China), Huzhou Jinlongma (China), Xinshen Group (China), Haerbin Yanshou (China), Zhejiang Golden Eagle (China), Meriti Group, Huzhou Goldrich Linen Textile (China), Qichun County Dongsheng Textile (China), and Jiangsu Chunlong Flax Textile (China).

COMPETITIVE LANDSCAPE

The linen market is characterized by a competitive landscape driven by sustainability, innovation, and regional specialization. Key players such as Libeco , Welspun India , and Berkshire Hathaway’s Fruit of the Loom dominate the industry, leveraging strategies like vertical integration, strategic partnerships, and sustainability certifications to maintain their edge. According to the European Confederation of Linen and Hemp, Europe remains the epicenter of production, with companies like Libeco controlling approximately 15% of the regional market through premium offerings and eco-friendly practices. Meanwhile, Welspun India leads in Asia-Pacific, capitalizing on cost-effective manufacturing and global retail collaborations to capture over 8% of global exports, as per the Indian Ministry of Textiles.

Competition intensifies as emerging players from Asia and Africa enter the market, offering affordable alternatives while adopting sustainable practices to meet regulatory standards. The International Trade Centre highlights that small-to-medium enterprises (SMEs) are increasingly challenging established brands by focusing on niche segments like organic linen and handcrafted products. Additionally, technological advancements in blending and finishing processes have leveled the playing field, enabling smaller firms to innovate and compete. Despite this, the market remains fragmented, with no single player holding a dominant global share. Instead, competition is shaped by regional strengths, product differentiation, and consumer education. As demand for sustainable textiles rises, companies that balance affordability, quality, and environmental responsibility are likely to thrive, ensuring a dynamic yet fiercely contested marketplace in the years ahead.

Top 3 Players in the Market

Libeco (Belgium)

Libeco, headquartered in Belgium, is one of the most prominent players in the global linen market, renowned for its high-quality linen products and sustainable practices. The company controls approximately 15% of the European linen market, as highlighted by the European Confederation of Linen and Hemp. Libeco’s vertically integrated supply chain, from flax cultivation to finished products, ensures traceability and quality, making it a preferred supplier for luxury home textiles and apparel brands. The company’s commitment to sustainability is underscored by its adherence to the Masters of Linen certification, which guarantees that all production stages occur within Europe. Libeco’s innovative product lines, including organic and biodegradable linen, cater to eco-conscious consumers, reinforcing its leadership role in promoting environmentally responsible textile solutions.

Berkshire Hathaway (Fruit of the Loom) (USA)

Berkshire Hathaway, through its subsidiary Fruit of the Loom, has established a significant presence in the global linen market, particularly in North America. The U.S. Department of Commerce reports that the company holds an estimated 10% share of the North American linen-based apparel market. Fruit of the Loom leverages its extensive distribution network and economies of scale to offer affordable yet durable linen products, appealing to both mass-market and premium segments. The company’s focus on blending linen with other fibers to enhance functionality and affordability has expanded its application in casual wear and workwear. Additionally, Fruit of the Loom’s adoption of sustainable practices, such as water-efficient dyeing technologies, aligns with growing consumer demand for eco-friendly textiles, solidifying its influence in the global market.

Welspun India (India)

Welspun India is a leading global player in the home textiles sector and a major contributor to the linen market, particularly in Asia-Pacific. The Indian Ministry of Textiles highlights that Welspun accounts for over 8% of global linen exports, with a strong emphasis on innovation and sustainability. The company’s state-of-the-art manufacturing facilities and partnerships with international retailers enable it to produce high-quality linen products at competitive prices. Welspun’s "Green Governance" initiative focuses on reducing carbon emissions and water usage, earning certifications like OEKO-TEX® and GOTS. Its diverse product portfolio, ranging from linen bedding to blended fabrics, caters to markets in Europe, North America, and the Middle East. By combining traditional craftsmanship with modern technology, Welspun India plays a pivotal role in driving the global linen market’s growth and accessibility.

TOP STRATEGIES USED BY THE KEY MARKET PARTICIPANTS

Vertical Integration

Vertical integration has emerged as a cornerstone strategy for key players in the linen market to enhance efficiency, quality control, and sustainability. Companies like Libeco have adopted this approach by overseeing the entire production process, from flax cultivation to finished products. This ensures traceability, reduces dependency on external suppliers, and allows for better adherence to environmental standards. The European Confederation of Linen and Hemp highlights that vertically integrated companies can achieve up to 20% cost savings while maintaining premium quality. By controlling every stage of production, these players strengthen their brand reputation and meet the growing demand for transparency in supply chains, particularly among eco-conscious consumers.

Strategic Partnerships and Collaborations

Strategic partnerships and collaborations are widely employed by linen market leaders to expand their reach and innovate. For instance, Welspun India has formed alliances with global retailers such as Walmart and Target to penetrate mass markets while maintaining its focus on sustainability. The Indian Ministry of Textiles notes that such collaborations have enabled Welspun to increase its export share by 15% annually. Similarly, Berkshire Hathaway’s Fruit of the Loom collaborates with textile innovators to develop blended fabrics that combine linen with other fibers, enhancing durability and affordability. These partnerships allow companies to leverage complementary strengths, access new technologies, and cater to diverse consumer preferences, thereby solidifying their competitive edge.

Investment in Sustainability and Innovation

Sustainability and innovation are pivotal strategies for strengthening market position, with key players investing heavily in eco-friendly practices and cutting-edge technologies. Libeco , for example, has adopted the Masters of Linen certification, ensuring all processes adhere to strict European Union environmental standards. The company also invests in water-saving technologies and bio-based finishes, reducing its carbon footprint by 30%, according to the European Environment Agency. Meanwhile, Welspun India focuses on R&D to create innovative products like antimicrobial linen blends, which have gained traction in healthcare and hospitality sectors. By aligning with global sustainability goals and addressing evolving consumer demands, these players not only enhance their brand equity but also future-proof their businesses against regulatory and market shifts.

RECENT HAPPENINGS IN THE MARKET

- In September 2024, Johnson Service Group (JSG), a UK-based workwear and textile firm, acquired Empire Linen Services Limited for £20.6 million. Empire Linen provides linen services to luxury hotels in London and the South East of England. This acquisition is expected to enhance JSG's service offerings and contribute positively to its financial performance.

- In January 2023, Healthcare Linen Services Group (HLSG), backed by York Capital Management's private equity group, acquired Linen King. This acquisition enabled HLSG to expand its operations into the South Central United States, increasing its processing capacity and customer base.

MARKET SEGMENTATION

This research report on the global linen market is segmented and sub-segmented into the following categories.

By Type

- Long Flax Linen

- Short Flax Linen

By Application

- Clothing

- Table Linen

- Decoration

- Bed Linens

- Other

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

Is linen more expensive than cotton, and why?

Yes, linen is typically more expensive than cotton because its production process is labor-intensive, and flax fibers are harder to cultivate. Additionally, linen’s durability and luxurious texture contribute to its higher price.

What are the main uses of linen in global markets?

Linen is widely used for clothing, home furnishings like bedding and curtains, and industrial applications such as upholstery and canvas. It is also popular in eco-friendly and sustainable fashion markets.

Is linen suitable for all seasons?

Yes, linen is highly versatile; it keeps you cool in summer by absorbing moisture and provides warmth in winter due to its insulating properties. It is commonly blended with wool or cotton for winter use.

How do you maintain and care for linen fabrics?

Linen should be washed in cold or lukewarm water with mild detergent and air-dried for longevity. Ironing is optional, as its natural wrinkles add to its charm, but a steamer can be used for a smoother look.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]